The Man-Made Money Cycle |

Natural cycles very often happen in parallel with cycles that human beings create themselves. If we paid attention to history, we’d realize that we create these same cycles over and over again. After a major economic crash, a cleaning out of the fraud and financial manipulation, of you will, we go about creating the same house-of-cards all over again.

We go from bust to boom and back again.

In the video, I take a rather simplistic look at the route we take to destroying our economy and the lives of innocent people throughout the world, because the basic themes are the same each time. Governments begin by learning lessons from a recent crash and then gradually turn authoritarian, despotic, and end up legalizing (and in many cases, participating in) the fraud that eventually ruins that society.

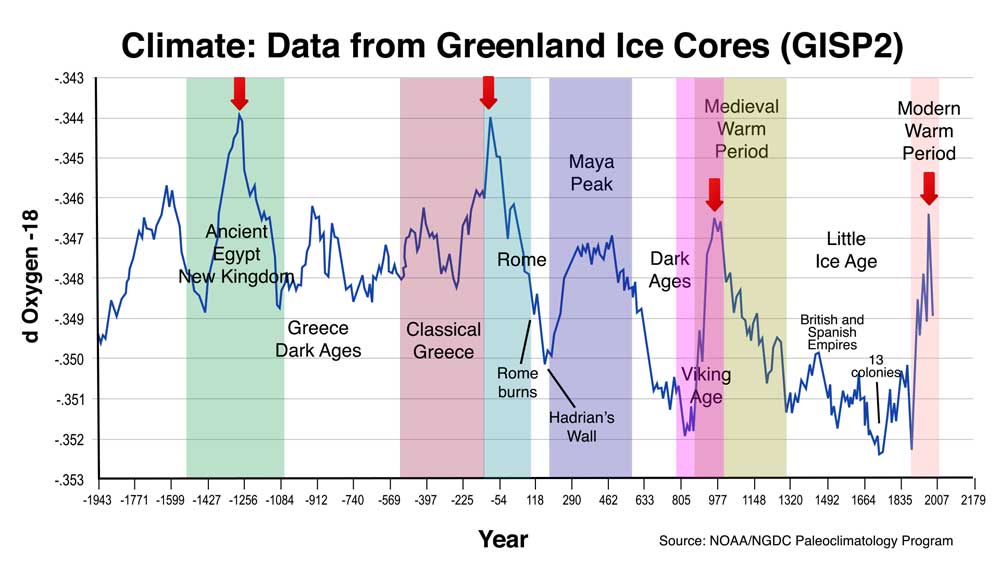

Above is a chart of the climate (the blue line is temperatures on Earth) from 200 BC until today. Every five hundred years, there’s a major cycle that ends in an historic revolution. You can see how the temperature rises as the great civilizations take root and grow to their height. When the temperature turns colder, each civilization starts a downward spiral. (this data comes from the Greenland ice core studies of the 1990s and is not under dispute within the scientific establishment)

The first temperature spike coincided with the pinnacle of Ancient Egypt. It turned colder and we dropped into what we refer to as the Greek Dark Ages. It gradually warmed up and Greece formed, became part of the Roman Empire, and then at the warmest part of the cycle, Rome started a downward trajectory. The revolution at that point involved the coming of Christ.

Following civilizations followed the same pattern—the Mayans, the Vikings and Medieval period and now the United States as the dominant world power. Climate is turning colder and this is all about to change. We’re at the height of another civilization peak (For more information on this, watch my Global Cooling video).

The revolution we’re moving into now will be every bit as powerful as the unravelling of the previous empires. It will make the Great Depression of 1929 look like a little blip on the expansionary radar. The size of the problem matters little to the eventual result. The good news is that after all the pain involved in this major overhaul, we end up with a more democratic world and a better life for you and me. But, it’ll be a long haul to get there.

Governments and banks are the cause of the man-made element of this boom/bust cycle. They get together to create inflation and promote it as a good idea. Well, it’s good for them, not for us.

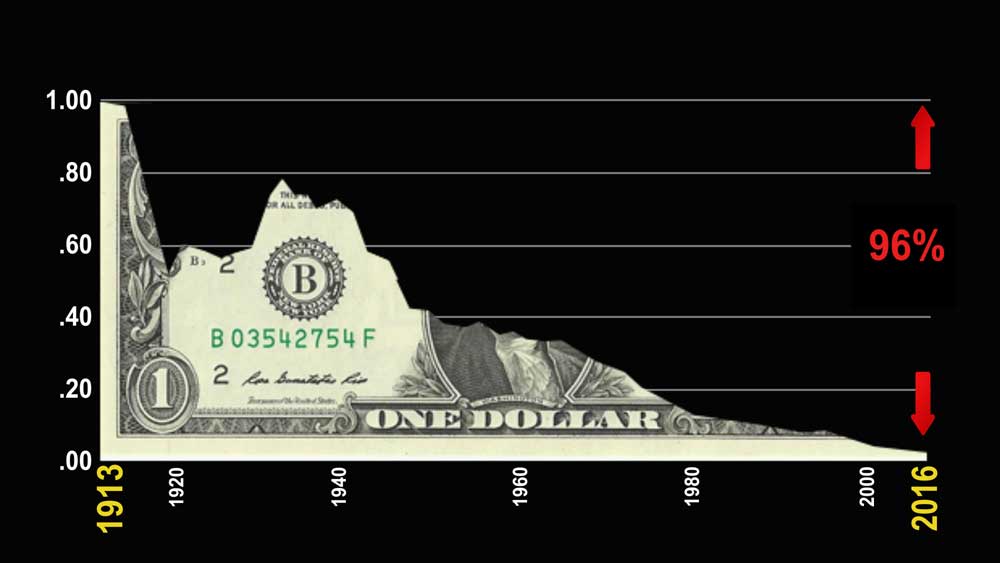

What inflation does is devalue our money. For example, since 1913, the dollar has lost 96% of its value. So, in fact, a 1913 one dollar bill is worth four cents today.

That’s why everything seems to continually get more expensive.Our money is relatively worthless. It takes more dollars every year to buy that new car, for example. Car prices continue to increase, but it’s actually our money that’s becoming worth less.

Likewise, as inflation eats away at the value of the dollar, prices for products and services rise. However, our salaries don’t rise nearly as much (if at all). Our standard of living decreases, as a result. When we attempt to keep the same standard of living, we sink into debt.

Business gets hit in a similar fashion. Costs for raw materials continue to rise. But if companiles raise prices too much, they lose business. So they work on finding less expensive ways to make the same items, or cut back on quality.

While prices go up and quality goes down, your salary virtually stays the same. So you end up going further and further into debt to maintain your lifestyle.

The bottom line is that inflation destroys our economy. It makes us poorer.

Governments love inflation.

When prices go up, the GDP goes up. That’s Gross Domestic Product. That’s like the government’s salary and assets—their net worth. A higher GDP allows them to borrow more money and go further into debt.

And they take full advantage of it. In fact they’ve borrowed so much money, all the G7 countries are bankrupt. Here’s a summary of amounts owed by the G7 countries as of September, 2016 (data from the world debt clock).

| G7 Country | $Trillions |

|---|---|

| Canada | 0.818 |

| France | 2.314 |

| Germany | 2.373 |

| United Kingdom | 2.323 |

| Italy | 2.459 |

| Japan | 8.989 |

| United States | 19.394 |

| Total | 38.668 |

As our money loses its value, we start spending less. We lose confidence in the economy. Businesses start to suffer. They lay off workers, who default on mortgages, which starts to impact banks, and destroys the economy even more. We end up falling into spiralling deflation.

Along the way, governments lower interest rates and make money almost free (like it is today). Those that can afford it bid up homes they can’t really afford. This creates a real estate bubble. People also start to play the stock market. When people eventually start to lose their jobs, the entire house of cards start to fall apart. This leads to a depression.

This cycle gets repeated over and over.

United States Examples of Depressions Fueled by Inflation

Downturn of 1819

- Inflation caused gold and silver to rise in value and along with that was an overall lack of confidence in the economy

- The price of cotton halved (the economic driver in those days) – example of deflation of an asset

- Rapidly growing credit eventually led to banks collapsing due to an overload of debt and a general economic collapse

Panic of 1837 (began in 1835)

- This was the era of substantial frontier land speculation due to easy credit

- Andrew Jackson suddenly tied bank notes to gold and silver (deflationary)

- The resulting run of bank gold and silver created a credit contraction

Downturn of 1857

- We didn’t learn the lesson in 1837—massive land speculation after 1852 reared its ugly head again

- This fueled rapid growth and speculation in railroads (easy credit)

- It resulted in major bank failures and credit contraction.

Downturn of 1873

- Chicago land values increased 500% from 1862

- Railroad expansion across the West created heavy levels of debt

- Led to a sudden stock market collapse and credit freeze, failed banks

Downturn of 1893

- Again, substantial land speculation from an ongoing westward land boom

- It ended in a run on banks due to a sudden contraction in credit

Great Depression of 1933

- The stock market crash began in 1929

- The depression really began with the collapse of real estate prices (1930)

- There had been wild real estate speculation during the 1920s (similar to today)

- In the 1920s, income of the wealthiest rose 75%, while the rest rose only 9%

Recession of 1974

- The highlight of this contraction was the collapse of the US National Bank of San Diego

- Land speculation again had been the norm during the early 70s and this led to extreme levels of debt

Great Recession of 2007

- Sub-prime mortgages, derivatives, and banking failures.

- Extreme real estate speculation in the US. This led to even more extreme levels of debt. Between then and now, not much has changed. Our level of debt has increased, the gap between poor and wealthy is even greater, and the interest rates are so low that money is almost free, which has led to a real estate and stock market bubble.

The Roman Empire

- Over centuries, there was a constant debasement of coinage (inflation). Successive emperors removed more and more silver from coinage. This drastically reduced the value of the currency, just as flooding the market with debt does today.

- Multiple wars, which were paid for through inflation made the gross debt so large that it could not be paid back.

- The eventual financial crisis brought about the demise of the empire. A study of the collapse of the Roman Empire parallels what’s happening in society today.

It’s the same pattern over and over again throughout history. We end up with a rich elite class of about 1% of the population and a servant class of everyone else. It results in a revolution and a financial collapse. It always has. We simply don’t learn anything from history.

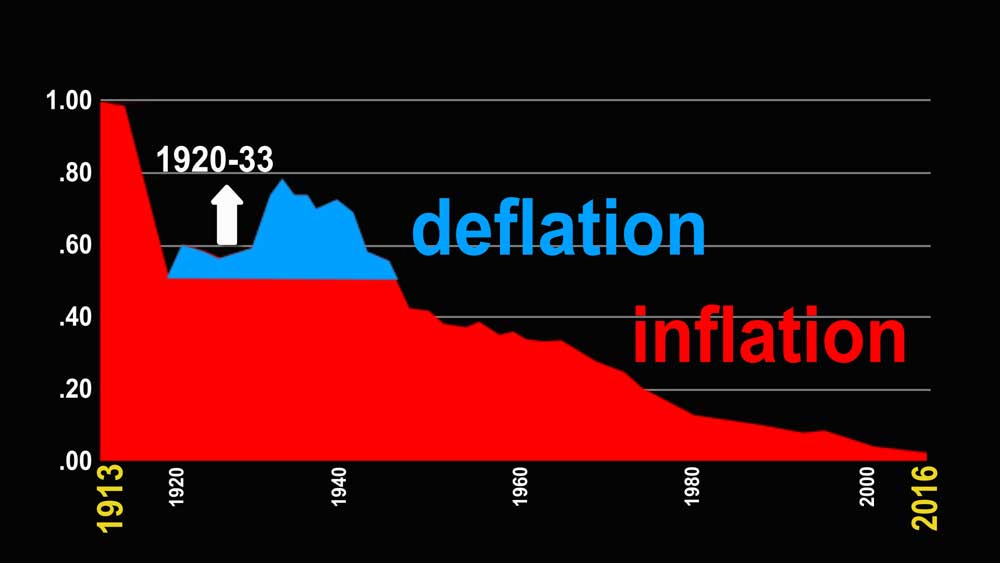

Each crash causes the value of money to reverse in value. We call it “deflation.” That’s what happened after the crash in the 1930s. It’s where our money increases in value.

About 1920, deflation started to rear its ugly head, just it is has this time around (starting around 2008). It wasn’t until the 1929 crash that it really got into its spiralling stage and it lasted until about 1933. The challenge this time is that the debt problem is many more times more pronounced and so the crash is going to be much worse.

Deflation and Debt

It’s important to understand what happens to debt during a deflationary period.

Deflation compounds a debt problem. This can sometimes be a difficult thing to understand if you don’t have a grounding in economics, or finance.

Let’s start with inflation. When we experience inflation, it means that the market is getting flooded with money (usually this is in the form of debt). A financial myth is that banks create money. They don’t. They create debt through mortgages and loans. It puts money into the market, but it also raises debt until that money is paid back.

In an inflationary environment, banks are lending and people are spending that money. As a result, there’s more of it around, but there’s usually a lot more debt, as well. Because the cash is so plentiful, it loses value. When you pay back that debt, you’re paying back your loan with cash of less value. It’s easier to get that money, as there are lots of jobs.

In a deflationary environment, people are losing confidence and holding back their money (this causes less of it to be around in the system) and so it goes up in value. Because money is harder to come by, products and services become cheaper (to get people to part with the few dollars they can get their hands on). What’s really happening in money is gaining in value.

Debt also goes up in value. You’re now paying in back in cash of greater value than when you took out the loan. Money is far dearer, because people are losing jobs, mortgages are failing, etc. Banks also lose confidence in the economy (as mortgages collapse) and start calling in loans. Therefore, in a deflationary environment, you definitely don’t want to be in a large amount of debt.

So What Now?

I would suggest starting by reading about the 1930s to get a sense of what the times were like and what people did to get by. There are some basic things you can do to prepare for the downturn.

You want to be in cash. Cash is king- because cash increases in value. Prices of virtually everything will drop drastically. Your money will buy more products and services at cheaper prices. Prices of homes will drop up to 80%, for example.

You don’t want to be in debt, because debt also increases in value and credit starts to dry up. Banks start to pull in loans.

And you want to learn all you can about deflation.

In the 1930s, great fortunes were made by people who understood the man-made money cycle.

If you don’t, and you’re mortgaged to the hilt with an over-inflated home, or have other debts you can’t pay off, you could end up in financial hot water.

But, if you play this right, it could be the biggest financial opportunity of your life.

an interesting aspect of the size of this top is that the world is now in a position to start a truly global civilization instead of the regional ones that just spread out mostly on land. The current toppling western civilization has spread around the globe unlike any other. The world civilization is already happening, but a lot of rubble has to be swept away first. The 4th turning talks the major event like the Revolutionary War, Civil War, and the great Depression WW2 made significant contributions – individual freedom. ending slavery, and stopping evil. The next big one seems to be a more equitable economic system. 62 people own as much as the lower 50% of the world population. The progression seems to be the advancement of human rights over property rights. An early sign of this was when Several African nations notified the pharmaceutical industry they simply would not recognize patents on anti aid drugs just so the drug companies could make huge profits.

I’m not entirely sure we are in a deflationary economic state at this stage. On a lot of counts we have all the things that a deflationary economy should have; all-time low interest rates, cheap basket goods (consumables) etc. However, scratch a little further into the CPI and re-weight the figures for household insurances (health, house, contents, car etc.) and you will get a different feel for inflation/deflation. It would appear that the G10 are trying to inflate their way out of debt. Keep rates low, let inflation run at 8-9%, play with the CPI and GDP, keep consumerism going, privatise more debt and let the banks keep lending. The end state is the same with the exception of cash being king. The fiat money system is broken so which form of currency is going to have value?