Video on Trend Changes/First Waves

Below is a short video on how to enter after a countertrend top is in place, using the EW preferred entry technique.

Trend Change Frist Waves |

_______________________________

First Waves

It’s time to start looking for a top in the US indices, and then a first wave down for the coming C wave, so here’s how that first wave should be structured.

First waves of a new sequence typically different in their configuration that a normal motive wave in 5 waves. They’re hard to discern, as all the waves need to be present and some of them need to hit specific fibonacci targets. If they don’t, you’re looking at an ABC wave that’s going to retrace right back up to the top.

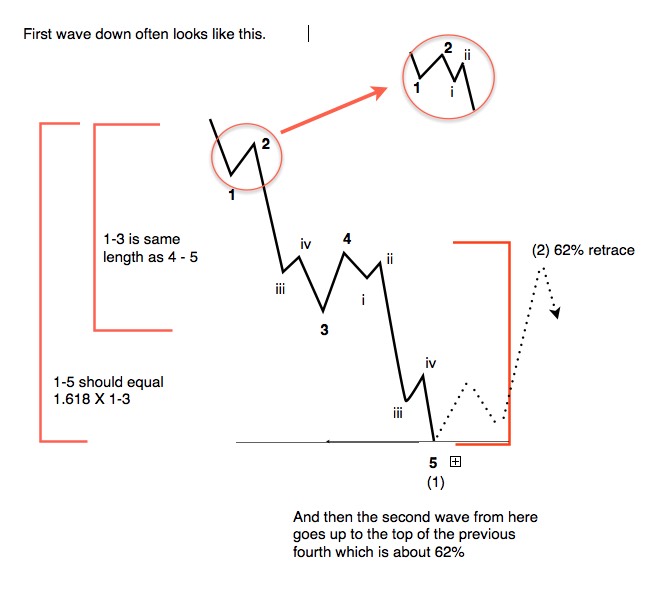

Above is an example of a typical Elliottwave first wave down. From a “big picture” perspective, you can break this wave down into two major waves. There’s a wave that comprises the 1-3 subwaves and then another wave of equal length that captures the waves 4 through 5. Of course, there are subwaves along the way. The 5th wave down (from 4 to 5 on in the diagram must have 5 subwaves). The third wave also must have 5 subwaves (I’ve included an inset circle to show the small wave i and ii of the third wave, as these can be quite small), and the first wave should have 5 subwaves, but they may be too small to make up properly.

IMPORTANT NOTE: In order to trade the second portion (wave 5) of this wave structure, you need to see wave 4 retrace to at least the 38% retrace level of the wave down so far (measured from the very top to the bottom of the third wave).

So this is ultimately what we’re looking for in terms of a first wave once the US market has topped.

The first wave should bottom at a previous 4th wave (of the final wave up in the opposite direction). This US indices now have several fourth wave levels at different degrees of trend, so picking a downside target is difficult at the present time. It will be much easier once we have some subwaves down in place.

In general, once the first wave down is complete, look for a second wave up in three waves to at least 62%. Wait for the turn. This is the least risk entry for a short from an Elliottwave perspective.