The Parade Grows Larger and Larger

The picture at left depicts a St. Patrick’s Day Parade in New York City. Somewhat appropriate to what I’m seeing in the markets.

The picture at left depicts a St. Patrick’s Day Parade in New York City. Somewhat appropriate to what I’m seeing in the markets.

All the Same Market: I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash.

We’re starting to deleverage the enormous debt around the world. Central banks long ago lost control (they never really had control, just influence). They have tools, like “TARP,” for example, but treasuries dictate interest rates (the Federal Reserve just follows along). They’ve been attempting to fight deflation now for years, but it’s slowly taking hold.

We have an inflationary bubble which is about to break and you’re going to have a front row seat.

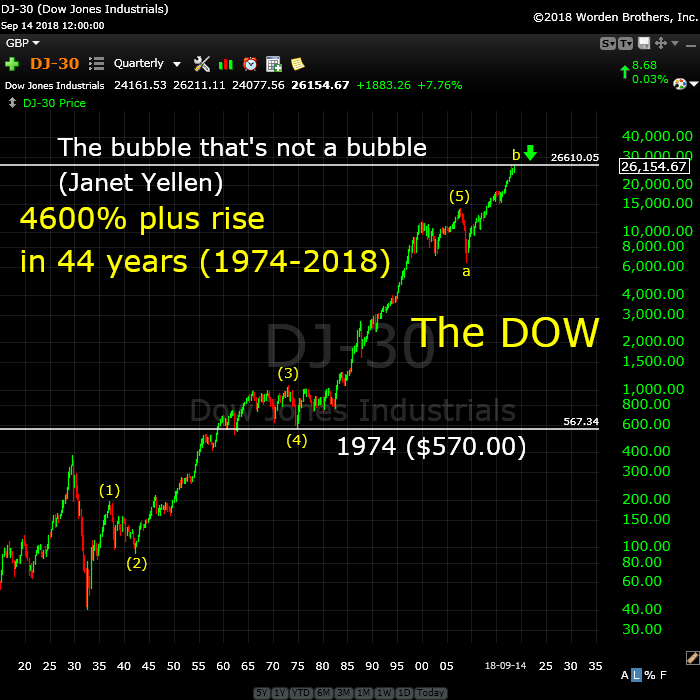

Above is a quarterly log chart of the DOW, showing the five waves up from 1932. This is the fifth wave of a three-wave impulsive sequence that began about 500 years ago.

What’s interesting to an Elliott-waver is that wave (3) is exactly 2.618 X the length of wave (1) and wave (5) is again about that same length. The “unnatural” B wave tacked on the top end has been inflicted by both the governments and central banks in collusion. But the history-making bubble is just about at an end.

Elliott wave analysts know that when you have a correction, it always reverts back to the area of the previous fourth wave of one lesser degree. That level was in 1974 when the DOW as at $570.00. I’ll let you mull that one over …

We’ve inflated away the value of our currency to the point that it’s worth four cents of what it was a hundred years ago, a few years earlier than the start of the above chart.

Much of the rise in this market is due to inflation. If you expect more inflation (and waves to the upside), you’ll have to wait for a very large correction in order to do so, because this wave count is all but done. It even has a B wave extension, which is a first time in history event. But even it’s at a full count.

I expect this market to turn over before Christmas. The crash may be early in the year, but the top is almost at hand.

The Dollar Leads the Way

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2016. For a short while, currencies were moving contra to the US market, but gradually all the assets classes have started “drinking the cool aid” and aligning themselves so that they’ll all top at the same time … internationally.

If you do not look at the overall market and the asset classes that matter (oil, gold, USD currencies, and the US equities —as well as international indices), you will have no real idea where we are. For assets do not just crash midway through their wave structures. They all finish up five waves together and then turn down in a very predictable, organized manner. Worldwide sentiment becomes more negative than positive and the trend changes.

Even intraday now, I’m seeing almost all the assets I cover moving as one … in a parade to the top – eventually. But, unlike a parade, the market doesn’t move in a straight line.

The market does the most predictable thing in the most unpredictable manner.

About three weeks ago now, my blog title on the free blog was “Turn of the Century.” Well, haha, I was just a little early. That turn is still about to happen. At the time, I said I didn’t know exactly how it would happen, but I knew just about everything would turn at the same time. Eventually, we’re all going to complete the final 5th wave together.

It looks now like the top of the B wave will have just about everything lined up. USD currencies, the US indices, oil, gold, and the US dollar itself should all turn at the same time.

_________________________

Update on NDX

We’re closer to the top than many think. The impulsive structure of the NDX suggests that, once we trace out what might be a more complex fourth wave, we’ll have one more wave up to a new high. After that, it’s a multi-year bear market ahead …

Above is the two hour chart of NDX (Nasdaq 100).

There are several ways to label this final set of waves up to the top of wave 3. I believe we’re in the fifth wave of the third wave with a top coming with a new high. That would lead to a larger fourth wave down, which will parallel the movement of ES/SPX as they complete a C wave of their fourth waves.

The larger fourth wave should come down to the previous fourth wave somewhere around the 6942 area. It cannot drop into the area of wave (1) or it would negate the impulsive wave and possibly lead to an ending diagonal.

These waves are the final two before the top of the 500 year rally. The fourth wave will likely come down “hard” as many of the FANG stocks are also set up for a turn to the downside. They’re all setting up for a turn at the same time, by the looks of it.

In any case, after the final 5th wave up in NDX is complete, we’ll turn down into the bear market I’ve been talking about here for the past three years!

The Australian Dollar—An Update

Above is the daily chart of AUDUSD. Last weekend, I showed the AUDUSD chart and called for a turn. This week, we got the turn and have now finished an impulsive first wave up and a second wave down to the 62% level from the turn. Much more upside is to come.

For details, you can go back to last week’s blog post.

______________________________

Elliott Wave Basics

There are two types of Elliott wave patterns:

- Motive (or impulsive waves) which are “trend” waves.

- Corrective waves, which are “counter trend” waves.

Motive waves contain five distinct waves that move the market forward in a trend. Counter trend waves are in 3 waves and simply correct the trend.

All these patterns move at what we call multiple degrees of trend (in other words, the market is fractal, meaning there are smaller series of waves that move in the same patterns within the larger patterns). The keys to analyzing Elliott waves is being able to recognize the patterns and the “degree” of trend (or countertrend) that you’re working within.

Impulsive (motive) waves move in very distinct and reliable patterns of five waves. Subwaves of motive waves measure out to specific lengths (fibonacci ratios) very accurately. Motive waves are the easiest waves to trade. You find them in a trending market.

Waves 1, 3, and 5 of a motive wave pattern each contain 5 impulsive subwaves. Waves 2 and 4 are countertrend waves and move in 3 waves.

Countertrend waves move in 3 waves and always retrace to their start eventually. Counrtertrend (corrective waves) are typically in patterns — for example, a triangle, flat, or zigzag. Waves within those patterns can be difficult to predict, but the patterns themselves are very predictable.

Fibonacci ratios run all through the market. They determine the lengths of waves and provide entry and exit points. These measurements are really accurate in trending markets, but more difficult to identify in corrective markets (we’ve been in a corrective market in all the asset classes I cover since 2009).

To use Elliott wave analysis accurately, you must be able to recognize the difference between a trend wave (motive) and a countertrend wave (corrective). There’s very much more to proper Elliott wave analysis, but this gives you the basics.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

No change from last week. We're still waiting for the fifth of the fifth wave to a minimal new high before a turn down in the long-awaited C wave of a flat pattern.

My preference is for this unfolding fourth wave pattern is that of a expanded flat. However, technically, it could also be a running flat. At the present time, the B wave (that's the ABC wave up from about 2532) is longer than the A wave (marked as the 4th wave down from January 29, 2018). A regular flat registers as an expanded flat when the B wave is over 105% of the length of the A wave—ie, the B wave would need to reach above 2889, which is has done.

That means that the ES/SPX has multiple possibilities as to a target on the downside. Accuracy (in determining the most probable target) is going to depend upon both counting and measuring the waves to the downside. It's impossible to pick a downside target at this point in the process.

If we select all of wave 4 (on the chart—down from January 29) as the "A wave," then we're looking at an expanded flat. In that case, this outcome is the most probable:

- the C wave of a flat is typically 100 - 165% of the length of the A wave (so the target would be from 2532 - approx. 2360) - preliminary targets

There are other options:

- a running flat would trace out a C wave that is NOT longer than the A wave (in other words, it would not go to a new low). I regard this option as very low probability because it's extremely rare (I've only ever seen one of them). However, if NDX is tracing out a final impulsive pattern, its fourth wave should not be very deep, which may also restrict the length of the C wave in the SP500.

Volume: Volume has ticked up with Wall Street back at their desks after the summer break. However, it hasn't changed much in terms of market direction. This market is so weak, we'll likely need that volume to make it up to our target.

Summary: We're waiting for a top in a B wave, which will result in a C wave to a new low. My preference is that this structure represents an expanded flat, but there are other options. Once the c wave (down) is complete, expect a final fifth wave to a new high. That fifth wave up to a new high will be the end of the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, September 26 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Hi Peter, Thanks for beying my the guide.

Me, the old one predict this:

The next week there is a high of my old indicator from 17-24/25 sept. The ultimate high is 19th after 1pm until the day-beginning the next day. (roughly) The 28th is a (very) LOW. The red line indicator must confirm it. But I trade at 2929 or the high 19(/20th)

Watch http://www.prognoseus500.nl/

I won’t predict any further because that is not reliable yet

Thank you SIR PETER! As always..a master piece of analysis. I always appreciate the time and attention to care.

Your viewpoint right in line with mine..

I have SPX getting as high as 3020 in B wave..Dow getting to 26.7k or new high!

If NQ100 needs new high..thats almost 2% higher.

If you add 2% to SPX..thats 2963.

If you add 2% to Dow..thats 26,677..and a new high

Now looking like Im on same page as you! Thank you for confirmation. You

Added some more calls on this dip. Almost..fully loaded for SIR PETERS 2% upside..looking for a spike in volatility to add some more VIX puts too. Great buying opportunity today! Come on..bigger dip!

N100 now at 7479..needing almost 3% to a new high. Fully loaded on calls now..added some QQQ calls!

I’m loading up on the longs today as well. I follow your successful lead Charles. Seeing the light of your ways in this manipulated market.

Q

As a trader, it is critical that you develop and follow your OWN trading methodology.

If you simply follow what other people are doing without understanding why and how, you will probably also end up blaming them for loosing trades, which are inevitable. Just a friendly word of advice. 😉

My trading strategy is leading to losses. Charles trading is leading to profits for me. I keep my stop losses and its working. Let the bull roll on.

Change your strategy!

There is no substitute for the bruises you have to endure while you fine tune a methodology that is consistently effective. Listening to what others have to say should be a means of confirming or re-examining your own due diligence.

Most of my stuff is short-term..but i love buying the dips and watching for my targets which are based on fib ratios and wave lengths. I use SIR PETERS big picture but use my own analysis. Bollinger bands are used for short-term trades. On a day like today..im buy wed and fri calls..dont like 1 day contracts when im trading against the trend.

Rolling NQ and ES profits… 😇

I was going to wait for a fill of 11.31 VIX gap to add to my remaining batch of 11.00 strike calls but I am taking the money and running on a 50% gain. I am backing up the truck on any move back below 11.00

Long vol remaing the most explosive potentila in this market. Just my two pennies! 😀

I know its playing with fire Mr Verne..but my vix trades are playing with house money at this point..made a killing shorting vol in this B wave. I typically trade and set profits aside until I have a big pot of house money..then trade that and keep setting aside profits. Has worked like..a snake charmer! I dont see a real vix spike til nov mid terms when demoncrats prob take house n senate..then trump rally fizzles out cuz he will be handcuffed.

Sir Charles, I am not the least bit worried about you! 😊

A break and CLOSE below 169.50 in IWM will decisively violate a long-held uptrend and trigger a sell signal.

It is not a matter of IF, only WHEN. Steep negative divergences at recent highs makes it higly likely, unless divergences are overcome.

How do we get to SIR PETERS N100 top..now about 3% from current trade..without all the indices following?

People seem to forget that bearish divergence among indices is a common feature of market tops. Peter earlier explained this subtle point. The markets do not all have to top AT THE SAME TIME!!!

If fact DOW theory stated that their failure confirm each other’s most recent high is what forms the basis of the theory.

For short term traders, the key issue right now is the banksters’ attempts to hold onto the DJIA and SPX pivots of 26K and 2.9K respectively. I don’t really care who wins this battle in the short term. If they hold today we likely get another 1-2% upside.

It would be an incredible entry point….

I think..if SIR PETERS count is correct..the indices all have 2-3% upside then the rollover..thats how im playing the trend.

Possible. The market looks lethargic to me. I don’t expect price to reach the too of these bearish rising wedges for a 3% gain.

Yeah took a small gain on my SPY calls on trip from 289.80 to 290.30 for 25%..Not feeling the dip today!

Spending most of day near lower BB. Only one move from oversold to overbought. Unless we get a massive sell-off..im done for today..not liking the action..one bit!

IWM attempting to reclaim broken former support shelf at 170.5

I expect it to fail…

A new IWM low beneath 169.58 WITH a lower close means it’s time to short small caps for a 3-5% trade to the downside.

Opening order to buy October 26 170 strike puts for 2.00 even or better. Look for the banksters to spike it up in a classic head-fake before the plunge. These cretins are SO predictable it is not even funny. The bid/ask on the puts should temporarily improve in the buyers favor but you will have to be quick…! 🙂

From a trader’s perspective, one of the things that in my view makes this market a very dangerous place right now is the candle profiles. There is virtually no selling pressure to speak of. The central banks have done a remarkable job of intimidating short sellers, and driving a lot of hedge funds out of the market who are so critical to hammering out bear market bottoms when they cover short positions. This market has no back-stop besides the central banks. Despite the absence of sellers, we are still seeing some very nasty downside candles on many indices. This is evidence of a market in a very precarious state, plunging under the weight of its own bloated torpidity. I think traders are going to be absolutely stunned with how fast this thing collapses once it begins. Caveat Emptor!

Im agreeing with your viewpoint..seeing some VERY spooky activity and we aint even close to Helloween..hardy har ha. Lightening up on some of my trend trades..better to be safe than sorry. Usually use 5 min charts..today needing 1 min cuz of downward trend.

IWM needs to break 169.83 next….

While as Charles says, we could see another upside push, we could also see a precipitous downside break. I will guarantee you one thing. If the latter happens no way you are going to be able to profitably trade it unless you are pre-positioned.

Bought some UVXY calls in event there is a big overnight move..out of vix puts completely for now..looking more like something is up..will still scalp during day as I can control my risk..but dont wanna be short vol overnight.

Sometimes an index will make a directional break seconds ahead of the corresponding ETF, and occasionally vice versa. I have no idea why this happens other than HFT front-running orders. You can make some really great trades if you are alert and looking for an initial signal from on or the other.

Either we get a ridiculous big green candle in IWM that goes all the way up to tag the underside of the 170.50 pivot for a kiss good-bye, or the bears take ‘er down past this morning’s lows. “Time to shake and bake!'” 😀

IWM October 170 puts at 2.11/2.18 bid/ask spread. Last sale at 2.19 and still down 20% for the day so I am pulling the trigger on any take out of this morning’s lows…

The banksters stepped in and bought at exactly 169.70. Let see how deep the pockets today. They clearly don’t want the lows taken out…

As expected, they are ramping prices higher and it could go back to the 170.50 shelf.

Won’t change anything though….”sound and fury”

Hehe! Looka dah Bears are saying… “Oh no ya don’t! Not today!” 🙂

Yeah imma not touching these dips..bears winning for sure today.

You’re one smart cookie. I hope Q is following your lead. This is exactly the kind of thing I was referring to earlier on the risk of blindly following anyone….

Yes. Stopped on the new long and it’s looking weak. If the bears fail to gain momentum back to long and new highs.

I move up my bid for the 170 puts to the current bid at 2.11. Let’s see if anyone bits. Hopefully I get a fill with another bankster attempt at a ramp higher… lol!

If SPX 2900 falls, DJIA 26,000.00 will follow. Free trade from my proprietary bankster

psychology analysis! 🙂

Bang bang the bulls are back. Snapped up Dow Kong’s as the 100 point drop from overnight is reversed. The bears got zero fight. 25500 needs to be broken for me to consider a change in trend as these days 500 point drops are illegal.

Wow! The banksters are back!!

Trying to put in another floor at 169.59 Lol!

Can you believe these guys????!!!

DIA 260 puts now nicely in the green. Looking for another 10% to roll profits forward to 259.00 strike puts.

Pulling the trigger on the IWM puts. I had to cough up 2.15 per.

I think the bears are gonna gap this baby down bit time…. 🙂

If you are holding UVXY or SVXY shares or option contracts, remember they reverse split after the close. Another way for the crooks at ProShares to try and rip off traders who don’t know what they are up to. Sell credit spreads!! Boo-Yah! 🙂

Banksters pulling out all the stops to defend the 26K and 2.9 pivots in DJIA and SPX.

This ought to be real interesting!! 🙂

Really uncanny how prices are just sitting at these pivots. There is no selling, but there is also no buying. The banksters seem content to fend off any attempts of the market to fall below these levels that would issue a short term sell signal. Looking like nothing gets resolved to day. Perhaps price action in futures overnight will tell the tale. Keeping some powder dry!

See ya later, Alligator! 🙂

Cashing out DIA 260 puts. Sitting tight for now and awaiting clear sell signals before re-loading…Bye again! 🙂

OK … now the real run begins …. https://www.zerohedge.com/news/2018-09-17/trump-orders-immediate-release-all-text-messages-russia-investigation

SIR PETER..are you of the keen opinion..this is the start of the C wave or just a fake out?

‘Bout time!!!!! 🙂

heehee.

Banksters are baaaack!!! It was clear from all the long tails we were seeing on candles yesterday that deep pockets were aggressively buying the market decline. They were unable to hold onto the 26K and 2.9K pivots during the cash session so they steadily bought futures in an attempt to reclaim those levels. What we have going on here is a confidence game folks. The banksters will be successful so long as the herd remains convinced they have the buying power to arrest and reverse every market decline, and it is certainly true for the last ten years they have appeared omnipotent. I have always contended that this market would meet its demise ONLY when the criminal cartel lost control of it, and that would happen only when the sleepy herd woke up to what was really going on. We are seeing now for the first time long candle tails are NOT resulting in immediate intra-day reversals. Clearly the BTF dippers were not so enthusiastic in joining the banksters yesterday. And then there is that small matter of TEN consecutive Hindenburg Omens, never before seen. No amount of irrational exhuberance can mitigate the remarkable deterioration of market breadth that is evidenced by such an unprecedented streak. Finally, many of the stocks responsible for the lion’s share of the market’s gains, no doubt by design, are starting to crack, for example AMZN. Let’s see just how deep the pockets of the banksters are in the face of the developing situation, shall we? 😜

I was expecting this move by the cartel and will be watching closely from the sidelines for now…

Looking at the chart, I think we either have a completer a,b,c for a small fourth wave, or just the “a” leg of a larger a,b,c, with the b leg now underway, and a final C down to come. As long as we remain above those round number pivots the banksters are fiercely defending, they remain in control near term and that has to be respected.

The chart hasn’t provided any confirmation yet of a potential 4th wave. As of now, the market has had enough chances to break the up trend line and every single time it has refused to do so. Maybe we get a 4th wave like 2006-2007. 4% down move on the day trend line was broken.

i dont think we will..far too many bulls..need some trigger to get party started..my guess is mid term elections..or false flag event.

My, my my! What have we here? Thatsa big fat juicy, spicy meat…er, I mean red candle in futures!

Looks like the banksters are gonna have to break a few more piggy banks.

A green VIX print and I am back fully short…

Imma waiting on the next dip..looks like bulls back in control..Bears had one good day. Hardy har ha..but they cant string together two in a row. Pretty telling if ya ask me.

Yeee haaaaa. The bulls are back and ripping the Dow higher. My profits are exploding and to be sensible i have indeed set my stop losses at breakeven now. The bears are incompetent at follow through.

Back to buying dips..had to go to 1-min chart but just made 25% from 2899 back up to 2903. Bulls back in charge..like its nobodys biz.

Yep! The banksters sure are busy!

They need a few of you BTF dippers to join the party.

There is not a competent trader alive who does not recognize that candle today as nothing but a steaming pile of cow pie! Huyk! 🙂

I know..definitely hinky..but scalpings working so I progress until i see danger..like yesterday.

OBV did give a bullish signal with a new ATH yesterday so signals are mixed. Just before the plunge in Feb we had some technical metrics still showing bullish signs. I suspect you are not going to the real danger coming in this market.

My signal to get defensive is either a new high for Dow and/or SIR PETERS technical level of 2790 on spx. The spx drop is 117 points down. My spx target is 3020..which is 113 points higher so risking 117 to make 113 more..on top of 300 points imma already up from 2600. I will take dem odds every day and twice on Sunday.

Hi There, the top this week is 19th and perhaps the 20th a little higher. But then the decline into the 28th must start. The 24th gives a little recover. Watch http://www.prognoseus500.nl/

I have no time to answer.

But tomorrow the second part of the day I expect the High. I Like the 2929. but a double top is O.K. OR perhaps the DOW also the double top 26.684

Sounds good to Willem. So long as the herd does not get spooked! Haha!

Finally someone else seeing that Dow could and IMO will hit new high..before markets rollover..

Sitting pretty on yesterdays trend trade for QQQ to new high. Thank you SIR PETER!

I remain on the sidelines, happy to watch you BTF dippers frolicking in the surf…! 🙂

Yes Me Verne..i fully understand your position. I obviously like risk..but if SIR PETERS target works out..QQQ still has almost $4 more upside..boo yeah..baby..cha..cha..ching! Imma ready to bank some coin following SIR PETER forecast and my own independent analysis. Gotta be in it to win it..as they say!

Back to a fully long position on that little drop. This bull is ferocious..gonna ride this bronco to 3k on spx.

I think it’s going way above 3k now charles. More like 3300 and then the multi year crash begins. Trying to keep away from all the news like the US budget deficit and the corporate leverage etc. The waves up look corrective but only Jesus knows when they end so as you say keep riding the bronco. I’m fully converted to short term Uber bullish and I’m staying away from EW on US indices as they keep telling me a top is at hand but the market has a mind of its own

I have one calculation at 3020 on SPX for this current B wave..which lines up with new high for Dow and N100. Im not sure SPX will make it as high as you say..3300 in this wave..the 5th and final wave..should get there..depending on how deep the C wave is. I suspect it will be shallow..vis a vis a running flat..then back off to the races in 5th and final wave..which I think takes us through 2019. My target for prolonged bear market starts 2020. Just my two shiny Lincolns. Hardy har ha!

Almost a year has passed from this post. https://worldcyclesinstitute.com/time-for-a-small-dose-of-reality/#comment-21931

I’m superstitious about tsla.

https://twitter.com/FT/status/1042083279221010432

Today in PST timezone, it was tweeted 9:09 9/18/2018.

Here are 3 occurrence of 9. The hour, minutes and month. 999. For me, this signals bearish energy will continue.

If you look at the day of the month, it is 18. 1+8=9

Then the year 2+1+8 = 11

Put together it becomes 911 for emergency information that tesla is done.

Good luck if you remain a bull.

Hardy har ha Liz..Thats some mighty good mathematics. I was in TSLA many a moon ago. Made well over 400%..but once it topped $300..I hit the exits..and havent touched it since. I like the car..not the stock..and used to respect Elon..but he has shown his true colors..great inventor..lousy leader. His drug use has him off the rails and prob heading to jail. At least thats where he belongs..blatant stock manipulation..unless youre a central banker..is illegal.

Market strength still in check..despite yesterdays spook..

Some key items imma watching..

– 10yr treasurys above 3% while bonds dropping

– Dow near Jan high

– SPX near all-time high

– N100 held 50-day MA

– Key industrial leads Boeing..and Caterpillar breaking through upper channels

– Semis bouncing off 200 day MA

Looks good fellas..back up the truck. Next stop..new highs!

BOOM BOOM. I’m doing fantastic since i started using your strategy. I wish we had a never ending bull market but sadly it will end some day. Dow record almost a certainty now. I’m not as confident of Peters current wave labelling now we have ripped so high.

This B wave is still valid IMO..SIR PETER is a very good analyst..one of the better ones i follow. Ive learned you cant be too bullish..or too bearish..follow the price movement and have good stops in place..dont get greedy. I typically take profits at the following levels: 25%..50%..75%..100%..150%..200%..250%..300%. No one goes broke locking in gains.. Using Bollinger Bands I move stops up as trade goes in my favor.

anybody watching Copper ??

Nice ramp! My problem is we simply do not have a capitulation fifth wave down so far as I can tell.

initial indications are that the bears lost the battle of the round numbet pivots. Follow through with more upside tomorrow means DJIA 27K and SPX 3000 will be a powerful magnet. I personally am not trading. To my eyes, this market remains a very treacherous environment. My concession to more upwards movement is steady deployment of bull credit spreads several months out and I would be very happy to acquire puts courtesy of the house! I think the market remains vulnerable to a significant downdraft at any time.

Joe,

The weekly Utilities Index seems to be in a ED for a wave C correcting the 5 Wave decline from January 26th. Any thoughts?

US 30y treasury rate is at a huge level. A rate sell off led by the 30y is not normal for this late in the cycle. 3.25 has been a significant level. If it gets taken out, it opens the door towards 3.40. Its not my view that it happens, but if it does, then I have to respect it and trade accordingly. 10y can get to around 3.25-3.30 in that move.

Buying back DJIA 263 short puts of 262/263 bull put spread.

Selling 263/264 bull put spread.

Loading the truck on VIX 12.00 strike calls for Oct 6 @ 1.90

This is a terminal wave imho and the big profits ahead are to the downside, not the opposite.

VIX may or may not fill the open gap at 11.31.

Once it does, it is free money!!! 😛😛😛

You’re welcome!

Yes I shorted VIX last night..yee haw!

Shorting the vix is too risky for me Charles. Happy to buy Dow jones 24/7 at the moment though. Other indices are weaker which is a little worrying

Yeah Ive just been shorting when i see higher prices on indices like qqq and spy..i have some long vol positions open for Oct and Nov in case this C wave down ever shows up..

i tend to wait for small moves in VIX in my favor and tap out with 25-50% gains in most cases then wait for next little spike and short again..wash..rinse..repeat.

Dont usually hold overnight to avoid a XIV situation..but will when i see a good multi day setup. Was funny i actually had cashed out of vix shorts two days before blow up. Was holding a lot of stuff overnight back then and riding the wave..but that blowup was an eye opener. Never trade money you cant afford to lose..and control risk. Thats why i prefer day trades..but still have some non vol..trend trades for more up in markets. Stop at SIR PETERS 2790 on spx. Til then..imm planning for new highs for SPY..DIA..QQQ..IWM..etc.

Buying back half of DIA 264 short puts. Just a bit higher to close our remaining short puts of spread…

Nasdaq had an inside day and may be the canary… 😉

Still looking for a decisive break of IWM below 170. 50 to reload 170 strike puts.

Imma waiting on new high for IWM..QQQ..SPY..and DIA. I have top of B wave getting..all 4 to new highs! Then I will go other way for C Wave.

I think IWM is done. My indicators remain on sell….

Oh i love me some small caps..with strong $..ive been mostly domestic in 2018..and owning small and mids. Thats where my serious coin is..

Oh my….!!! 🙂

Considering the size of the coming correction, I am expecting to see a huge bearish engulfing candle and it is not because sellers are going to magically appear. The dirty little secret is that the market is now largely driven by central bank purchases and the anemic volume suggests to me that they are employing massive leverage to drive these markets higher, along with vol suppression to allow others to do the same via risk/parity manipulation. A huge bearish engulfing candle will tell you the rats are leaving the ship (deleveraging), and leaving the suckers holding the bag ahead of the dive. Nothing new here folks.

Yes but..we need to properly top 1st..all indices IMO should get to new highs..then boom..down she goes..vix getting hammered down..showing much more up before the next down cycle.

That, my friend, is a dangerous and ERRONEOUS assumption. Intermarket bearish DIVERGENCE is a key feauture of market tops and the very essence of DOW theory non-confirmation.

Mind you I am NOT saying we will not see new highs in all the indices, I am saying we do not HAVE to….

Oh i know we don’t have to..my thesis is we get a new high for all indices in B wave..then down in C wave..then in 5th wave is where major divergences will rear them ugly faces. Thats what imma seeing and how imma trading but if SIR PETERS 2790 comes 1st..then i will shift course. The vix hammer tends to signal higher highs mostly..even on down days..vix don’t staying up..thats a good indicator that markets still have some legs..just my 2 shiny Lincolns.

I think if VIX is going to fill that gap at 11.31, it may do so with a quick downward spike. One nice trick to pick up cheap calls is to open a “stink bid” to catch the spike down. You just might be able to snag 12.00 strike calls for 1.50 if that spike comes.

The market makers use to pull this stunt every Wednesday morning at liquidation to rip off traders holding slightly in the money calls and I pointed this out to a few of my trading friends. We started opening massive contingency orders to buy calls when the market makers pulled this stunt and would get filled on calls that literally doubled in a few seconds. I guess they got tired of getting hammered and they no longer do it. Maybe more traders noticed the practice. What a pity. It was nice while it lasted! 😁

I am out. That is good enough for me on DJIA. Buying back remaing short 264 puts.

You know what they say about pigs….!!! 😁😁😁

I really want to close out my bear call spreads on GLD and SLV but I am just not seeing the kind of capitulation that you see in commodity fifth waves. I suspect we have more downside ahead. Waiting for a HUI buy signal to load the truck. One PMs turn it could be a rocket ship higher. Has anyone noticed how hard it is becoming to acquire large amounts of Silver at the current prices? A few folk predicted this would happen.

Yes my silver dealer is short on inventory..Gold much easier to acquire.

Yep. Wait time for Silver Eagle monster boxes now several weeks. Yowza!

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.