Goofy

There was an article that came out at the end of the day Friday on zerohedge that I was going to comment on, but then I had defend myself when I commented a major clam analysis … and it just put me completely off.)

This followed a commenter posting and promoting a competitive site, which no business owner would allow (and I’ve been extremely vocal about this practice).

I’ll address the US Dollar in the coming weekend post.

This is the last week for the comments area on this free blog. The blog posts will continue each weekend without the ability to comment.

A July 4 Present

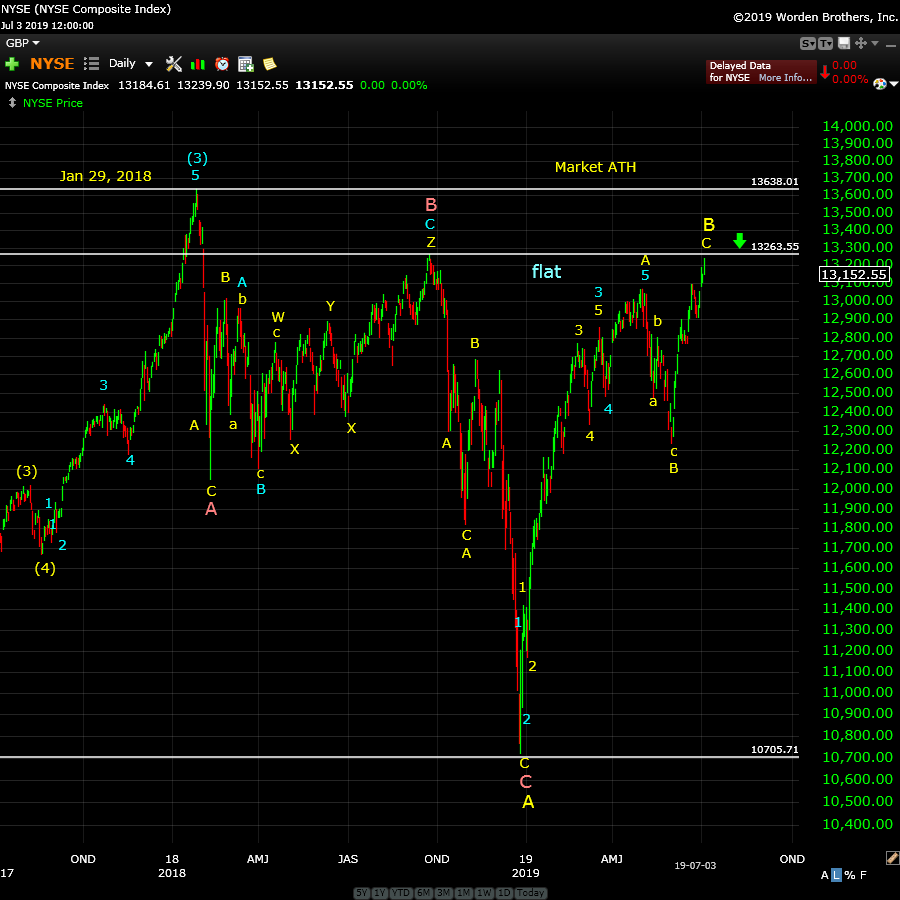

Above is the daily chart of the NYSE exchange, which as of now, is set up as a flat. That means you should expect an imminent wave down to a new low in 5 waves.

___________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Last week was a disappointment due to the fact that the four indices that had traced out ending diagonals had them all fail one by one at the start of the week. That meant the top that I expected was going to be put on hold while we navigated through a larger fourth wave. While I warned it might happen, it's still disappointing.

This weekend, we're still looking for the bottom of this fourth wave.

Once that bottom is in place, we'll be looking for a new high across the SP500, the DOW, the Nasdaq, and all the other NYSE sub-indices. It looks like we have a C wave of a fourth wave down still to go and then and final wave up to a new high. That will lead to a what I believe will be five waves down over the balance of the summer to a bottom below 2100 in ES.

I'm expecting the C wave of a regular flat to the downside. In that case, a first wave should drop to the 2725 area (previous fourth of one lesser degree) and then bounce in a second wave to the 2875 area (62% retrace), before a third wave down to about 2250. After that, a fourth and fifth wave down to under 2100 will round out the drop.

There is an option of a set of zigzags down to the same level. If that's the pattern that traces out, the retraces will not be as strong as they would be with the C wave of a flat. We'll get a lot of information about the probably path from the first wave down.

The coming drop will be a world-wide phenomenon across all most all sectors. It will last throughout the summer months and most likely culminate in a low and final round of QE.

As I've said since the low on Dec. 26, the waves up are corrective in the NYSE-related indices, and as a result, will completely retrace. Expect an imminent top and a major move to a new low under 2100.

Summary: Expect an imminent top to complete this large, corrective "B wave" up from the Dec. 26 low. The overall pattern is a record-breaking broadening top (not an EW pattern).

I'm looking for a dramatic drop in a 4th wave to a new low. ES will eventually target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave of this 500 year cycle top.

No Chart Show this week due to Independence Day.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

I do a nightly video on the US indices, USD Index (and related currency pairs), gold, silver, and oil).

______________________________________

Sign up for: The Chart Show

CANCELLED THIS WEEK (due to Independence Day)

Next Date: Wednesday, July 10 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

Peter T

Enjoy Canada day 🙂

Your time and efforts are appreciated

I burnt water this morning ( burnt the pot anyways ) I forgot about

The water boiling on the stove ( actually happened )

No mother Teresa or virgin Mary images showed up though .

Just trying to lighten up your weekend .

Wishing you a great week

Joe

Enjoy the Holidays.!

Peter keep your chin up..and looking forward to the webinar..

..just curious if anyone on the site has heard from Tom..sounds like he has some health issues from what he has written and just hope he is ok..

Peter T

I’m not sure what to make out of that article you posted the link of

From zerohedge

I read an article many years ago which told about Henry Kissinger and

The agreements made with everyone except Iraq and Iran .

We already had the war in Iraq so a war with Iran has seemed inevitable

To me .

Iran has no agreement stating they will sell oil based on us dollars .

The US Dollar is the only currency that can absorb the huge amount of money flowing

Around the world .

The US Dollar is not just the world reserve currency its the only place to park .

If and I’ll just say if the US dollar was to decline then trump would be very very happy .

That said I think the author failed to explain what he felt the repercussions would be

Other than a hypothetical political battle which I’m not sure would happen .

Interesting article .

Thanks

I will perhaps write about it next weekend.

The dollar going up is deflationary, going down deflationary. That’s why I’m expecting QE at the top of the next dollar wave up. That should send it down to a new low. (The US Dollar dropped substantially in 2009-12 with QE).

Rival countries have been working on their own SWIFT system for a while now. Getting it in place is deflationary, because it works against the need to use the US dollar (less of them around, so it will go up in value, meaning deflationary). It is obviously going to take a while to take hold (years) but the wheels have been set in motion.

Also, having a parallel system will reduce the ability to use it as a weapon (sanctions), which the US has been going more and more (an act of war, as far as I’m concerned). Similar tactics ended up triggering Pearl Harbor. I’ve been expecting this system to get launched for a while now. It’s just another step (a big one) in changing the current world order.

Next weekend will bring to an end the comments section of the free blog. It became very obvious this weekend that I simply don’t have time to manage it and it’s negatively affecting my work.

The sheer volume of email generated from the site in the last 2-3 weeks filled up the server and took down the site on Sunday. It took two and a half hours to get it back up and running, which is not fair to my paid subscribers, of course.

I’ve come to the conclusion that managing a comments area of this nature is almost a full time job.

So, with reluctance, I’ll be shutting down the comments area next weekend. The blog and posts will still survive. I say “with reluctance” because there are some terrific, knowledgable people who comment regularly here and I will sincerely be sorry to see you go. I’ve tried very hard to keep it going as long as I could.

However, with the pending downturn, my attention is more rapidly turning to writing and getting the word out as to what’s to come. My speaking career will give me even less time to manage the comments area, and planned books are requiring much more uninterrupted time.

It’s been an interesting experience, and I wish you all the best. The good thing is that getting out of this NYSE fourth wave that I’ve been complaining about for a year and a half is going to set up some quite predictable longer-term patterns, which I will still cover as they unfold, in the weekly post.

Peter T

I’m not surprised about shutting down the comments section .

That said, thank you for the amount of time you left it available .

Please make a post when you do get your book out .

I know you having been working on it for several years now .

In my opinion, message boards should be in a private board with only paid subscribers .

Anyways

Spx divided by vix has a defined weekly triangle that is worth a look at the very least .

Hopium on steroids is a possible outcome if we are in the final thrust .

Yeah, let’s stay in touch. We are definitely in the final thrust … imho.

Peter T – I strongly support Joe’s idea of having a private message board for paid subscribers. I have picked up quite a few things both from you and from some of the people in the comment section. It is completely understandable that you don’t want to invest time on every comment that shows up here. Thanks for all you have done. It has definitely helped me.

That’s an option I would certainly consider. If anyone else wants to do this, perhaps they can weigh in. It would certainly reduce the management …

Well, I’m way behind on the books because this market has been so darned difficult the past year and a half. It’s taken a huge amount of time to analyze the multiple asset classes I cover in this fourth wave. Slowly catching up.

Sad to hear but understand..was nice to have some colleagues.. 🙂

Please pass my email to Joe, Johannes…and Tom…much appreciated..i am hoping that we are too….!!!! Thanks for allowing us to post as long as you have

I will miss you folks, but a “free” comment area has turned out to be a lot of work. And I can’t seem to keep some people from taking advantage of my time … the old 80/20 rule, I guess. I’ll still be posting, though.

Thanks Peter, looking forward to follow your posts.

How to become a paying customer?

Cheers

Serge

Hi Peter, I wish you all the best and thank you very much for all your time an effort.

Please also share my email with Joe,Tom and Marie.

Cheers.

You can always join as a subscriber. The link is in the blog post. I’m considering putting out a monthly newsletter on the market, but I’m behind in other areas at the moment. Technical issues and health are to blame there.

And here comes the solar eclipse and mercury retrograde 🙂

A swift lick indeed

back to the grind so out of touch yet …..not completely

The drought that I’ve been predicting for years (because of Dr. Wheeler’s work) is upon us.

https://www.zerohedge.com/news/2019-07-01/devastating-crop-losses-are-literally-happening-all-over-globe

Pete – yet the drought keeps getting worst here in Oz. Very low probability of an sort of wheat crop now. What I can’t work out if the world is so dry then why isn’t the grains futures going up hard. Is this whole market controlled somehow to protect the cost of food. Very strange.

I’m trying to get a post out on this. The larger cycle is dry but there’s always a smaller wet cycle that causes the havoc with food (as per the constant flooding in the US and Europe. This extreme up and down climate is like fall … going from wet and warm to cold and dry. You always get extreme weather from summer to winter (fall) and this is just on a grander scale, with larger timeframes.

I still like the freeze-dried food idea (emergency food) and I’m partially stocked up.

Great ideas to top off the MREs. Did I see 3-4 feet hail in Guadalajara? Like I mentioned in our emails, we all need to choose times to reduce noise and focus. All the best in your journey! Cheers! Mike

Eastern Oregon hail storms last week .

A friend of mine is a wheat farmer in eastern Oregon .

A farm near him just planted 200 acres of marijuana at a seed

Cost of $1000 per acre ( this does not include equipment cost or fuel

Or labor costs )

The entire crop was not insured and was destroyed by the hail storm.

Call it bad timing on planting those starts .

What my friend has done is he has begun using sub soil moisture

Sensors to monitor his fields . There is technology out there to

Help but that alone will not stop what’s coming .

If we listen to AOC then we should do away with daylight savings time.

Apparently that extra hour of sunlight is helping to warm the earth .

Some things are so stupid you just can’t make them up.

Maybe it’s just ” fake news ”

To be honest I will never know and truth is I’m not interested

In following up to find out .

The supposed quote and the link below . It’s probably satire but

It’s total bs crap.

My anger lies in the bs that were seeing warming earth .

In Oregon our governor has just stated she may use her executive

Powers to pass laws to fight global warming .

The huge push can only mean it’s really about TAXES and

Government Pensions !

The quote :

If we change our times with the sole intent of increasing the amount of daylight we receive, that’s an extra hour of sun shine that will warm the planet. That’s one extra hour per day of extra heat warming our already unstable planet. We need to repeal Daylight Savings Time as a primary measure to decrease the rate of climate change. Less hours of sun shine equal less heat hitting Earth’s surface. We’re running out of time!

Alexandria Ocasio-Cortez

https://npcdaily.com/2649/aoc-opposes-daylight-savings-time-because-the-extra-hour-of-sunlight-drastically-speeds-up-climate-change/

Now that is some kind of logic! Changing our clocks somehow changes how much sunshine we receive. OK then. Maybe we should just get rid of clocks altogether …

On another note: hey maybe the sun does have an impact ?

They will never admit that

Eventually they will … lol.

I have been working on creating a small garden in my basement using..grow lights and working on creating hydroponics..I always have very large ones for outside so I freeze the food for the winter…

even if you don’t want to do hydroponics..really good grow lights work well for growing many foods like lettuce.tomatoes..herbs.. if you just have some shelving and space..hopefully will have this pretty large by the time this thing hits…

I tried hydroponics. Was an abject failure for me. Very difficult to maintain water quality in the north east.

Good for you. The top is still a year and a bit a away at least, I think. I don’t know when the food shortages will hit. Historically, these floods usually last more than one year. It depends where you live to a large extent. Transporation is likely to break down in a big way.

The weekend analysis of ES has been restored to the free blog post. I’ll do something on dollar/gold this coming weekend.

My astro date July 4, will invert into a top I guess.

Joe,Marie and Tom, I will sent you a Forum message with my email address, please answer this message?

A Forum message.. not sure what you mean by that and if you mean in our emails….but yes if I see something in my email..i will answer..thanx

I could not find you on the forrum Marie.

You have to register first I think.

https://worldcyclesinstitute.com/wishlist-member/?reg=1396740553

I am there it is under M for Marie..alphabetically…

You have got mail…

JOE..I read the quote… and I had to reread it and said to myself I must be reading this wrong..lol…so crazy WOW

Peter thanks for your blog. Have been an ardent reader, wait for weekend to read it. Due to some, others are affected also. But respect your wishes

🙂 thanks. It’s not going away … just the comments area.

True but some valuable posts by Tom. Joe and others will be missed

But not valuable enough to pay for … lol.

Crazy is an understatement . The big push on climate change ( global warming ) has

Bothered me the minute al Gore began selling it . Back then I had been studying both

Warming and cooling cycles and reading everything I could about the up coming global cooling .

Now some 20 plus years later you can’t even find the basic theories online unless you do some serious

Digging . Peter T has brought even more info to the table .

My email : joesmail618 at gmail dot com .

I am not a person who is attached to my phone so at times I’m slow to respond .

I work on the ocean and travel from the Columbia river in Oregon down to long beach California and back .

It’s a buss route of sorts hauling lumber for the most part .

Other times a different route .

Phone reception not consistant .

I can reply from time to time but for the most part over the next 45 days .

Call it mid August , it’s going to be in and out .

As I’ve noted prior there are times when my cycles work will fail, specially as the spread between the

20 month and 2 year cycle widens as is about to happen .

My main theses will not change unless the market proves my wrong .

We have a cycle high due mid August to Sept 3 and the very last week of August in my opinion should be sold short

Targeting an Oct 27 and Nov 10 low .

After that everything gets tricky and until the market action has been seen I’m just going to say

Next year is cycle wise a Bearish Year .

Early January is a 2 year cycle top ( Jan 10 2020 to be specific ) I also am pretty sure that is a lunar eclipse .

Not touching puetz or anything at this point yet I will also say from my opinion that I see a political battle

So I’d expect many to just sit back and let the politics happen and wait until the election is over before putting any money

Back into the stock markets . My gut says it’s going to be a nightmare and we will be in a bearish cycle .

I’m not even including Peter T and his very long term cycles .

We have a mi or bearish cycle begining now into July 17 . Let’s see what the market does then decide .

July 17 into late August should be strong . But we are approaching the end as I see it .

I’d rather be out and or hedged and wrong than watch this market tank from early September into November

And I certainly don’t want to fight next year’s bearish cycle .

The year 2021 I have no solid opinion on at this point in time .

As much as I’d actually like to see trump get elected I can’t see it happening .

Cycle wise , no way in hell trump gets elected .

I have no opinion on Elizabeth Warren ( um she kind of reminds me of an older sister I have and don’t respect )

I think we should pay attention to her .

Those with student loans may like what she says .

Trump has an up hill battle and I am not even going to attempt to call the election .

Next year my tv stays off when it comes to politics . Yes a casual follow up but other than that

I’m staying out of it because if it’s going to be the battle I expect I can wait until November and see what really happens .

Brexit news coming July 22 I believe .

Either watch the charts or get caught up in the media and get whipped around like the tail of the dog.

Or as Chris carolan puts it . Pay attention or pay the offer .

The stock markets are going to get even more difficult from here on out .

Make your plan and trade that plan .

The shit show is about to begin!

On a completely different thought process to think of

Over the next 4 years .

https://en.m.wikipedia.org/wiki/Curse_of_Tippecanoe

The Curse of Tippecanoe (also known as Tecumseh’s Curse or the 20 Year Presidential Curse) is the alleged pattern of death in office of Presidents of the United States elected in years that are divisible by 20, from William Henry Harrison (elected in 1840) through John F. Kennedy (1960). Ronald Reagan was elected in 1980 and was wounded by gunshot, but he survived. George W. Bush (2000) survived his terms in office, despite an assassination attempt.

March 4: A forgotten huge day in American history

https://constitutioncenter.org/blog/march-4-a-forgotten-huge-day-in-american-politics/

March 4 1789 to March 4 2022 would be a Fibonacci 233 years

March 4 1789 plus a fib 144 years equals March 4 1933 <—

March 4 1789 plus a fib 89 years equals March 4 1878

The Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 until 1877, and even longer in France and Britain.

March 4 1789 plus a fib 55 years = March 4 1844

Railway Mania was an instance of speculative frenzy in the United Kingdom of Great Britain and Ireland in the 1840s. It followed a common pattern: as the price of railway shares increased, more and more money was poured in by speculators until the inevitable collapse. It reached its zenith in 1846, when no fewer than 272 Acts of Parliament were passed, setting up new railway companies, with the proposed routes totalling 9,500 miles (15,300 km) of new railway. Around a third of the railways authorised were never built – the companies either collapsed due to poor financial planning, were bought out by larger competitors before they could build their line, or turned out to be fraudulent enterprises to channel investors' money into other businesses.

https://en.m.wikipedia.org/wiki/Railway_Mania

Oddball stuff I realize but it began as a whim and I just ran the Fibonacci years to see

What showed up .

More research needed .

Years ending in 2 tend to be lows .hence the year 2022 2023

Will most likely be a very different economic picture than today .

This is just brain storming

Joe, are you going to post your email?

Best of success to everyone.

I will truly miss you guys! 😘

Peter,

Do you leave everything posted on the blog, that would be nice to be able to read back?

Johannes,

I don’t understand what you mean.

What I meant to say, all the old posts in the blogs, do you leave them on the site.

Yes.

Thanks Peter,

Joe – I would love to continue following your thoughts. Is there another place you put out your ideas ? I have picked up quite a few things from your writings.

It’s official. US 30-year yield just inverted vs. the Fed funds rate!

Same warning ahead of the GFC, tech bust, Asian crisis, S&L crisis, and 1980’s double dip recessions.

The only false signal, 1986.

We now have the entire US Treasury curve below the Fed overnight rate.

Thanks for this. This market is on its last legs, imho.

But when could occur the next drop, what is your feeling?

Thanks

Days. Lets see what the labor report does on Friday.

PLease let me know where to subscribe to your services, could’nt find!

Oh, sorry. I’m going to make it much more prominent then. It’s in the sidebar on the right … Trader’s Gold … and in the blog post.

Here you go: https://worldcyclesinstitute.com/traders-gold-signup/

It’s certainly a good time to sign off. We’re counting out the last couple of waves until we top.

No market comments from me yet … This week was to be a closing high .

The next few weeks into July 17 sideways or bearish .

Back in the 1990’s there was a consistant rally into Fed meetings followed by

A sell off ( amongst a bullish trend )

My email is posted above for anyone who missed it .

I do not post my market thoughts anyware on the web . I have in the past

But stopped many years ago .

Peter T

Thank you for the past 5 years of this free comment section and thank you for helping me

Get ‘re focused on the up coming decline .

Please when you can continue your updates on the global cooling cycles .

What I’ve learned from your posts on Dr wheelers work was very educational to me and it

Added to what I have researched .

Robert prechter mentioned many many years ago that trading is Work .

Paying for a subscription is no different than buying a book .

The old adage stands :

Give a person a fish and they eat for a day , teach them to fish and they can eat for a life time .

If you want to learn Elliott wave theory and you want to keep up on all the markets

Peter T follows you will learn not only Elliott wave theory but his systematic approach

To the markets .

Ask yourself this 1 question .

How many trades will it take you to pay for that education ?

Do the risk reward and you will find out the cost is meaningless .

We all pay a commission blindly assuming it’s just the way it is

But rarily do we think about the benefits of educating ourselves .

Trading is a business and if you treat it as one you will do much better

Than the average speculator .

The more disiplin you have in your entry and exit the better off your trades become .

Elliott wave theory is a disiplinned approach to trading .

Blah blah 🙂

You must invest in yourselves and learn how to fish ( ex commercial fisherman here of 23 years in the Bering sea )

For less than a cup of coffee a day 🙂

For less than a pack of cigerettes a day 🙂

Laugh please

Thanks for the kind words and promo, bud.

🙂

Joe – probably some of the wisest words ever posted on this site. Thanks Mate.

Last note :

I have paid much more than Peter T charges for subscriptions in the past .

And it’s because of those people whom I learned from and studdied their methods

That my posts have been appreciated on this fee blog .

Peter T has done an excellent job navigating the markets and it’s why I have followed

This blog for some almost 5 years now .

I want to keep this short .

Anyone who posts intraday analysis has his head in the charts through out

The entire trading day and then has to put all that information down in a written

Format or video format . Imagine the hours spent .

It’s much more time and effort than most realize

I can see 6 1/2 hours through out just the open session plus

Another 4 hours minimum ,

A 10 hour day

Now add in all the markets one wishes to analyze.

I know my own research takes me weeks .

My cycles work takes me 40 hours minimum just to lay out

1 years worth of data . Then I have another 10 or so hours in research

And then the real work comes in back testing and corrolating everything .

Easy 80 hours of time before I have a handle on the what ifs on cycles .

Then it’s how does all that ” theory ” relate to the actual market .

I have a fairly good idea how much time and effort Peter T puts in

On just the free blog and I understand he must put in even more time

With video updates .

When I say thank you for your time and efforts

I really to mean it and appreciate it .

As prechter once said

Trading is Work

Trading profitably is work. Trading on its own is like going to Vegas.

Your welcome

I added a July 4 present at the top of the post: A chart of the NYSE set up as a flat.

While compiling crashes and eclipses to study correlation, I came across this expanded flat ABC which could be relevant. In 1962, DOW dropped more than 20% in wave C.

Wave A : Jan 1960 to Oct 1960 (9 months)

Wave B : Oct 1960 to Dec 1961 (14 months)

Wave C : Dec 1961 to June 1962 (6 months)

Focusing on wave C :

It was a 3-3-5 correction

Solar eclipse : Feb 5th

Lunar eclipse : Feb 19th

Full Moon : Feb 19th, March 21st

Top of the market before the crash March 19th.

The market topped 2 days before the full moon about 6 weeks after the Solar eclipse and one moon cycle after the lunar eclipse.

2019 Analogy :

Solar eclipse : July 2nd

Lunar eclipse : July 17

Full Moon : July 16, Aug 15

Going by similar analogy, I would expect a choppy price action from now to Aug 15th with a small net gain for the markets. Then a decline starting Aug 15th into Nov 15th.

The Fed flooded the market with liquidity starting June. This is directly from their released minutes as reason given for easing:

“To take into account the recent sharp reduction in stock

market credit and the abatement in speculative psychology

in the stock market.”

Please take it for what it is. I am in the process of compiling all market / eclipse effect to study correlation.

Thanxxx again Peter T!!

I was thinking outside my normal box

And thinking of some of Raymond merrimans thought processes

After running through some general data I did a Google search

Just for an outside opinion .

I have more digging yet I’m sharing a link .

It’s worth the read .

https://astro-chologist.com/jupiter-in-capricorn-2019-and-a-history-of-financial-crisis/

Vivek

Damn good work in my opinion.

It’s been a while since I dug through 1962 yet

I’ll pull out that old research ( for a few other reasons )

Thanks for the input .

Peter T

Thank you for the update 🙂

More ” oddballs”

https://austincoppock.com/saturn-in-capricorn/

Outstanding articles you have posted. Thank you for posting.

1982-2000

2002 – 2020

Both 18 years of a low to a high .

Thanks Peter

https://timenomad.app/posts/astrology/event/2019/03/14/timeline-of-saturn-pluto-conjunction-of-2020-and-its-karmic-meaning.html

Peter,

Do you agree with this count of waves?

https://goldtadise.com/wp-content/uploads/2019/07/sc.png

Thanks

Serge

No. First of all, you haven’t given me enough information (the blue 1 which I assume is there is off the chart). If that looks like I think it might, then you probably have an ending diagonal, but the wave 4 top is where your green seven is. The third wave is where your large blue 5 is. You have one more wave down to a new low to come (the fifth wave) and you’re sitting at the moment near the top of the B wave of that fifth wave down.

All the smaller counts should, of course, be letters, because all the waves are corrective.

Peter T

I’m curious about your thoughts on a return to the gold standard .

To me it’s deflationary ( if it actually happened )

Any thoughts ?

https://www.google.com/amp/s/qz.com/1646318/why-trump-and-judy-shelton-want-the-us-back-on-the-gold-standard/amp/

You can’t go back to a gold standard for a few reasons:

1. If, for example, the US Dollar was locked to gold at a pegged price, we’d have the same situation we had in the 50s and 60s. Countries cheat and they inflate their currencies (including the US), driving them down in value and then they redeem trade dollars for gold (which retains its value) at a constant price. So Fort Knox was losing its stock and gold was going for less than the pegged value. My memory (without looking it up) is that Nixon first stopped the ability to redeem and then later delinked.

2. Deflation – well, in a way. Inflation to any great degree is not an easy task with a dollar pegged to gold, but the problem is that it keeps the amount of money in an economy constant, so you can’t grow the economy through creating more cash (loans from banks). So, all the advances we’ve had on borrowed money would be almost impossible (certainly in the time frame they happened). The amount of gold on Earth doesn’t grow even to the level of growth of the population (and now, of course, which always happens at the top of a major cycle, the population is decreasing). Wait until the pandemics, which are coming, are let fully loose.

3. That up and down of the population is what would cause it to be deflationary. The population in good times grows and so a constant money supply in that case becomes deflationary.

So, you need to peg the reserve currency to a floating entity, like maybe CPI, which goes up and down with population. You could grow the money supply then as it’s needed, which would keep inflation and deflation mostly in check.

There were examples of money being used wisely before 1970s in Canada and Australia, for example, with no inflation. A great book on this is “Web of Debt,” by Ellen Brown. A really interesting read and it explains the history and provides examples of solutions. It’s in my recommended books list.

(I haven’t read that article yet, but will).

That article is all over the place and a bit naive in places, I think. Central banks can be deflationary, where, in the case of Canada, in 2012, we paid BIS one trillion dollars in interest for creating our money, which is really stupid, because we created our own for many, many years at no cost prior to the fiat explosion in the 70s. It paid for the St. Lawrence Seaway, our medical system, the Trans Canada Highway, the rail system across the country, etc. When it’s production-related (creates value), you can grow the money supply without consequence. When it’s used to speculate, all Hell will eventually break loose, like a rubber band. Anyway, taking a trillion dollars out of the Canadian economy is deflationary, of course. So, we’re talking a lot more complex than that article lets on.

But to counter deflation, you have a banking system that’s a ponzi scheme. None of the present debt is supported by anything at all in Canada. We’re one of six countries in the world without a reserve system in place (and we sold all our gold … AND we have a resource economy), so when the SHTF, we’re going down like a rock. Stupid, stupid, stupid.

One more thing. Politicians are not in charge, nor should they be. And that’s why you need the money supply tied to something that reflects the health of the economy, so that it can fluctuate as needed on its own. A country central bank is a good thing, but blood-sucking European central bankers that essentially created the European Union without thinking through the implications of a bunch of disparate economies tied to a single currency without any responsibility to adhere to a set of economic principles to support it, is about as dumb as they come.

We’re going to go back to each country being in charge of its money supply and currency, and I think that’s a good thing … in the short term (several decades) at least.

Peter,

I will continue to follow your posting’s no matter free blog or not. I might enjoy the dialogue at times but its just chatter to me. I pay attention because of your input.

Anyway, as a comment. I heard Gerald Celinte of the Trends Journal interviewed this week and he feels the FED will cut rates 4 times in the next year. That goes along with your EW counts.

Appriciate all you have done to help this small investor.

Jeff T

Thanks, Jeff. Well the only thing going away is the ability to comment. The rest stays. I’m trying to focus my time and articles for the landing page and work on my book over the summer as the market tanks.

Guys, just got this newsletter from SAXO, generally quite disturbing! 🙂

Have a look (did not read yet at all):

https://www.home.saxo/-/media/documents/quarterly-outlook/q3-full-report-2019.pdf

Opinions welcome….

Serge

I scanned it. Not much new. Basically what I’ve been saying. Big wave down coming, quantitative easing at the bottom, final 5th wave up after that to end Dec 2020 to early 2021. Then the five year (roughly) drop. The next cycle is what we’ve traditionally called a “Dark Ages.”

Here’s an entire 172 year cycle: https://worldcyclesinstitute.com/same-wheel-different-hamsters-a-typical-172-year-cycle/

We’re at the top of 3×175 (516 year cycle), which is always much stronger than the smaller, 172 year cycles.

I continue to get attacked for that view, but there you have it. It’s simply history repeating.

Peter,

China has a tremendous power in hand of more than $1.1 trillion worth of U.S. Treasuries.

Probably risky for China to use this weapon, but Chinese are smart and they could use it as ultimate way to fight against Trum.

What do you think?

Cheers

Serge

Not my area of expertise.

Peter t

Thanks for your response .

I don’t see how we can go back to the gold standard but I also

Think we will have a completely different financial landscape 5 years from

Now than we do today .

And then you mention DR Wheeler,

The more I dig into my timing stuff from different angles the uglier it looks .

I’ll have a better handle on that in the next month as I put the pieces together

On my off watch time periods .

I won’t really have a solid view on timing for next year or the following 2020-2026

Time frame until next year .

Right now though, the rough outline is historically terrible .

It appears to me we are at a point in history that many

Average people understand but the masses really don’t get

On a world wide scale .

Everything gets torn apart and then has to be rebuilt .

Only those who have gotten into massive debt personally and have

Lived through those life changes will really understand ( sadly )

I call it financial suicide

It begins with the collapse of government as we know it.

The powers that be are already fighting this but they will not win .

The harder they fight the more extreme to the left they go by trying

To make promises they will never be able to keep .

All of those on the dole , the ones who get their food stamps and various

Welfare subsidies, social security, pensions etc are afraid of losing them .

Everyone knows something is wrong ( social mood )

All its going to take is a trigger

Just 1 event and the house of cards begin to tumble .

Just like we all personally will defend ourselves we have governments trying

To survive .

We get fancy ideas like the lie of global warming as a reason to tax

But there is no basis .

We are in a cooling cycle which I know you understand

Now it’s limited freedom of speech to prevent the truth from coming out

There is an entire section of the world population brain washed in believing

They will be taken care of .

There really is no good ending or possible fix

Come July next year we in the USA will have our main candidates decided .

My guess it’s Elizabeth Warren vs trump .

She will be pushing for the break up of some major companies and taxing those

Based on wealth . That implies me proving I have less than X wealth and probably

Implies a form to fill out showing what I own .

Trump the other extreme and we find out in November which way the pendulum swings .

That battle regardless of who wins creates a battle of the masses of those who pay taxes

Vs those who don’t .

Civil uprising has already begun .

How the stock markets hold up next year based on my own cycles is beyond my site .

It’s all bearish next year from what I’m looking at ..

Come mid August early Sept everything begins to change from positive to negative .

My issue is timing vs Elliott wave theory and I believe in both very strongly .

My weakness is currencty analysis and that is something I’m working on .

You ( Peter t ) have made several good points over the years of what is coming

And yet I think most of your readers have missed it big time .

The problem is that most people are short sighted and also only read what they want

To hear vs look at everything as it is .

The coming dark ages is a very good conclusion .

I have learned to basically ignore most people’s opinion because they base it

On the assumption that everything is linear .

Nothing is linear .

Warming trends become coolining trends , stock markets ebb and flow both up and down .

People have kids , spend money to raise them we age we stop spending on cars , houses etc

And as the population ages and our spending declines we create deflation .

It’s a natural cycle .

Today’s youth are in debt ( student loans ) they have to pay a cell phone bill .

I didn’t have a cell phone until much later in life ( 2004 ) I was able to as a 19 yr old

Earn a living with pretty much zero costs ( fishing commercially most of the year )

McDonald’s was a stepping stone as was washing dishes at the local restaurants.

Now McDonald’s is a carreer ? And because people want a ” living wage ” McDonald’s has

Installed kiosks which just eliminated many of those jobs .

An aging population I consider deflationary, student debts deflationary until those debts are paid off .

I ran the numbers one day . A person who goes through the system today

Begins with student loans a car loan and then somehow gets a mortgage will be debt free

By around age 75 . That is our system today .

Elizabeth Warren wants to change that ? Yeah right .

Let’s squeeze corporate America ( or any corporations ) = job losses and a down stock market

So tax them more yeah !

All of this just royally pisses me off

Tax me for the good of all so I’m forced to live on hand outs .

I have a better idea

I’ll position myself to profit off the deflation and I’ll do so in such a way that

I can survive .

I’m going on a bit of a rant so I’ll stop but I am not happy about what is coming .

I except it though as the inevitable.

Christine laguard the new future of the ECB come Oct 31

Britain new prime minister July 22

The blow up of the entire European union

It’s all trumps fault they say

What happens AFTER TRUMP ?

Oh change is a coming

As an old captain said one day many years ago

It might be cold and shitty out but it’s going to get worse !

I have survived every market crash from 1987 to date

I’ll survive this next one as well

This time though I understand much more clearly how they work

Rightly or wrongly I’ll stand by my own thoughts

Joe,

Thank you for all your posts over the years! You have great insight…as does

Peter T.

Peter and Joe,

Many thanks for all of your hours spent on this blog, you both learned me a lot about cycles and the markets.

All the Best.

My astro dates are July 4,7,10,15 and 21/23

🙂

From a Swiss economist:

“Shadow banking due to lowest ever interest rate level created 80’000 billion of risky debt, that has taken the central banks hostage: the slightest rise in interest rates means a global economic crash”.

Tyx ( 30 year treasury bond )

I have limited charting out here yet that almost 4% move

Looks impulsive .

Did the bond market get it wrong ?

The next 2-3 weeks into July 16-17 should be all over the place .

Stock market wise .

It looks the minor bearish cycle has begun .

July 16-17 and possibly July 21-22 lows and then kabboom

To finish off this rally phase .

From there who really knows but my bias will be downward

For the next year plus into January 2021 .

Let the games begin !

Thanks ed

May whatever “Bar” chart you follow bring you through well, Joe (pun intended). Your posts have been appreciated on so many levels. Thank you and God bless.

Interesting read ..

All the same market ?

I don’t follow bitcoin or the crypto’s yet I find his comments

Worth reading .

No highlights just the link

https://www.mmacycles.com/free-weekly-forecast/mma-weekly-column-july-8-2019/

Thanks blue

Another interesting view, close to the precipice!

https://spockg.com/2019/06/22/audjpy-the-death-of-central-banking/

inflation vs deflation….

Serge

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.