The January Effect

from TradingSim “The month of January in the stock market has strong significance in predicting the trend of the stock market for the rest of the calendar year. This phenomena occurs between the last trading day in December of the previous year and the fifth trading day of the new year in January. The January Effect is a result of tax-loss selling which causes investors to sell their losing positions at the end of December. The January Effect is predicated on the idea that these stocks, which have been sold off to realize the tax losses, will be at a discount to their market value. Bargain hunters step in and load up on these laggards and this creates buying pressure in the market.”

Statistics from the first five Trading days in January

“When the S&P500 has a net positive gain in the first five trading days of the year, there is about an 86% chance that the stock market will rise for the year, it has worked in 31 out of the last 36 years (as of 2006). The five exceptions to this rule were in 1966, 1973, 1990, 1994, and 2002. Four out of these five years were war related, while 1994 was a flat market. As history suggests, the markets average nearly 14% gains when the January Effect is triggered.

On the flip side of the coin, when the first five days of January are lower, there is no statistical bias of the market, up or down. It is anyone’s game at that point. Not a very reliable indication.”

My Take

I’m expecting a very negative period in the first five days of January … VERY negative. Then we should get a large fifth wave to a new all-time high, which might carry us through March. But after that, we’ll revert back to the type of market we’ll get a small taste of next week … times ten! It’s going to be a year for the record books!

This week, we should see the culmination of the fourth wave that’s gone mostly sideways to down for eleven months – good riddance! It should be a dramatic drop to at least the current low across major stocks and the US indices, with similar spike (but to a new high) is the US Dollar. It will be a dramatic end to what I like to think of as “The Fourth Wave from Hell!”

An Update on the NYSE (New York Stock Exchange)

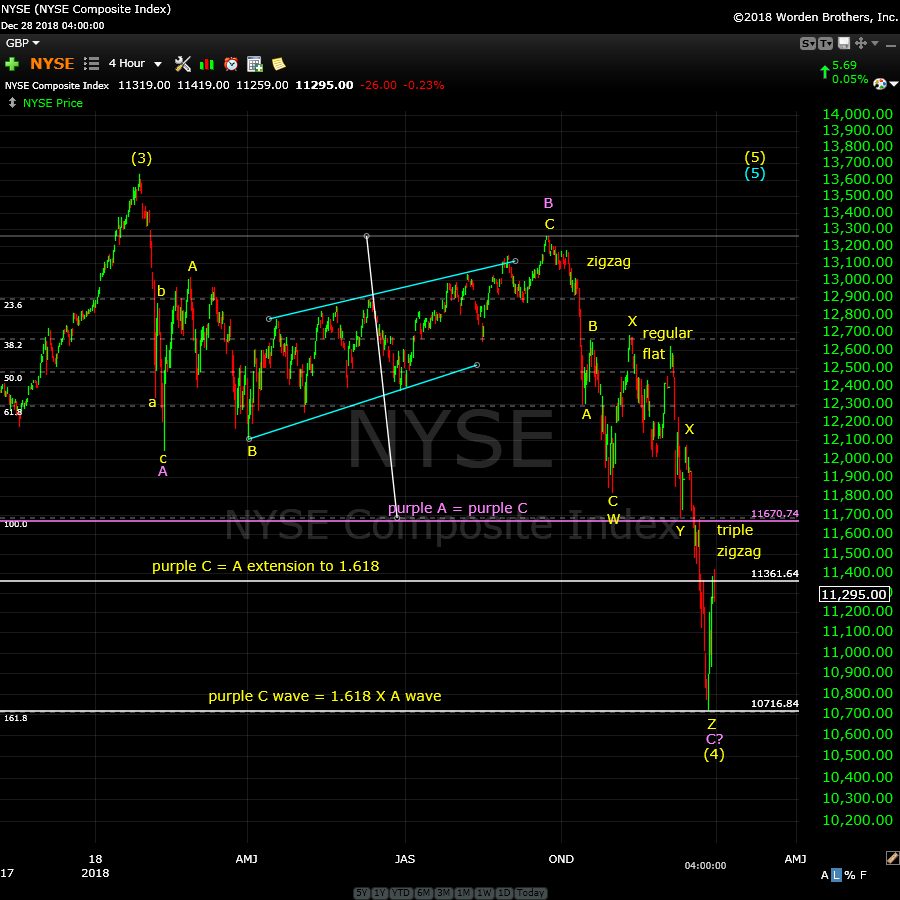

Above is the 4 hour chart of the NYSE (New York Stock Exchange). You can click to enlarge, as with all of my charts. I always look to it for a clear big-picture-look. It usually provides one, devoid of the animal spirits of indices like the SP500.

Last week, I posted this same chart, expecting a drop to my target of 10,716. Well, there you have it — the power of fibonacci. You can see the same phenomenon in the SP500, where we hit my target of about 2330.

This week’s large bounce is corrective, which means we’re heading right back down to that target. We may simply bounce into a fifth and final wave up after creating a double bottom. That’s my preference: We’ll see what Mr. Market thinks.

In any event, they all have one more wave up to a new all-time high once we complete this fourth wave.

I’ve labelled the sub-patterns of the combination pattern that’s played out in the normal WXYZ manner, which simply delineates the different sub-patterns. We have first of all, an ABC rally to the area slightly below 13,300. Then I count a zigzag down, then a regular flat, and now a triple zigzag to finish things off. Triple zigzags are fairly rare patterns, but this entire fourth wave down from January 29 has been anything but ordinary!

The triple zigzag is not complete, but may bottom around the January 6 eclipse. Then expect a trend change to a very large fifth wave to a new high. We’re very likely to see this trend change across all asset classes internationally.

An Update on the US Dollar Index

Above is the daily chart of the US Dollar Index. I usually use the chart of UUP (for ease of access) to do my dollar index analysis, but there is a rather large non-confirmation between UUP and the Dollar Index. UPP seems to have completed a first wave down already, while the US dollar still has to top out of an ending diagonal.

This week, the ending diagonal widened slightly and changed the internal count; I’m still expecting one more wave to a new high, which should coincide with a fourth wave bottom in the US indices.

The wave up is corrective (and there are a couple of ways to count it). I’ve chosen what seem the most likely, a zigzag pattern. In any event, the pattern is corrective. There are additional clues, which are denoted by the asterisks, which identify 3-wave patters within the larger wave.

The bottom line is that I’m expecting a complete retrace of the dollar right back down to the 89.50 area. I expect this wave will trace out as the US indices finish up the fifth wave to a new high and end the 500 year rally.

It’s all falling into place rather well, even though I’ve certainly had my share of detractors, along the way.

____________________________

Elliott Wave Basics

There are two types of Elliott wave patterns:

- Motive (or impulsive waves) which are “trend” waves.

- Corrective waves, which are “counter trend” waves.

Motive (impulsive) waves contain five distinct waves that move the market forward in a trend. Countertrend waves are in 3 waves and simply correct the trend.

All these patterns move at what we call multiple degrees of trend (in other words, the market is fractal, meaning there are smaller series of waves that move in the same patterns within the larger patterns). The keys to analyzing Elliott waves is being able to recognize the patterns and the “degree” of trend (or countertrend) that you’re working within.

Impulsive (motive) waves move in very distinct and reliable patterns of five waves. Subwaves of motive waves measure out to specific lengths (fibonacci ratios) very accurately. Motive waves are the easiest waves to trade. You find them in a trending market.

Waves 1, 3, and 5 of a motive wave pattern each contain 5 impulsive subwaves. Waves 2 and 4 are countertrend waves and move in 3 waves.

Countertrend waves move in 3 waves and always retrace to their start eventually. Countertrend (corrective waves) are typically in patterns — for example, a triangle, flat, or zigzag. Waves within those patterns can be difficult to predict, but the patterns themselves are very predictable.

Trend waves move in 5 waves and partially retrace. The difference in these waves is not covered in “The Elliott Wave Principle” book. There are two types:

- Simple 5 wavers are found in zigzags, flats, and other nondescript corrective patterns. They have 5 waves, and sometimes the third wave has a recognizable 5 wave pattern, but most of the time, they don’t.

- Impulsive waves require each of waves 1, 3, and 5 to have recognizable 5 wave patterns in their subwaves

Fibonacci ratios run all through the market. They determine the lengths of waves and provide entry and exit points. These measurements are really accurate in trending markets, but more difficult to identify in corrective markets (we’ve been in a corrective market in all the asset classes I cover since 2009).

To use Elliott wave analysis accurately, you must be able to recognize the difference between a trend wave (motive) and a countertrend wave (corrective). There’s very much more to proper Elliott wave analysis, but this gives you the basics.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

This was quite the week! We had an unexpected large rally, apparently a result of some $64 billion in pension funds being placed in the market during a time of very low volume. It changed the immediate count, but not the larger prognosis.

We had been expecting a rally and another wave to the downside as part of a possible ending diagonal. However, the resulting corrections, along with the extended drop before them made an ending diagonal impossible.

The waves down have been less than clear ever since about 2700 in the SP500/ES combination. Because of overlaps, a zigzag pattern was a lesser probability until the middle of this past week. Now, the quite rare triple zigzag pattern is the most probable wave structure following after the regular flat pattern.

We completed two zigzags (5-3-5. 5-3-5) after the regular flat and hit my target of 2330 (the potential bottom of wave four). After this week's corrective rally, we're looking for a third zigzag down to a new low. We may drop below the previous low, or may end up with a double bottom; I have no way of knowing at the moment what the target will be.

A confirmed bottom will lead to a turn to the upside in a 5th and final wave to a new all-time-high.

At the end of the day on Friday, we were sitting at the top of an ending diagonal in ES and NQ, with a final high still in the cards. I expect a resolution early in the week (either Monday or Wednesday — Tuesday is a market holiday). Look for a fourth wave bottom perhaps in conjunction with the January 6 eclipse.

Summary: Look for a dramatic drop in a zigzag (5-3-5) pattern to complete a triple zigzag with a wave at least to the previous low starting as early as Monday. The culmination of this drop should mark the bottom of large fourth wave in progress since January 29, 2018 - almost a full year of Hell.

Once we bottom in this large fourth wave, we'll be looking for one more final wave up to a new high. That fifth wave up to a new high will be the end of the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, January 9 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Thank you Peter!

Will wonders never cease?!

I saw an analyst, whom I once admired, publish a bullish count today with a minor one up complete….

This is entirely in keeping with previous stubborn bullish counts in the face of bearish MA crosses and while DJIA was shedding 2,500,00 points and SPX almost 300!

It is a dangerous world out there…!

I honestly don’t know what goes on with people. EWI is STILL showing the top is in. It’s impossible. Their counts make absolutely no sense whatsoever and it’s been like that for an entire year. And you tell me someone is counting the wave up as an impulsive wave? Unbelievable. You’re welcome.

Hello Verne,

I’ve noticed in the past that you posted that you successfully sold some very short term credit spreads at pivot points indicated by Peter’s analysis. I think you also mentioned that you often traded the corrective waves as well as the primary impulse waves. I’ve been using supplementary indicators to try and gauge the best timing and location for getting in and out, but often find myself on the wrong side of moves. (Example; the recent 1000 pt spike)

Could you share what indicators you use to supplement Peter’s analysis, in order to get good entries and exits for your option trades?

Thanks

Nothing will cost you more money than Free Week at EWI.

Funny, ironic, and unfortunately, true.

Hi Lon

The main thing I try to do is get the immediate trend right, and for the last several weeks imho it has been clearly down. The numerous rallies, as violent and unexpected as some of them were I simply viewed as counter-trend. I cushion the drawdown on my main positions with hedges and will even occasionally add to my hedges, as was the case with the recent thousand point ramp we saw. While I occasionally speculate with near expiration contracts, I usually try to go out at least three weeks on spreads so the trade is not too greatly affected by near term whipsaw. I remain bearish as I have simply not seen, despite some admittedly very capable analysts’ claim to the contrary, true capitulation selling. My main trade indicator is volatility and the VIX related instruments. What I am seeing there is consolidation, NOT capitulation, so in my opinion the trend remains down, and I continue to sell the rips. Finally, I am using more generous stops as I don’t mind being temporarily under water during counter-trend bounces.

Equally important I remain very disciplined with profit targets and exit the trades as soon as they are hit. This is a trader’s market! Hope that helps a bit.

Thanks for the Reply Verne. How do you decide you profit target, do you get out partially or completely on profit target. Do you use Support resistance or BB band to get out with profit.

That is a very good question. I try to find set-ups that offer the possibility of at least a double on option contracts, and so option delta will detetmine strikes and expiration choice.

Here is where EW really is extremely valuable. As Petet often says, while it does not give good info about WHEN, it does provide stellar info about WHERE.

I tend to scale out of trades. Half on 50% gain, another 25% on 80%. and then a trailing stop or contingency order to exit on thr rest. Of course there is always a number that says I am wrong and will stop out the entire trade, OR, the target is met very quickly with short term reversal signals that militate against remaining in the trade.

ES candles looking progressively weaker, and that move up clearly is going to be fully retraced.

How anyone charging people money for their analysis can call that price zction impulsive is quite a mystery!

The 2520 area is proving stiff resistance, and I am eyeing my biggest trade of the year by way of SPY 250 strke puts expiring Jan 11, that should easily return a double and then some. I expect the party to get going with a brutal gap down, and a race toward the target that will leave anyone on the wrong side of the market shell-shocked….!

This rally clearly looks to be in 3 waves as of now. At this point, wave C up is already 0.78 times wave A. If someone wants to count the rally as impulsive, they need a break of 2550 with strong momentum in the next 2-3 trading days. The probabilities as of now clearly argue for a short position. I had already exited my longs last week. Will try and set shorts today hopefully between 2510 and 2525.

They can certainly try!

This year-end ramp is looking way too cute for my taste.

Smells like a classic bull trap. As one savvy observer opined:

“…there is one born every day!” 😎

How far out are your shorts and are you using SPX option spreads or just straight puts

Surprised no one took the bait and corrected me on P.T. Barnum’s supposed quote regarding the arrival frequency of suckers…😁

I have been gone the past several days so just posting a short term thought .

tossing time out the window for now .

on a 15 minute chart I see an A B C X , X being this mornings low .

Looking at a Daily chart I see A and B with B being this mornings low assuming we don’t see a lower low this week.

There is a GAP between dec 13-14th on the cash dow at 24597-24431 . this gap will most likely get filled . after that I do not know what happens next .

a conservative upside projection where wave C will equal wave A on the daily chart targets the 24354-24597 range based on the daily chart .

looking at the 15 minute chart the cash dow had an initial rally in wave A then a 50 % retrace in wave B then another rally in a wave C followed by a somewhat relative lengthy time retrace but not much of a price retrace in wave X .

short term resistance sits at 23432 .

the next higher levels that matter to me are : cash dow 23679.62 and cash spx 2569.78.

Some of my indicators are looking a bit stretched to the upside on a short term basis which is typical on a market bottom yet stretched is stretched

The question I ask myself is did we just begin a new bull market ?

if so then the higher targets will be hit / tested .

Today is showing a fair amount of buying so I do not see today as a day to be shorting this market .

the new moon / solar eclipse comes next week and the mars Uranus cycle calls for a low jan 4th. so jan 4 – 6th still matters as does jan 20th .

No opinion on those dates being posted today .

Nothing more for me to say until I see the weekly closing numbers .

Joe

Interesting. I just looked at a weekly chart of ES. That weekly candle from December is sporting quite a long shadow…the incredible whipsaw continues with bearish reversals in futures and now bullish reversals in the cash session. Chaos reigns!

Looks to me like any move past 2520 has to be viewed as bullish at least in the short term. We managed to hold onto the 2500.00 round number today…..

ES is treating 2520 as a ceiling. Do we get a higher low tomorrow / Monday and then start a stronger rally ? I will cover my short and flip to long in case I can get that move lower.

Yep. That area has so far proven stiff resistance. I remain stunned by the bullishness of the herd, especially so-called analysts, and the complete absence of any signs whatsoever of anything remotely resembling a vol spike capitulation. I heard some talking head insist that VIX peaked on Dec 26 at around 36. Granted it was the highest it had traded in many months, considering how over-loved and over-bought this market was, that is NOT capitulation….not even close!!!

I am still looking for at least a 1K down day in DJIA to signal that the strongest leg of this move down is complete. The harder the bankster fight to prevent, the more certain I am that we will eventually see just that….

It might happen later today. Tomorrow is a big event day. Jay Powell speaks and will be capable of moving the markets big. Given the turn dates expected by astro guys, it would not be surprising to see a combined drop of 1K – 1.5K between today and mid day tomorrow. Sentiment surveys are close to extreme. So is put call ratio. All that points to some sort of a low coming along. Just not clear whether it will go below Dec 24 or not. I will be ok with a variety of prices between 2300 and 2400.

Next week is where the rubber meets the road as far as im concerned .

I needs to see the weekly readings in my indicators which include this Mondays up coming close .

while we are not making new lows as we enter the end point of the mars Uranus cycle which hit tomorrow jan 4th . we also have the solar eclipse which hits jan 6th .The technical back drop I look for in regards to the puetz cycle is for a market high 1 month prior to the solar eclipse followed be a decline into the solar eclipse .

We are kind of seeing this taking place .

Jan 20th ( lunar eclipse ) now is going to be a swing date . I cant say its a high or a low at this juncture .

My bias is upwards into September yet I am not blind to the bearishness of this market . My positioning in several stocks includes commodities which are for the most part bearish the US Dollar .

What I have done is created a weighted stock portfolio with out using any ETF’s or Mutual funds . Each individual stock has its own weight . The dow is a price weighted index so I have followed a similar method . By adjusting the Number of shares owned it is actually possible to have a decent return even in a bad market .

My purchases of the gold and silver stocks in mid sept and my increase from 45 % long to 75 % long on dec 26 open gave me a flat year on year return not counting dividends . My hedging and outright short positions is where my profit came from . I really have no repositioning to deal with now for the next several months . Its now all about being right or wrong and letting the market decide .

My weighted positions if I am proven correct have me set up for a rough 40 % return for 2019 and that assumes No New All time highs !.

Regardless of my positioning I have to say this market does look rather bearish .

there are many concerns going forward and with that in mind ill bring up George Lindsay .

From 12 years 3 months to 12 years 8 months from a major top you look for an important low .

The high in 1919 called for the year 1932 low as example .

The high in march 2000 and august 2000 ( NYA and spx and ndx ) called for a Nov 2012 Low . It was from this low that the market finally broke out

The july and Oct 2007 highs were the next important top from which the market crashed .

counting forwards from July and oct 2007 12 years 3 months to 12 years 8 months is where we should be looking for an important low .

The is a confluence of cycles calling for a low in the years 2020 into 2022

From that perspective id say we are already in a bear market for many individual stocks .

That said im bullish as we enter this year into Sept and possible into year end but …… The Big picture is Bearish .

The oversold readings I have been seeing along with the cycle low which is due tomorrow is my main reason for having a bullish bias . The puetz cycle for me is suspect to failure even though it has not failed at this juncture .

Next week will most likely be a Very Strong Up week !

the solar eclipse to lunar eclipse under the puetz cycle is bullish with in a crash phase yet its short term bullish . The mars Uranus cycle bottoms tomorrow and hence another bullish cycle into at least sept if not dec 2019 .

The venus bull market is now in effect .

I have to trust my own work yet I am not blind to how ugly this market looks .

Good luck everyone and enjoy your weekend .

This is a very, very strange and dangerous market today (which I said first thing this morning to my group) but even more so now. Be careful. It has no direction. The wave down in SP500 from the open was very strange (a three).

Absolutely! I believe we are seeing horrific wave distortion due to massive and relentless CB intervention to try and arrest this decline. This is a Frakenstein market. Just look at those freakish candles.

That put/call rato number is BULLSHIT!

I don’t know exactly how they are scewing with it, but the volatlity readings have now become entirely divorced from ACTUAL market risk…do be careful people!

The start of an ED 5 down ? (i of 5)

I suspect we are in some kind of second wave…

We are back testing 2520 from the downside. Given the whole consolidation over the last few days, a break above 2520 should be good for 50-60 points on SPX over the next week.

Recapture of 2520 probably means a quick run to next resistance at 2560.

Daily chart wave count anyone ??

looks like buying with both hands today and possibly

using their feet as well .

Wave C or 3 up using daily chart .

shorter term charts im not going to mention .

next week will matter to me .

Hello Peter,

Does today’s action change the projected near term downside target, of ES at =< 2329 ?

Thanks

No change.

Peter T,

Thanks for your guidance in the Chart Shows. I see this week as the up move of the triple zigzag you show on ES (right up to the previous high). I carefully prepare for downward zag to finish, but still ponder if this is flourish or fury in near future 🙂 Looking forward to Show next week. Cheers!

Another hopium overdose, which I think is going to wear off real soon.

Thanks, mojo, for the kind words.

Joe,

Back in 2015, the swing high from the 9/13/15 partial solar eclipse was Sept 17, 4 trading days later.

Same scenario here, partial solar eclipse on a Sunday.

Liz H

ill ask you to look at that 9/13/2015 in reverse .

the new moon prior to the solar eclipse , was that a low ?

a market rally into the solar eclipse ( 4 days later ) and then a drop

into the lunar eclipse / full moon ?

im not looking at the moment yet ill check.

this time around I think it is way to soon to label yet this time around

we did see a high on orr near the new moon on dec 6 and a decline

or a higher low . its not the same set up from what im seeing .

today being the mars Uranus cycle low date and the solar eclipse being sunday

im not tuned in enough historically to call this . Just being honest .

my shorter term indicators are becoming overbought . the triple zig zag

peter mentioned above does make sense on a short term perspective .

the daily chart is not the same though and it does tune out the noise .

cash spx 2551.30 is the .618 of where C = A the 2569.78 level on a closing basis

is a key level im watching as is cash dow 23679.62.

The mars Uranus cycle low due today is the norm for this cycle yet the mars Uranus conjunction comes Feb 13th and the puetz cycle dove tails with this .

Feb. 13-19th is a huge cluster in terms of time .

I have stated before looking at everything that the time period between Jan 4 to march 8th should be the end of this bearish period .

I may have gotten lucky buying back in on the dec 26 open at the lows ( near them anyway )

We are not out of the woods in terms of potential downside action .

I need to see the weekly closing numbers as well as Mondays close before claiming we bottomed . and even that wont prove anything .

In bull markets the oscillators are very good t calling bottoms .

In Bear markets you basically throw it all out the window because nothing works !

Happily long and trusting my own research yet not blind to how ugly this market looks .

The daily 1 2 or A B and now wave 3 or C up will still need a weekly 1 2 or A B and wave 3 or C up . The intra day is sloppy 3 wave moves , the daily a bit cleaner yet we wont know until next week The weekly has not developed enough off this recent dec 26 low to call . this is why im more focused on the weekly oscillators and Daily vs the intra day noise .

Aug 14 2015 new moon

Sept 12 2015 solar eclipse

Sept 27 2015 full moon ( not sure if lunar or not yet just noting )

Busy morning for me so not into digging .

This puetz cycle is not working out to perfection currently yet it is

not failing . It will take more work over the week end which includes actual market comparisons to pin point where the typical failures come .

id say the new moon Feb 4 can be a crash low or just a pullback low ( weekly wave 2 or B ) the Feb. 13-19th time frame is the end of the puetz cycle .

Joe,

the swing low was 8/24/15, 5 calendar days before 8/29 full moon.

If you notice spx low was about 12/24/18 or 12/26/18 depending on when you bought your calls 12/24 at end of day or 12/26 11 am.

That said, today may have played out like 11/7/2018 so let’s see how it goes Monday.

Very interesting. Many of us were expecting a low to co-incide with this week-end’s partial solar eclipse. How very much like Mr. Market to throw a curve ball. Peter warned of the three down yesterday so I was looking forward to cheap puts via bull put spreads today and boy did Mr. Market deliver in spades! lol!

A new weekend post is live at: https://worldcyclesinstitute.com/the-hopium-effect-is-waning/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.