We’re headed for a long period of spiralling deflation …

We’re headed for a long period of spiralling deflation …

Inflation, according to Ludwig von Mises, is an increase in the money supply that is not offset by an increase in the need for money. It causes the value of money to decrease, which causes price increases for goods and services.

A good example of this is the current housing bubble in Canada (it’s popped on schedule in 2018) created by next-to-free credit. Mortgage interest rates have never been lower and the prices of houses have never been higher.

Lets look at how we cause inflation.

Banks create money out of thin air. In actual fact, they create debt. They do this through loans. In other words, money comes into the economy when banks create a loan. They simply enter the loan amount as debt in their books and you, the customer get borrowed money on the other side of the ledger. A digital entry appears in your bank account. Instant money from nowhere!

You pay interest on that money and both interest gets paid to the bank and the digital money disappears to where it came from … nowhere (it ceases to exist). In any event, it’s newly “minted” (today, it’s mostly digital) money that the banks create out of thin air and then charge you for its use.

For more detail on how banks create this money, see my post on “How Banks Create Money Out of Nothing!”

When interest rates are really low, people borrow more money (mortgages) and bid up the price of homes. People see it as an inexpensive way to buy the home of their dreams. But is it?

Lets look “under the hood.” The increase in money in the economy causes the value of money to decrease. We realize that lower value through higher prices for assets.

Inflation: money decreases in value; houses rise in price

Deflation: money increases in value; house prices decrease

The good thing is that as long as the inflation keeps up, you’re paying back that loan in “future money,” which is gradually decreasing in value. Inflation makes is easier to pay back debt (and that’s why governments like to inflate and amass large amounts of debt — they can pay back that debt in less valuable money in future).

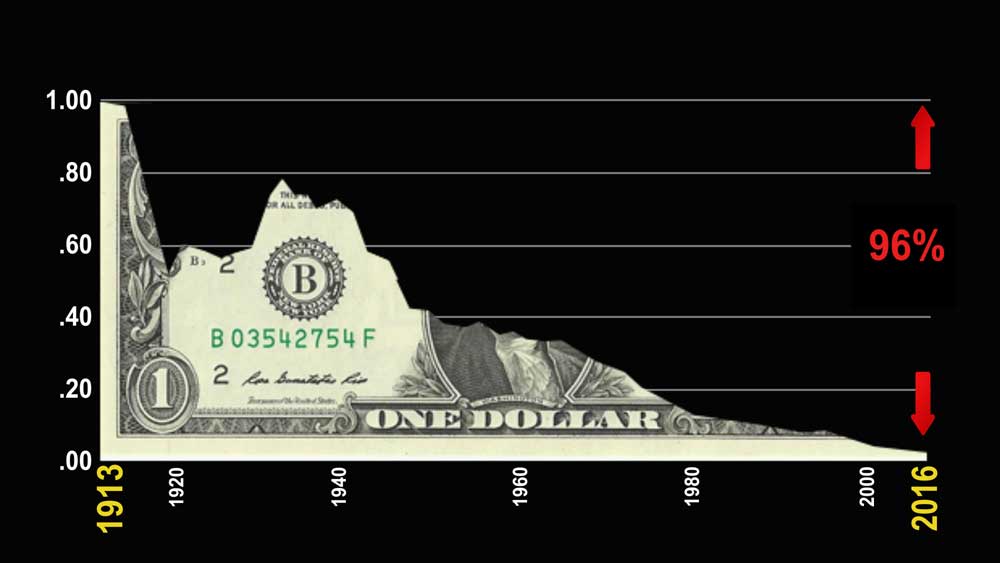

Below is a chart of the American dollar and how inflation has reduced its value by 96% over the past century.

In the chart above, you can see how inflation has been fairly consistent except for the period from about 1920 to 1936 and again around 1940.

Deflation is the opposite of inflation. In deflation, particularly in a credit-based economy, which is what we have, there’s eventually a loss of confidence in the bubble that’s been created, and a slowdown in lending (which has been an ongoing problem since 2007). This leads to less money in circulation and people start spending less and hoarding money (Europeans are somewhat ahead of the North American continent right now in this regard). The reduction in consumer spending leads to job losses, eventually company failures, even lower prices, and we end up in a deflationary spiral that feeds on itself.

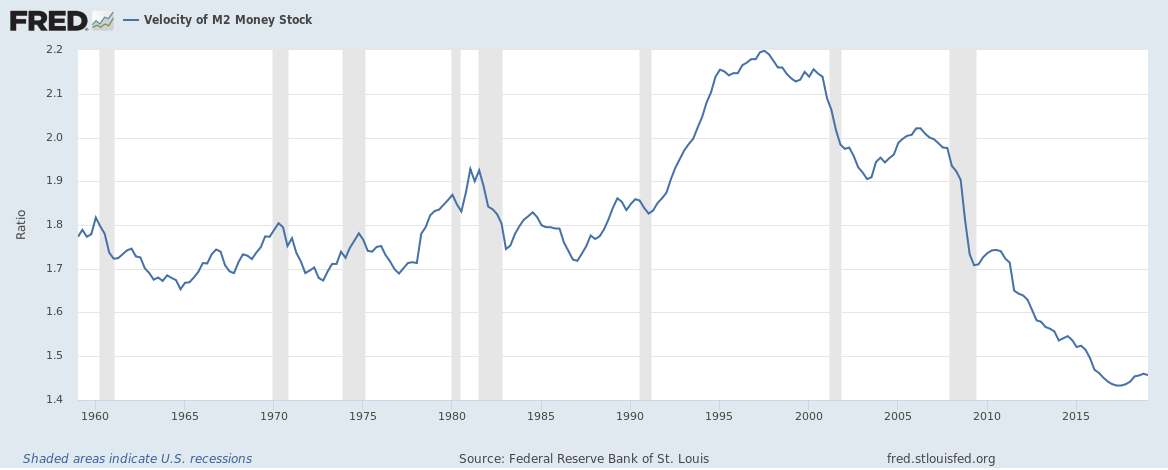

Above is the M2 chart of the velocity of money. It comes from the Federal Reserve in the United States (FRED). This is a measure of the levels of currency available in society at a given time (it actually measures how many financial transactions are taking place — higher levels are inflationary, lower levels are deflationary). You can see how the velocity of money has declined since about 1998. Incidentally, that was the warmest year on record, which I explain in by post: “Don’t Like the Climate? Wait a Cycle.” A reduction in the velocity of money marks the onset of deflation.

Lower prices for goods and services is great for consumers who have cash. But if you have lots of debt, that’s a problem. Because the real value of debt increases—because less money in the economy increases the value of money. So, you’re paying back those loans with money that is more difficult to obtain (and is actually worth more) than when you took out the loan.

Assets like houses and cars reduce in price. The deflationary cycle in a depression picks up steam until we have a deflationary spiral that historically has reduced prices by up to 80%.

Almost all recessions and depressions in the US throughout history have been accompanied by various levels of deflation. Here are some key examples:

Examples of US Depressions Fueled by Inflation (Ending in Deflation)

Downturn of 1819

- Inflation caused gold and silver to rise in value and along with that was an overall lack of confidence in the economy

- The price of cotton halved (the economic driver in those days) – example of deflation of an asset

- Rapidly growing credit eventually led to banks collapsing due to an overload of debt and a general economic collapse

Panic of 1837 (began in 1835)

- This was the era of substantial frontier land speculation due to easy credit

- Andrew Jackson suddenly tied bank notes to gold and silver (deflationary)

- The resulting run of bank gold and silver created a credit contraction

Downturn of 1857

- We didn’t learn the lesson in 1837—massive land speculation after 1852 reared its ugly head again

- This fueled rapid growth and speculation in railroads (easy credit)

- It resulted in major bank failures and credit contraction (deflation)

Downturn of 1873

- Chicago land values increased 500% from 1862

- Railroad expansion across the West created heavy levels of debt

- Led to a sudden stock market collapse and credit freeze, failed banks (deflation)

Downturn of 1893

- Again, substantial land speculation from an ongoing westward land boom

- It ended in a run on banks due to a sudden contraction in credit (deflation)

Great Depression of 1933

- The stock market crash began in 1929

- The depression really began with the collapse of real estate prices (1930)

- There had been wild real estate speculation during the 1920s (similar to today)

- In the 1920s, income of the wealthiest rose 75%, while the rest rose only 9%

- Deflation ran rampant from 1920 – 1936 dropping prices of real estate and the stock market by more than 85%

Recession of 1974

- The highlight of this contraction was the collapse of the US National Bank of San Diego

- Land speculation again had been the norm during the early 70s and this led to extreme levels of debt

- We experience mild deflation before Nixon unpegged the US dollar from gold (fiat money), which led to an enhanced level of inflation

Great Recession of 2007

- Sub-prime mortgages, derivatives, and banking failures.

- Extreme real estate speculation in the US. This led to even more extreme levels of debt. Between then and now, not much has changed. Our level of debt has increased, the gap between poor and wealthy is even greater, and the interest rates are so low that money is almost free, which has led to a real estate and stock market bubble.

- Since then, central banks have attempted to inflate the economy but have been unsuccessful

History tells us the road is fairly clear regarding the immediate future: Free money leads to a bubble, which leads to deflation and a depression. When a deflationary environment takes hold, gold is reduced in value. Gold will regain its value and start to increase when we return to an inflationary environment sometime down the road.

Strategies in a deflationary environment:

Strategies in a deflationary environment:

Cash is king. Currency goes up in value, while prices for just about everything that’s not a necessity, go down in value. Food is a notable exception. At the same time we have a major economic collapse, we also have a major worldwide drought. This raises the scarcity of food. Expect banks to stop lending and for the current credit card scheme to end. It’s a good idea to have cash on hand in a safe place just in case banks start to fail, as they have so often in the past.

Get out of debt, because debt becomes a lot more difficult to pay back. As money increases in value (deflation), you’re paying back your debt in more valuable (and harder to come by) money. In an deflationary environment, many companies fail and there are far fewer jobs to be had. Salaries also tend to decrease. There simply isn’t the same level of currency in the market.

Reduce your cost of living. Taxes are going up. The only way they have of solving that problem is to tax the population. Banks, if they run into problems, will raise interest rates. They’ll also start to limit credit and call in loans. It’s better to rent than to own during a deflationary period, as prices of all hard assets go down in value substantially.

If it makes sense, sell your home and buy it back in a few years at a fraction of the current selling price. In the 1930s, homes devalued by over 80% very quickly. Many homes previously owned by the fabulously wealthy or well-to-do (who has lost everything is the stock market crash) were on the market for fire sale prices. We expect to see this scenario once again. During deflation, all assets drop dramatically in price. You can already see this in the price of oil.

Hold off on major purchases … because things are going to get a lot cheaper. As people stop buying, products go down in value. Double this with the fact that currency is going up in value and you have lower priced services and products.

Traditional investment is dead. Stock markets are in the process of topping. We’re going to see a crash sometime in late 2020 or early 2021. Lower demand right across the board will lower the price of most products and services. As a result, more and more companies will land on hard times. Most bonds are also vulnerable. We’ve already heard of major cities going bankrupt. If you read your history, you’ll know that no investment is safe during a major collapse. That’s why “cash is king” (it increases in value).

Community is exceptionally important. Mend any broken relationships with family and friends. You’re going to need them. Have services that you can offer to others, to make yourself a more valuable commodity. Blue collar jobs (fixing things) are always the first jobs to come back after a depression.

In reality, deflation is cathartic, and a necessary condition to heal the economy.

These are only some of the strategies you can use to defend your wealth and sure your viability during an major downturn. I hope it provides a sense of what’s to come.

So don’t get fooled by the idea that inflation is a good thing. It’s ruined the world economy. We’re awash in debt. Thank you politicians and bankers!

Deflation is good .. if you’re prepared. The train is just leaving the station …. It’s time to do some research and get ready to buck the trend.

Governments, Debt, and Banksters

The current situation with our economy is not unlike many of the previous collapses in history. But what makes this particularly scary is that we’ve created a debt bubble larger than any in history. See the recent article on the International Monetary Fund blog entitled, “New Data on Global Debt.” This isn’t the first time the IMF has warned about the extreme debt around the world.

What exacerbates the problem is that sovereign debt, by and large, is owed to private “banksters” in Europe (or in the case of the US, to twelve private banks in the US packaged into something inappropriately named “The Federal Reserve.” It’s not federal (it’s privately owned) and it keeps no money in reserve).

These central banks create money out of thin air and then charge governments for its use. Creating money is something the government could do on its own and there would be no interest, and of course, no debt. This is something I explain in my upcoming, related post: The Wonderful World of Oz.

Peter,

As you have often stated that all markets move in tandem, since the US stock market still has a final fifth wave to go, does that mean RE market is also in a fourth wave correction and hasn’t topped yet? Along that same train of thought, I’m thinking RE prices will probably have one more push up along with the 5th wave in the US equity market. Appreciate your thoughts on this since I’m trying to decide when to sell my house.

Ko,

Possibly, but I would expect the any additional upside from here will be muted. Keep in mind that many markets don’t participate in the final wave. It’s been tech stocks that have fuelled this market. With the very large drop that I’m expecting over the next few months, I would expect the Real Estate market is all but done. The market markets (Australia, Canada, Hong Kong, New York … ) are down in double digits.

The larger 172 year topped back in 2007 and larger cycles dominate smaller ones.

Peter,

In a deflationary period, if you have cash, but in the bank, can you please explain what will happen to it?

I assume it is best to have cash on hand in a safe place.

Would another alternative be to have the mortgage on your home as high as possible while saving cash and when shtf let them take your home while you have saved cash, in a safe place, to start over?

Is it possible to withdraw 100-200k from the bank without being flagged by their tax collecting department?

Ma

Hi Ma,

Good questions.

What happens to your cash in the bank? Well, that depends upon the bank. Cash in the bank belongs to the bank (not you) by law. They pledge to give it back when you ask for it (if they have it!). So, it’s not a safe place to keep it. You should only keep what you need to there to cover any transactions (pay bills). In a deflationary environment, banks tend to go bankrupt … a lot, particularly when mortgages start to default in large quantities, which they always do in a depression. Alberta has a public bank (ATB) — backed by taxpayers — and that’s a safer alternative than private banks, by it doesn’t change the fact that banks use your money to their own ends and pay you nothing for that privilege.

In terms of mortgages, a few years back, I did a reverse mortgage on my home to get out 55% of the equity in cash. There’s a clause in that contract that states that I will never be liable for more than the market value of the home. Since I know it will eventually be worth less than 20% of its current value, that seems like a good idea to me (but you can only do that if you’re over 55). These banks believe that home values will always rise. In a deflationary environment, as you obviously know, the nominal value of all assets crash, so assets become a liability. The short story is that cash will be king for quite some time to come and it’s a really good idea to have it in a safe place, as you suggest.

Do large withdrawals get flagged by the CRA (I take it you’re in Canada)? I don’t know the answer to that, but I’m going to attempt to find out. My accounting firm will probably know. If your taxes are up to date, it doesn’t really matter. It’s supposedly your money (which belongs to the bank, as long as it’s there).

Hope this helps.

On another note, I had someone tell me it’s crazy to carry money around to pay for things. Well, we all used to do that fifty years ago. The situation now is that you have to carry around a lot more due to inflation making our money almost worthless, but that’s going to change with deflation. Your money becomes more valuable (as prices crash), so you need to carry much less of it around. Nobody alive now has lived through strong deflation (there was a little during the ’70s), so they have a hard time imagining a scenario where money goes up in value and assets decrease in price, as a result. A new world awaits.

Ma,

I talked to my contact at BDO (national accounting firm) and there are no issues with you withdrawing 200K from a normal personal bank account. It’s your money (actually, it’s the bank’s money by law until you withdraw it).

CRA does not get contacted, nor does anyone else.

Peter

Thanks for your detailed response Peter. It seems I qualify for a reverse mortgage being 59.

I am in BC and work in the suffering logging industry. I have a two room b&b that does really well for about six months so the idea of a reverse mortgage appeals to me more than selling.

I am wondering though, if by the time home prices find their new low (and all the cash hidden away hasn’t had to be spent to eat and keep warm) how hard will it be to buy a home with cash? I suppose keeping withdrawal receipts would be important to show it is your money.

I wish people would understand that cash is our sovereignty…there is nothing the banks and Gov’t would like more than to have a cashless system. I use it often since I read somewhere that the banks can’t go cashless unless cash transactions are below ~2%. But if they do manage to pull off a cashless system over the next five, or so, years, and we have all our assets in cash…would we be screwed?

Hi Ma,

How hard will it be to buy a home with cash? Well, homes will be worth less than 20% of what they are now at the bottom … in about 7 years, I think. Many of them will likely be owned by banks, and those banks may end up on the rocks. So, I don’t know the answer to that question. In a world with little credit available (at the bottom), I would think it will be a lot easier than it is today, but I don’t really know. Nobody’s ever been there … not since the 30s, in any case. I don’t think you’ll have to prove it’s your money.

They would like a cashless system, yes, but we won’t get there. I expect a mini=crash before November is done. That will change things dramatically. I expect we’ll lose at least half of the big zix banks before this is all over. The entire financial system is going to collapse. I expect the DOW eventually under 3,000 points. We’re looking about seven years from now. The top of the market I’m predicting in 2021.