This week, we should see the top of the 500 year bull rally. Sentiment is at 93% bulls, which is rivalling the top of the dotcom bubble. All the assets I cover are at major inflection points. The dollar is about to turn or has turned. Oil is about the top. Gold is headed down.

Oops! Tesla

Above is the 2 day chart of Tesla.

Time to think about bidding “adieu” to Elon. Things have not been going well lately, and they’re about to get a whole lost worse.

Tesla has topped. It’s completed one wave down, along with a second wave. It’s now arguably in a third wave (arguably, because often in bear markets, you get a double-pronged second wave. So we may head about up to 347.44 for a final kiss good-bye!!

__________________________

My Original Intent in Starting This Blog

When I began this free blog, it was for the purpose of helping people understand the power of Elliott Wave Theory to lower risk in trading any market, based up its ability to predict market movement to a higher degree than any other tool that I’ve been able to find. I believe that Ralph Elliott discovered the secret to the market that it takes an astute analyst to unlock.

I believe it should be classified as a science because in the tens of thousands of hours that I’ve spent studying it, I haven’t found it to fail. The analyst can fail in interpreting the signals, but the science remains accurate, churning out wave after wave, day after day, to a specific set of rules.

In all my writing over the past two years, the hours I spend on analysis each weekend, and my attention to detail in explaining these charts and market direction each and every week, I have failed to make a dent in the perception of Elliott’s very important work.

I’ve tried very hard and failed. So, I’ll shut down the comments area next weekend, unless someone can come up with a benefit to keeping it alive from an educational perspective. I’ll explain my position in more depth below.

I’m also providing a list an explanation of some of the inadequacies and errors I’ve discovered in the “Elliott Wave Principle” book, by Prechter and Frost.

Other People’s Kids

In my endeavour to create a constructive environment to discuss EW and cycles, I’ve had to act a policeman for internal fights, spreading of proprietary information, and spreading of misinformation about Elliott Wave. It’s this last aspect that I vehemently object to. Mr. Elliott has been slammed enough and it’s kinda hard for him to defend himself in his current condition.

So, this week, we have Dan charging on here believing he has the right to command the audience I’ve built with his predictions that are neither possible, nor backed up by any evidence whatsoever. While I’ve written extensively about this wave up from 2009 being corrective, and the fact that one has to look at the market as a whole to determine its direction, he’s stolen the narrative with one single, completely unsupported comment.

Others have decided that this opinion is worthy of consideration, if fact, perhaps the operative scenario. It flies in the face of everything I’ve posted to the contrary over the past couple of years.

The inference is that I’m either stupid, incompetent, or have little to no understanding of the finer aspects of Mr. Elliott’s work. Maybe that’s true. But at the very least, it’s extremely rude. It shows no regard for me and my work, and without a shred of evidence to back up these statements, or even the a suggestion that these little morsels may be opinion only, borders on maliciousness.

I’ve had enough.

The challenge I’ve had in spreading the EW “word,” of course, is the accessibility of the knowledge, which has been helped and hindered, both at the same time, by the book, “The Elliott Wave Principle.” Unfortunately, it contains a number of errors that have led to the discounting of the scienfitic aspects of Elliott’s work. Chart examples in the book are invalid, for example. The most obvious example is a chart of an ending diagonal that is not an ending diagonal at all, because it breaks the most important rule in determining one. I expose this example below.

The error in this chart was so obvious when I read the book, that it led me to research all the other chart examples (charts pulled right from the market). What I discovered was that most of the examples were invalid.

Two charts in the book that are to provide evidence of a truncation are invalid. Neither one is a truncation. You’ll also find this example below.

So I’m fighting an uphill battle. Thanks to Dan and others, this challenge has become insurmountable, in my humble opinion. There’s simply too much erroneous information about Elliott Wave for me to overcome. I do not have the time nor desire to combat this uneducated blather any longer.

And now we have a final wave up from 2009, engineered by central banks, that’s clearly a B wave. That’s a problem for the integrity of the book, because Mr. Elliott was adamant that B waves at the top of a market exist (an irregular top). Bob Prechter decided to change this aspect of Elliott’s theory.

Mr. Prechter has solved this problem in recent charting by ignoring certain waves. Of course, you can’t do that, but ironically enough, that’s a trait of this cycle top (based upon the work on Dr. Raymond Wheeler, whose work I’ve cited over and over again). It’s an age of terrible grammar, and fake news. This extends to science, of course; we have global warming and the ozone scam as great examples of this phenomenon.

Sloppiness is normal at the top of this cycle (where we are right now), so I can’t expect anything different, I suppose. But that doesn’t mean I have to accept it.

The B Wave (that others are trying to make into an implusive wave)

Above is a 7 day chart of the SP500 showing the final wave up from 2009, which I have referred to in previous posts as a B wave, contrary to Prechter’s assertion (which was contrary to Elliott’s original work) that a market top cannot end in a B wave. Oops!

However, to alleviate that problem, Bob has posted a chart in the most recent version of his publication, The Theorist, that ignores some waves, which of course, you’re not supposed to do. Thanks, Bob! That really helps the cause.

Unfortunately, based upon Mr. Elliott’s hard rules, I can find no other explanation for the above wave sequence other than it’s a B wave, because it breaks many of the rules and guidelines of impulsive waves.

However, for all those who disagree, here’s a test:

The Motive Wave Quiz

This little test is primarily for our guru, Dan, who believes this wave up is impulsive. He obviously knows better than me. But I’ll open it up to anyone. I’ve posited a short set of questions, but can certainly provide more.

- An impulsive sequence requires a valid second wave that retraces 62%. Please identify it.

- An impulsive squence requires a valid fourth wave that retraces 38% of waves 1, 2, and 3 of that sequence. Please identify it.

- The most important element that both Prechter and Elliott noted is that an impulsive wave must have “the right look.” How does this wave up, which has a corrective look to me, fall under the category of “impulsive, based upon its “look?”

- How is it that none of the waves in this sequence fit the required fibonacci wave relationships, but is still considered “impulsive.”

- How is it that this wave up, if considered to be impulsive, has more waves than a normal impulsive sequence? If you have an explanation for this impulsive anomaly, please provide your count in a posted chart somewhere.

_________________________

The Elliott Wave Principle Book (the errors)

In the process of building on the work of Ralph Nelson Elliott and the interpretation of his work provided by Robert Prechter and A.J. Frost, my research has uncovered a lot of errors and omissions in “The Elliott Wave Principle” book. I would assume that any good EW analyst has done much of the same work. Or do they believe everything they read?

In the process of building on the work of Ralph Nelson Elliott and the interpretation of his work provided by Robert Prechter and A.J. Frost, my research has uncovered a lot of errors and omissions in “The Elliott Wave Principle” book. I would assume that any good EW analyst has done much of the same work. Or do they believe everything they read?

I’ve decided to provide my findings as a lead-in to a comprehensive course I’m developing. I’m providing it here as an example of the erroneous information that’s out there, to support my comments that the tools many EW analysts are rather “dull” and this is the reason for all the EW misinformation and counts that are simply incorrect.

I came to Elliott Wave Theory through Robert Prechter and his EWI site. After over a year as a subscriber, I became so dismayed with the continual errors of his analysts, that I determined to take a few years, devote myself to the market and the EW principle, with a goal of eventually excelling in its use. I discovered so much more in the process than has been written by either Prechter or Elliott (and several gross errors in the Prechter/Frost publication).

But I’m only expanding on their work; I’m not doing anything extraordinarily ground-breaking. My belief it that the work I’m done solidifies the principle and maybe, just maybe, it will help others in their analysis.

I’m convinced that Elliott’s description of the movement of the market should be considered a science. The reason the Elliotticians waver in their analysis is because of the errors in the Elliott Wave Principle, most of them due to the additions, or changes to Elliott’s original work, done without proper research.

Here are a few examples (all the charts expand when you click on them):

Ending Diagonals

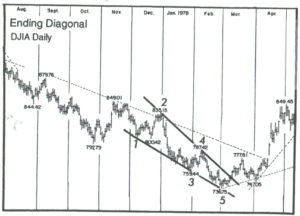

There are two examples of ending diagonals in the book, one totally invalid.

The first example (p.39, fig 1-18) isn’t even an ending diagonal, and it’s glaringly obvious as to why. One of the key determinants of ending diagonals is that the fourth wave must intersect the area of the first wave; they must overlap.

In this example, they don’t. End of story.

The second example (p. 38, fig. 1-17) is a valid example of an ending diagonal. However, one of the defining tests is that it must be in a fifth wave, in this case above the fourth wave. However, the trendlines drawn suggest that the fourth wave is part of the ending diagonal. It cannot be, based upon very definition of an ending diagonal.

A fourth wave triangle has the fourth wave as part of the triangle (it forms the A wave, in fact)—an ending diagonal does not.

An ending diagonal starts with the first wave of the diagonal. The lower trendline should begin on wave ii and contain wave iv.

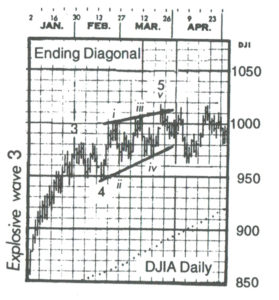

An expanding ending diagonal is a Robert Prechter invention (added to Elliott’s work). However, nobody has ever seen one. All we have is a line drawing in the book and it’s shown to the left (p. 39, fig. 39)

An expanding ending diagonal is a Robert Prechter invention (added to Elliott’s work). However, nobody has ever seen one. All we have is a line drawing in the book and it’s shown to the left (p. 39, fig. 39)

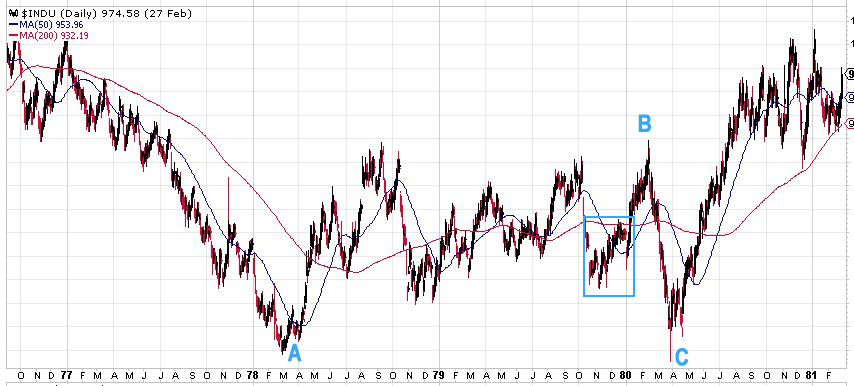

When I went to the original source, which is a DJIA hourly chart from early 1980, I found that the position of this pattern within the larger structure didn’t support the supposition that this existence of this pattern is remarkable, important in any way, or even repeatable.

It’s at the top of a B wave in a continuing corrective pattern. Ending diagonals are supposed to be in C waves, or most importantly, fifth waves of an otherwise impulsive pattern. This one is not.

Below is a chart pulled from the DJIA showing the above example in its original habitat.

Above is a daily chart of DJIA showing the position of the supposed ending expanding diagonal. It’s at the top of a B wave in a large bearish correction. What value this has is completely beyond me. It’s not even interesting.

_______________________

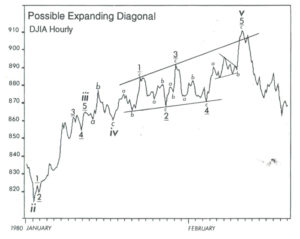

Leading diagonals

Here’s another “ghost of charts past.” There has not been a valid chart presented to support this pattern anywhere that I can find. It was a Prechter addition to Elliott’s work.

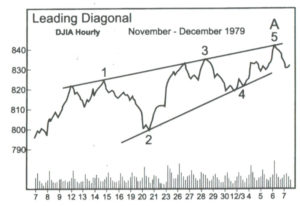

The only example we have is in the book and it comes from the DJIA hourly chart in 1979 (p. 40, fig. 40)

Let’s look at where this leading diagonal originally existed, by taking a look at the original chart, but over a longer period of time.

Above is a daily chart of DJIA. It’s actually the same chart from the ending expanding diagonal idea described above. So, what we have is an example of a leading diagonal and an ending expanding diagonal in the same corrective B wave. That’s quite a wave, just chocked full of diagonals! And it’s a B wave, a place where diagonals are very unlikely to appear.

Even if this was a repeatable pattern, providing an example in a corrective B wave is hardly an example that is likely to have any effect on the count. It certainly doesn’t here. It’s at most an odd pattern that’s not particularly interesting, and is of little practical value, imho.

Outside of this questionable example, nobody else has ever seen one.

__________________________

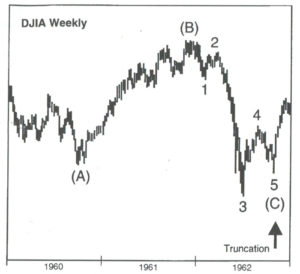

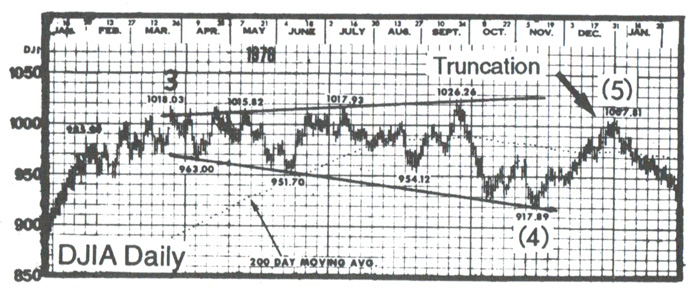

Truncations

Nobody has ever seen one. The example charts in the book on this subject are invalid. The example on the left is a three-wave, fourth wave of a sequence, mislabelled in the chart to the left (p. 36, fig. 1-13).

It looks good here, but if you look at the bigger picture, it makes no sense. The chart below tells the real story.

It’s really an odd example, because it’s an ABC structure, which is a corrective wave. The C wave down already has a small fifth wave within it, and the overall look is consistent with a normal C wave.

Above is a daily chart of the DJIA showing the “truncation” example above in its natural habitat—in a bullish third wave sequence, surrounded by impulsive waves, it’s simply a small fourth wave correction, not a truncation of anything. As such, it’s supposed to be in three waves!

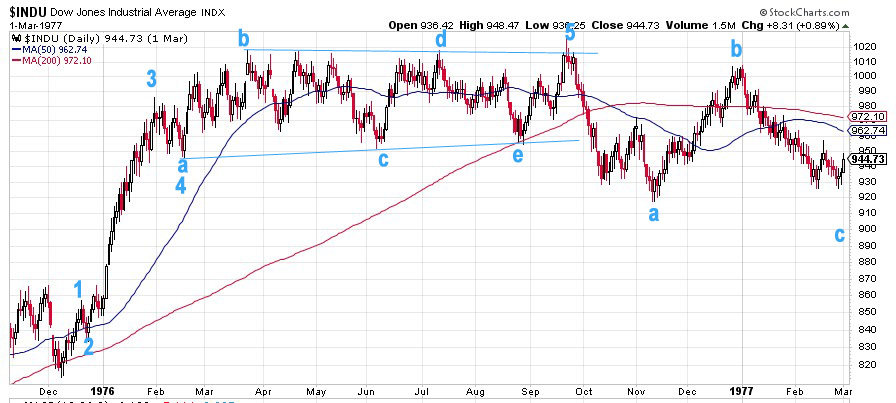

Above is the second example of a truncation from the book (p.36, fig 1-14).

Here’s the same chart labelled properly – another daily chart of DJIA. This wave up from December, 1975 is an impulsive wave with a simple contracting triangle as a fourth wave (abcde), with a small 5th wave up to a final high. I have no idea what they were thinking when they labelled it the first time. If it’s a truncation you’re suggesting as a result of your analysis, it seems to me (as Mr. Prechter states in the book) that all other options should be exhausted. He apparently didn’t heed his own advice.

Bob Prechter, in his writings, has expressed a desire that EW Theory be classified as a science. However, his adoption of this truncation “anomaly” certainly doesn’t support this desire. You can’t have a valid scientific theory that fails periodically. After going back a hundred years in the DOW, I can’t find a single occurrence of a truncation either at market highs or lows.

As far as I’m concerned, truncations don’t exist; nobody has ever seen one.

_______________________

Inadequacies in the book

Here are some areas in which the information in the book is not complete, imho:

Second Waves. Second waves in an impulsive pattern must retrace 62%, based upon my experience. I’ve cited this several times over the past two years and it has yet to fail. This fact is often the difference as to whether analysts are correct in their calls, imho. In Prechter’s book, the requirement is that they only have to retrace 38%, which has caused analysts to be wrong over and over again.

Fibonacci Ratios. The role of fibonacci ratios in both corrective and impulsive markets is woefully incomplete in the book and, in my work, has time and again proven the most important factor in determining both wave end-targets and whether a structure is corrective, or not.

Third waves of an impulsive sequence are almost always (I haven’t found an exception yet) 1.618 or 2.618 (in an extension) times the length of the first wave. Fifth waves are typically 1.618 X the length of the first wave. They can extend to 2.618 times the length of the first wave, but this is rare.

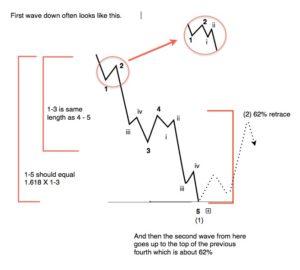

First Waves

First waves of an impulsive pattern have a different structure than all other impulsive waves. This fact simply isn’t addressed in the book. This is why first waves often have the appearance of a three wave sequence. The different is subtle.

First waves of an impulsive pattern have a different structure than all other impulsive waves. This fact simply isn’t addressed in the book. This is why first waves often have the appearance of a three wave sequence. The different is subtle.

In a true impulsive first wave, wave 4 must retrace to the level of wave iv in the diagram and also must reach a retrace level of 38% of the distance to the beginning of the first wave.

If it does not meet this requirement, the wave is to be considered a zigzag, which is a 5-3-5 combination (in this case, it’s corrective).

Waves in Five. The difference between a corrective five wave pattern and an impulsive five wave pattern has not been addressed at all in the book. This perhaps the most important distinction in determining corrective vs. impulsive wave structures.

B Waves as Irregular Tops. I’ve tackled this interesting phenomenon at the top of this EW expose with a chart showing the SP500 from 2009 to today. Irregular tops appear (if at all) at the top of an impulsive trend. This is referred to as an “irregular top,” which Elliott identified as a feature of his theory, for different reasons that don’t apply to the current situation I describe above.

But, here we are with a B wave. It should not be ignored, or “papered over” by breaking the rules. That’s not the proper way to advance a science. Recently, I’ve seen a chart from Mr. Prechter that ignores a fifth wave in order to skirt the issue of this irregular top.

In summary, what we have a technical publication riddled with errors. It’s no wonder that elliottwave practitioners come up with different counts. However, there is seldom more than one correct count. The issue is the rudimentary condition of the tools they’re using.

I’ve been attempting to research these tools with the goal of clearing up the misconceptions. That’s been my goal.

I’m not disparaging the work of Robert Prechter. He did a great service by publishing this book, which in my view, is the most comprehensive interpretation of Mr. Elliott’s work. However, like any science, it often undergoes intense scrutiny, with the ultimate goal of proving its viability without doubt. In my small way, this is what I’ve been attempting to do, and all the research I’ve done doubles down on the integrity of Ralph Elliott’s work and the Elliott Wave Principle itself.

________________________

I get asked often why EW analysts come up with different counts. Erroneous information is a great foundation on which to construct a building that will eventually collapse. If science is rock solid, then the building will stand forever.

However, if your tools are blunt, you’re going to do a less than adequate job as an analyst, through no fault of your own (other than laziness, I suppose).

Some have offered statements to the effect that the Elliott Wave Principle is a subjective method of analyzing the market. That’s an attitude that suggests a minimal understanding of the process.

Prechter himself spent a few pages on this very topic:

“Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means an objective study, or as Collins* put it, ‘a disciplined form of technical analysis.’” — page 94

• Charles Collins wrote the foreword to the Elliott Wave Principle.

As a result, I don’t generally look at anybody else’s work. I don’t let news or events play any part in my analysis. My job is to remain completely objective. I only look at indicators after I have done my initial analysis to see if they support (or not) my prognosis.

So, as an EW analyst, are you an “artist?” Perhaps, because you’re given a set of tools that are roughly hewn and have to use them to bring clarity to a market that moves in a predictable manner, churning out the same patterns over and over again, with Fibonacci relationships to each other most often provide multiple target options.

I suppose the real art is weeding out those options through experience. So, there is art in analysis, but I believe how the market moves to be a science that was uncovered by Ralph Elliott, with rules and guidelines that were refined, clarified, and communicated by Prechter and Frost.

In my work, my interest has been in refining the tools, finding the errors in the communication of Elliott’s work. However, the free blog is obviously not the correct platform through which to undertake this task.

It looks like it’s time to move on, by spending my time where I can have more of an impact.

____________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

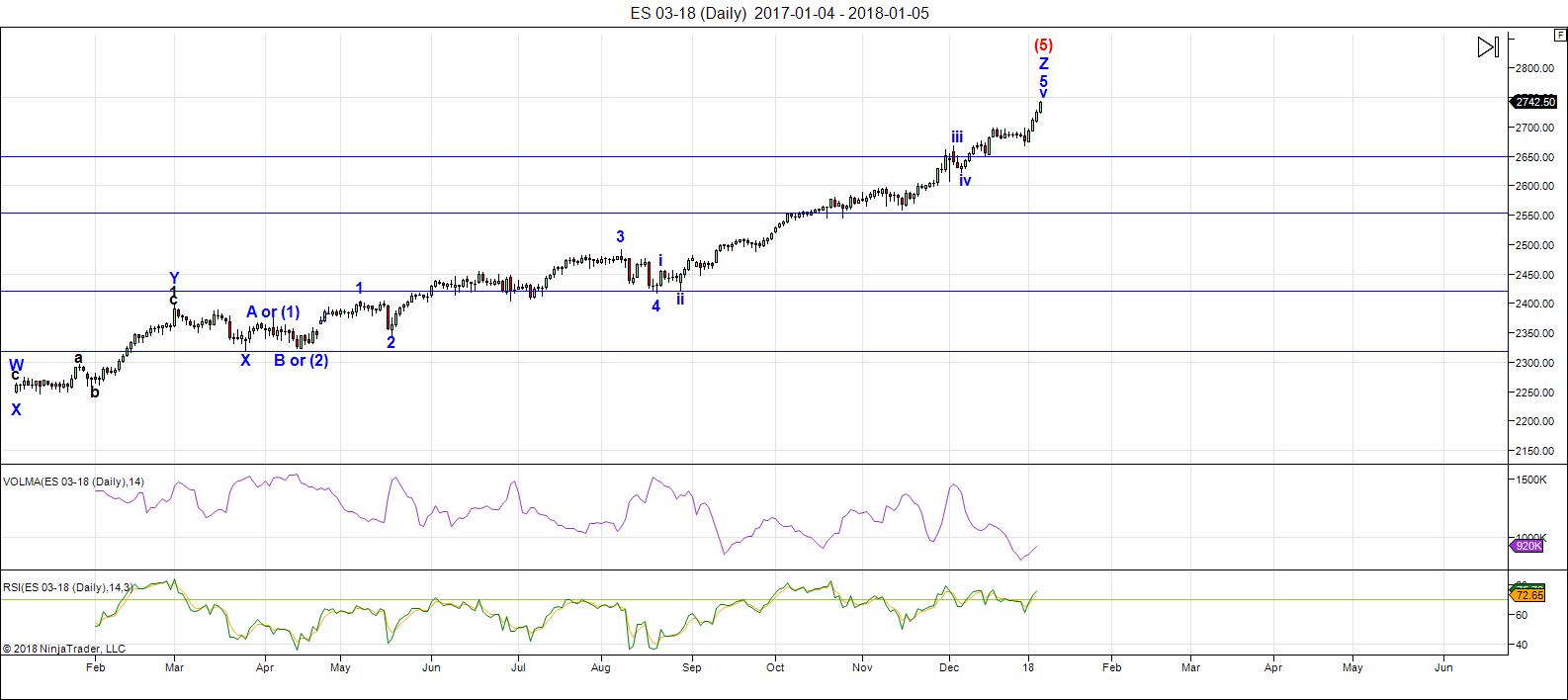

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down this week.

I thought last week we might have a large contracting triangle in play, based upon the need of currencies to top. However, with the dollar topping earlier than I expected, the US market has rallied to a final high. Everything is in place for a major change in trend.

My Trader's Gold subscribers know that every one of the ten assets I analyze daily is at a major inflection point this weekend.

Volume: It's dismal. Bullish sentiment is now at 93%, the highest it's been since the top of the dot.com bubble.

Summary: The count is full for the US market in general, except for small subwaves that form the balance of a motive set of waves in SPX and some other major US indices. Watch for a turn this week, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, January 18 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

SVXY notched a new 52 week high and now red. Possible key reversal underway….

It seems surreal to me to attach any significance to this widely recognized signal knowing the criminal FED is actively shorting vol futures….vultures!!!!!!

One thing is certain. If we have an ED per luri’s chart, I will be (happily) proven wrong on the matter of a cash session reversal…

Hi Peter, Don’t stop. I never seen these analyses and market predictions before!

I only wanted to add something to the predictions.

I do my little research from 2003 and predicted the decline of 4 oct 2008. But with QE it didnot work anymore. Now I have 6 indicators that can predict the pattern low and Highs(I think). Still working on it. But it seems to be working well if we have a decline to the end of march.

Sweet Lake city

Holland

It is really quite a connundrum watching this market. Hard to get excited seeing things like bearish engulfing candles and forays above the upper B band as they no longer mean what they used to…. 🙁

Taking profits and rolling spreads to 248/250 strikes. Incredible!

Price continues to charger higher…wow!!!

If we have a final ZZ up, that open gap WILL be closed, and I mean immediately…if it closes I am buying back short 248 strike puts.

peter,

is this considered a baby contracting ending diagonal in the ES????……..

https://invst.ly/6amsj

Wow! Talk about ” impending trend change resistance”! It does not get anymore dramatic…we SHOULD have confirmation just ahead.

Awesome charting luri…!

No, because on my chart, the 4th did not extend low enough to be within the area of the first

But I’ll give you a “really close!” on that one.

peter, a little tweak here and there, and an adjustment gives us this………https://invst.ly/6am-5 ???

In this case, the 5th wave is much longer than the 3rd and the pattern doesn’t look correct.

Yep! Move degree down one… 🙂

Any thoughts on the persistent VIX divergence?

Why are we not at new 52 week lows like the futures instruments?

Looks like folk expecting something the next 30 days…

so what you are saying, is that the FED is allowing a divergence to occur??? hmmmm….logical question is why??? why allow divergence? and why now??

maybe they can close some of their short vol when markets are up

VIX only measures 30 days out so FED may not be playing in that time frame, OR, if they are, put buyers are overwhelming them….

As rare as it is, I would not be surprised to see an intra-day gap higher in VIX. Unless the whole world had gone completely mad, I think we should see some kind of “smart money” exit that could trigger this…one usually does at such significant turns….

If they have been doing this as far back as 2012, and likely before then, they have to be sitting on a mind boggling short futures position to have kept vol at these abnormally placid levels all these years. They could only do this by rolling those positions forward AND increasing them as market prices marched higher in order to maintain same effect. If this is indeed the case, I simply do not see how it can be unwound in any kind of orderly fashion, particularly during a precipitous decline.

IWM has topped with all other indices . AAPL about $.90 away from testing high.

https://invst.ly/6ao1l

ok. changed from small ED to the above…….. grrrrr…

luri, what do you think of Trader Joe’s latest RUT count? 🙂

I am really tempted to exit that short leg of put spread. I see a classic bearish rising wedge but so many bearish signals are being negated of late it is as if all means of price discovery has been rendered NULL and VOID…

Once again profile field filled with information of someone named Barry Brewer.

I just loaded the site from a different network and his information was pre-loaded in the comment section. Very strange indeed.

Taking profits on 248/250 put spread and standing aside for now.

How can a market go straight up with no pullbacks ad infinitum??

Ummm….you could have not used my full name there, Verne, but yeah, clearly a problem in this comments section…

That said, I completely understand and agree with your frustration with the current market.. Honestly, I’d like to know who to contact to apply to be a Central Bank…

It must be really nice to be able to print as much money as you’d like, buy whatever you want, and just keep buying until it goes up…

Then count your profits..

*repeat until rich*

On a more serious note, it’s a bit disturbing to me that the money the rest of us work and struggle a lifetime to save, is replicated (many, many times over) by nothing more than a push of a button for others..

Is this the “new world” we live in? Because the ultimate resolution with that is Central Banks own quite literally ~everything~…

Barry,

I have the developer working on the comments issue now.

My apologies Barry. I wanted to give Peter the info in the event he could track down how the problem was occuring. I should have simply e-mailed it to him.

Not a biggie, Verne.. I think I was just a little surprised, because even in my own “Leave a Comment” section, ~just~ my first name is listed…

My email address is certainly a clue, but still, I don’t even know how my last name got in there… Completely weird… :-O

Thanks. It did also post your full e-mail address which I of course thought NOT prudent to divulge! 🙂

What happens when the SNB decide to cash in their winnings? Can they??!! 🙂

https://www.zerohedge.com/news/2018-01-09/snb-made-55-billion-2017-foreign-currency-holdings-soared

Fair question, but I think the bigger question is, why would they?

They don’t seem to need to..

Need to pay a bill? Print it..

Need to buy a stock? Print it..

Need to buy a bond? Print it..

Want to buy an entire company?? Just print it..

Honestly, why do the rest of us even pay taxes?

Deficits? It’s just numbers… Print it….

This little rant is not directed at you, Verne, I’m just shocked that this is our current financial “system”…..AND that it’s continued to go on this long too, TBH….

As you mentioned earlier, how this isn’t the largest fraud the world has ever seen, is beyond me… (which kinda goes with Peter’s 500-year cycle top, in my mind…IF it’s about to go *poof*)

Been there my friend. The thought of central banksters is literally depressing….*SIGH*

Man alive! Talk about an under-the-wire exit! Entirely fortuitous and NOT due to any skill of foresight whatsoever!! 🙂

If what I think is happening IS happening, look for a blast of VIX past 10.00 before the close. If that happens I’m on it like white on rice!

Did I pull my funds out too soon??!! lol! 🙂

TSLA puts back below entry price so any trade not following my own personal dictum of ringing the register early and often would be underwater. A 1,2 count not yet invalidated so in a real world situation I would re-load those puts for a second bite of of the Elon apple! Third wave down not yet underway apparently but with March expiration those puts have plenty of time to pop…

Until I started trading with Bryan Bottarelli, it would have never occurred to me to re-enter the same trade multiple times to take advantage of price whipsaw by market makers. I once watched in utter amazement as he led us in and out of ULTA one year

for some really scandalous option gains. Some weeks we executed literally dozens of trades on it. Those were the days when you had real market volatility. Not so today. Of course the kind of volume we brought to those trades would scare the hell out of the corrupt market makers. A few times they tried too screw us at expiration with robber baron spreads and Bryan had us take delivery on the in-the money calls! Boy that was fun! It really put a stop to that stunt. Can you imagine those SOBs having to go out and buy those shares at the market so they could make the delivery on those options…? he! he! 🙂

Shorting ES with a hard stop at 2760…what the hell! 🙂

Divergences abound on the ramp higher – momentum, MACD, stochastics. Of course sometimes this can continue for some time….yikes!

Don’t know Verne, VXX might push out of a BB squeeze yet…

Once again everything at new all time highs except DJU, which looks to have completed an impulse down. Is it now the downside leader, or will it play catch up??!!

So far, DJU is a 3, but could become a 5 with some more work. It could also completely retrace.

I guess I was counting the move outside the lower B band as completion of the third, but apparently it was on the third of the third. I stand corrected! 🙂

Verne,

It’s actually more the look that I go by. The second wave is too large for the waves that follow. It would need a fourth wave as large as the second wave to have the right look and then a fifth wave down, of course. So right now, it’s half an impulsive wave. There are some other subwaves that don’t look good either, to my eye.

Voice of experience!

Thanks for the EW tutorial Peter. Spotting the “right look” is one of the things I have found that separates the men from the boys… 🙂

Oh what should I do?

I keep wanting to take these quick scalps as timing today has been exquisite.

I hate the fact that the banksters have turned me into a day trader! lol! 🙂

The VIX 10.00 pivot has been a contested area for weeks and a close above today would suggest on-going accumulation of long vol. We do have a nice uptrend line in place…

Let’s see how they respond to the knee-jerk short sellers of near term vol…

The waves down in futures do not look impulsive.

Interesting. It certainly would not be the first time a break down from a bearish rising wedge failed to stick…

Once upon a time I used to make vol trades with a high degree of confidence and not even think about it. The FED has me totally spooked by what they are doing and even the anticipated move today I am looking at with a certain skepticism…I guess we will see. Have a great evening all! Bye! 🙂

https://worldcyclesinstitute.com/new-years-resolution/comment-page-2/#comment-25972

interesting assessments by Brandon Smith…the assessments speak for themselves…however, some may have missed some important facts when reading the zero hedge article…

https://boblivingstonletter.com/alerts/party-can-central-bank-ready-pop-everything-bubble/

– “Last Friday the Fed finally released the transcripts of its monetary policy meetings in 2012″…2012 transcripts not 2017

– “When it is time for us to sell, or even to stop buying, the response could be quite strong…you take 60 months”…2012 + 60 months (5 years) = 2017

-“it’s also unloading our short volatility position”…2012 + 60 months (5 years) = 2017

https://worldcyclesinstitute.com/new-years-resolution/comment-page-2/#comment-25927

Peter G,

I assume your channel trend lines still apply going forward! So the…

Blue channel line for tomorrow is 2749.66+1.47 would be 2751.13…

Red channel line for tomorrow is 2750.98+2.29 would be 2753.27

Yes, Ed, and I have added the shortest one which was not on the previous chart and which pinpointed yesterday’s high just outside the boundary of the other two channels… https://imgur.com/a/JShyF

Peter G,

Thanks for the update! We closed back below those trend line calculations you provided above…I think that was important. Perhaps we can close back below your calculation of the 30 year S&P trend line from 1987 which stands at 2743.99 all month!

Interesting times!

Today was the opening of the window for a top .

The spx tested the 1760 level ( I’d like to see that level hold )

Next higher level is 1860 .

My bias is wave 4 in the utilities should correspond with the Dow and spx

Yet I have nothing cast in stone, it’s just a bias .

No details with market data to go by so just being generic .

We should know soon enough if the market has topped .

All for now

Joe

I will be stopped out of ES above 2760 also.

If cash session closes above I switch to a 274/276 March SPY bull credit put spread until we impulsively take out ES 2760

I think if we take out 2760 we are headed for 3000.00

2760 and next 2860 ( if 2760 gets taken out )

Staying bearish until proven wrong

Not trades placed currently for downside action

After looking at daily and hourly charts this afternoon, I too, have a bearish bias for the next two days. Unfortunately, since I’m being piggish, I still have weekly calls for one stock. 🙁 I’d appreciate a flurry of more good news for the stock for one more high print at open tomorrow so I can unload the calls.

energy chart update

https://ibb.co/bXH1j6

energy chart update

https://ibb.co/bXH1j6

Tom’s chart looks like a gap down and trend down day. My remaining calls will be worth nickel and dimes by Thursday.

You might be able to salvage a portion of the trade by turning it into a calendar spread and selling some longer dated calls against your long position….

Thanks Verne but nvm. The stock gapped up at open. Lol at the bulls saving me.

If you don”t like spreads, the next no-brainer trade is a short of oil.

I just love trade set-ups where you can REALLY stick it to the banksters. I hope everyone on this site takes their money. I will be doing so via USO leaps and a few DRIP calls. 🙂

Not at all happy with futures action. The despicable banksters are STILL in control.

I am exiting my ES short at the open and cashing in my long vol VIX scalp. Keeping remaining powder dry for the real onset of the GREAT CALAMITY….

Keep an eye on VIX. It represents the most dangerous threat to the cabal. Destroyed volatility is the elixir the banksters concocted to sedate the herd into a mindless risk-embracing stupor.They will come at short term vol with a vengeance with even a slight market decline so today should be fascinating.

The volatility event horizon for these miserable miscreants is around VIX 15. You will probably see one hell of a dogfight if and as it approaches 14 with monstrous red candles. The rumor is that a few hedge funds are getting together with a plan to make the FED pay for their arrogance. What took ’em so long??!! 🙂

That”s more like it!

Let’s really get some downside momentum. 😉

Peter, ‘people’ must be monitoring our emails…Bill Gross, Jeff Gundlach, and even China…be well!

https://www.fxstreet.com/news/china-officials-said-to-recommend-slowing-or-halting-treasury-buying-201801101038

“worth a read…if you are so inclined, post to the public blog…however, the knuckleheads probably won’t be able to comprehend the information!”

https://twitter.com/ElementMacro/status/951065216464445440

“This is so much bigger than ppl realize…”

Took the money and ran on the futures scalp. Let”s see if the cash session is worth another. 🙂

DJI and SPX futures tracing out diffetent corrective structures. Looks like expanded flat and zig zag respectively. One more push higher it seems…

As of now it looks like a corrective move down overnight for sure. Be careful of $AAPL. The 5th wave up could extend another 5 waves, exactly like $NFLX is doing.

Netflix is setting up to be one helluva short play. It is going to make a few traders very happy as I know a lot of em are eyeing the divergent new highs! :

It’s in a 3 of a 5 right now, so when 5 of 5 happens, I’ll be right there with ya.

Not the real deal…yet.

What is coming will not be amenable to any bankster B.S.

The decline will be seismic, not this hesitant crap. Time to be patient…

yes, it looks like chicken little right now, but it takes a lot to turn this big ship and gain momo… particularly this time of day. Holding long vol into open, we’ll see.

It is more than amusing, considering how ridiculously overbought this market is and has been, to see silly talking heads trying to attribute a long overdue pullback to clap-trap about Chinese purchase of Treasuries. What fools these mortals be! 🙂

Verne, but those talking heads have a limited run sheet…….

…they can’t talk about the 5th Wave of EWT, they cant talk about Gann’s square of 9 and how 2759 sits right at the top of the cardinal cross when 666 starts the count… they can’t talk about astrology and the triple Geo conjunction of Sun,Venus & Pluto at 18 degrees Capricorn (288 or 2×144) …. nor the Mars Jupiter conjunction at 18 degrees Scorpio (228) …… should we mention Uranus and Price BiQuintile at 145 degrees (~144)

I expect the Ghostbusters (Plunge Protection Team) are on standby to alleviate all of the above, again : )

Yikes! Not the PPT!!!! 🙂

could that be the same as the Fed sell vol strategy? … was digging into that yesterday…

No doubt…!

Peter, this is the Mike D who started posting in the last week or so, changed my email because of concerns on the board lately. If you can use this instead of mojozone1, I appreciate it. All the best, Mike

Here is an interesting scenario. Everyone and his dog is convinced that what we are about to see is just an ordinary pullback in a very healthy on-going bull market. I have long contended that this twisted, freakishly distorted market CANNOT endure any kind of pullback because of the excesses spurred by suppressed volatility and the historic leverage that has resulted from this insanity. Of course the banksters are going to throw tens of billions into the fray to limit any downside momentum and they may well succeed and live to play another day; but here’s the thing. Whatever they do, they are going to have to keep VIX from rising high enough to blow up the VAR monstrously leveraged trade. To pull this off, they MUST, at all costs, keep the lemmings convinced that all is well. Anything that happens to disturb the sweet herd somnolence is going to be certain disaster for the banksters. What am I saying? This correction has to stay under 3% and VIX under 15.

If either one of those rubicons are crossed I think it is game over!

Have a great trading day everyone!

VIX tag of upper B band retreat suggests this brief move down is done before it even got started. Not even the slightest B band expansion confirming the deep slumber continues. Let’s see if futures overnight herald a decline that will stick..

e mini forming right shoulder of 3 day H&S, don’t know what that means for EW count

10y treasury auction at 1:00 PM. First real test of bond market sell off. Then there is the 30y tomorrow. Equities are getting spooked by rate move – lets see if 1pm leads to any volatility.

TBT telegraphing outcome-it flew above upper B band today and probably headed back below.

Very good auction. I bought around 2.58 (looking for lower yields rather than higher). Going with Peter’s view – 0.75% before 3.00%

It’s the dirty little secret that everyone knows. Rising rates will blow up the joint, and will never happen voluntarily ( I expect they will eventually forcibly!). Of course, at least we know that QE is now over…wink! wink! 🙂

Resistance at gap. Bulls need to close it to send stirring bears back to hibernation.

SVXY gap down already filled. Short sellers of vol futures doubling down….will it propel prices still higher, or does divergence grow?

Yet another bearish rising wedge. Long lower wick bullish. Market personality schizm.

My SPY short over night paid nicely.

I covered just after the open. Anytime you get a nice gap over night taking your profit with-in the first 30mins is always advised.

I am shorting again right here @ SPY 274.29

Perhaps the C leg of an abc correction might provide some coin! 🙂

Nice entry! 🙂

Thx V,

At 272.91 I will start trailing.. 274.43 is my stop so only risking .14 cents.

Hoping for 270.65. Would like at least $3.50 per on this trade.

I don’t trade equities a whole lot nowadays, mainly forex.

The great thing about forex is that it is open 24 hours a day, the bad thing about forex is it is open 24 a day 😀

Hyuk! Hyuk! Ain’t that the truth! Futures too! lol! 🙂

Back in November, starting on Nov 7, VIX printed a series of higher highs and higher lows, despite long upper wicks showing the trend was being fiercely resisted, and by November 15 printed an intraday high of 14.52

It would appear that approach of the 15.00 pivot brought out the big guns and they unloaded them over the next six trading sessions to drive VIX to a new 52 week low at 8.56, as if to make a statement.

Undeterred, the VIX bulls came right back and drove VIX to an even higher high at 14.58 on December 1, prompting another round of persistent selling to drive price back to a close below 10.00 by December 8, but not an a new 52 week low. Two days later we saw a VIX signal that I think few people have ever seen and which has not appeared for many years, and that is the “Three White Soldiers” reversal pattern. Although VIX has gone on to make lower lows since that pattern at an intra-day print of 8.92 on January 4, it is starting to look like it (vol) is being accumulated by some savvy traders.

I think those two ramps toward 15.00 was a test of sorts and we could be seeing a preparation to make a more sustained assault on that pivot in the near future. I think it is the Achilles’ heel of the short vol cohort, and I suspect the most critical price action to watch to get a clue of where this market is headed….

Well, we should know soon if we are about to get an A,B,C, or a 1,2,3…. 🙂

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.