Update Thursday, Nov 19 After the Bell

We have kind of an interesting situation here. This is a chart of the SP500 (10 min) at the end fo the day. It shows the path to the top. I have labelled it based upon the most obvious wave count (there’s another way to label this).

There are two hard rules of Elliott Wave:

- The third wave cannot be the shortest wave. If this labelling is correct, in order to make the top, wave 5 cannot retrace below 2075.56 or wave 3 will become the shortest wave.

- Wave 4 cannot go into the area of wave 1. Therefore, it can’t retrace below the area where I placed the ‘1.’

We could also label the tiny wave at the bottom wave 1 and 2 and the entire larger wave up as all of wave three. In that case it, the wave length wouldn’t be an issue.

It’s a rather odd configuration for an ending wave, so we’ll see what happens. I don’t see a valid EW count for a top where we are now, particularly when you take into account the other indices.

If wave 2 is as marked, there’s also the rule of alternation. Since wave 2 is deep, wave 4 should be shallow and more horizontal than vertical.

______________________

Update, Thursday before the Bell:

Futures went up slightly overnight which should complete the third wave, I think. I would expect a negative fourth wave day today.

A Note on “All the Same Market”

I’ve written before on Bob Prechter’s long range forecast that due to debt deleveraging and credit contraction, all the markets internationally would fluctuate in tandem. I’ve been watching this develop over the past few years until today, it appears to me to be in effect.

Today, I notice the pick up in gold (GLD is up a buck and a half today as I write this). We are nearing a top in equities. Currencies appear to have reversed over recent days. I’ve been watching USD/CAD for quite a while and it’s completed a first wave (of 5 waves). I’ve been expecting a turn for the past month or so. It was due for a reversal and should now retrace 62% of the length of that first wave. That should take it back up to about 1.100. Other USD currency pairs should also retrace to varying degrees.

All this comes about as the US equities seem to be completing a corrective ABC wave (wave 2), getting ready to turn down in wave 3.

I think it’s important to keep the bigger picture in mind. This is the largest financial bubble in history. It will have tremendous repercussions as it all unravels.

__________________________

Original Post:

We’re back to “Waiting for GoDown.”

The market is not making my job easy. It’s giving few clues.

After reading the wave down as a possible first wave (leading diagonal), that idea was discarded after our rally this morning passed the fourth wave level without a turnover. In fact, we sky-rocketed up past the 62% retrace level in virtually all the indices (not the NYSE, however—it’s lagging).

The leading diagonal idea, as well as the first wave down option are off the table.

Bottom line: Wave 4 down is being retraced. I expect we will reach or exceed the previous high at approximately 2116 in the SPX.

Timing: The key turn date on my schedule is November 23. However, we have US Thanksgiving coming up on November 25, so I don’t quite know how that works into the bigger picture. I do know that when the wave structure ends at five waves, so does this countertrend move.

Above is a 15 minute chart of the SP500 showing the wave structure. While I’ve labelled the rally wave with a 3 and 4, it’s likely the entire wave from 2 up is wave 3, which is not quite complete. This would be the same structure as the entire C wave (on a smaller scale). I would expect wave 3 to finish and be followed by wave 4 with a relatively deep retrace. Finally, we’ll end with wave 5.

You’ll get a clearer picture of the wave structure from the futures charts below.

Last week, I mentioned that wave four on all the indices had dropped exactly 1.618 time the length of wave 1 of C (from Sept 29). Since the fifth wave is typically the same length, this suggests a double top on each of the indices.

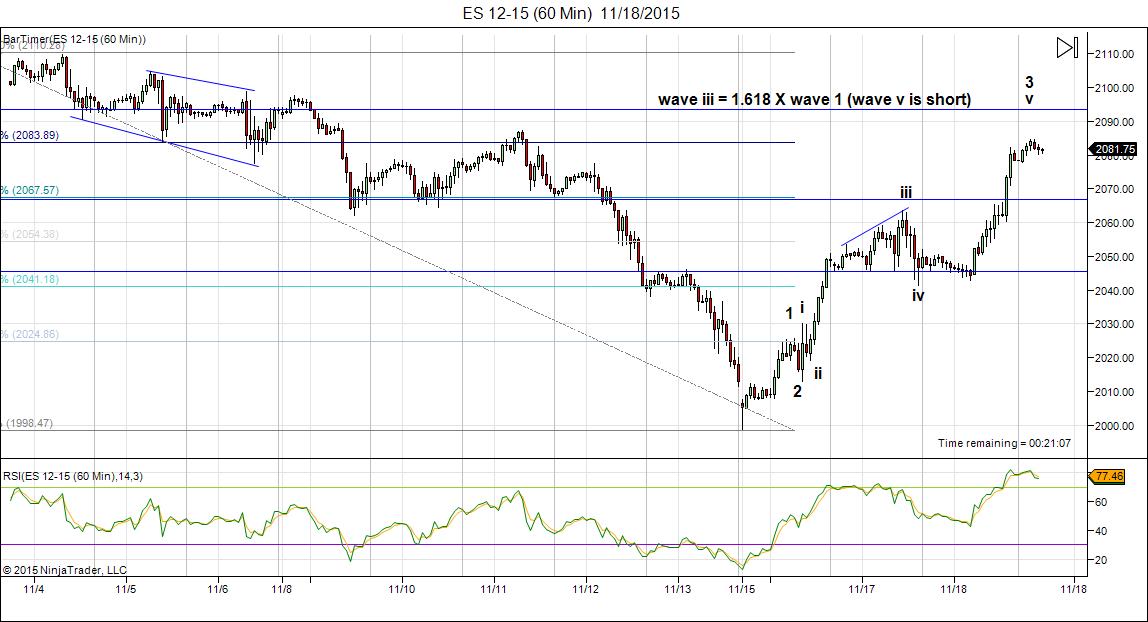

Above is tonight’s 60 minute chart of the ES (emini SPX futures). Click to enlarge.

This gives a clearer look at the structure of the rally wave. On the screen, I’ve labelled the subwaves. Wave iii is exactly 1.618 X wave 1, as is wave v (except that, at the moment, wave v is slightly short of that mark—shown by the horizontal line and the 3, v labels).

Next, I would expect a wave 4 retrace (possibly to the previous 4th (wave iv) before a final wave 5 up. In ES the fourth wave would typically retrace 38%, in that case dropping to about 2052.

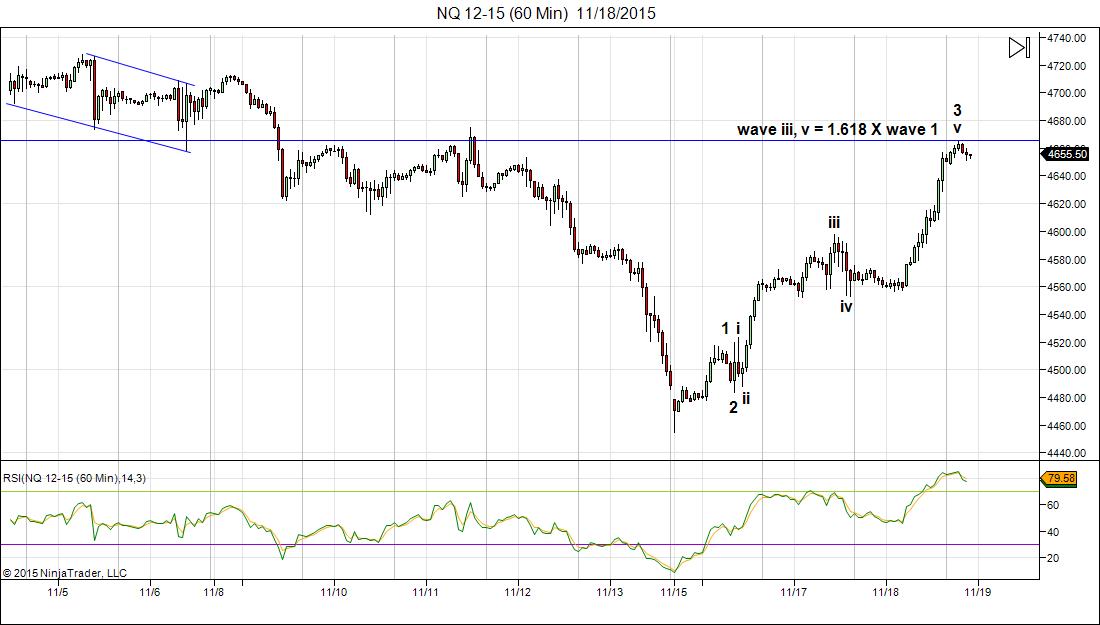

Above is the 60 minute chart of the NQ (Nasdaq futures). Wave iii an v are exactly 1.618 X the length of wave 1. This chart mirrors the ES chart above. The wave structure is very clear.

Above is the i5 minute chart of the NYSE. While all the other indices have reached 62% and above, the NYSE is lagging somewhat. I don’t know if this means the other indices may rise above the previous highs while waiting for the NYSE to test its previous high, or not. Something to watch for.

I’ve labelled the more likely wave count. You can see that wave v of 3 is not finished yet. Following should be wave 4 and then 5.

The Bigger Picture

Let’s remember where we are in the bigger picture

Above is the 2 hour chart of the SP500 showing the ABC corrective wave we’re in. Once five waves up are complete, we should turn down into the third wave.

Finally, here’s the 2 hour chart of the NYSE. The NYSE is lagging the other major indices. The horizontal line is the 62% level from the top of the market.

Prosperous trading!

hi Peter

I’m looking at an amertrade screen on my phone and a yearly chart close only .

closing low 16102.38 , first high at 16433.09

was 330.71 pts ( 330.71 *5.618=1857.92 pts)

secondary low at 16314.67 plus 1857.92=18172.59. the closing high so far 17910.33 then the drop to 17245.24

count based on these 1) 16102 to 16433

2)16433 to 16314 , 3) 16314 to 17910

4) 17910 to 17245. low to high has so far been 1807.95 pts . if wave 5 equals 50% of the total move it would travel 903.95 pts .

903.95+17245.24=18149.21.

this implies 18149-18172 as the range ( to me )

for a top , it would also be 5 closing waves up

Joe

Peter-

Why do you think the 2nd wave that retraces to around the 76.4 level is off the table (other than the leading diagonal is so rare)?Using SPX, that level is about 2093.5. It would mean that the A wave (2019.29- 2066.69) equals the C wave (2046.03-2093.5) at 47.4.

Getting the SPX to .764 should also have the NYSE up to the 61.8 retracement.

It just wasn’t clear why this was no longer on the table.

Thanks for your hard work!

Ted,

I could get it to work with the fourth wave yesterday but once it did that (and I had a chance later on to look a the charts, it just didn’t work, and then I started really taking the whole thing apart. Did up a page of my musings for Dmitri https://worldcyclesinstitute.com/dmitri/

Hope this helps explain my thinking.

Also, the Nasdaq Comp doesn’t doesn’t make it as anything resembling a first wave down. It’s clearly corrective.

Thanks Peter!

🙂

I’m expecting a fourth wave down today. Futures went up just enough I think to finish the 3rd wave.

Peter,

according to your count Es should retrace down to 2060 ?

It should correct the entire wave, so I put 38% at 2055. If I thought the fifth wave was going to a double top exactly, measuring the fifth wave at 1.6 X the first, then I’d pick 2059. So … somewhere around there.

It could also drop even lower to the real previous 4th at 2042, so keep that in mind.

Looks we have done a motive wave down in ES now

The fourth wave is in the area of the first on that.

On IG chart that I use the bottom of the 1st and the top of the 4th are at the same level 2089.39 without overlapping

Look at YM and NQ for confirmation.

I didn’t think about that

Once you really get into EW, you find you’re looking a similar indices all the time, cause if there’s a big change, they all have to do it; they all have to be in either motive or corrective mode at the same time. No free lunch.

Thanks

I’m sticking to currencies. They’re off on a tear today, as expected. USD/JPY continues down. Euro into a third wave.

Some life in GLD this morning!

Hope it’s not a dead cat bounce

I’m seeing this large picture pattern. The dollar has topped for the medium term, so currency pairs have all reversed. Gold should reverse here and the equities market should follow along. We’re in the midst of a very large shift, as far as I can make out. Everybody is slowly getting in sync.

Peter,

if all the markets have to go together than how is it possible that you expect the currencies to have already turned and the stocks to make another leg up ?

Because markets aren’t perfectly aligned. You can look at currencies. CAD turned Sep 29, has done one motive wave, retraced, and is in a third wave. AUD bottomed about Sep 9. The euro turned yesterday or the day before with USD/JPY. So, they’re all slowly changing. Various currencies make up different weights to the overall picture. As it is with other assets.

Sorry, just changed those dates, they were wrong.

The other thing to remember is that humans are in control … haha. Sentiment changes towards different assets over time.

I put a little chart up at the top of the post on USDJPY showing what should happen from an EW perspective.

Dmitri,

If you’re in ES, I don’t know that you’re going to get a whole bunch out of it. I added a chart from today to the post with some comments.

Peter,

We could also label the tiny wave at the bottom wave 1 and 2 and the larger waves that you’ve marked as 1 and 2 might be labeled as 3 and 4 ?

Well, you could, but wave 5 wouldn’t typically be twice the length of wave 3 or several times the length of wave 1.

The other thing to watch for is a triangle, because this wave up is a three and the wave down is a 3. That would prolong the top, of course, but it also forecasts the end of the wave.

Well, in case if we roll over here the wave 5 will be of the same length as wave 3

Well, if we roll over here, it won’t really matter, because it will disprove the entire Principle.

I agree with Ted. I believe we are finishing up wave 2.C5 today/tomorrow.

Cheers,

W

I think we’re still looking at Monday, the 23rd.

Down today in a fourth, up Friday and Sunday to a top. I wouldn’t bet on it, but that’s what looks to me to be shaping up.

I’m just enjoying reading the daily summary, please keep sending to my email inbox.

Thanks again.

The whole formation from the May top looks a bit like a leading diagonal. The drop to the low of late Aug has always looked like a 3 to me.

Why are so many folks fighting the idea of an edwards and mcgee broadening top pattern developing??? This would mean a new all time high on the dow and snp but not on the broad market. Just like Jan 1973. A new high with only glamor stocks leading the charge. Afterwards, if like 1973-74, a severe bear would follow.

Don’t know that they are. In terms of Elliott Waves, I have nothing so far to support it. I just trade what I see (and what EW tells me). I think there are lots of folks who see otherwise.

That’s why NYSE is lagging so much comparing to SnP or DJ.

Because of bad breadth.

It happens often during topping process

Makes sense.

Roger,

I will say that the E&M broadening top formation pertains for sure to the overall market (on a weekly or monthly chart), something we EWers might call an expanding diagonal. I don’t personally see it in the shorter term picture.

I had to go look it up in my dusty old technical analysis bible 🙂

Just went short with 3 XNL 445 puts (we are at 470 currently, close to the November 4th top at 473,03) januari 2016 for 6,92 a piece.

My November puts XNL 390 became worthless. 🙁

Cheers,

W

Peter–Too many dollar bears, too many gold bulls.

A number of years ago I attended a William O’Neil (founder of Investor’s Business Daily) seminar related to his book “How To Make Money In Stocks”. He never talked about EW. The chart pattern most discussed and leading to in some cases huge gains he called the Cup With Handle. I have noted a number of analysts calling a top in the US Dollar….based on the chart pattern on the attached chart, that might be a questionable move as it has formed the Cup With Handle pattern? We might be forming the handle in the near term.This chart suggests a dollar moving much higher in an impulsive manner. Gary (Denver)

http://stockcharts.com/h-sc/ui?s=%24USD&p=D&yr=3&mn=0&dy=0&id=p45682347759

Gary,

It hasn’t formed a “cup and handle” until it does a double top and then backs off and takes another run at it.

Same pattern, btw, as the eur/usd flipped, of course. And the eur/usd is heading up now in rather motive waves.

The dollar is in a long term uptrend. Problem is it hasn’t corrected enough. It hasn’t even retraced 38%. It has to at least do that. I would suspect, though, since it’s done a motive first wave up that we’re going to get a 62% corrective second wave while the equities tank.

All the currency pairs are in the same boat – they need to correct. Plus the dollar is in a corrective pattern and to continue up, it needs to be motive. For me, from a technical perspective, there a far too many issues to support the dollar continuing up in the short term.

Peter–There are numerous examples in his chart book where stocks would not achieve a double top and some would over shoot before creating the handle. As I listened to him, it was the tightness of the overall pattern and the handle pulling back toward the 200 Day MA that he was interested in…..a better success rate. I can tell you this, based on the charts he gave us to observe, he would be watching this one like a hawk. Gary

The cup and handle is a breakout pattern, based upon a third try at breaking through a previous top or bottom. Valid for what it is.

Looking at the SP500, it still looks to me like three waves up. So, this fourth wave needs to get some bulk to it if it’s to look somewhat equal to the very large second wave. I suspect that has something to do with the lack of action today.

I’m still sensitive to a roll-over here, but the issue with that is that I can’t technically label the structure of “the fourth wave” to make it into a motive first wave.

Peet,

The top is in as of November 4th if you ask me. Today we topped (3.2?).

Good luck to all! And that this year may not be a positive one so we can end the tale of years ending in 5 are always positive. 😉

Cheers,

W

Believe me, if I could find 5 waves down in this mess, I’d be with you. But so far, I can’t …. 🙂

There is another rule:

If something doesn’t fit in the principle stretch it. 🙂

The only thing I could come up with is that leading diagonals are in fact real and that we’re creating a double second wave. The second wave part of it is OK … it’s the first part of the wave that concerns me, particularly in the Nasdaq.

The waves does look corrective. It we roll over here, we follow it and figure it out later.

Dmitri,

An ending diagonal would make your alternative of a long 5th wave possible.

It seems, we have over-thrown the ending diagonal ?

On the DOW …

What does that mean ?

On the DOW … we have over-thrown the ending diagonal.

DO NOT COUNT YOUR CHICKENS BEFORE THEY HATCH.

That last comment, was in respect to the years ending in 5

Hey Wazz,

I’d like to think that the top is in, also, but I’m troubled by the remaining gap in the VIX. Today closed the gap at 16.0, but there is a remaining VIX gap from 11/9, at about 14.40 on a 15 minute chart. I think it would take another rally to try to close that gap.

Peter – interesting observation to me – today’s es up action stopped directly at an apparent possible fourth, but not ‘the previous fourth of lesser degree’. It doesn’t ‘mean’ anything to me, does it have any significance in EW??

see link, note two arrows

http://invst.ly/iksu

Thx

In this case, no.

going back to 1970 week of Thanksgiving SPX

positive 68.89%

avg gain if positive 1.58%

avg loss if negative -1.37%

Weds thru Fri SPX positive 82.22%

Weds positive 80.00%

Fri positive 66.67%

From another blog, Max

Hi Peter,

Last gap on SPY is closed .

SPX now @ 2093 . I think 10 – 15 points up MAX and we should turn.

IF we do not stop , then we are heading toward 2160 !!!! a big magical number

I do not know about EW count …

AZ

If we go to a new high, we could stop anywhere, agreed.

There’s also the possibility of an ending diagonal. We’ll just have to see what unfolds. The more the wave progresses, the fewer the options there will be.

watching vix for a clue…..to close gap at 14.32

see link

http://invst.ly/iqbp

“IF” the market is doing a broadening top, then is today’s action the fifth wave of the third wave up???

Roger,

If I were to imagine a broadening top here, this would have to be the C wave. Since there would be, say, another 1500 points up to do in the DOW in this wave, then this is likely the first wave of a fifth. Then you’d have a D wave down and a final E wave up.

Peter–IMO the attached is important and may give us clues as to how, not when, the next crisis will begin. There is no doubt in my mind the Dollar is key and will be the lead actor.

http://www.zerohedge.com/news/2015-11-20/how-next-global-financial-meltdown-will-unfold

Gary Denver

Thanks, Gary,

Well yes, this is the process I see. The article doesn’t take the next step of forecasting. But if you go back to Prechter’s writings of some years ago, the reserve currency is going to rise (the dollar) long-term, as it’s deemed the safest of the lot (for a while, at least).

I was alluding to this the other day when I was saying to someone that equities will not stay up here because the movement of currencies is far more powerful and the dollar really controls the movement of the market. I think that’s been obvious for a couple of years, at least.

So, debt is the issue, and fear from that, and as the article says, the perceived safest place to put your money will rise in value (as there won’t be enough of it to fulfill the demand—borrowing from Austrian economics).

This is why I’m so fixated on the currencies and how they’re affecting this topping process.

I think Prechter got it right overall, but it’s a long process and I think the dollar has to correct first before heading up in a third wave. It’s done one wave now and it’s so far been moving with the equities market. This suggests that it will tank in a second wave as the US market rolls over (and the other currencies will do the same, in the opposite direction, of course). What I’m having a challenge figuring out is once that happens (that first spike down), how the dollar heads back up again, while the market weakly rolls over once more.

My guess is that it’s all based in spiralling deflation and that this will change the relationship between the dollar and equities. The dollar will go up in value (due to demand – ‘I want to be paid back in the reserve currency’), while debt (and the inability to pay it back, as its relative size also increases) forces major organizations into bankruptcy and equities roll over.

It’s always interesting to me that the waves tell me what should happen and figuring out why (in terms of what humans will do to make that happen) is the part that’s fascinating to me, rather than the other way around.

Peter–Thanks. I wonder if the wave count on the Swiss Franc would have identified the overnight spike in the currency. It would be interesting to see what would happen if the dollar managed a similar feat? Underlying conditions are very dicey to say the least. Gary

Gary,

I was looking at it yesterday, in fact. It’s doing a double top, so I suspect it’s about ready to turn down. That’s a three wave advance on USD/CHF so it’s likely to implode and head back to the previous low at 0.706. Yeah, interesting signals shaping up right now.

I was just looking at the dollar. I’m not convinced it’s actually done one motive wave up. It might be a 3 and we might see it drop in 3 waves to a new low with the US market. That would set it up to start a whole new advance.

GLD today. Has put in 5 waves up and is working on 3 waves down (a second wave). It’s filled a gap, but it has a bit more down to go.

Well, USD wants to break up

Euro is bottoming. It went up in 3, coming down in 3. USD/JPY hasn’t budged, although I’m not positive it’s come down in 5 waves …

It’s going to have to come off a bit to get the equities to the top, I think, ’cause we’re running out of steam. This is looking more and more like an ending diagonal to me.

Actually, now that I measure it, it does look like USD/JPY has come down in five waves. It measures out perfectly. If it retraces 62% in a second wave and turns over, then the trend has changed for that particular pair.

My guess (only a guess) is that we might see the second wave in USD/JPY as equities (& futures) reach the top. I’m still focused on Monday.

Gary,

haha … and this is why I say I’m not that interested in fundamentals. The opposite is true, of course. However, I find musings about what will happen tend to cloud my thoughts on the wave structure. Prechter taught me (through his writing) that the waves will do the forecasting and if you take them into account, then they will give a clue as to the underlying fundamentals.

Because we humans conjure up all kinds of things in our minds, based on what we think might happen, but it’s often impossible to take into account all the opposing forces and come up with an objective forecast. The wave principle gives me the insight into where things are probably going. Back to the ‘trade what you see, not what you think’ principle. 🙂

Well, Peter,

what do you see ? Do you still see the top for USD here?

Normally the strong currency has to penalize the stocks.

But nope. The market struggles up

You can pull up USD/JPY and measure first, 1.618 X for the third, same for the fifth.

Remember, the US dollar on its own has been rising with equities for over a year and a half …

Sorry has not seen your answer higher

New chart, top of post.

looking at the weekly chart of nya. The broadening top started with the july 2014 peak. Then A down, B to a new high, and C hard down—-bull flat. Final peak may 2015. Now–daily chart. “IF” five waves can be shown in the august decline, then an A-B-C rally should be a wave two and not have to hit a new high.

Roger,

Thanks for this. You got me at a good time, as I was poring over cycles charts. (I’m getting too obsessed with this market!!)

I put together a page for you (I’ll use some of these in a post this weekend) that helps to illustrate what I think we’re talking about and I’ve taken it a bit further with the cycles “overlay.”

OK, using NYA, I’m with you now on the broadening peak. The other indices don’t provide the first wave hitting the upper trendline. So, using NYA, you would now be in the 5th wave (or e wave, as we’re in a larger C wave) back up to the top.

Here’s the page I threw together as I was finding material for the post: https://worldcyclesinstitute.com/broadening-top/

To your comment on the first wave down, here are two legacy posts that I put together at the time. They’re interesting in that the show my count on the first wave down: https://worldcyclesinstitute.com/that-sinking-feeling/

This one for wave 1: https://worldcyclesinstitute.com/steady-as-she-goes/

And there are likely some others around that time (I’ve made a note to put a past link on the posts so that people can more easily go back to previous ones. The great thing is I now have charts showing the progress of the train wreck … haha.)

Next week down again into 12/15. 11/20-24 is a major turn window with Monday HC Mars square Saturn. Tomorrow some more background. Counting on Peter to confirm this 😉

Cheers,

André

haha. I’m with you. You should know that if you’ve been reading the comments 🙂

Monday is the major turn day. Cycles are all pointing that way. Currencies have turned. Gold has little green shoots.

EW count is at the top of the C wave, with 5 waves up. GDOW almost at the top of the second wave and 62%.

I’ll have some compelling charts of indices and cycles this weekend.

The top 10 stocks in the S&P 500 are up an average of 13.9%. The other 490 are down an average of 5.8%. This is the largest spread since the late 1990s.

This shows the market is very sick. The long term trend is down into 2018 as I have stated before. But there was a reason for the market to stay lavitated into this weekend.

This was a middle term astro cycle and it peaks 11/21. All my other long term cycles are down. Hence the narrow market.

Next week will be revealing.

There’s a cycles chart I provided to Roger tonight … lower on the page. https://worldcyclesinstitute.com/broadening-top/

Dear Peter,

Great post on the broadening top.

If you would be so kind to compare it to the last solar cycle peak of 2000 and see if we can get some clues as the animal spirits are the same.

The megaphone patter is an important long term indicator over the past decades.

Just maybe, maybe we can see some similarities regarding the broadening top on nyse and SPX between 2000 and now..Maybe we can see similar non confirmation on nyse and how it got concentrated in just a few stocks in SPX last solar cycle max.

Thank you in advance.

Vince

I will put it on a very long list as an interesting exercise.

AAPL is a great example of a perfect setup. I will mark up that chart tomorrow. Short of the century.

Andre,

That’s a cool stat on breadth. I was looking at the a/d charts tonight and a number of other indicators. You can see the underlying weakness in almost all of them.

“Fed To Hold An “Expedited, Closed” Discount Rate Meeting On Monday”

If only this could provoke something.

Otherwise the market should hold at least until ECB on the 3rd of Dec

It’s true, looking around last night, we still have a little bit of work to do. We’ll see what happens Sunday/Monday and whether we can get moving again. We still have a small fifth wave to complete in whatever form it decides to take.

http://www.zerohedge.com/news/2015-11-21/global-trade-just-snapped-container-freight-rates-plummet-70-3-weeks.

Guess QE didn’t work…….

Alternative crash window.

Sidereal equinox 10/18. Last new moon before that 10/13. Add 6 weeks and we get 11/24. Full moon 11/25.

Cheers,

André

Heliocentric Mercury translates the Jupiter-Saturn square 11/22-23.

11/20 we had the natal Sun opposite the transit sun. Conjunction was 5/18. We all know what happened then. Allow for +/- 3cd.

Geocentric Venus 180 Uranus 11/23.

André,

Let us hope it will go down for real this time since we were a bit early thinking shit would go down. 🙂 You short already too?

Cheers,

W

The real turn is in the weekend; so Monday will be safer.

Hey André,

Well if it goes a little up, I can still add to my shorts. 🙂

Cheers,

W

New post: https://worldcyclesinstitute.com/seasonal-uncertainty/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.