NOTE: I’ve been having some technical challenges getting these posts to go out to subscribers. Hopefully, that’s fixed now, although this one will end up going out later than it should have – Peter

Well, here’s another “ridiculous count,” as someone on solarcycles.net called my previous entry …

It might be ridiculous, but so far, it’s been right (let’s hope it stays that way …).

The chart above is the 2 hour DOW at the end of today (Wednesday) with my Elliott wave count. The second wave appears to have topped after 5 subwaves up. You’ll get a better look at that count in a chart of the ES (SP500 e-mini futures) below. I suspect we head down tomorrow, as well. This should be wave 3 and the target is just about the $17,000 mark in the DOW.

The chart above is the two hour NYSE showing a similar count. Both indices completed an ending diagonal (the end is marked with a ‘5.’ We should continue down Thursday in a third wave—the target is denoted by the lower horizontal line (SPY has a similar count, even though it almost went to a new market high).

I note that the euro and pound also seem to have topped and are both retracing in a second wave tonight. Everything seems to be lining up for the convoy south.

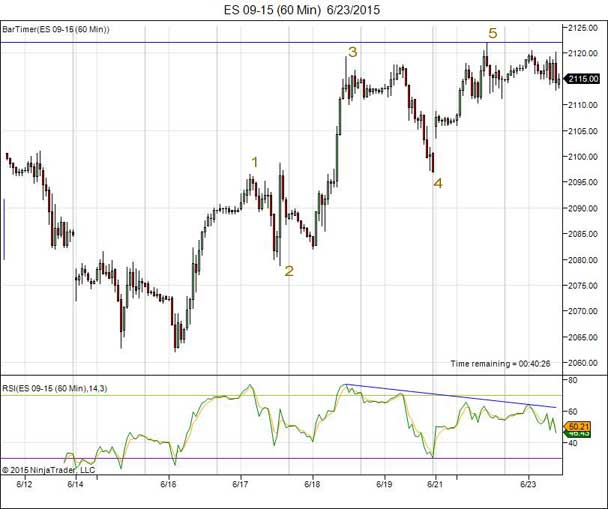

Above is the ES e-mini chart from last night. This shows very clearly the five waves up. Five waves, as the last wave of a flat (an a-b-c configuration in which the subwaves are 3-3-5) denote a trend change. You can also see the divergence in the RSI was quite pronounced, signalling a downturn was eminent.

It looks like the market will choose a new direction when the Greek deal is done….they fight like cats ,just like the democrats en republicans over the budget in the end of 2013..

So maybe when the deal is closed ?

In Holland we have an old saying “the possession of the deal is the end of the play” so maybe than we will see a sell off?

Bradley makes its biggest turn June 27/28 but it can be an up or down move

Well, thankfully, that isn’t the case, as we now seem to be heading down quite nicely. My posts haven’t been getting out on schedule, so hopefully I’ve fixed that problem as of a few minutes ago.

Thanks that would be nice

We sure are living in interesting times can you imagne a plane filled with euro’s that flies to Greece every day to fill the banks and prevent a collapse!

I think Stan Harley has a point a soon as the media hype is over about Greece thinks can go down verry rapidly.

http://www.equities.com/editors-desk/investing-strategies/technical-analysis/the-long-awaited-nasdaq-high-arrived

That’s a cool chart Stan has showing the Nasdaq cycles. Thanks the posting. I’m expecting the US indices to continue down … SP to about 2068 before a bounce into a second wave. Usually the first wave of the third is the same length as the higher degree first wave. I’ll post last this aft as I’m trying to take off to the mountains at the end of the day.

There’s an article this morning on zerohedge about the province I live in falling apart. http://www.zerohedge.com/news/2015-06-26/mourning-malinvestment-canadas-oil-patch-confidence-crashes

It is, but nobody “gets it” yet. We just voted in an NDP government (labour) so that everyone will be “taken care of.” From bad to worse. I find the psychology fascinating, which brings up Robert Prechter’s great work in Socionomics.

Have a great weekend, John!

No thanks,

It is fun to share the information to share is to multiply is my way to do things ,I will read the article later.

I m still recovering from a heavy burnout so excuse me for my english from time to time

My focus and concentration is getting better but still not 100%.

I think monday we will see a bounce in Europe /US and from there on I will short the market.

Have a nice time in the mountains it’s a pity we don’t have them in Holland.

John.