Wave Four Continues: A “Great Fall” is Not Far Off

For weeks now, I’ve been expecting a large fourth wave as part of a motive five wave sequence, because that’s what you’d expect to get in a normal market. We would expect an end wave in 5 waves at the very top. However, the market has spoken and we’re now not likely to get a large fourth wave.

This action confirms my count as a corrective wave in the SP500. Therefore, we have the tail end of this zigzag up left to go and that should be the end of this rally. Therefore, you’ll find the large fourth wave missing from my projection and I’ve created a Big Picture video to show what I’m seeing across major assets.

Currencies and the US market are all in corrective (countertrend waves) that are nearing an end,

In short, this all points to a major turn down in the next couple of months.

Two weeks ago, the market signalled a downturn. We are in a wave four. However, it’s not the very large fourth wave of a 5 wave ending wave. Rather, it appears that we’re going to get a much smaller 4th wave, which will be the fourth wave of the final 5 waves of the final zigzag.

This means that the final wave up from here should be the final wave of this huge rally. In that case, I put the top less than two months away. My preference is for a turn in the first part of September, but we could levitate a little bit longer.

The short term path will be continued downside (a C wave of an ABC correction in the US indices) and then a turn into the final wave up … perhaps later this week or next.

The Bigger Picture

I put together a video on the market “Bigger Picture” which shows some of the elements I watch that are all pointing to a major top in the US market being imminent.

The Big Picture |

______________________________

The Market This Week

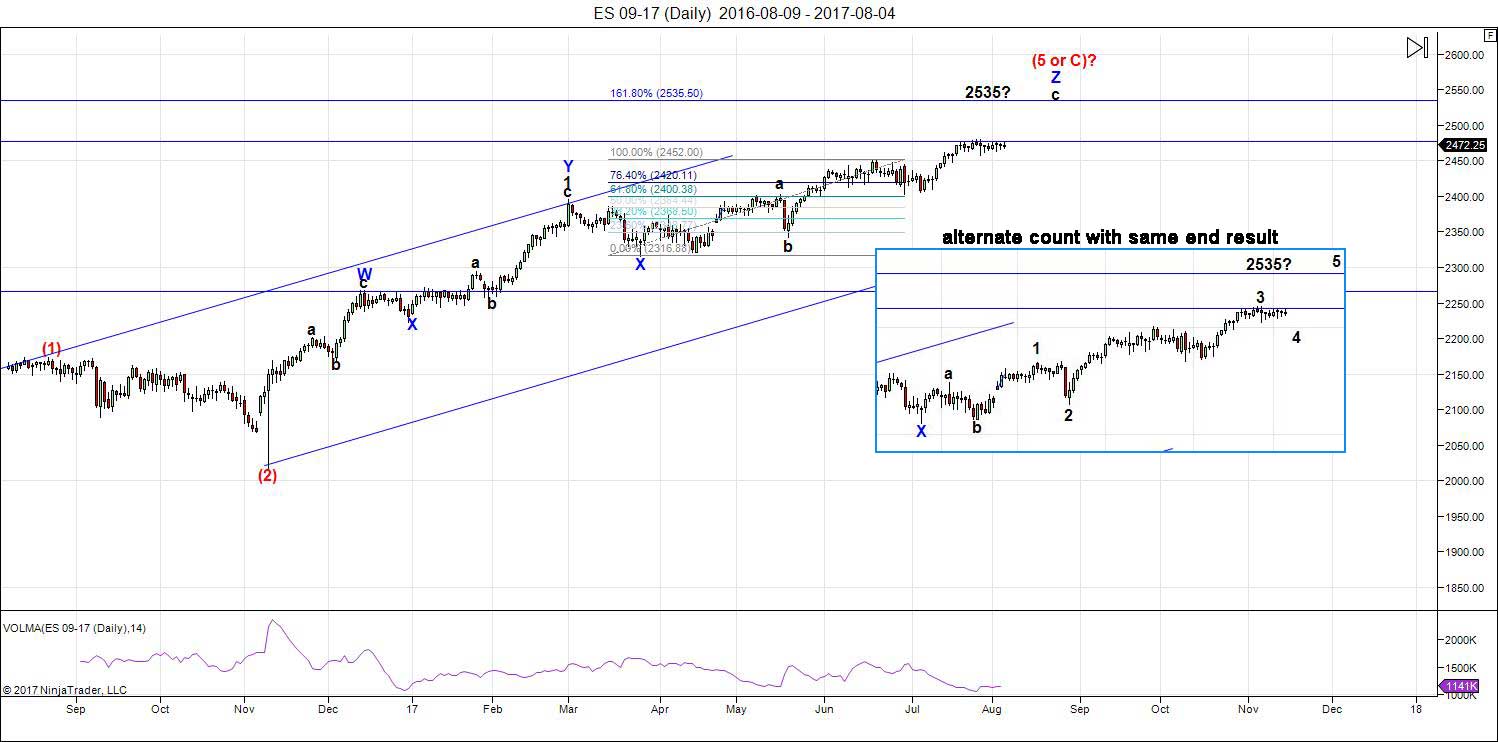

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts). While we still have another leg up to a final high, we're not done with this fourth wave yet.

It has become obvious over the past week that we're not going to get the large 4th wave that been expected for so long. That was a projection based on this pattern somehow morphing into a five-waver, which you'd traditionally expect. We have one in the NQ (Nasdaq), but as I've been saying for a very long time, the SP500 has a different structure, a corrective one. That only requires a three wave structure overall.

There are two ways to count the final wave we're in (the blue Z wave). Interestingly enough, the measurements come out to exactly the same projected top: 2535. For many months, I've had a projected top of 2500-2550. We're close enough now that the measurements can be a bit more accurate (I hope).

The subwaves will end up tracing out five waves, but the larger structure is a triple three (again my contention for months now) and, if that's indeed true, we're in the final fourth/fifth wave combination of the final zigzag.

The USD currency pairs are in countertrend retraces at the moment (small fourth waves), also getting ready for the final wave in their larger countertrend moves.

Summary: The final wave four is in progress. It will be shallow and lead to a final fifth wave up to the market high.

______________________________________

Sign up for: The Chart Show

Wednesday, August 16 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

last time i write on here instead of pay attention to the market

keeping my posts to late in the day from now on if not after the close

last post for today

i initially said the other day 21898-21848 as a wave 4 extreme

and noted the gap in the weekly chart .

another mistake yet im going to slow down a bit

and get back to basics .todays low hit the upper range

almost anyway 21899 and change . nothing changing just yet

even though this is begining to look ugly

vix hit 15 id like to see a divergence where the market goes lower

and vix fails

refresh

the if

if the cash dow comes into the range of 21838-21835

ill go long . ill also consider that price level an extreme

if it gets taken out ill toss my hands up to the shorter term

bullish scenario and accept the market is going lower.

my line in sand for now .

doesn’t change mental stops but stops me from taking any short term trades

for a few weeks.

that is the maximum downside i can accept on the short term

wave count as i see it and i prefer the dow does not get that far

yet it is what ill consider a maximum extreme

below that im dead wrong

closing low july 24 closing high aug 7th

10 trading days . times .382 = today

or tomorrow yet my chart shows it as today .

given its based on closing prices ill consider

today a low close , hence not a day to buy a reversal .

not going to bet on that because its not a 5 wave move

its only a 3rd wave which was a vertical move yet its the

guideline . hence if we close near the lows today ill go long

the overnight session or tomorrow morning .

other things to do today

ill watch the market yet not going to focus on it

wave count based on dow stocks shows 5 down

yet actual dow does not .

ill see how this looks next week .

if it is a clean 5 which it looks like then the bottom is in for now

this is just a test of something im only beginning to work with

so take it with a grain of salt . it get refined when i get back

from working in November and its going to take me a while

before i really get this all dialed .

a further break down below todays lows id consider a 3rd wave type move

to the downside . that said the math shows this to be a completed wave as well

take it as a grain of salt though its just a demo

http://imgur.com/UjVE7iS

Some sites make such kind of promotion now:

“We Are So Sure Of The Upcoming Crash Like Move-We Are Giving A Money Back Guarantee-IF It Doesn’t Happen!! ”

O-o

This wave 2 down on the SPX hasn’t quite reach the 61.8 yet of the 2407 low and 2490 high. Waiting to go long in the wave 3 up.

Ok, we have hit the. 618 retracement, but there is that gap fill at the 2429. Patiently waiting for entry.

Joe ! My compliments to you. I certainly enjoy your in-depth analysis of the markets. Certainly no one can ever call you a one trick pony. You are able to combine several financial techniques to come up with a very defined possibility of the direction of the markets.. Joe, I have been massaging this new time cycle Biorthym I have been playing around with for some time. Back testing, from the last five years, it has a approx. 75% correlation with the markets. The last time that this time cycle biorthym occurred was June 2nd. That was when I went short the markets in my short tern trading account. ( long term account 40% Long) You also had June 2nd as a pivitol date. Unfortuntely the markets did not correct. My next time cycle says Aug 12 th. This cycle drops like a rock, meaning some thing fairly major is about to occur. Unlike your work Joe, their is a lag in time if the markets do indeed take a hit. Up to as many as seven trading days, which brings us into the solar eclipse time frame. From their, my time graph says we will go significantly higher into Sept. As of now, I will stay 40% long and add hopefully with this correction. As for the long term, I am in the same camp as Valley for the markets to be much higher than where we are at this moments. For my short tern trading account, I have been sliding in some shorts. One more batch to go, hopefully Friday. I will exit my shorts if we see new highs or at the latest. ( Aug 21st – 23rd )

Verne, nice to see you here on the blog. You will be a great asset to the blog.

All the best every one !

As always, use your own discernment with what I have written.

Dave, explain your biorhythm system in 20 words or less. Please =)

An interesting part of the theory of this time cycle biorthym is the notion of historical periods “in resonance” with each other, in which the events of the earlier period are in some sense repeated in the later. Sorry Valley, 37 words. LOL

Fascinating!

Dave,

I’ve missed your posts. I had to wait vix to spike to 15 for you to come back.

Hi LizH, Unfortunately for my self, I will be exiting one batch of shorts within the next few minutes due to my theory on trading discipline. ( DONOT BE GREEDY) That leaves me only one batch of shorts. I am hoping for small rebound tomorrow to go fully short for approx. seven trading days. All the best to you.

We won’t be in a market mania until people that you meet at the gym or grocery store are actively trading in the market. No one I talk to in the places I go are trading, and the ones with assets are in mutual funds managed by someone else.

On the contrary, http://www.zerohedge.com/news/2017-07-31/schwab-new-accounts-are-levels-we-have-not-seen-dot-com-bubble-millennials-rush-stoc

Published 7/25:

Open an e-trade account and you can live a yacht life.

https://www.youtube.com/watch?v=yZ2Fa0zVglU

LizH,

The site flagged this as spam I guess due to your two urls. It shouldn’t have. It’s supposed to flag it at 3. Anyway, I retrieved it from spam.

Peter,

Yes, thank you for the reminder.

New accounts due to brokerage discounting and e-trade glitzy ad doesn’t mean Uber drivers, store clerks, or friends at the gym are interested yet in market trading. Will take some time to develop this mania, I am guessing about another two years.

Many indices are tracing out what are clearly rising bearish wedges. Considering the maturity of these structures, projections for another two years is remarkably optimistic! ?

I would imagine that a bearish wedge could be interpreted as a bullish sign. The longer the base, the higher in space.

A few things signal the termination of the move.

A “throw over” of the upper boundary

A break back under the top boundary

A break below the lower boundary.

If you get all three, it is NOT bullish… 🙂

Technicals are interesting. Fundamental change in economic/regulation/tax environment may carry more weight.

dimitri

the problem with money back guarantees as im sure your aware of

is actually getting your money back 🙂 lol

Dave

thanks

im trying to cut back posting on this blog

but just going to say , i try different methods all the time

and add what works and discard what doesn’t .

i m keeping an open mind right now and admitting

i blew it even though i saw the potential for this decline .

damn trump lol 🙂

Joe,

NVDA after-hours went as low as 151.46. Someone bought a huge amount of 155 Puts an hour before close.

LizH

🙁 i saw it and i read about the big short

i forget his name though

dow closed with in a 8 points of my line in the sand

the mindset has turned negative no doubt .

no opinions at the moment .

the obvious trade would be no body wants to hold long

over the weekend . today was the .382 time retrace .

ill keep my eyes open Friday morning and not lose my focus

Dave i get what your thinking ( i think ) if history repeats

this gets uglier .

im keeping an open mind

Joe I think the bottom of the rising wedge of this last wave up is around 21,800.00 for DJI. We already had a nice throw over and the last two days moved back under the wedge’s upper boundary. What happens next week is critical as a break below the lower boundary would suggest a much deeper downside move underway to around 20,400.00

THE YEAR OF THE ROOSTER

The Year of the Rooster, 2017, in the Hsia calendar, is symbolized by two elements – with Yin fire sitting on top of metal. According to the cycle of birth and destruction, which governs the inter-relationship between the elements, Fire conquers metal and so they are on the destructive cycle and have fighting relationship. Normally such conflicting elements means disharmony. In particular Yin Fire symbolizes a candle flame which is flickering and unstable, hence it also represents a emotional, sentimental and sensitive person, it is not quick temper like Yang fire, but it can be tense and nervous and its temper will accumulate and once explode, it will be more serious than yang fire. Like the Chinese saying – A Spark of fire can burn down the field. Hence Yin fire is more associate with fire disasters and explosions. As fire and metal are in conflicting relationship, there will be international conflicts and clashes. And Yin fire also symbolizes bullets and guns which can bring more clashes with fire arms. Looking at history, there are quite serious disasters related to Yin fire. Just pick some significant examples – 911 attack on World Trade Towers in 2001 happened on yin fire day and yin fire rooster month, the first atomic bomb was dropped in Hiroshima on 6/8/1945 which is Rooster year and Yin fire day, Osama Bin Laden was killed on a Yin fire day on 2/5/2011…. Also yin fire sits on rooster is apparently weak as the metal below does not support the fire above. However, we cannot discount the strength of such fire as the Rooster is considered as the “birth place” of yin fire, in the Yin element life cycle. So it will not be surprising that there will be serious explosions, fire disaster and war in 2017

yin fire year often boost peoples confidence about the economy bringing good performance to the stock market. Particularly during the spring and summer seasons when the wood and fire seasonal element will make the candle burn very bright and such illusory fire will drive up the stock market sky high. However, once the seasonal support of wood and fire expires in around August onward, there will be dramatic downturn as the illusive candle flame is dying. Hence for people play in shares and stock market have to prepare for big disappointment in the second half of the year. Such phenomenon of crazy market in first half year and collapse in autumn happened in many previous yin fire years before, such as 1987, 1997, 2007.. The bearish market may commence from around August 2017 and this time the impact can be long lasting as there will not be any support to fire element between 2018 to 2022 I posted this back in the winter time frame on what to expect going into Aug. Good luck every one.

interesting . where do you get this? Raymond Loh?

Allen. I can not confirm that author. I am a way from my main computer. I cut and pasted on my calendar for Aug. Time frame. All the best to you.

Most interesting comments Dave. Thanks!

When I first came across the interesting history of years ending in seven, I did not realize they were part of a larger so-called “decennial pattern” which includes in the theory years ending in 3 and 10 as typically down years.

Heavenly stem monthly cycle is earth element during August and September. Earth months tend to have a balancing effect to the Yin Fire of year 7s. Earth gives way to Metal in October. My guess is October is the month to watch.

If we are going to get a crash, I have been insisting that it has to be a third wave. That means we will need an initial impulse down followed by a corrective second wave. It is quite interesting that we appear to now be in an initial impulse down. If it turns out to be at minor degree, it is just getting stated and we will probably need at least two weeks to get an intermediate one down completed. This would allow the rest of August for an impulse down and a second wave up setting up a third wave down for the September/October window. Of course this could also turn out to be just a very shallow correction with new highs to come prior to a final top but that would be really pushing it for a Fall waterfall, so to speak! 🙂

How has your trading gone this week, Verne? Weren’t you buying Vix earlier in the week. Also, you were short SPY via a put also, right? Seems like you had a good week.

Yep! Was long volatility. You saw what it did. Now short volatility. 🙂

Good gains on KSS, SVXY

=)

Valley. Their is some truth to your above statement. My models says we rise significantly after this vulnerable period Aug 12th thru Aug 23rd

Into well in Sept

PALS suggests market will rise into eclipse 8/21. And then fall post eclipse into early September.

We just had a five wave impulse down off the highs. Any move higher next week will probably be a corrective bounce. I suspect we continue lower for August.

very good dave

years ending in 7 relate to this week as well

this is the week of august 11th which historically is a turn .

i wanted it to be a high but not the high yet i was wrong .

we now have an outside weekly bar showing a higher high

and a lower low and if we close below last weeks low

then it would be considered an outside weekly reversal bar

to the downside.

i put my line in the sand where i admit im wrong

at 21835-21838 on the cash dow for this to be a minor 4 .

don’t think ill change that .

This bull market may very well be over with

i don’t want to admit it but its something i must accept.

if it is over the first stop is 20404 ( the april lows )

the next stop after that is 15660 .

ill have to pull back the book to calculate the final low

yet it is basically the 10650 range .

once these type patterns complete they get ugly fast

and it doesn’t take much relative time to complete the downside moves

the 2007-2009 market was the same pattern , it took 10 years

to complete the entire form yet the decline lasted on 18 months roughly.

this one took a little over 7 years to form yet is not complete ( the downside portion is needed )

it began July 5th 2010 and looks like it lasted 7 years 1 month

Bottom line : if this turns out correct there is a lot of downside as i see it .

might not be as bearish as others yet these patterns tend to be fairly

accurate . ill keep my mind open.

12 years 3 months to 12 years 8 months from the Oct 2007 high

targets a low early 2020. ( that doesn’t change from a timing perspective)

Dow 10,000 by 2020 ??? seems a bit conservative .

in the mean time .

for tomorrow ( friday ) ill be considering a long position on the dow futures

in the range of 21785-21765 and that is my final bullish call

if we can hold it and head upwards ill give the bull market a bit of credit

if not i m tossing in the towel and looking for a long term bear market.

time cycles etc… don’t change ill still give this market some room

into June 2018 regardless and the October dates don’t change either

Venus bull etc .

when support breaks i accept price as number 1.

Nice in depth summary Joe.

Both the indices and DIA ETF sporting outside weekly bars. SPY missed it by a few points. The strong move above the upper B band is probably pointing to a strong bounce next week. The fact that this move back above the B bands came so very early in this decline after a weekly bar in unlikely to be signaling that we have a very shallow correction completed, but that after the bounce we are gong to see a real explosion in volatility with the B bands continuing to expand outwards. I expect next week’s bounce to be deep and come right back up to the touch the area of consolidation – 22,000 for DJI, 2470 for SPX. In fact, as crazy as this sounds, the mother of all sell signals would be issued with a sharp bounce next week to lower highs and a new VIX all time low. This would confirm the deranged bullish mania present in the markets in the face of clearly rising market and geo-political risk. SPX and NDX are just at about the trend-line anchored at the November lows, RUT has broken decisively below it, DJI is not quite there. It sure looks like they will all bounce together from different stages of the initial decline and then all turn down together it what I expect will be a third wave for all of them. Look for a jack of futures to confirm this possible scenario,

July 2 2010 was the starting point

https://astrologyforganntraders.wordpress.com/2017/08/11/1335-days/

https://worldcyclesinstitute.com/september-lining-up-for-a-great-fall/comment-page-1/#comment-20962

Such a typical abc from the top. Let’s see now, what does that mean? Is that the abc that finishes Peters wave 4 and we now head to 2535? Is it actually the end of wave 3 of 5 waves of a larger wave 1 down, which means the top is in and the fall commenced? Or is the abc simply a larger wave A down, with B and C to go to finish Peter’s wave 4? I guess as always, we have to wait and see.

As mentioned yesterday, sold one batch late in the day expecting a bounce on Friday. Waiting for a possible higher highs late today to buy anther batch short. New traders. My short term acct is my fun entertainment acct. This allows me to sleep at night. Good luck every one.

Joe, I know I said I was seeking a low right around this time because of the 92/94/96 TDs cycle but something you said made me think.

https://worldcyclesinstitute.com/wave-four-from-hell/#comment-20678

Dave I think said 8/12 with a lag time of 7 TDs. The day counting I cited below makes me apprehensive forcing me to hold off on any new longs.

10/15/2014 low to 9/29/2915 low (double bottom to 8/24/15 low) – 240 TDs

9/29/2015 low to 9/14/2016 low (A swing low to 9/22 swing high then down to

lower low 11/4) – 242 TDs

9/14/2016 low to 8/25/2017 ?? – 240 TDs

Dave,

I enjoyed reading your ‘ yin fire over metal’ post. Very interesting! I learned something new. Same feeling I got when Peter started writing about the Rothschilds .

Thanks LizH. Please remember, Aug 12th thru approx. 23rd is a vulnerable period for world affairs. Could the markets rise, yes. But based on my new model, I am going short. Use your own tools LizH All the best to you LizH

As Joe and I have mentioned before, Option expiry weeks tend to be positive.

I did not buy a new batch short, I will hold off until next week. As of now, only one batch short.

I needed the intra day high to be taken out for me to buy back that short I sold yesterday. Have a good weekend every one.

note there is a new all time high target posted on this chart

yet that is only if the market heads up not because im stating

new highs are coming .

The Mirror image should be considered at this juncture.

if we chop around sideways for several days and then

head lower this is probably what is taking place .

In short , the market tends to retrace its steps and some times

you get the exact opposite or very similar.

http://imgur.com/bWx2cKq

Very impressive Joe.

Wow! Joe that chart is truly uncanny!

My hair stood on end when I looked at the price levels for the horizontal lines.

I have never ever seen anything quite like that. Really amazing!

Joe,

Do you still intend to update your “bullish Decades” and your “bearish Decades” charts you posted several weeks ago? You mentioned doing that around mid-August!

Ed

ill post it tomorrow .

those charts showed the week of august 11th as a turn.

so this reversal this week does have merit

I am seeing some conflicting signals right now. I got spooked out of some of my short trades a few days ago because of a failure of BB expansion in VIX and it was a head fake as the market tanked the next day. Upper B band penetration by VIX as we have seen the last two sessions is also usually also a signal that the decline is coming to an end. I have been wrong every time I have ignored it. Price has also met a trendline going back to December last year. On the other hand, the breakdown from the consolidation are has come on high volume and it is hard to be believe it could be over in just three days of downwards movement. Could it be that we get a deep bounce followed by a resumption of the downtrend and a spike even higher in VIX? VIX price has been remarkably suppressed and I think most of the shorts are still holding on despite the move above the upper B band. Any thoughts?!

Ed

Keep in mind that i look at the markets differently then other do.

for example i tried to find an example of a 3 bar reversal pattern yet

i could not find what i was looking for online. i also tried to look up a 5

bar reversal pattern and could not find it online . im not saying it does not

exist just saying i cant find it so i drew it in myself as an example of what

im looking for over the next few weeks . i will be going to work august 20th

i don’t want to be overly posting on this blog , i feel it takes away from peters

work and i don’t want to do that . so i wont be posting much going forward

mostly for work related issues yet also out of respect for peter .

if the dow can manage to either gap up on the pen above 21938 ( which i prefer)

or just get above that level early nest week then i feel there is a chance for new all time highs. the key level id watch for next week is 22044-22049 . if that is

all it gets to for the week then i would be skeptical of a new high and i would

watch the 22104 level . as for the historical charts related to decades

ill post it first .

note :weeks of aug11-18th and sept 29-oct 6th

http://imgur.com/7mvLRxg

this is daily chart of 1987-1929 and i have adjusted this and re scaled it

do to many errors i initially had in it .

this chart only correlates with my understanding of Chris Carolan work

work from the spiral calendar ( my work yet his studies posted many years ago .

dow 22282 is still possible but im not going to count on it .

http://imgur.com/nC3Z87N

Next week im thinking will become an inside week ( 22044-22049 might be

the most to expect ) 22104 maybe a stretch if we already peaked .

http://imgur.com/cOqynq8

That’s it for my posts for a while other than a few comments

take these charts with a grain of salt . i have put a lot of work into them

and i do use them in my decision making yet i also understand the potential

failures . i view these charts as the perfect bearish set up .

if something goes wrong then you must accept that while a good run

so far . nothing is perfect .

no more charts from me for a while yet i will comment from time to time .

Thank you peter for allowing me to post as much as i have .

I’m not going away i m just letting this market prove itself and with mercury

going retrograde as of today i m expecting this market to flip all over the place

it is not the time for me to be forecasting .

See you next week .

Joe,

You had mentioned that you had not included the decade of 2000-2009…in your composite chart of worst performing decades. I believe that history indicated a turn by August 11th. Is that what your charts show?

Would the inclusion of the 2000-2009 decade change in a meaningful way the previous charts from approximately 4 weeks ago?

A new weekend blog post is live at: https://worldcyclesinstitute.com/a-question-of-probability/

Ed

count how many decades are shown ??

2000-2009 is in there .

its in red

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.