We Wait …

Last week, I noted that “the ducks were all lined up” for a turn to the downside. These “ducks” are all the assets I cover on a daily basis.

But stubbornly, my ducks have not budged. They have been moving sideways this week in what might be a final contracting triangle. We don’t have a complete E wave in place for that triangle, so I can’t be sure it actually is one … until we drop down one more time to the lower trendline.

In any case, we need a new high before getting excited that this rally is done.

We wait.

In my experience, one of the biggest psychological fights traders have to deal with is FOMO — the fear of missing out — in other words, sitting on your hands and waiting for the set up.

Resisting “being in the game” is an extremely important part of being successful as a trader. It’s why I continually point to the Elliott Wave entry methodology as the least risky way to enter a trade: You wait to see a first wave of five waves, and only enter after a turn of corrective second wave (which has to retrace that first wave at least 62%, and then turn back in the direction of the first wave).

You lose very little of the trade (in fact, only 38% of the movement of the first wave) and it provides a relatively obvious point at which to place a stop. The most important benefit of this methodology is that it keeps you out of the fray of picking tops, which are notoriously difficult to enter safely (because it’s mostly guesswork — there are few signposts to go by). Picking top and bottoms is the way most people lose money.

So, it might hurt your brain to sit on your hands, but the payoff is well worth the struggle.

This ten week rally is a good example. People may not like the fact that I’ve been advocating not trading this countertrend move up. The reason is that corrective waves can travel farther than you have funds. From an Elliott Wave perspective, corrective waves are the most difficult waves to attempt to predict the end of, because they can be complex and have many possible points from which to measure a typical fibonacci turn point).

Corrective waves as part of a fourth wave (the corrective pattern that is the most dangerous one of all, because the bulls and bears are usually very closely matched) can be volatile, and patterns can easily morph into other patterns just when you think you’ve got it all figured out. In other words, the options for turns are more plentiful than just about any other pattern.

Staying out of a corrective wave for ten weeks might be difficult, but the larger payoff comes in multiple forms:

- you don’t waste your time watching every tick looking for an entry

- you fork over much less in trading fees (compared with day-traders)

- you know that a corrective wave has to completely retrace, so this gives you a relatively reliable target for an exit

- you experience far greater losses and longer trade runs

It’s a fight against human nature. FOMO is a very powerful force. The best way to combat it is to have a system and to stick to it. And when there simply aren’t any reliable setups, it’s much healthier to go fishing, or sailing, or skiing, or whatever your passion is … away from the market.

A Recap of Where We Are

This week, as has been the case for the past few weeks, it’s the US dollar that’s the asset to watch. It’s retraced 62% of the previous wave up, as I predicted it would. We now turned back up, but I expect a retrace of the 96 level. When it crosses that line and turns back up again, everything else should turn with it (USD currencies, all US equities’ indices, oil, and most likely silver and gold).

The “indicator” ducks that are all lined up are:

- market sentiment

- volume

- the EW count generally

- the ending diagonals in multiple assets (and asset classes)

- the time vs. percentage of retrace of this corrective wave up

Even though I’ve talked about all of these in previous posts (as we’ve waiting for this monster), here’s a brief summary.

Market Sentiment is at bullish extremes. You can get a bit more information at to the extreme levels by visiting this site.

Volume in emini futures is ridiculously low and it seems to market could collapse through lack of interest.

The EW count in the US indices is an ABC corrective wave, with the C wave having a full extended five waves in its count. Five waves requires a retrace – it represents a full count.

There are ending diagonals in WTI Oil, emini futures, the SP500, and USDCAD. Ending diagonals are ending patterns that forecast a dramatic turn and imminent trend change.

In terms of time, the corrective rally has now retraced roughly 75% of the previous 12 week drop to the Dec. 26 low. A 75% time expectation of the wave down would suggest about 9 weeks for the rally duration. We’re at nine and a half weeks this weekend. Ten weeks exactly takes us to Wednesday, March 6. It’s also a New Moon, and there’s talk of a US/China trade deal being signed on that date.

However, I’d sit on your hands and wait for a first and second combination before thinking that the turn is in. As I often say,

“Trade what you see, not what you think.”

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

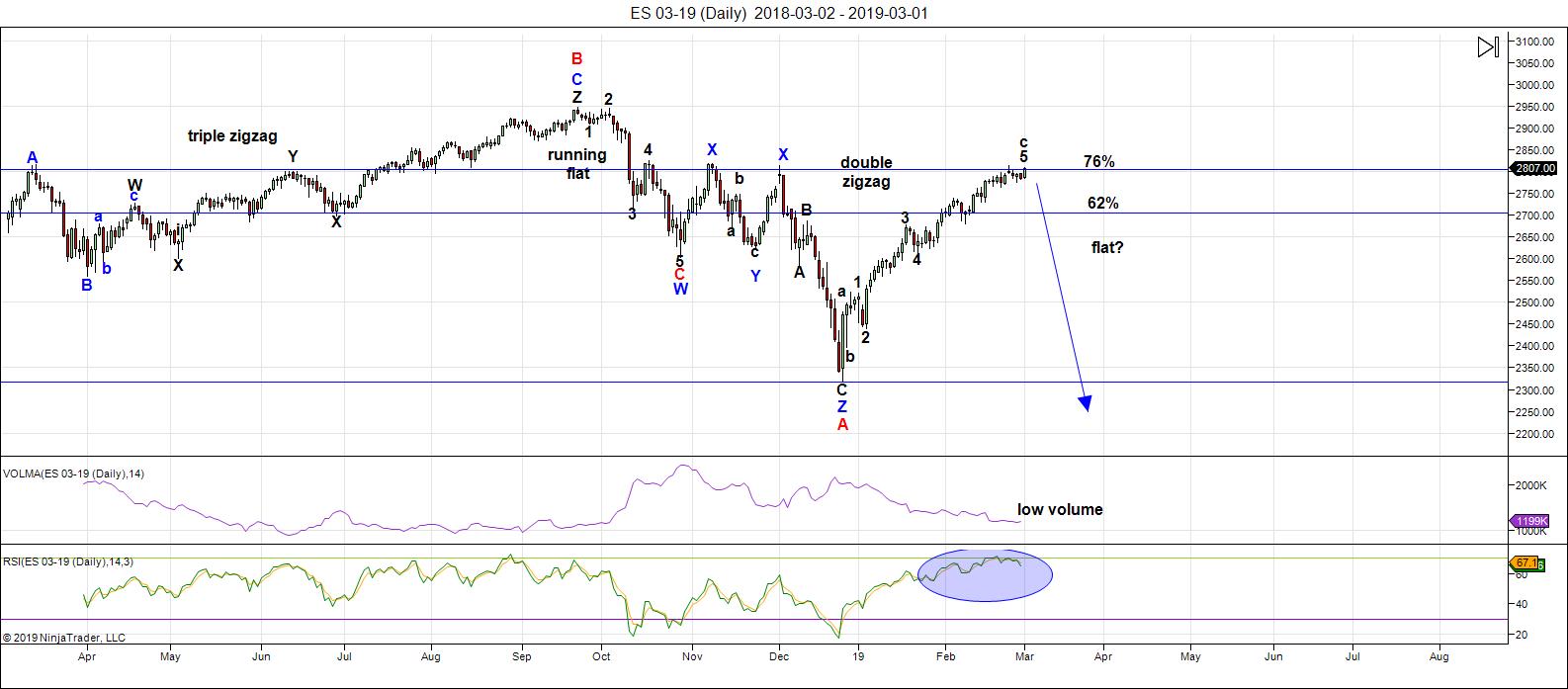

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Very little has changed in the past week. We're still sitting at the top of a B wave that's now risen to about the 76% level of the height of the previous set of waves down from the all-time high at October 3, 2018. Almost all the other assets I cover on a daily basis are hovering at inflection points. The "greed factor" is at an extreme; volume is at a low. It's past time to look for a turn down in a continuation of the larger fourth wave.

Towards the end of last week, it became obvious that both the SP500 and ES (emini futures) were tracing out a possible contracting triangle — they've both being going sideways for over a week. NQ appears to be at the top of an ending diagonal. Both of these patterns signal an imminent trend change.

As I've been saying, the wave from Dec. 26 is clearly corrective and, as a result, must fully retrace. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX and other international exchanges.

There is a new moon on Wednesday, March 6, which is also apparently the day the US/China trade deal will be paraded in front of the public. This particular new moon has been described to me as a "hot mess," which is what we might also get as the core of the trade deal. So, between now and Wednesday offers a timeframe and a set of circumstances that points to a forming top.

Summary: My preference is for a dramatic drop in a C wave to a new low that should begin this week. The culmination of this drop should mark the bottom of large fourth wave in progress since January 29, 2018 - over a full year of Hell. It may be a dramatic drop that lasts multiple months, and will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 6 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Hi Peter and friends

attached is the energy chart for this week

Note: this chart tracks the ebb and flow of energy hitting the planet

it’s not a stock chart. Use it as a guide for weekly market flow

not detailed daily movement. I use special daily energy charts for that kind

of detailed movement. Last weeks energy chart played out very nicely with the market’s overall move

https://ibb.co/wSWR0Sb

click on the GIF button

Thank you Tom. Is this chart implying sideways movement until Friday then a big drop?

when you see a flat line on the energy chart it means the day will most likely end flat but it doesn’t mean the market will move sideways. You might get a big move up in the morning only to retrace all the gains to finish flat. The chart tells me this week peaks Wed and then moves downward but the drop on Friday is not a shoe in cause the FED watches the same charts and I’ve seen them invert those down days many times, so be careful. Monday and Tuesday appear as big up days for the following week so this thing may still have legs. Maybe China drops tariffs announcement on the weekend?

Shorts may need to “Duck” for cover!

Tom,

Thank you most kindly for making your energy charts available. Very helpful BTW. My studies have taken me away from the daily ebbs and flows of Mr. Market. I’m hoping to free up some time in the near future to trade again. Do you make the daily ones available too?

TIA

Professor Hawk

thanks hawk

I have posted daily charts

on occasion when I see something interesting

and a warning post needed

next week is looking like that

Hi Tom.

Why is it that so few accept what you said about FED ambushing traders?

Man I have seen this happen SO many times that I can only conclude folk who deny it are not really paying attention.

They absolutely look at market patterns and reverse price at critical junctures…you simply cannot miss it if you are paying attention!

I appreciate these weekend updates as they gives me..an alternate point..a…view..

imma jus not seein da bearishness.. all hands on deck mateys!

Imma in da game so to speak and expect a push at 2900 on S&P this week.. U gents heard it here 1st!

Imma fully locked & loaded as they say. Will see if my count or SIR PETERS is correct..my guess is I will be correct on this being the 5th wave.

However..a break below 2600 would throw out my count.

Thx SIR PETER..you usually beat me..but imma thinking ur count maybe off? Only time will tell.. Hardy har ha!

Charles,

You need to check out Peter’s chart show. He has been highlighting all the bearish signals. Ignore at your own peril! Peter spends many hours going through these markets and his count has been amazingly accurate over the years. He has called many tops and bottoms. Be careful because the turn down could be quick and furious. You have been warned.

– Milo

IMHO, the market waves up imply they are going to a new high above 2940. I think that the China Trade Deal which is not baked into the current market price could take it there. How quickly is the only question in my mind. Though I’m not as bullish as Charles, most of the EW counts I have seen show this as a 5th wave up with the 4th ending in Dec (a bear with in a bull market so to speak). The bearish trend looks like it has ended and a lot of foreign capital is piling into the US. Once a trade deal with China is finalized, we could get a major 5-7% spike over a few days to a week. That should be the final wave up before we get a minor correction. That’s how I’m playing it. Still thinking the market rally this year will be similar to 2017 with a 30%+ year over year return. This also tends to be the most bullish year in the presidential cycle. Next year, watch out!

I’m with Milo. All signs show a turn to the downside is imminent. The SPX might have a little more upside, but this rally looks long in the tooth. Peter is an amazing chartist! Trust his big picture analysis. I bet there’s a turn down sometime this week.

Thanks, Matthew!

stock futures exploding higher. Charles will be laughing with his profits. I remain on the sidelines waiting for the turn down.

Charles,

I’m amused at your optimism but since you threw out numbers here, out of curiosity I decided to look back and see how accurate your price targets short-term or medium-term.

On October 1st, your targets were dow 27.5k, spx 3020, ndx 7900, russell 1750. https://worldcyclesinstitute.com/tick-tock-a-top-is-near/comment-page-1/#comment-33134

Listed below the highs since then and well you know…what happened next.

Oct. 1 high

spx 2937

ndx 7700

djia 26951

rut 1703

oct. 3 high

spx 2940

But cheers to your 2900 spx calls. Which expiry dates did you pick for this target?

Liz why engage with the troll? You pointed out he is trying to ruin this website with his pointless calls so don’t give him the satisfaction of attention. He clearly doesn’t make enough $ to become a premium member so why believe Charles? Peter are you going to take any action to ban this troll from your site?

Jealousy is not a good trait Q..you landlubber

Why are you calling to ban someone who has been fairly accurate? He never is disrespectful and follows EW. His count may just be different than yours.

While I don’t always agree with Charles’ bullishness but his track record is decent. If you don’t like his comments, why not just ignore them?

Apologies everyone. Charles is a genius. The best EW analyst in the business who has very opposing views to Peter T. Let’s all follow Charles then who is always around when the markets go up and disappears when the market goes down. Lol can’t believe you defend him so much when my grandma could be as accurate as him by saying buy every dip. Challenge for Charles. When the market next has a correction please forecast the level to which it will drop and your reasoning behind it.

Mr Q..ive alread told you..well in advance..my targets. I dont claim 2 b the best Ew analyst..jus some1 good at forecastin market moves..a market prophet..ha!

I said this is the 1st of the 5th wave up..my target has been a min of 2820..but suspect it could go as high as 3020 before the 2nd of the 5th comes in roaring like a lion.

Then i use fib ratios..2nd wave should be a 38%er..if 2813 was high..dont think it is..but if that holds then min retrace should b 177 points..down to 2635. Doesnt take a rocket scientist..and YES..imma smarter than ur grandmother..Hardy har ha!

“2nd wave should be a 38%er” Don’t know where you get that idea. It’s neither a rule nor a guideline and in fact, is never true.

No guarantees SIR PETER on a 2nd wave..but my best estimate is a healthy retrace in the 2nd of the 5th..i would anticipate at least a 38% retrace of this larger wave up..

With todays 2816 spx high..its moved 470 points from bottom..so imma expecting at least a 38% retrace which is about 178 points..2nd wave should get down to 2637 or lower if my calculations are correct.

I currently now have a stop around 2750 on my S&P long positions..still targeting new high before new low..but playing it a lil safer..given the large run up.

You have to look further back..in apr & may 2018..

every1 was saying S&P..had already topped in feb 2018..i said no that wasnt top and new highs were coming in 3rd wave. Peeps doubted me..my target was 3020 for wave 3..which fell short by 80 or so points..

but i was in @ apr lows around 2550 and made almost 400 points.

Then I said 4th wave was coming if drop below 2800..Said target was 2400..Was off by 60 points..made almost 400 points on downdraft..

Now imma saying this is 5th wave and new highs will hit before new lows..Target for 1st wave of 5th is 3k. Maybe it now hits my 3020 target but the 4th wave is done. Thats me point me hardies!

Heres some evidence on my genius work.. where i called da highs in advance

https://worldcyclesinstitute.com/september-should-be-interesting/

I can’t discount Charles because I actually felt Jan. 22 was the best low to get in if you didn’t catch the late December low. Every dip was getting bought because as Peter T said FOMO is alive and kicking. Just check out Boeing daily chart and for intra-day action, when SQ gapped down, I threw calls on it too as soon as it stabilized. I was out by noon but the fomo crowd still pushed it higher.

I agree Liz. I doubted Charles when he said the S&P would make new highs back this summer and everyone else I was reading said the market already topped. He was right on back then!

Thx Ms Liz for the vote of confidence..

i always say..a market that refuses 2 go down is a bull market..

thats what we are seeing..market shrugging off bad news & embracing good..is a new bull cycle..sharp rally off dec lows and cut through resistance like a knife thru butter..that tells me the 4th wave is dead on arrival..Long live da bulls!

In fairness to Charles, that comment in October was after the S&P had already hit new highs, which I know for a fact, he had called the highs well in advance.

I was following this blog this past summer and Charles kept saying “a new high was on the way” which meant a high above the February 2018 highs. Mostly everyone joked at him back then. I do know once the high was hit, he kept extending the targets as the waves grew longer.

But I did see him calling a new high, then 2900s, then 3000. I remember clearly because I was surprised on how he called it when no one else that I follow was saying we’d hit a new high.

Yes, I saw Charles’ comments on the new highs this summer too.

Personally I thought he was crazy. He’s one hell of a bull but he was right. Hope he’s not right this go around because I’ve been short since 2700 in quite a few pioneer trades. 2830 is my maximum pain threshold so I may jump on the bull train if we get above that level.

Here we go again with Mr. Lloyd’s crazy bull calls. You can swap the “c” with a “b” too. Lol. I have to admit, part of me sometimes agrees with him. I’m very optimistic by nature and use EW in an attempt to minimize my natural biases in trading. Charles has been right many a times (often enough to earn my respect).

No crazy here..jus a un poco loco..hardy har ha.

Imma jus calling it like I see it..i personally think SIR Peters count is off..i suspect when we hit the new high above 2940..he will see what imma seeing. Time will tell which of us gents get that gold star from ur class Prof Hawk.

From the way I see it, Charles is just being a momentum follower, not a forecaster. He wasn’t on this blog at 2350 or 2450 or 2650 or 2750 posting every day. He is here right now AFTER the market has already rallied 20% calling for further rallies. Momentum following methods will never look for a turn – they will assume the current trend will continue till a trend line is broken. Its a fine method and has been a money making tool for many, but then you have to be able to trade the last part of a move to make most of your money. Trying to fit his forecast into an Elliot framework is futile. I thought I could learn something from his ideas, but have given up and read his comments as those coming from a trend following model.

Nicely explained Vivek. Thats exactly what Charles is doing which is fine if it works for him. But this site is for EW theory and finding turns which as you rightly say cant be done with momentum theory. Maybe as we turn down with the huge bearish divergences we have Charles will dissappear and come back at the end of the drop chasing the momentum lower but my feeling is he only chases momentum to the upside. Based on what is about to happen over the next few years Charles will need to identify when to go long earlier as the rallies will be more and more short lived.

Q..i use EW & momo combined..i think were in the 5th wave..SIR PETER has spx in 4th..we shall see whos correct. i respect EW theory but believe many get count incorrect.

My theory is SIR PETERS count is off.

I mainly day trade..with some longer term options in the direction of my choice..today i owned puts and calls..with todays exp..and made $ on both sides..

If you look carefully, there is a plethora of bearish divergences in this market.

Momentum indicators in particular are flashing red. I think this market will vist 2000 before it does 3000.

Just one trader’s perspective. Risk reward analysis under such a scenario is a no-brainer.

Bulls make money, bears make money…etc., etc…

Lowered cost basis on this morning’s gap up. Will add to position on any move higher.

Slightly in the green… 🙂

Verne you nailed the turn again! Charles are you still buying this dip? I think you said a move below 2600 S&P invalidates your super uber bull theory so we are not there yet

It came really close Q.

2820 was my mental line in the sand and I got really nervous when ES crossed the 2019 thresh-hold overnight!

Hell yeh! Bought 2775 calls today & doubled my $

There is nothing wrong with Charles’ apporoach.

Some of the most explosive gains you will ever see is in trading counter- trend moves. That is clearly demonstrated by the move off the December lows. The danger of course, is when counter-trend trades over-stay their welcome. That is when COMPETENT T.A. will keep you out of trouble, and on the right side of the primary trend.

Thx..Mr Verne..ur one heck of a trader too! Imma playing both sides. Had some daily puts at open and made a bit but really made coin on buying the dip!

In the end, we are currently due for a correction, volume indicators are pointing to it be it quick and short or a more long..in near term..

And Oil is definitely ready for a turn… I think saving a good chunk to wait for that will be worth the wait..as Peter says ..

I don’t think it matters who is right or wrong..we are all doing the same ..lets just support each other.. !! It’s a great group blog..and appreciated they are hard to find!!

Perhaps canaries in the coal mine. SPLK and WDAY just broke uptrend lines from late December lows.

Voice of reason. I have never quite understood the adversarial posture you so often see on some public forums. We all share the same objective, and that is executing PROFITABLE trades, whatever side of the market we are trading.

As to the size of the upcoming correction, the indicators I am looking at are quite frankly showing steeper bearish divergences than at the 2018 highs. That of course is alone not necessarily conclusive, but I suspect the move down is going to exceed the expectation of the herd.

BOO-YAH!!!! 😁😁😁😁😁

A drop like this on pending China news and out of the blue. A very valid reason for the start of the drop Peter has expected. Need to remember next time to wait for things to get very bullish before the market really tops.

Rolling out 280 SPY puts to 277 strikes….

I bought some SPX 2775 calls and doubled my moola.

The drop has nothing to do with fake China news story. Today’s energy chart paints the real story. Tomorrow is going to be wild folks!

https://ibb.co/zx1hbmd

What does tomorrow’s chart look like?

wild!

Wednesday, March 6 is a PD-1 pivot date…be ready!

https://worldcyclesinstitute.com/the-ducks-are-lined-up/comment-page-1/#comment-36627

Tom.. do you mind explaining a little when I see the first energy chart you put up it showed energy as flat through the sixth..and you explained that this means it could be a flat range day..

the recent one you just posted showed the energy dip intra day today..but I don’t see how you read that tomorrow will be a wild day especially with the original chart posted earlier.. can you show me how to interpret that..or what you expect when you say wild day?

the weekly chart is very general Marie. It’s like looking at a mountain range from a great distance. The daily energy chart is more detailed, it’s like you’re on the mountain trail it’self. Macro vs Micro. If you saw tomorrow’s chart you would understand why I’m saying it will be a wild day. The energy impact tomorrow is greater than today, so depending how the FED plays it? it will be a big high day or a bigger drop than today. I will know better after the open the path they will take.

Bought the dippidy dip dip today..cha ching cha ching!

interesting that you made the post after the market bounced…I don’t believe anything you post…you are just another troll!

i watch the 5 min charts & clear buy signal @ 120pm 2775 spx..go see for ur self!

My trading is all based on 10 day..&..20 day smas along with crossovers..

I have spilled da beans on my trading strategy long..long ago!

Long = SPX above 10day and 20day & 10day above 20day

Short= SPX below 10day and 20day & 10day below 20day

Then i use profit targets of 25..50..75..and 100% based on support & resistance trend lines of previous 10 trading days.

Also use bollinger bands..rsi..macd..and full stochastics along with able trend fractals to get complete picture & setups.. just cuz ur not making money doesnt mean u can call me a troll.

That’s better. Explain why you bought or sold on every post you make highlighting the key levels and it’s easy for us to understand why you placed a trade. Purely stating you keep buying the dip is pointless without the backup. Some posts in real time are required to prove your credibility. One issue I have is your trading strategy cannot work with EW so as Peter says please post your alternate wave count. We would all like to know.

Mr Q..my day trades arent as focused on ew but rather a few simple tools any trader can swindle.. if u need my setting lemme know.

..macd

..rsi

..bollinger bands

..10 & 20 da sma

..ao

..full stochastics

i plot em all on 1 chart & wait for ideal setups..its bout 75 to 80% accurate.. most moves are in da 25% 50% or 100% variety..depending on how patient i am. keep losses small & let winners ride.

you don’t know anything about me…however, anyone who regularly reads this public blog knows you are the consummate troll…

well i honestly dont ever see u adding any value here..so imma thinking ur da troll! imma at least giving an alt point a view and alternate wave count.

Charles,

Let me know where your alternate wave count is. I must have missed it. I’d be interested.

your a troll…

you are one of the reasons why some of the previous posters stopped posting…as a result of your nonsense and others like you a back channel (email) has been established…

https://worldcyclesinstitute.com/the-ducks-are-lined-up/#comment-36771

http://tinyurl.com/yxdk2dmb

below is an edited version of an email sent today to an individual who operates a paid trading/subscription service, as well as several other individuals…the prospect of me ever sharing substantive information on public forums is slim to none…

__________________________________________________________________________

From: rotrot

To:

Sent: Monday, March 4, 2019, 11:21 AM EST

Subject: XXXXX xx/xx, 2019

…my ongoing analysis of the data led to a recent discovery of prospective ‘mystery dates’…the ‘pivot dates’ and ‘mystery dates’ are not the same…however, when they fall on the same dates (or close) it is significant…the advantage of the ‘mystery dates’ is polarity (highs and lows)…the next ‘mystery date’ is XXXXX xx, 2019…XXXXX xx, 2019 is both a PD-1 and PD-2 pivot date…the last dual PD-1 and PD-2 pivot date was December 24, 2018 (check my Twitter feed https://twitter.com/allerotrot/status/1087381526705250304)…XXXXX xx/xx, 2019 should mark a significant low…

rotrot – stop entertaining him. Its pretty clear that Charles has never posted a trade in real time. His “buy the dip” post comes AFTER the market has already bounced. And of course he is so good that he can pick the absolute bottom and top in a 24 hour period ! He bought the dip @ 2785 last week when the market was already at 2800. Of course he never mentioned when he took the trade off. Maybe he never did – why would he if he is expecting the move to 3500. I sincerely try to learn from everyone here, but he is one guy I will have to completely ignore from now on.

Vivek, I thought he was a troll too, but he’s been right many times. If you look at the 5-min chart like Charles suggested the 10 and 20 day moving averages seem to do exactly what Charles said. Around 1:30pm EST there was a great buying opportunity for SPX based on what I gather from his methodology. Maybe he can send a real time trade to prove he’s the real deal?

got you thanx…

I really do think that Peter T should not permit us posters, who after all are just guests on his site, to engage in personal attacks on other posters. It really fouls up the atmosphere and drives others away who are interested in simply sharing our strategies with one another. So what if someone chooses to “manufacture” trades, who cares?! There are some sites where the hosts do not even permit specific mention of trades being made. In that regard I appreciate the leeway Peter T has given us as traders to share openly.

PLEASE people!

Don’t F_ _ _ it up!!!! 🙁

I agree Verne. I’ve learned a lot from both you and Charles. Would love to continue to see both of your dialogues and trading strategies.

Verne, we’re trying to learn from each other price-wise and timing-wise. So I find it misleading and dangerous for someone to target spx 2900 this week.

Were those calls closed at open? With due respect, he didn’t call out any bearish signals at start of trading day.

Ms Liz..as ive mentioned on many occasions..my trade strategy is 3..part

1..long..individual stocks like nflx..panw..ttd..cybr..mlnx..veev..xlnx..team that ive owned off & on..for many a moons.

2..long or short 2..3.. month option contracts for..trend trading

3..day trading..using 1..to..3day contracts..can go either direction using charts on a..5min basis..along with 10..and 20 day smas & several tech indicators..

Todays shenanigans included 3 open & closed trades..

a..long at open..stop @ 20day ma..ouch..50% loss!

b..reverse position to short on drop below 20day..moved stop up as momentum gained..100% gain..couldve rode until cross of 10 for MUCH bigger profits..but this pirates not greedy!

c..long on rise back above 10 & 20 day and cross of 10 back over 20 for another 100% gainer..

net 150% gain..

My long calls and stock positions took a small hit today..but not worried!

Sounds like a solid approach. How do you set stops?

Stops are based on 10 & 20 day smas

..i stay long when 10day is above 20day & spx is above 10 & 20

..i stay short when 10 day is below 20day & spx is below 10 & 20

i set target gains @ 25%..50%..or 100% and often move stops up once its cleared levels.

i like looking at past 10 trading days to see pockets of support & resistance.. those mark key levels i use for exits as well. hope dat helps!

I start to get my back up on personal attacks, so let’s please watch our language.

Agree Peter and I apologize for my earlier posts. I just got frustrated that Charles kept posting how his EW count was correct and yours wrong yet he provided no details of his count. Once he shares his count we can debate.

Q,

I can lend you some of my outer skin, if you like (ooo… I know … creepy!). It’s fairly thick at this point …lol.

Imma not saying SIR PETERS count is def wrong..i said we shall soon find out..

My alt spx count is..

Wave 3 topped @2940..

Wave 4 bottomed @ 2346..

Wave 5 started @ 2346 and going to new high above 2940..

SIR PETER has amazing track record..so i wouldnt be SURPRISED if he out loots me..but my trading strategy is reflected in my alt wave count and has snatched me some dang good booty so far..

Thanks for sharing that Charles. I have seen some other EWers with a similar count. I guess as long as you are making money then it’s working for you.

Charles,

That isn’t a count. You would need to provide a chart. You’re obviously missing waves.

How do u upload a chart SIR PETER?

Today was not about some fake China trade story

what a joke the media are

today was about a strong surge of energy from the Sun

because of a very large coronal hole that was earth facing 2 days ago

the large energy surge has a negative or opposite affect on markets

see the result of the chart I posted earlier today

the blue spikes down match the drops in the market

no China involved it was all Mr. Sun

https://ibb.co/3y2pB8z

picture of the very large coronal hole shown in link below

https://ibb.co/8798h0G

This is a..good..count IMHO which lines up with my trading outlook..

https://www.tradingview.com/chart/SPX/3iYqvWz5-SPX-Elliott-Wave-Count-2009-to-2018/

Showing 3rd wave..ending oct 2018

4th wave…ending dec 2018

Currently in 5th wave up beginning..with bottom in dec 2018.

That is an impulsive wave up from 2009. Peter has got it as a corrective ABC. The count you follow couldn’t be any more different to Peters lol. I like how you just sent a link to someone else’s count. Do you have your own or do you just browse the internet for counts that fit your momentum trading strategy?

just sent an email to Mark Rivest with a link to the post on this public blog…

Charles ….

Seriously?? You know, or you should know by now, that Elliott Wave is not one of those sciences (if there are any) where you are encouraged to pay absolutely no attention to the rules. This count is crap; it makes no sense. This stuff just makes my blood boil.

So, you’ve proven you know little about Elliott Wave. I personally don’t know how you have the gall to criticize my count if you post something like this and tell me it’s a “good” count.

We’re not even talking about the wave up from 2009. We’re talking about the B wave (or a first wave, as you think it is) up from Dec 26 of this year.

Just as an example, on the chart you posted, you don’t have a valid second wave. You yourself stated that a second wave must retrace at least 38%. Well, there isn’t one on this chart that meets that erroneous criterium. So, you don’t have a valid second wave, nor, in fact, a valid fourth wave and yet it’s marked as a set of impulsive waves up. Go figure! And that’s just for starters. Here’s a more realistic version that adheres to the rules. https://worldcyclesinstitute.com/elliott-wave-the-long-term-corrective-scenario/

Thx..for the criticism..and points to consider..well noted! As ive mentioned i use ew for trends and try to take into account many ew analysts. Yours have been most accurate.. my charting & forecasting are a combination of ew..and tech..analysis.

I havent criticized ur counts..said maybe they are wrong..maybe right..

time will tell! i even pointed out i wont b surprised if ur count is better than the one ive been using. That chart i posted was one close to mine..i dunno how to upload charts.

EW is just one of the systems i use..whether ur count is right or the general one imma following is correct..you can still make $. Theres been a 400 point move up..whether its corrective or not..both camps can make money if they went long off dec lows. imma trader and dont care which direction i go..i follow trends & use ew and tech analysis to get high prob set ups. didnt mean to offend..but a good lesson on some ew basics..imma more of a big pic kinda guy.

FWIW, a few months back Charles and I made a number of trades in real time over several days and we posted what we bought and sold and when, and how much we paid, as well as what we sold for. He is actually one of very few who has ever done that on the site and he has explained his system in detail in the past. In my humble opinion the man is a real trader.

The intetesting thing is that his trades were mostly bullish, and mine mostly bearish, but we both made money, an impirtant lesson in itself….

Thx Mr Verne..yes its often times difficult for me to post my trades live because imma trading. When i come up 2 breathe is when i often post and yes after fact but i explain what i did.

Today

1..went short @ 2788 on drop below 10 and 20..sold for a quick 25%..5 point SPX move

2..went long @ 2788 a little after 11am with cross above 10 & 20..and macd cross..and 10 back above 20..sold at 2792 for 7 points and 50% spx gain on cross back below 10day..at 1150am

Short now @ 2790 on drop back below 10 & 20 day ma.

Fill was..6.20..open order to sell @ 7.75

Filled at 7.80 for quick 25%

Now have a cross of 10day below 20day so could be bigger move to downside..

If short..stop would be @ cross around 2792

SPX poked back above the 20 day..stochastics turned up..so my 25% gain was about the best i coulda done in that cycle.. still flat

Long 2795 calls @ 6 on break above 10 & 20..macd crossover & stochastics turned up..sell order @ +25%.. 7.5 target.

Stop @ 2792

Moved stop up to $7

Theres..7.50..out for 25% gain

Theres 4 of my trades..2 live..and 2 with set ups used..showing you my process..up 125% on day.

All on 2 day contracts..i like 1..2..3 day max contracts on spx..try to keep buy price in $4 to $8 range..look for 2-5 point moves which can be 25%..then if all indicators line up..will shoot for bigger gains..usually in am.. will move stops up to protect gains.

most losses are 50%..or less

win 3 outta every 4 and ur in business..racking up some big booty!

Also..most contracts are at $..or slightly in or slighly outta $..all depends on delta & price.

Wow, quite remarkable Charles!

I followed along with you. Wish I had joined you in the buying and selling. LOL! I will be studying your methods and hoping to see if I can grasp it. How long have you been at this?

well over 40yrs..young gunslinger!

LOL!!! If 63 is young, I will take it!

Move down yesterday looks impulsive.

I don’t like the time relationship of what should be a second wave at this degree of trend change.

I was expecting a 5,3,5 upward correction but the look and duration now seems off.

What do you guys think?

Some EW folk are calling this move down an on-going fourth of five in an incomplete c of B up, with a fifth up now underway.

Problem for me iis move up also looks corrective, although now imho too long in ES.

Banksters at work, mucking up the patterns? 😠

2799 is 62% retrace. 2808 is 78% retrace of the move. I am adding to shorts with 2820 as stop. I am not very good with the absolute last few squiggles of a large move. So I stick to simple rules. This one seems like a reasonable risk reward. The drop yesterday broke at least one of the trend lines I was following. The more important trend line is still in place. Will be more comfortable with the short once that is broken

Yep. Looking for a break of yesterday’s lows.

Peter T – I finally got a free hour and wanted to go through your last week’s chart show. The website took me to the registration page for tomorrow’s chart show. Any way that I can view last week’s ?

Verne I have the pattern three ways..for DOW

either (5) complete and that was wave 1 down and now in in 2 up.we will know in the next couple of days how that holds

Could be a C down.. from A of Dec 24, B of Feb 25 and this a C down

and last but not least a till possible last leg of 5 up..and this is a wave 4 correction..

Hi Marie.

I am inclined to go with the last option. For either the start of a third or C wave down, there is a glaring lack of downside momentum, always a red flag for immediate bearish counts. I suspect we are consolidating in some kind of fourth and have one more push higher to go, perhaps even after one more head-fake spike down. For a trend change at this degree, VIX should be headed straight North and that just isn’t happening.

after further reflection..i concede SIR PETERS count is prob better than the one imma using..however im still bullish in trend but heeding his warning that this maybe..a b wave. tight stops on my longer term trades. who says u cant teach an old dog new tricks? 😉

also i have been meaning to mention..Joe you had posted a while back about the Saturn -Pluto conjunction on January 12, 2020..I didn’t know if you also new Martin Armstrong has January 18, 2020 as a large global turn date..

Rotrot

that chat f mystery dates was had to read the entire graph in the back ground.

that looked like the benner business cycle chart. Having back tested that

Ill say it must be expected yet I have also been looking at an altered chart

of this which leaves this year with a bullish bias yet calls for a multi year high this year . honestly I don’t know which is correct.

Charles Lloyd

I agree with the bullish bias just not at this time .

if the top is not in as of yet it should be with in the next 10 trade days .

im calling for a mid march low yet im targeting an early April low.

if mid march a high then an early April low

if the top is now already in then a mid march low .

the may 26- june 3rd is the most important time fame and is fixed .

as I see it : march 5-6 is now then march 15 ish then early April.

early April is a flexible date and can be a high or a low

The odds say a high now and a low in mid march and then a high in early april .

the rare yet possible ( I doubt this ) higher into mid march hen down into early April

So I trade with the mindset of an April low yet if the low comes in mid march ill take it .

I think ultimately that the jan 22 lows should get tested between now and late may . beyond that , im not all that bearish .

Basically Next week should be a down week .

staying short term bearish .

coffee on keyboard and cant type .

I have not yet taken the bearish trade im looking for yet this bounce is my interest . a new high is fine but I must see and want to be in for next weeks down move ( my trading mind you so please do you own research )

Great info..joe..you rock!

Imma keeping my long trades on short leash..will sell next 1/4.. @2820 if we hit..already locked in big gains on 1st half of trade..free $ at this point..

You’ve gotta love trading with “house money”…

the banner on my Twitter feed is the Benner Fibonacci Cycle…there is no chart for the ‘mystery dates’…the posted link was to a series of Tweets relative to ‘pivot dates’…

Marie

I am aware of Martin Armstrongs early jan 2020 date .

the jan 10 2020 date is going to matter yet I have not nailed

it all down at this point.

this will sound off bases yet im beginning to think the year of 2020 will

produce both an important high as well as an important low .

Big Swings ill just say .

I can make the case jan 10 2020 is a vey important high yet there is more work to be done and a few things in the mix that don’t add up . not convinced jan 10 2020 is a major date at this point .

“XXXXX xx/xx, 2019 should mark a significant low”…expect a high during the week of January 13, 2020…however, it will likely be lower (likely much lower) than any high made during 2019…

Martin seems to be 50/50 on his dates. As I recall, he had some big predictions a few years ago he said would be very major, that didn’t really pan out.

How has his track record been? I saw his movie a few years back and thought it was quite entertaining, but something in my gut just didn’t trust him. Maybe it was him being jailed that scared me away LOL.

Something has happened to Marty Armstrong and I am quite sure what.

He is one of the smartest guys on the planet, but I have been hearing him say some things lately that have me scratching my head. For example he called this ramp higher “short-covering” and “foreign inflows” . Eight straight weeks of short covering?! Where are the foreign funds coming from? Are you kidding me??!! I know Marty knows better. I am wondering if his release came with some strings attached. ‘Nuff said!

So far this year Martin A seems to be pretty on target..he actually seems pretty in line with Peter. and a lot of the target dates that people have discussed on this forum.

I am currently trying his new platform..to see if his reversal dates and prices can be combined with Elliot Wave..currently the platform is very confusing and they are still working out many kinks..but interesting..

Eye of the storm? I know some of you follow Randy Phinney rightsideofthechart.com

https://twitter.com/rsotc/status/1103018173664804865?s=21

Randy is a trader’s trader. He tends to be a bit early on his calls, but you can take it to the bank! 🙂

The market is clearly consolidating against a move higher, albeit a probable brief one. I have converted my long puts into bull put debit spreads to catch the move up.

Sold SPY 277, and 278 puts against my 278 and 279 long puts. Bought SPY 280 calls expiring Friday for 0.45 per contract. Will exit short puts and long calls on what I expect will be a move above 2800.00 the next 24 hours.

If we get a dive, which I do NOT expect, I am out of short puts and selling 279 calls

faster than you can say WTF! 🙂

We learn once again that you cannot predict what this market is going to do.

You simply have to trade what you see. Mr. Market is not going to make it easy for anyone….he never does!

Good luck everyone!

Well, I had my conclusion of a move higher challenged by an expert who has (correctly, I might add) pointed out a number of bearish patterns we are currently seeing in the market. Having said that, every trader on the planet has seen over and over again how very bearish set-ups can be negated by sudden buying in these treacherous markets. My thesis continues to be that the steepness of the bearish divergences and the degree of trend change expected for either a C or third down is NOT going to meander….we shall see, and I would be very happy to be proven wrong on this one!

Verne,

Are you currently short? I’ve tried a few times (unsuccessfully I might add) to time this top but it just keeps going higher and higher. I was kind of ready to throw in the towel thinking this somehow might be a new bull cycle, but Peter has kept me off the ledge.

I have hedged my short positions by turning my puts into spreads. In my humble opinion, we do not yet have confirmation of a turn although we do have some bearish signs. Some EW analysts are calling completion of a second wave up today and predicting a third down starting tomorrow and to be honest, the proposef ED does meet all the rules so far as I can tell. My trader’s instinct is more cautious. I offered some reasons above. In addition , VIX is not signaling the start of a strong decline imho.

I have learned over the years that there is a world of difference between analysing the market, and actualy trading it.

Very few do both well, which at first blush might seem ironic, but it is nonetheless my own experience.

I was expecting an up day for sure today. Good ole Mr. Market sure fooled this Aussie. LOL

I agree bout Martin def brilliant..his take is cash inflows will come from Europe as they progressively implode and confidence decreases ..and that the we are currently in consolidation..I look at his thought as same as the same as Peter and EW even though Martin doesn’t use EW…consolidation now..then up..which to me means wave 5 which is in line with the charts…and also Martins view.he does not exclude a possible monetary crash in 2020-2021 as well again in line with views here

He thinks though when the initial push for the Dow and wave 5 up in our terms will external money rather than internal at first

I have never seen..anything written about short coverings in literature I have read..

I imagine we could see foreign inflows as Europe implodes, but Marty has to know that much of the ramp higher in US markets has been due to corporate buybacks, not foreign inflows…

Yet another very slick bear trap being set for the unwary…!

How many times do the banksters have to pull this stunt before traders and analysts get a clue? 😜

Predicting flow of funds is not a simple exercise. I find it a lot easier to follow historical patterns. From what has happened since 1960 (thats where my algo data set starts), we have to assign some probability that wave 4 ended in December. There is of course Peter T’s count of getting another leg on this wave 4, but it is rare for a 20% drop to be retraced 76% and then get a retest. For those looking for a very clean wave 5, I would suggest looking at the rally from late 1998 into March of 2000. That was the last leg up and it is not a pretty looking move. The market went up 30%+ in 2 months from the lows (not unlike what we have seen here). Then went sideways for 10 months and then another 20%+ in 3 months. If that’s what we are up against, we will get multiple 5% moves both up and down and the only way to make money would be to trade that range. 2640 was supposed to be the classical resistance level and I think it should act as strong support now. If that is broken, I will go with Peter T’s count. If not, I will trade the range of about 5-7% with tight stops. As of now, I am short (from 2720, 2760, 2800 and 2790 – all levels mentioned in earlier posts here). Using 2821 as a stop. I was very comfortable being long from 2450 to 2640 zone as almost all historical outcomes were pointing to that bounce. I use 50 hour vs 250 hour moving average to look at 1 hour charts. There is a clear momentum roll over signature there. There was a head-fake at 2640 (the precise level given by historical algos on this indicator around 1/30. Lets see if this pans out. Will post the chart here..

https://invst.ly/a7kx6

Sold my long puts and bought lower strikes, essentially turning my position into a bull put credit spread. Looking for ramp higher into Friday at which time I buy back short puts. A move below the 200 day around 2750 says I am wrong and if that happens I exit short puts for just about break even. Very tricksy market and positions have to be actively defended, bullish or bearish….

“In 321, when, on the 7th of March, Constantine decreed that dies Solis, or “the day of the sun,” should be observed as a universal day of rest.”

Tomorrow, 7th of March 2019, perhaps, peak rest for bulls since March 4 peak. In other words, bulls will step away and more waterfall coming if spx 200sma is breached. Right now bulls are still alive and well pushing up roku and nflx.

I think Charles’ bullishness caused the market to top! LOL

https://worldcyclesinstitute.com/my-dawdling-ducks/comment-page-1/#comment-36810

SPX already broke below Jan. 14 low’s uptrend line.

DJI breached uptrend line from Jan.28 low.

NDX right here at the 1/29 uptrend line.

They have this deceptive habit of allowing just enough bearish signals to entice traders into short trades and then….you know…! 🙂

If you’re uncomfortable shorting then step back. Stay in the sidelines. Cash is a position. Wait for support instead of catching falling knives.

Look for them to just take out Monday’s low with a long shadow….

Sometimes the essence of market timing is very much in the basics. My last post was on Feb 26, and it suggested the possibility a top had been seen based on a very major trendline on a log chart (important that the scale be logarithmic) of SPX from the March 2009 low to the Feb 2016 low. I gave the exact location of that trendline and said we saw a very slight throwover above it on Feb 25 (around 6 S&P points) but the line was of paramount importance to any bearish case. Credit to Verne who immediately agreed with the importance of that log trendline. So far, that high on Feb 25 was the exact high on both the DJIA and the Russell 2000, while SPX snuck in a high 3+ points higher this past Monday, stopping almost exactly at the long term log trendline again (high was 2816.88, log trendline was at exactly 2814.46 on the weekly chart). Mind you, this is a rising trendline so it will continue to rise ad infinitum and could be approached again after a decline. That log trendline should be attributed to Dana Lyons and I did so in my previous post. ALWAYS give atribution when you refer to others’ work… BUT, have fun with this one from Peter Eliades report of a few days ago. Draw a bottoms line on the DJIA from arguably the 2 most important emotional bottoms of the past year or so, 2-9-18 and 12-26-18. Now parallel it off the October 3, 2018 all-time high. The whole dramatic rally from December 26 was stopped virtually exactly in its tracks by that upper parallel line. Do the same thing with the Russell 2000 which often leads the market (or use its ETF, symbol IWM, to replicate it). Draw the same parallel channel but this time use the April 2, 2018 low to the Dec 2018 low and parallel it off the all-time high on Aug 29. Notice the different dates with exactly the same results, tending to lend validity to the analysis. The IWM upper channel saw the rally stop virtually exactly on the upper parallel channel line, also on Feb 25. So far, that’s all you need to know. I can make a case that the all-time highs in 2018 will be the final highs before the enormous bear grabs hold. But if Peter T is right and the market heads to new highs later on this year into 2020, both the Dow and the Russell will first have to break above those declining parallel channels that produced tops on Feb 25. Until and unless that happens, reacquaint yourselves with the bear!… Good luck, all!!

Thanks Peter G!

Knowing the banksters, who are also watching that log trend-line, I expect them to smoke out a few early bears by ramping futures sky high overnight. I will be aggressively shorting any such feint…Hyuk!

Peter G…once again the voice of reason…if you are so inclined, authorize Peter Temple to share your email address with me and I will email you some ‘stuff’ you might find very interesting!

I do hereby authorize it, rotrot…

Just as I was about to write I thought id read the other posts on here.

Peter T , Well put

My guts says wee about to see a head fake .

Not anything to go on as I see it .

My cycles work is pointing lower short term yet the mkt is not really

proving itself .

Going with my gut only. A head fake probably up then a reversal down

The wave count I posted the other day using the heavy weights of the dow

has fallen enough to argue the top for this move is in .

the drop so far being a 3 wave move implies a B wave rally vs a wave 2

so the drop would not be impulsive ( implies new highs once complete )

The Feb 8 Lows ae a minimum as I see it and then the jan 22 lows .

Im seeing the same divergences between the heavier weighted stocks vs the lesser weighted dow stocks as this past oct-nov period .

the lesser weighted stocks for example ae above the jan 2018 highs

while the heavier weighted dow stocks are below the jan 2018 highs

The lesser weighted stocks made their all time highs in ealy dec 2018 while the heavier weights made their highs in oct .

we ae at the important resistance is the take away .

Tomorrow kind of mattes to me yet more from a Fibonacci time point of view than anything else .

if feb 8 was wave 4 ( tying to quantify my wave count ) then from feb 8 to

feb 25 was a completed ( and debatable ) 5 wave move in wave 5 .

The initial drop the other day created an invalidation for this to be a continuation

higher in any type of valid Elliott wave impulse .

so I must conclude the high is in for now . possible B wave up sure but

not seeing anything impulsive coming up or down .

Feb 8 lows then jan 22 lows and possible Gartley 222 pattern in some Fibonacci formation which I cannot call at this point .

Next week must be a down week regardless.

I swear Joe! As soon as I posted as I saw your comment!

Talk about trader instinct! Yikes!

going to buy new keyboard today

sory fo typo

https://www.profitf.com/articles/forex-education/harmonic-pattern-gartley/

just an example is all ( the link above )

clarify headfake

Tomorrow is a vey short term fib ratio day which im thinking begins as a gap

down then reversal up day . im not changing my bearish bias .

The end result is down so I don’t want to lose focus of that .

another consideration is the feb 5-6th highs as the top of a left shoulder

this makes the feb 8 lows the bottom of what has yet to become the Neckline .

feb 8 lows and jan 22 lows are both magnets as I see it despite any potential headfakes

Phi mate turn date on Friday. I think we ramp higher tomorrow and then all hell breaks loose in futures on Thursday evening…

https://www.youtube.com/watch?v=au0bd5S1n0M

3/8 will be a high. HC Merc latt velocity @ zero : 3/8.

3/11 32nd harmonic Gann and Berg astro. 3/11 will be a high.

Think the job report will disappoint.

the Berg dates alone are nice to knows…how they fit into the bigger picture is really the question…there are two PD-1 pivot dates next week…

https://worldcyclesinstitute.com/my-dawdling-ducks/#comment-36827

Thank you André! Do you mean, despite a disappointing job report tomorrow, the SPX may go up until 3/11? That (not 3/8 high) will be an opportune time to add shorts?

3/11 very strong day Vedic moon exalted 3/12,

Think 3/11-12 is a very important time window.

Thank you 🙂

I should add the tidal field is bullish into 3/15. Does not mean the market is up into 3/15. It does mean 3/15 will be a high and things will speed up after 3/15.

Hi Andre

your 3/15 high is confirmed by next weeks energy chart attached below

don’t forget to press the GIF button

https://ibb.co/JvM1hpq

Thanks Tom

Ramakrishna Paramhansa Jayanti : 3/8 (hindu calendar)

Covering 25% of my shorts (here A = C in case this is a correction). But my bias is still for a larger decline.

Charting IWM..so far a perfect EW impulse wave down..

IWM definitely looks more impulsive down than SPX. All the major trend lines are now broken. I covered 25% of my shorts in SPX just to improve my cost base in case there is a bounce. Will sell IWM if we can get move higher tomorrow on payroll report.

Imma flat now..took my gains on my longer term SPX calls. Shorted SPX at open for nice ride! Might add some May or June puts soon.

Something about this decline not looking quite right to me. I don’t like the volume. I don’t like the momentum. I sure as hell don’t like how VIX is acting. Things look way too “managed” for my taste. Out of only half my hedges.

As I suspected, there is really not that much selling pressure when you take a close look at the A/D line.

Clearly, the banksters have so punished the bears that there are now very few sellers left in this market.

Are the banksters so confident that bears are running so scared that they can execute a managed decline down through important averages and avoid the typical piling on one would expect at the onset of a confirmed C or third wave down?

I am sitting on deep in the money puts going out to March 22 and very conflicted about holding or folding.

I agree..Mr Verne..i jus dont like the fact that the bullish momentum has dwindled. I made the easy moola on da way up..no need to get greedy for a lil more loot..

Yet..Imma not ready to short this market jus yet. Still could be a rip ur face off rally b4 we head down. Aint gonna let dem skullywag bankers sink me ship!

I was conflicted as well – that’s why covered 25% of the short at A=C level (2748). Start of big declines can look choppy – and in that sense I am not sold on the idea that the very first leg down has to be violent. I say this purely based on what has happened before. This decline can easily turn violent next week or just get smoked out and we get a nice ramp up. For me, 2615-2645 is the real support zone. Till we break that, I will assume that we can go back above 2820.

It looks like a 3 wave down to me so far which is not good for the immediate bear case. I’m on the sidelines

Def..a 3 waver..so more upside IMHO. Ive sold all long positions and jus day trading..until i see another trend setup. Cash is king..for now!

UVXY looks like a bull flag so we could see some more downside…it will be interesting to see what happens in futures and how traders position into the week-end.

Hi Andre

your 3/15 high is confirmed by next weeks energy chart attached below

don’t forget to press the GIF button

https://ibb.co/JvM1hpq

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.