Edge of a Ledge

The large drop I’ve been expecting hasn’t yet materialized, but it’s sitting in the wings, and we may see a resolution as early as Monday.

This is a minor turn for the US indices — the more important turn will be at the bottom of this unfolding C wave — the bottom of the higher degree fourth wave that’s been unfolding in the NYSE (and related sub-indices since January 29 of this year).

There are turns in other asset classes, as well.

Oil looks to have topped. AUDUSD has bottomed. The US Dollar is topping. And we’re expecting a big turn down in the US indices on Monday. In short, all the major asset classes are turning, lining up for a parade — a parade to a final, all-time high — what I call the 500 year rally high — the top of which will usher is a five year bear market — a race to the bottom.

And that took me back to the 1960’s once again …

The Byrds were a major rock group that dominated the mid 60s (and here I go, dating myself once again!)

The Byrds were a major rock group that dominated the mid 60s (and here I go, dating myself once again!)

The song, “Turn! Turn! Turn!” was perhaps their most popular and certainly one of my favourites (that I remember playing on guitar). It was “written” by Pete Seeger (he wrote the title and one line) but 90% of it was lifted from Ecclesiastes.

The lyrics certainly fit the times, and resonated with anyone who knew about and believed in cycles. It came to mind as I was doing my analysis this weekend.

Here are the lyrics:

To every thing there is a season, and a time to every purpose under the heaven:

A time to be born, and a time to die; a time to plant, a time to reap that which is planted;

A time to kill, and a time to heal; a time to break down, and a time to build up;

A time to weep, and a time to laugh; a time to mourn, and a time to dance;

A time to cast away stones, and a time to gather stones together;

A time to embrace, and a time to refrain from embracing;

A time to get, and a time to lose; a time to keep, and a time to cast away;

A time to rend, and a time to sew; a time to keep silence, and a time to speak;

A time to love, and a time to hate; a time of war, and a time of peace.

What happens on Earth is highly predicable on a grand scale, but the specifics are always different.

“The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.” — the Book of Ecclesiastes

Nature’s cycles are the authors of the stories that determine shape our culture. But out culture changes over time to a persistent rhythm, just as it always has. These stories resonate because, although the details are different this time around, the themes are not. History does not actually repeat, it rhymes.

Elliott Wave tells this same cyclical story on another level. Elliott Wave Theory is price cycles; the patterns in the stock market repeat over and over again, each time with subtle changes.

Cycles are everywhere; they’re predictable to varied levels of accuracy. Earth’s cycles come from the movement of the planets in our solar system, for the most part, and from electromagnetic waves generated by the revolution of the Earth itself. In other words, we live, work, and play “at the pleasure of” Mother Nature

We’re experiencing a major turn at the moment, one that I’ve been predicting for months, and will transpire of over a period of weeks. It isn’t the final turn of the trend, but it’s an important turn that will eventually align all asset classes in a final journey to the 500 year rally top, and trend change. They will all reach that point together.

The Next Big Move is Down: All Aboard!

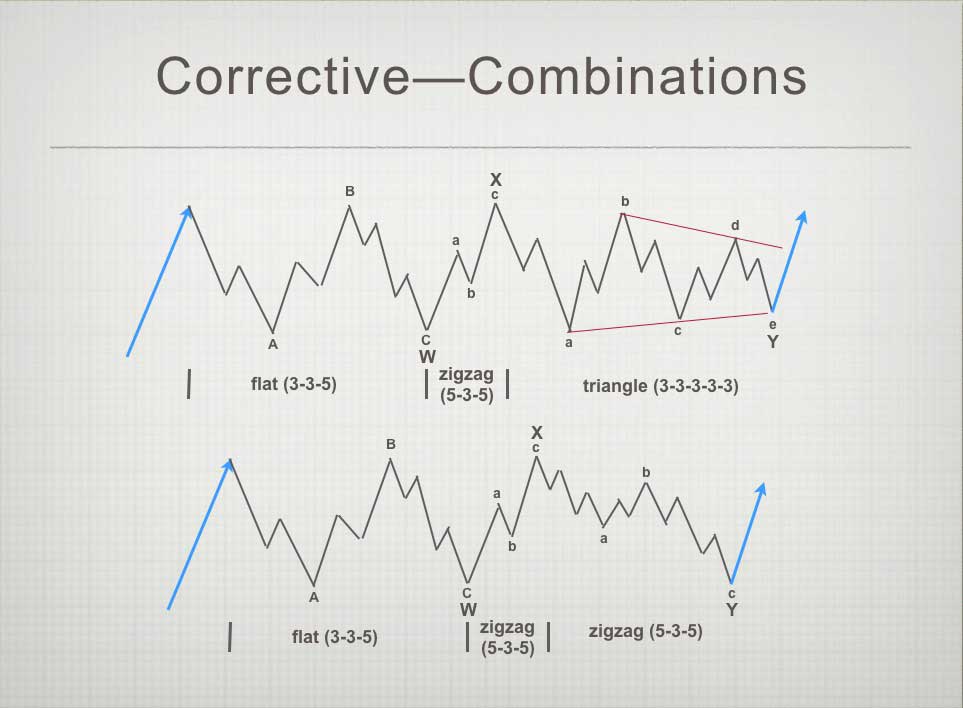

We’re in a very large fourth wave in the US Indices. Therefore we need to expect more than one pattern to complete it: a combination pattern.

We’ve completed a running flat in ES/SPX. We’ll either see just one more pattern to the downside, or two (you can’t have more than three all together). So, there are several options for the completion of this fourth wave. Let’s look at what we have and how it relates to the overall fourth wave prognosis.

Combination Patterns

Above is a chart showing combinations and the pattern options that can be contained within them. The two combination patterns above are each called “triple threes.” That’s because each corrective pattern (a flat, zigzag, or triangle) are always in a 3 waves and there are three patterns in each of the waves above.

Combination waves also can contain only two patterns, called a “double three” (a flat and a zigzag, for example). If a triangle is one of the patterns in a combination wave, it’s always the final pattern. There is also the possibility of an ending diagonal (which is also always the last pattern of a combination. So you can’t have both a triangle and ending diagonal in the same combination pattern).

Of the most common corrective patterns, a flat, is 3 waves (3-3-5), a zigzag is 3 waves (5-3-5), and a triangle (3-3-3-3-3) is counted in three waves, even though there are 5 waves (each wave is three subwaves). I know, all very complicated. But as you study Elliott waves and see these patterns over and over again, they begin to make more sense the more you see them play out.

The waves in the diagram above are horizontal in direction, but in real life, they would either slope up or down, depending in whether we’re in a bull or bear market.

What’s Next?

We’ve completed one pattern, an running flat (there are three types of flats). Flats are are 3-3-5 combination. The next pattern could be a zigzag, another flat, or a triangle. Because the C wave of the running flat was in five waves, it’s less probable that we’ll have another flat as the second pattern. However, because the countertrend move tagged the previous high in ES (at about 2820) and the fifth wave of the flat (below that level appears to be in three wave, it’s possible. However, the more probable pattern next is a zigzag.

Because of the high volatility we’re experiencing, I would put a triangle in the low probability category. If we end up tracing out a third pattern, all the options are again on the table.

So, I’m expecting a zigzag as the final C wave, or at least the next pattern to the downside. I’d also expect a sharp and deep fourth wave overall, because of the generally sideways motion of the large second wave in October 2016. That’s the “rule of alternation” that states that if the second wave of the preceding pattern is a shallow, expect the fourth wave to be deep, and vice versa.

And there you have it. That’s the background that’s gone into figuring out where we’re going next.

_______________________________

Elliott Wave Basics

There are two types of Elliott wave patterns:

- Motive (or impulsive waves) which are “trend” waves.

- Corrective waves, which are “counter trend” waves.

Motive waves contain five distinct waves that move the market forward in a trend. Counter trend waves are in 3 waves and simply correct the trend.

All these patterns move at what we call multiple degrees of trend (in other words, the market is fractal, meaning there are smaller series of waves that move in the same patterns within the larger patterns). The keys to analyzing Elliott waves is being able to recognize the patterns and the “degree” of trend (or countertrend) that you’re working within.

Impulsive (motive) waves move in very distinct and reliable patterns of five waves. Subwaves of motive waves measure out to specific lengths (fibonacci ratios) very accurately. Motive waves are the easiest waves to trade. You find them in a trending market.

Waves 1, 3, and 5 of a motive wave pattern each contain 5 impulsive subwaves. Waves 2 and 4 are countertrend waves and move in 3 waves.

Countertrend waves move in 3 waves and always retrace to their start eventually. Counrtertrend (corrective waves) are typically in patterns — for example, a triangle, flat, or zigzag. Waves within those patterns can be difficult to predict, but the patterns themselves are very predictable.

Fibonacci ratios run all through the market. They determine the lengths of waves and provide entry and exit points. These measurements are really accurate in trending markets, but more difficult to identify in corrective markets (we’ve been in a corrective market in all the asset classes I cover since 2009).

To use Elliott wave analysis accurately, you must be able to recognize the difference between a trend wave (motive) and a countertrend wave (corrective). There’s very much more to proper Elliott wave analysis, but this gives you the basics.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

As the blog title suggests, we're on the edge of a ledge, waiting to roll over ... probably Monday.

During last week's Chart Show (every Wednesday at 5pm EST), I called for a turn up into a B wave after 5 waves down. It's only taken us a couple of days to get to the area of the target. ES appears to be tracing out an ending diagonal and I would expect a turn on Monday.

Based upon the wave down that's now in place (in 5 waves), the pattern unfolding is either another flat, or a zigzag. It's too early to tell which it is, but it doesn't matter: The direction is down, way down.

It's also too early to determine a downside target. This week will be a quiet one. The US market is closed on Thursday, Nov. 22 and closes at 1pm EST on Friday. So, the Chart Show is cancelled for this week.

In the meantime, we know we're going to a new low below the February low (wave A of the fourth wave) at about 2535.

Combination waves can have up to three patterns within them. This pattern we're in is the second one (after the running flat). If we get another pattern after this one, it could be another zigzag, a triangle, or an ending diagonal.

Summary: Expect a very large drop to a new low. The pattern is likely to be a zigzag, but could also be another flat. It may not be the final EW pattern of this fourth wave combination pattern.

Once this c wave (down) has bottomed, expect a final fifth wave to a new high. That fifth wave up to a new high will be the end of the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, November 28 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Sir Peter:

May I suggest that you put out a few extra chairs for next week’s Chart Show? I think you’re gonna have a crowded house!! lol!

BTW, that potential ED would look perfect with one more wave higher and an overthrow of the top boundary. The descent back below the lower boundary will be swift and leave no doubt…

Hi Peter, Thanks for the prediction.

Confirmation: Monday starts with a decline and makes a Low (perhaps Tuesday morning) then up into the 23th. From there starts a big(?) the decline into the 29th or 3th Dec.

On the site I made a drawing of My Old Indicator into 18 december. “Medium term My Old Indicator” Perhaps a pattern can be recognized. ( http://www.prognoseus500.nl/ )

Hi Willem.

The next big decline is going to be a C (or third) wave. C and third waves are relentless.

I think your call for a four day bounce after an only one day decline suggests you do not expect the B wave up is going to complete next week. Am I right? Thanks!

Hi Verne,

My indicators expect the Highest High on Friday (One on Wednesday but is overruled). Expecting a High at the beginning of the day. So the C wave starts on Friday. Succes

I think this has merit, based on this morning’s action.

1929 + 89 (Fibonacci years) = 2018

https://worldcyclesinstitute.com/us-indices-running-on-fumes/comment-page-1/#comment-33652

DJIA…1929 high was 09/03…2018 high was 10/03…just saying…😀

“Like clockwork, #DumbMoney tried to Buy the Open at 9:30, Buybacks bought from 2:00 to 3:30 and #SmartMoney will sell from 3:30 until Close…”

https://twitter.com/MarkYusko/status/1064616875143979008

Stocks Typically Decline 38% When This Takes Place! – Chris Kimble | Nov 20, 2018

https://kimblechartingsolutions.com/wp-content/uploads/2018/11/nyse-hanging-man-pattern-average-declines-nov-20.jpg

Thank your Peter for your teaching. Thanks to you I know have a options trading account and am starting to apply your teaching. It is indispensable!

Jeff T

Peter T,

Just wanted to make sure, as per your analysis we will go from 2740/50 to 2300/2400. And you are suggesting start of Wave C start of next week.

Any idea on the time line of reaching 2400’s, I think earlier you said will be quick and may be in 2/3 weeks.

Thanks

Bill

Peter, a quick query about downside targets. I know you listed the 1.628 extension of red wave A. How does that compare to the A=C (blue) distance down? Gracias!

Robert Snyder ,

Thank you for your comments

Peter t

You Said it perfectly and I’ll quote you So, my take now is to understand the forces at work, prepare properly, and enjoy the ride. It may seem a bit callous, but the herding phenomenon is so powerful, it’s proven rather pointless to attempt to turn them around before they head over the cliff. History says it just doesn’t happen. Certainly, few in my immediate area want to listen to me.

And yes, the origin of these cycles is most certainly from the Universe of revolving, cycling planets and other similar bodies that are much larger than us.

Well said sir !,

Partial quote but to the point : )

Peter t

Thank you for your update .

I spent maybe 20 minutes reading about and looking at the 2 corrective combinations

You posted on top of that I read and ‘re read your WHATS NEXT .

When I mention I respect your attention to detail that is a perfect example .

Thank you

Rotrot 1932 plus 89 years ?

Wd Gann’s 30 60 and 90 year cycles ?

I’ll add the 18 year lunar cycle to this .

Rotrot

Some fib years for you

Year 2021- 2022

2009 plus 13 = 2022

2000 plus 21 = 2021

1987 plus 34 = 2021

1966 plus 55 = 2021

1932 plus 89 = 2021

Not sure what shows 144 or 233 years

The link is an old post but worth looking at

http://planetforecaster.blogspot.com/2013/11/fibonacci-countdown-to-2020.html?m=1

No need to ‘re explain .

Nov 21 Nov 23- 26 I noted previously yet Nov 27 is massive and should be

An up day.

Things get interesting from there .

Dec 3- Dec 6 next turn after but…..

If the market fails to make new lows this week

Then I have to ( want to ) take a bullish trade into Dec 3-6th .

The rally that can unfold should be similar to the rally

From late Oct into early November .

The difference though is we have now entered the Venus bull cycle .

With a typical mercury retrograde you see the market down for 10 days

And then bottom ( that 10 days is Nov 26 th )

Regardless , getting long Sunday night or Monday and exiting Dec 3-6 th

Should be a good short term upside swing .

After that a few things become more interesting

no comments or trading for me this week

Good look everyone

Charles Nenner is calling for a lower low in December followed by a rally into January. That lines up fairly well with Peter’s call for C down.

Thanks Willem!

Verne

Not saying anything about a bottom of this c wave

Only saying looking for a bounce from Nov 23-26 in Dec 3-6

After that we have a different cycle .

The move up should be similar to the late Oct to early Nov move .

Peter t

Somethings are just to amazing to see

I just read this headline and had to share it .

” ‘Tulip’ tower planned for London’s skyline ”

At 1,000ft (305m) high, it will be the City of London’s tallest skyscraper and about 3ft shorter than the Shard, the UK’s highest building.

If planning permission for the unusually-shaped building is permitted, the companies say construction would begin in 2020 with the project completed by 2025.

Perfect timing : )

https://www.bbc.com/news/amp/business-46259419

https://slopeofhope.com/2018/11/one-funds-instant-destruction.html

I expect a lot more stories like this as the bear takes hold.

I was puzzled that we have not see more reported instances of funds blowing up, especially after Volocaust I back in February. I suspect that we have yet to see the effect of margin call on this market so either they are trying to cover up the losses long accounts are experiencing, or the other shoe has yet to drop.

The US market is closed on Thursday due to US Thanksgiving, so I’m going to cancel the Chart Show for this week. The US market also closes early at 1pm EST on Friday.

There will be a usual weekend update.

Verne

Can you imagine how that option seller might

Have positioned his fund if he had understood the weather ?

As you well know as an option trader . The risks of being naked

Short an option ( put or call ) leaves you wide open for massive

Pain if your wrong .

Not going to tell my story on that yet I’ll never forget my

3 days of stress trying to exit . Thankfully I survived !

When you get a fast market trying to exit is impossible with a limit

Order and if ( big mistake ) you use a market order the pro’s will eat

You alive .

The only thing that guy could have done to save himself would have

Been to go long the futures and then sell yet did he have enough

Cash to do that ? Trading futures against a naked option moving against you

Can only work if you have that account set up in advance .

Being able to trade a fast market requires skill .

Most option sellers can do very well if they do their homework

Yet it’s not a trading style I’d advise .

Fast markets are not the same because there is fear

Fear based trading can only be truly understood when you

Have been through it .

I have only dealt with it twice yet truly only once and it was pure hell.

Both times I survived in tac bit I swore never to let that happen again .

Joe that is a truly hear-breaking story. Here is a guy who has supposedly written several books on options trading, and apparently specialized in option SELLING. In all the years I have been trading I have NEVER knowingly held a naked short position. EVER!

It was one for first lessons drilled into my head by the late great Dick Diamond on surviving the trading game. In fact a recent options trade was screwed up by my broker and he sold me the wrong option expiration and it turned out that the contracts were expiring the day of the trade and would have led to a monster naked short position. Fortunately for me I checked the position and discovered the mistake. I immediately got on the phone and ripped Schwab a brand new orifice. After they reviewed the order, they killed the trade prior to the next day open. It taught me a good lesson about carefully checking trades AFTER execution. That idiot in the article blew up some poor schmuck’s 400K retirement account and then stuck him with another 125K due after the fund blew up. If you have ever had any doubt about the monumental stupidity of a lot of folk in this market, well, there you have it. If you think that is the worst of it I got news for ya…very sad!!!

One problem right now is that the usual way that folk hedge is NOT working as EVERYTHING has been going in the same direction, so folk who may have thought they were hedged, got a very rude awakening by the all the same market syndrome. This is just the beginning!

Joe what some of these arrogant guys do not understand is that banksters and market makers can and do actively trade against your position if it is profitable for them to do it, sometimes even colluding in the effort. Any hedge fund manager that does not understand that and take the necessary steps to defend his trades against that kind of ambush, especially when trading with other people’s money, is guilty of both gross negligence and gross incompetence. This guy was a gambler, not a trader, and he got exposed….big time….!

Verne

I’ll imagine their are many who lost big with that guy .

On another note : some trivia

Busy Beavers

According to some sources, the Full Moon for November is named after beavers because this is the time they become particularly active building their winter dams in preparation for the cold season. The beaver is mainly nocturnal, so they keep working under the light of the Full Moon. Beavers make dams of wood and mud. In the middle, they build dome/shaped homes called lodges with underwater entrances. There used to be more than 60 million North American beavers. However, because people have hunted them for fur and their glands for medicine, among other reasons, the beaver population has declined to around 12 million.

Frost or Mourning Moon

Other names for the November Full Moon are Frost Moon, Trading Moon, and Snow Moon, although this is more common for the February Full Moon, while Oak Moon can be either the Full Moon in November or December, depending on which source you use.

Traditionally, the last Full Moon before the winter solstice has also been named Mourning Moon. The astronomical seasons do not match up with the lunar months. Therefore, the month of the Mourning Moon varies. Some years, the Mourning Moon is in November, while other years, it is in December.

Got wind of WEC..Armstrong..til at least 2020..Euro will collapse..CAD down..

Capital flow will be to USD and Dow.

Banks will collapse in Europe and begin a contagion of confidence..

The Wreck of the Edmund Fitzgerald

Gordon Lightfoot

The legend lives on from the Chippewa on down

Of the big lake they called ‘gitche gumee’

The lake, it is said, never gives up her dead

When the skies of November turn gloomy

With a load of iron ore twenty-six thousand tons more

Than the Edmund Fitzgerald weighed empty

That good ship and crew was a bone to be chewed

When the gales of November came early

The ship was the pride of the American side

Coming back from some mill in Wisconsin

As the big freighters go, it was bigger than most

With a crew and good captain well seasoned

Concluding some terms with a couple of steel firms

When they left fully loaded for Cleveland

And later that night when the ship’s bell rang

Could it be the north wind they’d been feelin’?

The wind in the wires made a tattle-tale sound

And a wave broke over the railing

And every man knew, as the captain did too,

T’was the witch of November come stealin’

The dawn came late and the breakfast had to wait

When the gales of November came slashin’

When afternoon came it was freezin’ rain

In the face of a hurricane west wind

When suppertime came, the old cook came on deck sayin’

Fellas, it’s too rough to feed ya

At seven pm a main hatchway caved in, he said

Fellas, it’s been good t’know ya

The captain wired in he had water comin’ in

And the good ship and crew was in peril

And later that night when his lights went outta sight

Came the wreck of the Edmund Fitzgerald

Does any one know where the love of God goes

When the waves turn the minutes to hours?

The searches all say they’d have made Whitefish Bay

If they’d put fifteen more miles behind her

They might have split up or they might have capsized

They may have broke deep and took water

And all that remains is the faces and the names

Of the wives and the sons and the daughters

Lake Huron rolls, superior sings

In the rooms of her ice-water mansion

Old Michigan steams like a young man’s dreams

The islands and bays are for sportsmen

And farther below Lake Ontario

Takes in what Lake Erie can send her

And the iron boats go as the mariners all know

With the gales of November remembered

In a musty old hall in Detroit they prayed,

In the maritime sailors’ cathedral

The church bell chimed till it rang twenty-nine times

For each man on the Edmund Fitzgerald

The legend lives on from the Chippewa on down

Of the big lake they call ‘gitche gumee’

Superior, they said, never gives up her dead

When the gales of November come early

A very haunting melody…!

I took some serious profits off the table at the close today.

We are still a ways from Peter’s downside targets but I switched to more long vol positions as I think we will see a spike in VIX before we have a trade-able bottom.

We may even hit downside targets before the next Chart Show!

How did you guys do?

Hope everyone was able to do some early Xmas shopping!

Have a wonderful Thanksgiving Holiday everyone!

Hi Peter …. here’s an aside on “global warming” that you may or may not have seen. In the form of an amplification on the nature of the problem we may be facing ….

https://nextgrandminimum.com/2018/11/22/professor-valentina-zharkova-breaks-her-silence-and-confirms-super-grand-solar-minimum/

Will be interested to see the comments it draws. One is already framing it as having ELE potential. If so, a VLT bear market in shares may become the least of our worries.

Pieter,

The REAL scientists have been predicting this for a few years and cycles have for longer than that. And yes, the market will be one of our worries, but pandemics, violence, food, water, and shelter will be a “touch” more important. (!) This period we’re going into has historically been called a “Dark Ages.” btw, no idea what ELE means … or VLT, for that matter.

Thanks for the article.

I think ELE is “Extinction Level Event”.

Not sure about VLT. Guessing very long term…

Actually, I received an email on those two. You’re correct.

Verne

I think you will enjoy this article

https://www.armstrongeconomics.com/world-news/corruption/goldman-sachs-going-down-on-the-pi-target/

Joe this is only the tip of the iceberg. The very early strains of the coming bear market that will grow to a thundering crescendo at its grand finale. The things that are going to be uncovered in the coming sentiment sea-change are going to be literally head-spinning. Strap in. It’s going to be a BUMPY ride my friend!

Full Moon

The moon is currently in Gemini

A new post is live at: https://worldcyclesinstitute.com/us-indices-is-the-cat-really-dead/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.