The Bottom of Four

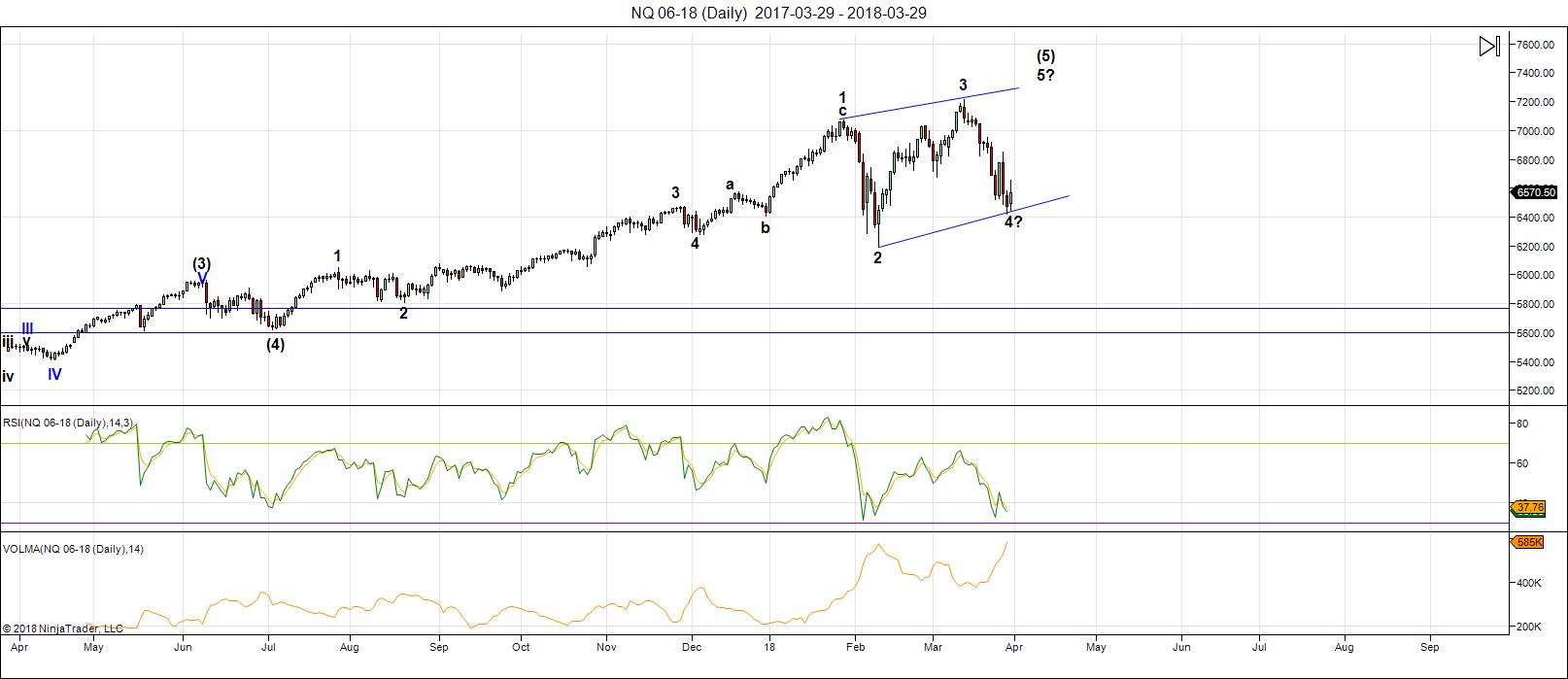

For the past few weeks, I’ve been referencing the pattern unfolding in the Nasdaq on a daily chart and making the case that it looks like we have an ending diagonal unfolding. Quite frankly, I don’t know what else it could be. This weekend, it looks like the NYSE side of the equation is confirming the ED pattern in the Nasdaq. Above is the 60 minute chart of NQ (Nasdaq futures) which is showing what can only be and ending diagonal. In that case, we’re looking for one final three-waver up to a final all time high (to end the 500 year bull market).

Above is the 60 minute chart of NQ (Nasdaq futures) which is showing what can only be and ending diagonal. In that case, we’re looking for one final three-waver up to a final all time high (to end the 500 year bull market).

It won’t actually be confirmed until we have a distinct turn up in ES/SPX, perhaps on Monday. For more detail, join my Trader’s Gold subscription service, where they get hourly charts and more information about how to specifically take advantage of the move.

So, to summarize, I’m looking for the completion of a small triangle in ES/SPX and the bottom of a small ending diagonal in NQ/Nasdaq before a turn up into a larger D wave of a larger triangle in ES/SPX. The Nasdaq looks like it’s about to start the fifth wave up of an ending diagonal.

Elliott Waves at Work — Boom!

Above is the daily chart of Tesla (TSLA). I’ve shown this chart before and there’s little change, other than the fact that it continues to move lower. This puts Tesla in the third wave to the downside which will drop to at least 217.64. There will be much more downside to follow in a fourth and fifth wave.

I would expect the fifth wave down to reach the previous 4th wave at about 180.00. At that point, there should be a second wave bounce.

Above is the daily chart of Facebook (FB). Everyone’s talking about Facebook.

I’ve posted this chart a couple of times upon calling the top. Last weekend, I warned that the second wave was ready to keel over into a third wave, which it did. The third wave should reach 141.74.

A fourth and fifth will follow and I expect then to descend to the 115.20 area to complete a first wave down (of 5 waves) before bouncing into a larger degree second wave.

Fairly easy to predict these moves when you know Elliott Wave. My Trader’s Gold subscribers are always on track for the big moves, which a video on the market every night. And there’s the weekly Chart Show for a snap shot of the market every Wednesday night after the market closes.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The last couple of days have changed my view of the road forward for ES/SPX and also, I hope, show the importance of being able to determine the pattern as early as possible.

It's taken the entire week for the C wave pattern down I predicted to reach a bottom. I has thought it might drop to a new low. However, one of the options is a larger triangle pattern for the fourth wave.

A triangle has been in the back on my mind for the past week or so, due to the fact that the Nasdaq went to a new high in three waves. That's NOT a fifth wave pattern. The only option that I can think of that's open to the Nasdaq now is to trace out the remainder of an ending diagonal. But, that would require ES/SPX to bottom right about where it is this weekend.

You only have to look at the RSI on an hourly chart to see that there's a fair amount of divergence in ES, signalling a turn in imminent. More importantly the wave pattern (as of Thursday) is signalling exactly the same thing.

For the past week, we've been tracing out a combination C wave to the downside. You only find them primarily (and possibly exclusively) in fourth waves and they're very difficult to trade.

Combination waves have a maximum of three patterns. We had a double zigzag down and the final pattern revealed itself on Thursday afternoon ... as a triangle. In combinations, triangles are always the final wave. On top of that, this one is a bullish triangle.

With one more wave down, I'd be expecting a turn up into a larger D wave of a very much larger contracting triangle, which should finish off the fourth wave.

After that, we'll have a final wave 5 (the last wave of the triangle) up to a new high. It won't be a huge wave 5. It may not make it too far past the high we have in place now.

Summary: More sideways to come as ES/SPX traces out a contracting triangle, which in a fourth wave position signals that a trend is about to end after one more wave (in this case, to the upside). That fifth wave up to a new high will be the end of the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, April 11 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Awesome call on TSLA! Ten bagger on 275 strike puts. BOO-YAH! 🙂

The advance of NDX has for some time been focused narrowly by breadth in a relatively small cohort. With the dramatic breakdown of FB, AMZN and TSLA, the line holding the index back from spectacular collapse grows quite thin. I would frankly be very surprised to see the index print new highs with some of those names in third waves down. I suppose we could see dramatic intra-index divergence with NFLX and GOOG heading to the moon…thoughts?

There are a lot more in ending diagonals: AMZN, GS, AAPL …

Bitcoin explained

https://www.youtube.com/watch?v=YHjYt6Jm5j8

not much to do with the markets but has to be seen

Thank you Peter T for your insight.

Question: Is there a typical time interval for a ending diagonal? Say, as compared to the length of wave 3?

No, not that I know of. And it would depend upon the degree of trend, at any rate.

Hi Peter,

My indicators:

Monday starts with a LOW and 3/4 is THE HIGH and Friday is THE LOW and starts to recover til 12 april.

Or can there be a lowest Low on the 6th (9th)?

I’m curious about your update of this weekend

http://www.prognoseus500.nl/

Third wave down underway after an absolutely beautiful set-up on Friday.

The banksters did a good job of shaking some traders out of short positions with the sharp expanded flat up ahead of the third wave down. This is a very common tactic they employ to confuse traders and if you can spot it it will present some of the very best trading set-ups there are. Trade safe!

Taking profits in the a.m.

Peter-

Is it possible that NQ futures are in a triangle (not the ending diagonal kind) and that the B wave just happened to create a new high or does that break a rule?

That’s probably what’s happening. It’s certainly unusual and I don’t like unusual. The ED for NQ appears to be broken.

I have always been strictly technical with an emphasis on cycles, but I do like to ponder what PQ Wall called the BBFs, the “Bullishly Biased Fundamentalists” might be thinking. Here’s what I think they are thinking today. “Hey, Ralphie, the S&P is back down to the 200 day MA again (this is the only technical indicator any of them has ever learned so they have a grudging respect for it) and is breaking slightly. On an hourly S&P cash chart, despite the two tests on Feb 9 and March 23 and 28, there had been no hourly (65 minute) close below until today. Today broke it with an hourly close and just over the last hour tried to regain it and has, so far, failed again. Psychologically, a break to new lows from here brings the BBFs to their boardrooms saying, “Hey, we sure have been brilliant making all this money over the past several years, why don’t we lighten up at least a little to preserve some of those brilliant gains.” SO they do and when they see the decline start to accelerate, the door is not wide enough to let everyone out at the same time. Barring an hourly close back above that 200 day MA (on the hourly chart it is at 2690.30), we could see a beautifully accelerating decline in the last few hours of trading. All the bears can then thank the BBFs!!! 🙂

And thank them I do….and thank them I do!! lol! 😀

Peter G,

Seeking clarification…Followed the hourly and 65 minute S&P after you post. My chart service has the 200 day moving average closing at 2589.85. So both the

60 minute and the 65 minute closed comfortably below that 200 day average.

What Implications, if any, do you see from that close today?

Two relevant comments, Ed. First, the S&P has not convincingly given up the battle to regain its 200 day MA. My 200 day on the 65 minute chart (that would be a 1200 period MA on that chart) closed the day at 2590.51, very close to yours with the cash close at 2581.88, not convincingly below (8.63 points). The futures have rallied up to 2589 in after-hours trading, almost right up to the MA, so the battle continues. The second comment is that the DJIA actually never closed below its 1200 period MA on the 65 min chart. Two hours before market close, Dow 65 min MA closed at 23,425 and the Dow closed the period at 23,435. So the battle continues so far and the BBFs have walked away with hope in their hearts…

Luri – What is your Bitcoin chart saying

I don’t know if luri will be so generous as to post her latest bitcoin/equties analogue but if she does, you will find it…how shall is say?…for lack of a better word:

supercalifragilisticexpialidocious! 🙂

Peter G,

Thanks for responding!

Thanks Joe you were right, and Europe did not join this fall, I still see us go higher into April 11, maybe we go sideways till Friday.

It seems to me we wr have a series of nested first and second waves. I am not sure wwh some forum posters are basing their expectations on. Very frustrating. I suspect I was one of very traders that shorted the smack out of what was absolutely clear to every trader, a violent bear market rally yeaterday, perfectly kissing the underside of the 200 day goodbye. This is my last post. All the best to eveyone.

Why is the your last post? Your insights are greatly appreciated. They may not commented on, but definitely appreciated.

DJIA measured move target: 20,050

S&P500 measured move target: 2,325

https://tinyurl.com/ycwe46eh

Joe Longwill,

A “Big Hat Tip” to you on your April 4th date! To anyone paying attention that was great insight!

with the cycle low in place im looking for a ( B ) wave back to the upside.

a new weekly high is needed ideally by Friday above 24446.22 to signal a weekly reversal .

best objective is a poke above 25800.35.

medium to short term bullish with in a longer term bearish trend.

price basis cash dow .

No new lows expected for a while . june 6 is a minor cycle low .

aug sept the next major cycle high .

guess id expect sluggish with the exception of the reversal pattern unfolding.

nothing else to expect in my opinion .

Monthly dollar index looking bullish as well

could the us dollar be a default DOW ?

if so dollar and dow rise together .

bear cycle on cash do to end jan 2019 yet

watch us dollar along side the dow .

$UTIL

5 waves down from Nov 15 2017 to Feb 9 2018

Approx 3 months to complete the wave count

.382 times 3 months = 1.14 months

.786 times 3 months = 2.358 months

my own cycles give general strength into aug sept

the cycle low due june 6 ill follow up on later

$HUI starting to look bullish ( bottoming )

DIOD

upside target 48.97 vs todays close at 30.44

48.97 is a triangle measured objective

any move above there targets much higher prices.

Cycle low still due jan 2019

$tran still has a sitting upside target of 11944 ( 12,000 )

favor the cycle low now as well as jan 2019 for buying opportunities

yet sector is select and i dont have it pinned down .

prefer gold and silver stocks despite a bullish us dollar outlook

hedged or plane nervous im not sure of yet thats what i see.

untill next time 🙂

hui more bullish than xau

its a toss up between the index’s

just looking big picture at the moment

Running Triangle starting to show up as possible

in stock index’s

week of 8 31 2018 XOM completed point 28 of a 3 peaks domed house pattern

the recent lows at 72.15 may hold for a while and price should now rise

up towards 95.55 or higher from presently 74.87 this should give underlying

strength to stock index

general reprieve to be expects with higher prices to be expected but not

new all time highs

Today is April 5. Just a reminder. Stay safe. https://worldcyclesinstitute.com/finishing-the-fourth/#comment-29266

Liz H,

Thanks for reminding us of that correlation.

ED

Now mind you i did do a bit of creative calculations yet showing the 2.2 to 3.2

extensions in some of the ways i use them.

My bias out of this cluttered chart is a general uptrend to at least 25613 bases the YM dow futures yet ideally a move to just above 25813 is required to have

this wave count correct and true to form. Note the 2.2 extension up at the 24901 level. if this is correct that target should get hit next week ( fairly quick )

Key support : the 2.2 extension at 23947 .

Extreme support i can allow for : 23211 yet the 23671 level is where the rubber

meets the road and a break below would target the 23211 level. doing this would also imply something else other than the general theme i have layed out .

Above 23947 bullish , 23671 caution .

upside : 25813 .

Let the market prove or fail that’s what i see over the next few weeks .

https://imgur.com/KKwD6w6

Joe,

Thanks for the update! I will need to find my “thinking cap” before even beginning to attempt to understand your post. I am assuming a close below 23000 is bearish and the current levels should be treated as bullish.

Last link on the 2.2 and 3.2 extensions

https://imgur.com/C2H1unA

final thought

giving the dow atleast 1 month into may 7th

to run higher .

https://imgur.com/wY98bgy

Peter T

id wish to have an elliot wave argument for a leading diagonal wave 1

and admit it is extremely rare and some claim they don’t exist some say they do.

Daily chart of the $UTIL Index began the sell off in the index’s yet the Dow peaked

at wave 4 to the downside vs the UTIL. to date having bought the UTIL at the dow peak and had sold the dow you did very well.

The chart i have labeled shows both labeling in the broad sense . 5 waves

down over 57 Trading days ( typical is 39-41 trade days ( Think DOW and 51 Trade days , 57 a bit long yet not outside the typical )

my argument though is the THEORY of a leading diagonal and why it matters

right now today in regards to the $UTIL index .

Under the theory as i understand it a wave 2 goes back to the previous wave 2

the initial wave 1 being a leading diagonal

wave 1 a b c 2 i ii iii iv v3 4 5 and so on as you know.

anyways based on either wave count the wave 2 if using the theory of a leading diagonal stands at 756.22 on Dec 15, wave 1 ending ( leading diagonal ) wave 2

ended dec 15th . then wave 3 . wave 2 of that leading diagonal was that dec 15 high , My argument being a .886 retrace back to 763.86 would be steep the 756.22 should be expected if it was a True Leading Diagonal .

Anyways worth an observation at this point yet later in the year its going to matter no doubt .

chart ;

daily util index

who knows might be completely off base yet the wave count seen in hindsight

will at some point come 🙂

https://imgur.com/CGHaNxW

yeah, looks like one to me.

Peter T

My final argument of the leading diagonal on the UTIL

i have mentioned the 2.2 and 3.2 extensions yet no body uses them

( prob shouldn’t be posting this )

Yet here it is textbook and somewhat real time .

just saying the math fits the wave count so its got some validity .

ED

this is what i was getting to on the 2.2 and 3.2 extensions

also why i say it shows up alot in deep declines

https://imgur.com/1QQe7re

Joe,

Thanks for the further explanation on everything especially the extensions.

Pivot on dow emini adjusted from 23947 to 23945-23961 Range Pivot and we closed

Below the pivot . A break back above the pivot range is required by next week in order to consider this past week is a bottoming week among-st the april 4 Th Day .

If Range is Up then buying below the pivot range with your own style stops would be required to get LONG ! .

Be careful if Short is all im saying .

Enjoy the weekend .

A new post is live at: https://worldcyclesinstitute.com/the-fourth-wave-triangle-warning/

Odd math :

2.2 Break Down

2.2-1.618=.582 ( not far from the .618 )

sq rt of .582 = .762

Hence an extension added to the 1.618 fib

3.2 Break Down

1.618 + 1.618 = 3.236 ( The 3.2 )

There was a method to the madness .

Last Rule :

You break below the 1.618 ext you target the 2.2 ( The 2.2 becomes the Pivot Always ! )

Breaking below the 3.2 is ugly yet becomes the next pivot down the road since

it would be from near extreme levels .

The 5.618 Ext does also show up in minor charts ( short term time frames )

For the most part the 3.2 Holds ….

Strong Retraces act like mini crashes , cant say all extensions for for both

bullish and bearish moves yet i watch them anyways .

The stock market has become like the commodity Market …

Yeah …..Yohooo oh know yippeeee

Lucy, You have some splainin to do …………

Aug Sept next bear cycle within a bear cycle kicks in .

June 6 shows up as a swing low of a Triangular pattern at which Point

the June 6th date would be near Wave E

A June 6th Low In this manner would target a mid august to Sept 9th Top

followed be a very steep Decline ( those Old 2.2 and 3.2 extensions still matter )

Yet more can be Added with more data .

Fib

2 3 5

2.2, 3.2,,,5.618 ect……..

Hey Joe,

There’s a new post out tonight. Don’t want all these comments to get “lost.”

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.