For Trading and EW Novices

For those of you who know little about Elliott Wave and apparently don’t want to read the book to learn about it, let me try to make a few things a little clearer.

I called this B wave (that we’re near the top of) a corrective wave right from the start .. because it was and is one. It will never be impulsive. That was a no-brainer to me.

I’ve been sniped at all along the way. That’s OK. People who don’t understand often do that, and I have a thick skin. But, as I’ve said, I will not allow the negative comments; I will remove the ability to comment if they continue.

For someone to accuse me of being stubborn because I will not change my mind about what is clearly a corrective wave up, is a sign of abject ignorance. To people who think like this (including Global Warming nut-cases), I would suggest you to go another blog and find a wave count that’s more to your liking. Let your ingrained bias direct your future in the market.

This is an educational blog. Here’s some is some educational points (all of which I’ve written about previously in this blog):

- Some time ago, I provided a list of 14 reasons this wave up is corrective. I had no points on the other side of the equation. To tell me my count is wrong misses the point

- You should not, under any circumstances whatsoever, trade based upon a single daily chart (like the one I provide here). That is sheer insanity and shows a complete lack of understanding of trading and the market, never mind Elliott Wave. ! As Bernie wrote me on Friday:” I was just saying that you probably would have a higher probability of getting struck by lightning than trying to trade on these EW forecasts.” He’s absolutely correct, but not for the reason he thinks.

- I DO NOT, as a rule, recommend trading corrective waves (I have written about this previously here). It’s a countertrend move and therefore, is extremely risky. You can triple that sentiment for this particular B wave; it is the most dangerous one I’ve ever encountered, as it’s in the middle of a fourth wave. On top of that, futures and cash have different bottoms (about a 30 point differential), so you can’t reliably measure it — which I have stated several times over the past few months)

- Elliott Wave methodology requires that you wait for a trend change, which is signified by a first wave with a 5 wave count that travels to the previous fourth wave of one lesser degree, followed by a second wave of three waves that retraces 62%. That’s the entry. That is a top. There has not been a top, so I HAVE NOT called one. I’ve been warning of one coming, but this is certainly not the same thing.

All you people who are really ticked off (and sniping) because you didn’t lose any money on my watch: Please go somewhere else and lose money there; you’re novices and have a lot of learning to do (and some growing up to do).

All those who don’t like the methodology:

- it’s not mine, so I don’t really care what you think of it (it’s cowardly to criticize a dead guy, because he can’t fight back)

- ignorance breeds fear and misunderstanding: Learn

- you should have your own trading methodology. This free blog is not here to provide you with trading entry or exit points. It’s here for educational purposes only

- don’t snipe at each other (or me, but I have a thick skin, so you’re just showing your ignorance)

- pay attention to the commenting guidelines; they’re quite simple

I’ve also written about FOMO (the fear of missing out) here. It’s a powerful force; don’t let it ruin your life.

One more thing. There are times when being part of the herd is a good thing (as in third waves). It is not a good thing at the top of a B wave. If you don’t think for yourself in the market, you are destined for failure.

And, if you don’t pay attention to the past, you are destined to repeat it.

The following article is from Investopia

What is Herd Instinct

Herd instinct is a mentality that is distinguished by a lack of individual decision-making or introspection, causing people to think and behave in similar fashion to those around them. In finance, a herd instinct relates to instances in which investors gravitate toward the same or similar investments based almost solely on the fact that many others are buying the securities. The fear of missing out on a profitable investment idea is often the driving force behind herd instinct.

BREAKING DOWN Herd Instinct

Herd instinct, also known as herding, has a history of starting large, unfounded market rallies and selloffs that are often based on a lack of fundamental support to justify either. Herd instinct is a significant driver of asset bubbles in financial markets. The dotcom bubble of the late 1990s and early 2000s is a prime example of the ramifications of herd instinct in the growth and subsequent bursting of that industry’s bubble.

By nature, human beings want to be part of a community of people with shared cultured and socioeconomic norms. Nevertheless, people still cherish their individuality and taking responsibility for their own welfare. Investors can occasionally be induced into following the herd, whether through buying at the top of a market rally or jumping off the ship in a market sell-off. Behavioral finance theory attributes this conduct to the natural human tendency to fear being alone or the fear of missing out.

Herding and Investment Bubbles

An investment bubble occurs when exuberant market behavior drives a rapid escalation in the price of an asset above and beyond its intrinsic value. The bubble continues to inflate until the asset price reaches a level beyond fundamental and economical rationality. At this stage in a bubble’s existence, further increases in the cost of the asset often are contingent purely on investors continuing to buy in at the highest price. When investors are no longer willing to buy at that price level, the bubble begins to collapse. In speculative markets, the burst can incite far-reaching corollary effects.

Some bubbles occur organically, driven by investors who are overcome with optimism about a security’s price increase and a fear of being left behind as others realize significant gains. Speculators are drawn to invest, and thus cause the security price and trading volume to climb even higher. The irrational exuberance over dotcom stocks in the late 1990s was driven by cheap money, easy capital, market overconfidence and over-speculation. It did not matter to investors that many dotcoms were generating no revenue, much less profits. The herding instincts of investors made them anxious to pursue the next initial public offering (IPO) while completely overlooking traditional fundamentals of investing. Just as the market peaked, investment capital began to dry up, which led to the bursting of the bubble and steep investment losses.

_____________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

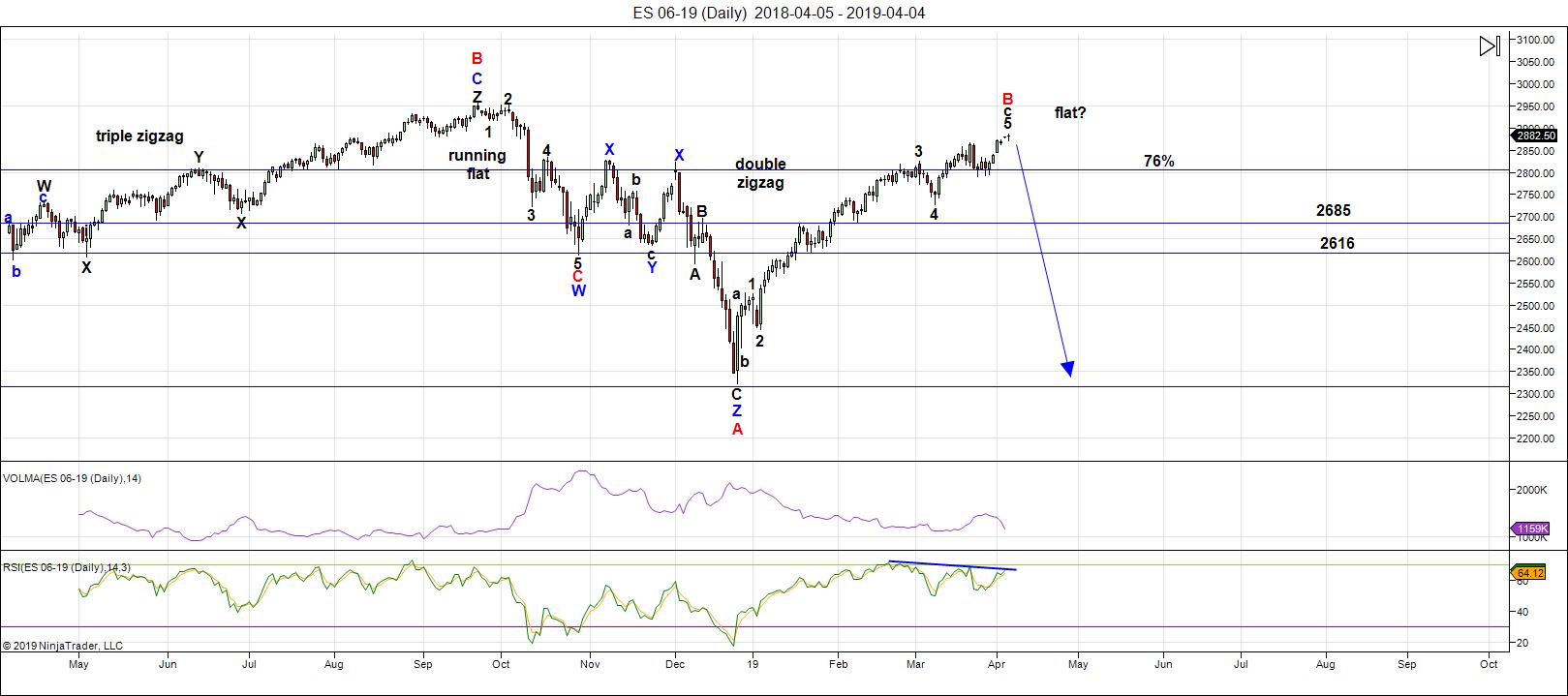

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We're still sitting near* the top of a B wave that's risen to about the 76% level of the height of the previous set of waves down from the all-time high at October 3, 2018. Almost all the other assets I cover on a daily basis are hovering near inflection points.

*That word "near" means we're close but not at. It was the same word that was there last week.

The US indices are are working getting all "the gang" to a new high (same line that was here last week), as predicted in past weeks; progress is slow. That's because all asset classes I cover have to top (all the same market) before we they can all head down in tandem (same wording as last week).

As I've been saying, IWM (Russell 2000) and the DOW both need new interim highs before everything heads down in a dramatic capitulation (UPDATE: the DOW has reached a top/IWM HAS NOT — go check this out and don't snipe at anyone in the meantime). The US Dollar Index also has another leg down before it turns up in earnest.

(So far, this write-up is the same as it was last week, although apparently I called a top somewhere — still trying to find that entry).

We're in the final bullish 5th wave in ES - a minimal new high to finish what appears to be an expanding triangle.

The next major move is to the downside (boring, I know, but the same as last week).

As I've been saying, the wave up from Dec. 26 is clearly corrective and, as a result, must fully retraced. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

Summary: Waiting for a first wave down; I suggest you do the same.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, April 10 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Sorry about missing c. I wish we had an edit feature…lol!

I am curious. Has anyone on the forum tried to label what I have assumed to currently be C wave up?

All my own counts were invalidated by upwards movement and what now looks like a sub-divided third wave. As I said EW is not my forte, but I do know enough to figure out my propsed count is not right. Since I am assuming primary four is incomplete, I am assuming the current wave is intermediate degree, and the subwaves minor degree.

This looks like good labeling from what I can tell:

https://ibb.co/rQvLBVM

This one shows the ED:

https://ibb.co/w6z78xH

From same source:

“Should the SP 500 close above 2914 and then 2930, then the following count should merit strong consideration. The possibility exists that the Feb high to March low was in fact a larger Wave 1 – 2 of the bullish count and we are currently in the midst of a 3rd wave to new all time highs. If so, we’d expect 3050-3150 in relatively short order. We will keep this in the back of our minds.”

These also seem to line up with Charles’ view point who called 2900, 2940 and 2950. Charles also said above 3,000 was the likely target to as high as 3,050. Many criticized him, but boy o boy, has he been deadly accurate!

A new blog post is live at: https://worldcyclesinstitute.com/the-us-market-stripped/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.