The “unexpected turbulence” I’m referring to in the title is only unexpected to the trading herd and the bulls.

The “unexpected turbulence” I’m referring to in the title is only unexpected to the trading herd and the bulls.

Anyone reading my blog posts lately knows I’m expected a rather turbulent end to this large B wave to the upside.

It’s seemingly never-ending but I think that’s just to add to the overall market complacency. Expect a turn down mid week.

We have the spring equinox on Tuesday and the latest Federal Reserve announcement on Wednesday at 2PM EST. It’ll be interesting to see if they raise rates. It doesn’t matter to the market, because it’s already determined what it’s going to do.

So, I’m still looking for a regular flat top in ES/SP500 and an expanded flat top in NQ/NDX.

The Big Guys are Losing Steam

Above is the daily chart of Tesla (TSLA). I’ve shown this chart before and there’s little change, other than the fact that’s it starting to move lower. This puts Tesla in the third wave to the downside which should bottom below 208.91.

Above is the daily chart of Facebook (FB). After completing an ending diagonal and an apparent first wave down, we’ve been stalled out at the top of the second wave (at the 62% retrace level. If we’ve indeed topped, we should see a third wave down with the drop C wave drop we’re expecting in the US indices.

Regular and Expanded Flats

The pattern tracing out in ES and the SP500 seems to me to be a regular flat. Here’s an description of the traits of a flat (from the Elliott Wave Principle):

“A flat correction usually retraces less of the proceeding impulse waves than does a zigzag. It tends to occur when the larger trend is strong, so it virtually always precedes or follows an extension. The more powerful the underlying trend, the briefer the flat tends to be. Within an impulse, the fourth way frequently sports of flat while the second wave rarely does.”

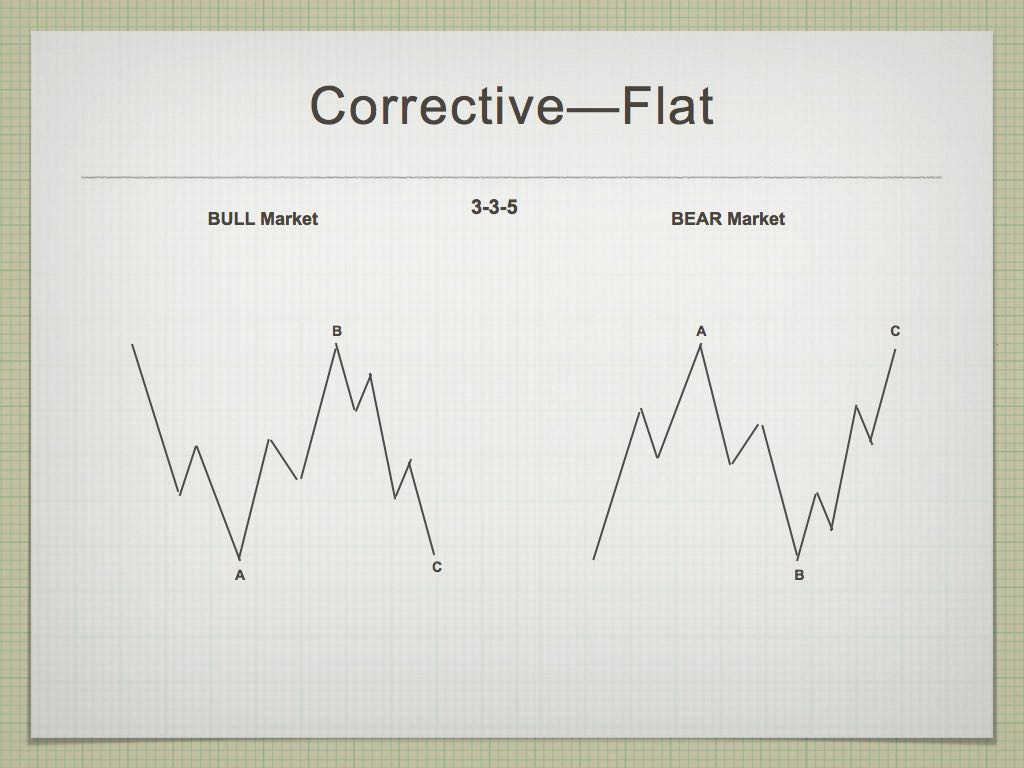

Regular Flat (below)

Above is a chart showing a very simple drawing of a regular flat. Think about the large fourth wave in ES that we’ve been tracing out since January 29. The BULL Market wave on the left in this diagram relates to the probable pattern we have unfolding.

Above is a chart showing a very simple drawing of a regular flat. Think about the large fourth wave in ES that we’ve been tracing out since January 29. The BULL Market wave on the left in this diagram relates to the probable pattern we have unfolding.

The first set of waves down from the 2875 area was in three waves (a zigzag). This is the A wave of the flat.

The wave up from about 2530 is also in three waves. This is the B wave of the flat, and it’s not quite complete. My target now on the upside should be above 2850 in ES and a 2838 in the SP500. A turn down into Wave C that traces out five waves will complete the pattern (3-3-5).

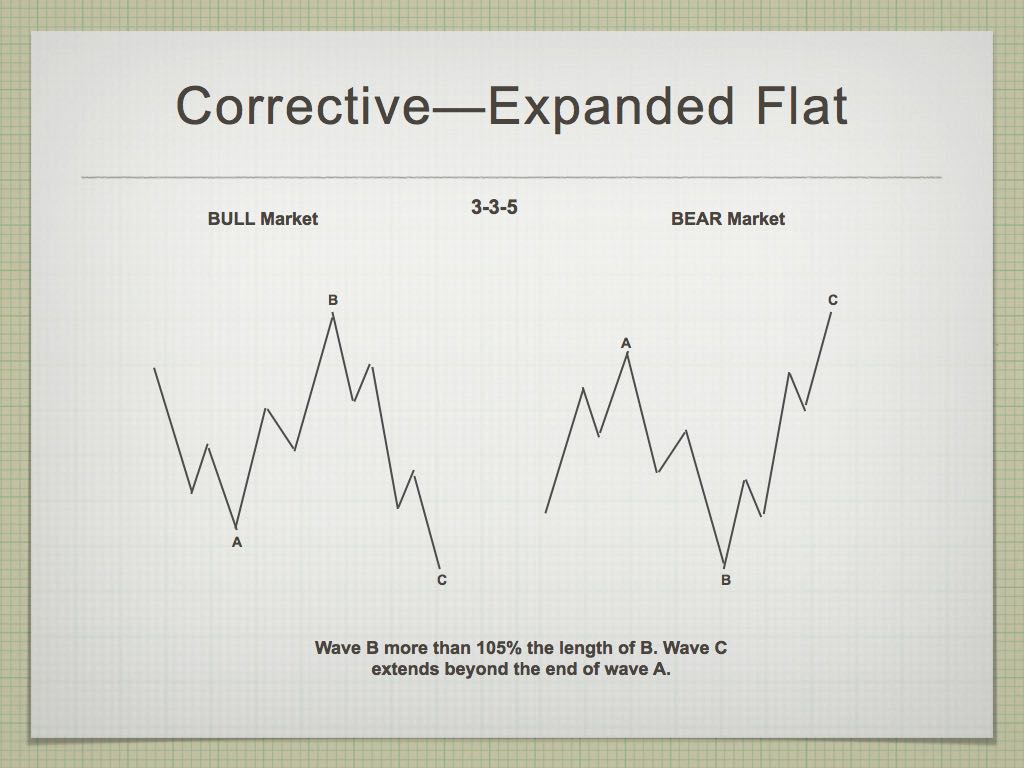

Expanded Flat (below)

The only difference between a regular flat and an expanded flat is that in expanded flat, the B wave goes to a new high (the pertinent diagram is the one on the left, for a bull market)

The only difference between a regular flat and an expanded flat is that in expanded flat, the B wave goes to a new high (the pertinent diagram is the one on the left, for a bull market)

Summary: We seem to have a regular flat in progress in ES and an expanded flat setting up in NQ. Look for a final rally into perhaps midweek and then a sudden turn down into the C wave. The C wave in both flat patterns will drop to a new fourth wave low.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

We're looking for a top in the B wave of a regular flat this week (after one final leg up to a new B wave high and above the 90% retrace level — measured from the all time high). That 90% level is 2850 in ES.

The flat is still the best option for both ES (regular flat) and NQ (expanded flat).

Expect a turn up either this weekend or Monday. Then expect a top perhaps in conjunction with the Federal Reserve announcement on Wednesday. The medium term projection is for a new fourth wave low in a C wave down.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, March 28 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Hi Peter, Thanks, I was the Federal Reserve announcement vergotten. If I look at the movements now, we will make a High on the 21th. (what you expected). And if there is a panic created by the FED we could make the LOW in April 2-6. The redline must confirm it. I will be updating it every day. http://www.prognoseus500.nl/

energy chart for next week

https://ibb.co/jdERPc

Hi Tom, Nice to see youre indicators. Do not be angry but i do not like them inverted, because you/we can’t predict the invertion. And the moment we go to normal. But you can work wit it. 🙂

Thanks for the update Peter 🙂

I’m still working yet concerned at this juncture

Due to the moon as well as the puetz cycle which

Is not working as a bearish cycle . The momentum move

Typically ends near or on the new moon yet the cycle

Still points to an end point on April 4 th .

Mercury is about to go retrograde on Friday I think

March 23 rd ( need to check ) I’m starting to consider

April 4 as a high yet technically it is a forecast LOW.

June 6 is another low and if that is indeed a low then

We should see more sideways movements for the next

Couple months .

August – Sept is where the next bearish cycles kick in again .

I’m not bullish this year due to the many bearish cycles yet

My gut tells me to be cautious with any bearish trades .

Crude oil went sideways for a very long time before it broke down

As did the Sox index back in 2004-2007 .

I have yet to pinpoint what us holding this market up .

Lastly in regards to the puetz window I’ll note bitcoin.

A strong bounce this week would not suprise me yet

I do not trade the crypto currencies .

Present moon borrowed from the bottom left

Of this blog :

The moon is currently in Aries

The moon is 1 day old

It’s been a while since I updated the repeat patterns

Of the moon yet it might be worth looking into .

Mini bear cycles in the Dow tend to last 51 trade days

And or 60 to 90 calendar days . If wave C is indeed a flat

It needs to get moving rather quickly and travel a long ways

In a short time .

The full moon near the end of March and the mid point of mercury

Retrograde along with the mars Uranus cycle point to April 4 as a low

Option expiry is now behind us so the next 10 to 13 trading days

Can and should be wild ( assuming wave C is coming )

The Dow though has not poked above its late Feb high

Which leaves me mixed at the moment .

I have not looked at the NYA but feel it is warranted before

Making any solid bullish or bearish calls this late in this

Bearish sub cycle .

I’m hedged yet not outright short .

Something is still amiss in my eyes with this market

And having to much of a bearish bias may not work out so well

That said come August and Sept I’ll look for a better set up

To emerge and trade accordingly.

As noted before , a June 6 low ( from a continued sideways

Market ) targets a Sept 9 high followed by a steep crash like

Decline .

Maybe the Aug-Sept cycle highs is the top of wave 5 ?

To soon to call it but it’s what I’m considering .

All for now

Thanks again Peter for your updates

Joe

Joe,

Thank You and Peter T for your thoughtful and meticulous analysis.

Peter T,

Are you now expecting 2730 to 2838 from Monday to Wednesday and then down to C wave low.

Something like that.

The next fib level for ES that I have is down around 2710. Wait for 5 waves up and three down if you’re going to attempt to play this.

As I’ve been saying, surprises are now to the downside.

Currencies for the most part seem to have turned.

The wave down is corrective, but as per my last comment, I don’t really have another fib level until the 2710 area and they we’re looking for 5 waves up.

Hmm. Seems I didn’t make that comment before, looking back. But we may get weakness down to that level. I’ve been looking for other relationships, and can see another at 2716 for the SP500 but that’s a bit speculative.

FB has dropped into its third wave today. I had shown the chart in the free blog post on the weekend. It was ready to go.

Peter T,

Doesn’t traveling from 2710 to 2838 look diificult in next 3 days , so probably it wont reach that target. Is there a possibility we already had a B wave high around 2800 and going towards C wave.

March 7th through March 9th had quite a strong move to the upside over three days. This would be more extreme certainly. The top of the move could also occur at the open on Thursday on a gap up.

The 38% retracement level of the entire pattern up from 2532 is at 2702 in ES. It’s a rather obscure fib ratio at this point, but this might be the turning point. I have no other fib ratios that make any sense. NQ is at an important double bottom with a previous B wave.

It’s starting to look like we might be working on 5 waves up at small degree (1 min chart).

The 62% retrace level here in ES would be 2704. I would wait to see that (or at least no new low) and a strong turn to the upside before getting too excited.

Looks like ES is going to put in a double bottom … to me.

Food for thought .

I am not bullish yet here is my observation .

It appears to me that we are seeing an inversion in

Regards to the puetz window ( even if it’s a flawed set up )

Using the puetz cycle just by itself this decline should only last

Another trade day or 2 before a reversal to the upside .

Here is the twist : we are in several bearish cycles and the puetz

Cycle inversion had only enough effect to hold the market up

Into its momentum high cycle which is the new moon .

Don’t quote me though it’s the first time I have seen all

These cycles hit at the same time in this manner yet it’s worth

Noting so I am . Following the next couple days then technically

A weaker upward move would take place ( which I have doubts )

Then that cycle ends . According to Chris carolan spring crashes

Tend to be seen near full moons while fall crashes are near new moons .

It is a bit different viewpoint and method than puetz.

My point is we did make a high and this new moon turn

Based on both the mars Uranus cycle as well as mercury retrograde

Are dominating the trend which is down, the inversion in

The puetz cycle appears to have held the market up .

The next cycle turn due April 4 is dead ahead and technically is

A cycle low

WE might end up with a small ending diagonal on the downside of ES/SP500. It’s starting to look like one. It would drive to a new low and then turn around dramatically.

I have a bradley turn on March 22, I think this will be the new panic low.. with mercury going retograde..

This is an extremely dangerous market (even more so than I keep saying).

It’s not an ending diagonal to the downside, but all the waves are in 3’s in both directions, so if I suggested what futures were doing, I’d just be guessing.

Looking at the futures and SP500 at the end of the day (I have to run out for a couple of hours), I would expect more downside. The waves up in all of them are corrective, so maybe we’ll get a B wave before another zigzag down. That’s what we had today—a zigzag. I don’t know yet if the flat idea is dead.

The alternatives are a triangle (which I don’t see) or another zigzag after a B wave. However, neither of those explain the ATH in NQ/NDX.

Currencies have decoupled from futures, which raises a big flag.

The C wave of a flat is supposed to be an impulsive wave. However, the current wave down is corrective.

Joe,

I thought you might appreciate an interview or conversation between two other very bright market minds. The interview is posted over on stockmarketcycles.com.

The conversation is between Peter Eliades and Tim Wood…both cycles guys.

You mention the sequential preponderance of several cycles that seem to be overlaid one on top of the other. They mention a low probability watershed type decline. The key words being “low probability”.

It all fits with what you believe “might” be happening and with what our Peter T has said is a multi hundred year high.

https://www.youtube.com/watch?v=p5rNqcBk6Zo

The flat as a valid pattern has now been relegated to second place over a set of zigzag down or even 5 waves down. That’s essentially the same pattern as a flat, just from a lower level. It doesn’t look like we’re going to make the 90% retrace level in ES. That’s about the only difference in the projection.

Still expect a new 4th wave low for ES, but not necessarily for NQ. NQ may be tracing out an ending diagonal. Once the flat fails as a pattern in NQ, the ED is about the only option left unless something dramatically changes.

The big drop will be march 26/27…. we will slide sideways untill Friday.

Borrowed paragraph from link :

https://arstechnica.com/science/2018/03/when-will-the-us-feel-the-heat-of-global-warming/?amp=1

Let’s not forget al Gore said New York would be under water by the year 2013

Now they still deny global cooling and push it out 50 years 🙂

A team of researchers has now looked at heat waves in the US, trying to determine when a warming-driven signal will stand out above the natural variability. And the answer is that it depends. In the West, the answer is “soon,” with climate-driven heat waves becoming the majority in the 2020s. But for the Great Plains, the researchers show that a specific weather pattern will push back the appearance of a warming signal until the 2070s.

Jeez, I don’t know where this started …

It hasn’t been warmer for the past 20 years. As far as weather goes, we’re leaving winter and going into spring, which always has volatile weather. So does summer into fall. Re: climate, which is simply a higher degree fractal of the same thing, it has always turned colder and more volatile after a Uranus-Neptune conjunction. I’ve gone back over the following dates (in fact, I’m in the midst of doing this just this week): 1136 (1150), 1307 (1320), 1478 (1492), 1650 (1664), 1821 (1835), 1993 (2007). These dates are the conjunction dates (the dates in brackets are the dates plus 14 years. There is always a market crash and depression (and deflation) at each of these 14+ year milestones). I’m currently researching earlier conjunctions back to the 600 BC era).

These are the same dates in Puetz’s book and in Dr. Wheeler’s work and are supported by the work (books) of David Hackett Fischer (The Great Wave) and Peter Turchin (Secular Cycles).

I throw this out because the info is sitting right in front of me …

Where I live, this year we broke lots of records for cold, as expected. (obviously only one country and only a weather anomaly at this point).

The Uranus-Neptune conjunction is 171.4 years, as I’ve written about quite a bit before.

Joe,

Were you able to find the time to listen to the conversation over on stockmarketcycles.com site between Peter Eliades and Tim Wood? If so, what did you think?

Peter T,

So probably we go as high as 2800 /2810 and then go back to your initial projection of 2420. What kind of time line are you looking for this downmove..entire april.

Hi Bill Rider and others, my indicators are making a high on 22th. Then the high on Friday (after the close?) the decline slowly starts and to the LOW on 29th or even in 2-7 april. Just look at – http://www.prognoseus500.nl/

Tonight is a REALLY good night to be in the Chart Show … in 15 minutes.

Luri where have you gone.

red………”dog”………………………….are you ……”MISSING”….me?

internet connections are difficult in a nuclearized “bomb” proof …….underground “bunker”……

ES…..wide angle lens………https://invst.ly/6zrfe [to be fair…..a wide angle lens will easily add 12 pounds to the chart….that is, the chart looks “fat”] :-))

ES……close up………….https://invst.ly/6zrit

RUT……….https://invst.ly/6zrlp

as you can tell……all the charts are black……..the shadow has covered even these charts………..

oh yeah…………red…………………………”BE WARNED!”…………………

They al left the building, the panic is close still believe we will drop into March 27.

on the way to the store………………………i stumbled upon an ASI

well in the unabridged version of ………….”The Fairy Tales Grimm”………..the ASI is the accumulated swing index………….used for purposes as “confirmation” of change in trend……………………..

NYA……..ASI…………….https://invst.ly/6zrq- …………..uptrend over. broken on 2/2/18

hmmm………………. methinks the sale on sweet potatoes “beith”……… perfectly timed!!! ……………carry on……………oh yes…………and ……..”BE WARNED!!!!”……….

red,

i replied back to you……………although the response is “awaiting moderation”…..

patience is pleasing in purple…………………………….. said otherwise…………”reply cometh”

red dog………………remember ……”way back when”…………when you were still ……

red “pup”………………………….and you asked me for a bitcoin chart……

well here she be………………still in play………….hmmmm…

https://invst.ly/6ztmj

……………hmm…………….am i hearing “echos”…………………..or did someone disparage me ……and call me “FAT”!………………………….

well…….to you mr. echo……………………i give to the fine you….. the DXY…..

https://invst.ly/6ztpa

Fat??! Did you say “Fat??”. I would have the offender know that I deeply resemble that aspersion. We would much prefer “Nicely Filled”, now, would we not? 🙂

Verne,

Can you give Liz a call, we need an update about the fractals…

there are NO fat skeletons verne………………………nary a single one!……..so ashes to ashes, and dust to dust…………we are all ………skinny b*tches………… :-))

Sticks and stones may break…well, you know…! 🙂

…ES update….

“one at a time”……..you animals!!…..were you raised in a ….”barn”…….open the door for that gender neutral ….”moustached”……lady man!!…

https://invst.ly/6zv9a

Luri thank god your back. Chat hasn’t been the same. Sun is just coming up in the Land Down Under.

red,

anchovies melt away when sauteed……..and they add that certain ……”je ne sais quoi “……………to any dish…….that layer of complexity…..that giggle on the palate……………

so in short…………………….. ARE YOU BE CALLING ME AN ………..”ANCHOVY”????….

ES end of day…………[cough]………ahem…………..anchovy………”indeed”!

https://invst.ly/6zzo7

larger view…………https://invst.ly/6zzom

:-))

Sounds a bit fishy to me…and exactly what are you angling at, might I politely inquire…hmmmnnnn?

verne,

may i be the first person to ask you to explain…….”why oh why”………

…………..”why has there been no negative divergence on the A/D line??”

i need the answer………double spaced and hand written……….and yes verne………..you must utilize script writing……………..!

now about this fish obsession of yours…………………..would you care to share it with the class??

:-))

It all goes back to my childhood luri. I was devastated to be told as a young un, and in no uncertain terms:

“You can tune a piano,

But you can’t tuna fish!” 🙂

Ed

I have not listened to the interview yet I will .

Tim wood is a pure Dow theorist more so than a cycles guy from what I have seen.

His main theme being the 4 year cycle . It’s been 10-11 years since I have had emails

With him or listened to him . Peter elaides a fairly technical analysis type guy and uses

Low low high or low high high type timing methods . Both of them I have followed from a distance

From time to time . That said I must rely on my own work which calls for a swing low

April 4 yet the end of this bearish cycle runs into Jan next year .

With the primary trend as down in my work my thoughts are all surprises will be to the downside

Waterfall decline or not .

Not a forecast but….. The March 2017 lows are allowed for in my work . Whether the market

Gets there remains to be seen .

Joe,

What about your 2.2 x Wave A which gives 748 S&P points. That 748 points subtracted from 2802ish swing high gives a 2054 target for a Wave C should the price waves fall into place. Not seeking trading or investment advice.

Any thoughts? Thank you for responding.

https://twitter.com/allerotrot/status/976933411595137024

BPCOMPQ diverged negatively with price at the recent NASDAQ all-time-high…indicators cause me to believe there is more room for a continued run to the downside…?

Liz,

if you can hear me…………..up over there……………………..above the clouds…..and into the wild of blue yonders……………….the gang is back…..

correction … ……….”ALMOST”……….. back………………we are “almost” all here……………..and as odd a collection of personalities that there ever was……………………

We are unable attain full “gang” status…………………without you………….and we need you back ………………besides, remember that FENDI bag you loaned me……….ITS TIME FOR ME TO MAN UP……………….and TO GIVE IT BACK………………..(sniff)…….

OK now calm down……………………..”IT WAS A “GENDER” NEUTRAL BAG PEOPLES!!!!………………………..

Good to see you back. In your honour, I’ve relaxed the moderation to allow up to 6 urls. Everyone here has to sign in, anyway, so there’s really no need for that restriction.

ahhhh….thanks peter!!!

question……………………what exactly …..”IS” ……..the meaning of ….”koombaya”

it would be incumbent upon me to understand this concept, as i am experiencing ……………………”you guessed it”…………………a koombaya moment….

:-))

Oh, gawd, Luri … you just brought back memories of a week at Club Med … when I was (hopefully) much more foolish …

BTW LIZ,,,,,,,’

my fib levels for the ES are still in play………………………1800 – 1900 one fib level

and 1600ish………………………second fib level……………………….

……………………….who will contain me and my fib levels…….???…….you will liz….

come back!

Ed

Keep on mind I do not have much data to go off of.

The Venus bull cycle began in March 2017 , a return

To that point is allowed for yet is not a forecast.

The 2.2 and 3.2 times wave A levels I have seen hit many

Times .

At the moment though I am looking for a sub cycle low

April 4 . It is to soon to call this wave C even if it appears to be.

Without having more data and with out seeing the internal

Data and indicators I cannot claim that this market is oversold.

Without quantifying this leg I cannot make any valid wave decisions

Or forecasts . For me right now I can only say a cycle low is due

April 4 .

9 trading days to go until April 4 .

If the market fails to make a new low then what ?

On the other hand if the market does make a new low

Yet the internals and indicators fail to make a new low

It would set up some bullish divergences .

Without having the data in front of my only thoughts

Are if the Dow fails to make a new low below the Feb lows

Then I’d consider wave A down in early Feb and the initial

Leg up into late Feb as minor wave a of a larger wave B .

To complicate it more . A failure for the Dow to make a new low

Would imply we are in a deep minor b wave will with minor

Wave c going back above the late Feb highs .

(A) early Feb low then a and now b then c next ( if Dow fails

To make a new low below the Feb lows ) . The c wave would

Complete wave ( B ) AND to me if that played out would

Imply a possible triangle unfolding .

It is way way to soon to consider that yet it’s worth thinking of

Come April 4 .

My issue though is there is many bearish cycles in place

So I must keep a bearish view for the entire year

Joe,

Thank You once again for responding. I think I understand and am looking forward to your next post. Hopefully I am not badgering you.

Ed

I know Tim wood is a strict Dow theorist and I know

He has spent thousands of research on the subject.

This link is saying the market is close to a Dow theory sell signal

I’d bounce this article off of Tim wood’s work if you follow him.

https://www.marketwatch.com/amp/story/guid/3C849CD4-2E1F-11E8-81FB-B7175F43D5CD

A simple Google search : Dow theory sell signal will get you

To the article if the link fails .

Peter T

You may have hit paydirt with the Neptune Uranus cycle .

I don’t have time to explain it but I did some math the other night

And discovered wd Gann, Martin Armstrong and a bit of Fibonacci along

With a few others work

In that 171 year cycle .

I have always felt Uranus holds a lot of keys to the planetary

Alignments yet both Uranus and Neptune together is something

I’m going to dig much further into .

There are 32 points to a compass at 11.25 degrees

Each ( Gann )

Neptune and Uranus move approx 2.105 degrees closer

Or further per year ( 2.105 * 171 = 359.95 )

14 years after conjunct = 29.47 , approx 30 degrees of separation

2009-1993= 16 Years after conjunct or 33-34 degrees of separation

Note : the year 1906-1907 was approx 180 degrees

1/2 of 171 equals 85.5 which is very close to Armstrong’s

8.6 * 10, 86 year cycle .

Note 42 3/4 years swings which are 1/4 of 171 years

These represent 90 degree movements .

To nail this down though as I have with the mars Uranus cycle

Will take 1000-6000 years of data to even grasp how this cycle

Works with any consistency . That said I’m going to use the mars Uranus model

And run the progression and just see how well it’s held up

Since 1993 to date .

The 59-60 degree angle would be of importance which

I can get more accurate on but roughly 59 times 2.105 degrees

Per year 59/2.105=28 years from 1993 or the years 2021-2022

I will acknowledge you said 171.4 years .

Benner business cycle low is due in 2021 from a 2018 high.

I have much more research to do with this planetary pair

But for now just pointing out my observations .

Let me know what you find out about the Uranus Neptune cycle. I’m combining Puetz with Wheeler, Dewey and a few more recent luminaries. There’s fascinating independent data that supports these cycles (events, inflation, wars, etc.). It’s all coming together …

Puetz’ s crash sequence has largely played out and suggests the S&P500 has either bottomed or is within a few days of a bottom depending on how one runs the calculations. There is the chance of further erosion for another 4 weeks per the Japanese example, but otherwise, we should be on guard for a nice rally into June/July 13th if Puetz’s eclipse cycle holds form going forward.

Ed

Your not badgering me

It’s just I’m working 12 hour days and on a boat and have

Limited data .

As long as you understand that and understand I’m working with

Variables because of my lack of data then it’s all good .

4 hours to sleep then back to work .

I’m hoping to be home in a week or so at the latest .

Dan

How do you calculate the puetz cycle in order to come up that it has been successful ?

And how to you conclude it’s finished ?

How do you calculate the rally into June July ?

All info would be very much appreciated

Joe

Hey Joe,

I’ve been trying to put together my own coherent interpretation of the many pieces that go together in the Puetz possible. So any errors are that of my own making and anything I say is subject to further revision. Essentially there is the eclipse cycle which unfolds every 173.5 days from memory – a general description of what the market does based on what geomagnetism is doing. And then you have his topping sequence which is really just the eclipse cycle but I feel should be kept separate for analytical purposes. The topping pattern is a 6-week pattern (in most cases) with a bottom 2 weeks later (in most cases).The reason why I say they should be kept separate is that while more often than not the topping pattern is closely syncing with the eclipse cycle there are occasions when this is not the case, for example when the market peaks on the second new moon prior to the solar eclipse. The market may still follow a 6/8 week topping/crash pattern but it is slightly out of step with the eclipse cycle. If you look at what the S&P 500 has done, you had the peak not far off the new moon prior to the SE and 6 weeks later, you have had a secondary top which does not necessarily line up exactly with a full moon. 8 weeks from the top is essentially around now, which is not that far off the new moon which is what the eclipse cycle calls for. I hope that all makes sense.

Dan

Based on the eclipse cycle, geomagnetism sets up the potential for a nice rally of maybe 60-90 days into the one of the new moons prior to the next SE

Ed

I may have mis interpreted your thoughts on the interview

Yet after listening to Tim wood and Peter elaides it sounds to me

Like they are both bearish . Peter elaides did give a downside projection

To the 19,000-20000 range along with a few others . Overall I felt the interview

Was insightful .

For me though I’ll add that I use some of the very same indicators they do along

With a few oscillators that I created myself .

At the end of the day I must go with my own work and without having any internal

Data to dig into I cannot quantify where the market presently sits .

We began this week with the potential for a strong decline coming off of a March 17

Mars Uranus swing high along with the full moon . If the puetz cycle was standing alone

And had inverted then a turn up from a low around now would be expected yet that upward

Turn would be weak and last into April . The problem is the mars Uranus cycle points down

Into April 4 , Venus is now in a bear phase as it moves further and further away from the sun .

The Venus bear phase lasts until October and the mars Uranus bear phase lasts until January .

This latest very short term cycle involves mercury going retrograde . Which I believe is only now

Just beginning ( March 23 ) and lasts until mid April ( April 15 ) and as I have mentioned before

Add 10 days to that start and stop which is roughly. April 4 to April 25.

I have not completed my historical data on this cycle but the general rule I use is the 10 day lag

From the start if the market heads down at the beginning. So April 4 shows up again as a potential low

When mercury goes retrograde the market tends to go all over the place both up and down .

We have now entered the mercury retrograde cycle .

Now is not the time to be fixated on direction , now is the time to let the crazy market action

Confuse a lot of people . The picture won’t really come clear until after April 15 – 25 th .

What will really be the proof in the pudding will lay with the internals of the market along

With the indicators . Price is not always the ruler .

That may sound off base yet reversals and washout lows come with extremes in price

But not extremes in the indicators .

For another day I suppose .

Bottom line I’m bearish, I’m expecting a low ( higher or lower than the Feb low ) on or near

April 4 . After that I’m expecting a sideways to upward bias .

That sideways to upward bias may form a bearish B wave triangle which runs into August Sept .

If we do see a new low below the Feb lows form then I’d still look for a sideways to upward

Move into Aug Sept .

My point is that I don’t want to or intend to call for a significant low until January and that

Leaves us many months for the pattern to show itself .

We can have an A B C ( A ) forming if the April 4 low is below the Feb lows and that would

Get the bulls excited yet to me the move up would be a B wave and no new high to follow .

Or we have wave A in Feb yet now and as I posted above is something more complex .

All in all though regardless of the variables I must stay bearish until January .

Dan

Thanks for your input

It’s always good to hear another viewpoint 🙂

I’m going to be quiet for a few days and let the market

Do it’s thing .

Good luck everyone

ES – overnight

https://invst.ly/6-4ez

mornin’ poptarts!………………………….wakey wakey!

consolidation at the lower end of the range, is a “continuation” pattern…….look for ……..everyday……..”lower” prices…………..

VIX notched a high of 50.30, more than double its low for that day of 22.42, on Feb 6 as SPX completed a third wave down. VIX went on to make a lower high (41.06) on Feb 9 when the index completed the fifth wave of the impulse down. The index range on Feb 6, the day the third wave completed was roughly 2593 to 2701. The index made a lower low of approximately 2533 on January 9, while at the same time VIX notched a lower high, confirming the fifth wave. I used VIX for years to count impulses down until it stopped working reliably a few years ago due to the incredible distortion of the short vol trade. It seems to be working again with the blow up of the short vol skew.

Here is what I find quite interesting. While we have not made a lower low yesterday than at the end of the third wave on Feb 6, we have certainly made a lower high, yet VIX shows not a sign, at least not to me, of anything remotely resembling capitulation. This is most noteworthy. Despite the distance the indices have fallen over the last several days, the level of complacency in the market is truly stunning. Anecdotally it is evident in the comments traders are making, and certainly demonstrable in the relatively muted response of VIX, compared to where it traded last Feb 6. Granted it was up 5.48 at 30.68% on Thursday, we still have nothing even remotely resembling panic. In fact on Wednesday we had the weekly theft from traders when VIX saw its typical spike down intra-day to 16.36! (Stink bids placed on Tuesday in anticipation of this weekly event returned an instant double. It is really amazing that you can do this just about every week!) This is a time, in my humble opinion, to expect surprises to the downside. I thought we could see a reversal today but price may prove me wrong. RUT only on Thursday joined the other indices in penetrating its 50 day so this party may be just getting started!

hey verne,

yes, i am with you on your observations…………..

so……….what i am looking at in terms of RUT is that it hit the 200dma yesterday, which is why it was “lagging”…………….as the 200 dma was providing support……it seems that the RUT will give us insight as what is next….a drop through the 200 dma and the stop run begins……..and will potentially foreshadow the outcome for the other indexes……….. https://invst.ly/6-5hq

blue – 50 dma……..purplepink – 100 dma……..and the orange – 200 dma

…yeah….you probably mistyped the 50 dma for the RUT……..and meant 100 dma………………………….

my brain is always outrunning my typing…….so i guilty of such …….constantly!!

https://invst.ly/6-5wk

so the ES has the potential …..”confirmation” of a sell signal occurring yesterday on the ASI…….[accumulated swing index]……… this would follow in the NYA’s footsteps, as it confirmed a sell signal on 2/2/18 https://invst.ly/6-5zs

these signals are ‘rare’……………………and relatively reliable………………..

……..”BE WARNED!!!”

I am looking at a 3 month chart for the RUT 2000 and the 50 day is drawn at around 1560. IWM on the same time frame also showinig initial 50 day penetration yesterday. I now expect the indices to attempt an underside tag. SPX and DJI may have already failed with the Wed shooting stars.

https://invst.ly/6-75t

wow verne, thank you…………………something very funky with the “investors” platfomr for the RUT is happening….. above is the snapshot of the dialy time frame, and you can see where prices are registering……but in reality it is at 1540’s……huh….

it corrects itself when i am at the 60 minute time frame………my apologies…..

🙂

ES update – https://invst.ly/6-7bc

back test of the orange channel……and so far “rejection”……….

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.