The “unexpected turbulence” I’m referring to in the title is only unexpected to the trading herd and the bulls.

The “unexpected turbulence” I’m referring to in the title is only unexpected to the trading herd and the bulls.

Anyone reading my blog posts lately knows I’m expected a rather turbulent end to this large B wave to the upside.

It’s seemingly never-ending but I think that’s just to add to the overall market complacency. Expect a turn down mid week.

We have the spring equinox on Tuesday and the latest Federal Reserve announcement on Wednesday at 2PM EST. It’ll be interesting to see if they raise rates. It doesn’t matter to the market, because it’s already determined what it’s going to do.

So, I’m still looking for a regular flat top in ES/SP500 and an expanded flat top in NQ/NDX.

The Big Guys are Losing Steam

Above is the daily chart of Tesla (TSLA). I’ve shown this chart before and there’s little change, other than the fact that’s it starting to move lower. This puts Tesla in the third wave to the downside which should bottom below 208.91.

Above is the daily chart of Facebook (FB). After completing an ending diagonal and an apparent first wave down, we’ve been stalled out at the top of the second wave (at the 62% retrace level. If we’ve indeed topped, we should see a third wave down with the drop C wave drop we’re expecting in the US indices.

Regular and Expanded Flats

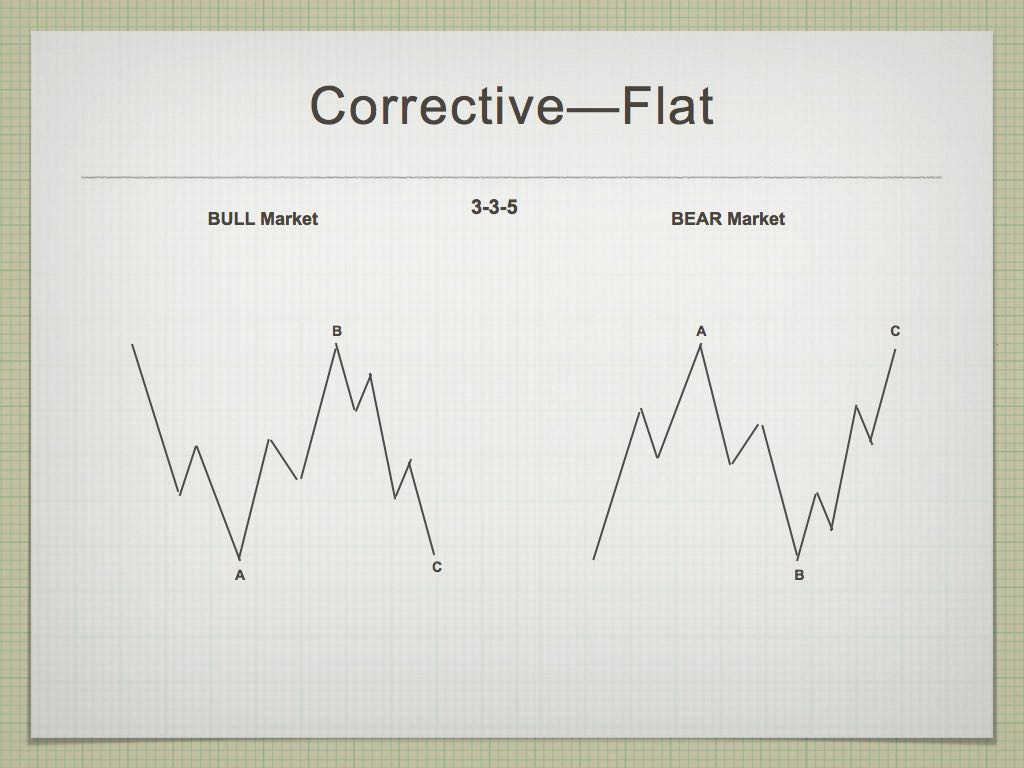

The pattern tracing out in ES and the SP500 seems to me to be a regular flat. Here’s an description of the traits of a flat (from the Elliott Wave Principle):

“A flat correction usually retraces less of the proceeding impulse waves than does a zigzag. It tends to occur when the larger trend is strong, so it virtually always precedes or follows an extension. The more powerful the underlying trend, the briefer the flat tends to be. Within an impulse, the fourth way frequently sports of flat while the second wave rarely does.”

Regular Flat (below)

Above is a chart showing a very simple drawing of a regular flat. Think about the large fourth wave in ES that we’ve been tracing out since January 29. The BULL Market wave on the left in this diagram relates to the probable pattern we have unfolding.

Above is a chart showing a very simple drawing of a regular flat. Think about the large fourth wave in ES that we’ve been tracing out since January 29. The BULL Market wave on the left in this diagram relates to the probable pattern we have unfolding.

The first set of waves down from the 2875 area was in three waves (a zigzag). This is the A wave of the flat.

The wave up from about 2530 is also in three waves. This is the B wave of the flat, and it’s not quite complete. My target now on the upside should be above 2850 in ES and a 2838 in the SP500. A turn down into Wave C that traces out five waves will complete the pattern (3-3-5).

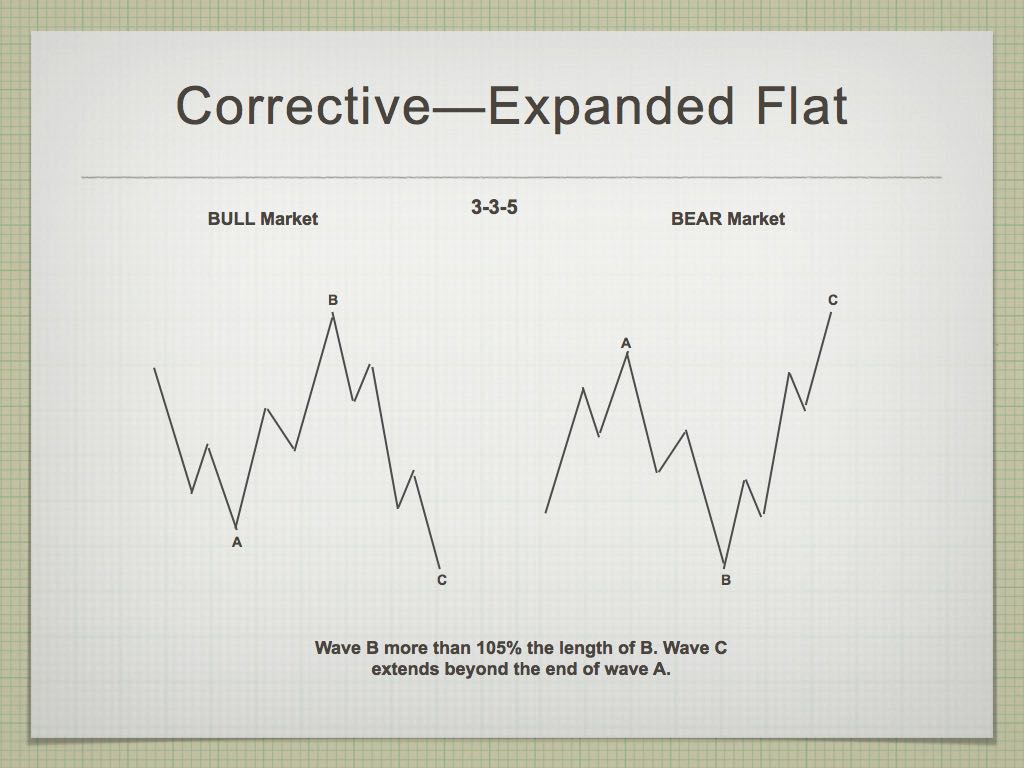

Expanded Flat (below)

The only difference between a regular flat and an expanded flat is that in expanded flat, the B wave goes to a new high (the pertinent diagram is the one on the left, for a bull market)

The only difference between a regular flat and an expanded flat is that in expanded flat, the B wave goes to a new high (the pertinent diagram is the one on the left, for a bull market)

Summary: We seem to have a regular flat in progress in ES and an expanded flat setting up in NQ. Look for a final rally into perhaps midweek and then a sudden turn down into the C wave. The C wave in both flat patterns will drop to a new fourth wave low.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We're looking for a top in the B wave of a regular flat this week (after one final leg up to a new B wave high and above the 90% retrace level — measured from the all time high). That 90% level is 2850 in ES.

The flat is still the best option for both ES (regular flat) and NQ (expanded flat).

Expect a turn up either this weekend or Monday. Then expect a top perhaps in conjunction with the Federal Reserve announcement on Wednesday. The medium term projection is for a new fourth wave low in a C wave down.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 28 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

bullets ……beans………and guns…..”here”////////////

getcha ……”bullet, beans and guns”……………….ES end of day

https://invst.ly/6-az7

you remember this???…….shoulder pads……………………..and all that ……”hair” gel!

this is the monthly time frame – DOW……………..and y’all have ………….seen this before…

so far, so good…………….we shall see…………….

https://invst.ly/6-bjz

spx monthly…………………………………… hmmmm….

https://invst.ly/6-bo4

Reminder from my Feb 27 post concerning Puetz crash window:

“The “panic phases” of all 12 crashes studied were entirely encompassed within one of the following periods: a) February 4- April 5, b) September 3- October 29.”

If it is happening here, it is interesting to note that the lunar phasing may have switched the importance of the full moon and new moon phases, implying that the full moon on March 31 could well end any crash-like behavior seen…

A new post is live at: https://worldcyclesinstitute.com/finishing-the-fourth/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.