Mother Nature Rules!

All eyes are on Hurricane Harvey which continues to ravage Texas this week. Along with tornados, forest fires, and other extreme weather events, the US has undergone several years of Mother Nature tearing away at the standard of living of so many, coupled with huge insurance claims and additional substantial costs from other sources of rebuilding.

All eyes are on Hurricane Harvey which continues to ravage Texas this week. Along with tornados, forest fires, and other extreme weather events, the US has undergone several years of Mother Nature tearing away at the standard of living of so many, coupled with huge insurance claims and additional substantial costs from other sources of rebuilding.

Although there’s still an opportunity to tie these events to “man-made global warming,” more scientific studies are coming out every month that instead reinforce the fact that changes in climate are natural events that are periodic (they fluctuate in a cyclical manner with recurring intervals that are regular and predictable).

I can’t help but reflect back on the timing of this historic event.

As I’ve written many times before, we’re at the top of a 500 year climate cycle, which is also the top of a financial cycle: The two cycles coincide. Even Donald Trump tweeted about it.

The United States is getting beaten up badly and soon, the social mood will turn distinctly negative, even though central banks (including the Federal Reserve) and the government have tried their very best to keep everyone on “Hopium”—a “virtual opioid” that has artificially elevated everyone’s hopes for a brighter future, in the belief that the economy is in far better shape than it actually is. In fact, the situation is very much worse than at any time during “the Great Recession” (2007-9).

When the climate turns colder (as it’s gradually doing), social mood will dip to the downside, deflation will become stronger (the US dollar will turn up, or increase in value), and the stock market will begin its descent. This “turn” should happen very soon, as the Elliott Wave Principle tells us we’re in the very last pattern before an historic crash that will leave our international financial system in shambles.

Historically, when the currency of a country has been devalued to the point of being worthless, when climate turning colder affects the food supply and health (pandemics thrive in cold climates), when population is declining (as it starting to do in many western countries), economies decline and deflation takes over. A major financial collapse has happened at the top of each and every 172 and 516 year cycle since recorded history.

Harvey – an Historic Event

We’ve had two quick events in a row the help us mark the top of this cycle: the American Eclipse (August 21) and now Harvey, which has virtually brought America’s fourth largest city to a complete standstill. These events have been expected, even predicted. That’s because the era we’re living through is a repeat of the 16th century.

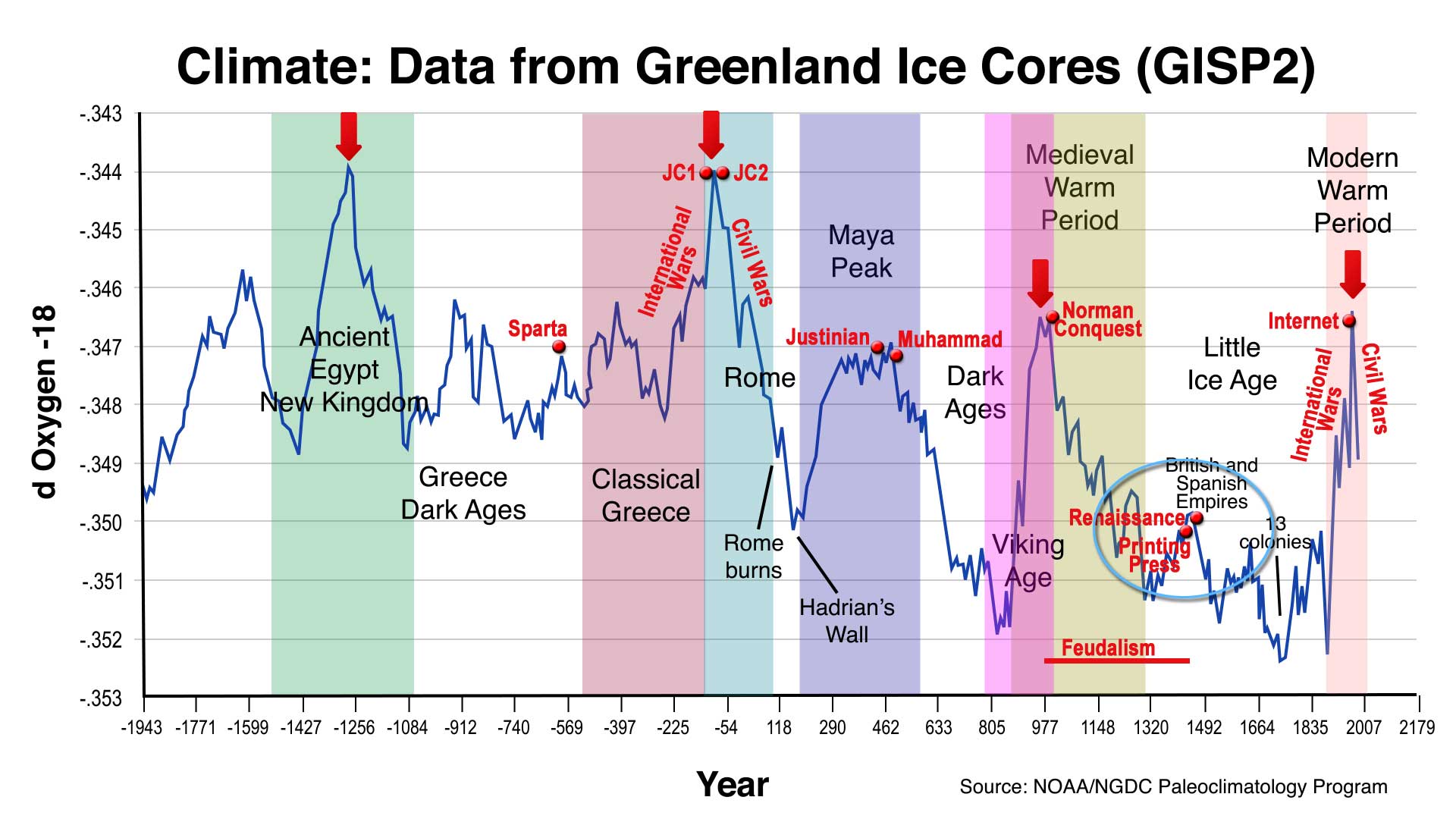

The data above comes from the National Oceanographic and Atmospheric Administration—from the Greenland Ice Core Research project ending in 1992. Ice cores are an extremely accurate method of determining temperature back through the centuries. This data is undisputed by the scientific community, but has been suppressed by the UN-associated, man-made warming advocates. It also reinforces the findings of Dr. Raymond Wheeler in his research over fifty years earlier of tree ring data, weather records, military records, locust plagues, historical chronicles, sunspot records, etc.

What the above chart shows is the temperature cycles over the past 4,000 years. Each time there’s a temperature peak, a major civilization also peaks and then goes into contraction. This has happened over and over again throughout recorded history. The red arrows pointing down mark the 500 year cycle tops.

Certain world events take place at predictable points along this 1030 year cycle peak spectrum. “JC1” refers to Julius Caesar, “JC2” to Jesus Christ and the start of Christianity. Note that the Islamic religion also began at a climate peak, around A.D. 600 (Muhammad).

_______________________

Harmonics: Discrepancies in 500 Year Cycle Tops

Dr. Raymond H. Wheeler, who spent much of his life researching cycles and events from 600 BC through to 1950, identified the top of a major 516 year cycle at sometime shortly after the year 2000. Stephen Puetz, a mathematician, statistician, and financial expert, living in Hawaii did extensive statistical analysis on cycles data that he acquired over a number of years, dating back to pre-historic times. He pegs the previous 500 cycle at 1663, while Wheeler may have selected 1492 as the date (one 172 harmonic cycle earlier).

It doesn’t matter in respect to the story I’ll relate here, as each 172 year cycle marks a financial collapse.

In 1491, the Italian city of Florence was at the height of its power. It was ruled by the Medici family, and the government headed up by their young leader, Lorenzo il Magnifico. Money flowed into its coffers at such a rate that three days before the Feast of St. John, the commune announced that citizens would be allowed to pay their public obligations at only a fraction of the usual rate.

On the fifth of April, in the year 1492, the sky suddenly turn black above the city. A brilliant bolt of lightning streaked down from the heavens and struck Brunelleschi’s soaring duomo with a mighty crash. A sinister friar named Girolamo Savanarola emerged from his cell at the convent of San Marco with this warning: “Tell Lorenzo to do penance for his sins for God will punish him.” The friar prophesied the death of il Magnifico, along with great suffering for the city of Florence.

Within months, both prophecies came true. After Lorenzo’s death, the peace and prosperity of Florence collapsed. By 1530, the proud Republic of Florence had become a dark and wretched den of despotism, which called itself the Grand Duchy of Tuscany.

Such is the power of 172 year cycle tops.

History Rhymes

On the chart above, I’ve circled (blue) the 16th century cycle high, a top that very much echoes what we’re experiencing today.

I’ve written previoulsy about Donald Trump being the “reincarnation” of Henry VIII. For a backgrounder on the similarities between Donald Trump and the ruler of England 500 years ago, King Henry VIII, go here. In short, Henry was a populist king, who marked the end of feudalism and the devine right of kings and the beginning of parliamentary governments (with the help of his “strategist,” Thomas Cromwell. The end of his reign marked a decline both financially and socially, as England devolved into many years of civil war.

One of the aspects of King Henry’s time that I didn’t cover in my previous article was climate. However, it was very similar to what’s going on today, because it was, of course, a 500 year cycle top. The year 1492 was the 516 year cycle top that relates to 2007 (516 years between them).

The temperatures at the time were not as high as they are today (they were slightly higher the cycle before, around 1100—the Medieval Warm Period). But extreme weather befitting of a cycle top was indeed in play. For example:

It’s been recorded that the Thames Valley turned cold and wet for a decade after Henry VIII married Anne Boleyn in 1533 (484 years ago). According to the history books, the king’s subjects blamed him after the divorce of his godly wife, Catherine of Aragon.

In fact, the turn in the climate was marked by a major flood just three years earlier, in 1530. The St. Felix’s flood happened on Saturday 5 November 1530, the name day of St. Felix. This day was later known as Evil Saturday (kwade Zaterdag). Large parts of Flanders and Zeeland were washed away, including the Verdronken Land van Reimerswaal. More than 100,000 people were killed by the St. Felix’s flood.

Inflation in the 16th Century

Let’s look at what transpired in the run-up to the top of the previous 500 year cycle (the predicted top was in 1663):

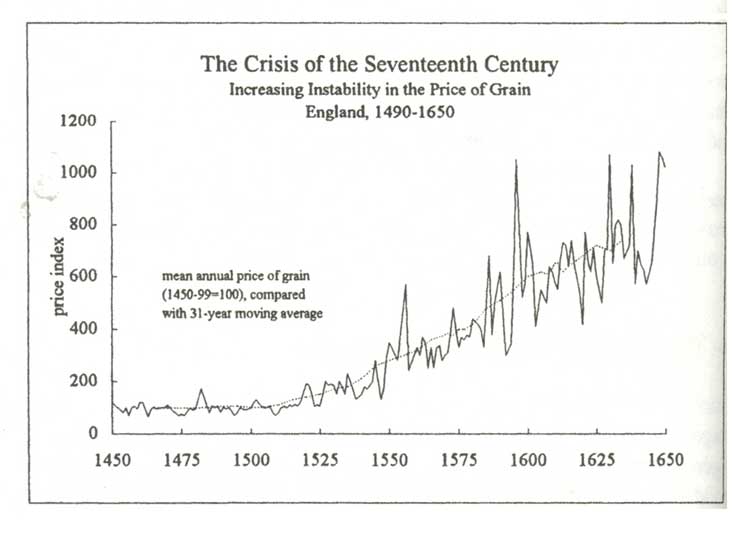

When Henry VIII came to power, England was in the fifth year of one of the most robust commodity bull markets in history. It lasted from 1503 through 1665. Following are excerpts from the book, The Great Wave, by David Hackett Fischer (1996), which is perhaps the most comprehensive and deeply researched analysis I’ve found of the price revolutions and recurrent inflationary and deflationary periods from Medieval times thought today.

Prices in Europe had been relatively stable until the bull market beginning in 1503. But, when inflation became obvious and prices were rising on a regular basis in the early 1500s, people sought explanations. Many looked for someone to blame.

“In England, members of Parliament attributed rising prices to ”covetous and insatiable persons seeking they their only lucre and gain.” Others blamed the price revolution on export merchants, who were thought to have sent so many goods abroad that ”corn, victual and wood are grown unto a wonderful dearth and extreme prices.” In 1555, Parliament forbade exports of food and wood when prices rose above a fixed level.

These laws had less effect than did the individual actions of ordinary people. Their responses to inflation caused more inflation. The daily choices of people made in the face of rice rising prices, tended to drive prices even higher. This happened in many ways—some highly rational, others not. One response was the hoarding of goods. Another was speculation. The third was panic buying. A fourth was the degradation of commodities.

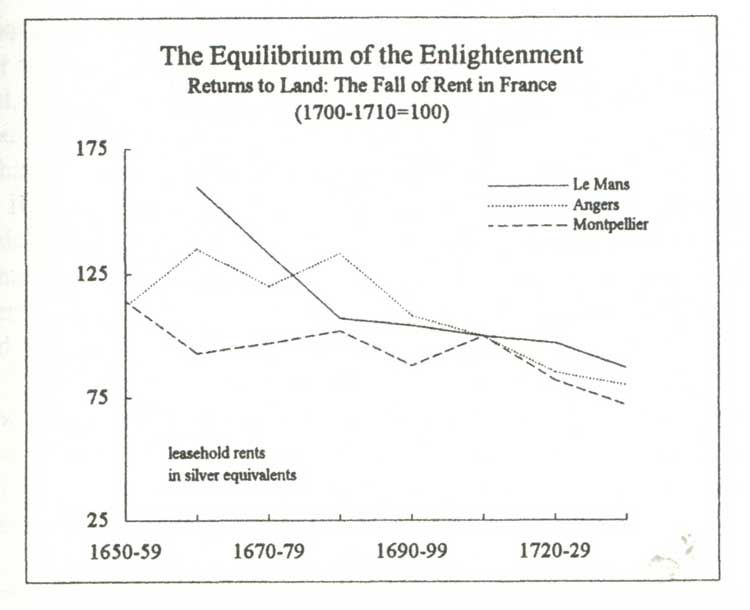

Above is a chart with data from three different European countries. It shows that rent went into a bear market after the market top at about 1662. The value of buildings and other hard assets also dropped dramatically.

One study finds that English rents increased ninefold from 1510 to 1640, while grain went up by a factor of four and wages barely doubled. In Belgium, land prices increased 11 fold; in Holstein, they multiplied by a factor of fourteen during the same period.

Historian Stanislaus Hoszowski concludes that the price revolution (inflation) actually strengthened the feudal system in Eastern Europe. Everywhere, it made the dominant elites richer and stronger that they had been before.”

In fact, in every period before a major correction, money becomes concentrated in a core group of wealthy elites.

“In every price revolution, one finds evidence of frantic efforts to expand the supply of money, after people have discovered that prices are rising in a secular way. The price revolution in of the 16th century caused the rulers of Spain (who were hard-pressed to keep up with inflation) to redouble their efforts to extract gold and silver from their American dominions. Increased supplies of European and Russian silver also contributed to rising prices.”

The quantity theory of money was invented during the second stage of this highly inflationary period. In 1566, Spanish scholar Martin de Azpilcueta proposed the thesis that ”money is worth more when and where it is scarce then when it is abundant.” This is key concept to embrace in understanding the fluctuating value of currency that is not tied in value to a commodity, such as gold. Central bankers have inflated the US dollar over the past 100 years to the extent that it is now worth four percent of its original value: In other words, that dollar in your pocket is really worth four cents.

“In the late 16th century, dangerous instability began to develop in European society. Prices surged and declined in broad swings of increasing amplitude. Historian Y.S. Brenner observed that ”while grain prices continued to rise gradually as the 16th century progressed, their yearly fluctuations became more severe.” He concludes that this pattern was ”consistent with the price behavior which is to be expected if a market’s equilibrium between supply and demand is upset.”

More importantly, climate plays a key role in the health of an economy. As we’ve been lucky enough to experience almost a hundred years of more than adequate rainfall and rising temperatures, we’re more than a little complacent about the power that Mother Nature wields when the tables turn. Today, man tends to think he’s all powerful and can control climate. As a sailor, I know that’s certainly not the case. But there are lots of examples closer to home: hurricanes, tornados, wild fires, ice storms, etc. We are, in fact, powerless to influence the whims of Mother Nature.

“As early as 1529, a major famine occurred throughout Europe. Its effects were especially severe in northern Italy. The city of Venice, with its huge granaries, was overrun by hungry peasants from the countryside. One Venetian wrote, ”Give alms to 200 and as many again appear. You cannot walk down the street or stop in a square or church without multitudes surrounding you to beg for charity: You see hunger written on their faces, their eyes like gemless rings, the wretchedness of their bodies with skin shaped only by bones… many villages in the direction of the Alps have become completely uninhabited.”

Conditions worsened towards the end of the century. The greatest suffering occurred in the period from 1594 to 1597, when four harvests failed in a row. Much of Europe experienced a cruel famine which was long remembered as ”the great dearth.”

With famine came epidemic disease. Rates of mortality fluctuated through the long period of the price revolution. When death rates fell several years running, prices increased and wages declined. On the other hand, when death rates rose, prices declined and wages increased. This happened in England during the 1550s, when epidemics took an exceptionally heavy toll—killing as many as 20% of the population in a five-year period.

During the last quarter of the 16th century, the economy of Europe was afflicted by the same cruel combination of rising prices and falling opportunities that neoclassical economists would call ”stagflation” in the late 20th century. Wealth became increasingly concentrated in a few hands. The rich got richer, while increasing numbers of the poor were driven very near the edge of starvation.

In 1591, the weather turned wet and cold. European peasants watched helplessly as their wheat and rye were beaten down in the fields and their hay crops rotted in the meadows. The same thing happened the next year, and the year after that, and altogether seven years running. In France, the wine harvest was late and small from 1591 to 1597. Grain crops fared even worse.

This was more than merely a short spell of bad weather. It was a shift in the climate—one of several sharp downturns in the early modern era that have been called collectively the ”little ice age.” The decade of the 1590s was so cold that Alpine glaciers began to send rivers of ice through inhabited valleys.”

In The United Cycle Theory, by Stephen J. Puetz (2009), the author reviews the mathematical probabilities for the 172 and 516 cycles throughout history. 1663 was both a 172 year and 516 year cycle projected top. (3 X 172 = 516)

“Theoretical peak, 1663: The great bull market in English wheat prices began in 1503 and lasted until 1655. It came to an end about one 6.36 year cycle early (without the moving average, the single year top came in 1662, making the actual top virtually a direct hit!) And 89 year bear market followed, ending in 1744.”

The Bottom Line

It’s seldom you find an economist who can predict the financial future. That’s generally because the study of economics does not embrace the influence of human emotion and social well-being on a market. Most economists are taught to look at the underlying data supporting a market and project from that where the market will be if conditions don’t change. However, conditions always change, just like the climate.

Thoughout history you’ll find that when populations are declining, when currency has been devalued to the point of worthlessness, when climate turns cold and negatively affects the food supply and health, no amount of innovation or technical know-how will change the direction of the market. We live in a world in which adequate rainfall and warm temperatures build strong and vibrant civilizations. However, when conditions turn down, so does the civilization; it begins to fall apart. It’s happened over and over again throughout history.

We’re on the cusp of a major downturn similar to all the other 500 year climate cycle tops throughout recorded history. No amount of “Hopium” will keep the international markets up much longer, in spite of the vain attempts of hubris of central bankers. Nature eventually wins and deflation takes over.

Steve Bannon

I recently wrote a letter to Steve Bannon (President Trump’s Chief Strategist) thanking him for his influence in declining to join the Paris Climate Accord. I didn’t expect an answer, and I wasn’t disappointed. However, I also mentioned his reference to being “Cromwell in the House of Tudor” (see my article for a full explanation), but warned to be careful of suffering the same fate as Cromwell (he was beheaded on an order from King Henry, who later regretted the action).

It’s interesting to see that Mr. Bannon has indeed left the White House—something that shouldn’t be any surprise, given the foreshadowing from the 1500s.

If you go back and do the research on the A.D. 100 period, which marked the top of the Roman Empire, you find a reference to heavy flooding and extreme climate events leading up to Caesar’s betrayal and the start of the decline of the greatest empire in history. You see, the patterns leading up to a financial collapse are similar; only the players, and hence the short-term timing, changes.

NOTE: If you’re interested, yuou’ll find the books mentioned above in my recommended books list with links to Amazon for purchase.

_________________________________

The Market This Week

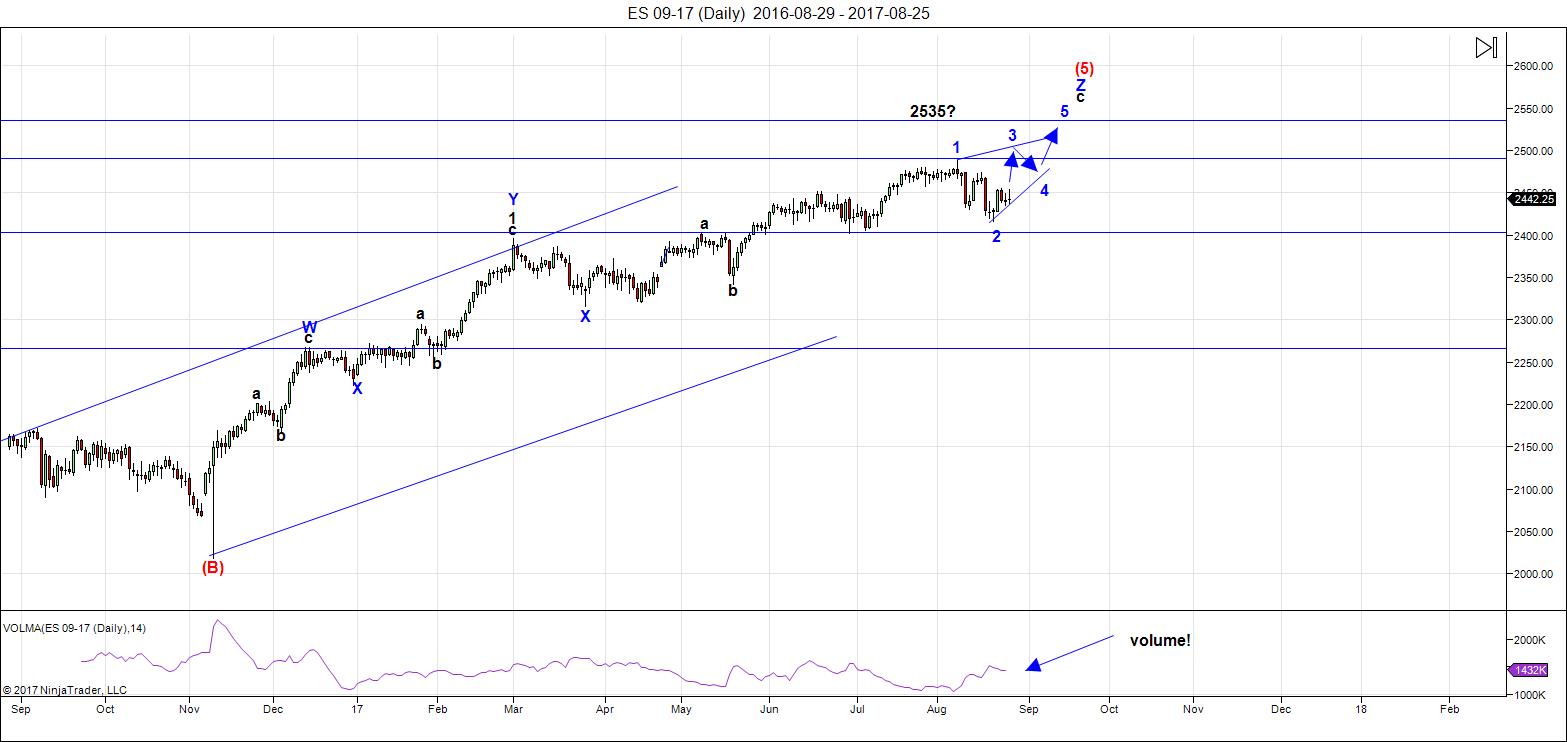

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Well ... it's taken an entire week for us to get through the first half (almost) of the third wave (the A wave) and complete a B wave. This week should be a positive week and allow us to get close (at least) to a new high. Everything seems to be playing out in support of my prediction of an ending diagonal. Although, I said at the start that this final pattern is not going to be "fun" to trade. It's going to seem like it's "all over the place."

There's another turning date for the SP500 on Monday (Aug. 28) and I would think this will simply send us up into the second part of this third wave.

NQ also looks like it's completing an ending diagonal, but it's much larger. However, NQ is in the final wave of the ending diagonal. so the distances to the top are somewhat similar. The fifth wave of an ending diagonal cannot be longer than the third wave, so a fibonacci measurement puts the maximum top for the NQ at 6190 (I cover this in this weekend's video.

USD currency pairs are also in their final waves and so they should all converge on their final targets together.

Volume: Note that volume now expands with selling, but drops considerably when the market heads back up. This is yet another signal of an impending top.

Summary: The final wave five in ES,NQ and SPX is in progress. Although early to call an ending diagonal, deductive reasoning has served to eliminate other potential patterns. Ending diagonals are final waves and mark the end of a trend.

______________________________________

Sign up for: The Chart Show

Wednesday, August 30 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Thanks for the update Peter .

I recently noticed an error in my work as well as something a bit odd.

The odd being Sept 6-7th and while I’m expecting to find an error I have yet to find it .

I’ll simply say something out of wack in my model and it’s on Sept 6-7th.

Now for the error I’m discovering its in regards to the mars Uranus opposition which

Is on Dec 1 2017. I have previously pointed to June 2018 as important . I made a similar

Mistake back in Nov Dec 2015 and won’t make that mistake again .

I’m not finished ‘re calculating this but to me we will get a double negative hit in Dec this year

The data from the Greenland Ice Cores are remarkable. Nothing has more powerfully exposed the fatuous fraudulence of the so-called “Climate-Change” cohort. What is even more remarkable is how they have conveniently managed to ignore, or attempt to dismiss how that data absolutely dismantles their idiotic notions about the causal relationships between temperature and human activity. It has truly been stunning to see how the so-called scientific community has descended into nothing more than a cabal of hucksters and swindlers, prostituting their craft to the highest bidder. From the criminal conduct of the degenerates at the CDC on the subject of disastrous vaccines, to the climate change and carbon tax peddlers with no greater concern that lining their own grubby purses. God help you if you try to stand up to them and point out what pathetic liars they are….

Dear Verne

If it’s any consolation in Australia we have close to the highest level of electricity prices in the world thanks to our “cabal of hucksters and swindlers”. 1000’s are disconnecting their meters because the dear souls cant afford it. Our LIberal Govt is a joke including our deadhead PM. Spending a fortune on expensive renewables. OOOUUCCCCHHHH

best wishes Phil. Thanks Peter EURUSD continues to rise.

Peter gold broke 1300 every one getting bullish

USD also yet to turn bullish?

I’d be careful getting bullish on gold at the moment.

thanks Peter

They gettig crazy bullisg on gold stocks

Amen! 🙂

Peter, much appreciate your creative and innovative work in connecting the dots between climate cycles and economic cycles. While it is very entertaining and informative, I wonder if it is really germane to compare historical effects on a segment of world economic and social history (W Europe and especially Britian) without considering what the economies and societies of Asia were doing during these eras. For example, I believe India and China have been very important world economic engines during much of the last 2000 years and their dark ages were from about 1800 to 1960.

In addition, the zeitgeist of today with instant communication, super computers in each pocket and desktop, robotic production with near zero marginal cost, AI efficiency gains, etc., seems on the face of it to be a game changer from pre industrial age economic reality. While I agree there can be deflations and currency resets, medium to long term, a mild inflationary and consistent equity appreciation seems likely.

Valley,

I’ve finally been able to finish writing this weekend’s blog post. If you get a copy of Stephen Puetz’s book (I mention it in the blog), you’ll find out that Asia and China were in similar positions at each of the cycle turns. However, when the West is at the pinnacle financially, the East is in the opposite position. This is why as America declines, we’re expecting either Russia or China to take the lead as the major world power.

Your second question is addressed I think a couple of times in my post. Technology was really big in the 20s as well. It didn’t stop the depression. In fact, there were so many technological advances that it parallels what’s happening today, imho.

We’re already in a deflationary environment. That data is all over the web and fairly readily “googleable.” In any event, you’ll have your answer from the real world relatively soon.

I wasn’t aware of Puetz data related to East vs. West economic cycles, thanks for that info.. As far as technology I guess you are correct and that each generation believes theirs is unique. And trees don’t grow to sky so this tech cycle can only provide so much before market will have to take a breather for the next cycle.

Valley,

Wheeler was the main one with East/West, although I think Puetz also covers it off. In any event, he has all the recorded data and analyses the plethora of data for both (there’s much more ancient Chinese data, so earlier analysis for China is much more comprehensive.

I just have so many sources and analysis that say the same thing about economic cycles that it’s honestly pretty hard to dispute at this point, imho.

It’s fascinating to research and write up these posts as I put together a large piece of work on all this. It all seems to correlate from several different sources so it’s fun to fit it all together.

Yes, that is why I appreciate your site so much. You are one of the best site designers and presenters and have a well developed knowledge base of climate/market correlations. Some of your content is really funny like the post about the lemmings. =)

🙂

Brilliant and fun guy in a world where most people rather stay dumb instead of putting thousands of hours in truthseeking like Peter! Thanks buddy for all your effort and sharing! ?

Cheers,

W

🙂

I’ve updated the main blog post article, so it tells a much fuller story. My site being down on Sunday got in the way of my schedule and so I just wasn’t able to complete it by my regular Sunday deadline.

HI Peter, can you share your view on USD also?

In the Chart Show.

September energy stream

https://s26.postimg.org/xeaorsmll/27_day_forecast_september.gif

Thanks much Tom 🙂

Valley,

Do you think we have further to go down.

Hi Bill,

PALS is very negative this week. Middle of lunar phase between New and Full, greatest distance on 30th, declination in south, seasonals weak. One of the weakest of the year. PALS doesn’t flip positive until middle of next week. I am guessing market doesn’t do anything this week or if selling occurs could touch 3% lower.

Don’t worry if it’s negative.

PPT protects you

Valley,

Do you think PALS had an inversion this week, looks like there was an existing negative sentiment which was already there and couldn’t follow thru on downside.

Probably, maybe market buoyancy is to counter hurricane negativity.

Valley ,

waiting for next week mid week to get out of shorts and go long?

Took loss on put (1% loss on account). PALS is looking positive next week and very positive week following (perigee approaching, declination post south, phase post full moon) but I will wait until early next week to decide.

At least you kept the loss small.

When the market does the opposite of what your PALS system predicts, do you generally attribute it to your misinterpretation of the info, or just an instance in which the system failed to accurately predict market direction? Thanks!

Not really small as 1% of entire account is quite a bit.

The former as I use PALS along with news/guessing.

Valley,

Good work of keeping the loss so small, I had more than 10 percent drawdown, but thats okay as I had a few big gain last few weeks. Will be little more cautious until I have few good gains. Now that we have reached upper limits, I am hoping we get a good retrace before aligning your self with PALS. One thing I have learned we can have PALS/Wave counts/News all in our favour and still have a loosing trade. I think Buying the DIP mentality has not still changed at all and it needs to be respected until proven wrong.

Seems like there are unlimited number of deep pocketed CBs, sovereign wealth funds, and other public/private funds that seem to be in accumulation mode in US equities.

Peter,

Thank you for your blog! Parallels between Bannon & Cromwell is quite uncanny. Wondering though who would be Anne Boleyn? :}

https://worldcyclesinstitute.com/wave-four-from-hell/comment-page-2/#comment-20669

Aug. 21 & Aug.28 after hours crash: both swing low.

https://worldcyclesinstitute.com/september-lining-up-for-a-great-fall/#comment-20992

8/28 – 241 TDs, 8/29 242 TDs.

Since possible lows reflect a cycle low on my part, I bought UDOW, TQQQ yesterday at open. Also, bought momo FANG weekly calls yesterday. Today in NFLX calls. Will sell nflx calls today if momo fades. As for the above ETFs, now just waiting for Peter’s targets. Good luck to all.

Haha … I think some of the players get so ticked off at how they were treated that they don’t come back round again …

https://www.armstrongeconomics.com/armstrongeconomics101/understanding-cycles/the-fall-before-the-rise/

my position on Armstrong’s historical stock market calls is a matter of record…having said that, Armstrong’s “computer projected August as the turning point this year and the week of 09/04” as a major turn…

during June 2017, I emailed a number of posters/readers of this blog regarding a major ‘trend’ to commence in September 2017 and continue for a significant period of time…further, my email noted that several other major ‘trending periods’ should occur during the next four years…stay tuned!

https://worldcyclesinstitute.com/back-to-the-future/comment-page-1/#comment-21259

Sold tqqq, udow and nflx calls. Managed to sneak in a quick trade on an amzn call at open. Month end closed for me. Off to enjoy the rest of the day.

Nice call Liz.H

/YM Mini DJ Futures: Draw a trendline from 5/18 low, 7/11 low, 7/24 low to 8/22 high and extend it.

/YM stopped right at the line. Daily candle printed a shooting star.

/ES Draw a trendline from 5/18 low, 7/6 low, 7/11 low and extend it.

/ES stopped right at the line. Daily candle printed a shooting star.

/ES, it kind of looks like a bearish bat. https://bpcdn.co/images/2016/05/grade10-bearish-bat.png

Down we go next week?

Peter, for /ES is it possible it’s forming a triangle. A from 2488.5 to 8/21 low. B to today’s high? So now down to C? Looking forward to your Sunday blog.

Exactly. NQ is an ending diagonal, ES is a contracting triangle. Down in E next. It will be pretty obvious in this weekend’s post.

Peter, thank you for the information! Thank you Dave. Have a good weekend. Just in case some forgot, market is closed on Monday in honor of Labor Day.

Thank you Peter. Kim Jong Un agrees with you.

Doesn’t look right Peter. Looks like we completed wave E at spx 2428 and are now in wave 5 to your new high scenario.

A new post is live at: https://worldcyclesinstitute.com/what-goes-up-must-come-down/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.