Ending Diagonals

We’re very close to the end of this extremely frustrating “B wave.”

Last week, I predicted a final wave up was in the works and this weekend, it continues.

We have ending diagonals of one kind or another finishing up as the final pattern before what will be a dramatic turn down to a new low below 2100.

This weekend, we have a full moon while the current ED patterns call for more upside and a new high. The next few days should be bullish.

Looking at each of the US sub-indices, here are the patterns I’m seeing:

SP500 — ending expanding diagonal

DOW — ending expanding diagonal (almost did a double bottom, but not quite). The DOW appear quite weak, compared to the others.

IWM — regular ending diagonal

IWV — ending expanding diagonal

OEX — ending expanding diagonal

I’d say we’re getting ready for a very dramatic week.

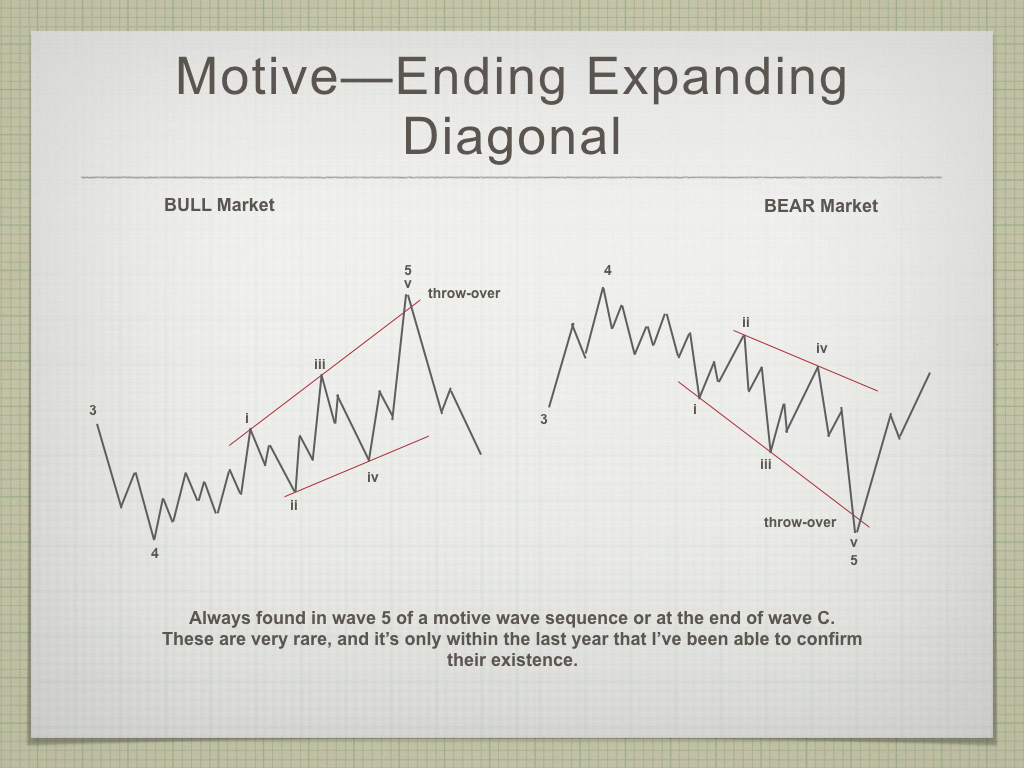

Above is a diagram of a rare ending expanding diagonal. The bull market version (left side) is the one that relates to our current situation. We’re close to the middle of the fifth wave up. The fifth wave targets the upper trendline, but often doesn’t quite make it; it should not rise above it.

The turn down is always dramatic and it retraces to the previous fourth wave of one lesser degree, which is below the start of the diagonal. After that, expect a second wave and then further downside.

_______________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last weekend, I predicted we had one more high to go before the long-awaited drop, due to the fact that we're in an ending expanding diagonal. We're not quite half-way to that top, and it's a rocky path, but a full moon this weekend should help get us there.

All US indices require a new high. The market will not come down until they reach it. Until this happens, the direction is still up.

The next major move is to the downside, and it's looking more and more that the turn will be in the first half of the week.

The wave up from Dec. 26 in ES is clearly corrective and, as a result, must fully retrace to the downside. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX, TSX, and other international exchanges.

Summary: My preference is for a dramatic drop in a 4th wave to a new low. The culmination of this drop should mark the bottom of a large fourth wave in progress in the NYSE since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that is quite fast; in any case, ES will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, May 29 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Thank you Mr. Temple. Hope all here have a profitable week! Shorted small on Friday just in case 😉

Thanks Peter,

It’s a nice blog if we all share our opinions in a respectful way.

I hope we will see the low on May 21,the Green (lunatic) period is starting on May 21.

The Red Lunar period was very clear to the downside.

So I will sell my shorts on Tuesday or Monday late.

My next astro turn date is May 31and June 1.

I forgot to mention, May 24 is also an important astro date.

S&P500 Long Term Chaos Clamshell – Al Larson | May 17, 2019

http://moneytide.com/hans/cc05172019.asp

“Since I discovered the Chaos Clamshell pattern in 1990, I have

found it to be a most useful pattern for trading. In it’s basic

form, it is a 7 move complex zig-zag. It shows up on charts ranging

from one minute bar charts, to daily, weekly, and even monthly.

This chart shows the S&P Exchange Traded Fund, SPY since its inception,

on a monthly chart. It starts out with moves 1, 2, 3, and 4, forming a base.

Move 4 was the Great Recession.

Move 5 is usually the biggest and fastest move. This is true of the SPY

which has risen in a ten year super bull market. Now it looks like that

bull is dead.

In 2018, the S&P make two distinct tops. It has now make a slightly higher top

in 2019. This has formed the pattern traders call “Three drives to a top.”

It is one of the most reliable patterns signaling the end of a move.

Move 6 and 7 follow move 5. One way to estimate move 6 is to project it as

a duplicate of move 2 or 4. That is shown on this chart. It suggests prices

in SPY pulling back to 200-220. In the S&P futures, that is 2000-2200.”

Thanks Rotrot,

I am fully short, with an intention to hedge my positions on any close above 2920.

We have a clear break of a decade old bull trend line.

We have a clear break-down of bearish rising wedge patterns.

We have confirmed negative momentum divergences at the recent highs.

We had a violent rejection after a retest from below of broken trend-lines, and another weekly candle with close at a lower low.

DJIA also remains in glaring non-confitmation of othet recent index new ATHs

My good friend Randy thinks opening ramps are due to institutional buying but I respectfully demure. Money flows show that they have been leaving the market for the past few years! My view is these ramps are due to leveraged CB purchases. What I now find fascinating is that the most recent ramp appears to have been unwound intra-day with failure of the market to close at the high.

If Peter is correct and we see all the indices negate these bearish portents temporarily, I think it will be a spectacular shorting opportunity! Just my two pennies!

Verne, what do you think about Randy’s “liquidity drying up on future contracts? Driving your position? If NOMB, got it 🙂

Hi Peter and friends

3 stacked comparison energy charts for next week

https://imgshare.io/image/may-20th-24th-3-energy-chart-comparison.p1HE5

looks 21st would be a downer and then 22nd rip higher

Thanks Tom, I m curious if you also have a low on May 31?

remind me again in 2 days

Thank you Tom.

Peter T

I’m just posting this link as a refresh so to speak of last year .

I will note only one thing : last year we were in a bearish cycle

Which ran from January 2018 to January 2019 .

This year we are in a bullish cycle into August as well as into Jan 10 2020.

The mid August time period is where things change .

All that said I do think it is worth ‘re reading Peter T post

Below

https://worldcyclesinstitute.com/the-influence-of-the-moon/

Rotrot

Have you seen any examples of this clamshell pattern he talks about .

I’d like to see his many examples 🙂

https://economyandmarkets.com/markets/stocks/2-scenarios-may-market-correction/

Harry Dent 2 scenarios… just to further the confusion 🙂

Scenario 2 seems closer to Peter T’s cycles, twin wicks on most indices right at 50 day exponential movin monkey will add confusion to tech boys and girls. No big overbot (OB) or OS in either direction, but Russell (IWM) is weaker with trannies (IYT). I dumped SRTY at HOD FRI, and bot VXX @28.06 at 3:03pm as VOL started to come back to up protection. Tweets and treat for next week. Cheers!

Harry Dent’s NASDAQ forecast dated March 16, 2015…he is a joke!

https://twitter.com/allerotrot/status/811006757434773505

If seekingalpha (or anyone) used one free, public tweet to make decisions vs. his paid service… THEY are a joke!!! It’s no different than using this public blog for decisions vs. Peter’s actual services. Dent’s 10X program is excellent… up >40% since 1/6/19, averaging 50%/year+. Funny how you dug up a 2015 tweet 😀

“I thought I had posed this question to you last night, but something must have happened because I don’t see my comment this morning.”

My first comment is now back. So one of these should probably be deleted.

And after reviewing my own charts …. either we start a major waterfall tomorrow,

or we retest the lows then run higher, and so the blue arrow would end up looking like a check mark.

Mojo I think that is an important point. I also disagreed with Randy”s contention that the big boys don’t trade futures as that is the main way they hedge. I interpret their absence there quite a bit differently, if you get my drift…!

Got it and appreciate your take…

Harry dent

His main work relies on demographics

He later began attempting Elliott wave theory around 2002

After being proven wrong about his sky high bullishness .

I’m not knocking his original work mind you . Actually

I think it has Merritt .

My issue is he has had to ‘re work what he does .

Good point Joe, he and Andy Pancholi (part of this site) collaborate on cycle work. Harry is big enough to admit when he cycle work doesn’t work (for his subscribers)! When market hit all time high after 2008-09 crisis, he re-examined his work and discovered 2 groups of baby boomers- those that started working right out of college, peek spending age 46, 2nd BBs went to college for 4-7 years, sometimes make more with career, and peak spend @ age 53, which is now. He always has 2 scenarios but was very bullish 2017-18 into fall ’18, got cautious, still sees new highs after current correction under those 2 scenarios.

Thank you Tom

Sold my shorts, Don’t trust the bankers Verne…..

could be a nice little pop for you this am Mojo on that vxx

We will see… either never have enough on or too much HaHa 😉

Too many newsletters, blogs, webcasts talking about next drop… I usually like to fade them but that is a blunt tool. Need to watch the waves like Peter, you and others do. Let’s be careful out there.

feel your pain lol …

I also called their bluff on the early ES ramp with a couple contracts that paid quite nicely, Thank You! 😉

Plan was to unload half short positions at the cash open in anticipation of a bounce at 2840.

The break by ES of that level prior to the open could be significant and brings 2820 firmly into play, imho.

Let’s see how the cabal plays it…! 😎

Could this be the big red candle…?!! :O

Yeh that is where I am too, but will probably hold this decent position and add to VXX if market rebounds to overhead supply (subject to changes like Dent 😉 My comments and ETF positions are usually ST hedge or leverage to my portfolio risk.

Pre-assumption never work in prediction, only if your analysis showed up

or down that really a key. Weekly candle that has lower low is the fact that we are in bearish mode.

The fact is we are in bearish mode, so no uptrend in my view.

If it is moving down, the fact will tell you. If you assume up or down,

Then act upon to it, never work!

Yeh, assume, pre-assume, predict, observe… or trade. Took profit on VXX, so I will observe like you… until time to act. Good trading y’all!

Ringing the register.

An expected bounce/pause at 2840 in play.

The shelf was broken in ES so technically it should now be resistance, but we know how the bankstetrs roll, now don’t we?! 😁😁

https://twitter.com/Hedgeye

Thought for the day… Quad 3 dropping back to Quad 4?

Series of corrective waves both up and down – go figure. I had bought a bunch of puts on friday – Took off enough to collect back the premium and letting the rest ride. The market is not making it simple for sure

Vivek, personal question so you can say NOMB 🙂 Have you worked with Van Tharp or Ken Long (tortoise capital)? Your name sounds familiar. Cheers!

No mojo. I worked for an investment bank and then for a hedge fund, but not those. Vivek is a very common Indian name.

Thanxxx Vivek, there are a lot of sharp minds in finance with same name 🙂 Best to you.

Yeh, letting this chop settle out… best to all. Gooday!

Mind the gaps!

Price action in the cash session looks to me like one big Psy Op! Nothing new under the Sun…

They are beyond pathetic! 😁

I’ll just keep surfing, don’t need to catch every wave, just a couple good ones every once in a while…

Yep! It’s a scalper’s market, and has been for quite awhile. Directional only traders are getting ground up and spat out…unless they adjust….

Sure looks to me like flagging price action in the short term down-trend…and we all know what that portends….! 😎

HFs think the sell off is over !

https://www.cnbc.com/2019/05/20/hedge-funds-bet-the-sell-off-is-over-they-have-concluded-that-the-correction-has-run-its-course.html

As I opined, we really do.need a few suckers on the other side…! 😁

CFTC Non-Commercial Net Long Positioning went from net short 150,000 contracts to net short 90,000, so that has taken some pressure off. Hedgeye called top of market 9/28 last year because of expected Quad4 in Q4 (inflation and earnings down). This year moved to Qd3, but dangerously nearing Qd4, so I think this plays into plans and cycles.

Qd3 (earnings slowing, inflation rising… on rate of change basis).

Not quite a bearish engulfing candle in ES…but close…here’s hoping they hike it back up for another scalp…

Looks like plan is to dump it into the close and rip a few faces off in futures….slick!!! 😉

Next resistance at 2810?

Weekly ppo indu crossed, daily below, and 2 hour looks close..looks weak

Real overhead resistance remains at 2910-2920.

Recapture of 2840 opens the door for a run higher the next few sessions.

Of course, the banksters also know that is EXACTLY what some of us are thinking and I would not put it past them to gap price back down past 2840…these banksters are tricksy…!!! 😁

SPX VOL much lower than NASDAQ VOL (VIX vs. VXN). I know, it’s obvious with DJI -.33%, SPX -.67%, IXIC -1.46%. Banksters going to have to get REALLY enthusiastic if they dub around much more…

Looks to me lkke ES and YM in different counts, one an expanded flat, one a regular flat or possibly a ZZ, as I am not sure just how deep the b wave goes…

Very short leash on VXX to pop up on narrow BB, QQQ drop below (just small hedge)

Out for $100 loss with $800 potential upside. I will now watch if upside grind brings OB indices

FMCC and FNMA are displaying a cup and handle pattern. Very close to a 3 of 3 move to the upside. Trump about to make them private again ?

Ringing the register on SPY 286 strike calls picked up for a song at yesterday’s close.

Looking for short side re-entry trigger. I suspect they will once again make the move in futures. Ya gotta love ’em!

Gap higher no doubt more misleading mischief courtesy of our feckless banksters. Tendency of late has been to unwind leverage intra-day so let’s see how they close the session

A gap closure would be in keeping with recent practice. If it remains open 2910-20 next upside target.

So, its clear that my astro point May 21 will be a lower top, I m looking down from here till May 31.

Very often the AEX is a good indicator for the market, and today we had finished with only a small gain..

Battle at the zero line for OB/OS… will it drag out or break out?

and it’s at VIX 15… HHMMM

Tom,

Is there an inversion or time shift with your energy charts ?

yes

it’s obvious that the weekly inversion that occured 3 weeks ago

has reverted back to the original format

making tomorrow a very big down day

there was a lot of Vix alogo buying into the end of the day today

https://ibb.co/XWmVxsq

C of B up just about done. Next is C or three down to at the very least 2801 or thereabouts…many cycle gurus pointing to a low this week.

Was thinking the same thing, but you know these NEVER ending diagonals. I built protection in today and it’s gone nowhere. Should I be scared 😉 (hopefully just kidding HaHa, but semis and pot stock treating me very well today ~~~~~~~~~~~

VIX below 14.90 stopped me out for minuscule loss, worth it with gains today. Some think the risk range for VIX is ~14-22, but below 15 is game changer for how I allocate.

Cash Dow

25459 pivot holding

25555 pivot holding so far

25840 pivot now support

26065 now key raistance

Above 26065 targets 26330 and above

Cycle low time period opens tomorrow may 22

And runs into June 3

Next cycle high July 2 ish .

A low of sorts June 3 is ideal

Most likely the bottom of this swing is behind us .

I can’t rule out new all time highs in some index’s

This is now the bullish window so it’s up to the market

To prove itself .

Leaving last hedge in place until next week and intend

To take on some bullish short term spec trades between

May 25 and June 3 .

So far this mini panic has followed the typical , now it’s

Up to the timing aspects to propell the market higher

And it can be a stronger rise than normal .

June option expiry is not a timing date yet my guess is

The market will rise into that expiry

Weekly options might be a trading vehicle I’ll consider .

Furthest out options for me will be basis July and possibly

September . Closer to money vs out of the money .

This market might defy logic through out the month of June

No more comments from me until next week .

I need the weekend to dig into the internals and I won’t be home

Until tonight .

Nothing has changed market wise as far as I’m concerned .

The ” bears ” might be taken out to the slaughter house and beaten

Badly . A failure of the market to really just thrust hard to the upside

Would cause me great concern .

The month of June must be a fairly to very strong month to the upside .

Looks good Joe thanks, The decline Okt-Dec 2018, was also inline with the full and new moon, so we are now in a lunar green period so let’s see what will happen?

Bradley data are also corresponding with your timeframe, a turn May 16, May 30 and June 3.

Verne, did you see what Randy said about SQQQ… >:0

Not yet. I will check out his closing take.

still could be no man’s land..still stuck in with a toe in VXX..just in case case does drop tmo..

Yep. They are shaking out the long vol trades ahead of what they know comes next.

The move below 15 will, I wager, be short lived. We should see divergence soon..

has been listless but gaps tried to close, I have bit of VXX and SQQQ. We’ll see, best to your trading Marie.

thanks..you too..mojo..just hoping to pick something off this week

QQQ and SPY nudged just up to zero line MACD on 60min chart and look tired. On half day chart (195min) over last 30 days, I think they look like toast (for at least a short term OB pullback. Knife’s edge VOL with 15 VIX is line in sand, makes headlines push/pull factor.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.