Historic High Hopes

The historic levels of optimism this week brought to mind one of Prince’s best-known songs:

“I was dreamin’ when I wrote this, so sue me if I go too fast

“I was dreamin’ when I wrote this, so sue me if I go too fast

But life is just a party and parties weren’t meant to last

War is all around us, my mind says prepare to fight

So if I gotta die I’m gonna listen to my body tonight

Yeah hey, they say two thousand zero zero party over, oops, out of time

So tonight I’m gonna party like it’s nineteen ninety-nine”

We have levels of optimism this weekend that are at historic levels.

On Friday, the VIX closed at 9.36, which is the second lowest close in history, exceeded only by the close in December, 1993 (9.31).

The Market Vane Bullish Consensus poll of newspaper writers has a five day average reading of 70%. This is the highest reading since June, 2007 (the top of the market before the so called “Great Recession” drop of 2007/8).

Successful traders are contrarians. These are extreme readings, consistent with a major top.They’ll no doubt go higher before this entire rally is done, but these readings are good enough for the top of an historic third wave rally. Look out below.

Looking for a Top

Above is the 60 minute chart of ES (emini SP500 futures) from Friday, July 14, 2017. That weekend, in this blog post, I predicted a top possibly in hours rather than several days. I posted this chart for my Trader’s Gold subscribers with a target of 2466, but cautioned that if the fifth of the fifth went to full length (1.618 X the length of wave i), it would top out at 2476. I was a little off on my timing, as we didn’t actually reach the high of 2476 until this past Thursday. But we turned back down at exactly 2476 and have not gone to a new high.

I had also predicted a new high of at least 5910 for NQ (Nasdaq emini futures) and that it was the one to watch, because it would signal the top of the wave in ES, as well. We’ve reached a new high in NQ. In fact, all major US indices have now reached a new high, which was a requirement for a top. It isn’t a signal for a new top, but a new top is required to “zero out” the jumble of waves near the top and allow the indices to start with a clean slate. A clear set of 5 waves down is a requirement for a continuing large correction (unless it’s a triangle that’s forming).

I had also cautioned my subscribers that the triangle shown near the bottom of the chart (red circle) may turn out to be a first wave instead of a triangle and that this might end up giving us an additional fourth/fifth wave combination to a new high. That caution had additional weight due to the fact that NQ also had an attempt at a triangle at the same position, but it was incomplete. Therefore the structure of the final waves up in NQ and ES didn’t match. This is why it’s SO IMPORTANT to look at multiple indices because more often than not, any inconsistencies will give a clue as to what the market is actually doing underneath all the noise.

Here’s the same chart that was part of the Chart Show on Wednesday, July 19 when it was obvious that we were going to a high of 2467.

However, in the aftermath of that top, it’s also become obvious that the triangle is a fake-out (red circle). It’s indeed part of a 1-2, 1-2 combination. That means we have one more fourth wave to go this weekend (possibly a bottom Monday morning) leading to a new high this coming week. That will end the extraordinary run of the higher degree third wave up (shown on the daily chart below).

So, while my timing might have been off, the wave structure is warning of an impending top, along with market sentiment, which is at extremes.

Trade what you see, not what you think.

All the Same Market

I’ve been mentioning for months now that the entire market is moving as one entity, the “all the same market” scenario, a phrase that Robert Prechter coined many years ago, when he projected the upcoming crash (although he and his group don’t seem to be paying much attention to it now …).

We’re starting to deleverage the enormous debt around the world. Central banks are losing the control they had and we’re slowly sinking into deflation world-wide, with Europe in the lead.

The US dollar is fully in charge of both the equities and currencies markets. They’re all moving in tandem, as I’ve been saying since September of 2015. For a short while, currencies were moving contra to the US market, but for the past several months or so, they’ve been moving together. The EURUSD is very closely aligned and will likely trace out a fourth wave as the SPX traces out one, too.

A large corrective move is on deck and will affect the US indices and the US dollar at the same time.

______________________________

The Market This Week

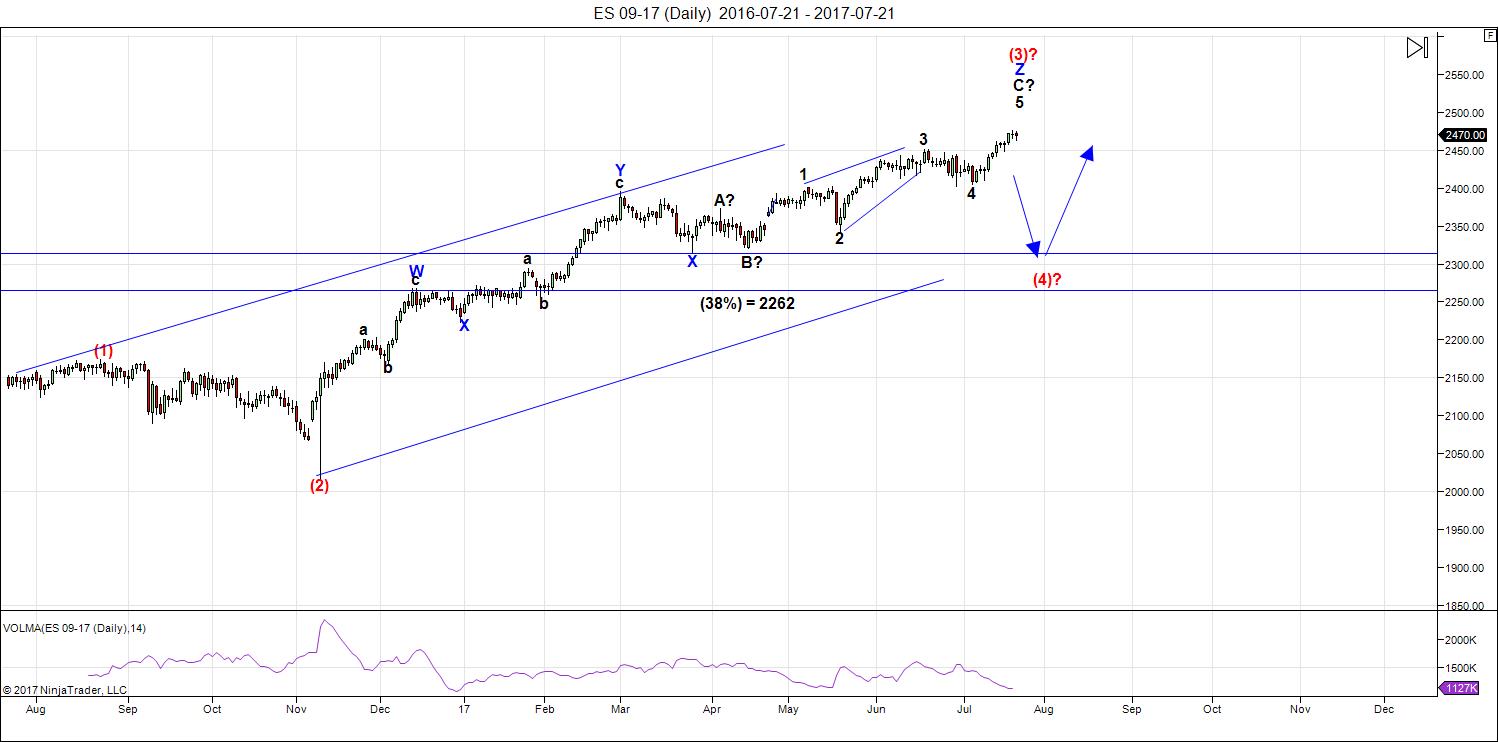

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts). Last week, I predicted a turn down at the beginning of the week at a target of 2475/6 (with a fully extended fifth wave). The turn at that level happened, but it took until later in the week, of course.

However, the market made it very obvious we're not quite done with this third wave. All boats have risen to a new high, but the market has signalled one more wave up ... and this is across most currency pairs and US indices and futures.

The USD currency pairs are still in various stages of topping/bottoming. The currency pairs continue to be near targets, but those targets, for the most part, have changed slightly this weekend. We're near a top, but we still have one more wave to go.

I've labelled the subwaves of the final wave up in the chart above so that you can see the challenge with analysis of a market that keeps telling me it's corrective. There are two many waves in the final wave subwaves and the only way I can make it work at the moment is to consider the first wave up as a wave in 3 subwaves (that's the underlying structure). So that means we have completed a third zigzag, which confirms my overall labelling of the entire move up from February, 2015 as a corrective pattern.

NOTE: There's a Fed meeting this week with an announcement expected at 2pm EST on Wednesday, July 26. This may be a market mover.

Summary: We have one more rally to a new high to go before we drop into the fourth wave.

After completing the larger fourth wave, we'll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

______________________________________

Sign up for: The Chart Show

Wednesday, August 2 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

NOT AN ENDORSEMENT

Gary Dean (Woody Dorsey) Video – July 20, 2017

https://www.youtube.com/watch?v=Ps4lHRXm8zY

1:27 – “we are in the Golden Halo time period…series of extreme bullish readings”

2:10 – “never been calling for a top until…the July, August time period”

8:18 – “the bigger drop is coming in August…will be a larger wave four to the downside”

ROTROT-does this Woody Dorsey have a good track record? thanks

https://www.youtube.com/channel/UCGGk-cwX7_Q_h8isFE65lwQ

Thank you rotrot …nick ..

Only difference is he has it as 5 waves up from the 2009 low. Peter has it as an ABC. Woodys option would provide a longer timeframe for a final top and Peters case would give one sooner. We will know which is correct once we see how deep wave 4 drops.

Apologies upfront for this little beauty, so appropriate for this Wave 3 which has pushed my buttons and limits.

https://www.youtube.com/watch?v=J9gKyRmic20

Peter / Valley, this came to mind following your Prince’s 1999 no coincidence….

1999 / 3 = 666 : ) 666 x 4 = 2,664 surely not : (

2,664 x 5 = 13,320, eventually. The Spy was in the 100s for much of the early 80s and now it is mid 2000s. 20 X. 20 X current levels is 40,000s. Nominal is not equal to real. Inflation has occurred for the last century. My guess is that it continues.

hey peter

Just a thought regarding the us dollar index .

march 2015 high

may 2016 low

plus 14 months July 2017 .

how this plays out im not sure

yet its a 14 month high to low to low count .

it does dove tail with the stock index’s

the other thing in regards to the us dollar weekly chart

is this

from the low the week of aug 31 1992 to the peak the week of

july 2 2001 the dollar rallied for 461 weeks .

from the low in the week of march 17 2008 to the recent high

the week of Jan 2 2017 the dollar rallied 459 weeks

both rally’s lasted 106 months each .

i was not expecting a new all time high in the Dow yesterday.

as we enter the month of august i m planning on becoming

more and more cautious . Aug 7th 10th we have a cycle

Aug 7th is the lunar eclipse Aug 10 based on planetary cycles.

i believe the 1927 high came in early august , the others line up

with the week of august 11th and the solar eclipse is aug 21st

mercury retro grade is Aug 12th to Sept 5th .

My focus being the 10 day lag gives me Aug 22 to Sept 15th .

id rather see Aug 21 as a high rather than a low.

Hence the wave count does matter to me a lot

but i tend to make my trading decisions around

timing .

the dates posted are specific yet how this plays out

is not set in stone at this juncture .

Lunar eclipses can move the market so i watch both.

we will see soon enough .

Joe,

It doesn’t look like IYT printed a convincing low yesterday. See you next week.

The new high in DJI I find quite problematic. A turn at this degree should really have the majors moving in tandem and when that does not happen something else is usually going on. Once again SPX is closing above the critical 2470 pivot so I would have to conclude what we are seeing is not the start of an impulsive downside move but incredibly, yet another corrective wave. Without exception these sideways movements have of late resulted in an ultimate upside move and while it was certainly not at all what I was expecting, price is what it is. I think we get a short move down to complete the corrective move on Monday and I am out of the rest of my short trades. We are apparently not quite done yet and I am starting to think the next top simply has to be the final one- nothing else this market is doing make any sense otherwise.

Have a great week-end all!

Verne,

I got out of my shorts yesterday when I read Joe’s post suggesting a possible low and saw 61.8% fib provide (temporary?) support for IYT at least for Friday opex magic pinning . 🙂 I am still looking for a swing low maybe Aug. 1, 2 or 3. I understand whitemare is looking for a high aug. 4 so she’s looking up and I’m looking down lol.

Back in 2014, IYT swing high was Nov. 28. DIA’s was 12/5/2014. Swing low was 12/17 for the former, 12/16 for the latter.

I’m not surprised at how the DOW is behaving, just frustrated at how long it is taking. DOW futures chart looks like it is a day and a half behind NQ. They were both in channels / ED’s. NQ broke to the upside, formed another one, and quickly broke down. The DOW hugged the top of the thing nearly all afternoon and finally broke. I see one of 2 options — it follows the same pattern as NQ or the top is already in, it meanders around over the weekend, and collapses at or before the open Monday. I don’t see much more upside. Opened a September DJX 217p position, very small, just in case there is no opportunity to do it Monday morning. I’m likely wrong, but will just add to it or take a higher strike when the DOW properly tops. I sincerely doubt it goes up high enough or takes long enough to erode my position to the point where a big drop won’t put it in profit. I was looking for 21,840 – 21,850 range for a top for over a week. 21,875 would be my next probability. I also had a substantial gain on QQQ lottery puts yesterday, so used their money to open DJX position.

Let us not forget, the other 2 have not retraced to a point of negating the top (at least not yet) so to me, everything looks like it’s supposed to.

PS: The DOW is a BS index of 30 stocks. It’s the one Mom & Pop retail investors use to gauge how the market is doing and most prominent on CNBC, etc… If you wanted Joe Public to think everything was okay for the weekend, what would you do? Yep. Close the DOW at a new high and throw a small bone to the other 2 indexes.

PALS suggests next week should be one of the weakest of the year. Seasonals, phase, distance, declination all bearish.

You guys may be right. I have saved myself a lot of headaches by not taking anything for granted with these busted markets. My experience with turns at this degree of trend is that they signal their arrival by mercilessly taking out prior support pivots; no ifs ands or buts. I have in the past marshaled all kinds of reasonable arguments to explain why the pivot held and the trend had indeed changed, only to learn that ignoring hesitation around these pivots is to miss an important red flag. If it were just the new DJI highs that would be one thing, but the refusal of SPX to surrender the 2070 pivot it a huge cautionary flag. It could be that we see the dam give way next week, but I for one am not ruling out another upside spike in all the indices before we get a real take no prisoners impulse down. When the trend change comes we are not going to be having these hand-wringing discussions. Until such time, I think caution on short side trades is warranted. 🙂

Of course I meant SPX 2470 not 2070…

Agreed, short side is not something I am interested in at least until 2020. When I say weak I am talking about moving to cash, not shorting. =)

I expect the next correction to find strong support at the Elliott channel around 2320 so I do not expect we will see 2020 until we have a final top.

I am starting to get a notion though that the next drop could be harder and faster than most of us expect. If there is a strong break of the channel at around 2320 on high volume that is really going to get my attention. In the meantime, I will be shorting all upcoming rallies vigorously. 🙂

The 2020 I mention is the year 2020, as I expect the market to be quite a bit higher in three years than it is today.

A very bold prognosis.

I seriously doubt that will happen. 🙂

Valley,

I see your post week after week regarding “PALS”…Is there a site that would educate someone concerning what exactly PALS is?

PALS is a system that I invented based upon the lunar phase work of Danny at Lunatic Trader, Olga Morales astro work especially declination cycle, seasonal work of Stock Traders Almanac, and lots of homework on correlating planet/lunar positions on “ThePlanetsToday.com” with market performance. A good beginning would be to read Danny’s stuff especially the archive articles. One bedrock of the system is shown on Danny’s site, which is buying four days after full moon and selling four days after new moon over decades accounts for almost all gains.

Valley,

Thank you for your response..

Ed,

Do you trade? What are your favorite methods of determining trading strategy?

nobody can argue that the market is at dangerously high levels and competes with 1929 and 2000 on measurement extremes. And nobody can argue that sentiment is off the charts positive and the VIX is at all time low extremes. nobody can argue that margin debt as at all time highs and that the rally has been created by easy money and central bank printing. nobody can argue when looking at a long term chart of the markets it is very scary high and we are in a bubble. and nobody can argue that nobody knows when the top is in proven that everyone has been wrong for the last few years calling the top many times especially the wave and cycle and sentiment gurus. I just want a crash because I am short and I can’t stand that buy the dip keeps working and short the VIX through ETFs has been a automatic way to make money. Fingers crossed that Prechter is right (and it is a good sign that Wall Street laughs at his predictions) and the big collapse is coming very soon!!! thanks

Bill Gross said recently: “Before we used to buy low and sell high but now we buy high and cross the fingers”.

Good definition of today’s market.

The one thing about the current market that I have found most stunning, and frankly something I noticed the last few years and had never seen before, is how technical signals that used to be very reliable seem to keep getting negated by what is clearly relentless market intervention by players with deep pockets. While I agree that over time the market’s larger trend will not be deterred by liquidity injections, people who argue that the market cannot be manipulated in the short term don’t know what they are talking about and simply have not been observing what has been going on for some time now.

Having said all that, I do think we are very close to a major top. At some point the CB shenanigans begin to loose efficacy and their attempts to keep the markets propped up becomes akin to pushing on a string.

I have spent some time looking at the charts and I think we are going to see a final spike up in the indices next week with a new all time high for SPX and DJI but not NDX or DJT and then we get finally get a coordinated turn down. There could still be some divergence in terms of which indices are in particular waves and first impulses down in some could well correspond with fifth waves in others. I think it will all be much clearer at the end of next week. Based on this expectation I will be maintaining current short positions and selling any rallies that unfold next week. On balance volume is indicating this to be the smart trade.

Verne how much should onr trust OBV ACC and divergent indicators on daily and shorter time frame. Couple of stocks which keep on making lows in light volume. These indicators not going down. Does it mean accumulation and that sock will go up.

Hi Rose:

For the S&P 500, I personally have noticed that whenever other technical indicators are ambiguous or in conflict with OBV, the latter tends to be more reliable. OBV on the weekly time frame for the index was bearish and is now sitting at a support line (not long held but worth watching). It looks to me like we are in some sort of small second wave correction and my expectation is that it should complete early Monday with a third wave down immediately to follow on high volume. That third down has to take out 2470 with absolute authority and if that does not happen I will be very hastily exiting my remaining short trades as it would almost certainly mean new highs are in store.

Actually my question was for a stock. If the are making highs and stock making low. Does it mean accumulation

OBV, AD, CMF – not going down, higher than previous low of the stock, and stock making low

Rose I assume you are referring to the number of stocks in an index making new lows versus the ones making new highs. This is one measure of market breadth and has in fact been deteriorating for several months in many indices the NDX being one good example where over 40% of the index gains have been concentrated a a relatively few stocks. When this situation starts to become extreme it is one of the things that gives rise to indicators like the Hindenburg Omen we have occasionally discussed in this forum. That kind of divergence with many stocks trading below important averages while the index continues to rise is generally a sign of market weakness and not an indication that those lagging stocks will move higher. Hope that is what you were asking.

Rose your question is somewhat confusing as you are indicating that a stock is making both new highs and new lows which is impossible. I assume there was a typo in there somewhere. You can have OBV diverge with stock price which would be interpreted as bullish divergence if OBV is rising and stock price is going lower. Longer time frames are of course generally more reliable so far as indicators are concerned.

So Marc, I take it Prechter did not send out a correction after the reversal and new ATH high in DJI on Friday?

To his credit he did quickly correct his call for a crash back in January 2016 and correctly concluded that what we had was a high degree fourth wave and not the start of a crash. His record otherwise on market calls has been absolutely horrid, and I am quite amazed that he apparently still has an many subscribers as he does. Frankly I started to become very suspicious of EWI and found myself wondering if they were deliberately trying to mislead their subscribers as they were so consistently wrong. After all, even a complete ignoramus should have a 50% chance of being right over time in calling a trend. I subscribed to their analysis for a long time and finally started making profitable trades when it dawned on me the way to make money was to to do the exact opposite of what their wave counts called for, especially at critical pivots. That is not a joke. It is the absolute truth. Caveat Emptor! 🙂

Valley,

I mainly follow trend following longer moving average crossovers like the 13 and 34 Week EMA. PeterT has helped me with my understanding of EW. The scales are finallly “falling off” my eyes in regard to seeing the Elliott Waves. You posts along with Joe’s and Verne’s have created interest in the planters influences. Always appreciate your posts.

Thanks, Ed! Glad to hear you are interested in lunar and planetary influences on market performance.

Looked at lots of charts and indicators this week-end. It is difficult to envision a situation in which markets in the US can become anymore extreme. There is no weapon iin the arsenal of criminal banksters that can abrogate the principle of reversion to the mean. I am going out on a a limb here with no mealy mouth pussy footing double speak-this HAS to be a FINAL wave up. Oh I know! All the ecperts are saying different. They are welcome to tbat opinion. I call em as I see em and if ever there was a terminal wave, we are looking at one. I am ready to batten down the hatches. I think six months from now we are going to look back in wonder at the madness of crowds…

i spent the past few days getting my new computer set up .

after reading the basics on all the parts as well as the monitors

i had what i thought was a dilemma. i set this room up so my computer

would have its own separate 20 amp circuit . so i added up the individual

stated watt draw added it up did the math and it said expect a 19 amp draw.

i then decided to buy a kilo watt meter on amazon for 25 bucks and test the actual amperage draw . the individual monitors state on the back 1.5 amps

so times 8 comes to 12 amps. well not the case total draw is only 1.9 amps

computer has an 860 watt power supply which you would think would be a 7 amp draw ( not even counting cpu , battery back up etc. ) but nope total draw is actually .9 amps at idle . so what was stated to come out at around 19 amps is really only 2.9 amps . now i am not running multiple software or pushing the cpu or graphics cards etc yet as is the usual . Things are not always what they are claimed to be .

The same applies to the stock market .

I call it a Bi polar market for obvious reasons , the spx falls 10 pts which implies

the dow down 100 yet it doesn’t happen . The NASDAQ can go anywhere it likes

and it doesn’t seem to move the spx or Dow . Some claim this is manipulation

yet to accept that then we should all quit trading and accept defeat .

What i think is going on in my opinion is that the increase in computerized trading has changed the game . For that reason alone i have began this venture

into a more advance computer system then i would normally think is needed.

I cant prove my theory but here it is .

the high end algo trading systems are hedging everything . that means they are buying long and selling short at the same time . these systems are not trading index’s per say but trading the stocks which make up the index’s.

in addition to this i also think these algo systems are programmed to run stops.

it is a shame that we have brokerages which can trade because they have all

the data right in front of them , they know where the bulk of the buy or sell stops sit and in my opinion these systems are programmed to run those stops for what appears to be a guaranteed trade . The average person does not have the money or ability to force an index to move in any direction and they do not know where those stops sit . yet those who do have this info and that ability can do it and in my opinion it is being done all the time . a few weeks ago it was a flash crash in silver which ran the stops . in the summer months trading gets thin

and we are in the summer months .

but….. saying all this i will not go down that road that this market is manipulated

and they cannot run this market in any direction they want to for any length of time.

the Dow is a price weighted index , Goldman Sachs is at what 223 a share ?

ill have to look but i think that makes Goldman Sachs the highest weighted stock in the Dow . ( yea i hate Goldman Sachs by the way ) . I have to wonder as we near the top if Goldman will announce a 3 or 4 to 1 stock split .

that to me would be a signal that they are preparing for a top in the market

and in doing the split its share price would be less effected in the event of a

stock market decline .

As i said its just my opinion yet its something ill keep an eye on .

Looking at the Dow only and using several longer term indicators it is not

overbought by any extremes, the shorter term indicators are overbought .

As with any indicators though you typically see divergences appear long before the actual top takes place .

Those divergences first show up in wave 4.

No doubt we are do for a top of this 3rd wave and i m expecting it to last longer

than most expect. so a few months down the road we all may be thinking this market is being manipulated to the down side and thinking when will this decline end. we had essentially a bear market from late 2014 into Jan or June 2016 depending on how you wish to look at it ( Feb 2016 included ). This bull market

from Jan Feb 2016 ( or June 2016 ) has lasted roughly a year and a half so far.

it does look a bit extended , the momentum as dropped off and as peter has noted several times now , It takes time to turn around a huge ship .

ill add to that , a loaded semi truck cannot stop as fast at 60 mph as a 911 Porsche can .

The masses watch the Dow that is my reason for following it . many watch the spx and a lesser amount watch the NASDAQ and hardly anyone watches the utilities or the transports .

very few to no one watches the leaders which move these index’s

My intent is to focus more and more on the individual stocks which move the market index’s and in doing so correlate those stocks price movements to the Dow or spx .

At the height of the tech bubble from late 1999 into march 2000 it was only

6 stocks that moved the NASDAQ 100 .

I need to dig into the Dow more yet it was about 12 stocks that was moving it

about a year ago .

its not that difficult .

and one last thing , we are being slowly deprived of data .

i used to be able to follow as many as 850 stocks for a very fair rate .

now depending on which data you use you will see your limited to about

100 stocks . i hate to say it but following only 100 symbols is not enough

to really have a handle on what is going on and by looking at only an index

your really limiting yourself even further .

it is a market of stocks not a stock market .

keep your eyes on the leaders and your ahead of the game.

i m don’t with my rant

things are not always what they seem .

ill post the 1987-1929 weekly and daily crash patterns which dove tail into the Aug 21 date Monday after the close .

It is just something i think is worth keeping an eye on since it is still tracing out

the patterns to closely to ignore .

Joe

I agree about the effect of the algos. In fact I think they will be the reason for the coming catnage. Several indicators I watch have now exceeded extremes set in both 1999 and 2007. We all know about VIX.

The bullish reversal off the all time low was text book. Red flags already abound.

I remain wary about the strange almost universal consensus regarding a third wave. I simply see conditions that point to a possible closer finale…but that’s just me…

verne- I agree the finale is closer than people think- the consensus is always wrong!!

Yep. The market will generally move in such a way as to prove the consensus wrong and hurt the crowd. Prechter joining the upcoming fourth wave band-wagon was a huge red flag for me folks. I never want to be on the same side of a trade as EWI.

what about the vxo ??

this is an older explanation of algo’s .

quote stuffing should be looked up .

there is more i could add to this but

ill leave it for another day yet in my opinion

a group of people could fake out the algo trading computers

yet most likely would end up in jail yet the computers

can do what ever and then its called a glitch .

https://www.youtube.com/watch?v=V43a-KxLFcg

if you watch this and think of a predatory programmed algo system

you can see how they could move prices around and profit on the spreads.

https://www.youtube.com/watch?v=LQO3EB7Cdjc

anyways just how things of changed in my opinion do to algo trading.

yet algo’s are not smart so you could if you had enough people involved

fake them out yet most likely you would go to jail for manipulation.

Boy have you got that right. You are also right on the money about being able to outsmart the algos if you know how they work. A good example is buying options. The programs are expert at running stops. The key is once the stops are run and profits swept up, the sharp price movement generally reverses quickly. I am sure most reading here have figured this out but it is for this reason that you NEVER pay ask for any option contract. The way you beat the machines is by keeping “stink bids” (at least 10 % below current ask) open in the market to take advantage of these arbitrage trades of the HFT algos. It is amazing how easy it is to do and how well it works. The price spikes do not last very long and allow you to get filled at favorable prides during these unnatural deviations from the usual bid/ask. I probably should not be saying this as the more people do it the less effective it becomes. Lol!

Anyway, anything to beat the machines.

A new post is live at: https://worldcyclesinstitute.com/wave-four-from-hell/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.