The 500 Year Bull Market

If often talk about the 500 year bull market. From my extensive research in economic cycles, the more specific measure is 516 years (3 times the 172 market crash cycles).

If the “orthodox top” of the market was in 2007 (which also coincides with a 172 market top (and the start of the current ongoing “recession,” the 516 year start was in the year 1492, which marks a major turning point in feudalism. You will also recognize the date as the euphoric top of the previous 516 cycle and the discovery of the “New World” (North America).

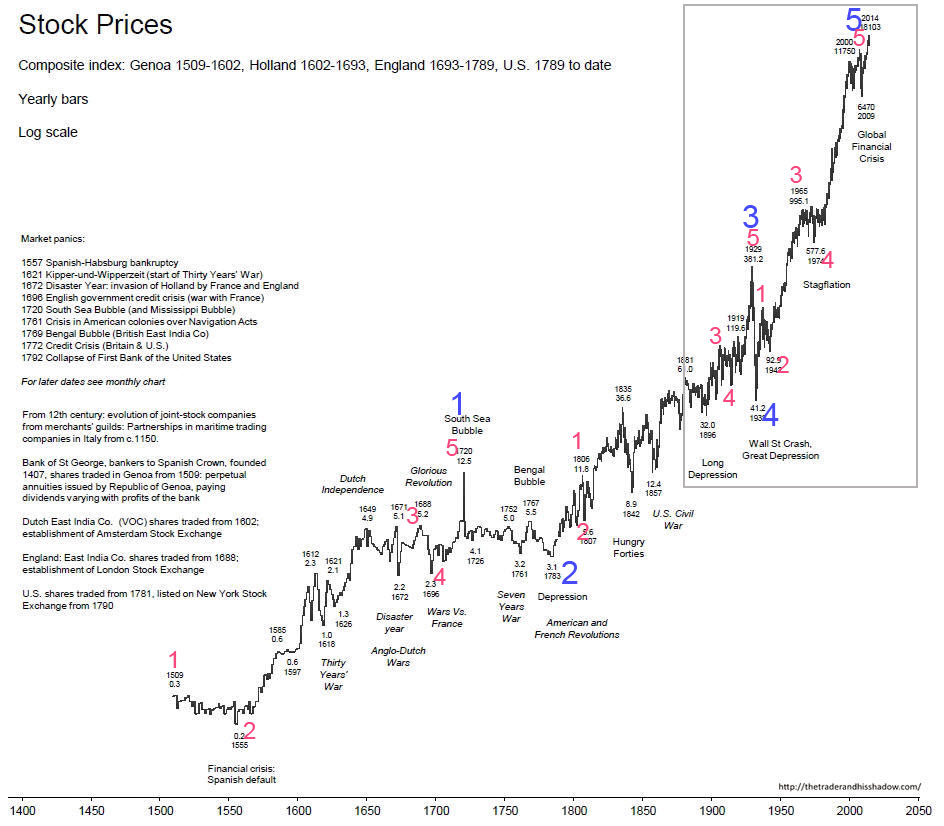

Above is a 500 year compendium of stock prices (click to enlarge) gathered from multiple sources to provide a guide as to the rise in prices from 1509 through 2014. You can find major events identified on the chart, including wars, which generally take place at the lows.

Above is a 500 year compendium of stock prices (click to enlarge) gathered from multiple sources to provide a guide as to the rise in prices from 1509 through 2014. You can find major events identified on the chart, including wars, which generally take place at the lows.

The above chart generally follows the Elliott Wave Principle in structure and places us at the top of a five wave super cycle, with an expected major downturn, crash, and depression to begin during 2018.

The labelling is open to dispute as I don’t have the ability to use the usual fibonacci ratio tool to confirm subwave levels, but the labelling about is simply a wave count based upon the usual Elliott Wave rules and guidelines.

The grey rectangle on the chart relates to the “zoomed in” chart of the DOW below.

Above is a quarterly (3 month bars) log chart of the DOW, stretching from about 1915 through to today’s date, with the Elliott Wave labelling of the final fifth wave up of the 500 year bull market (the price history relating to the grey rectangle in the 500 year chart above).

Near the top of the chart, I show wave (5) (the orthodox top) at the year 2007. The wave down from the top in 2007 was in three waves and ended at a low in early 2009. The final wave up from 2009 is a corrective B wave, and is almost complete (see my daily chart of ES below). I’ve shown this B wave count before and will again over the coming weeks as we near the final top (which I expect in the next couple of months, if not sooner.

Once five waves have been completed, the trend changes. The B wave is an anomaly, what I call an “unnatural wave” brought about by central banks ramping up enormous levels of debt with the result of fueling more inflation and the typical stock market speculation which has led to this extraordinary bubble.

The horizontal line at the 569.89 level identifies the previous fourth wave of one lesser degree. This is the typical target (the area of the previous fourth wave) that the market seeks out after a fifth wave top. Since the expected C wave down does not necessarily reach the target, I conservatively tell folks to expect the DOW to be under 3000 points by about the year 2022.

And there you have my analysis of where we are and, more importantly where we’ve been. History repeats. It’s important to pay attention to it.

Elliott Wave Basics

There are two types of Elliott wave patterns:

- Motive (or impulsive waves) which are “trend” waves.

- Corrective waves, which are “counter trend” waves.

Motive waves contain five distinct waves that move the market forward in a trend. Counter trend waves are in 3 waves and simply correct the trend. These patterns move at what we call multiple degrees of trend (they are fractal, meaning there are smaller series of waves that move in the same patterns within the larger patterns). The keys to analyzing Elliott waves is being able to recognize the patterns and the degree of trend that you’re working within.

The motive waves shown above are typical in terms of their look and length. Subwaves of motive waves measure out to specific lengths (fibonacci ratios) very accurately. Motive waves are the easiest waves to trade.

Waves 1, 3, and 5 of a motive wave pattern each contain 5 motive subwaves. Waves 2 and 4 are countertrend waves and move in 3 waves.

Motive waves also travel in channels. The red channel above can be drawn from the apexes of wave 1 and 3 on one side and waves 2 and 4 of the other. The end of wave 5 typically meets the trend line on the wave 1 & 3 side before it reverses.

Countertrend waves move in 3 waves and always retrace. You’ll find much more about them in the countertrend section and the page on “The Right Look.”

To use Elliott wave analysis accurately, you must be able to recognize the difference between a trend wave (motive) and a countertrend wave (corrective). There’s very much more to proper Elliott wave analysis, but this gives you the basics.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

This past week was very bullish and traced out the balance of the third wave of the C wave of the D leg of the contracting triangle. We are heading for the top of the D leg. This will lead to a reversal shortly ahead (likely this coming week), which will trace out the three wave E leg of the contracting triangle.

The D leg wave structure is very complex, as I've been predicting it would be and as a result, there are multiple targets for the top, landing in the 2750 - 60 range.

After the E wave down is complete, we'll take off again to the upside in a fifth wave, which will simply finish off the pattern. We'll get to a new high and probably more, but don't expect (as I've been saying for a very long time) a large fifth wave that travels any great distance. (I think 3000 is possible but at the high end of the probability spectrum)

Summary: We have one more fourth/fifth subwave combination to trace out to complete the triangle D leg. Targets for the D leg top are within the 2750-60 area. Once E leg (down) is complete, expect a final larger degree fifth wave to a new high. That fifth wave up to a new high will be the end of the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, May 23 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

“MAJOR turn…this week in all markets…when Uranus leaves the sign of Aries and enters Taurus. This is a new seven year Uranus cycle”

just following up…as another poster inferred, probably nothing…

– Taurus New Moon takes place at 7:47am (New York)

– Entry of Uranus in Taurus at 11:16am (New York)

Peter

Thank you for the excellent update.

Personally as I’ve noted before I am

Conflicted between the wave count vs timing.

Your wave count I agree with yet I must continue

To give the market more time and allow for this

Entire sideways structure to fail.

There are to many bearish combinations time wise for me

To trust this triangle formation yet I am seeing it all over the place

When looking at various sectors and individual stocks.

I will note, I have never seen an outright crash when these

Combinations are in bullish positions so come January I’ll be

Bullish. Yet in most all major declines these bearish combinations

Were in place. I simply cannot ignore my own research.

While the initial decline from the top into the Feb low can be disputed

It does appear to me to be a 5 wave structure . The sideways

Move since combined with my own timing keeps me bearish

Only until I actually see the Dow or spx for that matter make new

All time highs will I change this view .

Aug-Sept is a fair amount of time so no doubt you may

Be proven correct .

Thank you for all your efforts . Today’s update,

Ranks up there as excellent from both a long term and short

Term view as well as informational as well as educational .

Joe

Rotrot and Joe,

Both of you have mentioned the Uranus/Taurus entering this new 7 year cycle…

What is the best link to information about this? A source you would consider being a “go to” site for what you would consider good information about planetary influences on the market.

http://www.astrologyforganntraders.com.au/about.html

While structures that appear to be triangles right up the very end can and do morph into something else, if the current structure turns out to indeed be a triangle (which I believe it is), the end is near with just one leg, E, remaining. The triangle was entered in an uptrend, so the expected break would be to the upside.

Verne – are you going with june or july call spreads if u r planning for it to go down to 2600 and then make new high complete process might take 2 months.

I actually plan on going with March 25 bear call spreads. I expect the E wave to fall short of the A/C trend-line and for the zig zag to complete quickly. If I am wrong and it drags out a bit, I will roll the calls out an additional week. I do not anticipate the E wave is going to last longer than that.

March 25? or june 25 ?

“I actually plan on going with March 25 bear call spreads.” 🙂

I expect a rapid conclusion to the E leg as should be the case for a contracting triangle….

So a top should be in now, we should decline till May 23.

John could you please tell us what wave structure you think we are in that indicates a top, or other indicator you are using? Thanks!

Joe there are some interesting things going on with DJI. It was almost the the only index to make a new intraday low (actually DJT did as well) since the Feb lows.

It can also be seen as tracing out a bearish descending triangle. Quite a conundrum!

Ed

Google search Raymond merriman and click on his ” weekly preview ”

Also you can just scan the web . There are many who make claims that

One alignment or another will bring devastation or market crashes etc with

Certain alignments yet in most cases they are talking their book ( a bearish mindset )

The only way to know for yourself is to look at the previous set ups throughout history .

If I mentioned Uranus in Taurus then it was a reference from Raymond merriman

And not my own work . While I have been doing some research into planets individually

My main work is planetary pairs and not planets in say Taurus etc…

I do make posts though in reference to the moon in Aries Taurus etc… Because I see

Repeat short term moves from that however my knowledge on Uranus in Taurus is

Minimal at best . On face value based on your question Uranus in Taurus for 7 years

Implies Uranus moves through each sign for 7 years . 12 signs x 7 years = 84 year cycle.

2018 – 84 would be 1934, 1850, 1766, 1682, 1598…..etc . To start you would have to look back

And see what happened and it gets more detailed . 1934 for example and what actual degree in Taurus

Did the turn come ? Then what degree of Taurus at the 1937 low ? As another example . In each case

Did the market and or economy follow a similar theme ? All of the above a bit rough by just counting the years

And not including the exact degree. As Peter has said a few times, history rhymes but it’s not always exact.

Another close rhyme would be 43 years , 1889, 1932, 1975, 2018.

43 years is just a bit over 1/2 of that 84 year cycle yet it’s also exactly 1/2 of Martin Armstrong’s 86 year cycle 8.6 years x 10.

Peter talks about 516 years for example which is 172 years times 3.

516 / 43 = 12 and 172 / 43 = 4 . Just saying trying to break cycles down is what I try to do .

Half of 43 is 21 1/2 yet a Gann angle is 22 1/2 degrees . Half of 22 ( splitting it / rounding it to keep it simple )

Would be 11 years which correlates with the sunspot cycle .

Take it further , 34 is a Fibonacci number and 170 years would be 5 ( another fib ) 34 year cycles .

At some point when all these different methods come together at once which a rare event things change.

Has anyone or does anyone look at their electric bills ? My bills show the average monthly temperatures on them

For me the lowest temperatures were in March this year vs the norm which is January .

Lastly , one thing I try to do is to follow a cycle in various sectors and not just the Dow even though most of my research

Is based on the history of the Dow . The utility sector was the starting point of the decline in the index’s yet the bond

Market has also turned .

Never write off a cycle is my point yet do your own research

So you understand it’s accuracy

Joe

Verne

I like it when the majority think alike : )

I’ll agree with you on that potential bearish triangle

Take a look at the July – Dec 2007 top as an example .

Failed bullish triangles once broken come back to the apex of that triangle formation

Then TANK !

I’m out in the ocean so limited on data .

I’m sticking to this as a simple B wave or a B wave triangle until proven wrong.

Joe

Ed,

See the bottom of this web page

That is were I get this from .

What happened on the last new moon or the last time

The moon was in Taurus ?

New Moon

New Moon

The moon is currently in Taurus

The moon is 0 days old

Distance: 57 earth radii

Ecliptic latitude: -4 degrees

Ecliptic longitude: 54 degrees

Joe,

Thank you for responding! Very interesting perspective. All of your posts over many many months have jump started my curiosity. I always look forward to both your and Peter T’s posts and commentary.

Beautiful execution on SPY bear call spread. Already deeply in the money. Nice!

Verne – So what was your SPY bear trade did u do july spread?

As I said Bill, My expiration date is March 25, and two sets of strikes : 274/275, and 277/277.50, both CREDIT spreads. Sorry of If did not make that clear.

OK March 25 2019.. I was thinking a typo?

Oh my! May, not March…oops!

I am sitting on a mountain of spreads and cannot afford to overstay my welcome. Headed to the chart show tomorrow for the real skinny… 🙂

Verne

I think you meant ” may ” expiry

The daily $RUT now has waves 1 2 3 and today possibly 4.

One slight issue with this wave count is wave 2 was simple

So wave 4 should ideally be more complex ( it’s allowed for )

A slight new high in wave 5 should therefore be expected .

There is a slight gap near 2750 on the spx.

That all said today’s New moon appears to have turned the market

If I had a decent chart to work with I’d calculate the RUT

For an ideal wave 4 swing using .382 from the bottom in late April early

May and also use the . 50 retrace from the secondary wave 2 low

In early May . Both using the recent highs . Where ever those

Retrace levels come in at I’d use as the KEY support

And then I’d measure the .618 of waves 1-3 off that KEY support

And I’d look to go short up there . Breaking above that .618

Extension would imply something else going on . Also breaking

Below the .382 retrace of waves 1-3 and the .50 retrace of waves 2-3

Would argue the top is in!! It’d to soon to call it.

May 28 is a low to low to high count and June 6-9 th

Is another cycle turn .

A low in the June 6-9 time frame technically calls for a Sept 8-9 th high.

Aug-Sept is where the planetary cycles turn down hard.

Yet we are in several bearish cycles into January .

Just back from vacation. Last week Bradley turned from the mirror projection to normal on the 9th. I just compared the normal Bradley with my old indicator and they seems to have the same movement. 16/17 may the top and then the decline in to the weekend or even in to 25th? Then 30/31 High. 1 june Low 4 and 6 high and 8 Low and the last high before the start of a serious decline is 12 june. http://www.prognoseus500.nl/

Bias to the bullish side. Royal wedding this Saturday. It was bullish going into the last royal wedding, 4/29/11. Curious though of the selection of dates. Notice the day 29, 2+9=11 and the year ending 11. Wedding this Saturday is 5/19/2018. 2018 is an 11 yr then 1+9=1 so you get a combined 111. 🙂

Peter,

Do you think we are done with D wave and on to E wave down to 2600

Bill

Bill,

Not quite done with D. It’s a very dangerous market at the moment. Currencies and the US indices look like they’re all going to turn at the same time. I suspect Monday is the day.

It’s actually debatable whether we’re in D or E. We have one more small wave up, but I don’t know that it will fetch a new high.

A new weekend post is live at: https://worldcyclesinstitute.com/you-keep-me-hanging-on/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.