This week, we should see the top of the 500 year bull rally. Sentiment is at 93% bulls, which is rivalling the top of the dotcom bubble. All the assets I cover are at major inflection points. The dollar is about to turn or has turned. Oil is about the top. Gold is headed down.

Oops! Tesla

Above is the 2 day chart of Tesla.

Time to think about bidding “adieu” to Elon. Things have not been going well lately, and they’re about to get a whole lost worse.

Tesla has topped. It’s completed one wave down, along with a second wave. It’s now arguably in a third wave (arguably, because often in bear markets, you get a double-pronged second wave. So we may head about up to 347.44 for a final kiss good-bye!!

__________________________

My Original Intent in Starting This Blog

When I began this free blog, it was for the purpose of helping people understand the power of Elliott Wave Theory to lower risk in trading any market, based up its ability to predict market movement to a higher degree than any other tool that I’ve been able to find. I believe that Ralph Elliott discovered the secret to the market that it takes an astute analyst to unlock.

I believe it should be classified as a science because in the tens of thousands of hours that I’ve spent studying it, I haven’t found it to fail. The analyst can fail in interpreting the signals, but the science remains accurate, churning out wave after wave, day after day, to a specific set of rules.

In all my writing over the past two years, the hours I spend on analysis each weekend, and my attention to detail in explaining these charts and market direction each and every week, I have failed to make a dent in the perception of Elliott’s very important work.

I’ve tried very hard and failed. So, I’ll shut down the comments area next weekend, unless someone can come up with a benefit to keeping it alive from an educational perspective. I’ll explain my position in more depth below.

I’m also providing a list an explanation of some of the inadequacies and errors I’ve discovered in the “Elliott Wave Principle” book, by Prechter and Frost.

Other People’s Kids

In my endeavour to create a constructive environment to discuss EW and cycles, I’ve had to act a policeman for internal fights, spreading of proprietary information, and spreading of misinformation about Elliott Wave. It’s this last aspect that I vehemently object to. Mr. Elliott has been slammed enough and it’s kinda hard for him to defend himself in his current condition.

So, this week, we have Dan charging on here believing he has the right to command the audience I’ve built with his predictions that are neither possible, nor backed up by any evidence whatsoever. While I’ve written extensively about this wave up from 2009 being corrective, and the fact that one has to look at the market as a whole to determine its direction, he’s stolen the narrative with one single, completely unsupported comment.

Others have decided that this opinion is worthy of consideration, if fact, perhaps the operative scenario. It flies in the face of everything I’ve posted to the contrary over the past couple of years.

The inference is that I’m either stupid, incompetent, or have little to no understanding of the finer aspects of Mr. Elliott’s work. Maybe that’s true. But at the very least, it’s extremely rude. It shows no regard for me and my work, and without a shred of evidence to back up these statements, or even the a suggestion that these little morsels may be opinion only, borders on maliciousness.

I’ve had enough.

The challenge I’ve had in spreading the EW “word,” of course, is the accessibility of the knowledge, which has been helped and hindered, both at the same time, by the book, “The Elliott Wave Principle.” Unfortunately, it contains a number of errors that have led to the discounting of the scienfitic aspects of Elliott’s work. Chart examples in the book are invalid, for example. The most obvious example is a chart of an ending diagonal that is not an ending diagonal at all, because it breaks the most important rule in determining one. I expose this example below.

The error in this chart was so obvious when I read the book, that it led me to research all the other chart examples (charts pulled right from the market). What I discovered was that most of the examples were invalid.

Two charts in the book that are to provide evidence of a truncation are invalid. Neither one is a truncation. You’ll also find this example below.

So I’m fighting an uphill battle. Thanks to Dan and others, this challenge has become insurmountable, in my humble opinion. There’s simply too much erroneous information about Elliott Wave for me to overcome. I do not have the time nor desire to combat this uneducated blather any longer.

And now we have a final wave up from 2009, engineered by central banks, that’s clearly a B wave. That’s a problem for the integrity of the book, because Mr. Elliott was adamant that B waves at the top of a market exist (an irregular top). Bob Prechter decided to change this aspect of Elliott’s theory.

Mr. Prechter has solved this problem in recent charting by ignoring certain waves. Of course, you can’t do that, but ironically enough, that’s a trait of this cycle top (based upon the work on Dr. Raymond Wheeler, whose work I’ve cited over and over again). It’s an age of terrible grammar, and fake news. This extends to science, of course; we have global warming and the ozone scam as great examples of this phenomenon.

Sloppiness is normal at the top of this cycle (where we are right now), so I can’t expect anything different, I suppose. But that doesn’t mean I have to accept it.

The B Wave (that others are trying to make into an implusive wave)

Above is a 7 day chart of the SP500 showing the final wave up from 2009, which I have referred to in previous posts as a B wave, contrary to Prechter’s assertion (which was contrary to Elliott’s original work) that a market top cannot end in a B wave. Oops!

However, to alleviate that problem, Bob has posted a chart in the most recent version of his publication, The Theorist, that ignores some waves, which of course, you’re not supposed to do. Thanks, Bob! That really helps the cause.

Unfortunately, based upon Mr. Elliott’s hard rules, I can find no other explanation for the above wave sequence other than it’s a B wave, because it breaks many of the rules and guidelines of impulsive waves.

However, for all those who disagree, here’s a test:

The Motive Wave Quiz

This little test is primarily for our guru, Dan, who believes this wave up is impulsive. He obviously knows better than me. But I’ll open it up to anyone. I’ve posited a short set of questions, but can certainly provide more.

- An impulsive sequence requires a valid second wave that retraces 62%. Please identify it.

- An impulsive squence requires a valid fourth wave that retraces 38% of waves 1, 2, and 3 of that sequence. Please identify it.

- The most important element that both Prechter and Elliott noted is that an impulsive wave must have “the right look.” How does this wave up, which has a corrective look to me, fall under the category of “impulsive, based upon its “look?”

- How is it that none of the waves in this sequence fit the required fibonacci wave relationships, but is still considered “impulsive.”

- How is it that this wave up, if considered to be impulsive, has more waves than a normal impulsive sequence? If you have an explanation for this impulsive anomaly, please provide your count in a posted chart somewhere.

_________________________

The Elliott Wave Principle Book (the errors)

In the process of building on the work of Ralph Nelson Elliott and the interpretation of his work provided by Robert Prechter and A.J. Frost, my research has uncovered a lot of errors and omissions in “The Elliott Wave Principle” book. I would assume that any good EW analyst has done much of the same work. Or do they believe everything they read?

In the process of building on the work of Ralph Nelson Elliott and the interpretation of his work provided by Robert Prechter and A.J. Frost, my research has uncovered a lot of errors and omissions in “The Elliott Wave Principle” book. I would assume that any good EW analyst has done much of the same work. Or do they believe everything they read?

I’ve decided to provide my findings as a lead-in to a comprehensive course I’m developing. I’m providing it here as an example of the erroneous information that’s out there, to support my comments that the tools many EW analysts are rather “dull” and this is the reason for all the EW misinformation and counts that are simply incorrect.

I came to Elliott Wave Theory through Robert Prechter and his EWI site. After over a year as a subscriber, I became so dismayed with the continual errors of his analysts, that I determined to take a few years, devote myself to the market and the EW principle, with a goal of eventually excelling in its use. I discovered so much more in the process than has been written by either Prechter or Elliott (and several gross errors in the Prechter/Frost publication).

But I’m only expanding on their work; I’m not doing anything extraordinarily ground-breaking. My belief it that the work I’m done solidifies the principle and maybe, just maybe, it will help others in their analysis.

I’m convinced that Elliott’s description of the movement of the market should be considered a science. The reason the Elliotticians waver in their analysis is because of the errors in the Elliott Wave Principle, most of them due to the additions, or changes to Elliott’s original work, done without proper research.

Here are a few examples (all the charts expand when you click on them):

Ending Diagonals

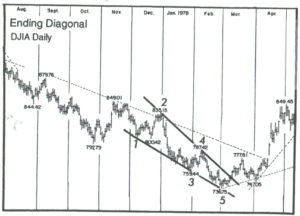

There are two examples of ending diagonals in the book, one totally invalid.

The first example (p.39, fig 1-18) isn’t even an ending diagonal, and it’s glaringly obvious as to why. One of the key determinants of ending diagonals is that the fourth wave must intersect the area of the first wave; they must overlap.

In this example, they don’t. End of story.

The second example (p. 38, fig. 1-17) is a valid example of an ending diagonal. However, one of the defining tests is that it must be in a fifth wave, in this case above the fourth wave. However, the trendlines drawn suggest that the fourth wave is part of the ending diagonal. It cannot be, based upon very definition of an ending diagonal.

A fourth wave triangle has the fourth wave as part of the triangle (it forms the A wave, in fact)—an ending diagonal does not.

An ending diagonal starts with the first wave of the diagonal. The lower trendline should begin on wave ii and contain wave iv.

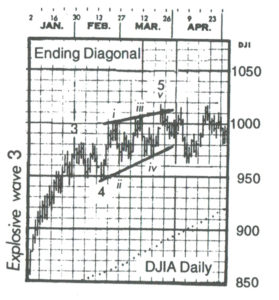

An expanding ending diagonal is a Robert Prechter invention (added to Elliott’s work). However, nobody has ever seen one. All we have is a line drawing in the book and it’s shown to the left (p. 39, fig. 39)

An expanding ending diagonal is a Robert Prechter invention (added to Elliott’s work). However, nobody has ever seen one. All we have is a line drawing in the book and it’s shown to the left (p. 39, fig. 39)

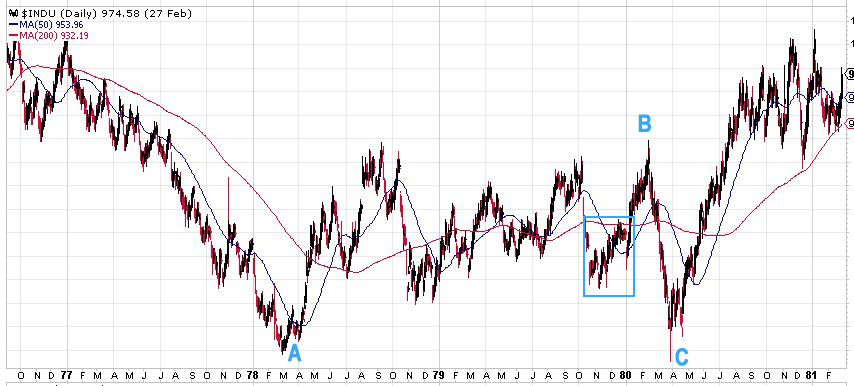

When I went to the original source, which is a DJIA hourly chart from early 1980, I found that the position of this pattern within the larger structure didn’t support the supposition that this existence of this pattern is remarkable, important in any way, or even repeatable.

It’s at the top of a B wave in a continuing corrective pattern. Ending diagonals are supposed to be in C waves, or most importantly, fifth waves of an otherwise impulsive pattern. This one is not.

Below is a chart pulled from the DJIA showing the above example in its original habitat.

Above is a daily chart of DJIA showing the position of the supposed ending expanding diagonal. It’s at the top of a B wave in a large bearish correction. What value this has is completely beyond me. It’s not even interesting.

_______________________

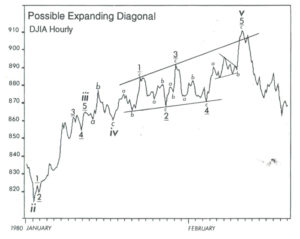

Leading diagonals

Here’s another “ghost of charts past.” There has not been a valid chart presented to support this pattern anywhere that I can find. It was a Prechter addition to Elliott’s work.

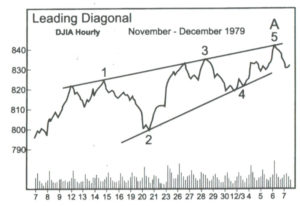

The only example we have is in the book and it comes from the DJIA hourly chart in 1979 (p. 40, fig. 40)

Let’s look at where this leading diagonal originally existed, by taking a look at the original chart, but over a longer period of time.

Above is a daily chart of DJIA. It’s actually the same chart from the ending expanding diagonal idea described above. So, what we have is an example of a leading diagonal and an ending expanding diagonal in the same corrective B wave. That’s quite a wave, just chocked full of diagonals! And it’s a B wave, a place where diagonals are very unlikely to appear.

Even if this was a repeatable pattern, providing an example in a corrective B wave is hardly an example that is likely to have any effect on the count. It certainly doesn’t here. It’s at most an odd pattern that’s not particularly interesting, and is of little practical value, imho.

Outside of this questionable example, nobody else has ever seen one.

__________________________

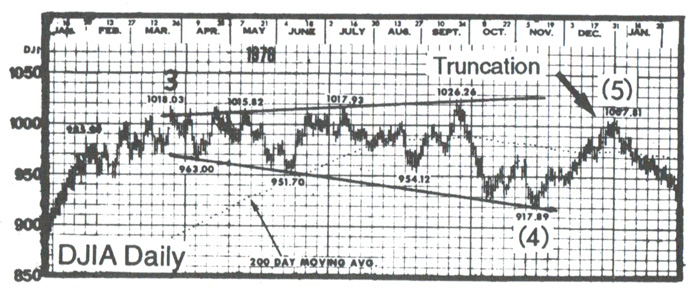

Truncations

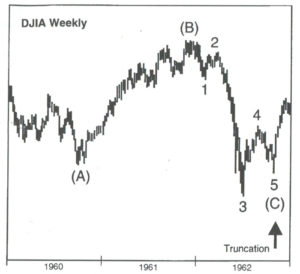

Nobody has ever seen one. The example charts in the book on this subject are invalid. The example on the left is a three-wave, fourth wave of a sequence, mislabelled in the chart to the left (p. 36, fig. 1-13).

It looks good here, but if you look at the bigger picture, it makes no sense. The chart below tells the real story.

It’s really an odd example, because it’s an ABC structure, which is a corrective wave. The C wave down already has a small fifth wave within it, and the overall look is consistent with a normal C wave.

Above is a daily chart of the DJIA showing the “truncation” example above in its natural habitat—in a bullish third wave sequence, surrounded by impulsive waves, it’s simply a small fourth wave correction, not a truncation of anything. As such, it’s supposed to be in three waves!

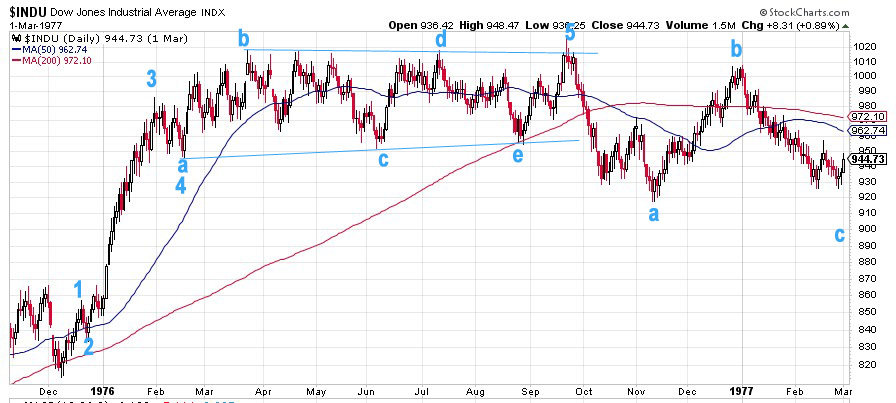

Above is the second example of a truncation from the book (p.36, fig 1-14).

Here’s the same chart labelled properly – another daily chart of DJIA. This wave up from December, 1975 is an impulsive wave with a simple contracting triangle as a fourth wave (abcde), with a small 5th wave up to a final high. I have no idea what they were thinking when they labelled it the first time. If it’s a truncation you’re suggesting as a result of your analysis, it seems to me (as Mr. Prechter states in the book) that all other options should be exhausted. He apparently didn’t heed his own advice.

Bob Prechter, in his writings, has expressed a desire that EW Theory be classified as a science. However, his adoption of this truncation “anomaly” certainly doesn’t support this desire. You can’t have a valid scientific theory that fails periodically. After going back a hundred years in the DOW, I can’t find a single occurrence of a truncation either at market highs or lows.

As far as I’m concerned, truncations don’t exist; nobody has ever seen one.

_______________________

Inadequacies in the book

Here are some areas in which the information in the book is not complete, imho:

Second Waves. Second waves in an impulsive pattern must retrace 62%, based upon my experience. I’ve cited this several times over the past two years and it has yet to fail. This fact is often the difference as to whether analysts are correct in their calls, imho. In Prechter’s book, the requirement is that they only have to retrace 38%, which has caused analysts to be wrong over and over again.

Fibonacci Ratios. The role of fibonacci ratios in both corrective and impulsive markets is woefully incomplete in the book and, in my work, has time and again proven the most important factor in determining both wave end-targets and whether a structure is corrective, or not.

Third waves of an impulsive sequence are almost always (I haven’t found an exception yet) 1.618 or 2.618 (in an extension) times the length of the first wave. Fifth waves are typically 1.618 X the length of the first wave. They can extend to 2.618 times the length of the first wave, but this is rare.

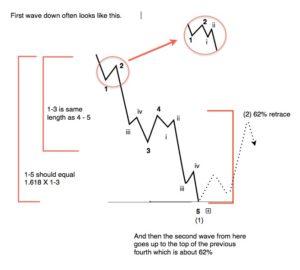

First Waves

First waves of an impulsive pattern have a different structure than all other impulsive waves. This fact simply isn’t addressed in the book. This is why first waves often have the appearance of a three wave sequence. The different is subtle.

First waves of an impulsive pattern have a different structure than all other impulsive waves. This fact simply isn’t addressed in the book. This is why first waves often have the appearance of a three wave sequence. The different is subtle.

In a true impulsive first wave, wave 4 must retrace to the level of wave iv in the diagram and also must reach a retrace level of 38% of the distance to the beginning of the first wave.

If it does not meet this requirement, the wave is to be considered a zigzag, which is a 5-3-5 combination (in this case, it’s corrective).

Waves in Five. The difference between a corrective five wave pattern and an impulsive five wave pattern has not been addressed at all in the book. This perhaps the most important distinction in determining corrective vs. impulsive wave structures.

B Waves as Irregular Tops. I’ve tackled this interesting phenomenon at the top of this EW expose with a chart showing the SP500 from 2009 to today. Irregular tops appear (if at all) at the top of an impulsive trend. This is referred to as an “irregular top,” which Elliott identified as a feature of his theory, for different reasons that don’t apply to the current situation I describe above.

But, here we are with a B wave. It should not be ignored, or “papered over” by breaking the rules. That’s not the proper way to advance a science. Recently, I’ve seen a chart from Mr. Prechter that ignores a fifth wave in order to skirt the issue of this irregular top.

In summary, what we have a technical publication riddled with errors. It’s no wonder that elliottwave practitioners come up with different counts. However, there is seldom more than one correct count. The issue is the rudimentary condition of the tools they’re using.

I’ve been attempting to research these tools with the goal of clearing up the misconceptions. That’s been my goal.

I’m not disparaging the work of Robert Prechter. He did a great service by publishing this book, which in my view, is the most comprehensive interpretation of Mr. Elliott’s work. However, like any science, it often undergoes intense scrutiny, with the ultimate goal of proving its viability without doubt. In my small way, this is what I’ve been attempting to do, and all the research I’ve done doubles down on the integrity of Ralph Elliott’s work and the Elliott Wave Principle itself.

________________________

I get asked often why EW analysts come up with different counts. Erroneous information is a great foundation on which to construct a building that will eventually collapse. If science is rock solid, then the building will stand forever.

However, if your tools are blunt, you’re going to do a less than adequate job as an analyst, through no fault of your own (other than laziness, I suppose).

Some have offered statements to the effect that the Elliott Wave Principle is a subjective method of analyzing the market. That’s an attitude that suggests a minimal understanding of the process.

Prechter himself spent a few pages on this very topic:

“Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means an objective study, or as Collins* put it, ‘a disciplined form of technical analysis.’” — page 94

• Charles Collins wrote the foreword to the Elliott Wave Principle.

As a result, I don’t generally look at anybody else’s work. I don’t let news or events play any part in my analysis. My job is to remain completely objective. I only look at indicators after I have done my initial analysis to see if they support (or not) my prognosis.

So, as an EW analyst, are you an “artist?” Perhaps, because you’re given a set of tools that are roughly hewn and have to use them to bring clarity to a market that moves in a predictable manner, churning out the same patterns over and over again, with Fibonacci relationships to each other most often provide multiple target options.

I suppose the real art is weeding out those options through experience. So, there is art in analysis, but I believe how the market moves to be a science that was uncovered by Ralph Elliott, with rules and guidelines that were refined, clarified, and communicated by Prechter and Frost.

In my work, my interest has been in refining the tools, finding the errors in the communication of Elliott’s work. However, the free blog is obviously not the correct platform through which to undertake this task.

It looks like it’s time to move on, by spending my time where I can have more of an impact.

____________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

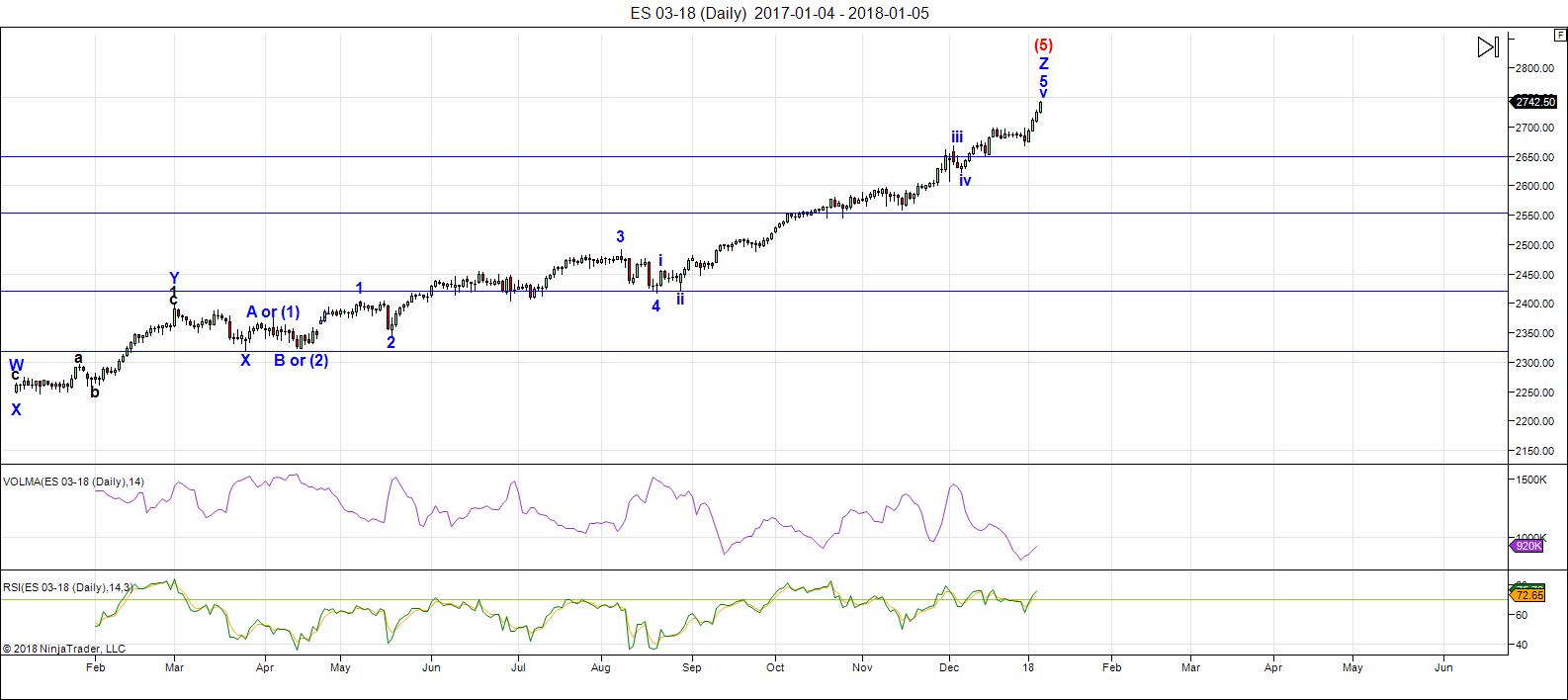

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down this week.

I thought last week we might have a large contracting triangle in play, based upon the need of currencies to top. However, with the dollar topping earlier than I expected, the US market has rallied to a final high. Everything is in place for a major change in trend.

My Trader's Gold subscribers know that every one of the ten assets I analyze daily is at a major inflection point this weekend.

Volume: It's dismal. Bullish sentiment is now at 93%, the highest it's been since the top of the dot.com bubble.

Summary: The count is full for the US market in general, except for small subwaves that form the balance of a motive set of waves in SPX and some other major US indices. Watch for a turn this week, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, January 18 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

RUT overthrows its ED…………https://invst.ly/6btj8

…….and the ES looks “done”…………….. just a few more minutes at 385 degrees…..and all shall be ‘roasted’………….

https://invst.ly/6btrh

i might take a small short trade today

ill consider it a day trade since its a friday

ill keep my stop near todays highs and will keep a close

eye on 25756 . Keeping my risk very tight yet its stop in my head

not a stop placed

i am seeing a very very short term roll over .

way to soon to call it though

that was fun , stopped out at the previous high 25760

ill give it another attempt just not yet

If the market closes near here today its going to give

a short term overbought reading .

the intraday roll over signals im looking at have failed to break down.

what im looking at has basically stalled .

not a good thing if im looking for a drop .

No signal to go off of .

re shorted at 25749 yet as before keeping stops tight and considering it

a day trade .

thats it till the close

out of my short just because im gun shy .

the market still looks like it is rolling over.

i want to see a clean 5 down and will reshort

once its seen and i see a valid wave 2 to go off of.

glad to see my very short term indicators working today.

enjoy the weekend everyone

food for thought on short term trades

https://www.mypivots.com/dictionary/definition/443/vold-nyse-volume-difference

Last post.

0958 west coast time.

if market rolls over right here it may get ugly.

i only give myself 2 trades a day and while the bearish case

has its merits im leaving it alone .

staying bearish and looking for a top and based pon the volume difference

very short term . i dont want to see it make a new high today since it

broke down out of a triangle . the dow also had an odd A B C which hit its target

and i a few other things i can explain .

to early to call the top in place yet from my point of view the market is done.

have a great weekend

1 minute time frame of the ES price action today for the 5th…..

https://invst.ly/6bvwe

could there possibly be anymore subwaves???

ES – 1 min – https://invst.ly/6bw46

possibly not.

Peter T,

you think we made top for this year or there is still some more room. do you think we hit 2800 before we go down.

BillR,

EW methodology requires a 5 wave impulsive wave down to the previous fourth, then a second wave, which then drives to a new low. Early, but looking good.

Hello everyone.

My target price of 2740 was 90* out, however, I believe my pivot date of today was correct.

Using the 2009 and the 2 May 2011 high of 1373 and adding a 200% Fibonacci to the range we get 2787. Close enough to today’s high.

This all squares out for today. The high could be in.

The next date for a pivot is 2 February.

ES has finished today with an ending diagonal. The measured maximum is 2789. If that holds, we should be done.

Peter T,

What time frame are you seeing the ending diagonal? Thank you for all you do!

I’m right down to one and five minute charts. Dollar also bottomed at the end of the day and I’ve been saying for two years now that would mark the top of the US indices.

Peter T,

Thank you for clarification!

BOO-YAH!! 🙂

I’ll be removing the comments subscription plugin this weekend, clearing out all the data and attempting to reinstall. This is in an attempt to squish that sign-in bug, which we haven’t killed yet. I think it must be that plugin, after attempting a series of other fixes.

Thanks Peter, hopefully that will resolve matters.

Kerry

It’s making me a bit crazy as it’s elusive, so yes, hopefully. I’m leaning towards requiring a log in that would mean as long as you’re logged in, you don’t have to fill in your information each time and it would protect that information so it’s not accessible to anyone. That’s the best way of putting an end to the problem for good.

well,

here is the ES day session…… 1 minute timeframe…….and when you thought it was done ………………. an ninth inning ending diagonal to top it all off…………

https://invst.ly/6bxvy

Peter,

In a situation where wave 3 runs 2.618%

Does wave 4 still measure 38% of wave 1-3?

And

Does wave 5 ever run 100% and 1.618% of 1-3?

The book shows a 5 can sometimes measure 1.618% of the entire 1-3 and I have never seen it, just curious if you have.

Thank you..

jody,

On point one, in an impulsive market, it usually does. It usually returns to the fourth wave of the third, which is usually about half way along the third wave (cause it’s an extension).

On point two, yes, this sometimes happens on an impulsive first wave. It can also happen, of course, in an abc correction. These can look like a first wave, and have a very large C wave. We may see this on the first wave down after the top.

Much appreciated! Thank you.

1/15-16 will mark a multi year high. All cycles I see are turning 1/13-1/16,

Will provide more detail tomorrow.

Basically the long term trend turned down 11/2-4 An overthrow into 1/16 was needed to bring all cycles in sync,

Next week 1/16 and 1/18 are the strongest dates. 1/18 will be tested a a lower high. 1/15 really the date. But US markets closed due to MLK day, Hence the high 1/16. I have reason to believe 1/16 is the most significant date after 1929,

So this won’t be just a high. This will be THE high.

And the cycle is down at least into late august 2023. but likely into 2027.

Next week will be entertaining.

André

Thanks Andre,

Do you also live in Holland?

All the best

John van der Meer.

energy chart for next week

https://ibb.co/ihVamm

energy chart for next week

https://ibb.co/ihVamm

wow… didn’t realize you were here posting, Andre — you the same one here ? I’ve tried studying your methods also :

André van Staveren Discusses Milivoje Vukcevic’s Formula and Theory

Posted on September 7, 2015

https://equityny.wordpress.com/2015/09/07/andre-van-staveren-discusses-milivoje-vukcevics-formula-and-theory/

Vibration- by André Van Staveren

Posted on July 16, 2016

https://equityny.wordpress.com/2016/07/16/vibration-by-andre-van-staveren/

don’t know if you or Peter T follow ::

Bussiere

@AstroCycle_Net

Jan 10

More

#SPX turned down on time for the ideal 10 and 16 day high of Tuesday the 9th, now let’s see if it continues lower into the ideal 10 and 16 day lows of Jan 16th and Jan 19th.

I saw some analysts tout way back in mid-December 2017 — targets for $SPX around the 3K area.

I do some crude math on it :

#PREDICTION

$SPX for end of Year 2018 ====>>> 3070 based on Aug 21, 2017 day LOW of 2417.35 x 1.27

= 3070.0345

/ OR might just be:

2417.35 x 1.25

= 3021.6875

think we run up to March 21, 2018 – #GANN New Year Day. last time we had a “meltdown” the $TICK indicator OPENS @ either 1.00 / -1.00 /thereabouts — normally 3 days b4 “meltdown”. could be wrong . but I watch for that among other indicators $BPSPX $FVX $TNX $TYX.

did some zig-zag — and came up w/some #s for this coming week on $SPX

2665.19 [ Dec 4, 2017 high ]

-2557.45 [ Nov 15, 2017 low ]

= 117.44

x 1.618

= 190.01792

+ 2624.75 [ Dec 6, 2017 low ]

= 2814.76792

OR

2665.19 [ Dec 4, 2017 high ]

-2557.45 [ Nov 15, 2017 low ]

= 117.44

x 1.618

= 190.01792

+ 2605.52 [ Dec 1, 2017 low ]

= 2795.53792

OR ::

Friday’s [Jan 12, 2018] HIGH 2787.85 – day low (2769.64)

= 18.21 (can either multiply by 1.27 / 1.618 or just add 18.21 to 2787.85

= 2806.06

A new post is live at: https://worldcyclesinstitute.com/a-full-count/

Hello Peter,

Thank you for sending me a link to this article on the various problems with the book. It was an eye-opener because it’s different from what’s insinuated in the mainstream community or rather the establishment. They all talk about the existence of a leading diagonal, but to be honest with you, I always found it difficult to grasp because they force some form of count into the chart and often break there own rules proposed by Bob. Mr. Elliot examined 100 years of chart data, something such as the leading diagonal wouldn’t have escaped his notice. The man was a genius.

An expanding diagonal even according to Bob is an extremely a rare occurrence. But many Guru’s on the internet expect this to occur all the time. I think many beginners become confused with Elliot Wave since the educational material and examples are wrong.

But I have a question if you have the time to please answer. You have stated that irregular tops appear at the top of an impulsive trend, does that mean such a pattern can’t exist within a corrective structure? For example and this is hypothetical, the current bull market in the SPX is corrective but could we have an irregular top within the smaller degree corrective patterns? This might sound like a dumb question lol, but I want to be sure. Thank you, Peter, God Bless You.

Omar,

I don’t understand the question. You’re asking me if we can have a corrective wave on top of a corrective wave, or within one? The answer, of course, is yes; it would be more of the same.

The whole idea of a B wave at the top of a market is that it’s a corrective wave on top of an impulsive ending wave.

Peter,

Thank you for answering my question. I very appreciate your input, as you’re a true master of Elliot Wave. You have answered my questions on AB Base, Half Moon and the difference between simple and impulsive five waves. Most Ellioticians find these questions difficult to answer. Thank you, once again.

Omar,

Thanks for the kind words. Those are not tough questions … but again, the book has a number of errors and omissions (It’s a good start, though).

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.