NOTE: I had originally posted Robert Prechter’s rules, but I’ve recently changed the ones that conflict with reality. For example, originally his rules suggested that the A wave of a zigzag is always an impulsive wave, but it actually never is. There is a vast difference between five waves in a corrective pattern and five waves in an impulsive pattern. Impulsive waves do not exist within corrective patterns at any time.

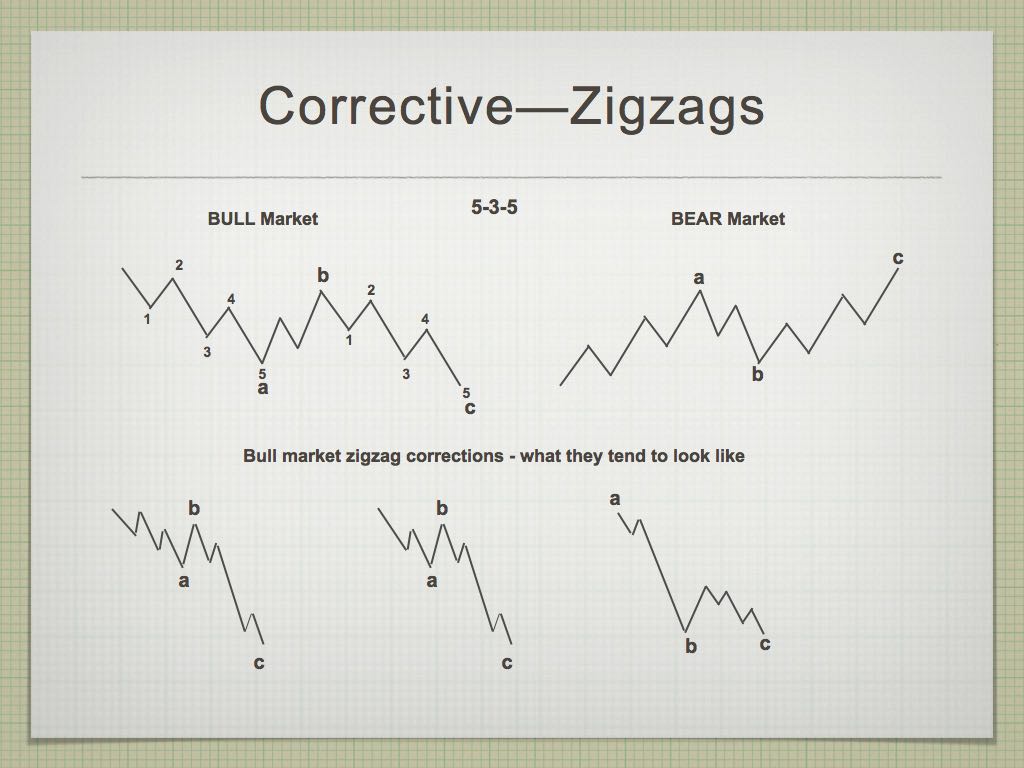

Zigzags are the most comment wave in the market. They’re in 3 waves overall (ABC), but the A wave and the C wave will be in 5 waves each. Much of the time, the A and C wave are equal in length, but the other common ratio is for the C wave to be 1.618 X the length of the A wave.

Rules (these are “hard” rules; they cannot be broken)

- A zigzag always subdivides into three waves.

- Wave A always subdivides into five waves.

- Wave C always subdivides into five waves or a diagonal triangle.

- Wave B always subdivides into a zigzag, flat, triangle or combination.

- Wave B never moves beyond the start of wave A.

Guidelines (guidelines can be broken but it’s rare that they are)

- Wave A almost always subdivides into five waves.

- Wave C almost always subdivides into five waves.

- Wave C is sometimes about the same length as wave A.

- Wave C almost always ends beyond the end of wave A.

- Wave B typically retraces 38 to 79 percent of wave A.

- If wave B is a running triangle, it will typically retrace between 10 and 40 percent of wave A.

- If wave B is a zigzag, it will typically retrace 50 to 79 percent of wave A.

- If wave B is a triangle, it will typically retrace 38 to 50 percent of wave A.

- A line connecting the ends of waves A and C is often parallel to a line connecting the end of wave B and the start of wave A. (Forecasting guideline: Wave C often ends upon reaching a line drawn from the end of wave A that is parallel to a line connecting the start of wave A and the end of wave B.)