Eliminating the Improbable and Impossible

The Elliott Wave Principle is a set of rules and guidelines for identifying recurring patterns in the market. The bulk of the work I do across ten specific assets on a daily basis involves deductive reasoning. There are thirteen simple patterns that repeat over and over again in the market. There are no other known patterns that make up either of two types of waves—motive (trend waves) and corrective waves.

The Elliott Wave Principle is a set of rules and guidelines for identifying recurring patterns in the market. The bulk of the work I do across ten specific assets on a daily basis involves deductive reasoning. There are thirteen simple patterns that repeat over and over again in the market. There are no other known patterns that make up either of two types of waves—motive (trend waves) and corrective waves.

Staying completely objective and paying attention to the intricacies of wave structure is the key to good analysis. There is seldom more than one valid wave to count a wave sequence. It’s the ability of the analyst to recognize these patterns and properly use the host of rules and guidelines to accurately predict future market movement.

“Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means and objective study—” a disciplined form of technical analysis.” If you do not believe what you see, you are likely to read into your analysis what you think should be there for some other reason. At this point, your count becomes subjective and worthless.

Without Elliott, there appear to be an infinite number of possibilities for market action. What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott’s highly specific rules reduce the number of valid alternatives to a minimum.

Under only the rarest of circumstances do you ever know exactly what the market is going to do. You must understand and accept that even an approach that can identify high odds for a fairly specific event must be wrong some of the time.

Of course, there are often times when, despite a rigorous analysis, there is no clearly preferred interpretation. At such times, you must wait until the count resolves itself. When after a while the apparent jumble gels into a clearer picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%. It is that’s really inexperienced to pinpoint a turn, and the weight principle is the only approach that can occasionally provide the opportunity to do so.

The ability to identify such junctures is remarkable enough, but the Wave Principle is the only method of analysis that also provides guidelines for forecasting. Many of these guidelines are specific and can occasionally yield stunningly precise results. If indeed markets are patterned, and if those patterns have a recognizable recognisable geometry, then regardless of the variations allowed, certain price and time relationships are likely to recur. In fact, experience shows that they do.” —The Elliott Wave Principle, Frost and Prechter

The Elliott Wave Principle (the book—you can find it in my book list) is a starting place to learn how to predict the market. Most people will not take the time to learn it, because it’s complicated. Many analysts don’t spend the time to learn it fully or don’t comply with the rules (which cannot be broken) or guidelines. Therefore their counts are inaccurate and useless.

For example, there are so many who throw around the term “impulsive wave” without the slightest idea of the rules for the formation of one. There are a greater number who pay absolutely no attention to the subwaves, which most of the time, can confirm or undermine a carefully considered count. There are also many who don’t look across multiple related indices to ensure they support the prediction. And then there’s the issue of “the right look” to a motive wave. If you don’t have the innate ability to recognize patterns, this can be a prediction-breaker alone.

All of these facets of a disciplined approach are critical in defining the future movement of the market based upon its current state. If done properly, I have found it much more accurate than any other method of analyzing the market. And by the way, it works on any free market.

Many analysts provide alternative counts, which in many cases, is a safety net for their minimal knowledge of the Principle or a lack of discipline. I only rarely provide alternate counts because, as a trader, it’s difficult to act on two counts, predicting a move in opposite directions. How do you trade that situation?

As a trader, it makes more sense to have one count and know when you’re wrong. EW does that exceptionally well. However, the greater benefit as an analyst is to be meticulous in your work, objective to a fault, and follow the EW rules and guidelines.

A Look at the Fall

The chart on the left illustrates the potential gravity of the coming drop coming this fall (click to expand).

When five waves up are complete, that’s the end of the rally. We’re virtually there, but we’re virtually alone as traders, because volume is almost non-existant.

The entire drop is in 3 waves (a zigzag). The A wave will be in 5 impulsive waves to about the half-way point numerically. Then we’ll head up to sideways for at least a year. The final wave down will be a stair-stepping affair, the longest wave (in time) of the entire process. I give it five years roughly to reach the bottom (below 3K in the DOW).

More to come as we move closer to a top over the coming weeks. It’s always rather sobering to look at this chart.

______________________________

The Market This Week

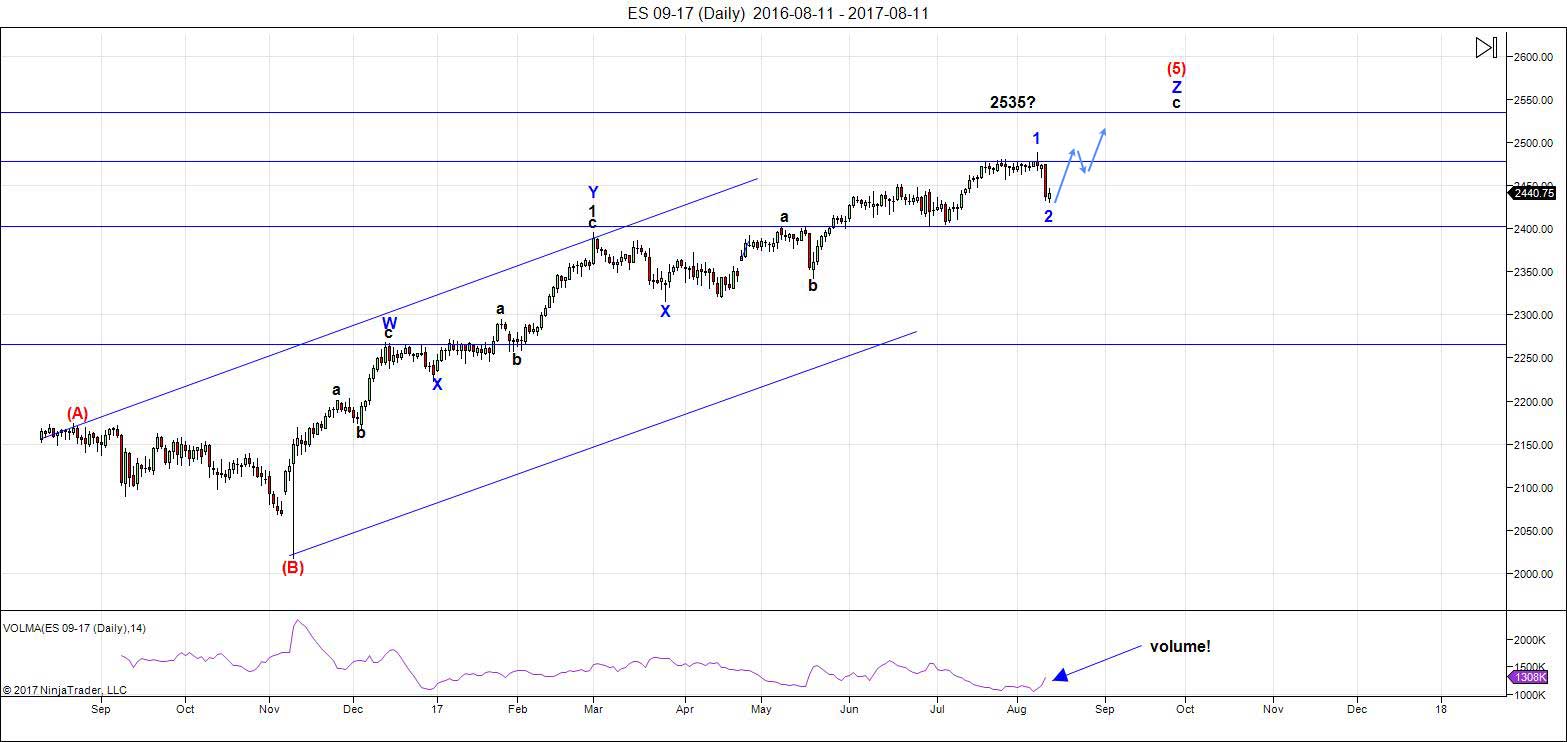

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts). This weekend, we're sitting in the final pattern of the rally from 2009. It's a fractured market with the Nasdaq slightly out-of-sync with the SP500. Rather than being a problem or making analysis more difficult, it's actually aided in firming up the most probable end-game scenario.

There are two ways to count the final wave we're in (the blue Z wave) thus far. I showed the alternate count in the ES chart last week. However, they both point to exactly the same result. The pattern of the final set of waves up (the Z waves—from the top-most X to Z on the chart) is a final third zigzag of a "triple three," or three zigzags in a row, the most you can have as a pattern. We are in the final "fifth wave" of that pattern.

The drop this week came down in two segments (an ABC wave), but measurements of both this entire corrective wave and the subwaves are "off." The lengths of the subwaves don't fall into the usual fibonacci ratios one would expect. However, the SP500 is sitting right on the 62% retrace level from the previous fourth wave bottom at ~2438. That's a very strong inflection point. At the same time, NQ completed five impulsive waves up on Friday.

There was also an issue with the final wave in SPX and ES that went to a brief new high (topping at 2488) before the drop: It was in an ABC configuration, a very obvious zigzag. This makes the entire structure from the previous fourth wave a corrective wave.

These facts (plus the position of this wave in a fifth wave location) point to only one possibility—an ending diagonal. You'll find a similar pattern in the DOW and Russell indices.

This has changed the projected "top tick" price level to possibly lower: I'm showing it here as around 2500. Of course, being we have an ending diagonal, we can expect it to go slightly higher than I project.

With the NQ and related NDX indices currently in a fifth wave, this places the two major US exchanges in sync, both finishing their final patterns (although structurally different) at the same time.

Volume: Note that volume now expands with selling, but drops considerably when the market heads back up. This is yet another signal of an impending top.

The USD currency pairs have finished their fourth waves (in conjunction with the US dollar) and have entered, or are entering the fifth and final wave, as well.

Summary: The final wave five is in progress. Although early to call an ending diagonal, deductive reasoning has served to eliminate other potential patterns.

______________________________________

Sign up for: The Chart Show

Wednesday, August 23 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Valley

Last note: i have seen inversion take place between Nov and Feb many times

in this and the seasonal bias is Nov 7 into year end .

if for some reason this inverts again ? it would do so in early November

and the basic model would there for be generally bullish into around June

2018 and that is where the beginning of the mars Uranus crash cycle sits.

Also, the combination of Venus and mercury near year end turns from

bullish to bearish , Venus has its inferior or superior conjunction along with mercury having its opposite ( one is inferior the other superior )

look up June 2008 for the sample and you will see what im talking about .

the ” venus bull ” market that began march 27th cycle ends at that point .

and a Venus bear cycle then begins , then its the mars uranus crash cycle

from June 2018 into Jan 10th 2019 . the Venus bear cycle should last approximately 10 months which would be somewhere near oct 2018 ( you would look for the superior and inferior conjuncts of both venus and mercury and the sun for that turn )

They run together with mars Uranus but they don’t always turn at the exact times, usually 1 turns then later the other turns and combined the market moves

or accelerates . the June 2018 into late 2018 and into jan 2019 is extremely bearish and should be a 3rd wave price action .

that is what im working with along with other things .

take it and dig and see what you find .

im out of here come monday so work work work on my plate .

i hope you find this helpful with your own work

Thanks, Joe!

Before I reveal my outlook I have to talk about gravity first. Gravity affects humans. If in doubt read Paradigm,

The drivers of gravity are lunar distance and the sun-moon angle. This angle will allways be between 0 and 360 degrees. Lunar distance shows multi year cycles (probably caused by Venus).

Most analysts that accept the notion of gravity look at tidal stations but this comes with some challenges.

I chose to use Newton law. This seems pretty easy (mass divided by distance squared) but the impact of the sun/moon angle makes it a bit of a challenge.

My indicator uses lunar distance as imput so the indicator also shows multi year cycles.

And here’s the thing; my indicator gives an extreme low 9/28. After this date gravity is bearish into spring 2020.

McMinn says financial panic comes when lillith trines the node. That would be 9/22. Carolans fall high is 9/21. So the 9/28 days is just 1 week off. ( ina multi year cycle!) A lower high 9/28 is certainly possible.

Because my indicator doesn’t have any reference I calculated a multi century average on it. 8/21 the indivator tests the average from below and gives a high reading 9/22. This makes sense as we have a new moon 8/21. My indicator also uses distance so the composite date is 8/22.

This makes the 8/21-22 window very sensitive. All the indicators I use point to 8/21 – 8/22. Carolans Summer high points to 8/22. The midponit between the summer high and the fall high is 9/6,

Gravity gives a low for 9/7. So a low 9/6 (tpv date) and 9/7 is likely. But this could be the low in a 3rd leg. With a high around 9/28 a low 9/12 is even more likely,

8/29 will be a significant high. So with 8/22-ish high and 8/29 high a low 8/25-26 is a possibility. Just some thoughts,

André

Typo; inidcator give high reading 8/22 (carolans summer high)

Many thanks!

Discussed some time ago — 8/25 is Saturn Station Direct in Sag, which was the alignment for the 1929 high. You have it inverted now? Perhaps Saturn will be pissed she’s been forgotten. Whatever direction it goes, should be a big move.

Mike,

8/25-27 we have an inversion window. 8/29 is very significant. So the 8/25 high will be a low to start a 4 day inversion window 8/25 – 8/29,

Good to see you back, thanks …Nick

Talking about gravity, some might find this scientific paper interesting:

http://notrickszone.com/2017/08/10/new-engineering-textbook-asserts-the-impact-of-co2-emissions-on-climate-is-negligible/#sthash.TLbh1Nof.dpbs

And I would like to personally thank Andre for bringing Garrett’s book to my attention. Amazing!

A new free blog post is live at: https://worldcyclesinstitute.com/back-to-the-future/

Ed

The short answer is yes i do expect this to last longer and be deeper than most

expect. The long answer is more complex and ill try to explain this in as simplest

as i can . sept 29-oct 3rd to me shows up all over the place so its an important time frame , this same time frame dove tails with the usa debt and the need to create a budget as well as raise the debt ceiling . if you remember earlier this year after they raised the debt ceiling trump said after he signed it . he said maybe we ill have to shut down the government next time because he signed a deal he did not want and he also wanted more money for his wall. many thought

trump back then caved to the democrats . so its up in the air how or if they actually settle on a budget . its becoming political is all i m saying on that note.

the decennial pattern is now pointing lower into the week of oct 20th .

6 weeks after the solar eclipse surrounds the full moon on oct 5th .

A cycle ends 6 weeks after the solar eclipse . what that cycle is we don’t know for sure until it actually happens, with new market data i have to adjust to what is working vs what is not. The crash comparison of 1929 and 1987 i have been posting was showing a high on monday and a decline to begin and then

secondary high surrounding the Sept 29-oct 3rd time frame and a decline into

the week of Oct 20th . The inversion i m seeing implies a low now and a new all time high or a counter trend high into sept 29th oct 3 time frame and then a decline into the week of oct 20th .

The major swing im assuming is surrounding the debt ceiling debate and the need to have a deal signed by Sept 29th which falls into the 6 week period after the solar eclipse . so i cannot rule out new all time highs in the Dow into that time frame . Now to add to this ill add a Hindenburg omen chart i was just

made aware of which includes several index’s for perspective .

to go on. with Elliot wave theory you know when your right or wrong , this present decline in both the NASDAQ 100 as well as the Dow to me seems to deep already to be considered a 4th wave on a minor degree .

the weekly chart low on the week of july 3rd in the nasdaq 100 was wave 4

and the weekly high the week of july 24 can only be 1 of 2 things . it is either

the final 5th wave top or it is only minor wave I of wave 5. this places the NASDAQ 100 in either a big downtrend going forward or a minor wave II of final wave 5.

bottom line: if the NASDAQ 100 makes new highs i have to consider it as a 3rd wave to much higher prices of its final 5th wave .

the .618 retrace sits at 5738.60 and last weeks low was 5770.14 which was a 54.22% retrace . that is not that far away from the .618 and can be considered a wave 2 of minor degree . so to confuse the picture further im on the fence as to whether the NASDAQ 100 is topped or not . new highs are bullish and a break of the july 3rd weekly low will confirm a 5th wave high was indeed seen back on the week of July 24th .

so now i talk of the inversions ????? the dow sits in a similar wave count .

the simple 1 2 3 4 cannot be the correct count anymore from the july 6th closing low on an hourly chart . this decline is to deep , so again we are facing a potential 2nd wave vs a 4th wave . breaking the july 6th lows in my opinion tells the tail

that a top is in place . if we turn higher from here and make new highs in the dow as well as the nasdaq 100 i must consider the wave a minor 3rd wave of wave 5 of 5 .

the week of july 17th low on the dow at 21471.14 to the week of aug 7 high

at 22179.11 would be wave I of a final 5th wave and we are now in a very deep wave 2 of this final 5th wave . this places the 21471.14 as the level of importance .

( my mental stop of 21472 ???? stands )

either the market has peaked or it has not yet there is no confirmation at this juncture in my opinion .

the daily chart is a bit different and calls the july 24 low ( the inversion ?? )

the low of importance at 21496.13 , the dow rose from 21496.13 for 11 trade days to 22179.11 and has now has had a retrace of just a few points beyond the .786 which can be considered a very deep wave ii of this leg ( not saying this is true but its possible ) we rallied for 11 trade days and have retraces for 8 trade days as i see it . 8 / 11 = 72.72 time retrace for just over a .786 point retrace .

if this is a minor wave 2 then the dow should rally at least 11 trade days to = wave 1 of minor degree yet it should really go beyond the time frame that wave

1 lasted , 1.618 as example times 11 would be closer to 17-18 trade days

so that is what im opening up to as for the wave count which has not proven itself to me that the top is in unless those respective lows i stated above are indeed broken . as for the decade charts ( decennial patterns ) they do point lower yet the cyclical stuff im looking at as well as something Peter G pointed out to me tells me to question it right now .

my reasoning for questioning it ill try to explain. Peter G may or may not agree

yet ill touch on it . The puetz window in my opinion has flaws in it yet it is a very useful timing tool , to me there is no puetz true puetz window this year and Peter G will state i am wrong , I am ok with that . What Peter G has explained is that Steve Puetz has altered the parameters to this cycle or window . He states that

the new version says you watch for the beginning point to be with in 1 lunar cycle

surrounding the lunar eclipse , since Peter G has not answered my questions

i m not able to take this much further yet ill simply say that the variable from what he is saying i cannot confirm since i do not know the 12 crashes puetz has focused on . since 1929 to date it is safe to say there has been at least 2 solar eclipses and 2 lunar eclipses each year ( if not more ) this means there has been

176 puetz windows since then yet Peter G stated puetz focused on only 12 which would be a very limited sample set . Steve Puetz has done a lot of market cycle studies and i am not going to argue his work or assume he only looked at 12

periods yet so ill assume there is other things that are simply not known.

yet a sample set of only 12 periods focused on only time periods of feb to april

or sept to oct would be extremely limited considering the actual windows that have been at play . to further this research in my opinion there is one more piece to the puzzle that i think has been overlooked yet i do not know if it has been or not .

if this last piece has been overlooked then we will know come sept 29th oct 8

which is the 6 days before to 3 days after the full moon which is 6 weeks after

the solar eclipse . im not going to say what this is at this juncture yet what i am going to do is buy some of Steve Puetz books and read his work . I will if i find

he has missed what im thinking i am seeing is i will write to him and ask a few key questions and from that i will point out to him what i think i am seeing and see what he thinks . since this is all an extension of his work i do feel that he needs to be informed and questioned regarding it . that said im leaving my thoughts out of this because i cannot claim to have discovered something i may not have actually discovered .

im finished with what im thinking .

if we rally hard for the next 10 trade days then pause then run higher

the cycle will end near sept 28th-oct 3rd . what that wave count looks like

will give me further guidance .

The actual wave count is becoming my primary focus and timing secondary

at this juncture .

the July lows the important lows and the august highs the important highs

the weekly chart im focusing on more so then the daily or hourly chart .

The weekly and monthly pivots ( high low close / 3 as well as open high low close / 4 ) i feel should be focused on going forward for the key price levels because i am noticing those levels being traded on and im beginning to think they are programmed into the automated trading systems.

heading to work early morning monday and will not be able to focus on the hourly charts all that much . we will see soon enough about whether or not we are seeing an inversion yet i m thinking we are .

i hope that helps even if a bit confusing

I said id had this link in regards to the Hindenburg omen so here it is.

My question is since this is the top of a bull market should the Hindenburg omen also make a new record before the top or is this high good enough ?

food for thought as you look at this .

http://www.financialsense.com/fs-staff/hindenburg-omens-flashing-major-warning-signal-stock-market

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.