All The Same Market

All major markets are continuing as one. It’s not a coincidence that you may have noticed downturns in just about everything this past week; it’s because everything is setting up for a final wave and final turn into a major bear market at the end of it.

So the thing to keep in mind in reviewing this weekend’s analysis is that virtually everything is in a fourth wave of the fifth, and that we have a final minimal high ahead of us (I’ve warned we might get a fourth wave and double top) before we get the final turn down into the largest and most devastating bear market in history.

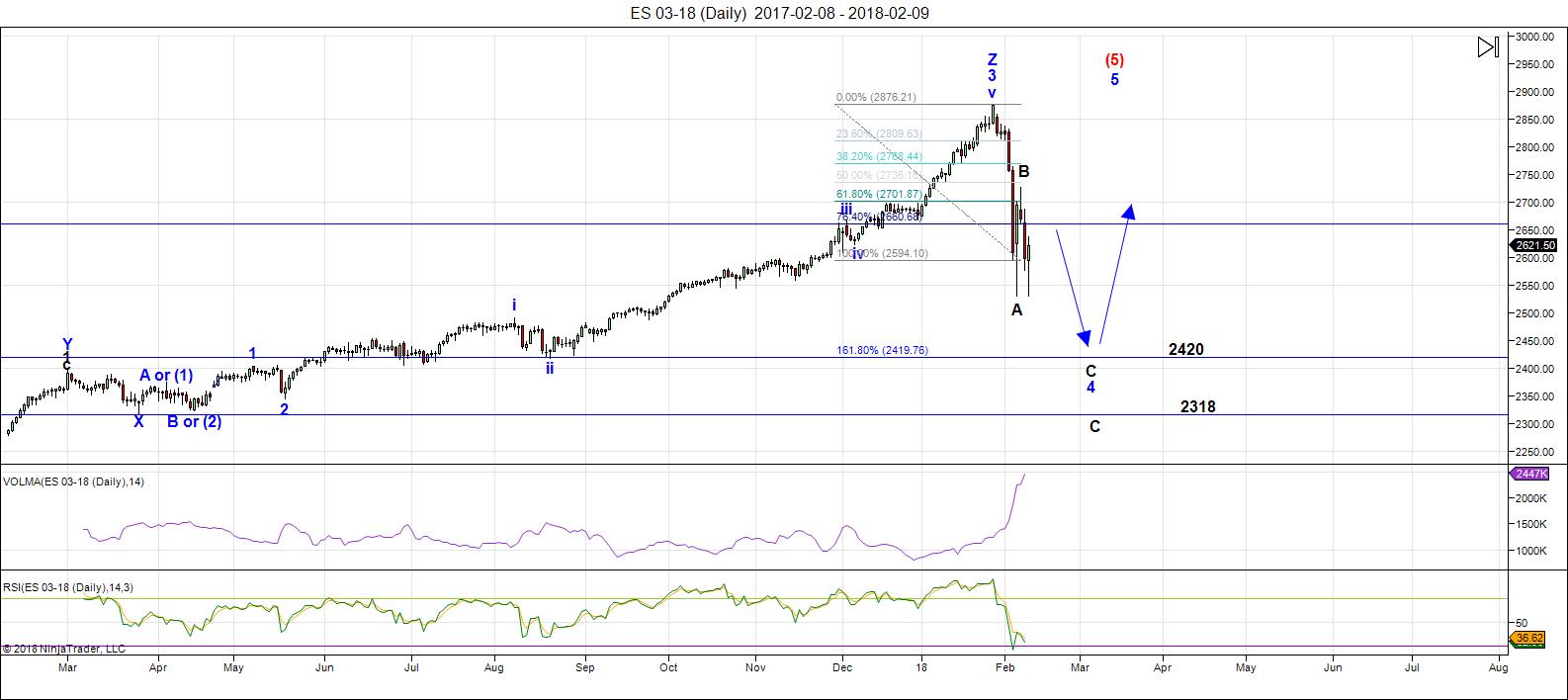

Overview of the US Market

Above is the daily chart of the SP500.

This chart is without a doubt the most difficult chart I’ve ever had the pleasure of analyzing. The challenge is with the wave up from 2009. It’s corrective and therefore doesn’t have any of the usual signposts. We’re missing a few second waves, for example, so it’s a guess, at best. The labelling above is a solution that makes the most sense, based on fibonacci relationships (it’s been changed slightly, based up the unfolding fourth wave).

Based on the labelling above, the previous 4th wave of one lesser degree is at 2420. That is also the target measurement from the A wave down. We could drop lower. (the bottoms of ES and SPX are not consistent and this is exacerbating my analysis.

I would expect a fourth wave to come down to the previous fourth, and this configuration suits that result. So we’ll see what happens.

Then we’re looking for a fifth wave up to a new slight high. However, all our players have to get to that new high, so the ultimate level is tough to gauge without more information (partial rally, a first wave of the fifth still to come). I do not expect a major fifth wave, as I’ve said before. You can get that sense when you look at all the currency pairs, oil, and the US Dollar. They are simply finishing 4th/5th waves of a fifth wave.

______________________________

AAPL has dropped dramatically to what looks like the previous fourth wave, but the structure of the wave has become somewhat questionable. Until it finishes, I won’t be able to determine whether it’s corrective, or not.

TSLA turned down after a double-pronged second wave and has dropped further over the week. FB turned down after spiking up in what looks like the final rally of an ending diagonal. It looks to have completed (or almost completed) a first wave down. It may have one more drop (it also may be a fourth wave before a slight new high).

The wave structure of the USD currency pairs are in B or 4th waves. They all need one more wave to reach their end targets, as does the US Dollar.

Oil looks to be at the bottom of a 4th wave. Gold and silver are heading down while USDJPY traces out an expected bounce.

Everything I’m seeing tells me a top is forming internationally.

The Elliott Wave methodology requires a second wave and turn down from the level (and a drop to a new low) to confirm a top. This methodology keeps you safe while a top is forming (as we’ve seen in the market this week).

By failing to reach 62% and dropping to a new low with corrective waves, I now know we’re in a fourth wave. We also have a potential target for a bottom of this fourth wave.

Turning the Ship — A Process

Let’s look at an update of the US Dollar.

I’ve been maintaining for the last couple of years that once the US Dollar found its low (it’s in a large fourth wave—a corrective wave), that it would mark the top of the US market.

Above is the daily chart of UUP (US Dollar ETF). UUP is representative of the structure of DXY (the US index) and will provide an excellent predictor of the impending top in currency pairs and the US indices.

Last weekend, I wrote here that I was expecting a small yellow wave 4 and then a new low in a wave 5. We now have the fourth wave in place, and it may or may not be fully in place. Nevertheless, I’m expecting one more small final fifth wave down to conclude this trend, culminating in a turn up and leading eventually to a new high above 26.82 for UPP and a similar new high for the US Dollar.

The movement of the dollar strongly influences the movement of just about everything else, so it’s important to pay attention to what it’s doing on a large scale.

___________________________

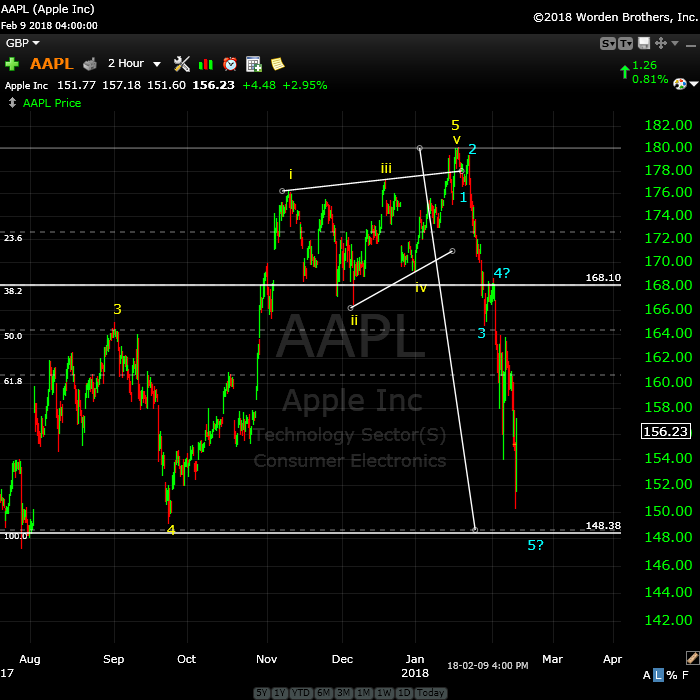

Apple Continues to Drop (as predicted)

Above is the 2 hour chart of AAPL.

Last weekend, I identified a pending top here, with a third wave currently in progress. We’ve continued down in that third wave to the point where we arguably have five waves down.

I identified the target last weekend in the 148.00 area, but it remains to be seen if this wave is corrective or not. Whether we get a second wave only, or not, will tell the tale.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

On Friday, it became apparent that we're in a fourth wave with more downside before we turn up in a final fifth wave to the top.

The final waves up on Friday late afternoon were corrective. It looks to me as though this last wave will make a slight new top to the 2900 area, if we meet one of the downside targets identified.

I'm expecting the downside target to be about 2420 or 2318, which would be previous fourth wave areas, as well as an extension of 1.618 of the A wave down.

Volume: It's risen as the "early rats are leaving the ship," as expected.

Summary: We've turned down across the US indices, but this appears to be a smallish fourth wave down to the previous 4th wave of one lesser degree. We'll look for a turn there and a final rally to a new high.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, February 22 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Peter T,

Is the ES18 chart posted above actually from last week’s commentary?

Yes, thanks. I’ve replaced it.

Hi Peter

last night I had another stock market dream showing that second drop down

just like the chart you posted above. Three weeks ago I had my first ever stock market dream where I saw markets going up and up until they hit this solid thick steel ceiling that could not be penetrated and then this massive straight down drop and two weeks later it happened. I told my wife and a few folks on this board about this first dream so you know I’m not making this up. I was also shown the numbers 275 or 257 I can’t remember for sure the order but I don’t know what the numbers mean?

me thinks the 275 may be the retrace level on the S&P before the next drop down?

this article that was posted today confirms the 275 number I was show in the dream

http://www.inthemoneystocks.com/free-services/rant-rave-blog/item/187837-The-SP-Soars-Here-Is-Where-Smart-Traders-Start-Shorting-Again?aaReferenceFrom=mcverryreport.com

I keep forgetting to log in. lol… ok.. here goes..

interesting, Peter T – 2420/2318.

my main concern, since I don’t use EW is $BPSPX — Fri it stopped @ 40.40 as the decline in SPX started ..but it didn’t rally back up.

am also watching $NYA — apparently 12240 is the magic # if we in a bull/bear territory according to Keystone dude/s https://thekeystonespeculator.blogspot.ca/2018/02/nya-nyse-composite-weekly-chart-40-week.html

also looked @ W’s chart & dates http://prognoseus500.simplesite.com

Jan 26 = 2872.87 (H)

Jan 29 = 2870.62 (H)

Feb 6 = 2593.07 (Lo)

Feb 7 = 2727.67 (H)

Feb 8 = 2580.56 (Lo)

Feb 9 = 2532.69 (Lo)

Feb 9 = 2638.67 (H)

not sure where we headed — think bottom’s but if 2503 breached — then yea.. can see the 2193-2200 area ?

Speculator dude has 2382 as one of the lowest #s IF it gets there this week

https://thekeystonespeculator.blogspot.ca

Hi Peter,

Thank you for the information. It is giving me support on what I am expecting with other indicators. This information is to confirm the pattern. Look to http://prognoseus500.simplesite.com/ thats the picture. So from Mondays High a (hughe) decline in to wednesday. Or will it be a small one? Be carefull.

Willem,

you’re welcome.

Hi Willem i concur with your view and that the decline should be steep into Wednesday but the retrace should only be a 23.6% retrace for the whole move into the 19th feb.

I am expecting DOW just under 22k for the fall into Wednesday and then comes the retrace.

I really appreciate your work, did you say its loosely based on a Dutch astrologer?

Dutch important forcaster gives a decline of 50% of the EU indexes. We are on the path.

Astrology gives an awakening of the people that the financialsystem is not working. Important date is 9/3. 15/5 gives a shock thrue the financial markets.

So I am stil working with this and my indicators and Peter is giving support.

So be carefull.

interestingly, Andre hasn’t posted since January 20, 2018…

Willem,

here is the update to your “time chart”……………….i am unsure if you saw it posted last week……..so far so good!

https://invst.ly/6m6tp

Thanks for posting that Luri, it makes the timeline very clear indeed!

my pleasure……i am fighting a flu right now……..although i will do my best to post Willem’s chart daily…….

Thanks Luri. For me it is Chinees. But that says something about me and nothing abouth the chart. I hope others wil have something to it.

Luri,

I wanted to also say thanks for creating that chart for Willem.

High so far today is only 5 ticks from a .382 retracement of the full decline using daytime prices only…

Equivalent cash number is 2662.64…

My view,

We go up into Opex feb 16., after that down again.

Good luck.

john, do you mind sharing reasons for your view? I take it from your comment you see us in a corrective wave but don’t eant to assume…

For those looking for possible points of resistance, here is another prime target: https://imgur.com/ahWfnPq click on chart for full-page image

Exact numbers at channel top are 2671.25 until 2:54 ET, 2668.00 until daytime close, 2664.75 for tomorrow’s first 81 minutes. It’s an 81 minute chart because it fits exactly 5 bars in each daytime market session…

This week’s energy chart

beware of inversions, trade with caution

https://ibb.co/byYhbS

Thanks Tom

Not perfect…but pretty darn good so far…

https://imgur.com/Uir7G5S

Fri’s Day high 2638.67 – low (2532.69)

= 105.98 x 50%

= 52.99 + Fri’s close 2619.55

= 2672.54

today’s high 2672.61

$SPX

looked @ $NYA —

$NYA > its 144 MA of 12413.75 where PRICE & TIME squared.

now looking for the 100 + 50 EMA ..see if reaches 2morrow

$SPX closed > its 100 MA of 2652.57 @ 2656

$BPSPX only up 1.00 @ 41.40 — so am cautious…not much umph today considering $SPX moved 50+

its raining …………………….like a “waterfall” upon thine empty hair covered head!

LIKE A WATERFALL!!!!!! https://invst.ly/6mhnu

here was an example of my thesis [zigzag down with triangles for B waves of greater degree]……….to create…………………………….”correct”……………LIKE A WATERFALL! https://invst.ly/6mhrz

I think that is correct as the 5 hr chart clearly shows sideways triangular price action. We need a D down followed by a final E up. Considering the triangles size, the break downwards is going to be nasty…

verne……………..

nasty will fail to describe the break of the wave E.

…………………….eating burned toast – “nasty”……. wearing wet socks – “nasty”……………………………….. sporting ‘short – shorts’ on a body needing to wear a kaftan – “nasty”………………………………….

the break of the E wave downward…………………………..X class level CME [coronal mass ejection]

How about nasty, brutish, AND….NOT SHORT?!!! 🙂

Luri i like to see the waterfall but the issue i take with it and its only a small one is that the retrace of “B” is too small i indeed think we test the sub 22k level on the dow(which fits with your s&p “A” decline) in the next few days/week but then i think the retrace much achieve at least 50% of the total decline.

Just my humble opinion, interested to your hear your thoughts

MS…..

fair enough ……….thank you for your thoughts…………………of what i know of B waves – they can pretty well do “anything” they want………in the way they want to………………they are very unpredictable, and nonconformist in nature……

what i am asserting is that in a “waterfall” scenario, in each successive B wave of larger degree – we triangulate [that is burn off short term oversold], and then resume price decline……………………….. i am with NO crystal ball……we shall see…………………..

We had a “reverse” waterfalling since 2009, so i am unsure what the hesitation of intellect prevents one from entertaining that we ………REVERSE……..what the market has previously done….?

https://invst.ly/6mjj9

Luri that rationale makes sense….but when has this market ever behaved rationally haha!

I would love to see your pattern play out. Consider that where we have reached is akin to the move up to the nasdaq highs in 2000.

I am by no means saying we crash 80%(although i know you are in this camp) but i do think we could decline into the year 2020 period if this market decides to sell in the next few weeks/month period.

The first leg down on the nasdaq in 2000 was around 27% the move then after retracing 61.8% declined in total from the highs to the low circa 80%

.

Thats three times roughly the first leg. Given this if the first leg is circa 20% i would expect 60% decline approx.

All just theory for now lets see how this plays out

Thanks for the reply

WILLEM’S TIME CHART DAILY UPDATE

https://invst.ly/6mn21

DXY update……………… y’all have seen this before…………..i have left all those “projected” blue lines…………untouched………………….

https://invst.ly/6mn58

Uh Huh. Final fifth wave down should co-incide with current counter-trend bounce in PMs and miners….

Thanks Luri

Willem has been on the money thus far but for this to fit we are going to need to see one almighty sell into late today and tomorrow indeed.

Hopefully Willem will comment soon

Thanks again Luri for update

My view is still upwards till Feb 17.

At the moment there is a nice correlation with the tides, It’s not always working very well but the high and the low did fitlike clockwork lately.

High tide (New York) Jan 28 and the low tide Feb9.

This is the time table …( tidal coefficient)

http://www.tides4fishing.com/us/new-york/new-york-city-east-41st-street#_tidal_coefficient.

Inversions happen so be carefull

Goodluck..

Respectfully watching Willems time line that Luri kindly plotted, could it be that the expected low of feb 14th can now be assumed as a high and that we should now move down into willems wave “3” on the 20/21st?

Followed by a fast retrace into the 22nd which should take us near to these current levels before we resume more downward pressure into march.

Historically that would fit with pattern as well.

I do wonder though once we see this heavy selling will this just be like 1987 and be a 3 month event or one that lasts longer.

I would love to see Mr Luri’s pattern at play but given the aggressive nature of this market I think this will be hard to navigate

What are your thoughts guys.

Also haven’t said it for a while but thanks peter for keeping the comments section open.

ms……………..”m.s”………………………….

it is simply “luri”………………… no “Mr.” is necessary……………….. although if it makes you more comfortable………………you can call me ………….” Right Honorable Chart Master” LURI………….. :-))

willems chart will be accurate again today, as the CPI is making the markets dump………………………… and as for the chart pattern i have proposed……….. sit back and grab some popcorn…………………..!!!!………………well the popcorn is to “eat”…….

here is the RUT chart……………..broken, and without spirit………….https://invst.ly/6m-n5

CPI dumping “honourable Luri” was pretty short lived unfortunately.

Lets see Willem gave a decent update below and he see’s no problem in the pattern as yet and has said that midday tomorrow is the longest we should wait for the low.

The only issue is on Willems website it shows the low for today/tomorrow as wave 3 and given this we should be going lower than last Fridays low…… I am pretty sure that would be “limit down” which right now I cannot see.

Just an observation, willem has done some great work road mapping this thus far

Joe,

Are you back around? How is Hawaii? Can you add any insight into this market decline? My recollection is that you felt we could decline into an April 4th low.

Has this decline been as you expected?

it be DA mornin!!!!……………..and here BE da mornin update of da ES…..

https://invst.ly/6m-56

will post willems chart at 10 am………….looks good again willem!!!

w4 zone fractal……………………………step right up……….see the w4 zone fractal here!!

https://invst.ly/6m-w6

this is the decrease that my indicators indicated. We can now make the LOW at the end of the day (24.00 US). But tomorrow somewhere in the middle of the day would still be possible. I’m sorry, but I can not interprete it any better. The next time on a LOW as on the 9th in a bearmarket I keep in mind that we are going up 3 days = 72 hours trading. After this 3-day recovery we go on with the indicators. This standard for a big LOW. Because it also in the Bull-market. Be carefull.

Willem thanks for the update, the low you are expecting tomorrow surely must be lower than last weeks low as its wave 3 on your website?

That would be limit down if it were to happen today are you really expecting this?

That’s just an observation buddy, thanks for mapping this out so well you have been on the money thus far that’s for sure

apologies Willem you listed the low for today/tomorrow as iii not 3 but that should still be lower than last weeks low.

Feel free to throw me under the bus and correct me if I am wrong though!

If fractal with BTC is still a match, /es is right around BTC 1/6/18.

http://timeandcycles.blogspot.com/2018/02/the-bitcoin-to-spx-41-cd-cycle-analog.html

https://worldcyclesinstitute.com/on-deck-confirmation-of-a-top/comment-page-1/#comment-27544

http://time-price-research-astrofin.blogspot.com/2018/02/s-500-index-vs-bitcoin-shifted-42.html

2740 target?

https://invst.ly/6n59f

I think it’s done. The measurements don’t add up, but SOX index has done an exact 62% retrace. I’m scaling in to the downside. Would sit here and wait to see if it gets a pop to 2738, but can’t babysit all day.

crossroads …..blah blah blah……………………and in conclusion……blah blah blah…..

“we want it to end, and it will, but how?

end of day https://invst.ly/6n6id

Just food for thought

We are now at the Feb 15 time frame

Yet it is the full moon in early March that is

More important . The next date following that

Is March 17-21 ( the 17th is my focus )

As far as a retrace is concerned it is a .545 retrace

From the all time high to the recent low I’m watching .

My bias being the Dow .

A break through that .545-.618 retrace is a warning

That something is amiss with the bearish scenario .

For the moment and with limited chart data I am considering

This recent bounce as just wave A of a larger A B C upward

Move into at the least March 1 ( the full moon ) to as late as

March 17-21 st which is a bit of a stretch for the wave formation

Yet not at all from a timing perspective .

The bullish scenario would call for a more sideways

Choppy market yet until we get past April 4 th I must stay

With my bearish mindset .

The immediate bearish scenario is from the March 1 full moon

Yet it gets tricky because of the mars Uranus March

17 date which should be a swing high .

Lastly , 6 weeks following the solar eclipse surrounds

March 31 full moon . Also mercury will be at its mid point

Of its retrograde cycle on April 4. Mars Uranus has a low due

April 4 and 3 days following the full moon which is 6 weeks

After the solar eclipse is April 3.

More info to consider .

Venus and mercury conjunct

On both March 4 as well as March 20 .

To sum this up .

March 1 ish full moon and March 4 ven mercury conjunct .

March 17 mars Uranus swing high and March 20 ven mercury conjunct .

March 31 full moon , 3 days after, April 3 ( and 6 weeks after solar eclipse )

April 4 is mars Uranus swing low date and mid point of mercury retrograde .

Based on previous crashes a .545 retrace is all I’d expect

Yet I’ll give it .545-.618 .

The following decline would be 2.2 to 3.2 times this

Previous leg down .

That implies a risk of 20 plus to 32 plus % downside

In the down from this next swing high .

I can be wrong mind you yet that is the math and we

Are now in several bearish cycles .

I have mentioned previously that I felt this was nothing more

Than a sideways move into mid Feb to early March .

Also I have stated that after March I cannot accept any

New all time highs or my cycles are wrong .

So far everything is playing out so I’ll stick to it

Untill proven wrong .

We made it to Honolulu and it’s raining lol.

All for now

Joe

joe………………..JOE…………………..”J-O-E!”…………………….enjoy! we miss you!

Joe,

Thanks for the thoughts, appreciated as always. I am doing some work on using NM, FM and Eclipses as timing anchors, so I found a comment you made interesting, which is the basis of my question: you state that the Full Moon in early March is more important than the current mid February eclipse. Why do you believe that, is it the associated planetary aspects that occur about the same time, or something specific to that Full Moon, or an unrelated timing aspect. Separately, do you have a view on the generally on the relative importance as it relates to market timing of New Moons (& Solar Eclipses) or Full Moons (& Lunar Eclipses). Thanks for your time,

Steve

DXY is within a……………………….”breadth of one single hair”…………from bottoming and turning………………

y’all know this chart………….posted it while wave iii was falling…… posted projected lines of price behavior at that time,,,,and it looks to be prescient.

…………………..hair’s breadth peoples……………..hair’s breadth!

https://invst.ly/6nfti

…………..and willem’s time chart update……………….

to be fair here………….we did have a 50 pt plunge in the ES in the morning before they bought it back up, so we had a “low” yesterday in the a.m, so in that sense it was extremely accurate – although for the day candle……….i put an “X” through it to indicate on the daily time frame an “inversion”……………….

also this time chart does not include the small changes willem shared with us yesterday…………………………

https://invst.ly/6nfyq

https://invst.ly/6ng0m

the ES has made its choice,

the ES has made its ……….”BED”…………so to speak………..

the ES has been know to …………………”wet the bed”…………..on occasion!

do …………”YOU”…………………need …………..diapers??

……….the “truth”!???………………..you can’t handle the “truth”!!! https://invst.ly/6ng-h

Joe,

Interesting update! Thank You!

i must be “stupid”…………………

only a “stupid” warns of a potential “price” dislocation to the downside on OPEX!!!

only a “stupid” would say…………………………..”BE WARNED”!!

i must be stupid!

50 day sma has said: “Papers Please!!” 🙂

the stasi used to say the same thing verne………………………….funny that!!!

hmmmmm…………………verne…………….do you have a little “stasi” roots you want to share with the classroom???

Now my dearest luri, did you hear me say: “PAPIERE BITTE!”?

Now dija?? 🙂

bitcoin…………..get yer bitcoin heeeerrrrrrreeee……………bitcoin………!

close view update – https://invst.ly/6nkew

forest for trees view – https://invst.ly/6nkfz

Are you talkin’ ’bout BITEcoin??!! 🙂

young man – you are full of “fire and brimstone” type of “cheek”……….. i am liken to taking you over my knee, and given you a RIGHT whoopin……………….!!!

now…………..what was that coin again????

lizzz…………..take down this time …1:29 p.m…………that’s when it began………@ 1:29 pm!!!!

oh and liz………..what is 1:29?????? hmmm………………?

Luri congrats on your bitcon! Sadly, even if you put a target of $1M (like McAfee says), you can’t drag me into that con.

1:29 pm of what Luri? btc? es? I only see /es 2721 at 13:13 edt and

nflx 277.58 (almost close to the Jan. 29 high 286.81).

liz……………..i only made the chart for bitcoin……………..that is all…….

block “chain” is a nomenclature of old……………..during the slave trade……..slaves were “blocked” and “chained” one after the other for movement……

neither a “slave” nor “master” be………………………………………..so the new block chain is the same as the “old” blockchain…………………

and……………….”it”……………..??? i am unsure what ……”it” …………is…..but once i find out…………..you will be the first to know!!! 1:29 is when “it” started though!!! you can take that one to the bank!

Wazzat about bitecoin blockheads?? 😀

verne…………….who unlocked you from your dungeon room……i thought you were …………..forever grounded???

You don’t know what “IT” is? What a tease! Are you saying all those buying btcs are slave to the con so tptb can see movement of money easily as opposed to cash?

Since you mentioned 129, did you know Templars were endorsed by the Catholic Church in 1129.

so i have this suit liz………………….

the suit has these small transparent pockets on the outside……hundreds of these “transparent” pockets…………….and well you fill all the pockets with OREO cookies…………….and it becomes a suit of “cookies”………….and well show up with a “suit” of cookies………….to a formal luncheon……………..in which the caterers are late by over 1 hour………………………….and the attendees are …..starving!!…………..

now……………………..THAT……………….SUIT………………………..is all tease!!!!

templars = temple + lars [sounds like liars] = temple liars :-))

question to ask????……………..will tomorrow be a “red” wedding day for OPEX????

https://www.youtube.com/watch?v=ZnxvUuSzbMI

Oreos not a tease for me. 🙂 Luri, what kind of red day do you foresee? The day after 12/16/15 or 12/29/15?

liz,

i foresee a “new” …………red day……………………….2/16/2018

2+1+6=9 and 2+0+1+8=11 said otherwise, 911…………it will be its own day, and be a day for fractal comparison in the future tense………………………………..

how about dutch dark chocolate truffles stuffed into those transparent pockets……..????????

chocolate liz…………..think about it……………………mmmmMMMMMMMmmm

good!

Yummy dark truffles! So 2/7 fractal maybe? 2/7 high and 2/16 high then? Like a double top. Both 911. Twin towers?

liz…….

tomorrow………………………its the end of the lunar year of 2017…….and the beginning of 2018 lunar year……………………………….its new years day!

and what happens on new year’s day………..that’s right……..”red wedding”……………………….

tomato for your thoughts???

Luri,

I am looking for this “horned” pattern, see red arrows, to appear on /ES. If it does then yes, Drogon, the black-red dragon, will burn a few late bulls.

https://imgur.com/a/5mTHE

I overlaid /ES chart over bitstamp btc chart to show it might be following same pattern. https://imgur.com/a/cUFzc

Thanks Liz that really great overlay but I am really struggling to see this keep following BTC . I think we see very slight lower lows in the dow/s&p but the move in the nasdaq have today negated that possibility IMO

I think the indexes have a chance at another new high round april time the nasdaq should definitely do this but the other two will be dependant on what occurs when they hopefully make new lows.

By no means am I saying significantly lower lows I am literally talking about an intraday move.

Something to not is that the futures low in the dow was 25064 so expect the 23k level to be penetrated briefly before a big bull move

Thanks again for the overlay

The BTC fractal is a possibility.

Another possibility is the V recovery from the Oct 2014 “fake puetz” crash. Another one is the 2/11/2016 to 4/20/16 I’ve talked about last Dec. 5 I think.

Last January 24, Dalio says “blowoff rally or melt-up in which investors begin to rush into equities for fear of missing out on gains, will take DJIA, SPX, COMP to ever-new heights. Against that backdrop, Dalio says hanging on to cash, rather than investing in risk assets, like stocks, may be a misguided strategy that could cost investors.” https://www.marketwatch.com/story/head-of-worlds-largest-hedge-fund-says-if-youre-holding-cash-youre-going-to-feel-pretty-stupid-2018-01-23

Yesterday, we learned he is now short large companies just a few days after encouraging investors to move out of cash. So yeah, I hope he gets squeezed. https://www.zerohedge.com/news/2018-02-14/bridgewaters-european-short-grows-massive-22-billion-here-are-targeted-companies

Now I said I want a melt-up to squeeze RD but …

5/19/15 = /es above 20sma, 50sma, 120 sma, 200 sma

7/6/15 = /es hit 200 sma

7/20/15 = lower high

8/12/15 = 200 sma retest. Yay! To the moon…

8/18/15 lower high

Ooops. “To the moon” became a waterfall.

1/29/18 = /es above 20sma, 50sma, 120 sma, 200 sma

2/5/18 11:25 pm edt = /es hit 200 sma.

2/9/2018 hit 200 sma regular trading hrs

To be continued…

Yes I heard about dalio “head fake” switch these guys really have no morals but what else should we expect.

Home builders have done what they did in 2008 prior to the top they sold off slightly before the ultimate high which is food for thought.

The fact remains I think this is anything but easy but I cant see this market just giving up like bitcoin did Liz.

I still favour a partial test of the lows next week which probably seems highly unlikely given this hyper bull move.

They will want to trap more bears at the bottom yet again

Thanks for the MA data below I did not realise that similarity too, that’s some good data Liz

Peter T,

Do you see similarities in our current market trend and the events of 2015, Liz points out below?

It’s unlikely (I haven’t read the comments you refer to). This market is an anomaly – it’s unlike any market before it.

morning y’all

reiterate – price dislocation warning…………………….https://invst.ly/6nvxp

dxy met target perfectly overnight…………………dxy looks to have turned……..next estimated move to upside to 96 area…………… https://invst.ly/6nvyk

close up of dxy……….target was 88.24…….it hit 88.18 overnight……

https://invst.ly/6nv-9

/ES 1 hr chart doesn’t look bearish. Looks like it’s squeezing to the upside possibly 2788.

liz…..liz……lizzzzzzzzz…………

hmmmm….. i see that “last” vestiges of a long ego era – an era bereft of leadership……………………………….!

https://invst.ly/6n-38

I see. Just kiss the 20 sma then 2750+- ? Okay, I sold udow, tqqq, upro because luri is warning me.

2750 ………………is known to have “bad breath”………………so no kissing…..oh and what i heard……………….that 20 sma you were telling me about……………………..[cough] …..”way loose”…… …….cough!!!

i have no crystal ball……………and i NEVER gossip :-))

to late……………..they are kissing!

Wow lol Luri. Upro at 150 now instead of 149. I feel cheated. I’m done for the day! You can continue watching the lovefest today. Let’s see if the romance lasts into the weekend, engagement by Tuesday and the red wedding on Thursday?

it was ……..”ONE”…………..kiss ……….liz,

ONE small peck on the cheek………….and definitely NO tongue!!!!!

i read the script………..red wedding………………………………………..today!

I think one of two things happens next. Either we hit and bounce off the 50 day in a corrective move down or we slice through it. What happens there will determine the market’s course for at least the next few weeks.

agreed….

slices of apples

50 day moving apple

apple pie…………….

cinnamon and nutmeg are extra!

alas,

no red wedding……… opex – 1 luri – 0

does some wedging count??………………and no…..its different than ….”THAT” kind of wedging………………….!

https://invst.ly/6o2u8

Yep. Market makers do like to engage in lots of whipsaw on OpEx with little or no final price change. Serves the dual purpose of shaking out traders on both sides of the fence and not allowing any directional OpEx windfalls. You can actually make some fairly decent coin trading the expected whipsaw. Sold and re-bought same strike puts a few times today…. 🙂

I do not let myself be misled by a longer term prediction based on the data of others. So I want to give you as confirmation the weekly updated “website” http://prognoseus500.simplesite.com/.

For the long term I must say from my indicators.

A top around 26-28 feb and then we make a decline that can be hughe until to 12-14 march. I can predict a week ahead with a reasonable certainty. So any longer is a risk. This must be confirmed the week before.

I had the First wave down filled in with dates. That was wrong. The decline to 14 march did not appaer.

This one has an explanation It is an Extended First Wave Impulse.

See http://studyofcycles.blogspot.nl/ I do not know what it means but I stick to my indicators.

No disrespect meant, Willem, but no one can consistently predict a week ahead with reasonable “certainty.” If he or she could, he would be rich beyond compare with the use of derivatives and margin which “reasonable certainty” would justify. “Reasonable accuracy” would be acceptable here and we are willing to put you to the test, although I hesitate to speak for the others… 🙂 You mention a top around Feb 26-28 but it would be great to have your reasonably (certain) accurate prediction for next week in particular.

Hi Peter,

The red line is confirming the prediction.

Next Friday can be also the top. Thats one day before HIGH-tje period. (i will translate it.

Just watch http://prognoseus500.simplesite.com/ for a few weeks/months and you will see.

I just finished my research (I think). And I do not want to give very positive results as others often do. If you are researching, you often forget the action on the right time. But also some indicators can work less through, for example, quantative aesing.

My advise is watch it for a time and ……

https://worldcyclesinstitute.com/the-big-top-fake-out/comment-page-1/#comment-27918

My prediction,

For Last week I said up into Opex, now I have down in into Thursday or 26/27 Feb.

We will soon know..

Good luck everybody.

on the S&P 500, the move down from the 01/26 high (2872.87) to the 02/09 low (2532.69) was clearly in five waves…thus far, that was followed by a three wave move up to the 02/16 high (2754.42)…if yesterday formed an interim top, will the subsequent move down be in five waves? if so, what would that signify?

It could be a third wave impulse to the downside, or it could be the C wave of a 5,3,5 zig zag for a larger fourth wave.

The double bottom in the dollar, the long upper wick on the candle, the race of VIX from negative territory to close in the green argues for a completed corrective wave. I think we’re done with upside action for now…

It would be a zigzag (a corrective wave).

$BPSPX = 40.60 (Oct 2014)

$BPSPX = 40.40 [Feb 9, 2018]

$BPSPX = 22.20 (Aug 24, 2015)

$BPSPX = 23.20 (Jan 21, 2016)

not sure how to do a link from stock charts.com .. so excuse my ignorance &/laziness to figure it out.

IF SPX takes a BIG dive — the 22-23 $BPSPX area will be revisited and for such a dive we’ll see 2216.0781 — 38.2% retracement from Jan 26, 2018 2872.87 high to the Feb 11, 2016 1818.10 low … if I’m correct.

another ‘funny’ thing I did with Date Calculator — took Feb 11, 2016 + 45 MONTHS = Result: Monday, November 11, 2019

& guess what’s in transit on NOVEMBER 11, 2019 ? …Mercury

https://www.timeanddate.com/date/dateadded.html?m1=2&d1=11&y1=2016&type=add&ay=&am=45&aw=&ad=&rec=

https://www.timeanddate.com/eclipse/list.html

T.O.T.A.L. LUNAR eclipse :: JULY 27-28 I see a correction then. 7th month? day of rest 😉

A new post is live at: https://worldcyclesinstitute.com/options-at-the-top-2/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.