Non-Confirmation

The principle of confirmation is one of the common themes running throughout the entire subject of market analysis, and is used in conjunction with its counterpart—divergence.

Confirmation refers to the comparison of all technical signals and indicators to ensure that most of those indicators are pointing in the same direction and are confirming one another.

Divergence (non-confirmation) is the opposite of confirmation and refers to a situation where different technical indicators fail to confirm one another. It is one of the best early warning signals of impending trend reversals. — Technical Analysis of the Financial Markets, John J. Murphy

The US Dollar

Most of the time when we’re talking about non-confirmation, we’re referring to indicators like Stochastics, Relative Strength, or MACD indictors, etc. In this case, I’m referring to a major non-confirmation is that the US Dollar is not confirming the direction of the EURUSD currency pair.

The US Dollar late in the week, rose to a new high and has potentially traced out five impulsive waves, which signals a change in trend. Elliott Wave methodology requires that we now retrace down at least 62% in a second wave and then rally back up to a new high. This will confirm the change in trend to up … for a very long time to come.

EURUSD, on the other hand, has dropped down in a set of overlapping waves, which conforms a fourth wave (or second wave of an ending diagonal), with a new high on the horizon, targeting the 1.24 level, which is a 38% retrace level of the larger wave down from 2010. So, EURUSD is still in the late stages of a larger corrective pattern that still needs to top properly.

I start off this weekend’s video addressing the US Dollar and EURUSD non-confirmation. It’s the first sign that a trend change is indeed in the works!

The Big Picture (Volume Two)

Big Picture, Volume 2 |

The above video is an update (October 28, 2017) of a video I produced this summer showing how all assets groups are moving in lock-step to a final market top, which will span markets internationally. Even though I haven’t included charts within this video, you can see impending tops in markets all around the world.

_______________________________

The Market This Week

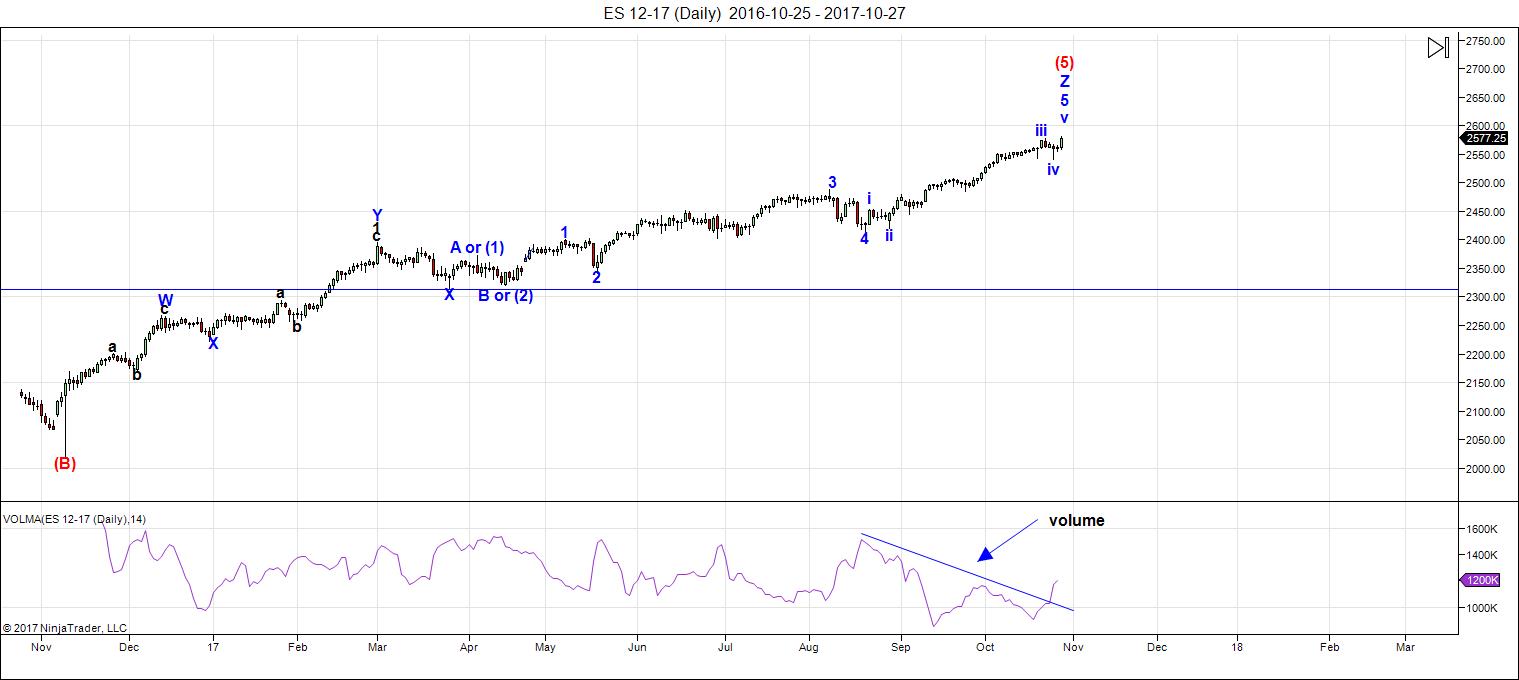

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

The big new this week is that the US Dollar rallied to new highs, without overlapping waves. This counts as a five and tells me the trend for the dollar has changed to up. My prediction here is somewhat preliminary, in that we need a second wave down to the 62% area and a turn up there to a new high. But the wave lengths so far are exactly what they should be, so I'm in the 85% probability camp that we've bottomed.

This is a major non-confirmation with the EURUSD (and other major USD currency pairs). The EURUSD has overlapping waves to the downside, so we need to expect another wave up to a new high. Non-confirmations between the US Dollar and Euro are typical at a market top. Usually, there is a small spike up in volume during the final "blow-off wave." We now have that, as well.

Last week, I called for a final fourth and fifth wave combination to finish off ES. We now have that final wave in ES mostly in place. NQ is in the throw-over stage of an ending diagonal.

I have a full count on NQ/NDX and ES/SPX now, but we still have subwaves to trace out, so the short term direction is still up for a few more points, at least.

I expect a turn down for the US indices this week; this should mark the top of the rally and lead to a multi-year bear market. There may be one more rally to a double top, after an initial turn down, so it will be important to watch the wave structure after the turn. Three waves down will retrace.

Volume: Note that for some time now, volume has been expanding with selling, and drops considerably when the market heads back up. This is yet another signal of the larger, impending top. There should finally be a small spike in volume in the last portion of the fifth wave—another predictor of a top.

Summary: The count is full for NQ and ES, except for subwaves as part of the final fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Wednesday, November 8 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

https://worldcyclesinstitute.com/wave-four-from-hell/comment-page-1/#comment-20399

NYAD…negative divergence formed with the recent all time high…a pullback is likely to occur…the degree remains to be seen…

I may or may not get burned, I bought a small batch of longs early Friday morning.

Peter, I enjoyed your perspective on the currency pairing.

Thank you.

🙂

This is regarding India. Instead of analysing INDY , I want you to analyse the NIFTY 50 Index which looks completely different from the other world indices and looks very bullish.

The market top call followed by a long term bear market is a very bold call.

haha … you’re not going to have one bullish index in a country and another bearish. The Nifty 50 is a zigzag at present … that’s a corrective pattern (countertrend) and the same as the DAX/AEX structure, although it hasn’t gone to a new high, which is more bearish than otherwise.

I tend to disagree on Nifty50. Maybe a correction.But not a long term bear market. The economy has recovered from the 2008 shock.

But even an imminent correction feels far stretched.

I don’t do fundamentals, just technical. Fundamentals don’t matter to me.

http://rs145.pbsrc.com/albums/r208/mike7084/gross1-1.jpg?w=280&h=210&fit=crop

the markets will look as such [see link above]

ahhhhhhhhh – p e t e r,

the figure to which you………”refer”…………… in more “refined” circles is known as Rubenesque ……. [an NO that does not refer to a type of NYC sandwich]

Historically you don’t always get a warning of a bear market. From June 1972 to Jan 1973, the market went straight up & collapsed. Jan is the time line, I have been looking for some time. I am not looking for a collapse. Just a good shot across the bow.

regarding the long term energy I post here

last weeks results were a very good match to market direction

https://s1.postimg.org/4imeidn01r/oct_23_to_27_energy_chart_results.gif

Tom, do you have one for this week ?

Thanks

Joe, sent you a email.

valley – I haven’t seen any update from you..please share your thoughts.

Peter,

you refer to hourly chart:

“I have a full count on NQ/NDX and ES/SPX now, but we still have subwaves to trace out, and my projection for them is shown on the hourly chart below.”

But I don’t see any.

Sorry for that.

Thanks the the head’s up. I changed it. I often copy the text from my subscribers’ page and then read it and make changes. I obviously missed that phrase.

10/19 was 291 days from jan 1st. In the sqr9 291 aligns with 10/19. This should have been a high. And the market leader index gave the high 10/19. And that was 37 months from the 9/19 high in 2014.

But FB and AMZN want up into 11/1. 90 degree overthrow in the sqr9 on 10/19 gives 11/7. The 11/1 – 11/7 window will bring the final change in trend. 11/7 we have HC Jupiter opposite HC Uranus.

So the market will be stuck between 2 vibrational dates.

11/1 is a crash date on 5/20/15 and will bring a high. But the real trouble will start 11/7 and then we will be down into 12/7

André

Peter, thanks for the video above. I have a question

Looks to me like the Russia probe is proving to be a lot of nothing .

Most of the charges are being brought from activities which were BEFORE working with trump.

To add to this , Armstrong explained all this before it ever became news.

This truly is a bogus Plot from the democrats.

Doesn’t change my bearish bias yet it explains the flat Market

The last 4 letters:

American…………….I can

Republican………….I can

Democrats………….Rats

To me this is all about the 2018 mid term elections and an attempt to regain power.

I am getting used to new software and using multi screens which at times is abit of info overload. the major dow stocks are flat ( slightly up ) yet cash dow is down .

I wont be surprised if the dow gets back to at least UNCH .

Looking like this maybe be a minor wave 4 from the oct 24 high in the dow.

https://invst.ly/5mml4

yes, the same RUT chart of the megaphone topping pattern – which looks to be complete ——- a break of 1477 in the RUT futures, and that last “snowflake” becomes the catalyst for the avalanche……. wear BOOTS peoples….. and…….

– BE WARNED!

Your killing me!!! That’s hilarious…..

Ding ding ding. Time is up! Mahendra Sharma has officially made the worst prediction of his career. Wont be mentioning him again but his mistake was an inability to follow EW. He should have taken some lessons from Peter!

Has he really admitted this ?

Not admitted it now but he did mention in July if it didn’t crash this would be one of his worst calls so far. His Astro model is simply broken. At least he was committed to his model for decades though. I’d like to see what explanation he has for the model failing but I don’t think he will have one apart from admitting it got it wrong this time. Any let’s talk about things that work like EW instead of planets!

QQ,

you could ….of course……. go dressed up tonight — [[on this very Halloween night]] —- as Mahendra Sharma – possibly the worst market predictor EVER……….

Shall we wager on how many people will “guess” correctly as to your costume….???

:-))

general question – for those who think this market “monster” is gasping for breath, soon to die,

are we seeing the “sluggish” efforts of the last subwaves of 5? or is the market playin’ “possum”??

Playing Possum, than off to the races to reach 2600 es.

Luri

I am comfortable with my timing methods and still think

being patients into dec is a good thing .

my issue is I do not have a complete grasp on the pattern in play from a longer term perspective .

monthly charts do not show me a 4th wave so as much as I am bearish I’m also realistic that I have yet to see a break down .

even this past weeks selling as example , the dow didn’t break below last weeks lows

thanks joe,

the “collusion” boys of wall street usually HOLD the market up till month end, and the sending of the statements. Also – the FOMC is tomorrow, and absolutely NO selling is EVER allowed to occur during or just after the 2 day FOMC meeting.

We shall see by end of week what direction the market is taken.

Every year I look for a new theme in terms of cycles , I have next years laid out .

Think ill see what the Bradley model shows just for a different perspective

Luri

I think it is a mistake to think ” wall street boys ” or ” bankers”

control this market and the same holds true with the fed .

If any of that was true then we would have never had a bull market or a bear market .

The drop in 2007 to 2009 where were those wall street boys ? or the fed

of the bankers ?

joe,

i see “events” in a less random way. the market is bi directional. in 2007-09 they were on the “other” side of the trade – just as they are on the “other” side right now. Karl Denninger still holds the “screen print” of the FED, pulling 200 billion from the market the day after Lehman Bros. failed. This was recorded and subsequently “pulled” from their public charts. Karl contends the fed was proactively crashing the equity/financial markets………. why? We had “financial” coup d’etat which occurred then, in which the banking cartel member banks were raised “above” the law – to which is the banking cartel introduced the more palatable nomenclature of “too big to fail”………….. the crash then was planned, as this one coming upon us is “planned”………………..The fed began QE in 2009 in effect, to buy the MBS from the market. They knew much of that paper was worthless, and was fraudulent and wanted to “hide” the evidence, thereby protecting their franchise cartel bank.

Catherine Austin Fitts – undersecretary for HUD under Bush, documented that the US government is run as a “criminal” enterprise. She has documented that since 1998 in just 2 agencies [DOD, and HUD] 21 trillion dollars of “undocumented” unaccountable financial adjustments have been made. [Remember the 2.1 trillion dollars Donald Rumsfeld says the DOD was unable to account for, and the next day the world forgot because of 9/11.] This 21 trillion dollar amount of undocumented adjustments has been verified by a forensic accounting professor, [his name fails me at the moment] who has lent his name to the cause.

We have a hidden system of finance – a black budget, that from only 2 federal agencies have stolen 21 trillion dollars from the American people to date. Who knows how much funding this hidden system of finance has stolen in aggregate, and what has this funding bought?

To hide the criminality, there is only one playbook – distract with confusion, and burn the evidence…………. how much evidence went up in smoke in the buildings of WTC towers – enron was one tiny example??? Thus we have a crash a coming, a currency reset, a financial whirlwind, all to hide the criminality of the few from the many…………… they have taken the markets to a dizzying height equal to the WTC because nothing survives such a fall.

……………yikes……………….i say too much……………………………

Joe, ALL of the price earnings gains in the markets have been due to stock buybacks. Net revenue has been declining for years. BOJ and SNB buy market equities directly as can be plainly seen on their balance sheets. Central banks have directly or indirectly injected well over 4T in this bull market.

Luri

there is just 5 letters that are in direct conflict to this

“planned event ” . This “planned event ” has to do with

controlling all the 401 K’s as well as pensions .

those 5 letters ?

TRUMP

Maybe, but these plans have been rumored for several years now. The banksters need a avenue to pillage the people, and congress might an easy scapegoat.

https://www.youtube.com/watch?v=SvEkloXzXtw

Senators to introduce bill to boost cyber defenses of voting systems.

I have just 1 question to that headline .

Show me just 1 voting booth anywhere in the united states that

is online ????? I know of NONE .

Smoke screen and distraction for whats going behind the scenes. Don’t trust any of it.

New highs in futures everywhere.

Andre’s on the money so far

going to take a very short term bearish trade near the open in the cash market .

considering this a minor 3rd wave high from the oct 30 low .

reason for waiting till the open has to do with the actual stocks that make up the dow.

the futures I’m thinking is minor 3 of wave 5 of wave 3 .

we still do not have a monthly wave 4 .

The dow making new highs from my point of view changes a few things.

it doesn’t change my bearish bias for next year but it does change my thoughts

to how bearish .

after next years correction is over 31,200 is my next dow target .

price is price and going above the recent highs targets 31,200.

next year will probably be more sideways after the initial April may low .

I’m ok with that

The Gann Quarterly Chart by Jerry Favors Longtime newsletter publisher Jerry Favors introduces a long-term indicator called the Gann quarterly chart, which will signal a turn up from bear market lows when the Dow Jones Industrial Average (DJIA) rallies above the high reached in the previous quarter during the trading day and not the high reached at the close of the trading day, which is more customary. Bear markets occur when the previous quarter’s intraday low is breached. This technique requires careful monitoring of the intraday highs and lows of the previous quarter. Favors points out that W.D. Gann, who invented this particular technique, said that the upturns or downturns in this chart often signaled the onset of new bull or bear markets. The Gann quarterly chart, a long-term indicator, will signal a turn up from any bear market low when the Dow Jones Industrial Average (DJIA) rallies above the intraday high of the prior quarter. Until the DJIA falls below the intraday low of the previous quarter, the trend remains up. However, the trend turns down when the DJIA falls below the low of the previous quarter. Those quarters run the traditional schedule: January to March, April to June, July to September and October to December. As each new quarter begins, for the Gann quarterly chart to be most effective it is necessary to keep track of the intraday high and low of the previous quarter. When prices rally above the prior quarter’s high, they normally go significantly higher before a major top is reached. The converse is also true in that when prices fall below the intraday low of a previous quarter, they normally go significantly lower before a major bottom is reached. This technique is very effective. W.D. Gann stated that upturns or downturns in this chart often signaled the onset of new bull or bear markets.

Here, Jerry Favors of “”The Favors Analysis”” newsletter delves into detail about what the indicator can and cannot do. The Gann quarterly chart is a tool that all readers can use with relative ease, but you must know the correct rules for its construction and interpretation. To begin, the quarterly swing chart will turn up from any extreme low when the Dow Jones Industrial Average (DJIA) rises above the highest intraday reading of the prior quarter. The chart will continue to point up to the highest price reached before the DJIA falls below the intraday low of a prior quarter. The swing chart is an indication of the trend direction, not a mechanical trading system. Nowhere in W.D. Gann’s works does he state that the correct way to use this chart is to buy when it turns up or sell whenever it turns down. It is not up- or downturns in this chart themselves that generate buy or sell signals. Gann specifically stated: “”Observe how many times after a prolonged advance (bull market) or decline (bear market) the first time prices break the bottom of a previous quarter it indicates a change in trend …. The first time the prices of one quarter exceed the high levels of the previous quarter, it nearly always indicates a change in trend and a bull market follows.””

that was easy .

done for that trade

No new high in the dow stocks despite the futures and cash dow .

that may change before the day is over

POT potash is looking interesting if it can manage

to break above 20.27 .

fundamentally though not so good .

decent sales growth yet no earnings growth .

above 20.27 would be a new quarterly high as well as yearly high

which would signal higher prices . its on the watch list is all.

oddball stats dow stocks

Price-Value

Intel 45.49-57.42 room to go +1

unh 210.22-241.36 room to go +1

V 109.98-97.96 abit over priced -1 ( +1 )

aapl 169.04-224.84 room to go +1

HD 165.78-146.80 abit overpriced -1

BA 257.98-217.94 abit over priced -1 ( = )

CAT 135.80-126.16 abit overpriced -1

JPM 100.61-121.55 fair with a little upside possible = +1 ( = )

MSFT 83.18-61.66 abit overpriced -1

JNJ 139.41-150.46 fair with a little room to go =+1 ( = )

TRV 132.45-94.99 getting stretched -1

MCD 166.91-132.84 abit overpriced -1

MMM 230.19-183.14 more than a bit overpriced -1 ( -3 )

PFE 35.06-49.78 a little underpriced +1

AXP 95.52-75.10 abit over priced -1

GS 242.48-317.83 more room possible to upside +1

CVX 115.89-94.21 over valued -1

UTX 119.76-127.26 fair with a little upside possible +1 ( -2 )

NKE 54.99-46.68 overpriced -1

VZ 47.87-69.04 +- little upside possible +1

DIS 97.81-117.91 abit further up +1

XOM 83.85-67.64 overpriced -1

CSCO 34.15-28.63 abit overpriced -1 ( -3 )

DWDP 72.31-63.96 overpriced -1

WMT 87.31-56.48 overpriced -1

MRK 55.09-71.86 underpriced +1

IBM 154.06-143.76 fair to overpriced -1 ( -5 )

PG 86.34-67.71 overpriced -1 ( -6 )

dow is a price weighted index yet the simple is it is slightly

overpriced based on valuation .

Might take another short term bearish trade based on cash dow

at the 23535 level later today

AEIS taking a bit of a beating

Might be in wave 5 down of either wave A or wave 1.

Possible bearish trade after a big bounce

AEIS- Thin to neg cost basis on bounce

if this is a 5th wave then id like to see

the range of 79.46-78.29 get tested

79.46 is where wave 5 = .618 of waves 1-3

and 78.29 is where wave 5 = 5.618 times wave 1 – weekly chart shows a gap at 80.85

SCCO appears to be in a very large triangle formation which

I’m going to label wave D yet a better labeling would be wave B

of wave C and if that’s the case then a break below 21.55 is a must

that would be a 50 % drop plus a little.

HOLX from a longer term perspective has turned down and that can

get ugly .

T is also on the verge of a break down and given that they bought DRTV

and then jacked the rates and a lot of subscribers cancelled I wouldn’t be surprised

CMS holding its own yet looks to be at an inflection point

ANDV bought out WNR , seems to be holding up yet

needs to break above 109.24 and its also at an inflection point

ADI I forget who they bought out yet its holding its own so far

id like to see 93.31 broken to the upside .

DIOD new all time high and stalled , ok so far

LKQ new all time high and ok so far

QRVO I believe was a name change and ok for 2016 to date yet

not really very impressive 79.34 needs to taken out to the upside

ABT new all time highs and ok so far

UNG may test the 5.00 level if it breaks into new lows below 5.78

WEAT making new lows .

HAL no opinion, holding only because its a negative cost basis

NVDA holding left overs because negative cost basis

UMPQ new high ( not all time high and ok so far

HBAN and KEY ok but at inflection point

ORCL interesting Juncture , possible wave 5 to go 47.64 key support neg cost basis

MSFT doing fine and negative cost basis

ON approaching a triple need to consider thinning

FXI hold and leave alone – Long term play

X- Hold – At break even

FITB slight new high ( not all time ) leave alone

AMD hold yet ……… 5 bucks is possible ( thinned at 15 )

WBA key support 62.20 at break even ( 63 cost basis )

dig through rest and adjust as needed

No trading today , Dow stocks UNCH on the day

and never made a new all time high

Not sure what you mean, Joe, but today did register a new all-time high on the DJIA at 23,515.71 intra-day compared to previous high on 10-24 at 23,485.25. The close was about 7 points below prior ATH close on 10-24…

hey peter g.

did we overthrow the resistance lines from your spx chart you shared with me?

Did anyone see the SPX500 impulse down in 5 waves and reflex in 3 today on the 5-minute chart?

Yeah … watching it.

harvey,

yes…………………. and yes…………………………………… !

although it fails to make a “5 wave” bit of difference ….if and until……..we start making lower LOWS……………………..

So true. We have seen many five wave impulses down in various indices lately only to be followed by a torturous grind to new highs. The repeated attempts to arrest and reverse declines in being clearly seen in the almost predictable price action, and will probably continue until they loose control of the market. I suspect it will happen overnight in futures and will be as relentless as the move up has been….

I was expecting a possible C down of an abc for a fourth wave today but that count was clearly incorrect. Possibly finished a third wave today. Who knows at this point. All we can do is patiently wait the inevitable outcome….

verne,

one ray of sunshine for you – it is my belief that when even the most meticulous of traders/chartists are completely confused [both bull/bear] and can no longer …..”count”…….. the waves that have occurred ………….then and only then, the change in trend is upon us………………

Fascinating! 🙂

TSLA breached July 10 low 303 target after hours. https://worldcyclesinstitute.com/unravelling-a-complex-topping-process/comment-page-1/#comment-22918

Since the beginning of the year TSLA has been trading above 120sma and 200 sma. Last week it went below 120 sma and was sitting at 200sma at close today. After hours, TSLA reported biggest quarterly loss ever which opened the gateway to abyss. Bulls need to flex their Schwarzenegger muscles to keep it from falling down to May 4 low 290 or even lower wiping out its YTD gain.

The triple 11 bearish energy spotted last September. My new technical indicator. 🙂 https://worldcyclesinstitute.com/time-for-a-small-dose-of-reality/#comment-21931

“oh MY”………………………………is that a tanezumi “RAT” running across the floor of this website????

ahhhh………….peter, methinks you have RATS on your website……. big , brown, MARKET RIGGING “RATS” over-running your entire website…….. it is overwhelming to my unusually large cerebrum ………….. oh “MY”………i think i am going to faint……

OK … so the blue pill isn’t working for you. Try the red one.

………………”cough”………………….ahhhhhhh peter, are you inferring that i am mentally “unstable”???

…………….although now i think about it, “red” is a very pretty color…………………….

Hi PETER

Apple just reported record numbers again, todays action was very strange as I would have thought yesterdays highs on all US indexes achieved all targets ready for the big turn. Would love to know just how high you think this can go now given patterns have fully played out.

I for one think we need to put a fork in this ……….its done!

Watch the labor report in the morning.

Hi Peter

I assume you mean it will be a bad number and the “fat lady will start singing”??

Oh yes thanks for a great webinar great value and educational

Nothin on labor. We may also have fallout from Venezuela … today.

Peter have we achieved all targets on EW? I am pretty sure we have we must be so close now to rolling over. I just don’t know whether its a 5-7% sell down and then double top or just a rebound retrace before the real selling starts.

Would like to know your thoughts sir!

Rumor has it and it is a rumor so I’m not saying this will happen .

Podesta today and huma on Monday .

There is so many bs sites on the web ill believe it when I see it .

Peter T,

Thank You for the very insightful post, “The MarketMoves in Predictable Ways”!

Everyone should read this!

Ed,

what post are you reffering to ?

WorldCyclesInstitute.com homepage

Ed,

found nothing. Could you send a link, please

It’s on the landing page of the site: https://worldcyclesinstitute.com/the-market-moves-in-predictable-ways/

However, it’s not new. You may have read it a long time ago. I’m bringing posts that were originally in the free blog up to the landing page of the site. I’m rewriting parts of them, but lining up one a week for the next while, along withe some new ones.

Thks. 🙂

I have to say thus far “andre” seems on the money he was calling for a high on the 1st of nov which the s&p and nasdaq achieved with a marginal new one on the dow today/yesterday and the down market to come next week.

Lets see one things for sure every bear has either given up or assed out with boredom and the bulls are now so relaxed and confident that they really are care free!

While waiting for Venezuela (like it matters), I must admit that fading Peter’s calls has been by far the best, most lucrative trading strategy for well over a year. This website is a goldmine! THX!!

ONLY The “smartest” among us would keep the location of their “goldmines” ……….close to their chest…………….lest they attract unwanted attention and lay ruin to their windfall.

methinks that it is the genetic consequence of the inbreeding of the “less” smart with the “un”smart ………….. that would explain why one would blurt out the location of their most lucrative treasure…………….

Diane – a little thought here – “you should seriously consider bringing in some genetics from the “outside” for future generations………………………

Diane, can you give me a trade idea for next week? I presume you’re long specifically what? dow, qqq, spy, svxy? You intend to keep that long trade until the end of next week? end of November? First week of December? Last week of December?

I just like to gain insight on your lucrative trades. Thank you in advance for sharing details on your ideas.

hmmm…..did we see and ending diagonal in the ES???

anyone want some spaghetti?

https://invst.ly/5ooyy

I cannot ever remember seeing so many instances of price breaking down from rising wedges being reversed with price going on to new highs. Clearly central banks are “all in”, and fiercely determined to arrest every market decline. While it is possible this could go on for some time, the level of ridicule I get for repeatedly pointing out the historic levels of market complacency suggests that may not be the case…

Verne,

i was hoping you would be alerted to the “co-ordination” of central banks in the ‘opposite’ direction – thus the “top” in the equity indexes being upon us.

BOE, raises rates – BoCanada, raises rates [surprises market with no forward guidance], ECB cutting QE by 50% in 6 weeks, BOJ has quietly reduced QE, and the FED w/ balance sheet run off/ and rate raises……………………… ahhhh the smell of ‘napalm’ in the morning……….

This directional change of central bank policy is incremental and represents the collusion of the banking cartel. Methinks they ‘help’ to engineer social moods, and we are well into the next move – but that poor herd is captured in a “bullish” frenzy of delusion – manifesting never-ending BTFD water mirages in a “now” vast land of sand and desert.

All true. Despite all the clamor of “this time being different”, it always ends the same way doesn’t it? I have to confess to being a little dazed by the things I am seeing and hearing. As bearish as I am, I am starting to think that not even I am going to like what’s coming our way. Don’t get me wrong, for some folk it will represent an opportunity of a lifetime, generations, in fact. The problem is that it is now clear to me that the vast majority of folk are going get hurt, and hurt very badly…nothing new under the sun…..

verne – my learned liege……………….

as you have taught me………….learning for each of us is birthed from each moment of life. Life must happen as it does – so that learning comes……………………………..”that is why cycles can be cycles”

A new blog post is live at: https://worldcyclesinstitute.com/tick-tock/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.