All this talk about a Trump rally … absolutely ridiculous! Elliott waves predicted this rally a years and a half ago—even longer, in fact. So, what are the financial pundits talking about this time? The thought of every word that Donald Trump utters having any real effect of the market is just ludicrous.

All this talk about a Trump rally … absolutely ridiculous! Elliott waves predicted this rally a years and a half ago—even longer, in fact. So, what are the financial pundits talking about this time? The thought of every word that Donald Trump utters having any real effect of the market is just ludicrous.

Knowing that the market is traded around the world, to think that the entire world buys and sells based upon what happens in Washington DC is really extraordinary. The height of man’s hubris knows no bounds. Next, they’ll think that we’re in control of Earth’s climate!? (oh, yeah, I forgot for an instant …)

This notion that events have any major impact on the market is part and parcel of this same kind of thinking. It will be fascinating to see the reaction when it starts getting noticeably colder right across the world, the market crashes big time, and the people realize that we’re really not in control of anything that happens on the third rock from the Sun.

Of course, that will only be some people, as the major media will blame the financial crash on Donald Trump and the climate, or an event that “happens to” coincide with the predicted top.

The truth is that the movement of the market is a mathematical representation of the mood of the herd.

The market will continue moving up in its Elliott wave rhythm until the herd is more negative than positive and at that point, it will turn down. There will be a major event in and around that time, but it will not be the single event that will change the course of history. However, as in the past, it’s likely that the herd will pin the cause of this historic market collapse on that single event, even though it’s highly likely that it won’t happen right on the day of the top, but somewhere close to it.

Major events do not change the market trend. The trend wanes over time until, as I said, it just keels over. At that point, the underlying weakness takes it down quickly and the concern that’s been percolating under the surface suddenly takes hold and quickly turns to fear. From a daily or weekly chart perspective, the market will come down in three very predictable waves, with countertrend subwaves hitting their targets along the way just when they’re supposed to.

It will be an historic drop that “nobody saw coming.”

Elliott Waves and the Stock Market

Waves reflect the mood of the herd. As a result, at the highs of the market, good events occur, because the herd is in a positive mood. At lows, bad things happen.

We’re rather regularly hearing the cries of pundits or even hedge fund heads that the market is reacting positively to bad news these days. They simply don’t understand how that can happen! Well, that’s because the market is bullish due to the overall mood of those who affect it.

I often find it amusing when pundits and other media types make every excuse they can think of to explain a market that’s not reacting to events the way they expect it to. Or when they try and explain a downturn on good news. They’re certainly very creative!

Elliott waves move in very specific patterns that always play out to their prescribed end points. Virtually all the waves have fibonacci ratio relationships to other waves and so the predictability is extremely high. Given the knowledge, it’s relatively easy to predict wave ends accurately.

As I explained last week in the blog post, every ending wave is in five waves, it doesn’t matter whether it’s a motive or corrective market. I’ve never seen a truncation, even though some say it could happen. Yes, if this time is different, I suppose it could. But that’s what this site is all about: cycles. Cycles play out over and over again; otherwise, they’re not cycles. Elliott waves are price cycles and they play out as predicted until the mood changes.

A Couple of Examples

Brexit (SP500): Above is a daily chart of the SP500 from April through July of 2016. The recent Brexit vote of June 24, 2016 had a dramatic effect on the market for a little more than a day. I remember it well. We had already started a correction and I had expected a drop. I happened to be on a plane when it happened and could not take advantage of it (it had been hours of delays on the road and I wasn’t able to access the market).

It’s interesting to note that the C wave shown in the chart ended up being exactly 1.618 times the A wave down, which is a typical fibonacci relationship in a correction. Two days after the event the market headed right back up (I had made the call based upon the wave structure) and it didn’t take long for it to completely retrace the drop. The trend did not change—the market simply continued the correction and then turned up again on schedule.

I remember all the pundits making a really big deal of the drop, as if it were the end of the world.

Nine-Eleven (SP500): Above is a daily chart of the SP500 from May – December, 2001. On September 11, 2001, the attack on the World Trade Center took place in New York City. The US market had already been in a downtrend since May 22, 2001 (on the above chart). The market bottomed on September 21, just ten days after the attack and turned right back up, eventually heading to a new high, of course. Although we had a steep drop on the day of the attack, an historic event of this magnitude did not have a major effect on the larger trend.

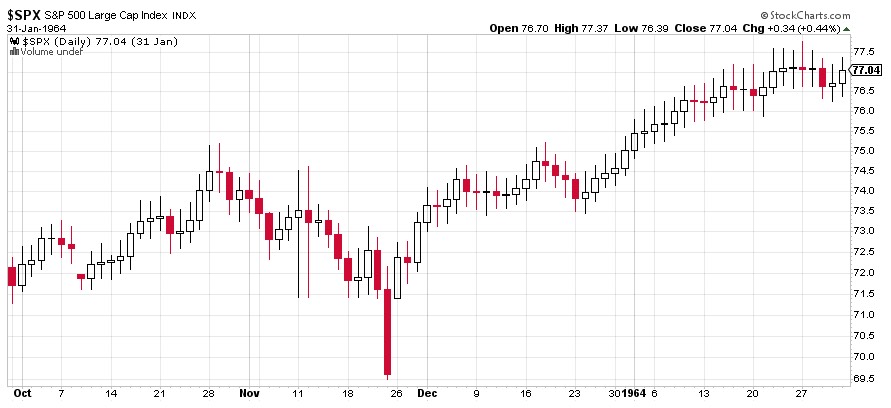

John F. Kennedy Assassination *SP500.” Here is a daily chart of the SP500 from October, 1963 through January 30, 1964. Kennedy as assassinated on November 22, 1963 (the big red bar down). We were already in a downtrend. That day (22nd) finished the downtrend and the next day, the market turned around and want up to a new high and continued on with the larger trend.

_______________________

Based upon these examples, it’s not logical that Donald Trump’s election has had any kind of lasting effect on the trend. After all, the rise in this fifth wave we’re currently in had already been predicted through the Elliott Wave Principle. Events do not change the trend.

But it’s sure fun to watch the pundits play!

The Market This Week

Above is the daily chart of ES (click to enlarge, as with any of my charts). The call was correct once again, of course. Last weekend, I had called for a dramatic turn later in the week and we certainly got it.

Fourth waves are ABC corrective waves. We've completed both the A wave and the B wave. We're starting down in the C wave.

Much more downside to come. This is the fourth wave of the C wave of a zigzag (the fifth and final wave of a larger topping structure).

Summary: We're in the fourth wave in ES.

After completing the larger fourth wave, we'll have one more wave to go, which could be an ending diagonal as a fifth wave. The long awaited bear market is getting closer.

______________________________________

Sign up for: The Chart Show

Wednesday, May 31 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here. NOTE: the weekday and time have changed - to Wednesdays.

Yeeeeeees. Finally the IV 🙂

🙂

Are you sure we do go back up to test the highs…futures looks strong

I meant to say we dont go back up and test highs…

Valley,

How does your PALS system look now. We trade options so have to be right on time and direction.. look at all angles..

Thanks

Bill

Phase: bullish all week

Distance: bullish all week

Declination: bullish from Tuesday

Seasonals: bearish until Wednesday

Planets: neutral

News: Trump on world stage, trading partners buying stuff, seems bullish.

Thanks, Peter. Excellent summary of current market conditions. While I believe we will see a few years of higher equity prices, I can foresee a 10 percent correction sometime during the next four months.

Iceagenow.com has interesting article on mini ice age that may be coming.

Valley,

Do you know what happened to john hampson..he was one of the best researched bear market guy..but its very difficult … I guess you are right you can’t fight the debt/liabilities without a rising market. So 4th wave EW is set for fail if we reach another high or we will have to redraw 3rd wave. Capital preservation time for bears i guess.

John Hampson was very good at teaching solar/lunar price correlations. His work on sunspot cycles and market performance was very easy to understand. The Styx song from the 70’s: “Domo arigato Mr. Roboto” succinctly states the bull market believers thesis. “Mr. Roboto” will deliver the goods.

Peter, great work! I really like to see this wave 4 coming down as well. In fact, I am fully positioned this down move since last Friday. I am looking for a gap down on tomorrow morning but future is not moving much yet. I understand the important of Elliott theory, but I feel that to be Elliott wave expert is not very easy. I view Elliott wave count is more based on price rather than timing. My focus is always more on timing rather than price. I feel that waiting for price to come is very frustrating sometime. Only timing is more predictable. Since I have discovered your website, I have been so inspired a lot by your cycle theory more than your expertise in Elliott Wave analysis. Your cycle knowledge gives me a lots of new idea. That is what I am really interesting on. Thanks for sharing your thoughts.

short term realtime energy stream data attached

I think Comey testifies on Wednesday

https://s28.postimg.org/45yu9t4el/MAY_22_TO_24_REALTIME_Energy_Stream.gif

Thanks Tom, I also have a turn.. May 24 into 25

Tom can we see the chart for 25 and 26th too? How long does the drop in energy last?

http://thehill.com/blogs/floor-action/scheduling/334336-this-week

“The House Oversight Committee asked Comey to testify at a hearing scheduled for Wednesday morning”…remains to be seen if it will happen…

http://www.politico.com/story/2017/05/22/chaffetz-postpones-wednesday-hearing-after-speaking-with-comey-238690

FED speaks @ 2:00 pm today, May 24th

Yep. That should align with the drop in energy. Any chance you could post the long term energy chart again or send me link to it.?

It’s a button on the dashboard (chart needs updating, I see).

https://worldcyclesinstitute.com/gold-and-oil-longer-term/

just post your email address here and anybody else who may be interested and I will forward you and them a long term chart when I get a chance. The next long term chart will be very special.

theomnipotentearthworm@hotmail.com. Thanks Tom!

ejoys2603@gmail.com Thanks much!

bret6@yahoo.com

Tom, can you explain the drop in the energy stream on the 24th without a drop in the market? What makes the most sense to you?

Thanks Peter,

A good example for me how EW works.

Peter

You said it perfectly lol .

I’m often humored by the morning news vs the news after the close .

Stock x down on disappointing numbers , then after the close investors shrug

Off stock x disappointing numbers .

I’m conflicted with this market right here right now .

My cycles point strongly up into June 30th and I have no counter to your wave count .

I place a lot of faith in the 20 day occilator on the Dow , it’s still showing an oversold reading .

I don’t know what kind of reading the trin gave on the other days sell off so no idea on the 5 day trim sum

Nor the 10 day trin. I don’t guess the numbers on indicators.

I’m accepting any sell off that comes yet I’m thinking the June 30 cycle high will be where I take a short

Position .

Andre , thanks for your post , I’ll ‘re read that .

I’ve got about 4 hours work to do and I’ll have my model completed to may 2018.

My gut is telling me to start following the US bond market on a much closer basis .

If there is a shoe to drop I’d think that would be a good starting point .

Liz h

You made me laugh and in a good way .

( politics )

Lastly , when president Kennedy was shot and killed you would assume the market did what ?

Great post Peter

Joe there’s a huge megaphone on IWM, doesn’t seem to have much space up until it goes down first. https://www.tradingview.com/x/EcIJ58WR/ unless we go vertical…you never know 🙂

https://worldcyclesinstitute.com/the-cycle-turns-on-canadian-banking/#comment-16400

March 28, 2017, 10:58 am

“I truly admire the perspective on the purposes and proper use of money. I deplore the sanctioned violence by some of its adherents. I do have to say though, considering what we have been learning of late about the depth of depravity of what appears to be quite a large number of our political leaders, not only in the US but across the Western world, their disgust is entirely understandable. I doubt few Americans are aware of the depths of outright wickedness being perpetrated by their leaders. So sad. There is now in the rumour mill, which obviously I cannot repeat here, some absolutely shocking news that explains the mealy-mouth conduct of FBI leadership the last several months in the face of spectacularly criminal conduct. How can some of these people appear in public and say the things they do with a straight face is mind-numbing. It betrays in my view, what is beyond contempt for the observing public. It must be the fluoride in the water…!”

https://worldcyclesinstitute.com/elliott-wave-taking-apart-the-chart/#comment-18159

May 17, 2017, 8:41 pm

“I think now that the rules are clear I hope Verne will post again?”

Joe,

I added the JFK assassination chart to the blog post. The last one on the bottom.

See now 5/24 is also a very strong date. Could be the market will be consolidate into that date. But Wednesday something happen.

Cheers,

André

May 16, 2017, SPX low 2,396.05…need to touch that level to close the gap down on May 17, 2017…

gap filled…

https://worldcyclesinstitute.com/elliott-wave-taking-apart-the-chart/#comment-18095

Andy Pancholi FREE video update

“Week Ending 19th May 2017…S&P 500 together with a whole series of global markets are going to change trend”

http://tinyurl.com/ksoewjm

Chris Kimble FREE email update

“The US Dollar…has shown strength versus the Euro…since 2008…But that market dynamic is at a crossroads… and may be nearing a turning point…A currency “shift” here would have short- to intermediate-term consequences for various assets across investors portfolios….Could these reversal patterns mark a turning point in the global markets for traders?”

http://tinyurl.com/ks5tf7n

2 1/2 feet of snow in Nye, Montana. IceAgeNow.com. The “cooling cycle” seems to be here.

I am long tech stocks this week. Guess we will see a nice rally into Friday’s close. Based upon PALS being bullish (next week is when I guess the market will sell off).

What kind of EW is this supposed to be?

Peter G,

Did yesterday’s a/d line take away the “slight divergence” on your Trade Station data? So the only way I see ever getting a divergence or at least a meaningful one is for the S&P to sell off meaningfully and the market rally much like Peter T (our host) sees in his EW count.

It sure did, Ed. Every time the a-d line makes a new all-time high, the implication is that a final market high lies in the future, and only after the DJIA and/or S&P makes a new ATH without confirmation from the daily a-d. Mind you, such a circumstance does not guarantee you are at an important high, it just seems to be a necessary concomitant in order to even suggest the possibility of a final high…

https://worldcyclesinstitute.com/elliott-waves-and-probability/#comment-17326

still concur…however, the divergence may not take years to develop…

Could the divergence stretch into September for the a-d line? If we turn down here for a wave 4 without divergence and make new highs in Sept with lower a-d than now, would that work?

in 2007, the NYAD high occurred in May…the SPX high occurred in October…four plus months…

NYAD +96.00…

Added another call option Tuesday. Wednesday to Friday should be bullish based upon declination, phase, distance, and seasonals. Next week should be bearish.

Sold out. Tiny gain. Will look for weakness next few weeks to trade to long side. Have low price Friday expiration call in case market decides to move higher.

Glad I kept the call as price has moved nicely higher.

Looks ready to drop tomorrow. Still can’t reconcile what wave from hell is this one 🙂

It’s a never ending zigzag, capped off by an ending diagonal (ES). A present from Satan.

🙂

Lol Peter you can tell Satan (GS) that it’s really appreciated 😀 a market too easy to trade would surely be boring *-*’

Market will probably move sideways into weekend, sell off “bigly” next week, and then rally into early June.

I am positioning this down trend since 5/15, tomorrow it should be repeating the 5/16 drop. This Monday I was expecting an inversion, but it ended up a rally up. Today it hits closed to a double top, but it didn’t break through 5/16 high. My down trend ended date is still 5/30/17 for this move.

5/25 is 179 squared from 1929; should do something. Also 1440 high.

May 24/25 is still my focus for a turn could be a sudden drop like 17/18 or a drop into May 29/31..let ‘s rock and roll.

Just a “news timing” note. The Comey’s outing is not today but sometimes after ThanksGiving (if it’s still alive by then). Today we have our lord and savior Queen Witch’s Minutes at 2pm 😉

FED also speaks @ 2:00pm today

Wow guys. Plunge Protection Team going mainstream. Explains to the public why the markets are so elevated – they can’t go down substantially due to the backstop! Just buy the dip, guys!?

Sure seems like setting up the BTFDers to be the bag holders. Only question is when?

https://twitter.com/CNBCFastMoney/status/867140373306458112

https://www.archives.gov/federal-register/codification/executive-order/12631.html

I seen the same thing yesterday..

My question though is if they were put in place in 1988..

Where were they in the crash of 08?

Peter, Have you ever heard of the PPT?

Yes, what effect it will have in a plunge is highly questionable. Doesn’t affect my work.

Ha…my thoughts exactly. Very good question. A friend of mine say he knew someone who works at EIA that told him a bit about it and was offered a job there lower level

Exactly, but my point comes from the fact that all the major indices are moving in tandem and when this thing comes down, the entire world is going to come down. It doesn’t matter what the FED does. They’re too small.

That drop @ 2:00 today very muted (PPT action?) but we saw it on the stream two days in advance. May 24 to 26 realtime attached below

https://s29.postimg.org/ap6fu36cn/May_24_to_26_realtime_short_term_energy_chart.gif

Might drop a little later. I doubt an effective PPT exists otherwise there will never be another market correction or crash. I’d prefer if a PPT that was viable existed as I’d put all my funds long and be able to retire early.

The PPT was quiet until yesterday.

So I wonder why now is it coming out?

And like I mentioned earlier, if they were formed in 1988 – where were they during DOT.COM drop and Financial Crisis?

Maybe they wanted it out there so when this market does blow up, people that are long will hang in there under false hope.

When it does start to happen I believe it will start overnight. The drop will be so devastating that folks will freeze in hopes it will bounce like it always does – but it wont for awhile and just before it does come back for W(2) everyone will sell as smart money is buying..

Just my take.. SPX 1750 I believe will be the target for W(1) when it does finally go.

please someone tell the market that wave IV was supposed to move the other way…

OK, this is admittedly one man’s opinion, but I would ask any of you who live near an ocean to visit it on one of its ornery days, perhaps a hurricane or, worse yet, a typhoon. Ask yourself if there is anything man (collectively) could do to control the beast. It would be quite obvious there is not. So it is with financial markets as large as ours. Perhaps they can be very slightly manipulated by outside influence for a very short period of time. Markets are strictly psychology and when the real thing comes along, the real “crash,” nothing on God’s green earth will be able to quell its passion. PPT to me is the excuse (complaint) by a bear when the market fails to crash or follow through with a continued and accelerated decline once one has appeared to begin, especially after a continued decline or crash was predicted by the complainer. “Well, it would have crashed if the PPT hadn’t stepped in!” Balderdash!

The “psychology argument” is very seductive, but it’s like an argument on human productivity. These are all bots. Programmed by humans according to human logic, not emotions. Most of the times programmed exactly to eliminate emotions. Bots not influenced by planets, as far as I know (not that I exclude it, the sea is not human last time I checked). What I mean is…don’t rely too much on a sudden global emotional awakening or something…better rely on an hacker attack on the CBOE or some electricity grid for how it works right now…

Human retail traders are 1-2% of ES liquidity, you (generic 🙂 keep ignoring this data. It’s huge. No matter what happens emotionally to that 1-2%, it’s a 1-2%. The remaining HFTs machine, institutions and HF algos, let alone money printed out of nothing from FED and other CBs can’t possibly emotionally behave the same way, or I’ll start looking at my PC with suspicion right now.

already started (better safe than sorry)

the PC is looking back, I quietly exited my home, running right now…

Let’s wait and see if your robots will be as unyielding to psychological pressure as you think, after the first 25…30…40…50% decline begins. Algorithms will easily ignore psychology, they are admittedly not subject to it, but at some point the programmer takes over, unable to stand the pressure of losses and the algorithms are overruled or forgotten (“Just this once!”) and psychology becomes the final arbiter once again…now if you want to argue that the bots take over and refuse to be overruled, you’re talking a different ball game. We may be closer to that than we all think, but we certainly are not there yet! Until then, I argue that psychology, whose patterns were ingeniously unraveled by Elliott, and cycles which are arguably caused/influenced by astronomical patterns will continue to reward those who are able to decode them…

I add as an epilogue, Alex, that I am amazed you continue to follow this group if you truly believe that 98-99% of investment decisions are ruled by bot algorithms, unless you argue the algorithms start to present independent patterns of their own 🙂

My point is, we usually get to those breaking points where the bot would get shut down (I agree) because there are human emotions in play. Not easy to get to that -20%, -30% now imho.

You are human, you don’t buy the dip all-in after a 50 handles drop causing these violent V shaped moves we’re seeing, systematically recovering every overnight flush in 24 hours. You are human, you don’t trade statistically, every trade is important, you care about a single trade, you think about it, you don’t flood the market with fast math-based orders, you don’t buy the dip if a nuclear bomb is flying over your house, a terrorist explodes in your garden or a complete nutjob with the IQ of a banana and an FBI investigation over his head wins the elections (Any resemblance to real events and/or to real persons, living or soon to be impeached, is purely coincidental).

Tell me if you think that an auction involving 100 humans and one involving 1-2 humans and 98 bots would behave the same and have the same outcome 🙂 .

NB: I don’t “believe it”, the 1-2% liquidity is an hard fact based on research by the FED after the flash crash. If that fact doesn’t suit our “mass human emotions” narrative let’s feel free to change it, we’re in the Trump era, I’m sure we can do that

I’m interested in EW and believe in cycles, I’m just pointing out that any sort of influence the planets can have now may not be the same they once were because the forces at play in the market are not the same (bot vs humans / finite capital vs infinite electronic money printed out of air / semi-free market vs state regulated/run market / globalization of policies with Swiss CB owning trillions in US shares / 1% of the population owning 50% of the resources / market needing millions of people money vs 6-7 HF algos battling each other and accounting for over 30% of liquidity…).

Seems a pretty different ball game to me. All those things are very recent changes in paradigm, big(ly) ones. Maybe we should take them into account. Maybe the planets influence everything including rocks (why not, really?). But saying that EW right now works because of Paul and Jenna cute retail traders’ emotions putting their hard earned money in the market is simply factually wrong, no such thing exists anymore.

Btw, what wave is this lol 😀 (inverted IV from hell, the bots are misbehaving…

Peter G,

Do you have an opinion as to where we are? Peter T, our host, believes we are looking a Wave 4 of some degree prior to a final Wave 5 up to finish off this Bull Market. I agree with him. Your A/D line would place evidence that Peter T is right.

Then there is record or near record bullish sentiment, consumer confidence that always exist at a market peak by definition. Low volume and nary a bear to be found. My only problem with the A/D line is the influence of the ETF’s and Indexing which pushes stocks not deserving of new highs to new highs regardless of the fundamentals (no price discovery). Are we hoodwinked by what has been a reliable indicator?

You have obviously thought about this. Bill Fleckenstein says, “bull markets just exhaust themselves”. Is there anything in particular that you are looking at that offers you perspective? I have admitted to myself that I do not know but thought I did.

Peter g

As someone who not only lives 4 miles from the Pacific ocean

And has made a living for the past 37 years in the Bering sea as well

As the Pacific ocean I will say you cannot stop mother nature period .

The addage is, mother nature does not ask for your respect , she demands it !

You put it perfectly when you said the nonsense about the ppt is from

A bears point of view since the market failed to drop .

Humans have a hard time accepting when they are wrong so the blame game

And denial go hand in hand .

It’s all trumps fault or George Bush or Hoover etc….

This cycle runs into June 30th so a move to new highs seems like a given to me .

No doubt there will be more denial going forward since there is still a month to go .

The June 30 date should be significant in some degree , Andre noted an early July date

On the previous thread . I have June 30 based on 2 completely different methods .

The Oct cycle is another peak yet the June 30 date by one method is the high of the year .

I consider it as important but to be honest I doubt June 30 is the last high of this bull market

That all said from June 30 to mid Sept is where a bearish window lays .

Meaning , June 30 high and mid Sept low .

I need more data to refine that but a bearish bias will be my mantra for July Aug and September .

Should be an interesting summer 🙂

Joe

Alex

You make several valid points

I’ll point out the obvious discrepancy

Program trading or algorithms type trading

Are based on human biased research .

Those errors are built into the system .

Statistics etc…..

No such thing as a 100% statistic unless you wish to debate

That for example , everyone that has ever drank water has eventually died

Or the tobacco industry sells more cigarettes today then it did 100 years ago

And people now live longer on average than they did 100 Yeats ago so you could

Say based on statistics that smoking actually increases your life expectancy.

You can make a statistic turn out any way you wish .

At the end of the day history repeats in some form because we humans

Tend to do the same things over and over .

Joe

Yes Joe, I agree. With statistics I meant that and algo has a very different approach to taking a trade, it behaves on the premise of the house in a casino: no matter how a single trade goes, the system wins over a statistically relevant serie of trades (thousands at a minumum…). It doesn’t get emotionally attached to a single trade like we do. We should trade like that too (just read “Trading in the zone” by Mark Douglas, a little gem on trading psychology imho), it’s the only way to have an edge on the long run really, but for a human being is almost impossible and you have to overcome your whole psychology to do that, for an algo it’s impossible to do the opposite.

Take what’s happening right now. If you’re short like I am now, this is not a normal loss, this is a devastating one. Is it on a math / point level? No. But there will be no trace in a bot of all the considerations and the emotional pain I’m going trough right now.

We just trade differently. If you’re analyzing a market where millions on me are trading right now you’ll have an outcome. If there’s one me every 99 algos, well, the outcome won’t be the same, it can’t be.

This morning you have (according to market participants composition, the real, factual one), 1 human bull that’s celebrating naked in the streets, 1 human bear thinking about killing himself (don’t worry, not my case, I have the gift of infinite rage keeping me afloat…), and 98 bots that don’t give a flying f*.

They won’t disconnect, unplug themselves or change job if they lose a trade. It’s just an insignificant blip in a statistical serie for them, for me, it’s my whole life => We’ll probably have a different outcome than a market with, say, 50 bull celebrating naked in the streets and 50 bear thinking about killing themselves.

With that said, I repeat, the planets can influence the microchips for all we know. I was criticizing the “collective human emotions” argument, because it’s based in sheer ignorance (in the Latin sense of ignoring-not knowing) of market composition, not the planetary effect / cyclical one, the climate isn’t changing because humans are sad, quite the other way around ;).

Peter says this market is extreme / nuts. Maybe part of that is cause by the above argument (maybe not who knows 🙂

Joe asked about the JFK Assassination chart and so I added it to the blog post.

I noted that for a good reason Peter .

It fit with your theme

Events do not change the trend 🙂

Yeah, it was a good idea. I was trying to think of major events and that’s a good one.

back to the drawing board…ES new all time high was just registered…2411.25…

It isn’t much of a change for me. The original target for ES was 2410-15, if you remember. It just extends the third wave by a few points. Always have to pay attention to Mr. Fibonacci is the lesson.

Any news from Mahendra ?

We may (hopefully) have a top forming in ES/SPX.

My question:

When we pullback, is another (and final) top around 2430 a possibility, or is that ruled out?

It’s an ending diagonal (if I’m correct) so it can actually do whatever it likes. But my measurement puts a top here.

Boy, tops don’t get much more brutal than this …

I like what currencies are doing … it’s amazing that ES/SPX keep on going. We have to be very close to a top. With an ending diagonal, I have no way of telling.

A typical ED ending. No warning. Just a sheer drop.

I pulled on a blindfold and got short ES at 2414.

Peter,

I would take off my hat if I had one -:)

Not out of the woods yet. 🙂

Back out. This monster is not quite done.

Have you seen the bitcoin today ?

That is the Monster

That is the kind of blow-off.

There is no way to enter

Hi Peter,

Would you consider this as fail or just say that 3rd wave is still not complete.How can we justify after having almost 50 points drop last week and saying we are in 4th wave, then going back and saying no we are in 3rd wave. I am just trying to understand do we have to be this flexible or this is just little abnormal situation.

Thanks and appreciate your inputs, want to see how you handle these situations

Bill

Bill,

Back a couple of weeks ago, my target for the top of wave 3 was 2410 to 2415. That was a fibonacci measurement. The lesson is to pay attention to fibonacci measurements. We eventually get there (once again proven out). This market is a really extreme example (particularly in a corrective market, which we’ve never seen before at the top of a third wave), so this is new territory, as I’ve said many, many times). We appear to have traced out an ending diagonal as the third pattern in a combination (to be confirmed).

So in ES, we’ve ended up 5-6 points higher than the previous high. As an ES trader, you know that’s nothing. My mistake (which I likely won’t repeat again) is to not pay as much attention to Mr. Fibonacci as I should have.

Now, I could be like Elliott Wave International and tell you we’re either going up or going down with each call I give – they do that all the time. I choose not to and I’ve been very vocal about that. If I’m wrong by a few points every once in a very long while (I analyze 10 assets a night and I’m seldom wrong), I’ll take the lumps. Would you rather trade from analysis when someone tells you we’re either going up or down, or would you like analysis that’s wrong less than 5% of the time and you lose 5 points when it is?). At least you know when you’re wrong and how to trade it. Your choice. If you want the former, don’t hang around here. 🙂

Now, I’m not slamming your question, just explaining the background. As I’ve explained over and over, this is a situation nobody has ever seen before: a corrective ending pattern, a 500 year top, and no volume. It’s just plain wacko. If you trade it, it helps to be out-of-your-mind. I can’t ever remember a market like this.

Hope this helps.

Peter, what do you think of the alternative count on this chart? https://4.bp.blogspot.com/-nDNYoLvCaAs/WSTbH8Q_gcI/AAAAAAAAdhY/ZvoL13SJ9A8cu3XVJpfV_staNiakLC9lQCLcB/s1600/Wilshire%2BDaily.png (notice that the primary count is your primary count). Thx!

PS: can you call Fibonacci for me and tell him that if he puts on another prank like this one I would definitely find him (I think he lives -some say lived- somewhere near here 🙂 and have an impolite conversation about his mother 😀

Thanks Peter…Helps understand your mindset which is very important. Its little difficult with options as it has decay. ES would be great with a stop off course.

🙂

Alex

I’m in the Santa Barbara channel off the California coast and phone

Reception in and out . I have to take a longer point of view when I’m working

Because of my work . I have noted on here a few times I am in the early process

Of building an automated trading system . My reasoning for this is two fold .

One is to understand how these algorithm/automated systems work and secondly

It is about putting everything I look at into one organized and very defined rule based

System .

What I do though today is I quantify where the market stands based on everything

This includes price time Elliott wave and indicators . In order for me to take a longer term

Trade I sell myself on where the market sits today . If I can’t make a solid bullish or bearish case

I do not trade .it doesn’t matter if you use a 14 day rsi or bollinger bands or the average true range

Or a pivot system . What matters is that you use a method that keeps you in check .

You have heard this said yet if not , trade by what you see not what you think .

If I can’t make a solid case based on my indicators then I wait for my indicators to line up .

The best set up to sell or sell short is overbought readings on an occilator and an upper extreme

In the 5 day and 10 day advance decline line . I do not use the cumulative advance decline line .

On the buy side I look for lower extremes in the advance decline line and while the 14 day rsi does not always

Go below 30 if it does and it goes below 27 I exit bearish trades and look for a bounce at a minimum .

In other words I trade extremes in my indicators .

Now if I configure all that into an automated system , my own errors in trading will be built into the system

Algorithmic trading system are no different . If you want to beat the algos then you should study them.

Yet Elliott wave theory should also be understood so you understand where the market stands wave wise .

Peter

Hurricane Katrina was an event as well , it happened right before a short term high in the price of oil .

Another odd event was in March of 2000 ,it was the IPO of Palm .

Palm was a spin off from 3com I believe and the day of the Palm ipo , Palm closed with a market value higher

Then it’s parent company . I remember that day very well .

One thing though I could say , the event may not change the trend yet it does seem that the event comes

Closer to the end of the present trend .

Donald trump puts out a best seller at the top and is in bankruptcy court at the bottom

His winning the white house I view as a best seller , what is next doesn’t sound like much fun

Maybe they impeach him near the low of some degree on the downside .????

Last thought on trump

Maybe they impeach him at the top ?

Not going to claim that but who knows

Peter, does the extended count to 2412 in wave 3 make wave 4 steeper?

Hi Charles,

No. But the time it’s taken to get to this target shows me how weak this market is.

Thanks for all your hard work Peter.

🙂

Market may be forming a sort of rounded top and then the final part will be a rapid drop to the low. Under that case we could hang around the top for a while and this should help extend wave 4 for the 10 weeks expected.

The planets are on crack…

not that I blame them…they’re probably looking down at us and thinking “cash me ousside”…

Finally, Finally a top to wave 3 @ES 2416.50!

I hope.

promise me Charles PROOOOMISE MEEEEEE

Based upon PALS ideal time to short is going to be next Tuesday at the open.

(phase post New, distance, post perigee, declination post North, seasonals May- June intramonth transition is weak). Still a Rooster year with incipient tech bubble that has just begun so won’t be shorting much or for much duration.

The max weakness is Friday’s close or Tuesday’s open until 6/11/19. I will probably buy a small short position on Tuesday at open.

Valley, have you ever looked at the midpoint of a Chinese (lunar) calendar year? Interesting turn points.

http://imgur.com/a/Tr4jB

Fascinating, thanks DWL!

12/28/15 was a significant torque high. Add 17 months and we have 5/28/17. Some major cycles have turned this week. That the market doesn’t react instantly does not mean the cycles are wrong. Short term inversions can delay events but only for a short while. 5/28-29 is yet another significant time frame. 6/23 will be a significant low and my cycles tell me that as of Monday we will be on route for 6/23.

So basically the market will turn 5/29. As US markets are closed on Monday we will see a high on Tuesday. 6/1 is another strong day. After this date things will speed up. 6/2 will be a low.

I have one cycle that gives a high 6/15 and then it’s down into august.

5/25 was a very strong day. Add a 4 day inversion window and w have 5/29.

I know; the market takes longer than expected to make the turn. But time is running out. Just a matter of days now.

Think the ultimate low will come 7/7-ish. That would be 100 months from 2009 and 85 years from 1932. And a Bayer rule 17.

Anyway; next week looks weak. Volatility will increase during the week. 5/29 mars opposite Saturn. 5/30 is Bayer rule 36. Rules 17 and 36 are the strongest we have.

Will give some background over the weekend.

Thanks, Andre! Hadn’t considered Mars opposite Saturn, and will look at the Bayer rules.

My site is loading incredibly slowly this morning. Something going on with hosting, I think. Trying to find out why (if you’re experiencing problems).

It is fixed now. The weird stuff I have to go through …

A new post is live: https://worldcyclesinstitute.com/elliott-wave-the-long-term-corrective-scenario/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.