We’re at market top. It’s about time to give this market last rites. It’s time for this market to get its affairs in order. This bull is terminal!

However, in this market (as in just about all markets), major tops are “a process.” As I’ve been saying for over two years now, the financial world as we know it is moving as one entity (as we work our way to international deleveraging). When a turn comes, everything will turn down more or less together. But, as with a large ocean liner, it takes time to turn around something this large.

On Thursday, the ending diagonal in the SPX failed. That’s the sign of an extremely weak market. The Investors Intelligence Advisors Survey of this past week reports that bulls jumped to 64.4%, which surpasses every extreme for the past 30 years. This strongly suggests that we’re at a major market top. The wave count confirms it.

We have a two step process left now. We’ll have a turn down this weekend to finish the fourth wave in the US market (and currency pairs will bottom—US Dollar, USDCAD, and USDJPY—which move in the opposite direction from EUR, AUD, and GBP—the latter three will top, of course). This week, everything should turn up into the final wave to a slight new high.

And then it’s down for a long time to come.

I’ve been unwavering in my conviction that a top is in progress because the Elliott Wave Principle is the best predictor I’ve found (through my extensive research) of the way the market moves (it applies to any market that is not government controlled).

Although this rally has been the most difficult market ever to predict, we’ve been exceptionally accurate across over ten assets (in the Trader’s Gold Subscription Service).

Wait until we top! The accuracy in the impulsive waves to follow will ramp up considerably, because it’s impulsive waves that are restricted by EW rules. Corrective waves (which we’ve been seeing since 2009) are much more difficult to predict because there are so few rules as to their movement—the key tool for corrective waves is fibonacci relationships, but their proper application comes primarily from experience.

This week, you got a taste for an impulsive wave, when we had the drop from the top of the ending diagonal. I was able to call the turns both down and up. However, the wave proved to be a corrective one (I’ve found that near tops and bottoms, waves start to become more impulsive-looking).

A Higher Tide Floats All Boats

Whenever we get close to a major top in ES (emini futures), the comments start to flow predicting a top (or not). Usually these comments seem to come from those fixated one one index—the SP500. But, the market actually consists of more than one index, and the driver of the entire thing is the US dollar (the reserve currency).

Whenever we get close to a major top in ES (emini futures), the comments start to flow predicting a top (or not). Usually these comments seem to come from those fixated one one index—the SP500. But, the market actually consists of more than one index, and the driver of the entire thing is the US dollar (the reserve currency).

I’ve written about this before. But, people have short memories, I guess, or see only what they want to see (now, there’s a well-known fact!).

I have always maintained that once one index tops, they all have to (so that they stay in sync). This is a market rule.

But it’s more than this that keeps the SP500 from not topping until the others top. The next wave down will have to start with five waves—across all US indices. So to get to the point where that can happen, the indices all need a “fresh start”—in other words, a new high.

The key, as I preach over and over again, is to watch the entire market, certainly indices that are related to each other. Both the SPX and DOW are subsets of the NYSE. They move more or less together. The wave structures have to be correct in order for the next wave down to start.

In all US indices (and USD currencies), we appear to have one more small wave up to go: a major turn of just about everything associated with the US dollar.

| Other US Major Indices (click charts below to expand) | |||

|---|---|---|---|

|

|

|

|

| NYSE | DOW | Russell 2000 | Russell 3000 |

All the Same Market

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash (although he and his group don’t seem to be paying much attention to it now …).

We’re starting to deleverage the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2015. You can look across many international markets and see the same phenomenon—most major exchanges are at or near tops.

_______________________________

The Market This Week

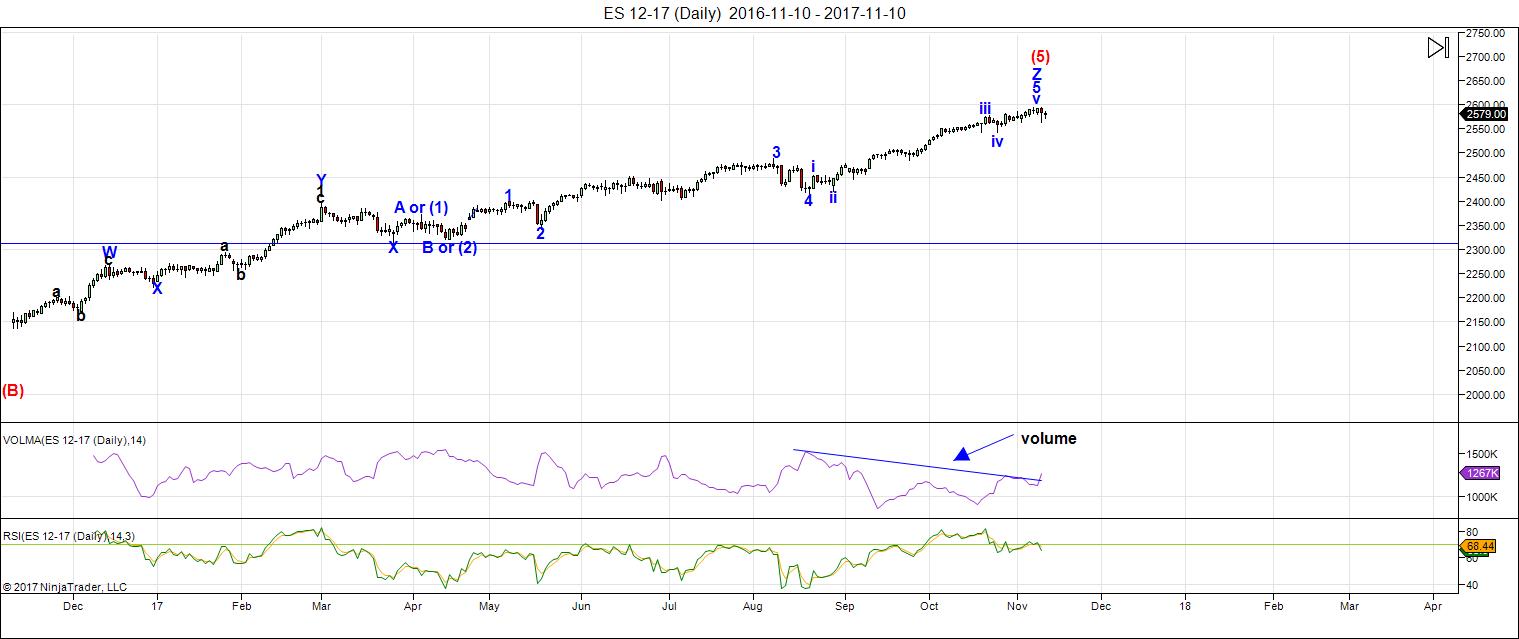

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There isn't really a lot to be gleaned from this chart other than

- the fact that we're at the top ready for a turn down,

- that this wave up continues to be a corrective one (which implies this is the final high and that it will descend with force once it turns to the downside), and

- we've been moving mostly sideways for weeks now.

The more important charts are the hourly chart of ES and NQ (futures) and the major US cash indices—they will all need to clean top in order to start down in the long-awaited bear market.

Volume: Note that for some time now, volume has been expanding with selling, and drops considerably when the market heads back up. This is yet another signal of the larger, impending top. The turn up for the final leg is now showing signs of turning back down.

Summary: The count is full for NQ and ES, except for small subwaves that form the balance of a small fourth wave and the final wave to the top. Down and then up ... and we're done.

_______________________

Here's the latest 60 MIN chart of ES (emini futures):

This chart is a example of the hourly chart and guidance that's a regular nightly feature of the Trader's Gold Service. (I'm providing this one-time preview of my service - I cover other assets (oil, gold, and currency pairs with similar charts and a nightly video). The weekend charts are also accompanied by a video, which provides more detail.

Above is the 60 minute chart of ES (click to enlarge).

Three weeks ago, I posted a "free" blog post entitled, "The Top is at Hand." I didn't say we'd topped or that it was imminent in the next couple of days (I tend to choose my words rather carefully, because your trading depends up it). I had also stated that topping is a "process." Note in the chart above (by the purple line and circles) that we're in exactly the same place we were three weeks ago. Monday we'll be below it, but we're not quite done with this bull market.

Thursday of this week, we had a wave down in ES in 5 waves (not impulsive). SPX was in an ending diagonal (as was ES) which actually failed—it did not complete the final wave up. This left an unfinished set of waves, for a failed top. None of the other US indices matched the structure of ES.

We are heading down on Sunday to complete a smaller fourth or second wave (not sure which yet), which should bottom at 2563. This will create a very obvious wave down in three waves in ES. Look for all the currency pairs to bottom with this move. We should see gold head up to the top of it's B wave. In short, the entire market is going to move in tandem.

This will set us up for a final wave to a new high ... right across the market spectrum. A final parade!

Short term: We should head down on Sunday to a double bottom at 2563, which sets us up for a final wave to the top.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Wednesday, November 15 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

jody,

this is what you are saying A/B/C of 4?

https://invst.ly/5v4sc

Yes that is what I was thinking because 4 was so short. However this could be w5 thought if it is 1,2 and 3 is about done with 4 and 5 of 5 of 5 of 5 of 5 of 5 ? Tomorrow or Monday.. lol

jody,

methinks it is W5 – because w2 is exactly 61.8% retrace……… normally wave B’s are either 38.2% to 50 % or they go over 100% retrace……. but exactly 61.8% – not so much…..

https://invst.ly/5v623

if this is w5, i have done some quick calculations….. if small w4 is 38.2% retrace,,,,,then w5 of 5 of 5 goes to 2594ish…where 1=5………

https://invst.ly/5v65n

the thick red line at top is 2594…….

https://invst.ly/5v68s

That is what I am thinking as well.. Unless the mythical leading diagonal is actually real and that deep wave 2 you mentioned just wrapped up.

Either way it is getting really exciting and we are soooooo close. (Hands ringing, mouth drooling)

Luri, 2600 by Monday??

Liz,

all is possible………its just that 2600 is too “too”……… to perfect…..the number to shoot for to year end.

in 2008 we topped just below1590 as the herd was screaming 1600 and beyond…..

what say you?

liz,

it could be this??

https://invst.ly/5v5er

Could be awaiting the completion of the right shoulder in DJI for a synchronous slide…

Hey 1590 now 2590 hmmmmm.. lol

Sorry Luri. I was distracted by TSLA’s failure to continue pumping today and joined the downside action.

Bought a few stocks & calls for a swing trade next week. Did my homework last night picking a few based on open interests in calls & puts expiring tomorrow.

I mentioned Tuesdays low, Bull trap. Staying long on my long term account. 2600 es is just ahead of us. Need to pierce thru 2588 decisively. It is right up against my trend line. It either becomes resistance or it will shoot thru the gap. Back to my on line course. Good luck to all.

A little bit of back filling, than off to the races.

Looking for 2600 next week

“Bear Trap”

At what level on the es, are you willing to say it was not a bear trap ? 2600, 2630 ?

How does this work for you, Dave M? Get above the upper black parallel channel, which is where prices stopped exactly today, we might believe your 2600 or higher. Barring that, it was a one-day wonder!! Click on the chart to enlarge…

https://imgur.com/a/cjNit

Very good Peter with your chart. The bears are still in control until we penetrate your line iñ the sand. Lol

Dave, you mentioned Tuesdays low as a “Bull Trap”? I just thought you meant Bear Trap. As far as the market, I posted my thoughts before. We are destined for new highs in spx of around 2650. Then comes a correction to around spx 2250 or so. It will not be the beginning of a bear market. When the correction ends, we will not see that level again for a decade…….. if ever. However, this is the biggest and most corrupt ambiguous gambling game in the world, so anything is possible at any given time. Step right up and place your bets and pay no attention to that man behind the curtain.

Ken, you are correct. I meant bear trap. I am juggling 3 three different projects at the moment. Trying to keep one eye on the markets. LOL It is nice to see some one who is open minded for a bullish view. My take is at least 2630 level. With a POSSIBILITY of 2720 I agree with you, that we will see a MODERATE CORRECTION, NO CRASH. My timing model, is for most of the damage to occur for Jan 2018 Good luck Ken.

The initial target down is 1850.00

YES , BEAR TRAP !!

If W(5) has showed up then overnight 4 of 5 will trace out and Monday/Tuesday SPX will top. Once 4 is done a top should be able to be measured out.

The only other count at this point would be that the B wave of 4 is now complete and a W(c) is next which would look to head down to SPX 2525 Then the final wave up. This is not my preferred count now although the bottom trend line of the wedge did act as resistance at 2590 as I mentioned earlier it might.

Either way we are on the door steps of the largest nastiest corrections we will ever see in our life times. Of course the bulls will shake their heads in disbelief and that is fine. They were warned and when their trading accounts are blown up they will wish they had of listened:)

jody,

hmmmm…….. are you sure there is 2 trading days worth of moves for top count of w5?……. we finished w1/2/3 in one day…….. i think opex friday we will finish?

jody,

another reason to think this has high potential for w5 is the channeling. this is channeling very well………https://invst.ly/5v7ga

No I am not sure there are 2 days, but I would think by Tuesday defiantly it would be done..

This all quite intriguing. By failing to surrender the 200 dsma, VIX did not exactly raise the surrender flag. As long as VIX stays above, I think upside is limited, and subject to quite swift and brutal revocation…. 🙂

That lone gap of Nasdaq Comp to a new ATH is striking. The failure of the other indices to come anywhere near joining it could be the ultimate display of an exhaustion gap – one to long be remembered…!

I had to really chuckle at the price action in JNK and HYG today. Whoever invented the theory of efficient markets is a complete doofus. It was as if those “destined for dustbin of market history” were defiantly proclaiming to all who would listen – “We can rise an entire 1% after falling like a rock for weeks and are therefore not really rotting piles of detritus after all!” Who or what among the brain-dead is buying this garbage??? Gotta be banksters!!! 🙂

I will be away on family visits this weekend so I’ll do my post now.

The market leaders gave the 2007 high 12/11. 10 year later brings 12/11/2017. This means my friend RotRot is right. Still, in 2007 the real high came 10/11. So 11/12 will be significant, but likely not a new ATH. See how 10/11 and 12/11 are connected by 2 months? Musical harmony on the 10/11/17 – 12/11/17 period gives 11/15 (low), 11/21 and 12/4 (other rotrot date).

So 11/21 will be a high. But 11/24 is the strongest date next week for many reasons. 11/23 is a squared number date on 5/17/1792. This should be a change in trend. But US markets will be closed 11/23. This makes 11/24 significant.

11/13 was a strong day and caused the biggest decline in months. This was the vix cycle and vix is up deep into 2018.

Again, in 2007 12/11 was the start of panic but not the yearly high. So chances are The high is already in.

Next week 11/21 will be a high. 11/22 a low and 11/23-24 a high. Then down into 11/29-30. 12/3 will be a high and 12/11 will be a high. A low in between around 12/7.

Peter is right; topping is a proces. This proces may take time but is unstoppable. Mount Everest is still being pushed up every year as India is still crashing into Azia. This proces has taken millions of years but it isn’t over. It is happening right now. So slow you cant see it. But it is upstoppable. So even if it seems markets are still up, don’t be fooled. It may take time, but the proces is unstoppable.

Cheers,

André

Thanks Andre! Enjoy your time with family…

Island reversal. Why the HELL is vix red??!

Don’t tell me nobody is screwing with these numbers…!!!

Red Market – Red Vix is very aggravating. It does that sometimes. Maybe because the market makers know there is one more move higher. This wave down is clearly corrective so a move at least equal to the first wave is coming. On the flip-side after the 5 wave move everyone knows to sell.

Well….. after reading some of the comments on this blog maybe I should not say EVERYONE… haha!

Thank you !!

verne…….”jody”……liz…….joe……”wake up!”…………..WAKE UP EVERYBODY…..could we be looking at 2 different counts for topping……one for the ES and one for the spx?…………..dunno – i am sure they will get resolved one way or another…….OMG – wake up…….this is like licking the bowl after your mamma just made a chocolate cake…………….!!!

i am throwing a bit of spaghetti – but please consider the ES overnight

https://invst.ly/5vc9n

now consider the spx is still sporting the “unicorn” leading diagonal

https://invst.ly/5vccb

as is the wilshire…..this is an alt count [full attribution – this is from DanEric’s site]

https://1.bp.blogspot.com/-_RNcFJf8ehg/Wg4GawwUFqI/AAAAAAAAd9o/BXPvxFezSTYlArZb8SQzF05bQIX0ZYIrQCLcBGAs/s1600/Wilshire%2B60.png

ES update – https://invst.ly/5ve86

Yep. I think we are headed for a double top. The action in Nasdaq yesterday was a giveaway. A lot of EW analysts are counting this impulse up as only at minute degree and expect it go go much higher than I do. VIX is also subtly giving its own message. I guess we will know soon enough….

verne,

we are at the squiggle level here….there is no “minute” level left……. and squiggle to “failure”……………. it smells like “napalm” time…… in with a BANG…out with a “whimper”……. if 3/6/09 had some basing to it, a little rounded – i would say the top would be a “banger”……but we had a contrived and explosive “V” bottom……. and that makes us snacking on “whimper” burgers right now…..

https://invst.ly/5vg3c

With what VIX is doing today, one can only assume that someone or something bought a freakish number of call options while market price was in a dive. I don’t recall ever seeing this level of disconnect between market price and VIX. Somebody is expecting a hell of a move higher in the coming days. Makes me wonder if someone had a monster long vol position with an expiration this week and there was some kind of co-ordinated assault on the trade. This is beyond nuts!!

Damn! You get up early Luri! Where I am at it reads 3:28am but maybe its just because I am in the CMT zone.. lol

I think wave 4 just finished and the Max wave 5 will take us is S&P 2611 and ES 2612.

***W(4) however did not go 38% it could drop a little low and if that is the case it will change the numbers by a few points we will have to see.

Just like in the last crash of 08 they both might tag the same level then BOOM!

To all the Bulls out there. THIS IS YOUR LAST CHANCE TO TAKE PROFITS!

As Luri says… YOU HAVE BEEN WARNED!!!!! 🙂

Good morning to you too Luri! Sold ULTA calls bought yesterday.

I’m thinking /ES might drop to 2576?

liz,

what happens if the ES drops lower than 2576?? will you buy back those ULTA calls??? hmmmmm……..cough………….. ahhh liz, i am waiting for an “answer”…..missy!!! ………young lady – what say you?…..hmmm…..?????

It’s odd, but I don’t see your name attached to this article: http://www.zerohedge.com/news/2017-11-17/weekend-reading-you-have-been-warned

Luri, i had an appt sorry. Still outside looking at this man-made lake. So peaceful. Those calls expire today. So no not buying again today. The setup was perfect yesterday a couple of minutes after open. You could see bollinger bands squeezing. I’ll see next week.

jody,

an observation……………..it seems the cash market is sporting the “unicorn” leading diagonal……… if this is one of the primary options…that would mean the market has topped….. we had a leading diagonal, and yesterday was w2 deep retrace [in an ABC form for w2]….. that is why i also showed you a chart from DanEric’s site, who has also seen the leading diagonal, and only charts the wilshire 5000 and has this as his “alt” count…..

the ES made a new high [see chart where big red down arrow is at the top], we we made a wave 4 – and yesterday was a w5 for the ES…..

so we may have a finished count in the cash, and a potential “failure” in the ES…..

it is opex, so the market will be pinned – and we may be unable to get “clarity” – but if the cash drops below a 50% retrace on the day….. that would be a big signal that the counts have diverged for now and all is done….

so be careful looking at the spx and thinking today is w4 of w5…..

https://invst.ly/5vgnj

also…. jody…..

be careful throwing around the 2600 level. It is a “fixation” bordering upon “distraction” for the “bulls”. Which is why i have dubbed the 2600 level as “too” too……. too perfect, too much another round level to be conquered with NO effort except by the central banks……..

it “could” happen that we exceed 2600 – but something tells me “don’t count on it”……………………. of course market sentiment and expectation and “counts” dismiss 2600 as a “cheap” wh*re………. please be careful in analyzing because …. 26 = 13+13…………….

I am familiar w/Danerics.

I hope the alt 2 count is indeed correct. ES 2576 is 38% retrace so I am watching that ATM along with SPX 2577.

bonus:

so we had a potential ED & the first move down was a wedge formation.

“sometimes…….apex timing comes into play……. if you take the “apex” of the first wedging, and the apex of the second one, and draw vertical lines from there, it can be used as a “timing” tool………….. for example….see chart………

for entertainment purposes ONLY – https://invst.ly/5vgz3

as w4 slides down, i keep adjusting the channel slope…… i join w2 to w4, and clone the line, and place it on top w1 to get the anticipated channel slope.

we keep dropping to that 2576 level [shout out to Liz and Jody on that one]……… hmm…… but too early to make assessment. more clarity come sunday at 6 pm….. and with Monday’s ALWAYS being green as mandated from GOD……. could be w5………..

https://invst.ly/5vl90

Copy and paste .

No changes in my thinking at this point .

Prior post a few days ago ( some parts edit out to keep it simple )

spx weekly chart .

beginning on : aug 21 2017, this being a very simple wave count

aug 21 low , wave 1 aug 28 from 2417.35 to 2480.20 ( 62.85 points up )

wave 2 from 2480.20 to 2446.55 ( 33.65 pts down , a .5354 retrace )

wave 3 up from the 2446.55 low pushed beyond the 1.618 extension

at 2548.53 and poked just beyond the 2.382 extension at 2596.68

and tapped 2597.02 before turning down is what appears to be wave 4.

a .236 retrace of waves 1-3 would be a shallow retrace yet considers

2554.61-2548.53 support. going further using a .382 retrace of waves 1-3

as well as a .50 retrace of just wave 3 i get 2528.38-2521.78 which to me

would be the ideal wave 4 yet i do not trust that price targeting at this juncture .

since wave 2 was simple then we should expect a complex wave 4 and under a complex

wave scenario we should expect time to be wasted more so than price ( we could get both )

the closing high on the weekly chart for this wave 3 was the week of oct 30th yet the print high

was the week of nov 6th . a .382 time retrace from the closing high labels next week as a

Fibonacci week and a possible turn higher in wave 5 would begin then .

this leaves the market the rest of the week to finish up what ever drop is coming .

next week is all i can allow for at this juncture.

To make this a bit more complicated we have another scenario that would extend

this wave count but not by much .

2548.53-2550.33 would be the KEY SUPPORT under both scenarios .

the wave count being labeled .

1 2 i ii and wave iii being the nov 7 high and we are in a wave iv of wave 3

vs just being in wave 4.

this count

is similar to the above with wave 1 2 being the same .

wave i of this 3rd wave being the sept 18th week of high and the sept 25 week of

low being a very shallow wave ii of 3 .

if this holds true we are in a minor wave iv and not wave 4 and the support range

becomes 2542.52-2539.54.

averaging out all the main key levels :2548.53-2550.33 and 2542.52-2539.54.

2545.18 <——– is where the rubber meets the road .

Wave 2 lasted 4 – 5 trading days wave ii lasted 4 trading days

Today is the 5th trading day and depending on how you wish to look at it

the market has basically gone nowhere for the past 3 weeks.

under both scenarios we have either a wave v3 then 4 5 to go or just a wave 5

up . following that we would need to see waves A or 1 down and then wave 2 of B up before any huge downdraft .

labels as of today 1 2 i ii iii and now iv which would be closer to its end in terms of time . or its 1 2 3 and now 4 which is also closer to its end in terms of time.

options expiry's i tend to avoid and i have a dec 1 dec 13-14th and jan 2

as my key dates .

bottom line : This market is most likely not going to break down and if so

it wont last very long .

hahahahaha! That is funny right there…

Watch what you laugh at, it very well may come back to haunt you. You have been warned !! LOL All the best Jody. Its all in fun.

Still watching the bond market with great interest. Is the canary in the coal mine. Luri posted recently on the fact that so many American companies are just empty shells, sucked dry vsmpiric VC’s who have left nothing but zombie so-called businesses riddled with debt and destined for bankruptcy. Cerebus Capital is a poster child for such economic piracy. Holders of their Remington bonds, already trading at .35 on the dollar, just moved a lot closer to their true value. One canary just keeled over!

It is just when I see things like that it hits a funny bone:)

If you believe in EW or not after a 5 wave move no matter what timeframe the market corrects.

Even if it’s only 50% from the 09 lows it will be substantial. It’s all good Sir!

Let us assume we knew nothing about EW theory, Hindenburg Omens, or even trader sentiment. An even cursory glance at the fact that the market is now trading at THREE STANDARD DEVIATIONS from a six year moving average, the most extreme every recoreded, and has gone the longest time IN HISTORY without even a 3% correction, much less a normal 10 % correction, would make any objective observer more than a little cautious. The only thing that I can attribute to the bullish giddiness you are seeing and hearing everywhere is a complete loss of reason on the part of the masses. it would not be the first time. Nothing new under the sun apparently! 🙂

Just looking a weekly or monthly chart – straight up. It is not sustainable and always ends the same way. A sharp reversal always follows. I get it Verne.. I guess that is why too I find it funny..

I am going to make a prediction. After the market has shed the first 50% of its bloated mass, there will STILL be fulminating bulls calling for SPX 30,000.00!

You should really get that funny bone checked out Jody, you may well have a medical issue. LOL

To counter that move by a Bear, we will hear more crash predictions as we move thru 2600, 2700, 2800, 2900 es ……………… Same old trash talk from the bears from the lows of 2009. where it was 666 sp LOL

Which brings me to my next point children.. Do not do drugs! They distort your sense of perception 😀

A recent Hurst cycle analysis from David Hickson suggests a downward bias till next May.

https://youtu.be/kMOs8OeNUR4

Life is not waiting for the Storm to pass, but learning how to dance in the rain.

To all my fine fury friends ( BEARS)

P/E ratio- The percentage of Bear investors wetting their pants as this market keeps going up. LOLOL

I would SO love to hear exactly how many Bejamins you have riding on bullish trades. If you are not TRADING your talk, you be blowing smoke. So tell me what you are trading and how much, so. I can actually keep track of your success. He! He!

As you have seen, I put up the numbers, win or loose. Tell us how you are positioned LONG this market…if, of course, you in fact are…! 😀

BTW, I closed SPY 260 puts this week bought for 2.46, sold for 4.90, and waiting to reload…will let you know when I do…

Verne, your passive aggressive remarks are getting a little tiresome. Would you feel better if I stated that I am a Bear in a bull suit ? Would you feel better, that I state you are a much better trader than I am ? Would you feel better, that I state that you make more money than I ? Would you feel better, If I State that you are far more intelligent than I am. Okay, I fully agree with you on all counts. Does your ego feel better now?

Verne, I am not in competition with your trades either now or in the future.

In fact, I am not even in competition with Mr Market. The only competition I have, is my own ego. Caesar who use to rule the great Roman Empire, wrote in his private notes that ( its not the enemy out their that he was worried about, Its the enemy within that he was concerned about. He was referring to his ego. Power money and greed. Which is what eventually brought down the Great Roman Empire.

Verne, I bring this to your attention to maybe help indirectly. Let go of the blame, whether it is the bankers, governments or the boogie man. Every time you blame, you give away your power. Instead of running on a full tank of gas, you are running on fumes. Your mind becomes cloudy vs having a crystal clear mind for trading. Verne, this matter is now closed. I chose not to waste my valuable energy, both mentally and emotionally on these frivolous innuendoes from you. All the best with your trading.

Talk is cheap Dave M. I Trade to make money, not to be right. I am willing to listen to anyone willing to share profitable bullish trades. You talk a lot but not about your actual trades. Just saying… 🙂

” Raymond merriman ”

ongress will now take a break for Thanksgiving holiday (markets will be closed on Thursday, November 23), before returning for the Senate vote, expected the following week, just in time for the first of three passages of the Jupiter/Neptune trine on December 2 (weekend). As discussed in this column before, Jupiter and Neptune in a trine aspect is indicative of euphoria and “irrational exuberance,” to borrow a phrase coined many years ago by former Fed Chair Alan Greenspan. That is an aspect of infatuation, of thinking you are in love, of feeling like it is time to celebrate. But afterwards, reality strikes, you wake up the next day, and you have to deal with the hangover. Was it even “real?” What were we thinking?

I am doubtful the Senate and the House will be able to reconcile an agreement and pass this tax reform bill before the Jupiter trine Neptune of December 2. And, if they don’t, this could spell trouble for the U.S. and other world stock markets into early 2018. If I am wrong and they do pass it, then for a while, it may seem like “Happy Days Are Here Again.” Until winter begins.

Looking further ahead, we note that both the Sun and Saturn ingress into Capricorn on the winter solstice, December 20-21, 2017. It hasn’t done that since the 1870’s. I think this is a very significant and symbolic cosmic event, and the basis for my thoughts on “The Great Reset” of 2017-2020, as covered in last year’s Forecast 2017 Book, and this year’s Forecast 2018 Book, due out shortly. By “Great Reset,” I am referring to the political and economic arenas of the world. Specifically, I believe this is the start of a 3-5 year restructuring of the Federal Reserve Board and other world central banks, which is turn will have a powerful effect on world currency prices (and currency standards), which in turn will have a direct effect on both equity and commodity values. Uranus (disturbance and revolution) beginning its 8-year ingress into Taurus (banking) also highlights this same issue.

Verne

I have cut back my long exposure over the past 2 years , this year adjusting

My overall weighting sitting near 35% long and 65% cash. Exact weights little over 35% long at just under $200,000 long

You can do the math . I can hedge with 2 Dow futures contracts and still get a few dividends and come out with a wash plus

A little . Come Jan 2019 I’ll go back to 85% long . I rarely go 100% long ever yet if I do it’s more of a buy more now

And sell something else later into the next short term cycle high .

I’ll be looking at several different strategies beginning April May 2018 on the long side yet….

I’m be looking for downside action ( near the top ) come Dec / January .

Your trade worked for you yet how many contracts for that 2.44 gain ? What was that gain after commission ?

What is your year to date dollar gain vs % gain ? How much of those gains vs loss have been eaten up by transaction costs ?

In other words are your trades generating enough to pay any personal bills ? Or is your account slowly being drained

Because of transaction costs . Not really any info I care to know but since you brought it up I thought I’d ask .

My overall personal accounts , trading accounts and investment accounts have been growing this past year because I have

Reduced debt to zero, cut back on spending , sold stocks and thinned portfolio and I have done very little speculative trading.

Yet my speculative trading account is down 320 dollars because of short term failed hedging . My investment account is up over 40 times that loss . My bank account is double its cash balance of 1 year ago and I’m sitting on just about 1 years after tax income and my pay is fairly decent at $570 per day .

It’s all relative. Next year because of what I have done to my house , my cost of living : mortgage , home insurance all utility bills

Cell phone, internet ext…. Will drop to negative 30 per month . In other words my cost of living will be zero .

That requires no trading at all . In up coming years I’m expecting property taxes to rise and expect that cost of living I stated above to hit around 300 per month ( less than 1 days pay, gross or after tax )

I can accumulate a ton of cash going forward yet it will need a place to park .

My bias will be commodities along with stocks . This next year though it’s all about accumulating cash and letting the chip’s

Fall where they fall.

We are only near the end of one cycle and that implies the beginning of another cycle , my preference is to watch

Which markets and or sectors are following the trend changes . Some should be bottoming while others topping .

It’s a juggling act .

As for the US stock market my bias is downwards yet the degree of that down trend I’m not so sure of today.

As we move through December I anticipate having a better idea . Once we are into April May ( initial cycle low )

It should be easier to calculate .

I am of the opinion that neck year pretty much sucks from a stock picker point of view yet I do have my own

Rules for every stock I purchase and if those parameters are not met I do not buy . It is not all about

Technical analysis yet that is most definitely included .

At the moment I still need this cycle high period to pass by before changing my mind on the short term.

My copy and paste stands as is above and until the market proves my wrong I cannot rule out new all-time highs .

Joe

I trade 100 contracts per lot at special rate of 10.00

Mostly cash in medium and long term accounts . Long Jo, Weat, and some miners in long term. Current all cash in medium term account after closing long-term trade in Intuitive Surgical. Trading weak sectors like retail and vol in short term accounts. Profits taken out monthly for charity and other purposes. Hope that is not too passive\aggressive whatever the hell that means. Opinions are good. Trade IDEAS are better imho 🙂

Joe email me for specific profit/loss if you want it. My accountant says people who post that stuff in public are stupid.

I forgot to mention I use covered calls in my long and medium term accounts to generate an additional 1-2 % per month Hope that helps a bit. If I get called away, I will get. positioned by selling naked puts and taking assignment. My accountant hates it when I do that as it complicates things but it is a good strategy.

” Tony caldaro ”

REVIEW

The week started at SPX 2582. After a gap down opening on Monday the market rallied to SPX 2588. Then additional gap down openings on Tuesday/Wednesday took the SPX to 2557. Thursday reversed with a gap up opening, rallying the market to SPX 2590. Then on Friday the market pulled back to end the week at SPX 2579. For the week the SPX/DOW were -0.2%, and the NDX/NAZ were +0.3%. Economic reports for the week were mostly positive. On the downtick: the NY/Philly FED, plus weekly jobless claims and the budget deficit rose. On the uptick: the CPI/PPI, retail sales, import prices, industrial production, capacity utilization, the NAHB, housing starts and building permits. Next week’s reports will be highlighted by the FOMC minutes, leading indicators and durable goods. Happy Thanksgiving!

LONG TERM: uptrend

While the new administration is having a difficult time getting major legislation passed. The fact that they have pledged, and are trying to do so, has clearly changed investor confidence. A quick look at the weekly charts bares this out. After the 2016 low, prior to and right around the election the market had 5% corrections. Since the election, one year ago this month, the market has had just one 3.3% correction. A recent analysis displayed there were only 9 times in the history of the US stock market, the market has gone about this many trading days without so much as a 5% correction. All of those previous events occurred during the 1949-1966 P3 or the 1982-2000 P3. More evidence a P3 Secular bull market is underway.

Caldera has been right in his long term bullish outlook and obviously does not share Peter T’s view that this wave is corrective and terminal. A few other analysts have his same Primary 3 count like Avi Gilbert and Lara Iriarte. They discarded the b wave after it exceeded the a wave b 2X. It will be very instructive to see who got it right. My money (literally) will be on the bearish view, but you knew that! 🙂

Here are some interesting market fib. relationships. I am learning to pay closer attention to them as they seem more critical than I realized. Peter recently pointed how they define impulse second waves.

http://studyofcycles.blogspot.com/2017/11/its-time-for-time.html

This week I begin scaling into GDX in mid term account. These are trades I expect to hold at least six months or until they hit my trailing stop. I am willing to pay 22.50 for GDX therefore will sell to open the December 13 22.50 strike puts for a limit price of 0.38 per contract. On fill I will set a trailing stop of 1.25, and sell monthly covered calls against my long position. 10 contracts for 1/4 full position. My cost basis for 1000 shares will be 22.12 pet share if filled.

A new weekend blog post is live at: https://worldcyclesinstitute.com/the-last-spike/

Let’s play nice in your comments, folks. Don’t get me upset.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.