Overview of Where We Are

Overview of Where We Are

I’ve spent a lot of time thinking about all the assets I cover and how they’re all moving to a synchronized turn. Here are my thoughts.

Last week, it looked like currency pairs were going to turn early. They seemed to be topping with everything else. In other words, it seemed like EURUSD would not make its 38% retrace target at 1.24. However, with Friday’s spike to new highs, that may not in fact, be the case.

The US dollar also had not bottomed, which seemed a bit odd. On Friday, however, it dropped to a new low and is flirting with a double bottom. I have for a very long time called for this to happen and said that the US market would top at the same time. Well, here we are …

In any event, I’ve seen this show before, where currencies shoot up to get to a pre-determined target at the last minute. That seems to be what’s happening. So a BIG CAUTION is in order here in terms of the US indices.

This is a 500 year top. The US indices are at a top. However, I’d be really surprised if they go easily; if we don’t get a double top. I’ll be looking very intently at the first wave down from here in the US market to see whether it’s corrective or impulsive.

There will be tons of time to react; after all, this bear market will last years. So, while I expect the US market to start down this week, I would not be at all surprised to see a test of the current highs before heading down in earnest.

Most everything is at an inflection point, or very close to a turn. Tuesday will be critical, I think, but patience is warranted still. This week should finally see a turn, but all our ducks need to be in order.

______________________________

Oops! Tesla

Above is the 2 day chart of Tesla.

Time to think about bidding “adieu” to Elon. Things have not been going well lately, and they’re about to get a whole lost worse.

Last week, I suggested we’d head up in a “double-pronged” second wave, which is exactly what we’ve done. We’re getting ready for a turn down into a third wave.

__________________________

And then there’s APPL

Above is the 2 day chart of Apple (AAPL). I’ve been expecting a double top here and a possible turn down from that level. We may get a small spike about this level, but the count is full. Also take a look at NFLX and FB, which are finishing ending diagonals.

Looking for a turn in AAPL.

__________________________

Changes to the Free Blog

I’m still on the fence as to the direction I’m going to take on this. In the meantime, this weekend, I’m fiddling with the website plugin that lets you sign up for emails every time a comment is logged. You may or may not see odd things happening as we try to nail this bug.

This past week, I had the developer of the underlying framework do a complete review of the site, which has led to quite a few changes “under the hood,” most of which you won’t notice. If something seems odd, first just empty your browser’s cache, which may alleviate the issue.

One thing that you might notice is that the site is very much faster in loading. Pages load much faster than they did before and overall, is just “snappier.” A lot of work went into it, so I hope you see the results.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

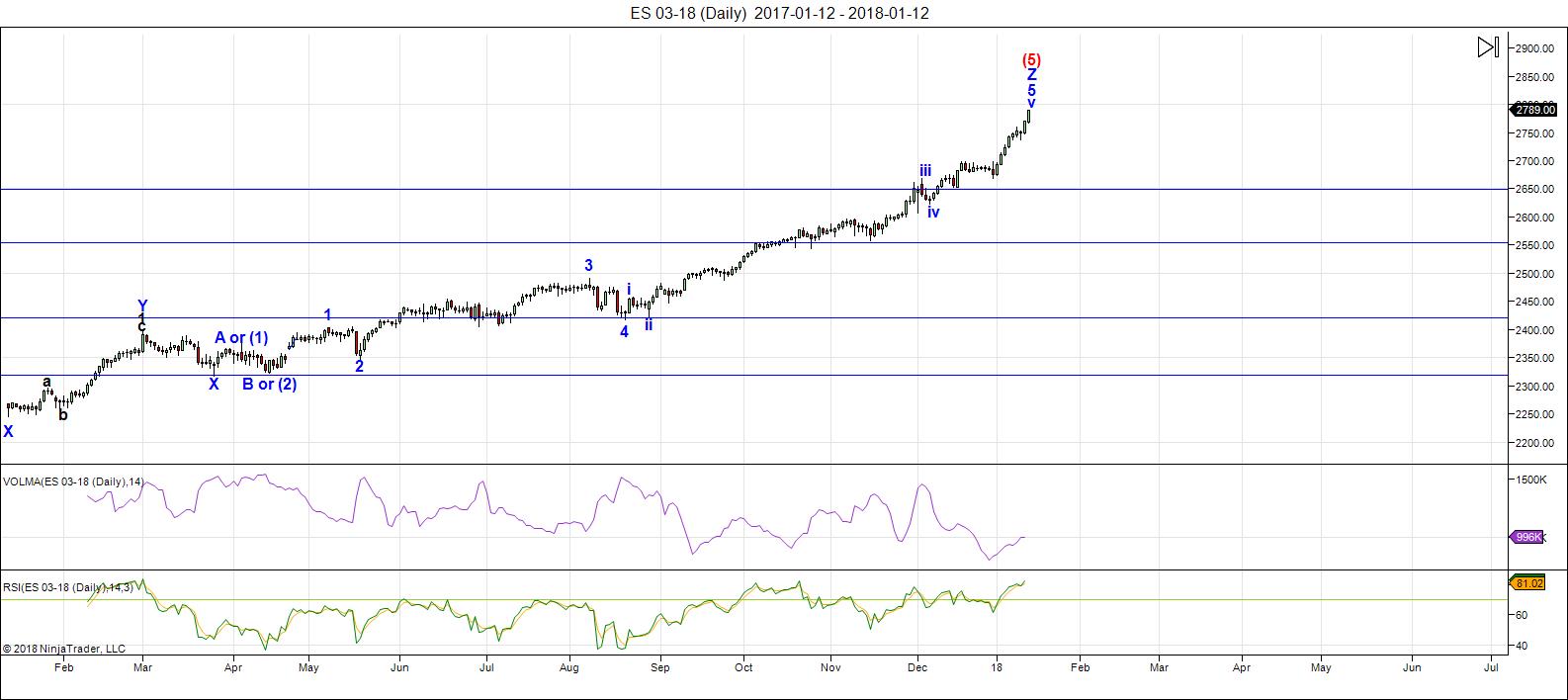

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down this week. But, we may end up with a double top, so the first turn might not be the final one.

On Friday, ES completed an ending diagonal (5 min chart). Ending diagonals can have double tops, so best to wait for the first wave down and then the second wave up to the 62% level before going short.

If the final pattern is truly an ED, ES, should not rise about 2790. However, with currencies and others not quite at targets, the US indices warrant a fair amount of caution.

Volume: It's dismal. Its the purple line, the top indicator at the bottom of the chart.

Summary: The count is full for the US market in general, so we're looking for a turn this week, once everything lines up. This is a major turn and will require all US indices, related currency pairs and of course, the US dollar, to turn at the same time. Be cautious and watch for the turn, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, January 25 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

It would appear that yesterday was a fourth wave correction, which means we are FINALLY in a fifth wave up. VIX hanging tough and seems to agree. If this is right, at the end of this move you will see what a real impulse down looks, smells, and feels like; there will be “no doubt”…! 🙂

This is going to get more an more interesting .

We are now entering a bullish mars Uranus cycle into

Jan 26 – Feb 2 and also entering a false puetz window

Which should be sideways to down into mid Feb.

And we are now technically in a Venus bear cycle .

Trying to navigate all three of these cycles when they are

All combined is not the norm . You normally get only one .

I’m very interested in how bit coin reacts over the next 2 weeks .

I’m not a crypto trader so it’s just an observation.

you don’t know what you missing 😉 actually its more like a social club than anything else…but if you want some chatter you can just check Peter Temple’s stream :: https://twitter.com/search?f=tweets&vertical=default&q=%40worldcyclesguy&src=typd & then if you want to see chatter on any subject — enter in the UPPER RIGHT box “Search Twitter” box, for example $SPX , Fibonacci, Gann or anything else/anyone’s moniker. this w/o having to log in &/have a Twitter account.

try not to follow those w/tons of followers. they give squat. look @ Peter Temple’s followers — not many — but he gives TONS of info…but many you’ll find are too damn lazy & very gullible and follow those Twitter has selected.

I just checked one of my archive tweets on $SPX .. I have July 27, 2018 as a CRASH. think I based it on NUMEROLOGY. #11 is a bad #

https://twitter.com/Eternity100000/status/538912422979858432

ALSO Jeff Cooper constantly mentions month of July — can’t seem to find the exact tweet I want to post — but here’s one of interest :: https://twitter.com/JeffCooperLive/status/621862392096382977

thanks for all the info, Verne !

am sorry, Peter !!! I have 3 sites. 4got about the 2 url rule !

my excuse — am multi-tasking.

That’s OK. I don’t mind. My note was more to let you know there’ll be a lag, cause I’m not around all the time …

thanks Peter ! 🙂

..its just that I have a tendency to over post (& tweet…to myself) ..this is how I do my dd…and I 4get there are others here.

Liz

I agree with Emily in regards to the puetz window.

Today is the new moon one month before the solar eclipse .

Nothing that puetz has written as I know of mentions the

New moon prior to the solar eclipse .

I don’t have a 10 trade day range as of yet to go off of .

Ideally tomorrow is a fade or down day yet I am not going

To make any trades until Monday .

Ed

Arch Crawford advising 200% short ?

Makes sense why he is advising that

wanted to get this out of the way::

The Economy Forecast Agency — they not always right — change daily. lol

S&P 500 FORECAST 2018, 2019 AND 2020

https://longforecast.com/sp-500-index-forecast-2017-2018-2019

you can check the DOW & other indices, Oil & some of the FANG stocks, including Bitcoin. not sure if anyone of you here know of this site.

ALSO:

Bradley Siderograph Turn Dates for 2018

https://bradleysiderograph.com/2018-turn-dates-sp500/

..he’s not always correct either. so keep an open-mind.

$SPX well…it did hit (almost) its 52wk H of 2807.54 — shy of a couple cents @ 2807.38 CLOSED @ 2,802.38 +25.96

$BPSPX @ 82.60 UP 0.80 — which bodes well for $SPX .. its when the 7 percent rule kicks in that bears in charge. I usually have the 70 as Line in the Sand.

$SPLV closed @ 48.22 well above DeMark’s BUY signal of 47.77

$TRIN closed 100 @ 118.06 on the daily

am also looking @ crude oil

— one astrologer has 65.50 (for this week ?) as a target. going to be interesting rest of week.

There are some very strange things going on in the markets. I have never seen market price and VIX both simultaneously trade above B bands.

Amen, brother… This market is broken, and been broken for a while…

No idea how that manifests itself from here, but having a hard (REALLY hard) time thinking “broken market” = “Perpetual Money Machine”….

Just a brief, very technical update on my side.

If you take the fifth of the II of the…….I CAN’T TAKE IT ANYMOOOOOOOOOOOOOORE

🙂 this market…

DJIA made a new all time high (26,130.45)…SPX got close (0.50 points away) to yesterday’s all time high (2,807.54)…SVXY ‘the market tell’ hit 135.63 which is well off the all time high (139.47)…SVXY began to roll over during the last ten minutes of the trading day closing at 132.84…this is options expiration week and anything can happen…

https://twitter.com/3Xtraders/status/953738499697586179

https://twitter.com/3Xtraders/status/953739975643758593

Joe did you see my question to you from yesterday?

If you get a chance can you take a look please sir.

You said choppy and today and yesterday sure constitute choppy indeed!

I cannot believe the resilience of this market given where we are right now all my time cycles are stretched and overdue .

Andre has not been on for a while so it will be great to work see his input like Joe he is an astro guy and Andre has been accurate in the past.

Don’t quote me but I am sure in Andre’s last post he said the high would come Tuesday?

Anyway Joe if you get a chance take a look at the question I asked re your timing

Thanks in advance

Incredible! No reversal yet so one has to conclude that the move up today was only a small degree first wave of the final fifth wave, which in turns implies yet another third wave move up before we are all done. Never seen anything like it. Let’s see if VIX continues to power higher with the market, a key sign I have been anticipating for confirmation of a terminal wave.

Received today from James Flanagan email/video re markets. He’s been away for sometime….Anyhow, he too is kind of off / “confused” how this markets been ramping higher. he now thinks it started from November 2016 — gather the election night? and its got legs…anyhow..am on his email list and might as well share his video w/you all ::

http://www.gannglobal.com/webinar/2018/01/18-01-10-Webinar-Invitation-MF.php?inf_contact_key=60a95d0de2631e9ccdfb4d501c61b65fb0f7d0a614a97af30195ba47eeb7feb8

Peter T,

Do you still think we have higher high further, Are you expecting turn this week or next week.

BilR,

I’m still hopeful for a top this week. The last wave has been really difficult to count as it’s missing an obvious second wave. I now put us in ES in a final fifth with only about a 20 point upside, I think. Everything right across the board is at or near its turn target.

James Flanagan is a good guy but he has had a terrible time in the markets of late. He relies heavily on historical and cycles to try and gauge where things are likely headed and practically all his calls last year failed to pan out as expected. He is certainly not the only one. I subscibed for about six months last year and he would send me occasional updates after my subscription ended.

True… he has been off lately. came across him in 2012-13 — thereabouts….one of his videos whereby he had one of the dates as Aug 24, 2015 — recall that one cause I tweeted THAT date as a CRASH in December 2013. lol… and you know what happened THAT date, eh! — Aug 24, 2015.

Looks like yet another triangle of some sort in futures. This kind of price pattern is now very well established as we have seen so many examples. It is likely either a forth of an initial first wave of a fifth, or the fourth of a final fifth. VIX should tell us which.

Image Candy… Lawdy, Lawdy…Yes, they could be broken above early today and one more potential barrier will have been penetrated. But do pay attention to this one. What makes it fascinating is that it uses both the daytime-only low of the futures at the November ’16 presidential election for the red channel, but the dark blue channel actually uses the very important Feb ’16 low and the overnight crazy low on election night that one would think had nothing to do with reality because prices got nowhere near those overnight lows in daytime trading. For those of you curious, the dates for the red channel are the daytime lows of 11-4-16 and 8-29-17 with the upper parallel at the external trendline high on 7-14-16. The dark blue channel uses the 2-11-16 low with the 11-8-16 crazy (or now maybe not so crazy) election night low with an upper parallel at the trendline external high of 11-3-15. As you can see, the two upper channels have just met (if you’re not impressed, remember the blue upper channel is over two years old) and over the past few days prices have just reached both channels. Another false lead? As my old buddy Ed Hart used to say on the old FNN, we will know in the fullness of time! Enjoy and hopefully benefit but no trades are implied or recommended:

https://imgur.com/a/Slu4y

Despite printing a red candle, VIX remains ABOVE its upper B band.

I am not sure what is going on nut I am sure this is NOT normal market behavior….

As you can see, I have added a daily SPX chart with its channel to the link in my post above…

Im holding out on the euro hitting its target before i consider shorting. GBP also need to ramp 130 pips or so and then the bull could be complete

did …..”YOU”…….miss me y’all?????? i’mmmmm baaaack!

“BE WARNED”!……………..https://invst.ly/6dqag

Thanks Peter. I would seem to me that a friendly visit to the bottom of BOTH those channels is called for by any initial impulse down worthy of a 500 year cycle top. I imagine if that occurs, they will no doubt BTFD… 🙂

Hi you prodigal…I was just about to send out a search party…! 🙂

was your “search” part – outfitted with a pure bred “ST BERNARD”….. complete with whiskey flask tied around its neck???/////////////

…….well verne ……………..was it??? …..[cough]

I also have a third wave shorter than one and we all know what that implies….! 🙂

Can we all join Cap’n Quint in the “Spanish Ladies” refrain, or is Mr. Market going to keep pulling rabbits…??!! :

look to the dxy for answers – …….”grasshopper”…………..https://invst.ly/6dqk-

Just what im expecting! Need the Euro and GBP to rip to the moon.

Q……

me thinks ……………….a prediction…………..seeth charteth!!

https://invst.ly/6dqzz

so it would seem we have one more dump to the dxy to 88.42 ish area??

does that sound about right …………class………………….anyone?? anyone? verne?

https://invst.ly/6dqsf

……………………..and the RUT futures………..they “BE” done…………..on earth as it is in heaven ………….https://invst.ly/6dqvp

“BE WARNED”!!………………..

TWO St. Bernards, I would have yer know!! 🙂

verne,

“2” St. Bernards???……….hmmm……….just back from vietnam then??……..you know ………..”very well”…………..that i am a “vegan”………………… it would morally impossible for me to “eat” that second dog………………unless of course you meant the second dog had “leashed” around its neck………………… a wine spritzer…………… i much prefer a wine spritzer to “whiskey”………………. i would also appreciate a 3rd carrying “cucumber” sandwiches – minus the crusts…………… and lighted sea salted, with fresh cracked pepper,,,,,,,,,,,, :-)))

Any Grey Poupon??! 😀

Yep. USD in final move dowm methinks…

https://worldcyclesinstitute.com/a-pending-top/comment-page-3/#comment-26410

continuing to monitor Dan and his subscription service…as we already know, Dan’s peeps are not in alignment with our esteemed host’s wave count…however, they are currently looking for a 12% correction in the S&P 500…ain’t that so Dan!

lot of interesting stuff… VIX cup&handle breakout, VXX cup&handle into resistance from 12/19 to 12/29, but long candle wicks to bite through before big vol move. Maybe give it a cucumber sandwich…

120 min chart

still chewing…

Yep! I noticed that very nicely formed C&H as well… 🙂

No divergence yet on UUP. MACD still bearish. The last couple gaps down may not have been capitulation moves as it initially appeared but I suspect we are not too far away from a turn…

DXY bouncing to downside off MACD mud (zero line)… maybe playing into Luri’s chart

In a previous post, I stated that we should see a correction to the SP2200 level and then that level will not be seen for decades, if ever again. We will still see a correction at some point, but we will not see the SP 2200 level. You can bid that level bon voyage, adios, hast la vista, and goodbye. Disclaimer: Lifetime events not withstanding.

Quite an optimistic outlook. Besta luck! 🙂

sounds like a Peter G forecast to me…?

P.S. not the Peter G who is a regular poster on this blog…he knows his stuff!

so where do you think we correct to Ken if not 2200

2200 Is not even a test of the 2015 highs. On what basis do you make such a call.

This year should be a repeat of 2015/16 IMO and after that pattern plays out only then can we assess whether or not this top was a major or a minor top.

Sounds to me like you are predicting a stellar bull run for ever and ever?

That’s a dangerous stance to take.

I look forward to hearing from you

watching $VVIX and $VIX : $VXV which right now is NOT > 0.91 — (hit earlier, but thats it) market rally still in up trend.

$BPSPX off by 0.80 @ 81.80 — until the 7 percent rule kicks in at about 76 area — won’t hyperventilate.

am also looking @ the DAX …which is green

ALSO .. MY 3 AMIGOS :: $FVX $TNX $TYX — all grrreeen

exception is SPLV ,,so far below its 48.07 DeMark S1

guys… keep eye on NTES … if anyone here playing tech stocks.

I also keep eye on $NDX : $VXN — VXN being the volatility indicator for NDX. looking at the charts & Daniel Code Ma’s 6-12-24 — that’s what I do to see when bottoms/tops in, besides other EMAs, MAs, zig-zag, etc

haven’t “mastered” EW

So tomorrow is 1-19. Any chance 911 events for tomorrow?

Liz…….[cough]………..its also a 111 day……….. !

oh… 111 day , eh! hmmm… TOP coming ? b4 a slight correction? or maybe nothing.

I got this from Gabby — an astrologer, wayback in 2012

“Moon’s effect on the S&P. It bottoms when the Moon is in Taurus, and Scorpio, and tops when in Leo and Aquarius http://astrologyandthemarkets.blogspot.ca/2012/07/new-moon-in-cancer.html … … … …”

ALSO:

= Ideal Annual cycle =

BUY when Sun ~~>Scorpio

SELL when Sun ~~> Taurus

https://www.google.ca/search?q=moon+trading&source=lnms&tbm=isch&sa=X&ei=asuvUrO9Jcb5oASP2oGoDQ&sqi=2&ved=0CAcQ_AUoAQ&biw=1600&bih=754#q=moon+trading+and+stock+markets&tbm=isch&undefined=undefined&facrc=_&imgdii=_&imgrc=TKj1Ru3ybtM7zM%3A%3BhU5CLTi1FuvoPM%3Bhttp%253A%252F%252Fwww.timingsolution.com%252FTS%252FArticles%252Fastro_trading_s%252Fa_7.gif%3Bhttp%253A%252F%252Fwww.timingsolution.com%252FTS%252FArticles%252Fastro_trading_s%252Findex.htm%3B682%3B443 …

also:

“Major financial crises are most likely 2 occur when moon’s north node is in the quadrants: Aries-Taurus-Gemini & Libra-

Scorpio-Sagittarius.”

LizH ? I don’t think so. but yea… get it how you took the #s from the right to left ..I do that all the time. 🙂

look @ the 1st chart :: https://www.pinterest.com.au/pin/113434484347441283/

keep these charts & dates in mind. #GANN

https://twitter.com/Eternity100000/status/910863154472673280

Either a corrective ZZ down as part of a possible fourth wave, or a 1, 2, 3 underway. Either way we should head lower…

https://invst.ly/6dsrr

Any one else seeing yet another ED in process?

If so, ONE MORE ZZ up….

I remain convinced that when this beast turns, we will not be counting squiggles.

Bulls and bears alike are going to sit bolt upright and yell…”WHAT THE HELL…!!??”

He!He! 🙂

ok verne,

i have been throwing some spaghetti —- and you say …..”what”……….what do you say? https://invst.ly/6dtbs

If this is going to be the greatest bull market, we need to start the year right like filling gap ups since the start of the year.

/ES 1/10 2750

/ES 1/3 2710

/NQ 1/4 6604

Remember this? https://worldcyclesinstitute.com/time-for-a-small-dose-of-reality/#comment-21931

Look at the date and time.

https://money.usnews.com/investing/stock-market-news/articles/2018-01-18/tesla-inc-tsla-stock?src=usn_tw

|Jan. 18, 2018, at 11:11 a.m.

1-9-11 11:11

From a strictly timing perspective the top is now

In place . We have 3 bearish cycles in effect yet

1 has a positive subcycle . I am bearish the stock market

Looking for an April swing low . I intend to short a gap

Up on Monday ( assuming these minor cycles work )

I do not see any advantage to trading any short term

Potential bullish wave counts at this time .

I’m going to assume yesterday as the top and will begin my time

Counts from that day . I still need 10 trade days to define

The range . I use the 10 range as a way to define my risk

As well as to make the decision later if the cycle failed.

In my opinion we do not see new highs for the rest of this year

One more high dude…just one more… 🙂

Sid Stone on the old Milton Berle’s Texaco Star Theatre used to say, “You say you’re not satisfied? You want more for your money?” “Tell you what I’m going to do!”

So, I’ll tell you what I’m going to do. Here is one more tidbit. A potential limiting channel on the NYSE a-d line. It is important to note, however that it would be rare indeed to see a final market top where the daily a-d is confirming new highs as it has done over the past few days…That does not, however, negate the possibility of a decline of significance here and now…

https://imgur.com/a/zHTAs

In keeping with my expectation of one more romp higher, picked up SPY 280 strike calls expiring tomorrow for 0.30 per contract. This will probably be my final bullish trade this year. Looking for quick double on calls and I’m gone…(to Carolina in my mind!) 🙂

Could not resist selling 75 for 0.52 on quick pop. Holding remaining 25 for tomorrow…

If anyone can find the last time VIX spent three consecutive days, with closes, above its B bands I would be very interested…

have you checked twitter ? https://twitter.com/search?f=tweets&vertical=default&q=%24VIX&src=typd & click on “Latest” to get all the tweets pertaining to $VIX

I always look at the VIX’en Familia end of day — and anything that’s out of the ordinary — I take note. well… w/ $VSTN [ near term] — its in NEGATIVE territory and the rest of the “siblings” are not that high, though they green. so methinks the MMs been selling VIX calls …

Symbol Last Chg

VVIX 103.68 +1.05

VWB 11.92 +0.36

VWA 12.53 +0.29

VIF 12.08 +0.38

VIN 12.27 +0.35

VSTF 12.32 +0.66

VSTN 12.41 -0.41

VXST 12.37 +0.71

as I’ve stated b4 — VVIX is one I pay MORE attention to. it telegraphs b4 the others and IF in panic mode — would have been in the teens by now.

I would ordinarily agree. However, it does seem to me like a stealth move has been underway for a few sessions now…no doubt part of the calculus for the powers that be is folk thinking…”Same as it ever was…!”

Verne — just went to StockCharts.com — entered dates Jan 1, 2016 – Dec 31, 2016 — I used BB & could see VIX price outside them week prior to it… the BREXIT is when ALL the VIX’en Familia started to act up b4 that BREXIT vote was cast. do you recall that week ? markets – DJIA DJU & SPX made NEW 52wk highs & then came that “shower”

I recovered some of my tweets pertaining to the VIX’en Familia & Brexit

” 20 Apr 2017

ok..during #BREXIT week — while $SPX was flying high — $VVIX + $VSTN were banging higher & higher also which was CLUE that vote was 2exit”

“remember week PRIOR to #BREXIT — the VOLATILITY INDICATOR for the pound $BPSPX made a NEW 52wk H & $VVIX $VXST etc elevated along w/ $SPX”

“June 16, 2015 @realDonaldTrump came down escalator

year later: June 16, 2016 #BREXIT $BPVIX made a NEW 52wk HIGH – week b4 #brexit vote ”

“recall VSTN along with VVIX during #BREXIT week and EVEN during June 23 spike in markets — these 2 STILL were elevated.”

” 27 Oct 2016

USA ELECTIONS = MIRROR IMAGE (?) of #BREXIT

during #BREXIT — ALL the MAINSTREAM MEDIA were with the STAY – something like in USA w/Hillary

Thanks emily! Very inteterestin!

August 8, 9, 10, 11 last year, Verne, but I don’t think that’s your point. Usually those closes above the BBs would be accompanied by obvious market weakness.

More:

2016: Nov, 1, 2, 3, 4

2015: Aug. 20, 21, 24, 25

2014: Dec. 10, 11, 12, 15, 16

2014: Oct., 9, 10, 13, 14, 15, 16

Indeed! Thanks! 🙂

“Dems threaten government shutdown over DACA”

gather tomorrow’s the deadline for all political sides to agree to some blackmail at the expense of the people at the bottom of the pyramid who shore them up.

I see many tweets stating/salivating at tomorrow’s markets. some expecting carnage. we shall see..

all I watch these days is the price action and if some fibonacci level been breached/not, etc.

today.. 2 of MY amigos made NEW 52wk highs:

$FVX = 24.23

$TNX = 26.20

but NOT $TYX — day high = 28.97 — last 52wk HIGH on Mar 10 @ 32.01

most traders watch the 10 year – $TNX — I keep track of the other 2 and also the indicators for rate hikes :: $IRX & $SRVIX which SRVIX made another NEW 52wk Low of 64 today — indicating to me ..rate hike next week ? FOMC week ?

& on a different note…if you haven’t seen this one b4…

Factors influencing the World Stock Markets [ ASTROLOGY ]

“LUCKY DAYS”

http://www.luckydays.tv/stock_markets.html

It all is quite amusing. Only a Democrat minority would have the cohones to shut down the government over not getting their way. I simply cannot imagine the spineless Republicrats pulling the same stunt when they were in the minority. It will be interesting to see how long they keep wailing, stomping their feet and sucking their thumbs. This should be fun!

I don’t belong to ANY political party. AM CANADIAN, eh! and took myself off the voting list — but I used to vote for whoever was the best for MY district. year 2003 was MY year of how dirty politicians are and also your FBI — the deep state. had my 1st hand experience. the higher ups live on a different planet & know how to talk from both sides of their mouths. in other words they all hypocrites & dangerous to ones pockets.

Yep! A pox on ALL their houses! I originally hail from the BVI and looking forward to heading home, far from the political detritus of the good ole U.S. of A!

BVI ?? where’s that, if you don’t mind me asking you.

The Caribbean, just slightly NE of Puerto Rico. Come visit. It is a beautiful place! 🙂

Where I sail.

NTES — AH :: After Hours 329.64 +7.45 +2.31%

said earlier to keep eye on it. didn’t expect this ..this soon. lol –apparently its been upgraded AH..by who else than Goldman Sucks/Sachs — they got price target of 432.

Well folk, we may have some kind of triangle underway and I consider them “bread and butter” patterns as they are SO predictable. I now am expecting a final thrust up out of this formation and see light at the end of the tunnel…of an oncoming 500 mph freight train…!

Have a great evening all!

https://invst.ly/6d-qv

First, to Peter … still seeing the previous author’s email address pre filled when I go to leave a comment.

Second … saw interesting point on Dems withholding funding for govt over DACA … and how by doing so they put the interests of foreign citizens (and perhaps would be supporters) over their own constituents.

Third …. maybe nothing … maybe SHTF …. google FISA memo per ZH tonight and remarks (from many) suggesting “the survival of our democracy” is at stake and public release of memo is imperative. Interesting timing on that, in that it will take at least a number of Dems on Senate side to pass the CR (or even stopgap) if I understand matters correctly. RP has already come out against.

Still working on that bug. Democracy will only get stronger during this cycle to the downside, although it’s likely to take a civil war/revolution to get there.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.