The SP500—About Five Miles Out

I’ve maintained for several years that this final wave up in the US indices is a corrective wave. It simply cannot be motive, as it breaks too many Elliott wave rules. But I see so many disregarding the obvious, which is the main issue I have with all the “pretenders”: They don’t pay attention to the details (the subwaves) and so we have all these incorrect counts out there from people who haven’t done the proper homework.

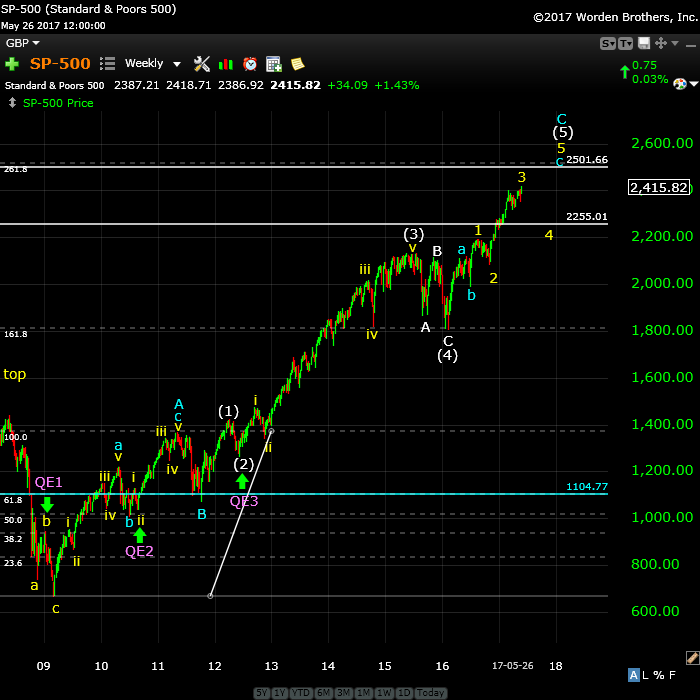

Analyzing markets using Elliott waves is an exercise in attention to subtleties. Below, I’ve placed a weekly chart and below that, an explanation of why this entire structure up from 2009 is a corrective wave.

Why is this important? Three reasons:

- Knowing the structure helps us understand the final subwaves in current wave circle wave 5 heading to the top

- It helps us predict a final top in price

- It helps us understand the potential magnitude of the drop once the market tops (more below)

NOTE: The term “corrective” does not mean that this wave is correcting another wave. It’s rather an elliott wave term that 1) addresses the structure of the wave and 2) the fact that it’s moving against the larger trend.

Above is the weekly chart of the SP500. I’ll take you through the important elements of this final wave up from 2009, moving more or less from the bottom up to the top.

QE 1, 2, 3: In purple, you’ll see the timing of the various quantitative easing (the Federal Reserve introducing cash into the system by buying mortgages, etc.). You can see the “bump” up in the market when they were added—fuel for the fire, as it were. In the case of QE1, it was set in place before the wave down in 2008 was complete. The result was that it shortened the wave, making the final 5 wave of that sequence only three waves. You can see that I’ve labelled yellow abc just below the green arrow. That meant the the entire wave down changed from motive to corrective—it was a subtle change that many of us did not catch when it happened (and many still haven’t clued into it).

The effect of that change to the final wave meant that in Elliott wave terms, it signalled that we would likely see a wave up from the bottom to new highs. To that same point, the blue horizontal line at 1104.77, marked the 62% retracement level of the 2007/8 wave down, which, if it had been motive, was where we expected the third wave down to occur. It began, but came down in three waves and headed right back up with QE2 kicking in.

Corrective Wave blue A: This is the most important wave of the entire wave, as it sets up whether the continuing wave up is going to be motive or corrective. Let’s review the reasons it’s a corrective structure:

- The first wave yellow ii is a second wave. However, it did not retrace even 38%, which is the minimum it must retrace (by Elliott wave rules in Prechter’s Principle book) in order to be a “legal” wave 2 in a motive sequence. This is a “hard” Elliott wave rule that cannot be broken. It has been, however. So, right off the bat, the entire wave up has to be classified as “corrective.”

- Wave blue b (a little higher) cannot be a wave four, as we already have a wave four in the wave up of on lesser degree, so it has to be a wave blue b. It is also too large for the sequence so far and therefore the sequence does not have “the right look” for a motive wave.

- The lengths of the subwaves of the blue abc sequence up do not conform to the requirements for a motive wave. Also, the 5 waves of wave blue are not the correct lengths for a motive five wave sequence; the blue c wave has the same issue.

- Wave A up is a zigzag, for the reasons I’ve mentioned. In fact, there is nothing that supports the idea that blue wave A is motive (that I can find).

Fibonacci Prediction for the Top: Knowing that we have a blue A wave in place means that the next major wave up will be a blue C wave (which is not complete yet).

In a corrective sequence, we’re typically able to measure the A wave and then expect the C wave to be either a fib ratio extension of that wave (in terms of length). Expectations are either for a C wave that is a measured extension of the A wave or alternatively, the C wave will be 1.618 or 2.618 times the A wave.

In this case, an extension measurement of the A wave at 2.168 projects at top at 2500. We achieve this same target with a similar measurement of the subwaves within wave white circle 5 (below).

Wave white (4): To be considered a motive sequence, this wave should retrace 38% of the entire length from the bottom in 2009 to the top of wave (3). It doesn’t come close; it is way too short.

Wave white (3): (from about 1104.77 up to about 2136.60):

- Wave white circle 1 is the first wave up of the C wave; however it is in 3 waves, which means it’s corrective (it is, in fact it is a zigzag)

- Wave white circle 3 should be 1.618 the length of wave 1 (in this case, the established blue A wave), but it is not quite long enough. In motive waves, you find that lengths tend to be exact, in corrective waves, not so much. So this tells me something else is going on (likely corrective). One more nail in the motive wave coffin.

Wave white (5): This wave is also turning out to be corrective.

The wave up from the bottom of white circle four is a zigzag. That’s because:

- The blue a wave up does not have the “right look.” The fourth wave is far larger than the paltry second wave. The entire wave looks more like a zigzag. Also, the 5th wave of the a wave is not nearly long enough for a motive wave structure.

- If the entire wave yellow 1 up from white circle 4 is the first wave of the fifth, wave yellow 3 is shorter, which it should not be.

- Wave yellow 3 is currently 1.618 X the length of wave yellow 1 (as marked on the chart), which it should be, whether motive or corrective. However, this means that wave blue a is indeed a different wave and not part of yellow wave 3.

- I have picked apart the structure of yellow 3 in another blog post. You’ll find it here.

- If I measure the length of the blue a wave of white circle 5, having a C wave that is 1.618 X the length of the a wave, gives me a target of 2500, the same target I got with the larger measurement of the blue a wave at the bottom of this entire structure from 2009. That supports the count as I have it shown and gives me two reliable measurements to the same target.

____________________

Even one of these rules or guidelines being broken would have me questioning whether the wave up was motive or not. However, we have warning bells sounding right from the bottom up. So, the wave structure is clearly corrective.

This means that:

- Once we reach the top, the waves coming down are likely to be impulsive to the point of downright scary

- The final wave up in white circle five is more likely to be an ending diagonal, as this traces out in overlapping waves, which is a final pattern with an underlying bearish theme and fast-waning volume.

Hopefully, I’ve given you lots to think about as we move haltingly to the top (in my calculations, it’s about five months away (“five miles out”)). Look to the September/October timeframe.

The Market This Week

Above is the daily chart of ES (click to enlarge, as with any of my charts). I had to backtrack this week on a call made in this very difficult "corrective" market. What appears to be a third zigzag of the third wave (you can only have three patterns within a corrective wave—this third pattern starts at blue X on the chart) has continued slightly higher and now looks to be building a very large expanded flat at the top of the circle red third wave. The analysis was confused by an earlier, smaller flat (May 16), which resulted in a down wave of five waves (the uppermost b wave down on the chart). Five waves down would normally follow-through to a zigzag to the downside.

A teachable moment ... lol: In retrospect, that final wave of last week's flat (5 subwaves down) must not be considered the beginning of a zigzag; it must be kept within the confines of the flat (3-3-5 configuration) and once done, it would need to completely retrace. To recap, the last wave of the flat last week was an ending wave of 5, rather than a beginning wave of 5. It can't be both.

In any case, my original target for this third wave was 2410-15, and we've now exceeded it by one point. That's a head's up as to the importance of fibonacci ratios in all markets. They affect just about every wave, in my experience.

This market, being such a "one-time-wonder," is rife with lessons one could only get from a major corrective ending wave, which we have never seen before (markets usually end in motive wave patterns; however, that's not the situation here). We have circle red wave three ending in overlapping waves: That's corrective (as I've maintained for months now).

Another technical signal to pay attention to:

As well, there was the non-confirmation between some of the US indices. The SP500 has previously gone to a new high, while the NYSE and DOW had not. While others thought that this non-confirmation was OK, the market has proved once again that it is not, as all the major indices are slowly reaching up to exceed their previous highs. Both these indices are likely tracing out flats as well (most likely regular flats, as opposed to the "extended" type).

I have always maintained that once one index tops, they all have to (so that they stay in sync). I had let that personal guideline slip from my analysis, wherein it should have been a big red flat (and something for you to keep in mind for future). I've not seen it fail yet.

For this reason, I look at multiple indices before committing to a direction, or turn.

Summary: We're completing the third wave in ES with a possible expanded flat. Look for a turn down early next week.

After completing the larger fourth wave, we'll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

______________________________________

Sign up for: The Chart Show

Wednesday, May 31 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here. NOTE: the weekday and time have changed - to Wednesdays.

The above implies another 20 pts roughly to the next spx resistance

Level . Breaking through that gives another 48 spx pts .

That means max of 68 points on spx by June 30 .

Yet not sure it gets that far but who knows .

20 points from here is where I’d watch for prices to stall on spx

For now anyways and I’ll see where market actually is on June 30

Before getting short

Long story short

Spx may poke through 2500 then pull back in wave 4

Then run up to 2700 before topping in 5 th wave

I can certainly understand the frustration of some observers who think most of EW is just BS. One can always go back and change the count AFTER the fact, which is a totally useless exercise so far as profitable trading is concerned. Even more amusing is how few EW analysts are willing to simply admit to being wrong. I recently said no one I knew got this count right and I was wrong. I subscribe to Lara Iriarte’s analysis and she actually did have a bullish count for S&P 500 with a target of 2446-2448 for completion of a primary or intermediate third. Avi Gilburt and a few others were still expecting an expanded flat to complete with a C wave down,so I stand corrected on that score. Another analyst I follow is Dr. Robert McHugh and he just made a startling call and change to his wave count as he was also seeing the possibility of an incomplete expanded flat. He now sees us very possibly in the final impulsive E wave up of a gigantic rising bearish wedge. Of the literally dozens of articles I read every week, he is the very first to have actually considered, and written, that we may be in a final wave up. The absence of any such call generally has had me wondering to be honest, and I just about spilled my coffee when I read this week-end’s report. If he is right, this thing is much closer to and end that just about everybody expects. One analyst, Steve Sjuggerude with Stansberry Research is boldly calling for a final melt-up with a DJI doubling from here to 51,000.00. Chris Vermuellen, on a recent SafeHaven post is also opining about a “perpetual bull run”, with CB permanently sustaining price and mood with endless liquidity. These are both very intelligent men. I can only conclude that they are on somebody’s propaganda payroll.

Verne,

Always appreciate you views! I am happy to see you posting again!

Thanks, Verne. Excellent info!

Velrne,

Just read Dr. McHugh…interesting and surprising change. Our own Peter T hinted that there might be an ED count in the making in his reply to me on June 2nd at 7:06am. I am assuming that he will make that point and possibility in today’s update!

My question relative to A/D line divergence is…Could the ETF and Russell 2000 index buying skew the A/D line? After all from what I have read there is indiscriminate buying and selling of good stocks with good fundamentals…and bad stocks with lousy fundamentals every time an index fund or ETF is purchased. No price discovery. I wish someone would comment on that.

Verne…Sorry!

No problem Ed. You make a very interesting point about market breadth and that is the one caveat of McHugh’s new thesis that he points out -no serious divergence there yet. One component of breadth that continues to decline is the number of stocks trading below the 50 dma. Another thing to watch is what happens with Transports as we currently have a DOW theory non-confirmation. I think there we have to be careful as few analysts thought transports would make a new high after the last decline saw it trade so far below its ATH. Another thing about market breadth that makes me very wary is that we have seen price continue to rise in the face of persistently bearish signals, particularly volume. I keep asking myself: if we cannot rely on bearish signals to reliably tell us what price is likely to do, what makes us thing that normally bullish signals (such as market breadth) will?

The top we are seeing is absolutely historic. Unlike anything any analyst alive has ever experienced. I think it is a very dangerous game to confidently blather about what Mr. Market has to do before such and such happens. We have not been here before and this makes that kind of thinking presumptuous imho.

While not definitive, the second Hindenburg Omen recently in thirty days is noteworthy. One has signaled every single prior market top.

“I think it is a very dangerous game to confidently blather about what Mr. Market has to do before such and such happens. We have not been here before and this makes that kind of thinking presumptuous imho.”

in the fullness of time we will definitively know if “this time is different” and who confidently blathers…

http://www.dictionary.com/browse/blather

Indeed! And the “fullness”, may not be too far off! 🙂

“The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem…All the currency pairs will turn at the same time as the US indices for this fourth wave. Even Andy Pancholi has alluded to this, but he didn’t get the date correct. It is still to come. This is the final hurdle.”

Peter Temple – June 4, 2017

“Just read Dr. McHugh”…he is crystal clear relative to the NYAD…

https://worldcyclesinstitute.com/events-dont-change-the-trend/#comment-18321

leading into the stock market tops of 2000 and 2007, a readily identifiable negative divergence developed on the NYAD…as of this date, the NYAD continues to power on without any sign of a negative divergence beginning to develop…at a minimum, it would take several months for the NYAD to do so…

In VXX position. Almost sure SPY will give back a few percent this week or at best continue sideways pattern. (Full Moon and apogee in same week).

A new blog post is live: https://worldcyclesinstitute.com/elliott-wave-probable-cause/

Hello Peter,

This post is relatively old but it peaked my interests. When I look at your count we see a clear ABC blue wave. The A wave has a three wave structure (abc) and the C wave has a clear 5 wave structure 1,2, 3,4,5 (white). In your opinion is this correction a zigzag? The reason why I ask is that in “Nature’s law” page 31-33 Mr. Elliot shows different zigzag structures (5-3-5) figure 9 (3-3-3) figure 10. In your example, it seems the structure is (3-3-5). Please correct me if I’m wrong. One thing is clear though, there is no Elliotican that can compare to your analysis. Not a single EW trader has labeled the 2009 bull market as corrective and I have read dozens of blogs excluding EWI.

You have stuck to the rules and guidelines which is a difficult thing to do as we humans fall into the trap of our own bias. But more importantly, your classification of simpler 5 waves and impulse waves has definitely enhanced and changed my outlook and how to count the waves. Cheers Peter.

Hi Omar,

The blue ABC wave is a zigzag and the C wave is in five waves. Altogether, no, it’s not a zigzag, it’s an ABC correction. I don’t look at charts of others, not let anything interfere with my work on the market. It’s important to stay totally objective. I always stick to the rules unless I’ve proven the rules wrong.

If you have an interest in the problems in the book, you might like this post: https://worldcyclesinstitute.com/a-pending-top/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.