The Value of Your Money is Changing

The Value of Your Money is Changing

The value of your money is changing. No matter where you are in the world, you’re going to be affected by the enormous changes coming to the worldwide economy. We’re moving from an inflationary economy to a deflationary one, so it’s really important to understand the difference; it will affect your wealth dramatically over the next decade (and beyond).

From the large amount of reading I do, it’s obvious to me that many people (even economists) don’t understand deflation, what causes it, and how to use it to their advantage.

In fact, I’ve read many articles predicting hyperinflation on the horizon, but if you read history (yes, it does repeat! … over and over again) or understand our current banking system, you’d know that hyperinflation is almost impossible to implement, and certainly isn’t going to accompany the coming depression. Depressions always result in deflation. They have throughout history, no exceptions.

For the past one hundred years (and beyond), except for depressions in the 1800s (there were several) and the Great Depression of the 1930s, we’ve existed in an inflationary environment. To understand the coming changes, let’s look at some examples.

Inflation

1971 was my first year at university in Toronto. A “24” of Labatt’s Blue (a Canadian beer) cost five bucks. I can remember hauling it back to my dorm on a hot summer’s day. Ahh … the things I learned at University. That was 48 years ago, I was much younger, and didn’t understand the long-term significance of that experience.

1971 was my first year at university in Toronto. A “24” of Labatt’s Blue (a Canadian beer) cost five bucks. I can remember hauling it back to my dorm on a hot summer’s day. Ahh … the things I learned at University. That was 48 years ago, I was much younger, and didn’t understand the long-term significance of that experience.

But think about that price: Five bucks for a “two-four!” That means a bottle was worth only 20 cents. Now, it’s 2.00. A two four today is about 45 dollars. But it’s the same beer — the same product. Now, they want 9 times as much for it!

That’s inflation. The price of beer has increased 900% in 38 years.

Before 1971, inflation wasn’t a really big issue. That’s because money was tied to gold. You could always go to the bank and exchange your money for gold bars. An ounce of gold in those days was worth about $35 and it stayed at that price. So the value of money was relatively constant.

Before 1971, inflation wasn’t a really big issue. That’s because money was tied to gold. You could always go to the bank and exchange your money for gold bars. An ounce of gold in those days was worth about $35 and it stayed at that price. So the value of money was relatively constant.

But in 1971, President Nixon changed all that and decided to go off the gold standard. He cut the ties to gold and let the US dollar float in value. It became fiat currency – not tied to the value of anything. The value is now subject to supply and demand, just like anything else.

Governments have resorted to fiat money over and over again throughout history. It always fails and ends in a financial revolution.

An ounce of gold today is worth about 1300 dollars US — forty times its original value. But the gold itself hasn’t changed. A gold brick doesn’t change over time; it’s static. Not very much gold is produced every year and so the supply is constant.

Beer is more or less the same as it always was. There’s really not more or less of it and yet its price is 9 times what it was in 1971.

Check out this great old house. Worth 250K in the year 2000, but now they want a million dollars. But the house itself isn’t more valuable … it actually needs a whole bunch of work done, mostly from wear and tear (and some water leaks). The land hasn’t changed at all … still the same pile of dirt.

Check out this great old house. Worth 250K in the year 2000, but now they want a million dollars. But the house itself isn’t more valuable … it actually needs a whole bunch of work done, mostly from wear and tear (and some water leaks). The land hasn’t changed at all … still the same pile of dirt.

In all these examples, the asset didn’t change in value; the money did.

Let’s dig a little deeper. Compared to a hundred years ago, our money today is practically worthless. A dollar is now worth four cents compared to 1913, or so (when the Federal Reserve central bank in the US was created). Since then, value of our money has been inflated away by the government. That’s why we’re all broke. Your government steals from you. Big surprise!

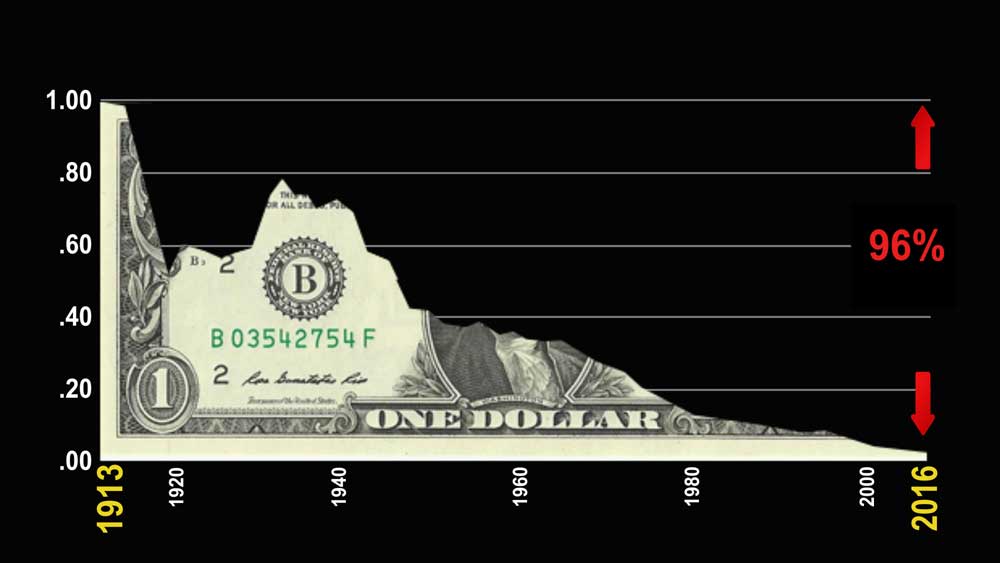

Below is a chart of the American dollar and how inflation has reduced its value by 96% over the past century.

In the chart above, you can see how inflation can been fairly consistent except for the period from about 1920 to 1936 and again around 1940. Originally the dollar was worth 100 cents (1913). Deflation started in 1920 and lasted through the mid 30s (the value of currency went up), but from about 1937, inflation began again and now our dollar is worth less than four cents.

Supply and Demand

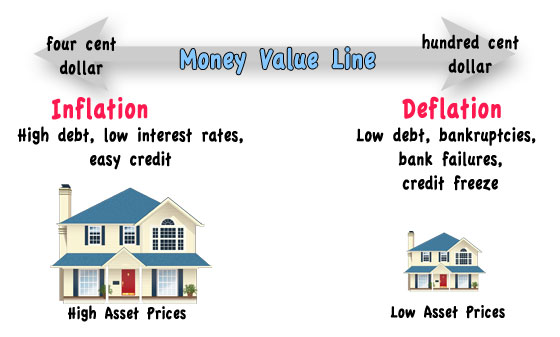

Supply and demand affects fiat money in a really big way. Too much money in society leads to inflation – money goes down in value. Too little leads to deflation – it goes up in value.

When the economy is good, more loans are made, more money flows into the economy and when there’s more of anything, its value decreases. Interest rates are low which leads people to borrow more, which puts more money into the economy. But the downside is that these loans flood the economy with money, which lowers it’s value. People get sucked in to the idea that “cheap money” is a good idea. It’s not.

It’s resulted in the four cent dollar we have today and all assets (cars and homes, for example) have sky-rocketed in price, as a result.

That’s about to change.

To see the effect that supply and demand has on price, you just have to look at the practices of airlines. As the plane fills up, the remaining seats go up in value — the airline jacks up the price because they know how to play the game. It’s the same with wide screen TVs. In the early days, they were much more expensive. Now they’re all over the place and stores are competing against each other to sell them while prices continue to drop.

Deflation

Money reacts to supply and demand just like everything else. More and more businesses are going bankrupt these days. The real estate market has topped all around the world in 2018 (as predicted — it’s a well-known cycle). As loans and mortgages start to default, that digital money disappears out of the economy (ninety percent of today’s money is digital, so it doesn’t really “exist”).

When the stock market drops, as it will soon, those billions of lost dollars go out of the economy. But our money becomes worth more, because there’s less of it around. The demand for it increases. That’s deflation.

When money increases in value, assets like houses and cars plummet in price. In the next downturn, we project they’ll lose 80% of their value, just like they did in the 1930s.

The short story is that cash is becoming “king.” Traditional investments are starting to fail. The stock market is going to crash in about a year and half (end of 2020).

The short story is that cash is becoming “king.” Traditional investments are starting to fail. The stock market is going to crash in about a year and half (end of 2020).

When that happens, you want to be in cash rather than “stuff,” like cars, paintings, houses, for example. Cash is going to go up several times in value over the next ten years. You’ll be able to buy much more for fewer dollars. What a nice change!

I’m waiting for that Labatt’s Blue to get to around twenty cents. Then you’re going to want to be in beer! No, just kidding.

Deflation is where we’re going and you want to make sure you learn as much about is as possible. Pay attention to what’s happening in the economy over the next couple of years, because when banks say everything is just fine … that’s when you want to worry. As money disappears out of the economy, it disappears from banks … and that can affect you in a very big way.

Thanks so much for that explanation. I was about 12 years old, about 1967, listening to the 10 o’clock news that was talking about inflation, something like “wages are increasing and the cost of everything is going up-this is inflation folks!” Even at age 12, I could figure out that if wages went up, the cost of any product would go up, also. So why raise salaries if costs are going to go up, too??? Didn’t it all add up to about the same thing? I’m no expert and I was 12, so I grew up and just put my nose to the grindstone. Now at 63, I still don’t understand why we went off gold and STILL are off it; why didn’t we get back on gold standard???

It’s scary to contemplate the big “failures” you predict and point to history as proof! Please continue to advise us peons, worker bees, how to financially survive (which means physical, mental, and emotional survival, too) these upcoming trying times! Will having a house that’s paid off be an asset or a liability? Is “cash in savings, CD’s” safe? I know being debt free is mandatory. Recently you hinted that “money under the mattress” was moving in the right direction, but I’m SURE timing the cashing in of investments/ 401k’s is also very critical to getting out as close to the top as possible and thus making as much profit as possible, eh? Again, thanks for your continued updates and early warnings.

Hi Deb,

You ask some excellent questions about gold and why we went off it. I’ll write an article on that and the thinking behind it. The challenge is that it may take a couple of book chapters to explain it all … lol. I wanted to start with an article that just helped people understand inflation and deflation (because it’s hard to find a simple explanation). I have another article later this week that explains historically how deflation accompanies depressions and another one as to why governments set it up — it’s how they steal from taxpayers and allow themselves to borrow more and spend our money with impunity. It needs a full explanation. As people understand all this, it will make them irate. We have a revolution coming and eventually a new, fairer system.

The US markets now are at the top. They will reach this level one more time (in about a year and a half, or so). We’re going to see a big drop during the summer months leading into the fall – a wake up call, of sorts.

A fully paid for house is a good thing. Taxes are likely to go up (and insurance, no doubt), but that’s the only downside. I’m turning now to more writing and getting more videos out on the subject. People are waking up to the systemic problems and so it’s time.

Bill,

Deflationary forces are well upon us designers goods, luxury items, TVs are all on sale and cheap. However as much as I love the idea of inflation.

Biflation seems more likely.

Sure you can get leather boots at extremely low prices, but money will flood towards food/rent/water raising these prices.

Debt deflation, the real economy will shrink(goods/services), however food and rent will continue to inflate rise at about 10% a year. Big Money is moving into hard assets, and jacking up rents to see returns. People get all cash offers on their house.

Deflation would be great for people with cash flow and no debt. But biflation will grind everyone to the stone.

Neofeudalism is not an accident but the system working as planned. The central bankers of old aristocratic families, will grind grain(commoners) into flour(debt-peons/serfs) over the next decade.

I believe you underestimate the ability of the establishment to keep stocks,real estate inflated pricing out people.

I don’t know who Bill is, so I’ll reply. Sure. This time is different. I hear it all the time. Find one time in the history where deflation has been averted at the end of a 172 year cycle, or better yet, at the top of 500 year cycles, which is where we’re at. The article coming later this week will go over the deflationary history of the 1800s (with the multiple depressions of that century), but I could just as easily go back to before 600 BC. But, maybe this time is different …

Banksters can delay the inevitable for a few years, but nature wins out every single time. “Those who cannot remember the past are condemned to repeat it.”

Peter, Your witnessing deflation of main street as more and more money goes to taxes, rents, food..etc.

Yes you can get cheap “goods” like TV’s/boots. So amazon and other deflate things further and further

But real inflation is going up like 10% in the major cities-http://www.chapwoodindex.com/

Silly cycles sound good, but this is a politically managed economy. Your well aware of intrest payments to private banks. Time have changed.

I am in agreement that biflation will accelerate yet I do sincerely hope that we are wrong. God help us all of there is an unprecedented biflationary collapse.

We have never experienced a time in history where all governments have been on a fiat currency. Major players are attempting to service the staggering levels of debt and avoid a deflationary collapse with hyper inflationary means.

I think we are all in agreement it will fail. In my mind, human folly is driving this more than an elite conspiracy.

Half funny that the spell checker does not even recognize the word. I searched on this term and came across the site. Happy I did so. Good insightful posts.