What we’re going through now is a major 1030 (and 515) year cycle top. 515 years is actually the half-cycle. The current pattern unfolding in society is much the same as the top of the Roman Empire and even more like the top of the English Empire at around 1600.

At that time, the economy was in lots of trouble, there was an attack by Spain (the Spanish Armada) that failed, Elizabeth I’s reign as queen was rife with palace intrigue and lots of corruption, and propaganda was at a high.

After all, she had Mary, Queen of Scots sitting on her doorstep for a large part of her reign. Mary was next in line if Elizabeth I bore no children (she didn’t). Elizabeth eventually had Mary (her cousin) beheaded.

Elizabeth I gave a the famous Tilbury Speech eleven days after the Spanish Armada had been defeated and were on their way home. It was supposedly a “big deal” and was done to show her courage, but the war was actually over. it’s not how the speech was portrayed.

Elizabeth I gave a the famous Tilbury Speech eleven days after the Spanish Armada had been defeated and were on their way home. It was supposedly a “big deal” and was done to show her courage, but the war was actually over. it’s not how the speech was portrayed.

But the propaganda went way beyond that. There was also an English Armada that attacked Spain the year after, which was a complete and utter failure on England’s part, and somehow never really made much of a splash in the history books.

At the same time, civil wars were breaking out all over Europe, depressions were the order of the day, and eventually England went through the Glorious Revolution — a bloodless revolution, in 1688.

For my video on Fibonacci Numbers (the Numbers of Nature),

go here (The Only Number that Matters).

We’re going through a very similar period at the moment, with the US in a cyber war and other western countries fighting for freedom. You can see this in Canada, the UK, Australia, Germany, and others. The period will result in civil wars across the G7 countries and beyond.

It’s the biblical clash between good and evil, pitting the oligarchs (the elites) and central bankers (and China, as well) against the 99%. It’s fight for democracy over socialism, and it’s playing out most clearly in the United States. The next month and a half are going to be decisive.

As well as this fight against the central bankers (and China), we have a financial system on the brink of a crash. There’s no way out of the situation, unless we go through a dbt jubilee (and there may be one in the wings). If you’re interested in the debt jubilee possibility, look up NESARA GESARA.

I don’t see how a debt jubilee is going to happen before we have a market crash, because I’m expecting a few years of relative chaos before the current situation finds some stability. It’s important for people to wake up and understand that life is not going back to what it was before 2020. It’s time to get prepared for the topping of this cycle and the depression that is most certainly on the horizon.

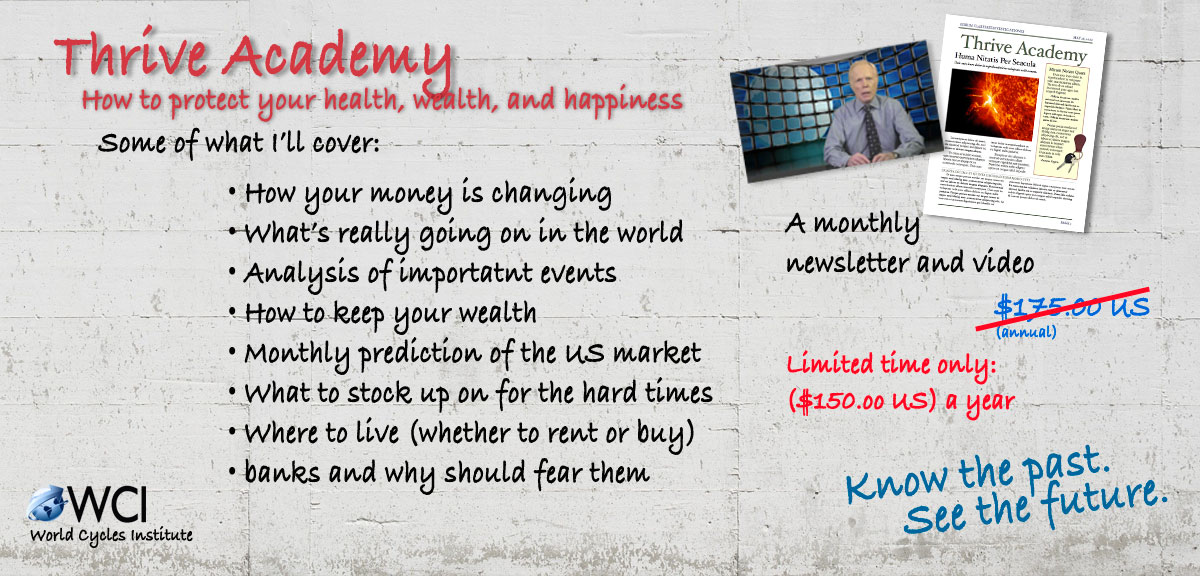

That’s why I’ve set up the “Thrive Academy” site at thetruthsage.com. It puts out a monthly newsletter as well as lots of information about what’s really going on in the world, information I can’t put out on public Youtube, because it will be taken down.

For more information, you can head over thetruthsage.com.

Normalcy bias is one of your greatest challenges to overcome especially when turbulent times are approaching. A simple excercise I practice is think the unimaginable then use a “What if, then what” analysis. From there, you can begin to build a plan to acquire needed resources and, most importantly, understand what mental state you might be in at the time. Remember, fear will quickly overcome and consume most people.

I don’t see how the US dollar can increase in value, unless it first collapses . The exponential growth in the number of dollars being printed into existence by definition reduces their value. Dollars are just a barter item, when scarce, their value rises and when plentiful their value drops. They are currently being created by the trillions. Therefore Elliot Wave cannot be applied to this commodity that is continuously being created with no restraint. No more than you can apply EW to the volume and flow of water in a river.

I can’t imagine why anyone would try to use the Elliott Wave Principle on the volume and flow of water in a river. I’d advise against that … lol.

It is certainly true that the dollar increasing in value may at first blush appear counter-intuitive, but not if we are headed for a deflationary cycle. People forget the vast majority of the world’s debt is dollar-denominated, and will most likely be defaulted on. Debt default equals dollar destruction. Fewer dollars means the ones remaining become more valuable.