Looking for the Trigger

Look no further than the US Dollar.

I’ve been maintaining for the last couple of years that once the US Dollar found its low (it’s in a large fourth wave—a corrective wave), that it would mark the top of the US market.

As per my graphic above, it seems like this bull market will never end, but we’re extremely close and it could fall over any time.

Above is the daily chart of UUP (US Dollar ETF). UUP is representative of the structure of DXY (the US index) and will provide an excellent predictor of the impending top in currency pairs and the US indices.

On Friday, the US Dollar began to trace out what looks like a small fourth wave. I’m looking for a bit more upside on this before it drops to my target of 23.40, or so. This target represents a measurement of the length of blue wave one near the top of the chart and extending it 2.618 times that length. It’s a likely stopping point for this blue wave (4).

The turn up will eventually lead to a new high. The dollar will turn with the euro, which is at a new high, and very close to my long term target.

Now, with the US dollar at the obvious end of a fifth wave of a corrective fourth wave (blue circle 4 on the chart), for those who think there’s another wave 4 and 5 to go, where is it they expect the dollar to go? You only get 5 waves before a trend change. The counts are all in the fifth waves.

The movement of the dollar strongly influences the movement of just about everything else, so it’s important to pay attention to what it’s doing on a large scale.

___________________________

DAX is now virtually at a new high (a potential double top). AAPL is at the top of a small ending diagonal, at the top of a fifth wave. EURUSD and GBPUSD are extremely close to my long-term targets, the 38%, 4th wave retrace level. AUDUSD and USDCAD appear to have turned (with first waves arguably already in place). Oil is topping, or has topped already. Gold and silver are heading down with USDJPY. The VIX has also foreshadowing trouble on the horizon. We’re all set—we just need the trigger.

Note that TSLA (yes, Mr. Musk’s baby, below) is sitting right at the 62% retrace level (352.60) after a corrective 3 waves up. Look for a turn down here, as I’ve been predicting. This highly speculative house of cards is foreshadowing our upcoming major bear market.

In summary, everything is at an inflection point, or very close to a turn, but a little more patience is warranted.

Bitcoin: here’s my take.

All The Same Market

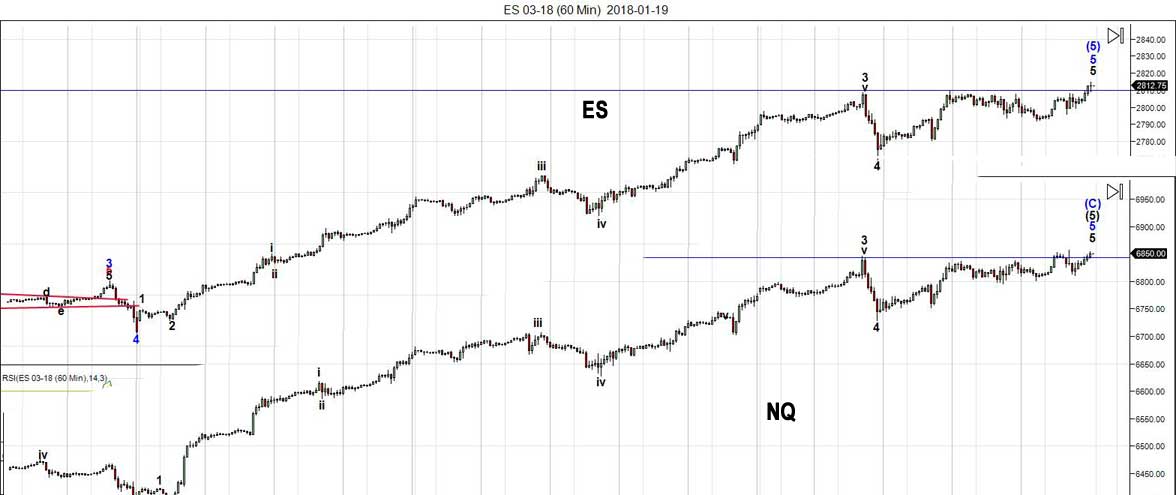

Above is the hourly chart of NQ (Nasdaq emini futures) superimposed over the same timeframe chart of ES (SP500 emini futures). For over a year, I’ve been talking about all assets classes moving more and more as one as we strive to reach the final high.

Here’s an example of how tightly aligned the two major exchanges that constitute the US equities market actually are. This is the first time I’ve seen the Nasdaq and SP500 move in absolute lock-step. We’re seeing the final stages of this rally, as all assets move to a final high.

To a lesser degree, you can find the same phenomenon across all major asset classes. There’s a very small gap now between their ultimate targets and present positions … right across the board.

The vigil continues.

______________________________

Tesla at the Target

Above is the 2 day chart of Tesla.

Tesla sits at the 62% retrace target as we wait for the turn. Blue wave 2 is corrective and we’ve completed a double top. The next move should be down.

Last week, I suggested we’d head up in a “double-pronged” second wave, which is exactly what we’ve done. We’re getting ready for a turn down into a third wave.

__________________________

Changes to the Free Blog

This weekend, I rebuilt the site, replacing all the WordPress core files in an attempt to quash the free blog. After spending almost all night at it, it doesn’t seem to have had an affect. I will therefore move forward to requiring all commenters to log in, starting sometime early this week (it will take some time to get this up).

This will provide much more control over transient bloggers and protect all names and email addresses. It will also mean that once you’re logged in, you can comment at will, without having to include your name and email each time. I should have this in place in the early part of this week.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

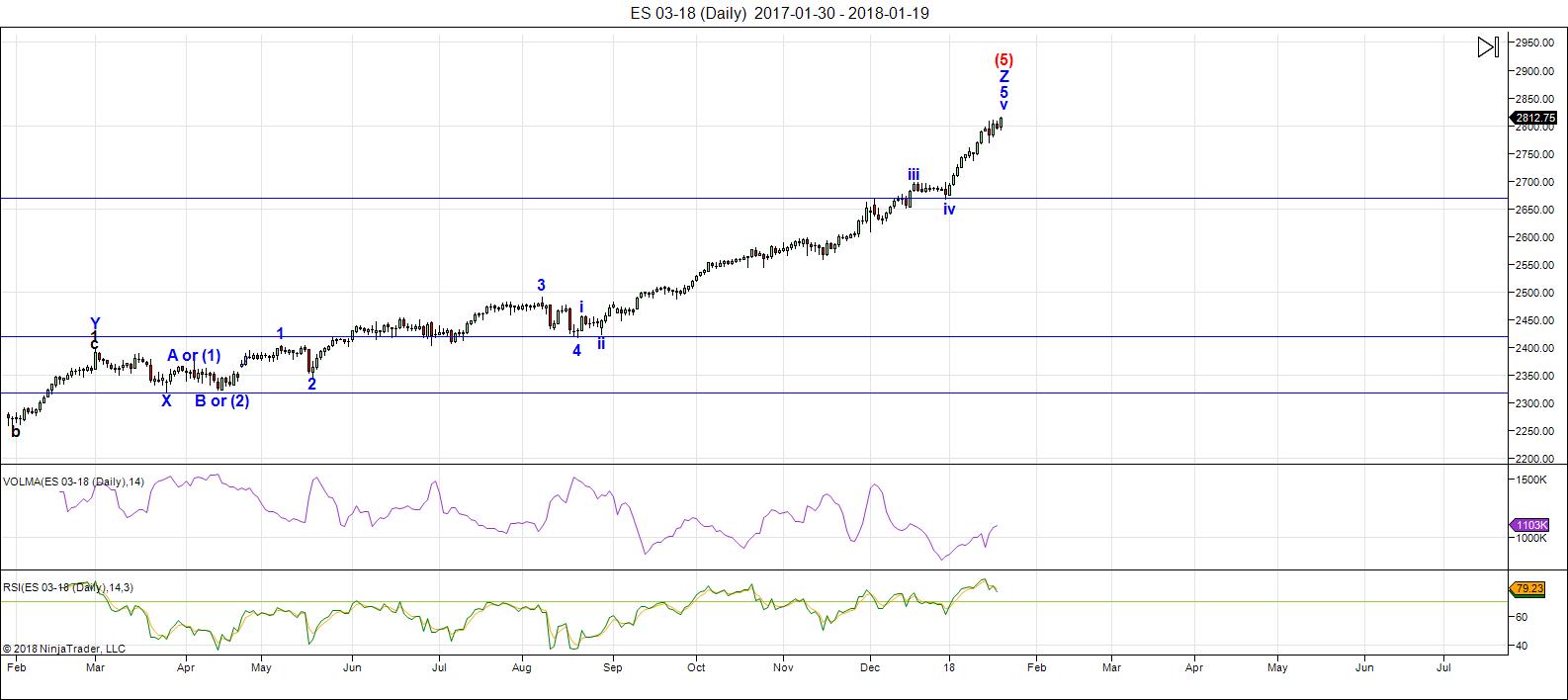

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down imminently. But, we may end up with a double top, so the first turn might not be the final one.

Another frustrating week as the US Dollar tries to find its bottom. As a result, virtually everything has inched a little bit higher in yet another subwave of the 5th wave.

Bearish financial advisors dropped to 12.7% this past week, the lowest level in 31 years. In other words, the bulk of them have given up and decided to go long—a perfect scenario for a turn. "Everybody's in!"

We're ultimately looking for an impulsive wave down in the US indices (and a double top beforehand would be a very nice predictor). Again, we may get a double top so the first move down will be important to watch for clues as to whether it's permanent, or not.

There will be tons of time to react; after all, this bear market will last years. So, while I expect the US market to start down this week, I would not be at all surprised to see a test of the final highs before heading down in earnest.

Volume: It's dismal. Its the purple line, the top indicator at the bottom of the chart.

Summary: The count is full for the US market in general, except for small subwaves that form the balance of a motive set of waves in SPX and some other major US indices. We're watching for a turn, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, February 1 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Peter T,

I appreciate your commitment to your discipline and what has become your life’s work!

tks. Don’t follow … it can get kinda lonely over here haha …

Thank you Peter ….Nick..

energy chart for next week

could be completely inverted; it happens, so be careful

https://ibb.co/hkc6mw

Tom, I think this will prove to be fairly accurate.

big time…

inverted!

https://ibb.co/hyS51w

I posted to this effect earlier today, but I am now getting comment prefills using MY name and email address. Bug fixed?

Peter T — do you follow Daniel Code ? just finished reading on the dollar & its correlation to gold

http://www.thedanielcode.com/public/Dearest%20Dollar.pdf

No, I don’t.

& yea.. know its dated 2009 — buttttt some swear by it — the DC (Daniel Code)/

The whole story behind Hillary and Trump comes out. Mind blowing interview with Joe diGenova. Fascinating. A preview of your TV watching for the next year …

https://www.zerohedge.com/news/2018-01-21/brazen-plot-exonerate-hillary-clinton-and-frame-trump-unraveling-says-former-fed

The Pundit, Judicial Watch & the other dude that did a special on Twitter spying on all of us, etc. name escapes me now cause I just got Locked out of MY LOCKED Twitter accounts. its bizarre — only one left is BUDDIEE18 cause they allowed me to delete that “offensive” tweet re Hillary wishing her dead….and I didn’t have to add my personal phone # in order to get in my public twitter accounts.

The Pundit, Judicial Watch & other dude were way ahead of ZeroHedge…many months ago.

anyhow — this is my bizarre relationship w/ the Gestapo DNC #snowflakes on Twitter — am so ticked off — all I want is my LOCKED accounts back which I’ve know they being spied on and I’m the ONLY ONE I ALLOW to FOLLOW MYSELF. I do my own DD in MY LOCKED Twitter accounts. couldn’t care less for the public ones./

https://twitter.com/BUDDIEE18/status/955446527417245697

DXY overnight update – https://invst.ly/6ep0z

close up of the price action….. https://invst.ly/6ep4i

“BE WARNED”!

peter,

question? i have adjusted the EW……Ending Diagonal for the ES to align with the DXY……………… as follows…………..https://invst.ly/6epf7

we have already had a w4 overlap of w1 -which is a good sign the dxy and the ES are aligned…………does the w4 of an ending diagonal need to make a price low ………..”BELOW” the prices of the B wave of the preceding zigzag of w3 to be valid?? see chart for clarification….

Peter, I think we are in a 3 of 5 up in Tesla, but I will definitely be watching both counts. Appreciate your time.

Give me just one reason why that’s possible.

Dan, take a look at a long term chart of TSLA and note the momentum indicator. This is a fairly reliable way to spot third waves.

the overthrow – of the ES…………….it cometh………….. as in NOWETH!

https://invst.ly/6esom

Thank you for your EW analysis and insight.

#22 , along w/ #11, 33, 44 they known as MASTER #s… for those who don’t follow Numerology.

today’s the 22nd — so yea.. can see why markets up today. usually BIG days on a 22nd.

most of you are aware of the seasonality clock :: http://www.equityclock.com/seasonality/ — you can also find for each individual stock also.

someone here mentioned TSLA ? yea.. played that one when it bottomed @ 305 — bought immediately the 335 Jan 19 calls — and as usual sold them early 🙁

http://stockcharts.com/def/servlet/SC.scan?searchString=tsla — some use this screener

NYA has an upside based on an inverted head and shoulders

pattern . The upside projection is 13572 and change .

I am allowing for it by taking the monthly nya chart using the

May 2015 high and the dec 2016 high as the neck line .

Time wise it doesn’t work yet price wise ill allow for it .

The 10 day trin has an overbought reading and has began to turn

yet still has not given a sell signal.

The overall market using the major index’s has about 1 % left

before hitting the upper trend line. ( just under 1 % )

NDX: needs to break down below 6762 to give me any kind of

signal that it has peaked . ( That level wont change )

NDX: has higher resistance up to as mush as 8369 <–No Typo

For now though

NDX: sell at 6979

NYA : Sell at 13572

All price targets based on either Monthly chart ( NYA )

or weekly chart ( NDX )

my point is to just define risk

i am staying bearish yet i have several concerns with timing

which must begin to show promise from jan 26th-feb 2

a failure to really see any meaningful bearish setups after that

time frame will begin to cause me to seriously consider these

bearish cycles that i see we are in .

An early april low still sits in front of us as i see it .

Feb 15-16th another turn and after march i simply cannot

allow for any new all time highs .

that's my basics for my trades going forward .

very very short term :

NYA 13428.28 is worth paying attention to .

A Failure at 13428.28 on the NYA would consider

the entire move from the sept 2000 top to the june 2012 low

a triangle . the thrust out of the triangle projects 13428.28.

Bottom line :

i have 2 price targets on the NYA

13572 and change and 13428.28 .

from the june 2012 low i can count 24 months to the high in june

2014. yea its not the high but it was the start point for a longer sideways

move and we did get some decent sell offs.

taking the low in jan 2016 and counting forward 24 months

we have jan 2018. so there is a bit of traditional timing thoughts

to consider along with my bearish cycles .

7222.87 june 2012 low

11025.91 june 2014 high ( not the actual print high of the move which was a later date )

that was a 52.652 % move .

8937.99 = Jan 2016 low

a 52.652 % Move = 13644 <——

We are very close to all targets

13428.28 + 13572 + 13644 /3= 13548.09

Todays high so far in NYA is 12422.48

Not saying we topped Just saying im watching for a top

and any minor 5 wave decline followed by a 3 wave bounce

will be shorted .

nuff for now

Thank you Peter, another masterful prognosis.

hmmm……

https://invst.ly/6ev-v

so there …..MUST…………be a limit to an extending wave? anyone?

https://invst.ly/6ew6g

‘

Clearly a third wave of some kind. We need at least one more down up sequence prior to a top.

i respectfully disagree verne,

we are within the “volcanic” blow off top………..there are enough waves to have a complete count – yet we extend……… i am unsure of the fib relationships to focus upon with a blow off top…………………is this vertical move sustainable?, the pullbacks are shallow and quick in nature……this is NO THIRD……………it is the final stage blow off…………..https://invst.ly/6ewwa

A fifth, but an ending diagonal in both ES and NQ. Bigger one than I originally thought. But you can’t just look at the US market. Everything has to top, and while they’re all very close, it will take the dollar to turn, and it’s just pennies away from its target. The DAX also must top. Everything must. Just a little more patience.

Your yellow III is the first wave of the ED, as far as my count is concerned. We’re in the final fifth wave of that ED.

You can have third waves even if we are in some kind of ED and of course they would be in the C portion of the ZZ. The kind of upside momentum we are seeing makes it hard to conclude otherwise. You can even have third of a fifth so I expect at least one more corrective move prior to a turn.

Hi Peter, at what level can we consider the current count invalidated? We’re way above the +-20 points you predicted when we were just under 2800. Thanks for your analysis.

Thank you Peter. You’re the best.

Verne

This post is not Verne either

Luri

Eventually we get to the top .

Look at bitcoin prior to the futures being introduced .

Look at tech stocks in 1998-1999 going in to 2000

Verne ( the real Verne )

One thing to consider is when did this 3 rd wave begin if

It’s a 3 rd wave . The monthly chart ? The weekly chart ?

Just a thought.

Also if it’s a 3rd wave, where are waves 1 and 2 ?????

Just a thought

Joe

Good questions. I based my conclusion mainly on price momentum. I am absolutely terrible at labelling waves…

Luri

Do you notice the constant 1 2 3 4 then 1 2 3 4 ?

No clear defined 5 th wave ?

All 3 wave moves . That is my main issue with this market .

3 wave moves or A B C moves are difficult .

Look at the longer term charts of the TYX or TNX .

All 3 wave moves

Hi Peter,

Do you expect this rally to end this year?????

Stardate 405679

Peter, do you consider the 4090 level for ES to be significant?????

Thanks in advance

I keep track of the $VVIX & $SKEW/X each day — when they make their 52wk highs & lows — usually a turn/reversal in SPX

https://twitter.com/BUDDIEE18/status/955611583715065862

& while waiting for that damn twitter snowflakes to get rid of the 21 phantom followers…after I’ve blocked the rest & waiting for – 9 followers so I can lock that account since the other 2 they have me locked out. gawd I hate twitter snowflakes — so am tweeting there.. so yea… think that this run is the beginning of a run like 2005/2006 TECH BOOM until March/Sept 2001 ? don’t know…but am keeping in mind what Lloyd Atkinson said back in Sept ’96 when I was chewing bubble gum & interested in gold since I read all the papers about BRE-X lol..(didn’t enter stock market until late 2000) he told a gasping crowd that gold price would NOT go up until about 2001-02 ..

anyhow here’s one of the tweets w/my prediction on SPX :: https://twitter.com/BUDDIEE18/status/955601638856642562

FWIW

that’s BMO’s Lloyd Atkinson — and its 21 fathom followers & I entered stock market for 1st time in late ’99 — not 2000… mind’s all over the place. been a long day — blocking & some trading.

here’s another tweet of some interest ? the chart, that is :: https://twitter.com/BUDDIEE18/status/955599312200777728

anyhow my brain’s fried right now soooo — g’night & very interesting thread & thoughts here !!

I’ve just turned on the requirement to be logged in in order to be able to blog. There are two links on the page so that you can easily do this.

One is in the middle of the page “Registration for Commenting” (in red text) and the other is in the white box at the bottom of the page below current comments.

I’ve turned off the requirement for login for today, so that I can troubleshoot any issues. If you’re logged in, you should get the benefit of being logged in. If not, you’ll just see the normal procedure to comment.

TLT has already broken its 200 day sma with a classic successful back test. I am now keenly looking at TMV to execute the samevprice action to the upside. No one is paying attention to intetest rates. It has long been me thesis that the bond market controls the destiny of the stock market. The perma-bulls may be in for a very rude awakening as the yield curve inverts.

Hi Peter; Is there any way to allow some time for editing after posting. I am so prone to fat-fingered tablet typing!!” 🙂

I will need to do some testing, as I don’t see what you see, so I need to simulate it … a bit later.

Cool! Thks! 🙂

I think we will see a a top today or tommorow and a bottom on Jan 31, full moon and it is moonwobble period.

http://bathtubbulletin.com/moon-wobble-february-2018/

Also

Geo bradley Jan 28 and helio bradley feb 1

It is also amazing how we dutchies, are leading in the turns…follow the AEX it can help you.

Yep! 🙂

Verne

Higher rates tend to bring a higher stock market.

do an overlay .

That may happen INITIALLY, yes, but ultimately rising rates will be the bull’s demise. The carnage will begin in the bond market as rising rates precipitate rising bond defaults, and falling equitiy prices not far behind.

so,

please ………….”disregard”……………comments posted that utilize my name, without the skill set to utilize mine own style of delivery…………………. “BE WARNED”!!!!

ED versus extended waves will have the same outcome….

https://invst.ly/6f4zb

we “be” seeing overlapping in this wave here…..hmmm…..https://invst.ly/6f504

I think the troll has been TERMINATED… and won’t be back!! 🙂

I am assuming some kind of fourth wave underway. If so, we need a final spurt to new highs. I don’t care what the final wave structure is, I expect the top to be signaled by a brutal reversal off the final high. Unless that happens, keeping some powder dry. As Peter mentioned, there will be plenty of time to ride the bear when he does put in his long-awaited appearance; absolutely no need to rush… 🙂

watching 13572 nya

—————26392- 26426 dow

—————6979 NDX

also considering overall market now less that 1/2 % from ideal top

Look alert people! In keeping with the thread’s title, I hereby note the new 52 week low in uup. I think the end of the fifth down is near. A bullish engulfing candle an I am in!!!!!! Yahoooo! 🙂

Whoops…there it is!!!

New highs in NDX, DJI, SPX.

DJT, RUT lagging so far…

verne,

dxy – https://invst.ly/6f64p

close up dxy – https://invst.ly/6f65p

US dollar index monthly chart

counting it as a 5 wave structure

wave 5 will be .618 of waves 1-3 at 87228

the 50 % retrace from the 2008 lows to the 2017 highs sits at 87257

calling this an expanded flat ( B wave top in jan 2017 )

wave C would be 1.618 Times A at 89.913 <———

if all these index's and the us dollar hit there price objectives

at the same time and i see a minor 5 wave move

ill go short .

Yes Sir!! 🙂

Utilities do not have a clean wave count anymore.

The best count i have is we now have waves 1 2 3 in place

and we are now in wave 4. wave 4 should be complete

in 6 trading days . 6 trade days is jan 31 .

waiting and watching is all . a high in the dow and spx in that same time frame

would imply wave 5 down in the utilities while we see wave 1 down in the dow .

i dont think ill make any intra day trades today .

the dow the us dollar and the tyx turned all very close together this morning

on a 5 minute chart .

A doji today would be good. A bearish engulging candle would be great!

If the former, I would really like to see crimson futures. “Crimson and Clover, over and…” but that’s another tune, no?

Here’s an interesting wrinkle. An analyst with a proprietary PPT indicator said it recently went from “Off”, to “On”.

Make no mistake about it. They will be hell-bent on atresting the coming impulse down. If is the real deal, they will have their

Gluteus Maxima handed to ’em…on a platter!

Or should that be Glutei Maximi?? 😀

OK, for fits and giggles we are now taking wagers! 🙂

Do we take out yesterday’s lows during the cash session, or will they wait for a futures ambush?

Step right up Tiddies and Bundlemen! ( Anyone recognize the nod to C.S. Lewis?

I would be MIGHTILY IMPRESSED if someone did!)

Just to keep things on the level, I Googled the expression and a search WILL NOT provide the answer; you would have had to have read the work to recognize it…! 🙂

Here is BIG hint…”Space Trilogy” … 🙂

No takers? Oh well, that was way too optimistic I suppose. “Tiddies and Bundlemen” is from the third book of the Space Trilogy: “That Hideous Strength”. A great read if you have not taken a look. 🙂

Verne get ready with your best bankster refrain when we pass the 2.850 mark, more or less 2 years and 650 points past and above Peter’s “prognosis”.

It’s cute that you still pretend to have any money left 🙂

Too much Vodka Dimitri? 🙂

Speaking of banksters, an intetesting tussle around VIX 11.50 pivot today. Looks like the short sellers being stared down. Sold March 11.50 calls enteted for 1,80 yesyetday for 2.15 this morning. Looking to reload.

Bought NFLX 260 March puts for 16.95… 😉

a devolving impulse taking place on very short term

10 minute or 5 minute or 3 minute chart ??

Nope. There will be no question marks when the beast turns! 🙂

https://invst.ly/6f73j

That’s the way I see it! 🙂

I think the fourth is yet incomplete…

Possible hammer in UUP and TMV.

Looking for bullish engulfing candles in both. Perhaps another leg lower to move past lower B band in final capitulation..

No 5 waves down as of yet but this is beginning to look impulsive

to the downside on the OEX.

That’s what i get for sitting back this morning and just watching.

what im looking at on 5 minute oex chart

https://imgur.com/MEmgW33

i dont like the 5 overlapping waves as a 5th wave

yet that is the other . guess we will see how this market

moves on this intraday bounce .

https://imgur.com/qYkjRQ1

I suspect we will get a cash session doji, and the move will come in futures, not necessarily tonight. The turn will be sharp, no pussy footing like we are seeing. The move down will decisively trap the most recent buyers…it always does people…!

now gives us a new low intraday for this move so i can

consider it 5 waves down from the high

I guess I see it differently when I look at all the indices; nothing impulsive imho about this price action…

NFLX 260 puts now bid at 17.00

Sometime within the next week NFLX will trade back below its upper B band and those puts will be bid at 20.00 or better. Talk is cheap… 🙂

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.