Pundits — A Good Laugh!

I found myself chuckling this past week as there were so many predictions of a turn down in conjunction with the Fed announcement this past Wednesday, which didn’t have a chance in Hell of happening: Events don’t affect the market in a lasting technical manner.

We were still expecting a new high (the previous wave down was in three waves, so it had to completely retrace). But, some people never give up holding on to inherent biases that are mostly a result of propaganda.

It’s akin to the problem that economists have. We still think they’re gods when it comes to predicting the economy. However, they’re ALWAYS wrong. That’s because they’ve never been taught about cycles. They seem to think that things move in a straight line.

However, there are no natural straight lines in nature. NONE. The Universe is an electrical entity influenced by spinning globes and electromagnetic waves (in the form of sine waves). There is no straight line anywhere to be found … anywhere in the Universe.

On top of that fact, is this (apparently) little known phenomenon: The market moves in pre-determined patterns and these patterns always play out to their predictable ends.

But … pundits have to make a living! They’ve certainly created a platform for themselves by constantly drilling in the lie that somehow every word of any politician affects the ups and downs of the market. Never going to happen.

There are lots of lots of laughable predictions this weekend about the future of tech, the market, the economy, hyperinflation, and the future in general … none of which make a whole lot of sense if you understand the past, cycles, or how the international banking system works (or doesn’t … haha … as the case may be).

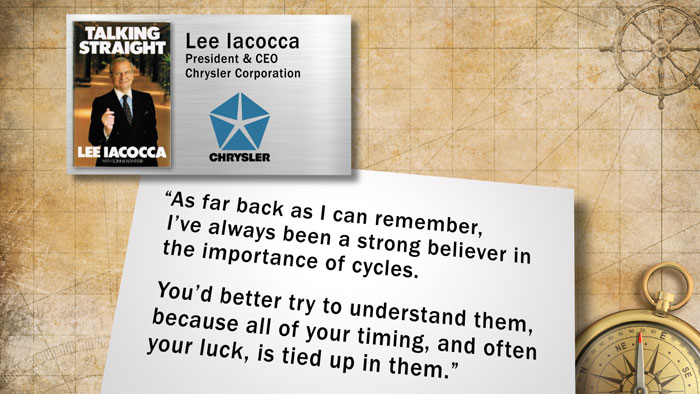

Take it from Lee Iacocca, who was the guy who turned Chrysler around in the 1980s by creating the minivan …

But, back to the pundits …

This weekend, the press is promoting gold as being in a bull market. Not a chance. That’s your first indicator that it’s going to implode — as soon as the pundits hit the airwaves and all agree on the direction. You don’t need Elliott wave or anything else to figure that one out!

The fact is that … This weekend, with the solstice, EVERYTHING is set up for a MAJOR turn. I’d expect to see that turn in the first part of the coming week.

It’s been a lucrative time for the Trader’s Gold folks, with wave structure clearer than it has been for a long time. After all, as I’ve been predicting for over three long years, we finally have virtually all asset classes moving in tandem … and that extends to major international indices, like TSE and DAX.

Fourth waves are the worst of all the patterns. In the NYSE, we’ve been in the largest one I’ve ever seen since the end of January, 2018 – a year and a half!

Generally, I recommend NOT trading them because they’re so unpredictable. This one has been that, and more.

But this fourth wave was SO LARGE, that you pretty much have to trade it — after all, we’ve been in it for so long …

We’ve had the largest non-confirmation I’ve ever seen, with SPX, the DOW, and Russell 3000 rising into that rare boarding top pattern I outlined a few weeks ago, while the NYSE has roamed about as a clear fourth wave. This means that, while the mother exchange (NYSE) shows a fourth wave, these sub-indices are actually at the top of a third wave. That’s the largest non-confirmation I’ve even seen, something that only happens near market tops.

The immense size of the first wave confirms that the waves up in the NYSE are corrective, and have been since 2009. We have a B wave in progress, as I’ve been saying for years. There is no other possible explanation for the current wave structure.

The US indices will all get back in sync with this next move to a new low. The NYSE will complete a C wave down of the fourth wave, while the sub-indices will start and finish their fourth wave as the C wave of a regular flat (most likely).

You don’t want to miss the coming turn and the NYSE group is apparently going to make it a little easier for us. I see an ending diagonal that’s about to trace out the final wave up this weekend.

The wave down will bring to an end the ugly fourth wave we’ve been in, what I’ve been dubbing, “The Fourth Wave from Hell.” At the bottom around the September timeframe, I’ll do a summary of the entire experience, likely entitled, “I told you so … ”

It’s going to be a summer to remember.

___________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

All the assets I cover have continued to perform as predicted. Across the board, they're now sitting at the targets I've been predicting for weeks now (gold, silver, oil, USD, USD currency pairs, US indices). All these asset classes are now moving as one (as I've been saying for the past three years that they eventually would do). This turn will affect all of them.

Trader's Gold subscribers have done well over the past few weeks, with setups across the board. The opportunities are increasing, as virtually everything is aligned.

The broadening top we're completing is not an Elliott wave pattern; they're so rare, that experience in trading them is minimal. The sub-waves up in emini futures (on hourly charts) have been the most difficult waves to predict due to the fact that they don't display the usual expected ending-wave pattern. In ES, they're clearly corrective (zigzags), while those in NQ appear to have traced out a motive set of waves. NQ is still searching for a new high.

ES has traced out an ending diagonal. Expect a turn earlier in the week than later. It appears the equinox of this weekend (with all the energy it unleashes) is having the final word.

The opportunities setting up this weekend extend to international exchanges like TSX and DAX. The coming drop will be a world-wide phenomenon across all most all sectors. It will last throughout the summer months and most likely culminate in a low and final round of QE.

As I've said since the low on Dec. 26, the waves up are corrective in the NYSE-related indices, and as a result, will completely retrace. Expect an imminent top and a major move to a new low under 2100.

Summary: Expect an imminent top to complete this large, corrective "B wave" up from the Dec. 26 low. The overall pattern is a record-breaking broadening top (not an EW pattern).

I'm looking for a dramatic drop in a 4th wave to a new low. ES will eventually target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave of this 500 year cycle top.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil).

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, June 26 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Thanks again, Peter!

Thanks Peter for your amazing work, really impressive!

For me it’s still really difficult to understand “how accurate are the waves against continuous manipulations from CB”!

Maybe they can influence the “timing” but not the trends?

Definitely need to learn more….very new for me 😉

Serge

There are lots of books out there, many on my recommended books list on the site.

Thank you Mr. Temple!

Thanks Peter,

Last week I expected the top of this market would be June 24/25.

But for now I think it’s going to be B.T.f.D.

My next turn dates are June 29 and July 4.

I think we will have a very volatile period starting this week.

Tom, do you have a new energy chart?

All the best

Johannes

Peter, do you pay attention to political forecast predicting war and stocks crash?

https://www.strategic-culture.org/news/2019/06/23/provoking-iran-could-start-a-war-and-crash-the-entire-world-economy/

Thanks

Serge

This stuff is like watching reruns, for me. All you’ll get now (war=wise) is posturing from a dying empire (skirmishes, as best – and the CIA trying to create a dust-up). You will only get civil wars from here on in.

Politics has no real bearing. For example, it’s not a coincidence that you get populist leaders at the tops of cycles: Henry VIII (populist king at the top of the last 500 year cycle), Andrew Jackson at the top of the 172 year cycle that led to the largest depression (1837) in US history to that point, Hoover in 1929, and Trump and this gang internationally … populism and weak leaders abound right now, as they always do in history at major cycle tops.

Cycles dictate politics and war. These articles are more punditry. blah, blah, blah blah … but if you know cycles and history, you know the eventual outcome. It certainly provides a sense of calm.

Amazing, in fact EW is also predicting political trends, in sync with financials!

And climate, of course … https://worldcyclesinstitute.com/dont-like-the-climate-wait-a-cycle/

For what its worth

The week of Aug 13 1956 The averages of the 200 400 and 700 week Oscillator Readings were the most over bought readings in the history of the Dow .

Last weeks Close Came with in a very tiny margin of hitting that reading.

Additionally the weekly dow based on just this Oscillator is now more overbought

than the week Jan 22 2018 .

The Combination of the Daily and weekly oscillator’s ( different method )

Have hardly Budged despite this run up from the june 3 lows .

For my work to hold true the cash dow needs 2 more weekly higher closes .

That said Fridays high did satisfy the price targeting I was looking for by early July.

Any side bets on me being quiet ???

I will be quiet until July 16 2019 .

Politics don’t really matter in my work yet I find them interesting near certain turn dates is all .

Note: Britain PM Vote

The winner of the runoff, due to be announced the week of July 22, will become the new Conservative leader and the country’s next prime minister, replacing Theresa May.

A Summer to remember Indeed !

Thanks Peter 🙂

https://www.politicshome.com/news/uk/foreign-affairs/brexit/news/104770/cabinet-ministers-tear-boris-johnsons-plan-no-deal-brexit

Peter T,

You mention that we are in the last wave of an ending diagonal…What Index?

I am assuming the NYSE since you mentioned the NYSE earlier in the paragraph.

Maybe I am not understanding the time frame of each bars on the chart! (ie. daily,

Weekly, hourly etc)

Ed,

ES, SP500, Russell 3000, DOW.

Peter T,

Thank you for the updates and counts. If you could clarify, you say all markets are moving in tandem, (but not all markets are at highs). With this being a broadening top (not an EW pattern), can we assume we can start a C wave to finish wave 4 can start without RUT, DJT, and semis do not have to hit new highs? Also, would we want to see everything hitting new highs when we are finishing wave 5 at 500 year high? Thanxxx Peter!

At the top of a third wave, with a corrective wave before them, these indices or stocks need a new high. Depends where they are in their counts. Currencies, for ecample at not at important highs or lows (except for perhaps USDJPY), but they’re at important inflection points. They just need to turn from the area they’re in. At the very top in a year or so, however, all the US indices will need to top.

My my! Bullish sentiments abounds!

I am seeing some remarkable bullish EW counts, one in particular opining that we are now in the middle of an intermediate third way up!

Will we see some very red faces this Summer, perhaps!?

( And I am NOT talking about sun-burn!) 🙂

I m still doubting what June 24/25 will bring, anyway I bought puts on the AEX this morning.

So maybe it is a top today and we will go down into July 4?.

Joe, who already mentioned the Mercury retograde period, sometimes prices fall to the beginning of the period, so July 7 could also be a low point, let’s see what will happen.

Or, we make la lower top on July 7 and dive afterwards.

Dear Peter,

From your last publication (The Manipulation of Your Money):

Traditional investment is dead. Stock markets are in the process of topping. We’re going to see a crash sometime in late 2020 or early 2021.

According to previous postings, I thought that a crash is probably coming sooner in 2019, but you mention now much later.

Can you help understanding your views.

Thanks

Serge

The coming roughly 20% decline will qualify as a bear market but will be just the conclusion of a protracted primary fourth wave. It will be followed by a final primary fifth wave up to complete the current bull market and put in a 500 year cycle top.

I think that is Peter’s view. Some analysts think we have already topped in some indices with a DOW Theory non-confirmation, others contend we are already in the final move up to make a final tag of the upper boundary of a massive megaphone pattern. Time will tell, but for now, the trend remains up.

http://schrts.co/bMYRcGHq

Dow & Tran, not pretty at all!

Anyone notice the island reversal in SPY but not in the index?

Could the ETF possibly be a bit ahead of the price action?

Very interesting!

I am remaining with my disciplined approach to to the market vis a vis my theory of bankster leverage being the primary driver of market price. I refuse to make any trades beside short scalps until we see evidence of leverage unwind, and that means and index CLOSE below 2900. Considering where we are headed, waiting confirmation worth missing the initial forty index downside points imho…

I exited all my longs today. Momentum divergence is pretty strong. It is impossible for me to time the top. Ideally, indices should have gone up another 1% (maybe they still will to tap the expanding trendline). I just don’t like how the internals are deteriorating. Most of the secondary growth companies are lagging and their charts exhibit a nice completed 5 on both daily and weekly time frame. Russell looks very weak. I will short that before any other index.

Probably wise. The trend remains up, and it is tough to know when we will get the turn. One thing is certain, it will be quite obvious when it arrives. No need to jump the gun on the short side…as much as I am tempted to based on the huge negative divergences we are seeing with this move higher….

CFTC non-commercials increased net short positions of VIX by 18.7% to (108,600) contracts short in last week. Not most shorts in last year (180,300), but shows the hopium is still being passed around. The hopium of a July rate cut is high, but the ammunition to cut doesn’t come out until after meeting. So there’s still time… until the markets start anticipating.

The move down in RUT is tempting but it is never a good idea to go all-in unless the decline being confirmed by the other indices. I think we are not quite done yet.

Perhaps futures will prove me incorrect! 🙂

I was a bit early on my latest RIOT position but one look at the break from the falling wedge along with the open short interest told me the short-sellers were in for a lot of PAIN! Glad I reloaded!

Strange how they remained short in view of Bitcoin’s powerful break higher.

The RIOT ROCKET has launched! 🙂

Verne..been watching that one too lets see..weekly chart in interesting position

Considering what Bitcoin has been doing, it is remarkable that fully 30% of the float held short…!

It is intriguing to see some EW analysts persist in posting downward counts in a market that is clearly still in consolidation mode. If we have arrived at these levels with CB leverage to overcome overhead resistance, the break-down will NOT be gradual. I think we see more upward movement before we turn. Just my two pence…!

I’m short RUT and others, miserable to watch sideways nothing, but uncomfortable in a comfortable way HaHa. Made a quick 15% in bitcoin (GBTC) and pulled, up 36% since (complexion of a pimple sometimes HaHa)… will watch for PB, more move to come… what direction? I am (almost) all VOL oriented (with Peter T’s counts in mind), with new source for Implied VOL vs. Realized VOL). That has paid me well since renewed focus, I need to pay attention. Focus is integration with EW waves, OB/OS (oversold), and steepness/flattening of curves (MACD, CCI, and RSI) on different time-frames. This has correlated well with EW to this po1nt but continue to test against my results and inclusion/concentration of key indicators.

No question about where we are ultimately going. The evidence is abundant.

The short-term price action points higher…

Currencies are all hovering. EURUSD is down in three waves, so it should retrace right back up to the top. This is going to be another slow grind.

I was critical of a few very bullish EW counts and that owing to my own bearish bias. I have learned over the years that Mr. Market could not care less about what we think or predict. It is starting to look to me like the 3000 price target for those bullish counts are not out of the question by any means. It will certainly take place under over-bought conditione and with intact negative divergences but that seems to be what price so far is telling us. I do not believe a tuen down is imminent based in what I am seeing. Just my two pennies…

Yes indeed. Mr. Market has three trading days to confirm or negate last month’s bearish engulfing candle, and it sure is starting to look like we will see a rare negation of a monthly signal!

Any near-term bullish case requires a successful defense of SPX 2900, which remains my personal bull/bear line in the sand.

If the sneaky banksters gap us down past it, it will be one of the most elegantly executed bull traps I have seen in quite awhile!

These banksters are very tricksy.

As I have said before, these cretins cannot HIDE a leverage unwind…locked and loaded…! 😀

A new low today gives five down off the recent high and signal a trend change at minute degree for the near term. I suspect it will be part of a larger three wave structure…

Clearly defending DJIA 26, 600.00 and SPX 2920, so no unwind so far.

I will assume if price moves impulsively below these levels on a closing basis that some deep-pocket bears have thrown down the gauntlet…boy would that be interesting…let the fur fly!! 🙂

Lol! Looks like the banksters are baiting bulls and bears alike.

Either we see a bounce off the 2900 leverage pivot OR an impulsive blast through it to the downside. Implications are clear…! 🙂

Fur could fly 🙂 I am seeing all kind of counts also. Dent is drawing his megaphone pattern again (similar to Peter’s expanding top). Thinks we could see 27k DJI, 3020 SPX before down move… or weakness starts soon with 20k DJI, 5700 NAS. Inverses and VOL positions pretty tasty today… hold em or fold em…

Poor old Harry. I believed him when he called a top in 2012.

I hear he is now quite bullish! 😁

TECS and SQQQ up >5%, SRTY (RUT) only up 1.5%… HHMMM

Def a holdem or foldem moment…I am more thinking they are going to sling shot this back up..I am mixed in what I am holding..TLT looks a little Toppy and not budging up with this ramp down today..

QQQ really holding that gap..so far

Fed-speak less bullish, no 50bps next month, so bonds regroup a little. Paring some positions, but VIX above MACD zero line first time in month 0n 195min (1/2 day) so see if it holds on for a trend change…

No surprise there. As I opined, the FED may be crazy, but they are not stupid…! 😎

Nice fur fight!

Let’s see how high she bounces tomorrow. If the bulls want to negate last months bearish candle, they had better get the party started…not too much time left. If VIX stays above 15 tomorrow the bulls are toast…or should I say juicy steaks??!! 🙂

Taking a brief gander at the 5 hour chart, methinks the bears may be celebrating a bit early. Price has come down to a previous support shelf of around 2920 and have held above. This tells me we have certainly not had a leverage unwind. If the banksters are in, not an auspicious time to short imho. With that shelf intact, the risk to the upside remains alive, today’s bearish exuberance notwithstanding…. 🙂

I have taken a stab by buying some call spreads. Too dicey to get long outright.

No leverage unwind today, volume unremarkable on drop so a bounce is likely. No all in/out situation here, hopium could continue into GDP and other reports mid-July… think it makes Fed behind-the-curve, particularly if quad4 in Q3 materializes. No free ride here, on you haunches for the right moves at right times. Gotta ring the register and know when to park for awhile. Best to all as we ride this out.

I agree. The danger for the banksters is that price may fall under its own weight under the leverage pivot and force them to exit. If so we we will see a gap down below 2900 and that would be a wrap!

They dropped some cash at the 2916.31 low today and again at the 2915.72 low but the dump was quite lack-luster. I think they intend for the long tails to be a warning to bearish traders, so it will be interesting to see if the bears none-the-less steam-roll them and take out the equivalent futures levels over-night. 🙂

I saw at least one EW count that has us completing a second wave down today and starting a third wave up. The VIX price action certainly seems to be charting a different course……

At least creativity isn’t dead …

🙂

Hyuk! Hyuk! 😀

This divergence between Gold and Silver, like in 2007-8 (but much shorter), could eventually announce the coming markets’ drop, but much deeper!

We should start praying for our soul.

Serge

https://goldtadise.com/wp-content/uploads/2019/06/Gold-and-silver-combo-line.png

Tech definitely oversold yesterday, could have trimmed more but will sell tech when overbought. My 2 key thoughts this morning… QUAD 4 = RISK OFF, The Fed can print money, but it can’t print earnings. Cheers!

Oh don’t you worry…they just buy a few billions worth of shares to boost that P.E. Who needs earnings when you can just buy your own shares with the proceeds of mony from bonds, many of which will never be repaid?

Bull market huh? 😬

If credit drops, it’s done IMHO

Those with clean bonds should kick A when we get the unwind

Did you say “IF”, my good man???!!! 😁

Perceptive!! Perception, with a plan, is most everything 😉

~All moving avg (monkeys) on all time frames are bullish (last ones turned up ~a week ago. I hate em but everybody watches them. It will take more than yesterday to get them pointing down (they’re always late), so the waves are important right now… and always 😉

Interesting. My indicators are starting to fire on the sell side.

I expect a dive in futures…

retail investors will soon be able to trade CDS and CDOs (both cash and synthetic). What can possibly go wrong…

https://www.zerohedge.com/news/2019-06-25/its-2007-all-over-again-jpmorgan-pushing-syntehtic-cdos-masses

We got another Hindenburg Omen on Tuesday. That makes a confirmed ten on the clock through September.

There will be PAIN…! 😎

QQQs resting with chin on 186.20. I hate relying on ST technicals, but if QQQ drops out of triangle, we should see some failure. Is it an omen? 😉

Thank you for this blog. I had a question. You’ve stated that the rally from 08′ is a B wave. Isn’t it too large to be considered a B wave since it will pass the 2.618 extension of the A wave down (07′-09′)? Are there limits to the size of B wave. I understand it can be one large expanded flat but I can’t wrap my head around how this B wave can be this long both by price and time duration. The subsequent C wave down, if it were to go below 08′ lows would have to even greater in size than. Thanks.

Sid,

There isn’t any restriction in the length of the B wave. It’s a corrective wave that goes in the opposite direction from an A wave. Then you get a C wave. This has nothing to do with a flat. The C wave will eventually find the DOW under 3,000 points, so yeah, it’ll be a “biggy”, or perhaps a “bigly” one.

Thanks, I have to say the count so far fits best with a zigzag from the 08′ lows so strictly from a EW perspective the B wave makes the most sense.

Looks like they plan the unwind in futures on the last trading day of the month.

Uber sneaky…!

Their only other option is nore leverage to forestall the threat of an imminent break of the 2910-2920 support shelf.

Things could get ugly…

There’s a new article on banking (The Wizard of Oz) that I just took live on the front page of the site. There are also a couple recent articles on deflation and the changing value of money if you haven’t seen them.

The G20 seems to be handing out Hopium tablets for the next couple of days, so the market may remain in a short-term quagmire — time for other stuff …

Great read Peter. Quite insightful.

The entire system is insanely leveraged, and I am not just talking about the 30 to one financial leverage employed by some of the banksters and their derivatives black-hole History’s largest transfer of wealth has ALREADY occurred.

Just think about it…over 13 TRILLION of global debt with NEGATIVE yields!

For those of us who understand what is really going on, it truly represents the opportunity of many lifetimes… 🙂

Indices sporting differing wave patterns. Truly remarkable!

Fractured markets are unhealthy markets!

Triangles in this market are multiplying like bunnies on Viagra!

I have never seen anything like it. They are great fun to trade as they are so predictable. It looks to me like this one is part of an ABC downward correction as it has persisted way too long to be a fourth wave. Good news for the bears if that is right is that we get a sharp C wave down. Bad news for the bears is the Summer brings new all time highs. Another possibility is some kind of second wave but I cannot get it to sub-divide in a way that makes any sense to me at least.

Outcome there would of course be sharp C up, then massive three down but that just does not look quite right.

We should find out in a few hours….

And just to make things perfectly cloudy, ES looks different from the cash session. It looks like a 3,3,5 upward correction. Yikes!

EGAD!!!

Is that a C wave ED in ES??!

( Not THAT kind of ED! ) 😁

If it is, we are going to get VERY red, VERY quickly indeed.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.