Everything is Wonderful!

If you pay attention to leaders of virtually any country in the world, everything is wonderful. The main stream media will back up that sentiment.

For example, in the US, the trade war is supposed to be a good thing … bringing lots of revenue into the country through tariffs (does anybody actually believe this?), unemployment is at almost an historic low, the stock market is at new highs and central banks (supposedly) are in full control, and we’re expecting strong levels of inflation in the near future. I’d say there’s somewhat of a disconnect from reality!

This weekend, in terms of the stock market, all the bears are piling on, due to the short-term weakness of the past couple of weeks (even though the market hasn’t damaged any Elliott Wave technical levels. But the trading herd always does that; they never learn. “Buy at the lows, sell at the highs” doesn’t ever seem to have an impact on reality … and nobody reads history, although most of us would agree that it repeats.

Such is what we can human psychology. Being contrarian can be a lucrative mindset.

You just have to browse alternative websites, like zerohedge.com, for example to find out what’s really going on. Here are some recent examples:

- Deutsche Bank is on the ropes, near insolvency

- In the US, congress is all but completely dysfunctional and corruption on both sides of the aisle has reached historic heights

- Iran is being threatened with military action — spoiler: International wars never break out at 500 year cycle tops; we’re headed for a long period of civil wars

- Negative interest rates are now spreading to bonds, which is a sign of impending doom

- Governments around the world are turning over and becoming either socialist, or populist (or both)

- Real Estate pricing around the world is collapsing, which will eventually lead to bank implosions. Australia is leading the way; they had arguably the biggest housing bubble of all.

- Economic sentiment among the young is turning down dramatically

- Family finances and standards of living are at all time lows

- American cities are falling apart; Chicago is bankrupt, Ontario (Canada) is more bankrupt than any other sovereign substate in the world. Here’s a financial update on American Cities. We’re awash in debt

- Complexity throughout business (and the Law of Diminishing Returns) are signalling a collapse is imminent (the 737 MAX debacle is only one small indicator, TSLA another)

- Floods worldwide are destroying future food production (these floods and the resulting worldwide hunger issue ALWAYS manifest at the top of 500 year cycles like this one)

- US companies are folding and many are laying off scores of workers

- Capitalist trumps health, as scientists around the world warn about the health effects to come from 5G

- And the population is getting “Dumb and Dumber” … and getting more so

- What on Earth could go wrong? Everything is wonderful. It’s time to starting getting prepared. We only have a couple of years to get our acts together for a downturn that few can fathom. History tells the tale of what’s to come.

I’ll be telling the tale in an upcoming webinar: “Navigating the Coming Crash” and I’ll have details within the next week. This webinar is going to explain all the things you can do to prepare.

Stay tuned.

_______________________________

Keeping Tabs on the Russell 2000 (Changes This Week)

Above is the two hour chart of IWM (the Russell 2000 small cap stocks).

Above is the two hour chart of IWM (the Russell 2000 small cap stocks).

The corrective pattern completely changed this week. The ending diagonal that had formed broke to the downside this week and has created a double bottom with the previous fourth wave. I suspect it will turn up from here.

I’ve chosen to use a 5 wave count in order to keep track of where we are. However, the large size of what you’d characterize as the 4th/5th wave can only be a B wave, which makes the entire structure a “three.” For more on the “right look,” go here.

The other issue is at the bottom with blue wave 1, which was itself in three waves. That itself makes the entire wave corrective right from the start.

There are a couple of points to be made here:

- When a wave starts off with three waves as a first wave, the wave itself will never be impulsive (always be corrective) no matter what happens to it

- The “look of the wave” is extremely important in determining whether it’s impulsive, or corrective.

Also note that the most recent wave down is in three waves, which is obvious just looking at it. That means the wave is corrective and must retrace back up to the top.

As I often say,

“Trade what you see, not what you think.”

___________________________

Elliott Wave Basics

Here is a page dedicated to a relatively basic description of the Elliott Wave Principle. You’ll also find a link to the book by Bob Prechter and A. J. Frost.

____________________________

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

US Market Snapshot (based on end-of-week wave structure)

This chart is posted to provide a prediction of future market direction. DO NOT trade based upon the information presented here (certainly NOT from a daily chart).

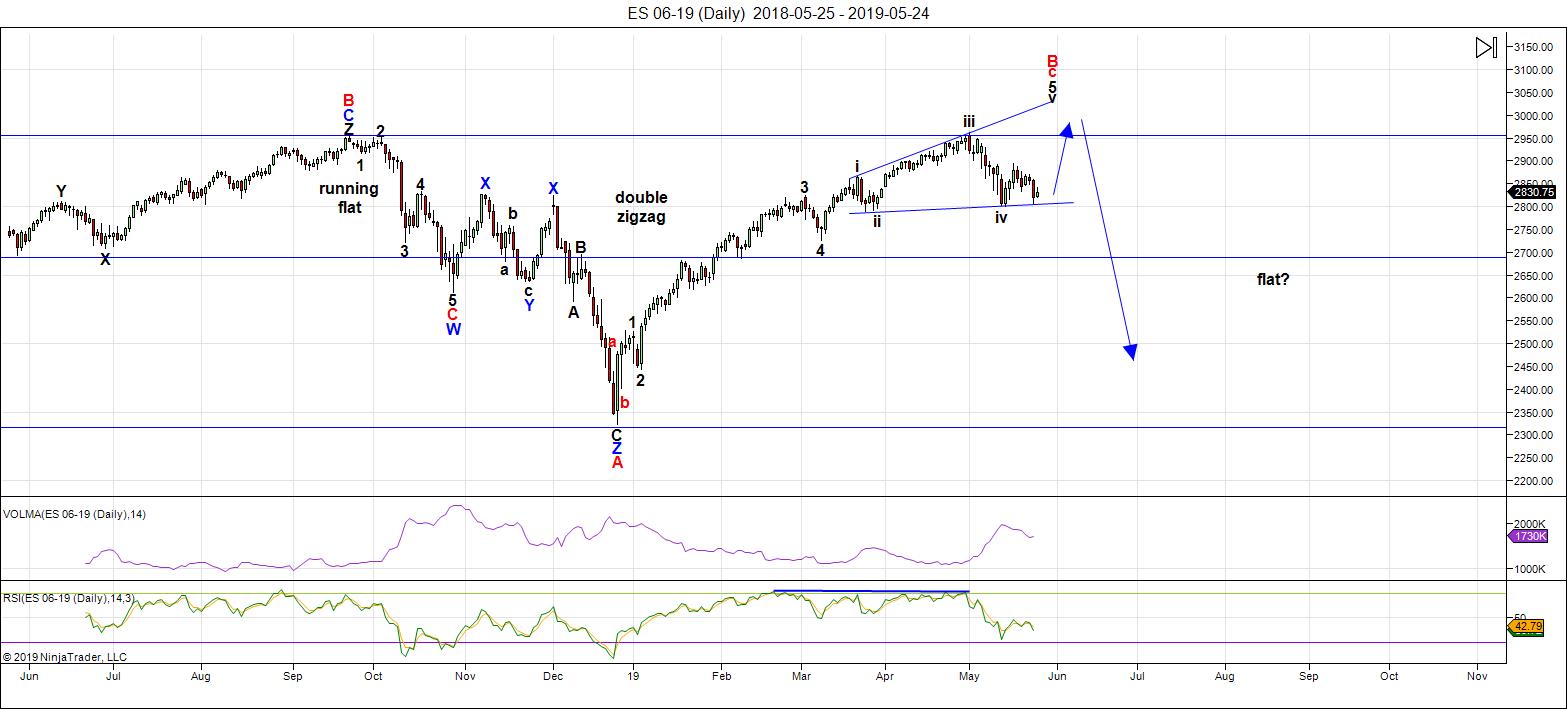

Above is the daily chart of ES (click to enlarge, as with any of my charts).

I've been predicting a new high for the current bullish (corrective) wave in the US indices for a few weeks now. That's because the wave down from the current top was corrective right from the get-go. However, this market is so weak, that the final rally attempt keeps failing. It'll eventually get there, though, because corrective waves retrace to their tops (or bottoms, as the case may be).

The next major move is to the downside (after the top is in). I can't provide a date for a top, because of all the wave failures. These wave failures have also affected current patterns in some indices. Some ending diagonals (at the tops of the DOW and Russell 2000, for example, have failed. This has resulted in double fourth wave bottoms (they're really B wave bottoms — the structure of the wave up from Dec. 26 is so corrective, as I've been saying right from the start). The corrective nature now couldn't be more obvious.

As a result, the wave up from Dec. 26 in ES is must eventually fully retrace to the downside. This is supported by the US Dollar Index, the major USD currency pairs, WTI Oil, along with DAX, TSX, and other international exchanges.

The current pattern in ES still appears to be an ending expanding diagonal. There is still the possibility that this pattern could also fail and drop a little lower over the next couple of days.

This week, the currency pairs (and the US Dollar Index) reversed, as I've been predicting they would, to allow the final rally, as somewhat of a "parade to the top."

It's impossible to successfully analyze this market without taking into account the movement of a number of related asset classes. The market has gradually been aligning across these asset classes and now virtually everything si moving more or less in "lock-step." When you trace out a major top, all major indices have to top at the same time. This 500 year topping process will include many international exchanges.

Summary: My preference is for a dramatic drop in a 4th wave to a new low. The culmination of this drop should mark the bottom of a large fourth wave in progress in the NYSE since January 29, 2018 - a year and a half of Hell. It may be a relatively fast, dramatic drop. In any case, ES will target the previous fourth wave area somewhere under 2100.

Once we've completed the fourth wave down, we'll have a long climb to a final new high in a fifth wave.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Wednesday, June 5 at 5:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

For more information and to sign up, click here.

| "I think you are the only Elliot Wave technician on the planet who knows what he's doing.” |

| m.d. (professional trader) |

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion.

FWIW, stockdisciplines.com does a great “Stock Market Review” daily with technicle indicators a lot of us use to dovetail with Peter T’s EW work. They just trade their own accounts, but one can subscribe to breakout candidates, etc. They use a Group Pressure Gradient to see if major markets are swimming with the stream or against it. The latter is in play on 3 majors now

2790 was an important level for me. It does eliminate some patterns looking for an immediate rally from 2800. Lets see if the cash markets confirm what the futures markets are prognosticating. If we close below 2790 today, I would expect further weakness towards 2720. I have been playing this leg of the declines through puts (and rolling the strikes to not die of decay). Longer term H&S pattern is still intact and 2790 is the neckline.

Yeh, H&S somewhat symmetrical until lately, but cannot tell if it turns into waterfall, or they BTD…

https://www.zerohedge.com/news/2019-05-28/morgan-stanley-warns-volatility-about-rise-lot

WOW, Morgan Stanley “ADJUSTED” yield curve and fit with VIX… VIXplosion!

I like Randy too..always like his wrap ups..but agree that was a risky hold.. sometimes better to wait and see then hop aboard..

I do think he is probably more right though with the possible bounce after they yank this down one more time..

Mojo DWT wasn’t an easy long play..I have been in and out on that one and some very tough calls..I told myself I would hold 2000 shares and then trade in and out..

but of course I didn’t ..never seem to be able to do that..I usually end up selling and then wishing I hadn’t..the triples can be tricky to hold..

Yeh, DWT is too choppy for me too, but looking back… 🙂 I took profit in SQQQ and VXX just before open… looks like I left some on table, but made 5.3% in <1 day. CCI and RSI5 look oversold, so I banked it and will look for next entry.

Best to your trading!

I rolled my put strikes just to be disciplined. This market is barely hanging on. We can easily see a flush out over the next 24-36 hours.

Looks like we are in a wave 3 down…of a possible (3) dow..

The market holding at the lower channel boundary (around 2880). I expected the market to blow through that line. Still a few hours to go before the close – lets see if the dam holds. If the market does hold over the next 2-3 hours, there would be a positive momentum divergence on 1 hour chart, looking for a bounce to around 2820 zone.

I have found VXX on 2 hour with ULT set at 3,5,13 has been very good as of late use to catch swings…

and OBV on that one just broke out..of wedge..soo..let’s see…

The dam broke – why does it feel as if the sell off is happening in slow motion. Maybe because I am short the market through puts and am paying decay ! I want this market to get moving !

It is a “managed decline” due to a deliberate leverage unwind as opposed to panic driven selling.

Are we really surprised?

We know from the anaemic volume that participants in this market are few indeed.

The market IS the banksters.

When they buy, it goes up.

When they sell/unwind, it goes down. The gradual pace of the decline suggests that they want to keep the maases sleeping.

Evidence of an interim low will come via a reclaim of the 2800 pivot and closure of the first overhead gap.

Until and unless that happens, the bulls will need to tread with great caution.

Great trading day!

I am outta here! ☺

The market continues to be very weak. Somehow, the decline has not been nasty at any point. Feels like a series of paper cuts rather than a more forceful decline I was looking out for. Guess I will continue rolling my strikes back and forth.

Today in the cash dow the low has been 24938.24 so far

not that far from the 24906 extreme I have been allowing for .

there is lower targets to 24737 yet id rather see the dow hold

near todays lows .

the 5 day trin is somewhat oversold

the 5 day advance decline line is now giving an oversold reading .

the 10 day charts are not into oversold territory .

the heavy weight dow stocks are now into the jan 22 2019 lows

the lesser weighted dow stocks have only just broken down

and are still much closer to their respective all time highs .

it is really going to matter how next weeks market action goes .

my timing is either correct or it is dead wrong .

a failure to see a weekly reversal to the upside next week

would be a huge warning .

On another note : the oscillators as of yet have not given me any oversold readings

The rally I am expecting for the month of June needs to be a strong one and

testing or making new highs in some index’s s a must .

A failure to make new highs would tell me we have already entered

the bear market in stocks even though the bearish cycles have yet to kick in .

Right hand translations tend to bring crashes ( a high after the cycle high date )

Left hand translations ( the high before the cycle high , tend to bring in long winded declines that are sluggish )

The mid august time period should answer that question .

Basically from what im looking at the market peaked on Feb 25th

I know the index’s went higher yet internally, the individual stocks peaked

on Feb 25th and there was a secondary high April 5th .

Feb 25 to april 5 was 38-39 days depending how you count it .

April 5 plus 38 days was may 13th ( a high to high to low count )

The if im wrong thought .

Monthly chart only ( assumes a break below 24906 and no reversal as expected next week )

Breaking below 24768 targets a minimum of 24049 .

Im not going to explain it just noting it .

Breaking below 24906 intraday is ok yet staying below there and closing the week is not a good sign at all .

currently they are panicking from the looks of the indicators im seeing .

A wash out low is possible this week .

Risky market for the bulls no doubt yet I still favor a cycle low forming now

Not sure why you think anyone is panicking.

What I see is a very orderly exit with a few folk who went long yesterday having to rush into insurance which resulted in that VIX gap higer.

Nothing about the way vol has been trading even remotely suggests panic so far as I can tell, at least not compared to what we would normally see.

VIX has not even poked above the 20 handle despite the size of this decline and that is really remarkable for the apparent lack of concern…just my two 🙂

I saw the p/c ratio reading was at 1.48 earlier in the day. It was 1.43 on 12/21 and 1.8 (which was very high). I think this could suggest some level of panic.

This was per a @sharkbiotech twitter post.

It has been a long time since volatility in general, and VIX in paricular has had ANYTHING to do with the put/call ration. Biggest scam on the planet.

Think short vol trade… 🙂

Looks like final wave down underway. Reversal should be sharp with a few confirmatory gap fills.

Enjoy your evening! 🙂

NYA

Weekly Close Only Pivot : 12409.68 <——- Key Closing Level For Next Week !!

Week of March 4 Close = 12415.13

Dow weekly 25450 <———

Either way it should be a decent Snap Back Rally .

This Weeks Close Near Present prices should be Expected

It really is all about Next weeks Market action and this weeks close below the weekly pivots

is flat out bearish it justifies a wave count that should be expected if we are seeing a cycle low

which should have begun from May 22 to June 3 .

My bias is we either bottomed today in terms of price yet I must allow for Monday as

a key day and I have to expect a weekly reversal to the upside for next week .

Those are the only parameters im looking for .

The timing is either right or it is wrong . Next week is all there is left and this week is

an ideal week for a weekly closing low ( even though I wanted to see it last week )

Nothing from me until next Friday . ( A week from now )

This Weeks close will also be a Monthly Close .

This makes Fridays close a very important weekly and Monthly Close.

In this case id look at a Line chart .

Its pretty much a requirement that we should see a close below

the march close this week .

Exiting all bearish positions on a Friday close that is possibly the lowest close

of the week and as well as lowest close of the month might be a bit difficult .

or buying that same close .

It would be quite interesting to see the market start a bull cycle after putting in a monthly bearish engulfing candle…!

Not saying that this is impossible, just that it would be most interesting!

https://www.msn.com/en-us/weather/topstories/mississippi-river-flood-is-longest-lasting-in-over-90-years-since-great-flood-of-1927/ar-AAC33HV?ocid=spartandhp

You always get major flooding at 500 year cycle highs and they always devastate the food supply.

They won’t let spy drop below the 200 mda and XLF below 26. Lets see what they got as pressure mounts.

DJIA already has. SPX sure to ultimately follow…

and here is our bounce….!….Let’s see how far we make it up!..bought bit of TBT and Tqqq, ytda for a bounce..let’s see how far we make it..Dow has to push thru that 25,222 area to go anywhere..

Not a bad idea to pick up some bulk dry goods at today’s prices and stock an extra freezer or refrigirator with frozen, vacuum sealed meats. Prices are going quite a bit higher. Food prices will buck the deflationary cycle, as they have been for years now, but it will get much worse unfortunately….

Its a pretty sad bounce if that’s what we are calling it. Moves in both directions are still corrective.

Designating a move as “corrective” for trading purposes is for me problematic if a time frame and wave degree is not specified.

The current trend imho is now clearly down, as the DJIA is now more than 2000 points off its recent high, and well on its way to meeting the downside target suggested by the broken wedge we saw awhile back. Don’t mean to be critical but trading is serious business, and if my indicators are not giving me a heads-up ahead of a 2000 point DJIA plunge, it’s time to make some adjustments! ☺

Hi Tom, do you have an energy chart projection for next week.

My next astro work shows May 30/31, June 3 and important June 7.

Thanks in advance

John.

Hi John

I was in the hospital yesterday

for a food related negative reaction

so I’ve been somewhat preoccupied

will try to post something before I hit the bed tonite

Oke Tom, take your time your health is number 1.

My best guess is a low today, after that we go up…

All the best.

John.

Verne you are right..I have been about getting another cheap freezer..time to stock up…

agreed very sad bounce …;(((

Looks to me like some kind of fourth wave.

We still have positive divergences on the hourly so a fifth down should unfold swiftly and then we get the real bounce up to around 2910-2920…

Stay alert traders!

They are probably going to complete this wave down going into the close and trap any bearish traders chasing it down.

We know how they roll! 🙂

New low in ES, not yet in DJIA. It should follow shortly and then we have them all heading up….

ES head fake?! 🙂

Stepping back from the action for a bit, VIX sure is looking like a classic cup and handle formation.

If that is true, we’re not done…not by a long shot! 🙂

$trin

5 day trin sum if the market was to close right here would be 6.32

this is an acceptable oversold reading yet a level of 7 to 9 is more oversold

and more of the norm .

Since this is an indicator based on closing price it still implies Fridays close

as the must needed ingredient .

Bottom line: I need to see a spike in the daily trin closing price before

taking on any bullish positions .

a Friday close for the daily trin and a possible hourly trin spike on Monday

if we see it .

Friday matters more to me on a closing basis ( I prefer near present price levels )

and Monday is the reversal up yet really its all of next week needs to be up

strong ( weekly reversal up )

From my point of view we are very close to a tradable bottom yet im not

going to get to excited until next week .

Its a wait a few days thing .

Peter T

I agree with you

Back in 2007-2008 there was also a big flood out that way and I thought

of it as an early sign of what is to come .

This past flood I feel a similar thought .

Some people do not realize that they could have purchased a house in

the Midwest in 2008 and would have doubled their money .

it was probably the only place in the usa where the housing collapse didn’t really happen . that was only because of the commodity boom back then ill assume along with home prices out there being undervalued ( according to the federal reserve article I read about housing in the USA ) The fed back then was very aware of how high home prices were .

Have you ever seen such drama?! Lol!

I have no idea what they are up to.

DJIA did not recover 200 day…bearish! 🙂

verne

you ever look at the vix divided by the spx ??

anyone noticed wheat prices lately ??

NYA testing the 12409 level ( weekly pivot )

Never have Joe. What will I find?😉

There is no denying those open overhead gaps.

They can thrash around ad nauseam, but until and unless they close ’em, the immediate trend remains down, imho.

Have a great evening everyone.

Rung the register on short positions and waiting to see what they pull out of the hat…

verne

I think the market lays flat if not a spike near the close tomorrow .

dow should close below 25450 , nya to close below 12409

sox is in a similar set up .

basically all index’s are very near their respective idealized weekly closing levels.

its going to be a tough call for next week .

it should be a bearish close and everyone should be saying total collapse coming

trap door open !

ill be looking to the long side for next week and it is killing me not to be loading the boat right now .

patients is not easy .

Gonna hold..still looks like pop..have a good night.

oops could pop

ES spikes to a new low for the month. Lets see if we can get to 2720 zone by tomorrow

Sounds about right….

Hi John

next week’s energy chart attached below

https://imgur.com/a/zwnUnNo

p.s. tell me how it lines up with your graph?

Thanks Tom! Hope you feel better by now.

yes much better today

thanks for asking

Hi Tom, today should be a low and we have to go up maybe till June 7.

I went long AEX calls this morning on the AEX.

Nice call Joe!

Looks like we get that fifth wave down tomorrow… 😎

Tom,

Are you looking at this 27 day forecast, I cant find an hourly forecast for more than 3 days.

https://www.swpc.noaa.gov/products/27-day-outlook-107-cm-radio-flux-and-geomagnetic-indices

sorry Bill

I don’t use Kp or Flux

it’s not my cup of tea

Thanks Tom. I read up the document you suggested. Well read partially and felt like most important is AP index and how it goes up and down. But i can only see 3 days of forecast on hourly basis. Thanks in advance for sharing the knowledge.

Covering some of the shorts in pre-market. There hasn’t been a 5 wave bounce yet. So the bias for me is still to the short side, but being prudent. Will roll strikes on puts again once the market opens. Kudos again to Joe who pointed out the importance of this period more than a month ago. I have been blown away with his accuracy in determining important time periods for the market. Would love to hear from John on whether this is the important swing he was looking for.

I have been expecting a relief bounce for a few days now and so far I have been wrong! Plain and simple.

I say “relief” because every single indicator I follow remains on a “sell” signal. Every one now is belatedly pointing to the confirmerd H&S pattern. Personally, I failed to attribute sufficient weight to the rejection at the 200 day so far as trading the outcome although I knew it was bearish. My long volatility positions are going to make up for that amateur error!

The open overhead gap and target of the busted wedge, as well as the VIX cup and handle really should have kept me fully short. Every time I start feeling confident that I know where Mr, Market is headed he dishes out a big slice of humble pie!

Let’s see if VIX confirms an interim low today. We do have 7 consecutive H.O.s on the clock and the immdiate trend remains down…

Verne – when I mentioned corrective both ways, I should have been more explicit. All declines that I have studied since 1960 have been corrective on daily charts. For my own trading, it means that I have to be a lot more nimble, reduce investment capital and increase trading capital. This is how large declines start. The first leg down of about 7-12% is an ABC (or a W-X-Y-X-Z). This one seems to be setting up as tripple zigzag for (A), double zigzag for (B) and likely a double zigzag for (C) with ideal target around 2735. After that, we should ideally get a very strong bounce to either 2892 OR all the way to 2960 (I do not know which). In some of the worst declines, this bounce is very anemic (like 1987 or 2008). I was not ultra confident of the count after the first decline. Thats why I converted my outright shorts to puts (which means I made less money, but it was a safer strategy). There are times when you do get a very small bounce (like 1987 and 2008), but it is very rare. That bounce allows for a great set up to short the market. Given how accurate Joe has been, I will look for that bounce to start next week. There is a solar eclipse coming up on July 2nd, with a new moon on Aug 1. I will let the astro experts comment on that (I just learnt about it from them on this forum a year ago – so I am nowhere close to being an expert). With Hinderberg Omens lining up, weekly and monthly momentum rolling over, Central bank cycle turning (yield curve), De Mark on weekly time frame going negative, EW counts close to completing and Puetz window on the horizon, there is no doubt a significant need for caution. My plan is to stay ultra nimble and use options whenever I can.

Agreed Vivek.

This is now a scalper’s market.

The one way bet enjoyed by bullish traders these many years is over.

Until the last few weeks of down-trend, directional bias in trades would be ground to powder, courtesy of the wily banksters. This glaring divergence of a strangely muted VIX in the face of a plunging market says somebody is LYING their ass off…not quite sure who….although I could hazard a pretty good guess…😎

FWIW, I was thinking this is a fifth and final wave down after yesterday’s fourth but VIX has to confirm. If VIX prints a fat green candle today it could mean we are in the middle of a third down after nested 1,2,, counts….YIKES!!! 😬😬😬😬

Great points. My eye has been on H&S and CWH you mentioned Verne. The last 3 weeks have been very good to me and I had biz to tend to the last few days so I lightened up, so now I feel like I’m on my heals. I will stay light but build positions if we get rebounds. This big red candle on weekly will raise some eyebrows. This QE/QT adjusted fed funds rate and correlation of VIX and inverse yield curve by MS is of interest to me going forward.

https://www.zerohedge.com/news/2019-05-28/morgan-stanley-warns-volatility-about-rise-lot

Ha… heels. We’ll see what gets healed

waiting for bounce today..so today is either last shake out or down..

sold tqqq to be safe..

will be a nail biter ;))…kiddn

John..will you still buy today? if we end up low..just curious…and Joe your timing is spot on..

I will prob buy back in for a pop..depending what the shake out is today..

it’s funny how the fake news

blames mexico tariff threat

for the drop today

the energy chart showed the drop today

and it had nothing to do with mexico

or Trump or china ……blah blah blah

Thank you for the energy chart btw..appreciated.

Very strange volatility price action. Absolutely no signs of any kind of capitulatulation.

Unreal that VIX is still trading below 20.

What we are seeing is an insane disconnect of vol and true market downside risk.

And no surprise, for a metric that has been so frightfully abused for so many years.

They will unwind that short vol trade, voluntarily or forcibly…but they WILL.

There is going to be hell to pay when they do….

This whole decline has been very benign – multiple opportunities to exit longs. There has been no real panic any given day. For those who are sitting long, this has been less than a 38% retrace. Not a good enough reason for a VIX spike just yet.

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.