Solar Cycles: How the Markets Turn |

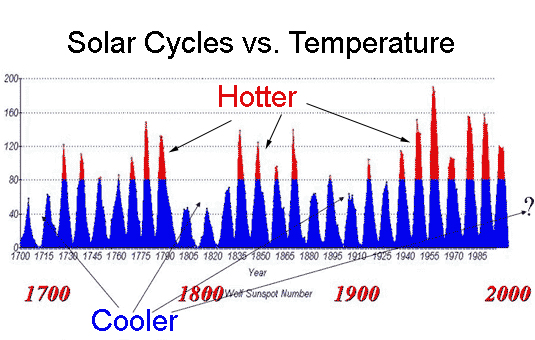

Sunspots (solar flares) are responsible for the overall temperature here on Earth. When the Sun is really active, it gets hotter. When less active, it gets cooler. It’s that simple.

Sunspots (solar flares) are responsible for the overall temperature here on Earth. When the Sun is really active, it gets hotter. When less active, it gets cooler. It’s that simple.

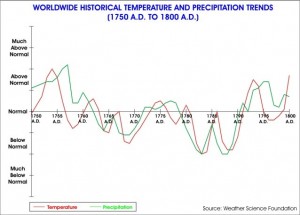

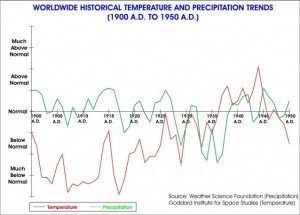

In fact, you can see by the follow two charts of weather patterns that it was cold at the end of the 18th century and quite cold at the beginning of the 20th century (from Harris-Mann Climatology).

|

|

Here’s a link to “The Next Grand Minimum” site with a more in-depth explanation of how sunspots have affected the weather over the last 400 years or so.

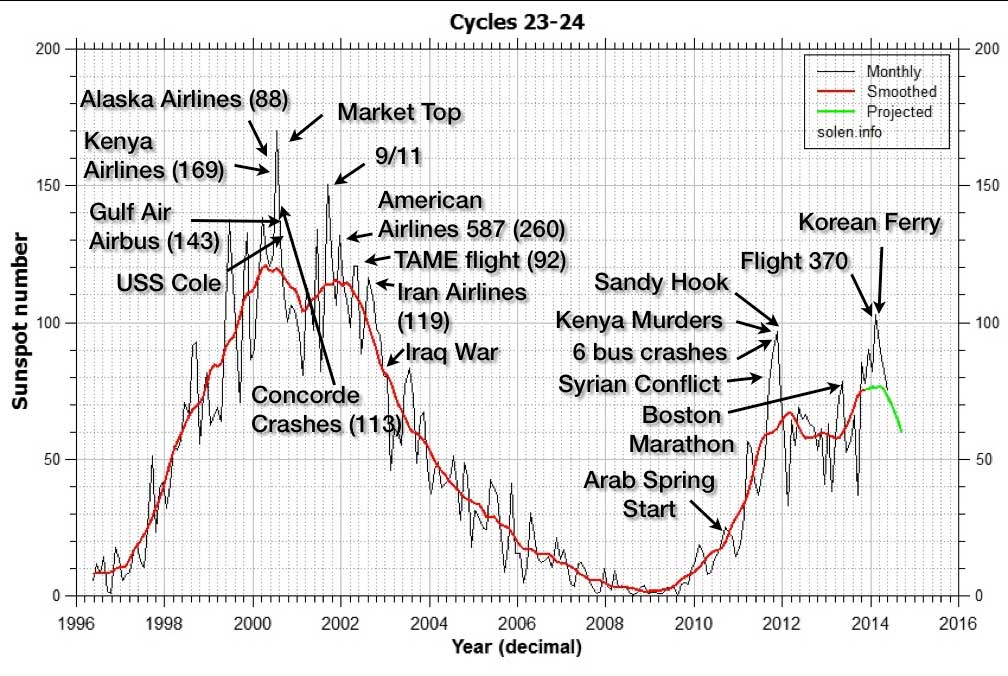

Sunspots and Extraordinary Events

Here’s an expanded list of events that took place at the tops of the past two solar cycles. The numbers in brackets are the numbers of people killed in each of the plane crashes. (click the image to enlarge to full size.)

If you look back through history, you’ll also find a long list of events that changed history.

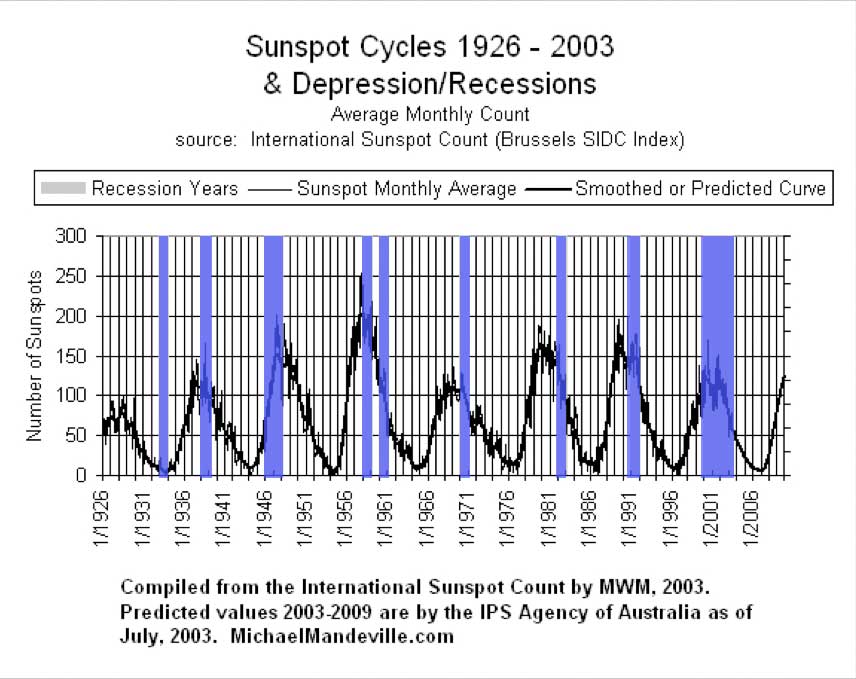

Solar Cycles and Recessions/Depressions

For the past several decades, sunspot maximums have been followed by either a depression or a recession.

International Debt

This was first posted in 2014. If you go to world debt clock, you can see how extraordinarily scary the debt levels have become in 6 short years.

Here are some numbers (as June 2014) to keep in mind that will help position the gravity of the international debt problem (Care of the Economic Collapse Blog).

Most people tend to assume that the “authorities” have fixed whatever caused the financial world to almost end back in 2008, but that is not the case at all.

In fact, the total amount of government debt around the globe has grown by about 40 percent since then, and the “too big to fail banks” have collectively gotten 37 percent larger since then.

--$17,555,165,805,212.27 – This is the size of the U.S. national debt. It has grown by more than 10 trillion dollars over the past ten years.

--$32,000,000,000,000 – This is the total amount of money that the global elite have stashed in offshore banks (that we know about).

--$48,611,684,000,000 – This is the total exposure that Goldman Sachs has to derivatives contracts.

--$59,398,590,000,000 – This is the total amount of debt (government, corporate, consumer, etc.) in the U.S. financial system. 40 years ago, this number was just a little bit above 2 trillion dollars.

--$70,088,625,000,000 – This is the total exposure that JPMorgan Chase has to derivatives contracts.

--$71,830,000,000,000 – This is the approximate size of the GDP of the entire world.

--$75,000,000,000,000 – This is approximately the total exposure that German banking giant Deutsche Bank has to derivatives contracts.

--$100,000,000,000,000 – This is the total amount of government debt in the entire world. This amount has grown by $30 trillion just since mid-2007.

--$223,300,000,000,000 – This is the approximate size of the total amount of debt in the entire world.

--$236,637,271,000,000 – According to the U.S. government, this is the total exposure that the top 25 banks in the United States have to derivatives contracts. But those banks only have total assets of about 9.4 trillion dollars combined. In other words, the exposure of our largest banks to derivatives outweighs their total assets by a ratio of about 25 to 1.

--$710,000,000,000,000 to $1,500,000,000,000,000 – The estimates of the total notional value of all global derivatives contracts generally fall within this range. At the high end of the range, the ratio of derivatives exposure to global GDP is about 21 to 1.

noticed most articles are around one year old, just checking to see if everything is ok

Odd comment. There are new articles being posted every week.

should have been more clear in my statement, what I was referring to yous your youtube channel. I figure ore I think I went through most of them and found most to have been posted last your. was enjoying your youtube work, just wanted more.

More youtube coming. Those videos take a lot longer to do. I have a couple of scripts in the works. Just need more time to get them done. Thanks for the query, Stephen.

Thnx

Your excellent presentation re 172-year climate cycle has been circulating among internet users. When and to whom/for whom was your original presentation made?

Thank you. Art Adam

Hi Art,

I’m not sure which presentation you’re referring to, but I’ll guess it’s “Global Cooling.” They were all published on my site (that one’s 4 years old) … so, to anyone following me. Secondarily to “me, myself, and I”, because I was so frustrated at the hubris of mankind (or in the words of our Prime Minister, “peoplekind” — which is somewhat beneath my dignity to comment on …. lol) to think that we have any way of overpowering the strength of the Sun.

Been following the same concepts but u make it clear. Its so obvious they LIKE scaring the poluation to encite $ movement so those in control profit from FALSE information. Screwed up mentality of government WE pay taxes to. Then irresponsible spending, The people running this country are out for themselves now because its limited time.

Peoe like you and I and otherd that enlighten people to manipulation. I too grew up nieve and trusting until reality sinks in.

And reading history helps, because it happens over and over again. Tks, Rommy.