Update Wednesday Evening: Today we climbed a bit above my 62% target at 2106 in the SP500 (we’re at about 68%). That’s typical for a second wave as part of the first wave sequence. That’s because this is still a very bullish market and it takes time to change the herd’s thinking. The up wave in all the major indices is an abc and so must completely retrace. I count 5 waves up in the c wave, but it may not be quite complete. We may need a little more to the upside on Thursday.

At this point in the motive wave projection, I rely very little on cycles. Cycles are great at tops and bottoms of beginning waves (ie—to help you with timing a market top), but there’s nothing like Elliott Waves (if you know you to read them, which takes years) to provide an accurate price path.

At this point in the motive wave projection, I rely very little on cycles. Cycles are great at tops and bottoms of beginning waves (ie—to help you with timing a market top), but there’s nothing like Elliott Waves (if you know you to read them, which takes years) to provide an accurate price path.

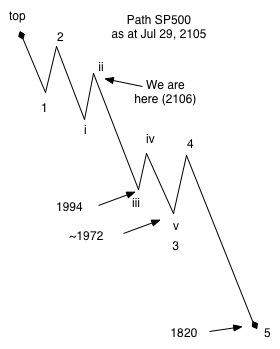

So here’s the path for the next few weeks. This may change slightly (in terms of the projected SP500 price levels), but I’ll update those as we go.

Wave 1 and wave i are typically the same length. Wave three of three (the one we’re entering now, is typically 1.618 times the length of wave i (or 1 in this case). There will be a small wave v at the tail end of this full third wave. Next, we’ll bounce about 38% in wave 4, which should bring us about even with the previous 4th wave (iv on the chart). The final wave down (wave 5) should also be 1.618 times the length of wave i (or 1 in this case).

Wave 3 and 5 could extend, but these extensions will likely be a multiple of phi (2.618, for example).

The entire sequence should end up at about the previous fourth wave of the final wave up (bottomed in mid October last year), which is about 1820 in the SP500. Following that, a large bounce should take us into the September/October timeframe.

The other indices will follow along. Because this is such a strong motive sequence, you’re going to find a lot of stocks moving in tandem.

Here’s a 4H chart of the SP500 (as of today) showing the expected end wave levels (horizontal lines), along with the final target (circled previous fourth wave) as per my projection above.

Really enjoy reading your analysis Peter… learn something new every time.

Thanks, Joel!

Thanks for your quick reaction Peter,

I think the summer storm we have had caused some delay lol…

Again it looks verry promising it is in line with the spiral from Peggy but not in the view Valley has…

But it will be very exciting to watch..

Good luck to all..

Peter,

One more question so the complete move down is possible in 2 or 3 weeks?

Roughly, yes. This is where cycles or planetary info comes in. I’m figuring first or second week of August. These waves down will likely be swift. Third waves usually are.

I think André has it pretty well nailed.

Well,

I posted this link before :http://www.marketwatch.com/story/this-ominous-chart-pattern-warns-of-selloff-in-bank-stocks-2015-07-24?siteid=nbsh

Maybe it’s a good guide the september top 19 Sept 2014 – bottom Okt 15 oktober 2014..

So if history rhyms… bottom August 15/16 like Valley predicts the Venus…..

Peter!

Thanks for the analysis again, really cool to read everytime! 🙂

@John, I don’t know this Peggy Spiral thing… Is it accurate most of the time or? And what about Valley? I got the feeling is spot on a lot of times, but I have not been reading the solar website that long…

Greetings,

W

PS: @André, see the old post, I hope you can still give me some hints. ^^

Bit busy at the moment; Sunday I’ll try to post a road map for August.

Cheers,

André

NP André! I just hope you will respond to my questions, but take your time! 😉

I am looking forward to your roadmap as well! 🙂

Greetings,

W

The waiting game again, my best guess is friday/monday we will start a new decline for now we will top again SPX 2010.

I agree with you John! I am short till 3-7 August?

Greetings,

W

I will short more august 3 …the show has to start from there…

goodluck…

It’s a waiting game now. We really didn’t go anywhere today. I think we’re all bulled-out – maybe a small pop of a dollar or two tomorrow. I expected the small rise today, but thought we’d roll over sooner.

Peter,

I think the bradley can be a good guide it shows an important turn august 3 (helio and Geo) .

It’s showing downward steps in to the basement of Oktober

If the DJTr shows the way it will be in smaller steps and not a crash… only God nows…

Sunday a lot more on this, but for now I can confirm 8/3 is massive cit and the start of the slide; at least into 8/18. I’ll be back 😉

WHIHAHOEEEEEEEEEEE! 🙂 Let’s go down whoehoe!!! 😛

Cheers,

W

Oke Arnie,

That’s an exact hitpoint in the Mercurius longitude cycle and turbo cycles.

In between points are August 5 and 10..

Cheers.

Let’s hope we are lucky…

John,

For the check, you also think that August 5 (my system got a time turnpoint as well on August 5), may be a little turn up? So this means 6-10 August up a little and down from 11 August to xxx (19 August my system says).

I think André can tell acknowledge this (as far as I read), I am dieing to read his analysis, haha! 🙂

Looking forward to your answer John!

Gegroet,

W

I have a lot to share, so I’ll do it in several post. Now the big picture as preparation. What did the market do last week? Previously, I said July 28 showed a severe weakening of trend force (astro). A very typical market response was to go up as if this could make it all go away. This reversal was supported by the moon entering earths magneto tail (caused by the sun) 7/28. The moon takes 6 days to travel through this tail and will exit 8/3. This move was utterly irrelevant to the big picture. Next week we turn down again in sync with the natural cycles. This should make things more volatile. Friday we already saw big pops in Gold and the eur/usd. This is only the beginning. Tomorrow details and confirmation. Peter is right; the 3rd of the 3rd is near. Very near.

http://www.nasa.gov/topics/moonmars/features/magnetotail_080416.html

Cheers,

André

Long term; the things I’ve said :

1) 7/20 most significant Gann masterdate of the year, calculated from the very significant 2007/2009 turns.

2) Long term lunar cycle peaked December 2014 and will be down several years. Basically, markets have gone nowhere this year; QED.

3) Very long term astro cycle turned down early 2014.

4) My 19 year cycle peaked June 2015. The worldwide QE-craze – with world debt spiraling out of control – is a very typical W5 thing, if you understand the character of waves. This is the reason the FED can’t raise interest rates. Not now, not ever, until we have seen a system reset in a period of creative destruction.

Stay tuned; there is more.

Before I expose you to my own little analysis, I want to show what analysts with more credibility than me are saying.

1) A Puetz crash window opens 6 weeks before the September solar eclipse. That would be 8/2.

2)The DeMark TD timing tool gave a ’13’ sell signal on the USD 7/31.

3) Raymond Merriman in his latest book says that the moon at worldpoint with the sun in Leo is correlates with strong reversals. That would be 8/4.

Pretty amazing how 3 very different techniques from 3 famous analysts basically confirm what I will tell you tomorrow 😉

P.s. Have been thinking about including Peter in the list of famous analysts. What really matters; Peters EW count is a fourth technique that is in sync with what’s stated above.

Thanks for sharing the information Andre very interesting

I agree that the Fed never is able to raise rates it’s a fake confidence trick but you can manipulate nature till a certain point until nature takes over..

I m looking forward reading your research..

And for Peter I would love to read your E.W. counts again.

Have a good weekend.

John.

For completeness I should add that the solar eclipse creates 2 windows : august 2-9 and October 18-25.

You may have noticed that the 9/27 supermoon that I mention below is the same date as the lunar eclipse. I have to research this but my gut tells me this is special. Another thing is that in the 2014 decline the lunar eclipse came before the solar. This time it comes after. This could indicate the decline this year will be deeper.

First post. Thank you for this awesome website and analysis. I want to believe the real crash starts very soon but have you seen AAII sentiment? extreme readings in june and this week, that are typical for a LOW… Also check Fear and Greed CNBC Index. Definitely a lot of skepticism in the market. So, I think that before breaking 2040 SP support, the market is going to break 2135 resistance, attracts more reteil money and then finally crash. Maybe final TOP at the end of august/beginning of september. This is John Hussman scenario and also what EURUSD COTs are predicting… What do you think?

Ricardo,

Welcome, thanks for your post and the kind words. I certainly can’t rule out your scenario. In fact, I’m half expecting a double top on this current wave at SP 2114 or so. However the wave structure from an Elliott wave perspective looks complete to me (or almost so) so I don’t expect much more of an upward movement. Cycles are negative, and a lot of technical indicators similarly. Of course, there are always surprises and this market doesn’t want to give up. We’ll see this week.

I want to treat this one separately as there is a lot to talk about. It concerns the full moon cycle. Although I know of no other analyst that uses this, it is a major cycle. This cycle gives the frequency of synchronization between the 27,5 day apogee cycle and the 29,5 day lunation cycle. This cycle handles the major supermoons (i.e. full moon at perigee).

The cycle takes 411.78 days and the last exact match between full moon and perigee was 8/12/14. Sure enough we see the next one 9/28/15. 16 full moon cycles create the Saros cycle that is used to predict eclipses. See how fundamental this is?

Anyway, when I apply the lunar based Delta technique to this anchor-date 8/1 shows up as a major itd/mtd date. The std gives 7/30 and 8/3.

Cheers,

André

Interesting read:

http://www.elliottwaveanalytics.com/2015/08/expert-that-correctly-called-last-two-stock-market-crashes-now-predicting-another/

Just another confirmation of what we already know and Peter has been saying for some time. But I like confirmation. No, I love it.

Only after I posted it, it dawned on me. Feels like a eureka moment. Every lunar eclipse requires a full moon, but:

a) not every full moon is a supermoon

b) not every supermoon kicks off a new 412 day cycle.

And this coincides with:

– the sun conjunct the node (mother of all moon wobbles)

– the sun changing sign

– mars changing sign

– Pluto turning direct

– Mercury conjunct the sun a few days later

– Heliocentric Jupiter/Saturn square exact.

The lunar eclipse is at 4 degree in Aries, the worldpoint, a new beginning.

Very explosive mix that illustrates that this year’s major decline will be very unlike last year. This makes total sense as last years decline was a retracement in an up trend (lunar cycle up into december). This year we will experience what it means to decline in a downtrend. Astrologer Richard Nolle identified 8 intense periods this year with ‘violent mass conflict’ created by mars alignments. One of the periods is 9/19 until 9/30 with midpoint 9/24, the exact date of the sun/node conjunction.

The previous period he gave was 7-11 until 7-30. Midpoint 7/20. We know what happened then.

What this means? After the August decline that I will show in my August road-map tomorrow, I expect a pull back up to test 9/24-ish, after which all hell breaks loose into early 2016 – for starters. This all makes sense to you?

Cheers,

André

Yup, sounds good. My projection hasn’t changed. I will post the 1929 crash chart this weekend, if I can find it, and it can act as a guide. You can also look at China recently. When the market comes down, it always does so in a similar manner. In other words, the waves infold in their typical pattern with the same fibonacci ratios. Phi (.618) and the reciprocal (.382) are the important fib ratios going forward.

This first set of 5 waves down will be quite tame compared to the second set in the fall (Sept/Oct).

I expect to see follow-through on Monday of this third wave 🙂

Andre,

I wonder do you still have time to sleep?

It still looks very promissing again.

So let’s first see how monday plays out..

After that Valley wants to sell the shorts again on August 5 ( maybe that will change)

And Peggy expects a bottom on August 10-13..

Cheers

I also will keep my eye on this I posted it before..

But if it works again the first decline should begin (beginning of august) and the bigger one starting somewhere in September al the way in oktober till beginning of next year..

http://time-price-research-astrofin.blogspot.nl/2015/06/tom-mcclellan-major-market-peak-in_23.html

August road-map.

Yesterday I showed you why September 24th is such an important date, and that I expect the market to test it.

With a high 8/3 and a high 9/24 we need a low in between. But it wasn’t easy finding the low in August. But Peter inspired me yesterday with his remark on 0.618 and 0.382. And now it all makes sense.

a) My Gann timing tool says that 9/4 is a major date. This is very close to the Super Full Moon 8/30 with the magneto-tail exit 9/3.

b) The overall trend is down – see above – so down moves should last longer than up moves.

c) From 8/3 until 9/24 is 52 days. 61.8% of 52 = 32. 8/3+32=9/4.

So, 8/3 high, 9/4 low, 9/24 high and then down again. The 9/24 high is close to the anniversary of the sept 2014 high. In October we have a Puetz crash window (see above) in the week from 18-25 of october; this will speed up the decline.

All we have to do now is fit the 5 waves in the 32 day decline period. August 14 we see a New Moon conjunct Venus. This will create a tidal pull on the sun affecting IMF. This should give a high.

8/7 will be an anniversary of the August 2014 low. 8/18 we see Lunar apogee, and earth and Mars changing signs and 8/19 is 90 degrees from the 5/20 high.

8/24-8/25 we have a heliocentric configuration with mercury translating the Jupiter/Saturn square. 8/26 we have the Sun conjunct Jupiter (geocentric) at 3 degrees Virgo. See : https://astrologyforganntraders.wordpress.com/

Summary :

1) High 7/31 – 8/3

2) down into 8/7 – 8/10 weekend

3) Up into New Moon conjunct Venus 8/14

4) Down into 8/18 – 8/19

5) Up again into 8/24-8/25 again

6) Down into 9/4.

I have so many more reasons to pick these dates but I posted too much already. So I’ll stop now.

Cheers,

André

AWESOME analysis, whiha! 🙂

Looking at my own system I would have said:

– down till aug 7

Next turninng points are (I miss the knowledge from Astro to tell the direction):

11 aug / 19 aug / 26 aug / 4 sep / 17 sep / 28 sep

Let’s work on my Astro first right! 😉

All I know is that this year is the transition from bull- to bearmarket! If you ask me, a clear blow off phase… I thought the bearmarket would start in 2014, but I did not have the right tools back than. 😉

Cheers,

W

Very Nice work Andre many thanks..

I m watching the Mercurius chart maximum E long west and east and conjunct Sun..

It has so many hits in tops and bottoms 2014/15..

September 4 is also a date….and the one’s before that Juli 23/June24/may 29/ etc…

These were all tops but before those dates I have spotted a lot of bottoms so the chance that this one will mark a bottom of the first wave down is very possible in my opinion..

After that we have Sept 30 ,Okt 15 and Nov 17..

Cheers…

@ whazzup (finally)

I started from scratch and learned most from my mistakes. There are so many knowitalls out there, all saying different things. So your question is wrong; reading other people in hopes of finding the holy grail is futile.

Most important lesson I learned (like that’s important!) is to look for confirmation. There simply isn’t – imho – one single technique that will do it all. Think Peter agrees on that.

If you want to read a book, read Merriman. In the mean time I will keep sharing what I learned.

Guess this was not the answer you were looking for but this is the truth (my truth ;-))

Cheers,

André

Hey André!

This was exactly what I was looking for, thanks! So I could read Merriman, good to know! Just for basics I guess than. 😉 On the solarcycles blog, valley also gave me a cool url about planets. 🙂

And yes I agree that there is no 1 true system. It is trying to align signals from different things (moon/planets/indicators/price action/volume/volatility/cycles/etcetera).

Please keep sharing, because something tells me you will be almost spot on! 😉

Last question: which Merriman books should I read before I start spending a lot of $$$ on the wrong stuff…?

Thanks again André, and keep up the good work mate! 🙂

Cheers,

W

If I was going to buy one of his books it would be the last one on solunar correlations. Above I gave you an example with sun in Leo and moon in Aries. I like this more as I am focussing on the inner planets for timing. The Uranus/pluto square is great but lingers for years; not relevant for next week. Mercury/Venus/Mars/Sun/Moon; that’s 90% of the work.

Example? 7/20 had Venus at 16 degrees. 9/4 (the low I gave you) has Venus at ……16 degrees; you guessed it. I would advise you to download both the heliocentric and geocentric ephemeris. So much to learn from that. And download Astrolog32; free tools but very advanced.

Cheers.

P.s. Richard Nolle has posted his August forecast and confirms (duh..) my early September low.

http://www.astro.com/swisseph/swephinfo_e.htm

http://www.astropro.com/forecast/predict/2015-08.html

So that you all understand what’s happening :

1) From the 2000 high to the 2007 high took 3*919 cd. From 2007 high + 3*919cd = 4/29/15. Some European markets made the high 4/27/15.

2) From the 2002 low to the 2009 low took 2340 cd or 20*117. From 2009 low + 2340cd=8/3/15.

The midpoint between 4/29 and 8/3 = 6/16; the top of my 19 year cycle. 177 squared cd’s from 1929 top gives 6/13; too close for comfort.

See? 8/3 is not just any day; it is the start of a new 2340cd cycle. Adding 10*117 to 8/3 gives 10/16/18. Adding 919cd to 4/29/15 gives 11/3/17. These are the real boundaries of where the multi year low should come. My longterm lunar cycle gives end of 2017/mid 2018. Nice!

P.s.

My Dewey algorithm gives 9/4/18 as first date after 7/6/15. Coincidence?

Would be really nice to see Peters analysis on 1929 and how that reflects on 2015. Gann’s financial table says 2015 should be a panic year.

New post up … 🙂