Overview of Where We Are

Overview of Where We Are

I’ve spent a lot of time thinking about all the assets I cover and how they’re all moving to a synchronized turn. Here are my thoughts.

Last week, it looked like currency pairs were going to turn early. They seemed to be topping with everything else. In other words, it seemed like EURUSD would not make its 38% retrace target at 1.24. However, with Friday’s spike to new highs, that may not in fact, be the case.

The US dollar also had not bottomed, which seemed a bit odd. On Friday, however, it dropped to a new low and is flirting with a double bottom. I have for a very long time called for this to happen and said that the US market would top at the same time. Well, here we are …

In any event, I’ve seen this show before, where currencies shoot up to get to a pre-determined target at the last minute. That seems to be what’s happening. So a BIG CAUTION is in order here in terms of the US indices.

This is a 500 year top. The US indices are at a top. However, I’d be really surprised if they go easily; if we don’t get a double top. I’ll be looking very intently at the first wave down from here in the US market to see whether it’s corrective or impulsive.

There will be tons of time to react; after all, this bear market will last years. So, while I expect the US market to start down this week, I would not be at all surprised to see a test of the current highs before heading down in earnest.

Most everything is at an inflection point, or very close to a turn. Tuesday will be critical, I think, but patience is warranted still. This week should finally see a turn, but all our ducks need to be in order.

______________________________

Oops! Tesla

Above is the 2 day chart of Tesla.

Time to think about bidding “adieu” to Elon. Things have not been going well lately, and they’re about to get a whole lost worse.

Last week, I suggested we’d head up in a “double-pronged” second wave, which is exactly what we’ve done. We’re getting ready for a turn down into a third wave.

__________________________

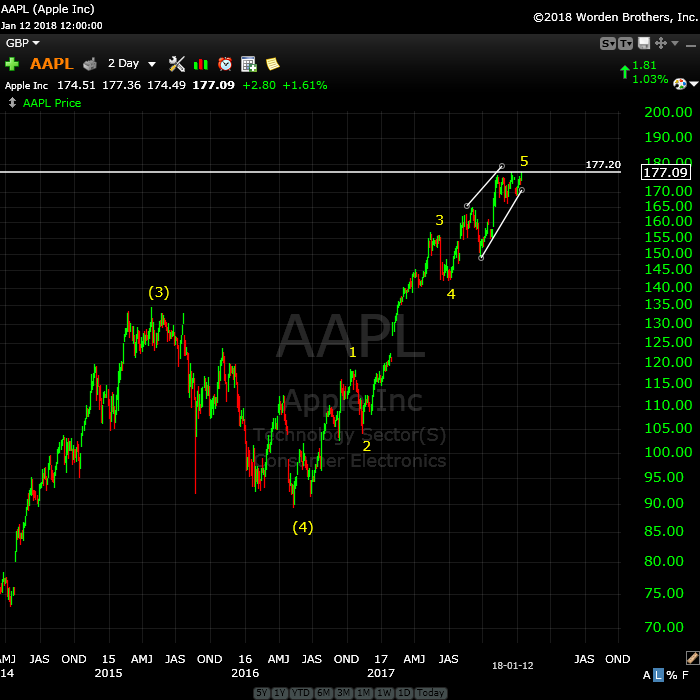

And then there’s APPL

Above is the 2 day chart of Apple (AAPL). I’ve been expecting a double top here and a possible turn down from that level. We may get a small spike about this level, but the count is full. Also take a look at NFLX and FB, which are finishing ending diagonals.

Looking for a turn in AAPL.

__________________________

Changes to the Free Blog

I’m still on the fence as to the direction I’m going to take on this. In the meantime, this weekend, I’m fiddling with the website plugin that lets you sign up for emails every time a comment is logged. You may or may not see odd things happening as we try to nail this bug.

This past week, I had the developer of the underlying framework do a complete review of the site, which has led to quite a few changes “under the hood,” most of which you won’t notice. If something seems odd, first just empty your browser’s cache, which may alleviate the issue.

One thing that you might notice is that the site is very much faster in loading. Pages load much faster than they did before and overall, is just “snappier.” A lot of work went into it, so I hope you see the results.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

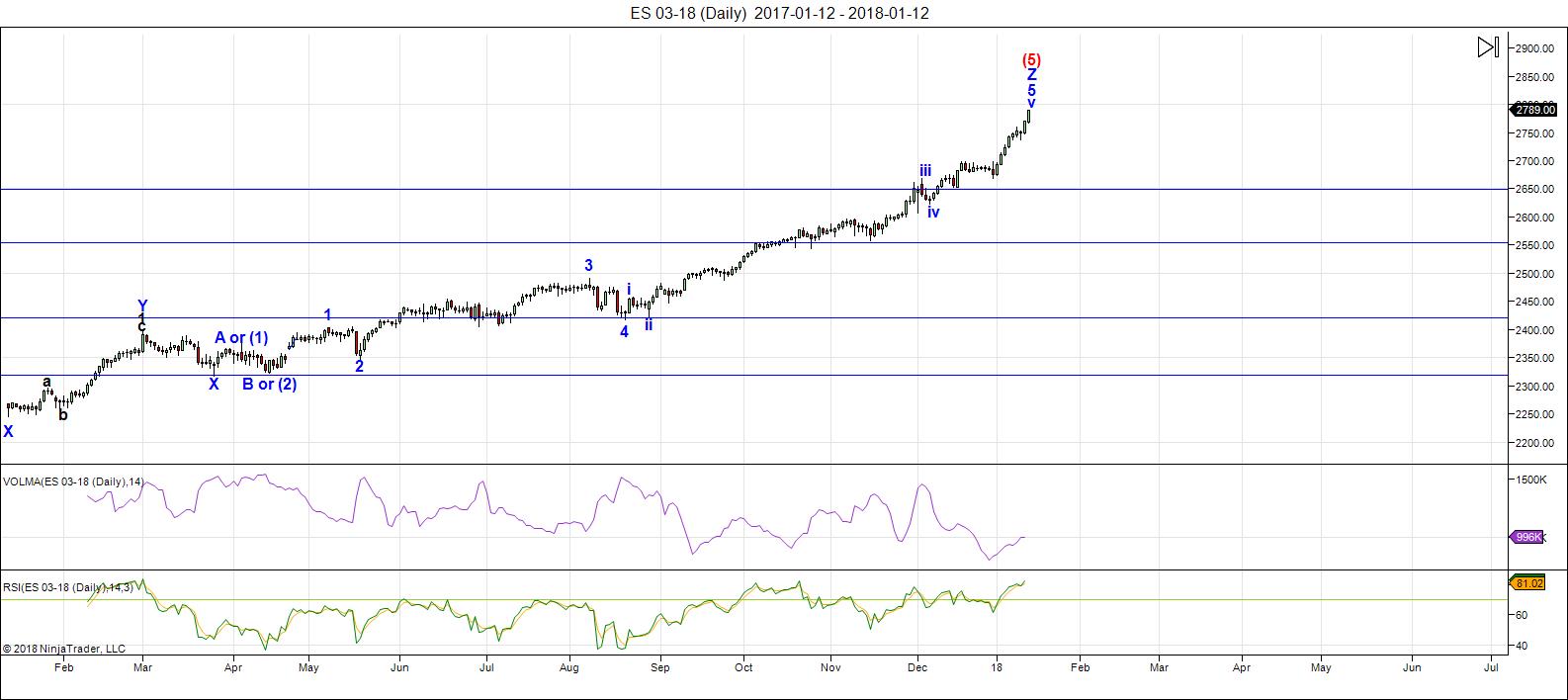

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down this week. But, we may end up with a double top, so the first turn might not be the final one.

On Friday, ES completed an ending diagonal (5 min chart). Ending diagonals can have double tops, so best to wait for the first wave down and then the second wave up to the 62% level before going short.

If the final pattern is truly an ED, ES, should not rise about 2790. However, with currencies and others not quite at targets, the US indices warrant a fair amount of caution.

Volume: It's dismal. Its the purple line, the top indicator at the bottom of the chart.

Summary: The count is full for the US market in general, so we're looking for a turn this week, once everything lines up. This is a major turn and will require all US indices, related currency pairs and of course, the US dollar, to turn at the same time. Be cautious and watch for the turn, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, January 25 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

rut – is DONE…………. “BE WARNED”!………….https://invst.ly/6e00v

Verne — read your reply through email alert. must be nice where you are 🙂

Sadly, still stuck in Illinois while my two girls get done with the “college thing”. One at U of I, done this May, Yipee!

The other at Northwestern with three years to go…Yikes! 🙂

verne,

this ……”BVI”……………place – what is it like? ………………how do you get there??? – time travel, or a “stargate” perhaps………………..and once you get there – do you have the basics such as “electricity” and……………………..ummm………………”running water” ……….and pink lady apples………for example?

so in order for me to …….”get my bearings”……………..BVI is one of the moons of planet NIBIRU??? yes/no???? :-))

oh yes…………….BVI or no BVI ……………. BE WARNED!!!…………https://invst.ly/6e31w

Richard Branson has a nice spread in the area on one of the British Virgin Islands, Necker Island.

A Google search should yield a wealth of info.

Shimmering crystal clear blue waters, snow white powdery sand pristine beaches, and some of the most beautiful smiles that side of the equator! And yes indeed, all of life’s creature comforts, including fiber optics!

Another famous family, the Voss family of Amway fame, converted another island, Peter Island (no kidding!) into a luxury resort.

verne,

earth………….to ……….verrrrrne………………..!!!! white sands …..aside…….its time to watch this ES chart….. this whole artifice could come crashing down at any second now….. a new high is unnecessary………………………https://invst.ly/6e3l0

Hi Peter G

I knew something seemed unprecedented or quite rare about vol price action but I asked the wrong question.

This zero hedge article spotted it!

https://www.zerohedge.com/news/2018-01-19/stocks-and-volatility-both-rise-whos-right

verne,

it is “obvious” that the fed has stepped away ……”somewhat” ………….from their huge short volatility portfolio activity………………..any vix “smashes” into the future, will focus the spotlight directly at the fed as the “puppetmaster”…….

when the “truth” comes out – get out of the market!!!…

https://worldcyclesinstitute.com/a-pending-top/comment-page-2/#comment-26228

finally someone is tuning in on reality!

I have my 18 wheeler standing by with palettes at the ready, and upon which I intend to load a scandalous quantity of March expiration 280 strike puts the nano second my sell trigger fires; keep an eye on VIX….it should head up with the final wave…

OR….another cohort with deep pockets stepping in to take the other side of the trade. You could be right though. That kind of tussle would produce huge candles and that ain’t happening at the moment…

https://worldcyclesinstitute.com/a-full-count/comment-page-1/#comment-26558

once again, a potentially significant matter that HAS NOT occurred is more important than what the VIX is doing!

Here we go…final move to a final high…! DROOL! 🙂

mentioned yesterday re VIX’en Familia — one that stood out was $VSTN [short term volatility ] which wasn’t in the green like that rest which (to me) indicated …no sell-off today (so far)

also — many don’t bother watching what the 10-year treasury doing — I always look at what I call MY 3 AMIGOS — FVX , TNX , TYX — the 1st 2 just made ANOTHER NEW 52wk highs today.

FVX 24.20 +0.10

TNX 26.31 +0.20

VWB 11.49 -0.41

VWA 12.01 -0.53

VIF 11.70 -0.40

VIN 11.79 -0.48

VSTF 11.59 -0.73

VSTN 11.12 -1.28

VXST 11.32 -1.05

VIX 11.76 -0.47

VVIX 102.31 -1.30

SOX 1,370.87 +0.31

BANK 4,208.55 +31.93

SPX 2,801.69 +3.66

SPLV 48.18 +0.12

don’t think NEW 52wk highs today in the SPX — could be wrong. also watched 1/2 of James Flanagan’s latest webinar — he has a 4.27% correction from Jan 16, 2018 $SPX 52wk High of 2807.54 — which equates to 2689

http://www.gannglobal.com/webinar/2018/01/18-01-18-Webinar-2.php?inf_contact_key=c5ca0fae5f2b17f2639c28fc9e3e3e52e9dcd1a97d9346b9a694352d26646076

as to Verne ? do we now call you Mr Branson ? 😉 JK !

Sadly, I don’t have the same cache my good friend John Carter who has been invited to Necker Island a few times. He used to make Oil hedging trades for Richard.

For a piddly 64K, one can enjoy the island for a week with a few friends, complete with excellent wine cellar and 40 staff! 🙂

oh wow… that’s interesting…didn’t know that about John Carter — only became aware of him in 2013 and especially in January of 2014 when he made a million on that TSLA dip — some tweeted they don’t do “weird”…and methinks they missed out on some great $$$. I also bought on that dip — but was headed to the airport for a holiday and I don’t trade over the phone — so just doubled.

as to 64K ? for a week ? don’t know about that. I’d rather take a portion of that & make a million in the markets. best times are in November, December & January, its been noted. rest of months — take a holiday.

A bit rich for my humble tastes as well! 🙂

frugal are we ? or as reality calls it — cheap ? 😉 I’m with you — can’t see dishing out that much $$ for a week…on being pampered & stalked. the earth was free to roam. now you have a guard on each imaginary corner demanding a piece of your earnings to do something you can do your own self.

I’ve been in the basement & also in the penthouse & now am on the 5th floor…so know how it feels to hit the lows & the highs — but especially the lows and so am frugal.

I bet there is an island somewhere you could grab for that kinda dough, albeit a tiny one…lol!

I am listening to his presentation. Interesting he starts with the “Similar DNA” premise that has resulted in disastrous previous predictions. I am not sure why it has not dawned on him that correlations with prior historical market events may not issue in the same result this time around. I do feel sorry for him. I learned the hard way a few years ago that even though I had traded volatility for years, something was changing, and I had to throw everything I thought I knew out the window and accept the new perpetually low vol reality. I guess I should withhold judgment until I have heard the entire thing but the way he starts is a bit unnerving considering his recent history.

Verne ? I don’t mind James Flanagan. don’t know much about him as a person — but he strikes me as being conscientious and has done a lot of legwork which I know, being on twitter since 2010 — many have copied his work & haven’t given him credit, nor acknowledged him…and have started subscriptions and charged others. that’s why I’m anti-gurus and anti-divas. know 99% of them how they got where they are.

I think James Flanagan’s trying to be open-minded. I know some swear by FIBONACCI only– example Chris Carolan aka @spiralcal . there’s astrocycles.net guy too. some have had health problems ..but they still come back.

I agree and really like him as well. I think he is a very humble man and has openly shared some of his past struggles. You make a cogent point about gurus. It is part of our design. We were made for worship, and when we don’t offer it the One it is due, we will invariably find some substitute! 🙂

🙂

Is Bezos finally in over his head? Whole Foods shoppers are mad as hell over a complete breakdown of quality control at a number of stores- empty shelves, fewer choices, empty hot food sections…..is it his intention to destroy this brand, or is he that clueless?

C wave of the fourth in DJI should complete shortly with synchronous new highs.

so much for the upgrade in NTES — couldn’t get to the 50dma of 336 area — yesterday b4 the AH news upgrade from Goldman — that they might take it down to the 144 ma of 302 b4 they did a repeat of last time to the 370s

anyhow — #earnings Feb 7

good to check :: https://marketchameleon.com/Overview/NTES/Earnings/Earnings-Dates — it’s not a bad site at all.

also :: https://www.earningswhispers.com/stocks/ntes

ES seems to still be tracing out some kind of b or fourth wave triangle. We need that final thrust up out of it followed by a sharp reversal to signal we are done. Hopefully we get it by session end….tick…tick..tick…

Ooops! I completely forgot about OpEx.

Chances are they are going to run out the clock with not much happening before session end, with the move out of the triangle happening on Monday. Oh well…could be a boring rest of the day folk. I think I will go make myself useful elsewhere! 🙂

ha ha.. most 4get about the 3rd week/friday of each month

https://www.theocc.com/components/docs/about/publications/xcal2018.pdf

I did also today. going to be a zzzzz rest of day.

now just stalking some stocks & doing some calculations.

Who blinks first? ES staying in high end of congestion… ready to break out to upside… or is the monkey getting tired of hanging up there??

Go pry those monkey fingers loose will ya? 🙂

Love to !! :O

SPY trying to push up out of narrow BB on 3min

crude math on $SPX

yesterday’s Day high 2805.83 – day low (2792.56)

= 13.27 (x 1.27 / 1.618) + yesterday’s close 2798.03

= 2811.30 — great to keep it close to the 2810 most have targeted for.

or

2819.59 [ 1.27 ]

or just close where it opened @ 2,805.08 / the morning’s high of 2,806.32

or… just nose-dive 😉

am watching SPLV for direction

yesterday $OEX made ANOTHER NEW 52wk high of 1245.04

missing a day — OEX made its latest 52wk high on Wed Jan 17, 2018 — NOT yesterday.

am multi-tasking & not paying attention

https://invst.ly/6e67a

Wow! Flanagan is unabashedly bullish! He compares this market to the 1955-1959 market cycle and is convinced that bull has lots more room to run. He predicts a “mild” correction with a continuation of the march higher. This would probably in keeping with counts that see us topping a some kind of third wave with a fifth still to come after a corrective fourth wave. The one huge difference is as emily noted, he only expects the correction to be around 4%, far less than one would expect for a fourth wave of this degree. Yikes!

O.K. There we have it. New highs all around. My expectation is that the reversal should be sharp. If not, I am simply WRONG in my expectations and we only completed a wave one of the final five up. Can you believe this market??!! 🙂

will it “overthrow” the ED pattern?……..more than likely – yes…….https://invst.ly/6e6bf

Looks like DJI diverging….

Yes, ED triangle getting close to apex on highs, VXX just went above symmetrical triangle… Verne? Luri?

and just as expected………”the overthrow”……

https://invst.ly/6e6pp

TSLA wave 3 of 5 up getting ready to launch on the weekly. Should bring new highs at some point. All this is my opinion.

A move of VIX into green territory before the close and I am fully short…

DJI 15 minute chart sure looking like sort of diagonal down under way. If so that means it is now in a second wave and should fall off a cliff next…

In my humble opinion, if we were going to get a turn prior to the close that was of any significance we would be seeing it in the futures market. There is no such evidence it seems to me. Unless we get a dramatic change prior to the close, it would appear that Mr. Market is not yet done. Are we surprised? 🙂

Have a great week-end everyone.

PS The shutdown is all “sound and fury”. The departments will simply make use of “carry forward” funds to keep things going while the Demoncrats have their little tantrum! 🙂

verne,

the alt count……………….https://invst.ly/6e6ut

Aha! That would ‘splain a thing or two! I like it! 🙂

When you don’t follow EW you end up making stuff up like this.

US stocks will likely run higher for another 11 years, Wall Street’s Tom Lee says

https://www.cnbc.com/2018/01/19/us-stocks-will-likely-run-higher-for-another-11-years.html

That is not my comment above as should be obvious from what would be self deprecation but I know what cocky little guy it sounds like… 🙂

Actually, it appears he was talking about Peter T, and it’s exactly the kind of bullish BS you would expect from a cocky self indulgent perma-bull… I wasn’t posting in 2015…

This person was silly enough to think we would not know the difference?

Figures! 🙂

By the way “real” Peter G, you are a far more gracious man than I. While I realize that post “could” have been made in error with the fictitious attribution, I seriously doubt it and it represent the height of disrespect in my view.

Ah, I missed the alleged ‘Peter G’ comment. I guess it’s deleted now.

Yep. Peter got right on it and probably blocked the IP. My guess is he moved to another device to impersonate yet another poster. Not cool.

I got a few hours last night and this morning to rebuild my site in a different location and found out (as I thought, and against what I’ve been told) that the problem lies in the core wordpress files. If I replace them with a brand new install, the problem of addresses showing up in the comments log in area goes away. So obviously, something’s become corrected in the core files.

I will need to shut down the site tonight so that I can rebuild it with new core files. It should only be down for a couple of hours (if I know what I’m doing … lol).

I’m also going to require logins, which is better for everyone here, as it means that once you’re logged in, you can comment at will without having to fill in your info each time. I may or may not get that part done this weekend. The immediate priority is to fix the underlying leaking information problem.

My you are such a gentleman!

Rather than “indulgent”, and “perma-bull”, the descriptor:

“CRETINOUS”, is far more apt for this sort of behavior. 🙂

SPY 280 strike calls expiring today fetched a bid of 0.53 at the close with SPY at 280.39

This is highly unusual as you very rarely see any premium on option contracts AT expiration. As a matter of fact, it is quite normal to see bids BELOW intrinsic value of the contract.

Bottom line? Very bullish.

Market makers expect SPY to be higher next week and were willing to pay holders of these contracts a premium to avoid have to make delivery on SPY shares tomorrow. We shall see!

ok,

overthrow of the ES ……ED pattern did occur…………..verne i was one week early – now we watch for ………….”limit down Monday”……………………………….. !https://invst.ly/6e79j

luri,

May have an ED, but I don’t think that’s it. We may have ended today at the top of the third wave of the ED, which means one more down and one more up.

as in the following https://invst.ly/6ebte

………….yes this could be , although the RUT is done [it seems] with a 1 down and an A/B/C up in a deep second wave……………………….??

rotrot

January 19, 2018, 5:32 pm

NOT ME…SOMEONE HAS HIJACKED THE BLOG!

I think Peter should close the public comments. If one wishes to post you need to log-in into Peter’s site.

He can simply block the IPs used by the troll.

So the US government is closed – for the second time in what? 3 years?.

Last couple of years the FED and China were the largest buyers of treasuries, But the FED isn’t buying anymore. Instead they are working hard on selling their treasury holdings. It seems China is also rethinking it’s position.

So even if they manage to strike a deal on raising the debt level, the question is : who is willing to keep funding the US government? If nobody wants to buy treasuries, raising the debt level won’t help. Millions of Americans living on foodstamps. Who will issue the food stamps when everybody is sent home? And when no stamps are issued, Wallmart will see a signifcant decline in revenue etc. etc.

Things are looking nasty and this confirms Peter’s analysis. Things are brewing. Early next week (monday/tuesday) markets will turn down.

A major cycle was 9 times 360 days/degrees from 2009 low. This gave 1/18. This should have been the high. As ussual the maket inverted and prices went up. 1/22-23 should be the final trun window. And then we will be down. At least into 2023 but 2027 or 2032 are also possibilities. We’ll see.

Watch early next week.

André

https://worldcyclesinstitute.com/a-pending-top/comment-page-2/#comment-26249

Oops,

Seems this is 18th time since 1976 the government shuts down. 18 is 9 times 2…..

I had been keeping an open mind to the possibility of a third wave top. I must say the absolute unanimity in the chorus of bullish voices is now giving me pause. People are not only bullish, they are militantly so. For any informed and objective observer, this has to be a huge red flag.

Peter G,

Could you share where the S&P is in relation to the chart you posted earlier this week? I have been traveling and noticed you S&P Chart accompanied by your NYAD Chart.

It looks to me that the AD line is “not” confirming these new highs. Is that assessment correct in your view? If that is true then you and Peter T seem to

be on the same page.

Your wish is my command, Ed. 🙂

Chart is through Friday close. Click on it to make it full page.

On Monday (I’m anticipating your next question 🙂 ), the upper channel will be at 2814.20 and is rising at the rate of 1.69 points/trading day.

The second chart is the daily a-d of NYSE, just very short term to show there have been two small negative divergences at the last two closing all-time highs on SPX.

https://imgur.com/a/PdsKG

I recently posted that Robert McHugh changed his expectations of market price owing to the recent tax cut which he expected to boost earnings some 40% and send stock prices higher, and that this in turn would affect his interpretation of the EW count. Joe at the time opined that anyone who permitted external events so affect his wave count was not a true Elliottician and I thought his comment quite interesting. One could reason, after all, that it would be illogical ignore events that could have a direct impact on the price of equities and earnings would certainly have to be considered among them. One could further invoke the EW principle of herd sentiment and argue that the euphoria that issued from the tax cuts, justifiable or not, would certainly argue for continued bullishness. I have been thinking long and hard about the historical extremes we are seeing in markets today, many of them absolutely unprecedented, and the virtually without exception, consensus that this bull still has quite a ways to run, a mild correction yes, but that we are nowhere close to a top. Peter T. is now truly a voice in the wilderness.

There is an article on zero hedge this weekend that is calling into question the vast consensus of all the talking heads regarding the salutary effect these tax cuts are supposed to have on the economy via a general boost of the earnings of companies. It was a real eye-opener.

Without going into any details about the article’s argument, it got me thinking about how it is entirely possible, in fact even probable, that the consensus expectation of the crowd could simply be wrong. I immediately thought about what Joe has said about EW theory and suddenly got a bit more insight into what he was implying.

Back to the matter of extremes. I will admit that my own fear of what I see as a very dangerous market environment so far has not been justified. The market has gone virtually straight up and those of a bullish perspective have clearly been on the right side of the trade, and bears have been wrong.

Having said that, just because as someone pointed out, that the market can remain irrational longer than traders can remain solvent, does not imply abrogation of the mean reversion principle. Things have become so giddy that there are actually some folk who are arguing just that!

What interests me now more that anything, is not primarily WHEN this market is going to revert, but HOW.

I have been contending that size of the current extremes militate against any kind of orderly regression. We know the basic reality of regression being constrained by size of the displacement as well as time, that is, you can regress via a measured displacement over a longer time period, or a massive one over a shorter time period.

Let us assume at the very least markets are going to revisit the 200 day moving average for a “normal and customary” regression at some point. Considering the distance we are now trading from those pivots, a high displacement, short time span regression, which is entirely possible, is going to be catastrophic. You can be sure that all time highs in prices, ALSO mean all time highs in leverage. The longer the deviation from the mean, the more violent the ultimate return, and not infrequently with a corollary of not merely regression TO the mean but THROUGH it. It is my firm contention that we do not need to get ANYWHERE NEAR the 200 day simple moving average to force a massive unwind of this freakishly leveraged market, to say nothing of the compounding real and synthetic short volatility trade. Where I ask you, is the FEAR??!!

Verne,

Your most recent comment got deleted because I switched versions of the site a few moments ago, nothing personal.

🙂 Still working on this bug that doesn’t seem to have been quashed.

“Still working on this bug that doesn’t seem to have been quashed.”

I am now seeing MY name and address, and not the last respondents.

S&P 500 The longterm stays a LOW end march. But be careful i cannot confirm it. The short term is:

Monday open – down to Wednesday open then up to Fridays close. On Friday we start a decline into Tuesday’s LOW. The start can be before closing.

If we get an agreement in the US goverment the S&P 500 can go up and that can make a mash of this prediction.

Sweet lake city

Holland

Gov’t shutdown = RUSE

NOT going to affect ESSENTIAL services.

Gov’t shutdown is like when politicians make a big issue when yearly BUDGET talk is on. you’d think that Gov’t has NOOOOO money @ all — yet take in TRILLIONS of $$$ and give out for budget some millions/billions. its all photo shoots – posing for the dumb & dumber public who are too damn lazy to figure out on how they being hoodwinked.

the Republicans have 51 in senate — they need 60 for this stupid gov’t vote that all MSM keep pointing fingers @ each party– mostly the Republican Party. they ALL BULLSHITTERS. beginning to think 99% of people are just plain brain dead.

anyhow FOMC is on Tues Jan 30 & Wed Jan 31 — where FULL moon is on 😉

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

just watching my usual indicators for markets

SPLV

3 amigos –> FVX – TNX – TYX

BPSPX

TICK

TRIN

ICJ

JCJ

oh yea.. for the bleeding hearts — the phonies aka snowflakes — (illegal)immigration is NOT simulation its OCCUPATION. so yea.. USA’s going down the shithole. over 330 million people & you guys want more slaves to clean your million-billion $ houses ?

good luck you hypocrites.

lol.. NOT simulation — meant ASSIMILATION. starting to shut off so-called news stations and many sites. feel I’ve outgrown them all.

Peter G,

Thank you for Responding! You definitely anticipated my next question! I guess we really need a weekly A/D line divergence like in 2000. Anxious to see what happens.

All my years of trading and investing makes me feel we are close.

A new post is live at: https://worldcyclesinstitute.com/the-daily-vigil-focus-on-the-us-dollar/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.