They’re Everywhere!

They’re Everywhere!

LIke lemmings, which multiply every three and a half years and end up eating themselves out of “house and home,” ending up drowing in the ocean as they search for more food, ending patterns are terminal. They end and the trend reverses.

In the case of ending diagonals, it’s a dramatic reversal. That’s just like what happens to the lemmings. The population dies en masse, but a few remain so that they can start the process all over again.

Lemmings are just like other herders — humans, who will no doubt be super-bullish as we reach new highs, something I believe will happen this week. Until then, the direction continues to be up.

Last week, I named the current topping process “The Last Waltz,” because I expected a protracted period of ups and downs to this current “B wave” in the NYSE-related indices. That’s given the fact that we’re in complex ending patterns in all the US indices.

If you were in the Chart Show this past week, you know exactly how things are going to play out, as some of these patterns were identified then. Now, they’ve spread throughout the other sub-indices.

Some of the indices have traced out almost all of an ending expanding diagonal and have one more wave left to go. Some have traced out a run-of-the-mill ending diagonal. There are subtle differences in these patterns, but the bottom line is that they will end with a dramatic turn down.

The Russell 2000 is the one that is sporting the regular ending diagonal. Here’s the chart:

Above is the two hour chart of IWM (the Russell 2000 small cap stocks).

The pattern is now a regular ending diagonal (an ending pattern). I’ve re-labelled the pattern to reflect this pattern, which will result in a final wave up to the trendline (slightly above in what we call a “throw-over”).

We’ll be looking for all the sub-indices of the NYSE to approach that high and turn down together …. sometime this week, hopefully.

What’s interesting to me is that we’re seeing ending patterns in all these NYSE sub-indices. Most are sporting ending diagonals of one type or another, which you can even see at the top of the third wave of the SP500 above (more of a megaphone, but still and ending pattern). The SP500 appears to have an ending expanding diagonal in progress. All of these patterns end with a final wave that approaches the upper trendline.

As I often say,

“Trade what you see, not what you think.”

_______________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

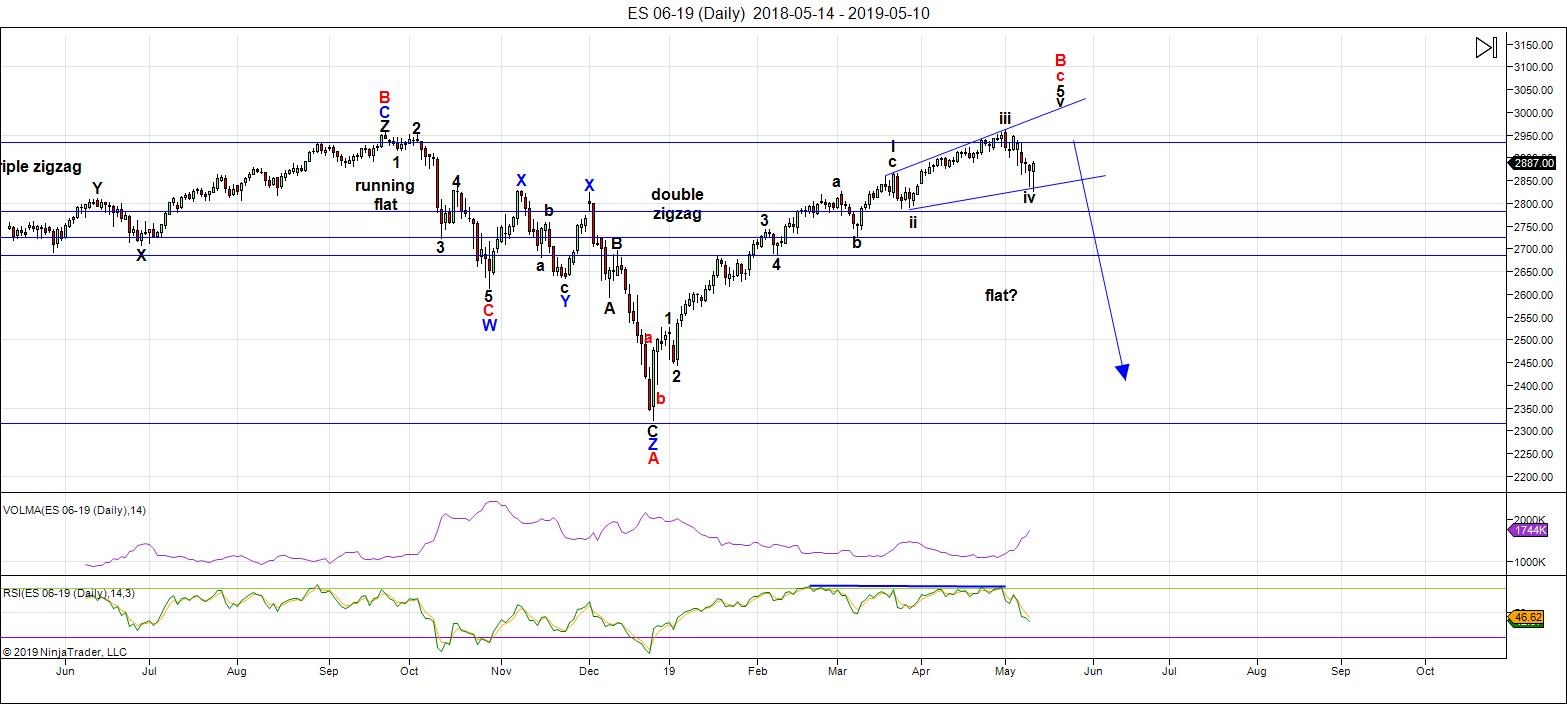

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We've been sitting at the top now for well over a month. This weekend, we're in the final leg of an ending expanding diagonal (this is an ending pattern).

All US indices require a new high. The market will not come down until they reach it. Until this happens, the direction is still up.

The next major move is to the downside.

I expect to be reviewing possible entries in the Chart Show this Wednesday.

While the NYSE is in a large 4th wave, ES and SPX are still topping out in a third wave. This non-confirmation between major indices near a top is very bearish.

The wave up from Dec. 26 in ES is clearly corrective and, as a result, must fully retrace to the downside. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX, TSX, and other international exchanges.

Summary: My preference is for a dramatic drop in a 4th wave to a new low. The culmination of this drop should mark the bottom of a large fourth wave in progress in the NYSE since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that is quite fast; in any case, it will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, May 22 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Thank you Mr. Temple. It appears equity put call ratio .80 is in sync with your analysis near term.

Peter T

Thank you !

Your chart of the ES reminds me of a mini version of an inverse chart of

The Dow / spx of the year 2000-2002 decline .

Back then prechter mentioned the ” expanding leading diagonal ”

Only mentioning that because of your comment regarding leading diagonals .

Obviously prechter was proven wrong on his ” new discovery ”

as for me, this next week should tell the tale so to speak and I’m having

Issues between a bearish cycle which is ending yet not over vs price

Which appears to have been satisfied . Not sure what to make of this market

So thank you for your perspective .

There are 2 cycles that will be in effect begining may 22 June 3 .

Typically they are both strong . That’s all I know at this point .

I’m going to keep quiet for the next week or 2

Your time and efforts are very much appreciated.

Calm seas and fair winds

New ATH will certainly see sky high futures Sunday evening and a close above 2900 on Monday.

Hi Peter and friends

energy chart for this week attached below

one is not like the other

note: any time shifting; if any, is not accounted for

https://imgshare.io/image/may-13th-may-17th-energy-chart-mirrored.pyVJ8

Thanks Tom! Curious if a day inverted, based on your observation, the next day chart usually gets affected?

no

the bottom chart is a continuation of what I’ve been posting for months and it includes the large time shifting that began a couple weeks ago. The top chart is just a best fit attempt on my part, nothing more.

Thank you sir 🙂

Thanks Tom, I have an astro turn date this Tuesday and the next one is May 21.

May 20th looks like a massive up day

followed by a massive down day on the 21st

must be a sell the good news event

I will not be short that weekend

it will be a deadly bear trap for sure

Thank you Peter..and Tom appreciated . :))

Such an amazing energy chart could be great trading…let’s see how it plays out!

Hi Marie

Bottom chart is looking good right now

I just had to post this one

https://imgshare.io/image/our-society-today.pIv8S

Exquisite! 🙂

Not what I expected in futures. Gaps are quite rare and usually very significant. If we take out Friday’s lows overnight the larger techical context will have me thinking third wave. I have never seen an initial counter-trend futures or cash indes gap lower following a trend change at minor degree. One would instead have expected the gap to be in the direction of the new trend. Price is as price does. I must confess I for one am surprised. I thought even a corrective bounce higher would test 2900.

Looks like the banksters are throwing a change-up and the unwind continues.

If that is true, not only will we NOT revisit 2900 anytime soon, 2800 falls tomorrow, I hope I am wrong and they fill tjat gap….!

good one Tom…lol

Don’t know what happened but whenever I plan to short higher, the market gaps down.

It is starting to feel like high-stakes poker in the markets. You had some classic bottoming signs in the market on Friday in the breach and recovery of a few longer term trend lines, ongoing VIX divergence with new market lows, the remarkable massive move off the mornings lows etc., etc. and now this monster gap down in futures. It looks like a bit of gamesmanship to me. I know a lot of traders went in heavy Friday and are going to get whacked when the session opens if they don’t hedge with futures. I had a small long position but no way I was going in heavy below 2900, I don’t care what things “looked” like. These banksters are tricksy…! 🙂

Just saw the gap down..yes not what I expected either..

Here is another reason why what we are seeing is important.

The lows on Friday temporarily breached a primary degree trend-line around 2865 with an opening gap beneath it. This was quite bearish in my book. Price managed to recover and close above that important level on Friday and it certainly looked as if it would provide strong support and issue in a reversal. The move back above it was quite impressive. Was it all optics for the benefit of traders watching that level and a nicely sprung bull trap? I am not sure.

The futures gap back below it is quite ominous in my view. It is suggesting the recovery of the trend line was a leverage induced contrivance. Very dangerous business…!

If futures fail to hold the 2860 level over night, 2820 will be in play during the cash session imho.

Price so far resting on the 2860 pivot.

I am not sure what they are up to but I suspect it is no good!

These banksters are tricksy!! 🙂

It will be interesting to see how VIX begins trading….not a lot of movement in after-hours trading on the other instruments. This gap down could be another ridiculous head- fake by the cabal crooks, a literal tempest in a tea-cup!

The business of defrauding stupid traders and investors continues apace, as evidenced by Barclays latest JNK scam. I was reading an article on burgeoning corporate debt ( now at 10 T, 60% higher than during the financial crisis and a whopping 47% of GDP!) and did a double take when I looked at the JNK chart and saw that monster monthly candle…WTF!!!???

Sure enough, the crooks had engineered yet another reverse split to keep stealing more of stupid people’s money.

The idiocy of the crowd is driving me batty. Peter’s article this weekend is apropos.

Why in the hell is not every trader on the planet shorting the hell out of that worthless piece of crap and sticking it the thieves running the Barclays crime family??? That POS is worth less than ZERO and yet folk are giving Barclay’s well over 100.00 to own it??

You’ve go to be kidding me!!!! 😱

Verne

One thing we can count on with these banksters as you call them .

We can count on them to blow themselves up and then ask for another bailout .

Why people think they are in control when they are the ones being bailed out

Time after time is beyond me .

A reverse split is a sign of weakness , the bond markets will at some point become

The short of the century ! I’m including government bonds as well .

There is no way possible to pay down the debts and historically all governments default .

You can call it a Strategic Default or an outright default yet it’s still a Default .

It takes time to turn an ocean liner around .

So….as I’ve asked many times before

Where do you put your money ?

Joe I suppose one could view it as a remarkable combination of hubris and stupidity.

The FED guys are supposed to be smart. How can they not see we have been down this road many times before, with increasingly calamitous results? They may not be as stupid as they appear, and may now have simply given themselves over to an endless pouring of damnable lies. NOBODY is THAT stupid. I do sometimes wonder about the public they are fleecing.

As to where to put you money?

In a deflationary depression, under the mattress, of course.

I plan to also hold shares of debt free miners with massive, unhedged, proven reserves.

Something not quite right about that overnight gap down.

It is way too cute. Too orderly. Too specific. I think those cretins are up to more bamboozling.

BTW, the miner shares are for what comes AFTER… ☺

Are intra-day peak to trough swings of 2% or more about to become routine?! 😵

I may have spoken too soon about an orderly gap down. A futures gap makes perfect sense for a stealthy unwind. Most folk are otherwise occupied. ES starting to break down and accelerate to the downside so word may be getting out to those in big bullish trades thinking we had a Friday reversal. This could get ugly real fast….

Yep! There was a whole lot of shucking and jiving going on on Friday and a LOT of traders got suckered. I have to say it was one of the slickest I have seen in a long time and it even had me convinced we had at least an interim bottom. The one thing that made me cautious was the five waves down I could count, granted in a series of threes ( I know some reject LDs but some kind of diagonal was the only explanation for what I was seeing personally), as well as the critical wedge and trend-line breaks. This is why you have to scalp bear markets. This is starting to look like a third wave, and you have to be in awe of Mr Market for managing to catch even bearish traders like me totally by surprise.

I will be making some changes going forward as I did admittedly ignore a few fundamental things…

This thing has been like a whip since 5/1, with the hand on the grip being short term and snapping end being long term. You have to pick your time frame (somehow), and be nimble as possible (that means shorter and smaller to me. I had a slow drain building a large VOL position into 5/1, took it down then off over last 1.5 weeks, adding and reducing on inhales and exhales (overbot/oversold). It worked well (obviously not everytime 🙂 but I took a small whipsaw on Friday, still increasing equity curve positive with other positions. I say this to emphasize positioning ST or LT with VIX 18 is going to be a different game that I CAN’T swing trade. This could easily be the whip hand flipping down before the whip snaps up (that Peter anticipates). That FRI engulfed THURS intraday was a sign of game changer for me, and if I would have stepped back (out of the trenches) I could have avoided the FRI whipsaw. I hope to step back and deal with it. Size and tightness of stop loss adjusted this weekend for next few weeks. Best to your trading. Cheers!

2 long tails, but I don’t think it lasts long…

If VIX notches a new high today, that would suggest to me a profound change in this market…!

I got a nice scalp off Friday’s lows based on VIX divergwnce. I am really glad I stayed disciplined and took profits on the big move off the lows but I left a few SPY 288.50 calls expiring today on the table.

I was so confident of an interim low I had no short term short trades loaded!

It has been awhile since I completely missed a 300 point DJIA move so I am eating some humble pie this morning!

Kudos to Tom’s very early call on direction! 😏

Yeh, it’s easy to feel dumb when you miss a trade, but it’s better than being big on the wrong side of a trade 🙂 I want to play the rebound but with lower highs and lows since 5/3 no one if correction or start of bear market (last few bears have averaged down 42% in 2.5 months), so I will watch the counts, OB and OS and nibble.

I am taking the money and running on a small ES short trade as we approach Friday’s lows. I am NOT chasing the cash session and standing aside to see if 2840 holds. We may be looking at more leverage unwind, in which case 2800 falls as well.

I got head faked too..bummer :((.still can be a corrective move..and then another large pop up.thats what I am thinking…still in the works..but agree not til finds support above 2900..

this could also turn into a larger A,B,C..still..

Looking to see if it divides as a big C. We would still need a new low….

Wow!

Boy, am I feeling sheepish.

I totally missed a third down…! 🙄

energy chart did not miss it

just covered my short

another great week

for a part time trader

VIX divergence intact. Either traders rightly not too concerned about this plunge and remain relatively complacent despite it, OR we are about to see a market melt-down…

Agree with you there. We are close to the point of choosing one way or another. I was out of my shorts on Friday low and am kicking myself for not reloading a bit on the bounce.

I have to admit. It was a beautifully crafted bull trap. I saw one count that did propose a possible second wave bounce complete after a LD down but I was definitely expecting a bigger bounce even if it was counter-trend. Live an learn!

Tom’s chart from last week absolutely nailed this. Wow! I am in awe!

I just cannot see a reasonable looking flat or zig zag pattetn for the move down. Very limitef EW skills…it looks more like some kind of combination if it is indeed corrective..m

We are right at the bottom of Peter T’s IWM ending diagonal, but with lower highs and lows since 5/3 no one knows if correction or start of bear market (last few bear markets have averaged down 42% in 2.5 months).

Looking at IWM…we are right around that DEC high approx 153.21…if we break that we could drop to 150 or 148 area where I am showing stronger support

Took small TQQQ position. CFTC VIX short 150k positions vs 180k last few weeks. Still has to be unwound (buy VOL) but timing crucial. Trading complacency is never easy.

out flat

I am still on the sidelines. It feels awful to have missed a move down this huge but the fact of the matter is I was completely wrong about the immediate trend and count. No point crying over spilt milk.

These kinds of moves simply do not allow you to climb on board after they get going.

If you are not positioned ahead of time it almost always futile trying to chase the move.

VIX divergence intact and that is interesting.

Great job Tom..!

Thanks Marie

My theory of a leveraged unwind calls for a move back to 2800.

As expected, it seems to be unfolding in a single session.

Wow!

Still no real panic though. The market seems to dip into Europe close and then rally for the rest of the day. Want to see if it does the same thing all over again.

Looks like market attempting to hammer out a bottom in the 2820 region.

We know know these candlestick patterns are not by any means definitive and in fact could be being employed to mislead traders. I am back to paying more attention to price action around resistance support shelves.

In hindsight, I ignored the break and failure to recapture the 2900 level which told me that 2800 would be in play yet here I was asleep at the switch! Yikes! And I call myself a trader! 😟😟😟

The disconnect between VIX and market price action is beyond stunning.

Something is very wrong here, although not quite sure what.

It does seem to be in keeping with the notion of large market moves being engineered by massive CB leverage and completely divorced from any real herd sentiment. Very strange…and dangerous times we are in…!

Despite the apparent weakness in volatility, there is no way I am shorting it.

There is something really strange going on in that arena and somebody’s lying!

Critical juncture just ahead. What happens at the 2800 self will be telling.

As I have frequently opined, they simply cannot HIDE the leverage unwind.

The only question in my mind is whether the unwind past 2800 continues, or they have now ripped off enough long traders to hike price in the opposite direction. If we take out 2800, all bets are off imho.

I am learning some idelible lessons today, that is one thing that is certain!

Stunning!

Gotta hand it to Randy Phinney. He told his traders the short side swing trade should be held through any short term volatility as he was expecting much more downside after the busted rising wedge. Gotta respect those rising wedges as they all conclude the same way…guess I forgot! 😊

Yeh, and he day traded long side Friday and sold it, leaving short on… WOW!

China may stop purchasing US agricultural products and energy, reduce Boeing orders and restrict US service trade with China. Many Chinese scholars are discussing the possibility of dumping US Treasuries and how to do it specifically.

— Hu Xijin 胡锡进 (@HuXijin_GT) May 13, 2019

https://www.thestreet.com/investing/stocks/china-retaliates-on-trade-boost-tariffs-on-60-billion-u-s-goods-to-25–14957237?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

The Chinese are going to loose this dust-up and they know it. What is going on illustrates that they will do anything to save face even when such decisions taken are hostile to their own interests.

This trade war is going to blow up their already fragile ecomomy and implode their propped up markets. The talk about dumping Yreasuries may be true but not for the reasons people think. They are facing a severe SHORTAGE of U.S. Dollars and their markets could face a liquidity “event” if supply dries up. The Dollar remains the global reserve currency, loud claimsvto the contrary notwithstanding…

We really should see some kind of bounce fairly soon.

I expect it to be counter-trend…

Selling some put spreads yet ?

I am out. I don’t fully understand where we are in the count and will wait to see how price behaves around 2810-2820.

Don’t want to repeat my mistake! 😊

A break of 2800 is a real possibility. Selling puts now is imho fraught with huge risk…the banksters are clearly unwinding…

Verne

Let’s suppose for a minute the Fed guys are smart but the politicians refuse to listen .

The Fed guys try as best they can to prevent the inevitable and they keep warning the politicians

Yet No Luck .

Come election time the polticians say I saved the day so vote for me and the people say

Bs you didn’t save anything .

So they let everything crash instead . Then they can say I’m going to get to the bottom of this

And make sure it never happens again, so vote for me and I will ” save the day ”

It’s a rugged game

Inteteresting. To be honest, I am no longer sure who is in charge of the FED.

There is no question that EU politicians all have a ring in their nose and are OWNED by the banksters, Macron being a great example. Look at how they are controlling the UK politicians and frustrating the will of the people regarding Brexit.

I think there is an ongoing battle over the FED.

I suspect the about face on rates was at Trump’s behest so it could be he has them on a short leash.

May 22-June 3 cycle low period

Cash down pivot now 25459

Key support 24906

Below 24906 and I recalculate

Untill then I remain slightly hedged .

So far I’ll say , I’m surprised this pattern correlation is staying on script .

If it continues then I’ll buy the close on the last weekly bar of the month of May ….

May 22- June 3 is highly important in my cycles work .

I’m keeping quiet .

No price projections from me .

Hats off to you Joe. You called it my man…

Very intrigued by VIX.

What on earth is going on there?

Are we seeing a slow roll-out of volocaust 2?

After today’s drop, the tripple zigzag has to be relabeled. It will now need another one (or two) round of up and down to finish off. May be Joe’s May 22 – June day range still plays out. That would mean a downward movement with a lot of chopping around without ever trading above 2900.

This VIX divergence HAS to be an incredible feint. I am just not buying it.

This makes absolutely no sense considering what the market is doing.

Where is the fear??!!

Governments around the world depend on debt

The banksters are the salesmen for that debt

The US Dollar will go much higher than anyone ( even me ) expects

A lot of foreigners have debt denominated is US dollars .

As the US dollar rises those debts rise .

In order to hedge those losses they will be forced to buy the US dollar .

At some point it’s a panic .

The US Dollar rising kills everyone including corporate America ( kills profit margins )

The money is now is flowing into the USA .

A similar yet slower situation happened back in the year 2000.

The strong dollar squeezed profits .

This next time around it will blow up bond markets around the world .

Trump

Trump has a history of having a best seller at a market peak and then being

In bankruptcy court at the market bottom.

He won the election and became the president ( the best seller )

We can guess what comes next .

Agreed!!!! Spot On!! 🤗

When do the June futures roll over to the Sept contract .

Might be coincidental to my cycles but worth a thought .

In other words which side will be covering going into expiry ?

I am curious. Does anyone think we are seeing something other than a third wave decline?

If so, I sure would like to hear your take..

I know a thing or two about volatlity.

This is NOT normal.

Not by a helluva long shot.

That metric is somehow being suppressed and those readings are TOTAL B.S.

I know a few Quant guys who have been massively long vol for some time and it is starting to look to me like they are trying to hijack that long trade. I’ve got bad news for them. Those guys are not going anywhere and sure as hell are not going to fall for phony reversal signals as I did. They are expecting a liquidity crisis with an exponential move higher in vol as this unfolds. Sold half my TVIX and was hoping to reload but never got the chance.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.