Looking for the Trigger

Look no further than the US Dollar.

I’ve been maintaining for the last couple of years that once the US Dollar found its low (it’s in a large fourth wave—a corrective wave), that it would mark the top of the US market.

As per my graphic above, it seems like this bull market will never end, but we’re extremely close and it could fall over any time.

Above is the daily chart of UUP (US Dollar ETF). UUP is representative of the structure of DXY (the US index) and will provide an excellent predictor of the impending top in currency pairs and the US indices.

On Friday, the US Dollar began to trace out what looks like a small fourth wave. I’m looking for a bit more upside on this before it drops to my target of 23.40, or so. This target represents a measurement of the length of blue wave one near the top of the chart and extending it 2.618 times that length. It’s a likely stopping point for this blue wave (4).

The turn up will eventually lead to a new high. The dollar will turn with the euro, which is at a new high, and very close to my long term target.

Now, with the US dollar at the obvious end of a fifth wave of a corrective fourth wave (blue circle 4 on the chart), for those who think there’s another wave 4 and 5 to go, where is it they expect the dollar to go? You only get 5 waves before a trend change. The counts are all in the fifth waves.

The movement of the dollar strongly influences the movement of just about everything else, so it’s important to pay attention to what it’s doing on a large scale.

___________________________

DAX is now virtually at a new high (a potential double top). AAPL is at the top of a small ending diagonal, at the top of a fifth wave. EURUSD and GBPUSD are extremely close to my long-term targets, the 38%, 4th wave retrace level. AUDUSD and USDCAD appear to have turned (with first waves arguably already in place). Oil is topping, or has topped already. Gold and silver are heading down with USDJPY. The VIX has also foreshadowing trouble on the horizon. We’re all set—we just need the trigger.

Note that TSLA (yes, Mr. Musk’s baby, below) is sitting right at the 62% retrace level (352.60) after a corrective 3 waves up. Look for a turn down here, as I’ve been predicting. This highly speculative house of cards is foreshadowing our upcoming major bear market.

In summary, everything is at an inflection point, or very close to a turn, but a little more patience is warranted.

Bitcoin: here’s my take.

All The Same Market

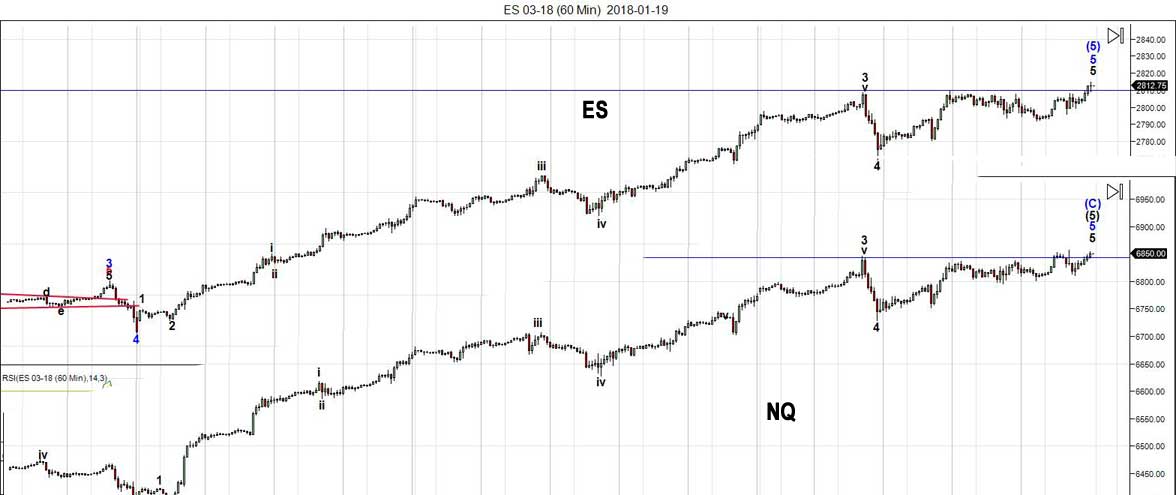

Above is the hourly chart of NQ (Nasdaq emini futures) superimposed over the same timeframe chart of ES (SP500 emini futures). For over a year, I’ve been talking about all assets classes moving more and more as one as we strive to reach the final high.

Here’s an example of how tightly aligned the two major exchanges that constitute the US equities market actually are. This is the first time I’ve seen the Nasdaq and SP500 move in absolute lock-step. We’re seeing the final stages of this rally, as all assets move to a final high.

To a lesser degree, you can find the same phenomenon across all major asset classes. There’s a very small gap now between their ultimate targets and present positions … right across the board.

The vigil continues.

______________________________

Tesla at the Target

Above is the 2 day chart of Tesla.

Tesla sits at the 62% retrace target as we wait for the turn. Blue wave 2 is corrective and we’ve completed a double top. The next move should be down.

Last week, I suggested we’d head up in a “double-pronged” second wave, which is exactly what we’ve done. We’re getting ready for a turn down into a third wave.

__________________________

Changes to the Free Blog

This weekend, I rebuilt the site, replacing all the WordPress core files in an attempt to quash the free blog. After spending almost all night at it, it doesn’t seem to have had an affect. I will therefore move forward to requiring all commenters to log in, starting sometime early this week (it will take some time to get this up).

This will provide much more control over transient bloggers and protect all names and email addresses. It will also mean that once you’re logged in, you can comment at will, without having to include your name and email each time. I should have this in place in the early part of this week.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

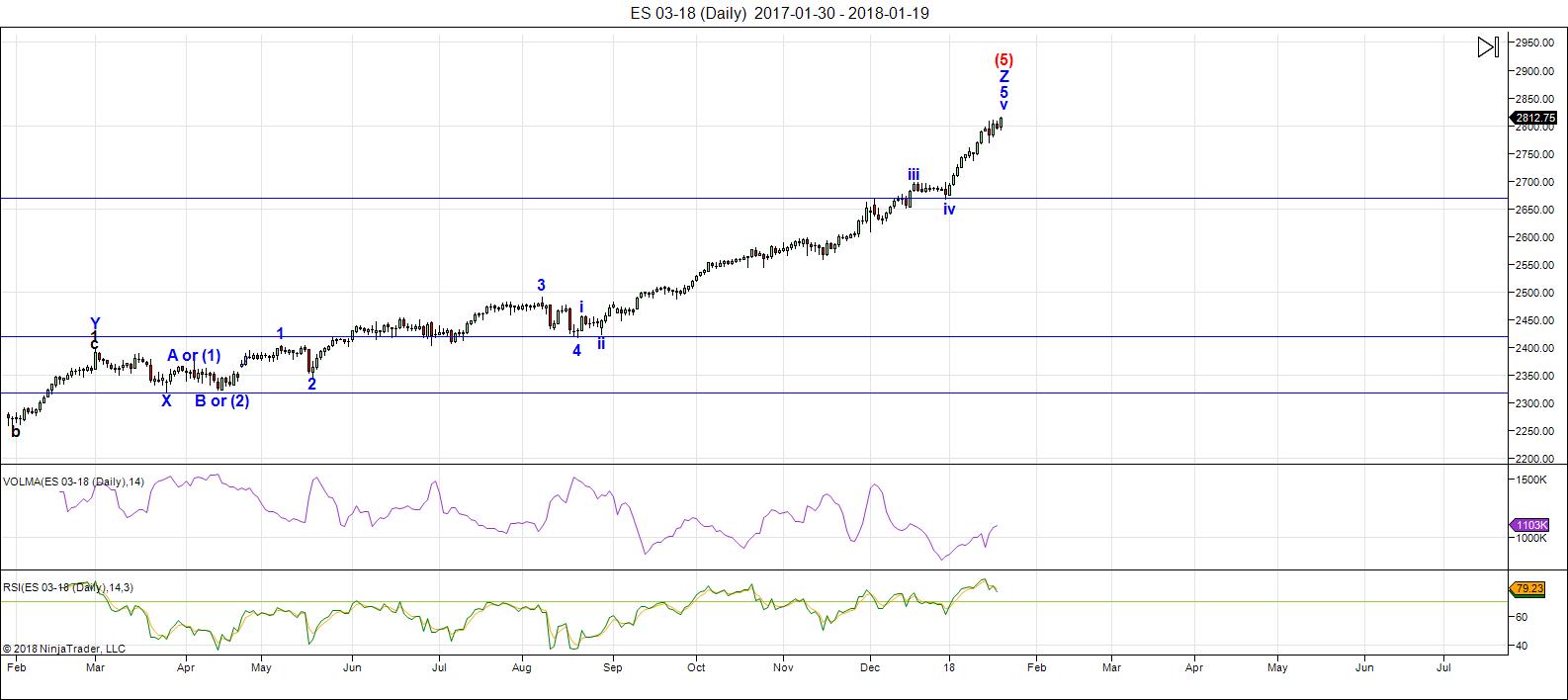

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down imminently. But, we may end up with a double top, so the first turn might not be the final one.

Another frustrating week as the US Dollar tries to find its bottom. As a result, virtually everything has inched a little bit higher in yet another subwave of the 5th wave.

Bearish financial advisors dropped to 12.7% this past week, the lowest level in 31 years. In other words, the bulk of them have given up and decided to go long—a perfect scenario for a turn. "Everybody's in!"

We're ultimately looking for an impulsive wave down in the US indices (and a double top beforehand would be a very nice predictor). Again, we may get a double top so the first move down will be important to watch for clues as to whether it's permanent, or not.

There will be tons of time to react; after all, this bear market will last years. So, while I expect the US market to start down this week, I would not be at all surprised to see a test of the final highs before heading down in earnest.

Volume: It's dismal. Its the purple line, the top indicator at the bottom of the chart.

Summary: The count is full for the US market in general, except for small subwaves that form the balance of a motive set of waves in SPX and some other major US indices. We're watching for a turn, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, February 1 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Any questions??!……I didn’t think so! 😀

O.K. people, listen up. If they buy back the cash session and futures continue to tank… DONT BE A SUCKER!!!! CAPISCE?!

Have a great day!

Peter’s Chart Show today should be a lot of fun!!! 🙂

haha … perhaps a work in progress! Exciting, nonetheless.

We do have daily bullish MACD divergence on that last UUP low…

A sudden turn for the US Dollar …

Dollar Surges After Trump Says “Mnuchin Was Misinterpreted, Dollar Will Get Stronger”

Trump had nothing to do with it….

who said he did?

Why post it if it is irrelevant?

who said it is irrelevant?

I did. If Trump had nothing to do with it, it is!

Thks. (my developer seems to have removed my emojis … another thing to add to my list …)

ES update………….https://invst.ly/6g0ac

aaaaannnnd – the dxy

https://invst.ly/6g0ej

I like that chart although I would have my lower parallel trend line intersecting your wave iii

Great charts. I expect big gaps up in VIX and UUP still ahead of we only completed a third wave today.

ben,

you have missed the nuances of my charting…………………….the lower trendline is exactly where it should be.

it captures the low of wave 1.

w3 was an overthrow of the trendline – typical behaviour of a w3.

today’s overthrow is potentially “also” a subwave 3, so the overthrow is acceptable.

notice the price level for today’s DXY candle. it overthrew the trendline, and it crawled back …………”into”………………… that very same trendline.

this shows me that the trendline is in the correct spot. it is also triangulated with the “dotted” lower trend.

once a trendline is established………..i would rather toss the chart to the rubbish bin of …………”charts”………….. than “adjust” trendlines………….

https://invst.ly/6g2lb

ben,

so you can see the “genisis” of the lower dotted line

https://invst.ly/6g2mt

Thanks

Thanks to Peter T. for patiently pointing out to us formerly clueless ones the central role USD plays in the movement of markets. Frankly, it was something I had never considered or heard anyone else allude to and that reality has really changed the way, for the better I might add, the way I have been looking at the markets. 🙂

Boo-Yah!

Volume on UUP today absolutely massive.

You couldn’t get a more spectacular capitulation! 🙂

But is it the bottom or just the end of (3) of 5?

I guess we will see! 🙂

The chart attached is real reason for the 2 dips today

it’s all about energy spike downs not the news or earnings etc.

but the FED’s manipulate the market by ramping up the US dollar vs Yen

to keep the drops from getting out of control

it’s all about control folks

they can’t stop the energy spike downs they can only try and control it’s impact

the giant spike up today right at the point of the afternoon spike down

was a beautiful example of how this manipulation happen each day

https://ibb.co/jvHkKG

I meant to say the spike up in the US dollar

verne

my comments on the dollar are valid .

unless it goes above the jan 2017 high which

would label that high as a B wave of an expanded flat

the trend is down .

I see no other way to count it .

im looking at the monthly chart , not a daily or weekly .

i also see that potential developing triangle in the ES

on a 60 minute chart

if it is a true triangle it goes back above 2847.75

and comes back to near present levels

2836.86 is the .618 retrace and would be the ideal spot

for wave E .

i see wave A B C so would expect the rise as point D

and the wave E drop could be monday .

i do have a problem with a bullish move at this time

yet i wont argue the wave count.

Jan 26-feb 2 is becoming a line in the sand of sorts for me

yet march 1st is it in my big picture.

any new highs following march tells me something is wrong

with being bearish .

tomorrow is where this timing cycle begins ,

we will see what the market does .

despite the deep drop in the dollar it still has not hit

its monthly wave count target .

verne

i have been a dollar bull for ever

yet i cannot ignore the 5 waves down

on the monthly chart

ES = triangle.

https://invst.ly/6g2hf

luri

that chart makes sense 🙂

A few things Joe.

I am not sure why Peter T has what he has labelled as a fourth wave down as a five instead of a three, so as currently labelled he has an impulse down for his larger wave four instead of a corrective three.

I take it from your argument that you consider the Jan 17 USD top as fifth wave and not as a three is Peter T has labeled the UUP chart. I am not sure how you see it in relation to the 2008 top.

Personally I have not looked very closely at a long term chart of USD so I cannot state with any confidence what degree the current wave is that we are seeing.

My position on a deflationary depression ahead with a rising dollar remains firm. Ordinarily even if we had a corrective wave in USD ahead, which is your position, it could take the form of an expanded flat reaching to new highs so that would not necessarily negate your long term bearish view of the dollar and viewpoints would not necessarily be mutually exclusive it seems to me. However, if you think this is the first wave down of a new developing impulse clearly the dollar cannot exceed the Jan 17 high as that would invalidate your wave count.

Finally, I also measured the dollar’s move down today and it perfectly met the measured move from a small H&S formation.

Bottom line?

The dollar goes higher from here and I expect it eventually to take out the Jan 17 high. We cannot both be right about that so I guess price will have to decide! 🙂

Luri

i zoomed in your chart

https://imgur.com/6vKTHGb

thanks joe…………………… by all means………..zoom away…………….it is my privilege when you zoom…………………. i learn so much when i study your charts…..

Best guess on weekly us dollar index

Keep in mind there is a cycle low due in early april .

the mid march wave 5 low is just a what if this becomes

a clean weekly wave 5.

the monthly chart has 5 down yet ideally needs lower prices

the weekly chart is not a completed wave .

https://imgur.com/auwtrib

Is this an elliot only site?

No.

Verne

i have posted on here several times that i only watch currencies from a distance.

i do not trade them so my view is the larger picture . if that jan 2017 high was a B

wave of an expanded flat then yes new highs in a 5th wave .

here is my wave count on a monthly chart going back to 2001.

i updated it on at major turns so don’t think i watch it all that closely .

i look at it usually about 2 times a month .

there is 2 ways to trade this , get long yet anticipate a failure near the .618

retrace . if that fails then re consider the wave count .

or consider the entire move from 2008 over and get short once the wave 2

or B wave completes near that .618 retrace.

you are correct, a break above the jan 2017 high will be the deciding factor.

the indicator on the chart is nowhere near oversold . indicators by themselves

are helpful yet the wave count will always stand on its own despite any indicator.

i have changed my view though so im going to consider this impulse and the 1st

leg down of a longer term trend.

the weekly chart above will need to play out though because if that turns

out to be an incomplete wave despite the month chart it leaves the door open

for alternates which im not going to get into at the moment .

ill look at it again in early april

my long term chart below

https://imgur.com/H2pICvX

Got it! That makes perfect sense as you see that last high as a corrective abc in a down trend. Thanks for the chart. I am atrocious at correctly counting waves!

Advanced Astro Indicator – July 2017

https://tinyurl.com/y8m8hqg6

obviously inverted…could the current time frame mark a top of significance?

Verne

i have no argument with peters wave count .

he shows a 3 wave move up to that jan high

i have a monthly chart that also shows that 3 wave move

The only difference i have allowed for is the prior wave

from 2001 to 2008 as a 5 wave move .

in order to really narrow this wave count down on a long

term time scale i would need more data going back many

decades . so ill deal with that in the future .

my count shorter term matches peter .

our difference is im going to allow for a failure yet if that jan 2017

high in the us dollar is exceeded it invalidates the count plane and simple.

for now ill stick to the monthly chart as well as the weekly .

keep in mind mid feb and possible march 1st and early april

as that time frame correlates to my stock market cycles and the dollar

does fit into this .

nothing else to say other than its a long term view to consider.

Joe

Joe, thanks for the USD chart. Using EW, your count is just as good as anyone else out there because as long as someone is following the basic rules of EW when making a count, interpretation of market direction and personal bias lead 2 different people in 2 directly opposite paths. This is the enormous flaw in using EW and it leads some people in making “predictions” of future prices instead of “reacting” to what price is doing. That is why you can get 5 people in a room and all can follow EW rules, yet they all can come up with a different count. For myself, I will look at wave counts (as well as many other things) to try to get a general macro idea but I leave it at that. My entries and exits are based on price alone and I have learned (the hard way) to block out opinions and predictions. Also I have set rules regarding position size, risk management, etc. and a system to try and keep my opinion and biases out of the way. In reading your posts you seem to have a lot more than EW to make your decisions and seem to really do your research. A lot of different ways to trade for people, just have to find the one that fits the best. Thanks for your contributions.

True. I have never before seen anyone label a third wave in threes so I know there are some things I don’t understand about Peter’s approach. I was under the impression that third waves unfolded in fives, not threes.

They do. His EW interpretation is a little “different”. 🙂

Rotrot

not sure you remember me jumping up and down about an august 2017

top. i did change my mind yet i can relate to that chart your showing.

thanks for the post.

im on the same page as you.

we will find out soon enough

Verne January 25, 2018, 6:52 pm

Got it! That makes perfect sense as you see that last high as a corrective abc in a down trend. Thanks for the chart. I am atrocious at correctly counting waves!

——————–

right or wrong that’s what i see.

Thank you

well… today $SPLV made a NEW 52wk H of 48.875 .. & tomorrow’s DeMark levels are:

R1 = 49.0215

P – 48.7993

S1 = 48.7235

SPX

R1 = 2843.905

P 2837.4225

S1 = 2826.285

I swear by DeMark daily levels. today SPLV was strong — so knew damn well — SPX wasn’t going to dive much. hung between R1 & S1

https://www.barchart.com/stocks/quotes/$SPX/cheat-sheet

oh yea… and 2 of the 3 amigos — $FVX $TNX made ANOTHER NEW 52wk HIGHS & also $BPSPX — unchanged — still @ 82.80 .. also $BPNDX unchanged @ 82 — but $NDX : $VXN changed ..down 7.58 @ 378.98 — just more volatility

$VIX : $VXV closed @ < 0.91 @ 0.8465 .. the one I keep track of is $VVIX 1st — rest of VIX'en familia come 2nd, 3rd, etc.

Super Blue Moon – Jan 31, 2018 — like Jan 1/2 — figure we might end up seeing 2900 — maybe the fibonacci level of 2923 by feb. 2nd. Jan 31, 2018 — will also be a LUNAR eclipse. and yea.. know many expecting crash when LUNAR eclipse — butttt –normally a SOLAR eclipse comes 1st B4 a LUNAR eclipse for the best "crash". in this case its the LUNAR 1st and then SOLAR

https://www.timeanddate.com/eclipse/2018

Jan 30 – 31 also FOMC day — think rate hike already factored in.

watch $IRX & $SRVIX indicators

am just winging it tonight…so am all over the place. been a long day

4got to add this astrologer — most likely most of you are aware of him ? am on his freebie email list. he’s expecting a considerable correction MAYBE … NEXT week.

http://rajeevprakash.com/significant-correction-due/

for Gold — these are the FIBONACCI levels I got

1438.40

1370.50

1302.60

1234.70

1190.60

when gold’s UP — Bitcoin’s down & vice -versa

as to OIL ? don’t really know but 67. being resistance ? then comes 74 area. if not we see 59 / 55 area.

UUP — guess many know it made today a NEW 52wk low of 23.08 & DXY made a NEW 52wk low of 89.16 b4 ‘recovering’.

I don’t follow news at all.. just price action and fibonacci along w/my indicators, etc.

‘night

Emily

you are correct about the Solar eclipse before Lunar.

Check out august 2017 though ( very much the opposite )

also previous merc retrogrades.

During the year 2018, Mercury goes retrograde for three times as below:

My note added ( add 10 days to the dates = early april swing )

• March 22 – April 15, 2018 In the fire-sign of Aries.

• July 25 – August 18, 2018 In the fire-sign of Leo.

• November 16 – December 06, 2018 From the fire-sign of Sagittarius to the water-sign of Scorpio.

I like those dates you got, Joe ! 🙂 I feel March 21st (GANN New Year’s Day) — around that date will see the 3% correction. that’s MY take. rest – consider minor (for now).

are you familiar w/Gabby’s site ? https://astrologyandthemarkets.blogspot.ca

also Christ Corolan’s work ? https://twitter.com/spiralcal

there are others .

thanks for the dates, Joe !

ES ……in a triangle………overnight …..action………………..it hit that “D” wave trendline perfectly……………………….no adjustments needed…….https://invst.ly/6g8vq

“Ben”………….for the public record……i will adjust the trendlines to a triangle, because there is no humanly way to “pre – establish” perfect triangle trendlines..

Some folk may think the discussion Joe and I are having over the dollar’s fate is entirely academic but nothing could be farther from the truth. What you expect from the dollar will probably exert a huge influence of how you position your long term portfolio, and wittingly or unwittingly, you are either in the inflation or deflation camp. Those of us expecting a crushing deflationary cycle ahead are of that opinion owing to the gargantuan size of global debt, now probably many multiples of global GDP. One only has to look right here at home at the fiscal state of the US, corporate and government. Most of that debt will never be repaid. It is not possible. If you accept that premise, and fair enough if you do not, then you must grant the the debt will be defaulted on. One example that quickly comes to mind is the state of the fracking industry, with over 300 billion of bonds outstanding. This industry was not profitable when oil was 100.00 per barrel. Does anyone think it is now profitable with oil at 60.00? It does not matter where those bonds are now trading, their true value is zero. It is only a matter of time. When governments and corporations default on their debt, this results in destruction of the currency in which the debt is denominated. That amount of the currency literally vanishes! The notion that the debt has a commensurate counterpart in the form of some kind of asset is BS. In the case of government it is taxing power, and we know revenues evaporate during recessionary times. In the case of corporations it is stock value which is linked to earnings and they have the exact same problem in an economic downturn. Unless you are prepared to argue that central banks have managed to abolish the business cycle, it is impossible to avoid the conclusion that massive defaults are coming. Look at Detroit. Look at Illinois, particularly Chicago and the miserable state of CPS. Look at California and the CALPERS retirement fund, billions in the hole, even if you trust their ridiculous and lying stated rates of return. Folk, this thing is a monstrous catastrophe waiting to unfold, and believe me, it will. I am not even going to talk about the leverage and duplicity of central banks buying of equities to freakishly distort capital ratios and allow companies to borrow insane amounts of money to buy back their shares when they are the most expensive they have ever been. But you get the picture.

I certainly agree that inflation is eventually coming, with the result that what remain of dollar value will shrink to a fraction of what it is today. No question. But the thing that will usher in that era is a massive deflationary depression and I do not see how that can be avoided.

I am truly interested in hearing what others on the forum think about this debate, and would love to hear your perspective. Thanks!

.

I’ve thought exactly that for a few years, Verne…

Thought 2015 (my last “good” year trading) was the beginning of the “turn”, and said, “Finally!, some semblance of reality will return to markets..”

Took me an embarrassingly long time (and much lost money/opportunity) to eventually realize that CB’s are determined to not let that happen…

I believe you’re 100% correct in what you just wrote, but until (for me) a couple of trend signals fire short, fighting CB’s is a less-than-worthless endeavor….

They know if they ~ever~ stop buying/supporting markets, It’s. Over….

Even as fewer and fewer people see value in the market (my theory as to why volume continues lower over time), momentum reigns, CB’s have no incentive to stop doing what they do…..at any price….

They can print forever (doing whatever it takes), so they do…..

The alternative is unthinkable…

So, until it blows up, they keep going. ~Can’t~ stop, ~won’t~ stop….

Market gaps up open every day… At this point, seems that opening lower for even ONE day strikes fear in CB’s….

So yeah, (in my eyes) it’s Just. That. Close. to blowing up….

And that’s why I come to this site… Peter’s is the only one (I know of) that’s talking about the peak of a 500 year cycle, which makes some sense to me, because, if CB’s are ~this~ afraid to stop supporting markets, every day, still, after all these years……..one mis-step and how can anything OTHER than a crash occur, destroying ALL of the liquidity/free money sloshing around?

Which means huge deflation, and stronger demand for fewer and fewer dollars…….UNTIL the Mother-of-All reflation occurs…..

Which pretty much ought to destroy everything left….

!%&#%^*# Central Bankers…. Soooo determined to avoid normal corrections, and normal business cycles, they’re gonna wind-up burning it allll down….

And they will….

(just re-read what I wrote… Wow… Too much coffee this morning… :-/ )

…………ok…………………….. i confess…………… i DO wear white pants “POST” labor day!

laugh as you will ………….although ……”if you prick me, do i not bleed?” [fomc meeting march 2014 – janet yellen] :-))

here is my “white” pants post labor day DXY monthly……………. [ps…..remember the “prick” comment above]…………….https://invst.ly/6gah0

Dow, ES and SPX all look to be topping right now.. A violent turn should happen if correct..

Been hearing that for months and months, even years. It will top when it tops. In the meantime, fortunes have been made following the trend, not fighting it. And stops are continually moved up in a conservative way to protect gains.

One thing NO ONE can argue is Time Frame Continuity. SPX,DJX,QQQ and IWM all just went inside 60. So there is only 2 things that can happen from here. One final little push or the fix is in and Kaboom 😉

Sure Ok. You might want to lay off the sauce during market hours.

Your remarks are totally uncalled for and unprofessional buddy. Us that contribute to this blog are very serious about what we do and call what we see in order to help one another. If you don’t like it please take your snide remark’s somewhere else. Thx

He makes a good point Ben. Peter’s site and one other is the only place i post these days because both hosts maintain some semblance of civility.

I think we can have lively discussions from different points of view without ever resorting to ad hominem attacks.

hmmm……..https://invst.ly/6gbaw

yes………………i get it……………the whole “wolf” thing……………… cryin’ and all that…..

ok………………get over it…………………… “BE WARNED”!

https://invst.ly/6gbj8

https://worldcyclesinstitute.com/the-daily-vigil-focus-on-the-us-dollar/comment-page-2/#comment-27062

Blake Morrow is another business associate of Dale Pinkert’s…Morrow is considered a guru among currency traders…

https://twitter.com/PipCzar/status/956926797383266304

yes………………… i rejiggered the dark red channel……………. i blame it on my ……”tormented”………….childhood!!

https://invst.ly/6gbmk

I have to give Martin Armstrong his due. In the midst of a correction in the summer of 2011 while the DOW was hovering around the 200 DMA trading around 11,000, he forecast the following 3 levels in the coming years: 1st stop 18,500, if the DOW broke that then 22,000-23,000. If it cleared that then 38,000-40,000. It was very hard to believe even the 18,500 number at the time given we were only 3 years removed from the meltdown in 08-09 much less the even absurd higher levels. Not only did we get to 1st target almost to the tick, but we had a several month stall and correction there. Of course the market blew right through the 2nd level. Pretty good I would say. Currently he sees major resistance at the 27,500-28,000 level where odds are the market finally corrects for a while before the last push up to 40,000. So far, he has been dead on. Pretty amazing the reasons he has explained why this is happening. Has nothing to do with conventional market wisdom. He is also calling for a blast off in the US$ to as high as 140-160 over the next 3-4 years. World capital flows will hide in the $ and liquid blue chips while everything else is melting down.

ben,

so…………..”martin” is also calling for the “blow up” of the treasury market……. can you please tell me………….”HOW” is it possible for the treasury [bond] market to blow up – BUT the US Dollar is bid to new highs??? bear in mind, we are in a new world of the petro yuan and soon to be petro ruble??? was THAT predicted by martin in 2011???……………………………..

I think what you are referring to as the treasury market blowing up is rising interest rates? If so, yes he is predicting the bull market in treasuries that began in early 1980’s is ending after a 35 year run. Seems reasonable to me. As for the question of did he predict the petro yuan or ruble – not that I am aware of.

Ben…cherry picking Armstrong’s commentary is a bit disingenuous…on January 1, 2018, what did Armstrong offer as his expectations for 2018, specifically the “first half of 2018”? Further, when is the “no sooner than” time target for the 40,000 level?

Cherry picking? lol. Just pointing out what (so far) has been an amazing call., especially after just finishing a monumental meltdown. Does it offend you that someone would point out an unbelievable call? Have no idea what you are referring to “no sooner than” time target. You’ll have to clarify

Armstrong has stated that the 40,000 target could not occur prior to a specific time frame…”no sooner than” are the words used by Armstrong that is why they are in quotes…on January 1, 2018, what did Armstrong offer as his expectations for 2018, specifically the “first half of 2018”?

Have no idea. Maybe you should contact him. You might learn something.

“Have no idea.” We already knew that!

Let me be a little more clear. I have no idea what he said on Jan. 1 2018. Since that date or what he said that day is so important to you, I simply said why don’t you give him a call and ask him. It’s obvious me giving Armstrong a compliment got under your skin a little. Too funny

“It’s obvious me”…as you previously noted, you “Have no idea”…I know full well what Armstrong has previously forecasted and what he is currently forecasting…you should consider your own suggestions…”Maybe you should contact him. You might learn something.”

Poor rotrot. Someone gives Armstrong a compliment and he got his feelings hurt. lol. What did Armstrong do to you rotrot? You been mad at him for a long time?

it isn’t about Armstrong…it’s about knuckleheads claiming to know something when in fact they “Have no idea”!

I’ve got an “idea” roTWAT. GFY 🙂

prima facie evidence you are a knucklehead…LOL!

The skyward march certainly does seem interminable. I think we knew what to expect today today based on my oft repeated mantra about futures being the coal mine canary. The fact of the matter is these sideways consolidations for many months now have been quite consistent in presaging additional upward movement. I have given up trying to map the wave action as it is giving me a literal headache trying to keep up with all the morphing going on. I am confident we will all recognize the change of trend when it does finally arrive and won’t have squint at sub-micro degree waves! 🙂

verne,

where is the “fun” in that?? the details become the picture……………i mean, sandcastles are really built one grain of sand upon another…………..

Verne, didn’t you know that’s the beauty of EW? You are guaranteed to get to change your count daily! lol

To be perfectly honest with you Ben, at times I have my doubts.

What I can clearly see is a global cohort of central bankers who are intransigent in their determination to flood markets with liquidity world wide. I used to get irritated when dullards would make snide remarks about “conspiracy theories” who by their very comments, display a stunning level of ignorance of what has been happening as regards the destruction of price discovery in equities markets. Even for the ignoramuses, I don’t see how you could have missed all the market anomalies if you were an actual trader, as opposed to a clueless talker. I used to make it a policy to ignore stupid people but I recently wrote an article in which I encouraged naysayers to go to the CME website and search the CBPBP available information. This outlines the so-called Central Banks Preferred Buyers Program. I have had more than a few people contact me and tell me how completely stunned they were by what they discovered. But this it the problem is it not?

I have absolutely no doubt that they are not being fully transparent, even with the mind-boggling information they do reveal. I think the leverage is far more egregious than they admit to, and as everyone knows there is no accounting whatsoever of “dark pools” liability.

The bottom line is we are looking are extremely distorted markets, with enormous hidden risks that have nothing to do with price levels of indices.

I have complete sympathy for analysts relying on metrics that these days have difficulty providing precise guidance for where equities are headed. It would be dishonest to state otherwise. I remain confident in mean regression but that is about it. I have no confidence whatsoever about the form it will take

Agree with you 100%. You are dead on.

Read this after I wrote my note to Verne above, but…..umm….yeah…. Here we are…. “Free” markets……. hahahahahahaha

https://northmantrader.com/2018/01/26/big-little-lies-by-central-bankers/

Sven is taking a lot of grief these days with folk who constantly mock him for pointing out the obvious. As he has sagely pointed out, extreme and overbought markets that continue higher do not become any less so! 🙂

Watching the VIX to confirm the top is in. Should be really really close!

Interesting action among markets, VIX, VXX and XIV… settlements and hedges on this diagonal move up. Small VXX working since am. Hope Ben gets it out of his system instead of beating his boyfriend tonight…

ok…………………ES is extending once again……………….i think there can ONLY be 3 extensions …………..and this would be the third………………….. yikes……

https://invst.ly/6gd4f

saw some comments come down my email. am familiar w/some of your thoughts. but one thing I’ve learnt is that STOCK MARKETS are NOT…THE economy. used to buy into that when I first traded and realized later on — that price action & Fibonacci levels, along w/some indicators (which most state, are laggards…that is indicators).

anyhow — keystone dude tweeted this hours ago re SPX :: https://thekeystonespeculator.blogspot.ca he ain’t bad @ all. many so-called gurus & divas read his blog & then charge traders for this info….many who have been traders for eons & manage OTHER people’s account…which blows my mind that they that stupid to even have that on their twitter bio. I’ve followed many — RT’d them to death — know their DNA inside out…and MAJORITY of them are copycats. you’d be surprised where they get their info from. anyhow who cares. lol

Blake Morrow…someone mentioned ? he used to paddle/peddle Wizetrade software…I bought that one in 2003? something like that. didn’t find it that much helpful. didn’t know about Dale — that they are/were partners… yet have RT’d Dale to death also. guess I was asleep. lol

Food for thought…Just listened to a recent interview of Avi Gilburt, an EW practitioner who has 21,000 followers on Seeking Alpha and 16 analysts working for him. Here are highlights on his views regarding the S&P 500:

* was correct in view on first 9 months of 2017, but expected pullback in Q3

* watching 2850-2880 closely. If market hangs around this level during 2018, expect 5-10% pullback this year, but no correction until next.

* if S&P shoots up to 3,000 in the near-term, expect 20% correction.

* 3rd wave started in 2010. Expect it to top at 3222.

* 5th wave to top in 2021-2022 at 3500 – 4100.

* once top of 5th wave reached, expect substantial decline to 1500 – 1800 under best case scenario, but more likely 1,000, and for a 10-20 year bear market.

* after near-term pullback in gold, expects multi-decade bull market in it

https://invst.ly/6ge5a

ES………… extends!

https://twitter.com/Trader_Mars/status/956995810742345729

Looks like his W(2) count is way to shallow. IMHO

thanks rot!

SPX…powering on…

https://twitter.com/allerotrot/status/957216144393371650

SVXY…volatility is returning…

https://twitter.com/allerotrot/status/957216639841390592

https://worldcyclesinstitute.com/new-years-resolution/comment-page-2/#comment-25927

A new, free blog post is live at: https://worldcyclesinstitute.com/way-too-much-bull/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.