Extremes Are Rampant!

I’m overly sensitive to the extremes in society, not just the extremes in climate. We’ve certainly seen climate extremes, not only in temperature but in fires, in floods, and in hurricanes. We also have lots of active volcanoes, but you don’t hear about them all that much (but then the media isn’t what it used to be). Active volcanoes is the Earth’s way of cooling the atmosphere. The ash gets into the upper atmosphere and blocks our sunlight. Wild fires do this also, but to a much lesser extent.

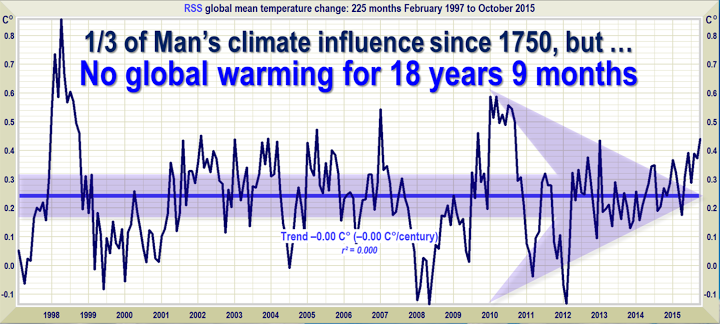

But I thought it time to revisit a chart on global temperature to see what’s happening.

Above is a chart of the global temperatures attributed to Lord Monckton and his extensive work on dispelling the frenzy regarding man-made warming. It’s always interesting to me when I look at this chart to see the large dip in 2007/8 as we had a “cold spell” that seeped into the market. There were also market drops in 2011/12.

I created a video on the correlation between temperature and the ups and downs of the market a couple of years ago, entitled, “Don’t Like the Climate: Wait a Cycle.” Whenever the temperature turns down, so does the market. There are lots of examples of this throughout the past one hundred years (1929, 1970-74, etc.)

As the climate (specifically the temperature) turns colder, the market will drop, as it always does.

Mini Ice Age 2024 Maths

This past week, David Dubyne of Adapt 2030 sent me a link to a video on the ice age we’re predicting. It’s entitled “Mini Ice Age 2024 Maths” and if you’re interested in getting into the numbers as to why we’re expecting this colder climate (and very soon), I’d urge you to watch it. It’s not a polished presentation, but I certainly found it interesting (and it’s short).

Mini Ice Age 2024 Maths- Its not good news - Milankovitch Cycles |

The Deep State and Shadow Government in the US

One of the traits of a hot cycle top is that the underlying truth comes out about things that are going on under the surface. Nefarious activities that were tolerated decades earlier are unearthed and prosecuted. You can see this is the recent hazing trials in the US and other trials involving sexual predatory activity that is considered unacceptable today.

The next step should be the unmasking of government activities that involve elites and their conspiracies to steal from the population. This will eventually lead to a complete breakdown of society as we know it and a revolution of the international financial system, “The New World Order.”

We’ve seen lots of this in the form of Edward Snowden and Chelsea Manning. These examples are the tip of the iceberg.

To that end, there’s a very recent video by an ex CIA high level operative (it’s slightly over an hour in length, but well worth it) that I strongly urge you to watch, particularly if you live in the United States. I found it fascinating, as well as being a very compelling talk in its own right.

New: CIA Agent Whistleblower Risks All To Expose The Shadow Government |

_______________________________

A Word of Caution (the Coles notes version)

We’re starting to get close to a major market top. We’re seeing some volatility in terms of large swings in currencies, gold, and oil particularly.

There could be quite a bit of volatility at the top. Nobody’s seen a 500 year top, so we don’t have a lot to go on.

Volume is light, which means that almost everyone is “in” on the long side and smugly enjoying their profits, believing this market is going to continue on for a whole lot longer. Of course, a lot more are “out.” It’s amazing how many hedge funds have folded as they simply haven’t been able to make any money (and are unsure of where the market is going). In any event, that takes a lot of money out of the market.

We have a lot of financial “cracks” developing. Amazon just set themselves up for a gigantic short by over-leveraging and buy out Whole Foods. Toys “R” Us looks like it’s finally going down for the final count. I expect Elon Musk to crash and burn: After all, none of these electric cars have sold and great quantities. They’re mostly government subsidized (certainly in Musk’s case) so it’s only a matter of time before it all falls to dust.

We’ve had many retail bankruptcies recently and this foreshadows a much greater problem. Insurance companies are getting quite scared, as there’s a lot of fraud out there, not to mention Houston, Florida, and Equifax. Who’s next? It’s going to be a wild ride over the next few years.

It’s going to get a lot worse before it gets better. Start getting prepared for a decades-long “winter.”

_________________________________

The Market This Week

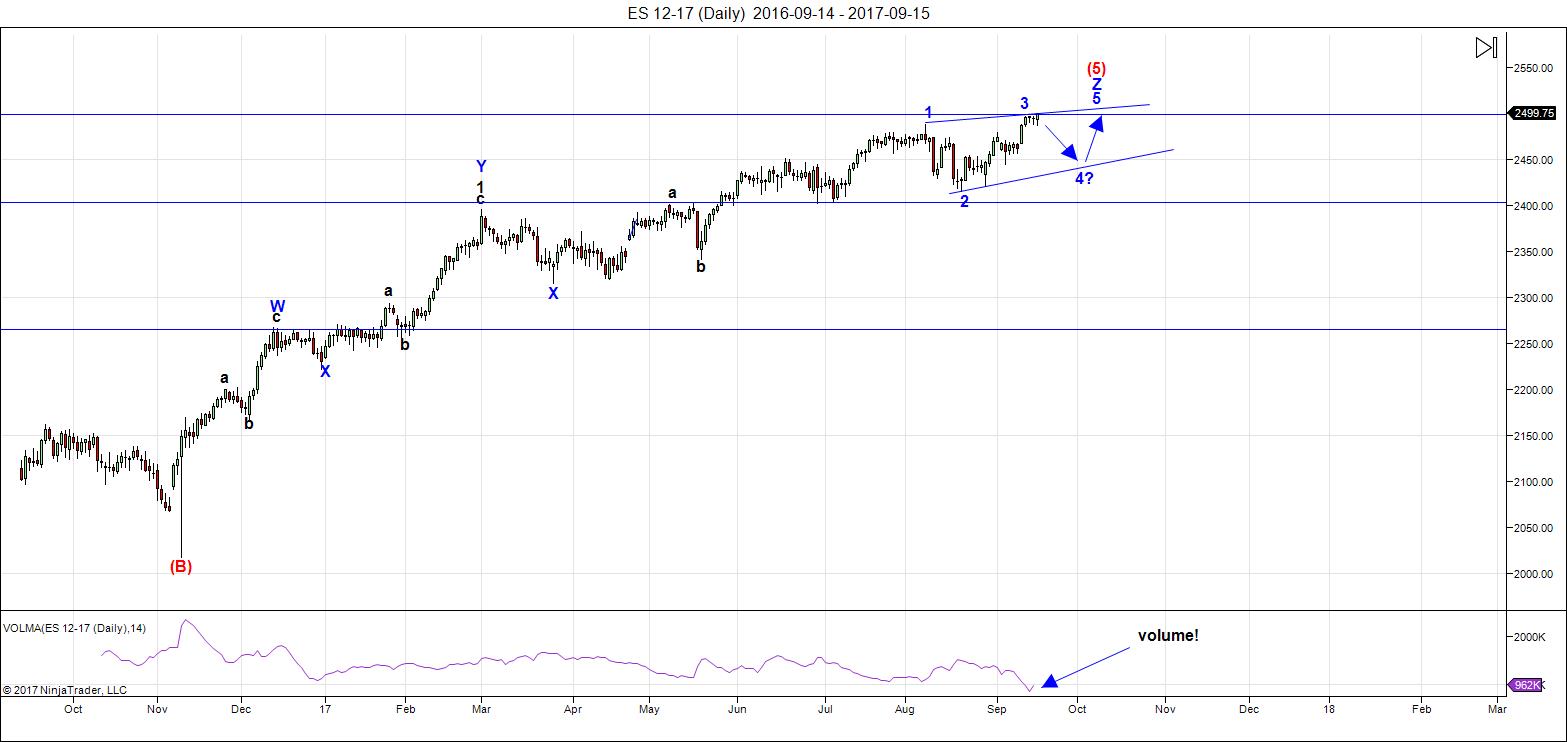

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Ending diagonals are notoriously difficult to trade. There are a number of reasons for this. The biggest is that all the waves are in threes and the upper and lower boundaries don't get defined until the 3th wave (upper in a bull market) and 4th waves (lower). So, you don't actually know you're in one until the fourth wave is in place.

The sub-waves are in three waves, which makes analysis difficult, volume is always low, and the final wave doesn't always complete a throw-over (exceeds the upper trendline in a bull market (lower in a bear market).

However, we know ... because in the fifth wave position of C wave at the top of a market, there aren't any alternatives given the wave sub-structure that we have here.m

Friday (Sept. 15) at the market close, both the SP500 and ES reached a target of 2500. For ES, this target is the point where the C wave of the third wave was 1.618 times the A wave, a typical end point for a three wave sequence. Expect an imminent turn down.

Volume: Note that volume now expands with selling, but drops considerably when the market heads back up. This is yet another signal of an impending top. It will likely pick up a bit during the final wave to a new high but drop off suddenly towards the final top.

Summary: The final wave five in ES,NQ, and SPX is in progress. We have a contracting triangle in the final stages, with a E wave down to complete this coming week (then look for a final fifth of fifth wave up to a new high to complete the 500 year bull market). Look for a fourth wave low around 2430 or so.

______________________________________

Sign up for: The Chart Show

Wednesday, September 27 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Peter, I was very impressed with your last weeks Chart show. I have always had a bad taste in my mouth with E.W Prector, back in the early 2000. I have seen so many Newbies blow their accounts trying to short the markets as the markets screamed higher , never to come back again. I admit, I never even wanted learn E.W. I had several other techniques at that time trying to grasp and perfect the perfect trading models. I was very impressed, on how you communicated very clearly on the wave structures of each market. You were very detail orientated in such a way, that even a dummy like me could understand. LOL

I can see, how I can combine my new Biorhythm model to confirm or not the wave structures in play going forward. Which will increase my positive returns each year.

So thank you Peter. It only took you three years to finally convince me. LOLOL

Dave,

Thank you!@

EW International has soured EW for many. I used to get so frustrated with their counts that I knew were wrong, but it’s not EW that’s the problem, it’s their analysts. And they usually give two counts: “It’s either going up or its going down.” How do you trade that count? I don’t do that and I’m seldom wrong.

Yeah, they’ve done a huge injustice to EW, imho. 🙂

Guys,

I have been with EWI for more than 7 years and after I found Peter T, I switched

completely to him.

This is not an advertisement for Peter T.

Just that EWI helps you loose money more than you make.

Peter T helps you make money than you lose.

No one is perfect but Peter T is a wiser choice if compared to EWI.

Try it for 3 months and you will know the difference.Not 1 month.

Like I say , this is not a paid advertisement , just from a trader experience.

No harm try 3 months and you will know the difference.

You will never to back to EWI.

Peter has done an excellent job of EW education on this site and I likewise am beginning to find EW a useful decision making device along with lunar seasonals. Your biorhythm model is so well named. Is it “shareware” in that you feel like giving out the basic input criteria of the model so that other market model makers can benefit?

Thanks for the update Peter

I enjoy your global cooling updates and how well

You have been tying all the pieces together in order

To give a broad view . Your attention to detail I have

Always respected and I agree with Dave .

Dave

Your on the right track lol . It gets tricky at times though having timing

And wave counts mixed together . I’m sure you will benefit from it greatly though .

Ed

I just want to thank you for the compliment and tell you that I laughed at your post.

At a recent company seminar we talked about “experience” .

The speaker defined it as the collective of our mistakes .

I view the financial markets as a never ending chess game .

Anyways – thank you for the compliment

Thank you Peter for all the time and effort you put into this blog

I know it’s your passion yet your very much appreciated

Joe

Thanks for the update. It was not clear to me if you thought we had an ending diagonal or a triangle unfolding as the summary stated the latter, but the wave analysis before the summary described the former….did I miss something?

Public is funneling money into dow and snp etfs. So, averages go up and volume goes down. Plus the russell 2000 divided by the snp shows big divergence. Generals are rushing out ahead of the army. —–peter—-Friends and I feel the HUI from April to early august was an abcde triangle. This led to a “C” wave plunge into mid august by several miners. Now the bull has begun. IF correct, coming corrections will be bull flats. While the bear trend of the market will be bear flats like the Russell right now.

had another dream last night and I clearly heard the words “we are slipping into a recession”

if you look at the moon phase chart; attached for September,

Sept 20th is the day where moonlight is zero

a military strike against NK will most likely happen under the cloak of darkness

therefore Sept 20th is the best day to pull this strike off

The Dow was up 21pts the day Bush launched the night attack on Iraq

Trump might wait till markets close on the 22nd to make the move

What concerns me more about NK is their ability to hack into systems.

People underestimate the damage they can do by hacking.

When systems go down and everything grinds to a halt the economy stalls and so does the market.

https://free-printablecalendar.com/wp-content/uploads/2017/04/Full-Moon-September-2017-Calendar-Northern-Hemisphere.png

Tom,

Does your “energy mapping” showing anything this week that aligns with the September 20th absence of any moonlight?

Tom, I personally have the 23rd my self as a key date ( 23 – 24 weekend ) As stated before, I am looking for new highs this coming week into the end of the week. If my model is correct, we may see Peters 4th wave down the following week. As always, take the above info with a grain of salt. All the best every one.

If indeed, we do reach new highs by Thursday this week, I will be exiting 5 – 10% of my holdings down 30 – 35 % long. This is going to be very painful for me. It will be like cutting off my left arm. LOL I have always been wired up to be bull, for many years. Like Joe, I use to rebalance my portfolio, taking cash off the table or rotating into other sectors. Old habits are hard to break.

Trump addresses UN assembly on Tuesday the 19th

Tom, I have a small blip down move on the 19th. I doubt it is a 4th wave. I am going to exit 5% of my longs here shortly today.

Still expecting higher highs thru til Thursday.

If I recall correctly, the sun is actually 3 million miles CLOSER in the winter, Conversely, 3 million miles farther from earth in the summer.

Distance in space has less to do with our climate than other factors. Sun flares have short term effects.

Volcano eruptions probably have the greatest effect on earth. It would be interesting to see where major eruptions fall on the cycle charts.

https://spaceplace.nasa.gov/seasons/en/

Hi Peter,

assuming if we will go through the wave 5 before crash, do you have any timeframe?

that’s because we have 2 more wave to go (wave 4 and 5) to go before crash, I think it is quite unlikely for it to be crashed in end Sept/ early Oct?

Reason being:

1) I think it should take some time for the 2 waves to complete?

2) I went back to look at 1929 and 1987 crash, both crash does not crash immediately at the top. instead it slowly flat, small drop, rebound, and follow by bigger drop (wave ABC)… we should have more time to prepare for it? or able to get more signal when crash is coming?

appreciate if you can share your view on this?

October for the turn most likely. However, EW doesn’t have a reliable timing element to it. It gives direction and price targets and will tell you when you’re at the top, but predicting a time should be left to other cycles tools.

My post on the “crash”: https://worldcyclesinstitute.com/back-to-the-future/

I sure hear a lot of bombs going off. A lot of gold bugs blowing up their accounts, by buying gold stocks and bullion within the last 2 weeks. I suspect, many newbies are also blowing up their accts by trying to short this market. Very dangerous times a head for many, but yet very lucrative for those who keep their emotions in check. All the best every one.

Nice video released by David Hickson at Sentient Trader…

https://youtu.be/-rV2BQeuTuU

Basically, he’s bullish now with a peak potentially in 2019.

I have been suggesting 2019 as peak for several years. Tech revolution (AI, robotics, drones), Trump Effect (dereg, tax reform), end of decade usually rallies.

in that case how will it fit in with so many people ..including EW people calling 5th wave and bull market switch to bear market

Just my hope/intuition/guess. Market could be topping into multi year bear.

The thinking by some EW’ers is that that 4th wave hasn’t even started yet. Peter Goodburn is projecting 3rd wave ending at 2766, 4th wave completing at around where we’re at right now (2500), and wave 5 completing at approx 4397 (2015 high plus 100%). David Hickson uses Hurst Cycles to conclude that the bull will last for a while based on the 7 year cycle applied to the peaks.

I think a good case could be made that many formerly reliable market metrics are broken in this CB driven environment. The market has continued higher for years on declining volume and continues to trade in overbought territory for months on end. Despite the over-bought conditions and many weeks now of expectation of some kind of correction (we have not had a single one this year), the market has now issued a strong bullish signal with a break above resistance of on balance volume. Does all this mean I am suddenly bullish?

Hardly.

It means I now pay very little attention to predictions, and view most signals with some skepticism, regardless of what supposedly great TA is cited to support the view. Predicting where this market is headed has proved to many an analyst to be quite a challenge to say the least. Another example is that Gold recently crossed above a McGee bear trend line prompting a veritable outbreak of bullish giddiness among many traders. The cross was real, and it is a signal that many traders respect. Nonetheless, price recently move right back below the trend line, frustrating many who had gone long on the signal. I could cite numerous examples of this kind of anomaly so when I hear people trying to make an argument about market expectations based on TA metrics I do wonder if they have been looking at the same market that I have.

I now approach the market on a strictly day to day basis and continue to keep my trading horizons limited to literally hours and not days or weeks with very few exceptions. I do think there are a few long term trends but few trades can be entered and held with any real assurance that the current trend will continue for any length of time. I suspect much of this chaos comes from the fact that there are so few individuals actually trading the market and we are seeing machines running amuck. 🙂

Verne

You said it as best it can be Said.

I don’t agree technical analysis has failed though

What I do think is we are seeing a cyclical trend change .

What your post reminded me of was my thinking in regards

To the recent sunspot spike . I found myself asking did the sunspot

Cycle bottom ? Yet in my mind it can’t be so yet looking at it strictly

From a technical point if view I felt it had broken out and we are what

Now could be a new cycle .( I still don’t think that is the case )

Then I read Peter’s update and Dr wheelers quote about 8 years and

I said ok , it’s possible yet in my own work I was looking for a high

In the sunspots into Oct . That means I wait until Oct ends and look out

Into Nov Dec etc…. And I want to see the sunspots collapse .

This assumes my correlation with the Dalton minimum is still working .

Apply this to gold , you get the break out and a failure etc…..

On a different note . Having dug into Orange juice prices and looking

At previous freezes in Florida I noticed Dec 12 th shows up to many times to ignore .

The seasonal bias is up . Then comes Irma , Orange juice prices rise yet was it really Irma

Or was it just seasonal ?

The US dollar and it’s rally from 2008 to Jan 2017 lasted the same duration as the previous rally

Into the year 2001 high. Was it trump that brought the dollar down or again was it just cyclical ?

Now we are dealing with a different set of parameters which if I have correct will throw many off track.

If the US dollar is in a longer term bull market to higher prices and yet global cooling is the real trend

Then commodity prices , specifically the grains such as wheat can rise with the dollar and for many

This correlation will throw them way out of wack .

The general rule is a dollar brings lower commodity prices .

How that trend goes in the future and it’s relationship to the price of

Gold remains to be seen .

Each year I notice a different set of cycles , not everything repeats exact

And I don’t think they should . I use planetary positions in many cases but

Not in every case yet think of it like this .

We have planets, we have the earth . At any given moment the angle of just

A few planets in relationship to the earth changes both in terms of height ( declination ) and angle ( rotation 360 degrees )

Then we have those same changes going on between each planet and all of those different parameters

Create slight changes cyclically each year . It takes decades in some cases just for 1 planet to move 360 degrees

Yet when it gets there it’s declination might be the opposite of where it was . If you have ever played 3 d checkers

You might grasp what I’m saying . The playing field moves both up and down and in a circle at the same time .

The sun can be closer or further from the earth yet the angle also changes which effects us as well .

Not sure I’m making any sense yet I will say I have a bullish bias long term on the good stocks yet I have not bought

Any . My issue is the gold silver ratio hasn’t bottomed .

Very interesting perspective Joe and good food for thought.

Let me offer another plausible reason for why we are seeing so many anomalies.

I have watched in amazement as the market absolutely refused to price in Puerto Rico’s 70 plus billion debt default. So far as I know those official losses have yet to show up anywhere. Now comes the recent astonishing announcement by the BIS that it has “discovered” 14 TRILLION in derivative debt in off-shore bank accounts that do not show up as anyone’s liability, and appear only as foot-notes in banks’ records. When data that is analysed consistently give erratic, unexpected, or seemingly erroneous results, it is entirely possible that something is wrong with the data. We know that in these markets there has been a deliberate suppression of volatility to mask actual Value at Risk (VAR) and allow algos to continue to trade the long side of equities and continue to increase said margin as the market has continued higher. It now would appear that this kind of conduct has gone beyond just deliberate mis-pricing of risk, but a clear conspiracy to conceal and mis-represent it. You will not find much reporting on this situation, but is has finally caused a few lights to go on in my own head regarding what we are seeing globally with market evaluations. Trade carefully….

Odd thoughts

I worked as a fisherman in Alaska for 23 years .

Most of that time was either as a captain or mate

Having to make decisions on where to put fishing gear

Daily . Some times the traditional rules just don’t work .

Example longlining for cod fish , the rules were the cod fish

Move off the bottom of the ocean floor at night and then move

To the bottom during daylight . Well that worked for a while

Yet we discovered that putting our gear in the water between 2 am to

5 am on a slack before ebb tide produced a much better catch rate .

At times that would produce 4 times more fish than making the traditional

Morning daylight set. Another thing we discovered was just before

A new moon or full moon the fish would move up to a slightly shallower

Depth . After the new or full moon they would then adjust back

To where they were ( depth wise ) . I think we humans probably

Do similar things yet we to adjust .

My point being at times what is traditional simply does not work

Case in point . The puetz cycle has inverted many times in the past

Few years . This some might say is not ” normal ” .

The key is paying attention to the details and making notes

On the inconsistencies or constants .

Once you find what works stick with it until it fails and it will

At some point fail .when it fails you adjust and adopt what the new

Cycle tells you . Things like the Santa clause rally or years ending

In 5 ( years ending in 5 not do great for 2005 or 2015 by the way )

Years ending in 7 ??? Only 1 comparison I can think of at the

Moment which is the year 1927. Years ending in 2 tend to be lows

Yet the year 1972 was a top. At some point what we think we know

Based on statistics changes and my only rational reasoning is

That if we all think the same thing at the same time then it won’t

Hold true . The only time the masses are correct is in a 3 rd wave .

That is only 1 point if a 5 wave sequence .

I’m rambling yet maybe it gives someone a aha moment

Great info. Joe!

Last thought before I lose phone for a few days .

Our financial system relies on debt because incomes

Are to low . Some of you will get this some maybe not .

For anyone who has dealt with high debt second mortgages

Etc… And has paid those debts off you know that you do not

Want to go through that process ever again . Our young

Generation has student loans , car loans and the idea of

Buying a house just is not on their radar screens .the older

Generation has no desire to take on more debt as they think

More about retirement . Our individual cities and states

Are in fact in debt . You can call it gov pensions or simply accounts

Payable or liabilities . The gov or cities or states think they

Can just tax and that will solve their problems and all will be fine.

Yet as Margaret Thatcher once Said. The problem with socialism

Is at some point you run out of other people’s money .

Higher taxes is just like debt . What we need is free cash flow

Or better put , disposable income . The more we get squeezed

By both our own debt and higher taxes the harder it becomes

For the economy to expand . Once we realise this we cut back

On our spending and we reduce our debts . Higher taxes

Cut our disposable income which will end up cutting our spending .

It doesn’t matter if your house goes up in value if you have

Made the decision to live in it and use it . The higher your

Property taxes go , the less incentive you have to make any

Repairs . Some call it the cost of living. I think it’s better Said

It’s the cost of government . It can be Australia or New Zealand

Or Europe or the United states . The same problems are all over

The world . It is all deflationary .

Peter- latest thoughts on why EW isn’t working on correctly calling the top?

How isn’t it working?

it has been calling for a wave four down for months

Don’t know what “it” is, but I haven’t been.

Peter- you haven’t been calling for a correction for awhile? with all due respect yes you have. I have read your weekly reports and you have been calling for a wave four down. it is hard to be right on calling for a correction when we haven’t had any since the election.

All the Same Market

I’ve been talking about this for about a year and a half now, as currencies and the US market got more and more aligned.

Tomorrow, it looks like gold and oil are getting added to the list. I expect all of them to turn at the same time for this turn: They’re all setting up. Quite a site to behold.

This, of course, is all related to the movement of the reserve currency.

Some will never accept EW or be patient enough to allow it to play out. Thanks for all your wisdom.

Thanks … and yes, I know … sigh.

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made big money for me. It was always my sitting.” — Jesse Livermore

In other words, be patient, and sit on your hands more than you trade.

Extremely valuable counsel. A delay in the onset of market reality does not imply its ultimate denial. If there was ever a time in this market to SOH (sit on hands). now is it.

Excellent, words of wisdom !

And be nice to our host or just do not read up on EW stuff. ?

Cheers all,

W

Peter, please sign me up for tomorrow’s chart show. Thks

SOMETIMES WHEN IT FEELS LIKE THINGS ARE FALLING APART,

THEY MAY ACUTUALLY BE FALLING INTO PLACE.

I can relate that to good chunks of my life … lol.

market tops (this is truly remarkable):

The legendary trader W.D. Gann reportedly claimed that capital and commodity markets tend to top on or around September 22nd more oft than on any other day of the year. There is not apparent economic logic behind this reported observation, but the notion might very well have a certain appeal to astrologers, in as much as September 22nd happens to be the usual date of the Autumnal Equinox…the day that the earth crosses the Sun’s equator going south, and one of the two dates each year that the days and nights are of equal duration. This is the day which, according to ancient lore, the Sun enters its “Fall,” thereby reversing for a time the rising animal spirits and other good things associated with Spring and Summer, and setting the stage for untoward events to unfold. Apparently this concept is so ancient it pre-dates even the oldest Mesopotamian culture

Entirely in keeping with the notion that we all are subject to forces larger than ourselves, despite the fact that many pooh-pooh the idea…! 🙂

I have to say I continue to be amused at how everyone waits with bated breath to see what the clueless FED is or is not going to do, as if they really made any difference to the ultimate outcome. They have quite a challenge before them. It is quite clear that they have embarked on a course to try and arrest each and every market decline for fear of what it could lead to. It is quite remarkable that the market has gone the entire year without a single real correction, something I think unprecedented. They are literally “all in”. I suspect that size of this cycle top is masking a tremendous amount of financial malfeasance that an unraveling market will quickly expose. I mentioned the so-called BIS discovery of some 14 trillion of derivative liability that no one seems to be responsible for in off-shore accounts. They are trapped.

At the same time, the FED is in business to make money. Their capital ratio is stretched to the point of their being technically insolvent in my opinion, therefore they really have to unload those assets before the great deflation sets in with the inevitable capital depreciation that will accompany it. The unloading of that better than 4 trillion balance sheet however, is going to be tantamount to some very serious tightening policy, and we know global markets have remained viable only because of the CB provided non-stop liquidity. A tightening CB policy could well hasten the onset of the deflationary depression looming in the wings.

I expect them to continue the charade while they try and figure out what to do and announce a delay in the unwinding of the balance sheet.

I do not expect them to change course until some exogenous shock, like an outbreak of war, jolts the sleeping financial world awake to the harsh realities of its precarious financial position. I think most are not going to be prepared, having bought into the notion of the omnipotent central bankster. After all, the BTFD crowd so far has been right! Let’s see just how long they can hold onto those historic gains…. 🙂

Well done! I think once we have a top in (and after the “crash day”), the opportunity to raise rates will cease to be an option.

Peter- will that top be at 2500 on the SPX or 2800? it just keeps going up without even a correction!

Great chart show Peter. Every thing is finally slowly coming together. HINT HINT Bill.

Bill,

This is not the place to begin learning about how the market moves, not that you’re planning on learning anything new (based upon your comments).

If you want to spar with me regarding Elliott Wave, you’re going to have to exhibit at least some knowledge and an infinite amount more intelligence than you’ve exhibited thus far.

There was a large sign post you obviously missed: “I reserve the right to remove any comment that is deemed negative, disparages the Principle, is otherwise not helpful to blog members, or is off-topic.”

I don’t personally have time for your crap, so I’m going to cut you free to try to make someone else miserable. You’re having very little effect on me.

Bye!

Amen!

🙂

I will be exiting another 5- 10 % tomorrow as my model suggest for my long term account. I will be at 70% cash. I will hedge the remaining long position. I will be sliding in some short plays tomorrow and Friday on my ENTERTAINMENT account for next week. Next week promises much more volatility. Good luck every one.

Shorts are only for a few days.

Peter- still think we fall sharply by early October?

SDS 52 wk low. UVXY, VIX – no bullish signal.

TRAN/IYT: printed bullish candles today

/YM still looks bullish to me.

LizH, When I was younger, I was never one who stayed until the end of the party. I believe we are in the 9th inning of this game. Early Next week, a shot across the bow will be evident. My own model says another possibility a high within the first few days of Oct. I will be definitely be short from the 5th into the 9th We shall see. I hope for the bulls, that I am wrong. It is a unfortunate time for me, I have to be in Portland Oregon for a conference that week. All the best o you LizH

Valley,

You plan to short at high and hold for next week??

Bill ( Not the Bill who is unnecessarily arguing with our host)

Not much of a White Sox fan, but one of Ken Harrelson’s famous Hawkisms, “right size, wrong shape,” seems appropriate for this market. He uses it to describe a towering drive that lands harmlessly foul; an impressive swing that, ultimately, earns nothing in return. If Peter’s EW blog posts have taught me anything it is that it not only matters how much an asset rises but how it got there. Shape matters.

If I could see tomorrows headlines a day ahead, but not market prices, for the last 12 months I would have gone bankrupt like 10 months ago. That is why I turn off the Boob tube.

Dave

I’m in and out of Portland several times a year . I don’t live to far away either .

I’ll buy you lunch if our schedules ever match up 🙂

Peter , your quite of Jessie Livermore says it all .

Getting in and riding the move is much easier and more profitable than making work out of

By entering and exiting daily .the key of course is getting that longer trend correct .

I am beginning to consider oct 10th as a turn yet I’m not sold on it , just seeing a few line ups with

That date . If the market chops sideways to up next week I won’t be surprised since

The next full moon surrounds the end of this cycle .

Oct 6-10th I’m thinking and that is rough .

Nvda has an island top from what I can tell with limited info .

Looks like a big round turn from 180 to 180 .

Low 140’s now support with 105 area as the next lower level.

Failing to break 194 to the upside gives me some conviction

On that many year triangle percent move projection I made several

Months ago . Elliott wave theory kicks butt lol .

Sept 29-Oct 8 still fits yet Oct 10 I’m watching .

No bigger opinions for me at this point .

Joe

The probability is high that the US indices are in the fourth wave now of the ending diagonal, so we should head south for the next couple of weeks (or perhaps a bit less). We just broke below a triangle.

Joe, it would be a great honour in meeting with you. I purposely threw that comment out with me being in Portland and hoping we could meet. Our lunch breaks are from 12:30 until 2:20 each day. The conference is from Oct 4th to the 8th If that works great ! I will send a email to Peter to forward to you. If that is okay Peter.

Interesting read given it was written in 2013 .

Fibonacci long term and a bit of Elliott wave mixed in .

Given the variables this guy allowed for I’d say

He was generally correct even if he allowed for the

Various possibilities .

http://www.thedailytick.com/dow-2018-2021-the-year-of-the-ox/

A few months ago I was asking Peter about the hubris of central banksters and he retorted something to the effect that they were subject to forces larger than themselves. I thought that was one of the most thought-provoking observations I had ever heard about financial matters. Developments today are starting to highlight, in my view, some of those “larger forces”.

China has agreed to cut off the DPRK from their banking system. This is a monumental development. Considering China has taken this step ahead of a US compliance with their demand for removal of the THAAD system from South Korea, it reveals that China does not think it is quite ready to go head to head with Uncle Sam. Their exclusion from the SWIFT system would cripple their economy. More importantly, this is going to be a disaster for “Rocket Man”.

His fragile economy cannot withstand a world wide US sanction against nations doing business with him, and on that score since China has thrown in the towel, so will everyone else. Without imports of fuel as Winter approaches, and food, the situation in NK is going to very quickly become extremely dire. Mr Kim is about to learn that he has severely over-played his hand. If he cannot feed and pay his generals and his army, he will face a revolt. The question is, how will he respond?

Will he acknowledge his loosing hand, or will he double down and take the course the Japanese did that caused us to enter WWII? I am betting he is going to do something really stupid….he just seems to be that kinda guy…..

Dave

I’ll be in long beach California the 23 rd of Sept

And it’s 7 days back up the coast to Portland

Somewhere Oct 1 st . Also I grew up in the Seattle area

And end up up there at least once a year and have cousins

In Vancouver bc.I doubt it works for you this time in Portland yet

I’m sure we could figure out something in the future .

It would be great to meet you as well .

Dave

I ‘re read your post , that may work .

I’ll let you know on here after we get to long beach and I ask about my time off .

I might be able to swing it depending on what feedback I get .

Joe

Verne

Your post I think is correct .

What does a desperate rocketman do ? Or does his own people

Rise up against him ? He really can’t show weakness or I would think

His people would take him out . I really don’t know what happens .

Guess we will see yet I tend to think the problem goes away temporarily

And comes back again later yet I honestly don’t know

Looking forward, if it works out.

https://twitter.com/business/status/910929531405561857

If you notice this tweet was posted today 9/21/2017 at 11:11 am. I’m not sure if you see the same date & time as I do. It’s Pacific time and tsla is based here in California.

9+2+1+2+1+7 = 22 which is a multiple of 11.

I find it curious. I’m presuming the triple 11 gives a triple whammy bearish energy to tsla. 🙂

That said, tomorrow is opex. There is a lot of open interest in the 370 puts so that might be the pin price. I covered my short today but I’ll reassess the situation Monday.

For some reason I can’t acces this site directly (bad gateway). So have to enter through responds in my mail.

Think I say nothing new when I say the trend is down. But some short term cycles peak early october so 10/3 will be a high. October looks very bearish. Longe term I expect a low 4/20/18 – 4/22/18. This is just the first low. Jupiter has been weak from early this year but turns real bearish second half of 2018. My gravity indicator peaks 9/28 and crosses the average 10/3. This is the start of a multiyear lunar cycle that is down into 2020. SO a bearish 2018/19 is likely,

This weekend Mars gives a change in trend (down). 9/24 we have lilith trine the real node. This will increase volatility. The first low this year early november. I see 2 cycles up into dec 2017 and this will fuel a retrace up into december 12-20. But this is all within a down trend.

As we will be down for some years 2017 is still a bit consoldating. But this weekend the first real cracks. From december more bearish and from june 2018 a serious bearish market at least into june 2019 but a real reversal up into 2022-ish won’t come before spring 2020.

No trading advice, just a braindump.

André

So Andre, you think a top is in? 🙂

I think 9/18 was a strong date. But As I said, I see some support into early october. Will this support be enough for a new high? Not likely. But noise and short squeezes can push prices higher although the trend is down.

One thing is for sure; 10/3 will bring a lot of clarity. So the next 10-12 days will bring all the answers. But Monday will be a high and thursday a low. Then one last leg up into 10/3. We’ll see how far that leg goes. But that is really the last chance for the bulls to show their cards, After that date my gravity cycle is down into 2020.

From your lips, to God’s ears…! 🙂

Andre, may I know if you are predicting Base on Chines feng shui yi jing?

Ty,

Have no idea what that is. So the answer is no.

Cheers,

André

My own model is very closely aligned with what you see. Unfortunately, I am working off of a old antiquated Dos program to transcribe the info into a graph. Each month I have to line each month going forward in a continuous graph of the markets. Bottom line, I am looking for much more volatility relative to this week going forward. Weakness early next week, Monday thru wed than back up into Oct 1st. As Joe put it best, lots of choppiness going into Oct.

Thanks André. Glad to see your comments 🙂

Valley,

Do you plan to short for next two weeks.

trust in the RUT, and let the RUT show you the way! who knew wave 5 would be a triple zigzag. WE ARE CLOSE HERE people’s…………. – BE WARNED!!

https://www.youtube.com/watch?v=B4fMpO9N3M8

LOL – that link to youtube above – ….”oopsie”

try this for the RUT chart https://invst.ly/5894f

Valley, are you in Portland Oregon ? (My spidey senses says no)

If you do, perhaps Joe, you and I can get together if you are open to it.

Ha, ha, ha! Like your metaphor. Like you said, I am not in Portland, but am only 12 hours south by car in San Francisco area.

AH………… That’s to bad, my leer jet is in the garage, or Joe and I could have flown down to meet you. LOL

You could drive your Lambo.

The correction continues to languish…amazing cash dumps at the open this morning to try and arrest the impulsive decline. The banksters seemed determined that the market shall not correct…! I would not be entirely surprised to see an outside reversal day on Monday after a new high. 🙂

President Reagan’s Tax Reform Act of 1986 —> 1987 Stock Market Crash … President Trump’s Tax reform/cuts —> ???

Given my bullish thesis into end of decade (Year of Pig 2019, end of decade cycle, etc.), I am however “almost sure” that we will see a 5 to 7% sell off in the next month. This is based upon several planetaries: uranus opposition and jupiter conjunction next month and mercury connects with mars next week. All three of these have tendency to suppress price into and after the event.

However, given recent lack of selling may just go side direction during next month.

The key to avoiding falling victim to false breakdowns is to pay close attention to how price behave around critical pivots. Right now the key one is 2500.00 and the fact that we once again closed above it on Friday in my mind does raise some question about whether a larger correction is underway. The next important pivot is 2470, and my suspicion is the start of the larger correction we have been so long anticipating will announce its arrival with a very decisive demolition of 2500 AND 2470 is very short order. When price reclaimed 2470 and closed strongly above it I immediately discarded my short term bearish outlook and belief in the onset of a fourth wave in favor of going on to new ATHs which is exactly what happened. Until 2470 falls, I am doubtful that the fourth wave has indeed arrived. If we are in an ED it should move back into wave 1 price area and should be a very clear three wave zig zag. I suspect we are going higher on Monday.

9/24 we have lilith trine the node. David McMinn found a strong correlation between this angle and financial panics. As it is a long cycle, we should allow for a few days around this date. So if it doesn’t hit 9/24, that doesn’t mean it won’t work; it will.

This angle alone tells us we are now in a very sensitive time period.

This coincides with a long term low in my gravity indicator. The 1929 high was with days from such a long term low. Why the moon gives multiyear cycles I don’t know, but I suspect that Venus – the second planet from te sun – is the cause. When Venus is close to earth and the moon at apogee in the direction of Venus is is thinkable the gravitational field of Venus reaches the moon to give it a push.

March 2017 Venus was at it’s closest point to earth. When the lunar amplitude increases, the average distance from earth goes up and gravity goes down. That is bullish for markets.

But Venus is moving out of sight again so the moon will slowly return to its standard amplitude, increasing gravity. That is bearish. This has nothing to do with lilith and the node as they both have no gravity. So it is a real confirmation.

10/3 is a strong date fro many reasons. The yoga cycle gives 9/20 and 10/16 with midpoint 10/3. My gravity indicator crosses the average on that date and is headed for 2020.

The short term gravity cycle gives a high 9/20 and a low 9/28. I have another lunar indicator that moves in a channel. This channel has a horizontal line above zero and a line below zero, equidistant. The distance of the lines is given by the moon, When the indicator is in the channel it is weak. Above the channel it is bullish and below bearish. 9/20 the indicator broke out of the channel to the upside, counteracting the gravity indicator. Markets went down Wednesday but recovered the same day, The lunar indicator peaked 9/22 and enters the channel again 9/24. So now there is nothing to stop gravity from pulling down the market.

The next time this indicator breaks out again to the upside is 10/17. As long term gravity is down by then, the lunar indicator needs strength, and move above the channel to give a low. So 9/16 we will have a low. 10/30 will be another low, 9/22-23 a high in between.

For next week I see a high Monday and Tuesday. This will give an ABC move down into 9/28 with Monday a high and a low, Tuesday another high and then down into Thursday. Thursday is a very strong day.

10/3 is critical. October will be very bearish into early november. The Daniel cycle gave a low 9/22 a high 9/26, a low 9/28 and a high again 10/3. Then a low 10/5 when the Mercury cycle – that was up into this date – turns down. This will bring a 4 day inversion window. So 10/5 low, 10/9 high and then down into 10/17.

So Daniel confirms yoga. As I said yesterday, 4/20-22 in 2018 should bring a low. And this is the cycle we are seeing currently. Most cycles I see have turned down. So it is just a matter of waiting until the last stort term cycle also turn and then the real fun starts. The next 10 days will change everything. Almost there…

wow, a lot to digest. Thanks!

The only model I have for trying to gauge market direction is the behaviour of the banksters and the overall technical picture. It seems clear to me from the buying patterns firmly established over many months now that they are detemined to try and keep the market in a perpetual uptrend. Every impulsive decline is being aggressively bought with the result that we have gone the entire year without a single correction. This is truly remarkable and probably unprecedented. They ate clearly terrified that the next correction could turn into something more and have been expending a stupendous amount of capital to delay it as long as possible. We are now, as a result at incredible market extremes. Unless you are of the opinion that market participants can abrogate the mean reversion principle, a correction is long overdue. The unnatural manner of its delay to my thinking suggests that when it does finally attrive, it will do so in defiance of all attempts to stop it, and will also probably make up for lost time. The banksters are right to be nervous- they probably know what’s a coming….,

In addition to my analysis yesterday I should mention that in 1932 9/26 was a low and 9/28 a high. Vedic moon is in scorpio 9/25-27, That should bring a low.

So the dates 26 and 28 are confirmed but inverted in 1932. If this is the scenario then 10/1 will be the low and 10/3 the final high.

In 2014 we saw the same; 9/19 the high but consolidating into the end of september and 10/2 the capitulation.

As I said yesterday; after 10/3 it will all get very clear. Next week could show a lot of absorption. The big boys need time to unload.

Again; not trading advise.

Cheers,

Yep. That sounds just about right to me Andre. Looking at the way the last decline was successfully arrested I don’t think we done quite yet to the upside and the move down Friday was corrective. I do think it is interesting that ES has stayed below the 2500 pivot. If the cash session takes out 2470 at any point next week that will be my signal that an interim top is in.

A new blog post is live at: https://worldcyclesinstitute.com/elliott-wave-ending-diagonals/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.