Update: Thursday, mid morning, Sept 24

Here’s the expected path for the second wave in ES.

The second wave will go up in 3 waves. It’s the same ABC configuration across the indices. Often, these will be waves of equal length. The A wave typically retraces once it reaches the previous 4th wave, in this case 1942. The C wave will finish the job ending at approx. 1970. We also could have a larger B retrace, where the C wave will end up 1.618 times the length of the A wave.

_________________________________

Update: Thursday Morning pre-market Sept 24

This morning the ES (Sp500 futures) formed a triangle of some sort and has continued down. So the conclusion is that this is a first wave and that it is going to conclude today. I can see triangles on each of the cash indices, although they’re not all that well formed. Triangles are waves in 3.

Here is the SP500 (above). The problem has been that the wave is not long enough and is missing a pronounced first and second wave. If we do one more leg down, this should finish up the first wave and lead to a bounce.

It looks like we have a fourth wave triangle forming (the fourth wave of the fifth (of the first wave down). Triangles signal the end of the wave is near. If we continue down past 1911, then something else is happening and the labelling would need to change, but if this triangle heads down this morning, that should signal the end of the wave is near. More to come when we see how today unfolds.

In terms of the expected length, you typically measure the first three waves and the fibonacci extension from the bottom of the third wave denotes the usual length of the entire wave. You can see the 100% measure at wave 3 and the extension down to wave 5 at 161.8.

The ES looks now to have completed a fourth wave triangle. A triangle in the fourth wave position signals an end of the wave is near at hand. Once the 5th wave finishes, we should bounce in a large second wave. I measure an end to this wave of from about 1903 – 1894.

_________________________________

Update: Wednesday AM Sept 23 before the bell: My recommendation is to let the market play its hand. I’m standing aside until I get more information. I am doubtful that this wave down is a motive wave, so we may be heading back to 2020 SPX. It’s too hard to say at the moment.

Last night, the SPX came down hard but did not bottom properly and set off in a rally almost immediately. The eurodollar has been all over the place all night long. I’d wait until things settle down and we can figure out whether this wave is corrective (which I believe it is) or motive.

Regarding this morning’s action: I count five waves up in last night’s wave – a motive wave. It’s been following this morning by a second wave (3 waves down to 62%). As I write this, we’re forming a second wave down (a corrective wave), which suggests to me a very large third wave up to come. The double pronged second wave is in the futures. Cash just has a second wave forming after 5 waves up.

Five waves up at this point also suggests to me that we’ll trace out a finishing wave with a double top. Not certain, that’s just what is suggested by what I’m seeing.

Chart updated after market close Wednesday, Sept 23 (double click for full size). Note that if we only finish the third wave at 1970, (1) would become A and (2) would become B, reflecting a corrective wave (and 3 would become C).

_____________________________________

Original Post, Sept 19

An important phrase that I learned from a long-time highly successful professional trader is:

Trade what you see, not what you think.

I come back to this phrase every time I have doubts about what’s going on in the markets and it always keeps me safe.

I see many traders quite often suggest what they “think” the market is going to do. That’s inherent bias. It often clouds the mind and destroys any objective view of the markets you might otherwise have. I refer to it as “noise” and I try to stay away from these types of conjectures. It’s important for me to stay as objective as possible and listen intently to what the market is telling me to do.

Thankfully, the Elliott Wave Principle itself helps keep me safe. Because the way I use Elliott Wave, I know almost immediately when my count is wrong. On Friday, mid-way through the day, the red lights went on. The market did what I didn’t expect, destroyed my count and gave a warning to “get out!” Today I’ll explain what happened and why this tool is so valuable.

Secondly, we’ll go through the forecast and why, using what we learned Friday and what a cycles analysis is projecting. It’s a compelling story.

Bottom Line: Friday was a pivotal day. By the end of the day, the market had come down in 3 waves, in all indices and the ES (futures). Waves in 3 retrace. This means the next short-term move is to the top of the current wave down. We’re very close to a longer-term top and a dramatic drop. The key is to wait for the signal. I would expect it sometime within the next ten trading days.

The Short Term Wave Structure

Above is a 15 minute chart of the SP500 to show the action from Friday. We had a turn down on Thursday from ‘C’ to ‘a’ and a continuation on Friday. The first wave down on Thursday looked motive, from an Elliott Wave perspective. However, EW rules call for a 62% retrace in wave 2 that would have had to turn up from ‘a’ to the line marked ‘62%’, and then a turn down into a 3rd wave. That didn’t happen.

Everything was fine until the market went to a new low from the top of ‘b.’ It stopped right at the channel trendline, at ‘c.’ As a result, we ended up with no second wave and a three wave move down, which is a corrective pattern. So, the result is that we’re going back up to the top of this wave, at the very least.

The blue trendline helps to show the ending diagonal pattern that had developed on Thursday. An ending diagonal is a triangle of 5 waves that ends in a sharp wave (in 3 waves) that reverses dramatically. Often however, this ending wave requires a final test before the market moves in the new direction (down, in this case). So one option is that the upcoming wave up moves up to test the top at 2020.86 and then reverses to the downside.

The Longer Term Forecast

Above is a one hour chart of the SP500, showing the bigger picture. Given that we’re going back up to the top of this wave, it would be nice to know if we’re going to stop there or move even higher. I don’t have the answer to that question, but I do have an indicator that will give a very good clue.

An ending wave (one that is going to stop at 2020.86) must go up in 5 waves. If you see 5 waves up, it will likely stop and reverse at the top of the wave. If it’s only 3 waves or some other pattern and moves up past the end of the wave, it’s likely going to continue. This would create the option that we could be tracing out a larger degree, double pronged 2nd wave. In that case, we could see this wave continue up to about 2095.00, before rolling over. The effect of a double pronged second wave like this would result in the next wave being wave 3, leading to a very much bigger downside than if we were in wave 4.

This brings us to the current count, because on Thursday after the Fed meeting, the indices (DOW, SP500, and NYSE) all retraced to the 62% level and retraced. Technically, we could be seeing a second wave top. However, there’s no rule that says this isn’t a 4th wave that has retraced to a very high level. For the moment, I’m leaving the count as a 4th wave, and we’ll consider the count again, once we see what the next wave up has to offer.

The key thing here is that the larger wave up from ‘3’ is a corrective wave and so we should not go to a new high. (The wave would have to be in 5 waves—an ending wave—to end in a double market top. Plus we’ve experienced ending diagonals on most of the indices, with double tops already. So the big top is in.)

In summary, we’re looking for a double top at 2020.28, otherwise we’ll look to other options (if we go above this level).

In terms of timeframes, there are a number of factors, some of which I’ll mention below that suggest September 28 may be a very important date and could result in a major turn.

Above is a one hour chart of the NYSE. This index didn’t quite make the 62% retrace level (it didn’t miss by much). This suggests that it may go slightly above the top of Thursday’s wave top. The three wave corrective pattern from ‘3’ up is even more obvious in this index. The DOW is similar to the SP500 chart.

Above is a one hour chart of the Nasdaq. The difference here (as I mentioned last week) is that the Nasdaq has retraced to an even higher level and has touched the 76% fibonacci level, another key Elliott Wave level. If it rises above this level, there’s a better chance it will retrace to a double second wave configuration, which could take it to about 5090 before turning and heading down. This would set the next wave down as a third wave. Again, this would lead to a much bigger downside.

I had mentioned the possibility that the Nasdaq was in a second wave last week. It has now wandered into the area of the first wave of the second wave, which makes it more probable that this wave is in a second wave position. I have labelled it with a question mark.

The same short term prognosis is in play here. On Friday, the Nasdaq came down in three waves, so we’re going to head up to the top of Thursday’s wave. We’ll see what happens once we get there.

Above is the Friday chart of the currency pair, eurdollar. I look to this as the “canary in the coal mine” at the moment. It’s clearly in a countertrend move and getting very close to the 38% retrace level (the horizontal line) from a first wave down. I would expect it to touch this level. This would be a major event, as the US dollar determines much of the movement of the markets (being the reserve currency) and a turn here may be the trigger for the turn down in the US indices. I’ll be watching it even more closely over the next week or two.

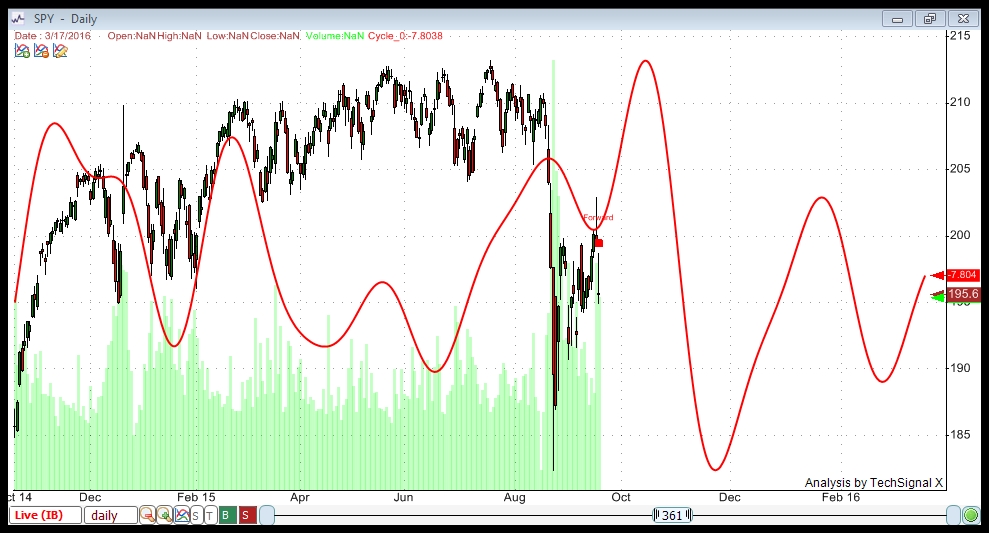

Cycles Analysis

This is the first of two cycles analysis I ran. I’m using data going back to 2002 for both these charts. The software analyses all the data and finds all the cycles inherent in this asset. I chose the top eight cycles that it returned based upon returns in profit (if these cycles had been traded both long and short, from bottoms and tops, over the past 13 years). Cycles repeat and so the past is a good indication of the future. This chart combines all the cycles found to provide a compilation wave. You can see how close-fitting it has been in the recent past. The fit with the current wave is quite stunning and therefore, something to pay attention to.

This analysis suggests a relatively strong positive bias to about October 1.

The second cycle I ran is the same as the first from a dataset perspective. This analysis focuses on percentage wins, playing both sides of the cycles. I used only the top 8 cycles (higher percentage win results) to result in a compilation wave. Choosing only the top cycles historically for this asset should provide a better forecast. The result is for a countertrend wave high into October. It is consistent with the first cycle analysis (net profit).

However, I note that the April through August time period shows a market with a possible inverse relationship to the cycle. That sometimes happens in cycles analysis. Therefore, there is a possibility that an inverse wave here (flipping the cycle vertically) suggests a turn down in the very near future, ending mid October. That would be in sync with the first cycles analysis I ran.

______________________________________

The Panic Phase and the TPD (Turning Point Distribution) Principle

The TPD Principle describes a period in time of several weeks in which an array of cycles congregate, including gravitational, geomagnetic, and nuclear. It’s around this time that markets have historically topped. I was asked to include a reference to this in today’s blog post, which I’m happy to do. This principle generally refers to market tops (which we’ve already seen on May 20, 2015), but it’s interesting to note how many astro events we have occurring over the weeks surrounding the upcoming major turn in the market.

In his book, “the Universal Cycle Theory,” Stephen Puetz writes, “The TPD principle involves the eclipse cycle as well. The eclipse cycle normally peaks on the first new moon before a solar eclipse. Following that reversal point, it takes six weeks for sentiment to shift from euphoria to panic. Then on the first full moon after a solar eclipse, a panic-phase begins. A panic phase usually last two weeks—ending at the time of the next new moon.”

The dates:

Aug 14 , 2015 – First New Moon before the Eclipse (there is a New Moon happing at the same time as an Eclipse—Sept. 13)

Aug 29 – Full Moon before the Solar Eclipse

Sept 13, 2015 – New Moon and Partial Solar Eclipse

Sept 23, 2015 – Fall Equinox

Sept 28, 2015 – Super Blood Moon Eclipse (start of panic phase?)

Oct 13, 2015 – New Moon

So … there’s a lot happening in the area of cycles right around now. Couple this with an ending diagonal Elliott Wave pattern and hitting the 62% retracement level and the September 28 date starts to look important to a possible major market turn.

Thanks Peter,

Great analysis for me.

It should be “second chance” top.

I added a link in the post to a page on ending diagonals. https://worldcyclesinstitute.com/ending-diagonal/

And cleaned up a few typos.

Dmitri,

With today’s action in ES, you should be able to count 1 wave up of 5 waves, a 2nd wave down in 3 (to about 62%) and this puts us in a third wave that should go to 1994 or so (1.6 times first wave). It’s beginning to look like (although early) we’ll top at SP 2020.68. Signs are encouraging. After the third, of course, a 4th & 5th to a double top, I hope.

Thank you. Peter,

I had the same count until the 2nd wave has retraced more than 76% of the 1st.

That put me in the doubt that it might be not 1st wave but a corrective wave to the other one down of Friday.

So, I’ve decided to wait and see if the market will go higher in the 3rd to confirm initial count.

I miss some patience and commitment. But I see we should have the reason when the second day the VIX is smashed by algos into the close and all the pundits at Marketwatch and Bloomberg look down.

Countertrend waves are vastly different than motive waves. The percentages can become extreme, also due to the fact that we’re very close to a top. Motive (trend) waves are much more likely to be on target in terms on retrace percentages.

I have learned to stay away from corrective waves altogether in a market like this. I’d rather wait for the top and a sure thing.

Does it exist “a sure thing” in the market?

Haha … got me on that one! Nope.

Peter,

Ok, there are no “sure things” in a market.

At the same time I have to recognize that for instance you read the market much better than anybody I know.

Why don’t you trade the corrective wave if you know that there should be one?

Do you suppose that it might not happen and the trend wave would continue its course or you are not sure about its target?

Let me ask differently, how more “sure” for you is the trend wave than a corrective one?

This is why—what’s going on tonight. I wasn’t sure we had bottomed correctly. It looks like a 4th wave, which means it should bottom at the previous 4th but it never quite got there. So, sure enough, it’s doing it now. I was also wondering why it was going to take all week to get to the top. Here’s the answer.

Sorry, Peter,

I don’t understand well what do you mean and where we go now.

This wave down is not motive as far as I can see. If you measure from the very bottom of the wave up from August, you’ll see we’ve come down about 38%. That suggests this is a 4th wave and that we’re going to turn around and go back up. But, based on the depth, it also suggests we’ll simply do a double top. It will likely take the rest of the week to get there, which fits well with the forecast for a turn Sept 28 or thereabouts.

That’s what I’m seeing tonight, but I think it’s time to go back to bed.

Futures have made a new low. Does it change the count?

Is the double top invalidated and we continue down?

Thanks, Peter,

I taped the question before saw your answer

This is the reason I want to wait for the big move down. This stuff (waves like this) make me crazy. Over-trading is deadly.

When you say ” It looks like a 4th wave, which means it should bottom at the previous 4th but it never quite got there”, what previous 4th do you mean?

Or 38%.

May be it is already the big move down.

In Europe it’s a sell off today

SPX has touched yesterday 1950

It’s 38% down from 2021 (if you count the up from 1835)

I’m expecting a turn up here.

If this has morphed into a first wave down, it still has to retrace 62%. It has gone past where I expected a turn.

If it’s a first wave, it should go down to 1907 spx and turn there. Although the Nasdaq has the right length. In the SP500, nothing measures properly and there’s still the issue of the missing second wave. So I’ll wait for the turn and see what happens. If it’s motive, it’s a very strange looking wave …

Hi Peter,

Is this count possible:

1st – from the high 2011 to 1975;

2nd – from 1975 to 1990 ( 38% – you told it to be the minimum for the 2nd);

And after you count the 3rd

What’s possible is the typical first wave configuration, where we would have a double fourth wave but I’m really having problems with wavelengths and that second wave. That’s what I think you’re describing.

https://worldcyclesinstitute.com/first-wave-down/

ES count

We look to be completing the final subwave down (5th of the 5th).

Once it bounces, there are two choices from here.

If it’s a first wave (and I don’t think so), then it will bounce 62%.

If it’s a fourth wave, it will go up and tag the top. Either one will be a great short.

It’s the upper half of this wave that I have the biggest problem with. It looks like 3 waves down.

Dmitri,

We look like we’re starting to bounce. If that’s the case the ending wave did not end properly—it’s a mess of overlapping waves. We can add that to the corrective wave list.

ES now looks like an ending diagonal. NQ, YM as well.

Ok, my be you’ll have clearer picture the end of the day

We now have ending diagonals just about everywhere. SP500 …

So we should bounce from around here.

Do you think it’s only bounce before the next leg down?

Or the move we are waiting for?

Ending diagonals end the wave, so we should be heading up. The bearish wave should be done. I still think we’re going to tag the top, but we’ll watch carefully at the 62% level.

The wave structure is not as bullish-looking as I would like, so be careful.

Of course, as soon as I say that, everything changed. Looking much better.

The question is What wave has been ended with ending diagonal?

Because we haven’t still determined the right wave structure

I have a lot of issues with this as a first wave.

So, we don’t know the target. I mean which wave up to what level we should retrace?

Well, as far as I’m concerned, there are only two choices. I can look this evening and post them for ES and SPX. I would be very surprised if we don’t test the top.

There may be a second wave retrace at ES 1940.

Do you mean that if there is a second wave retrace at ES 1940 than we go lower after in the 3rd ?

Ok, I understand, we’ll retrace from 1950 to 1937

Yeah, something like that. Remember I said if this is an ending wave, we go up in 5 waves? So if we’re going to the top, that’s what will happen. Usually the first wave up traces up to the previous 4th, then you get a second wave down, etc.

However, if we’re only going to 62%, we’ll have an ABC wave (it won’t look at lot different, but doesn’t necessarily have to retrace to 62%).

As I said, I think we’re looking at the former.

SPX

I’m not exactly sure where the first wave will get to as this wave is strangely structured ..

Well, Dmitri,

With one more dump the count has become clear. By morning, we should have a complete first wave down and be ready for the bounce in a second wave. I’ve updated the post with a couple of charts. As I’ve said before, once we have a first wave down, the rest of the waves become very much more predictable.

Hi Peter,

how can we know Which wave shall we retrace?

After the 5th wave is finished it may be the final wave of the whole wave from the top and not just the 1st of the 5th. So, it will go to retrace at least 62% from the top of Mai.

I don’t understand the question. I marked each of the charts with the 62% retrace line. You can measure it if you like.

I need to put together a course for you folks …

We retrace 62% of the wave down from 2020 SPX. Then the third wave starts down (you want to be ready to trade the third, for sure!). There will be a second wave of the third, as well. It will retrace 62% of the third. The fifth wave will also have a second of the fifth, which will do the same thing. All the waves have a similar patten, except that the first wave looks slightly different than the others.

I’ll be able to provide a chart of what to expect as these waves unfold. It’s going to be a really big drop.

I just measured it out. This set of waves (3,4,5) will likely take at least 3.5K off the DOW.

It should take the SPX to at least 1570. Once you have the first wave, you can measure all the rest.

Sorry, Peter,

the question was different.

How do you know that the we are completing only the 1st of the 5th now and will make 2,3,4,5 of the 5th?

May be like we’ve done already 1,2,3,4 we’ll just drop directly 100 points in this stretched 5th and make the double bottom?

Because, we’ve just completed the first wave, and if you look at the chart I gave you the link to, you can see the measurements. The measurements have to be exact. That’s only one wave.

Just like the third wave had 5 waves, every other wave has five waves. All the waves are fractal. So there have to be 5 waves of the fifth. It’s just that simple. It’s always like that. It doesn’t matter if you’re going up or down, trend or countertrend.

Plus they all have measured ratios. The large five will be the length of the larger 1, 2, and 3 combined.

The only challenge (and it takes time) is knowing where you are and what level you’re on. I find it very simple after doing it for so long, but it took a long time to understand in the beginning.

You’ll get a much better sense as we move down through all these waves.

Sorry for stupid questions

That’s OK. Elliott wave is simple in principle but complicated to know where you are in the first wave, for sure, and in corrective waves (like the fourth). But when we’re in trending waves, like the ones we’re going to go into, it becomes much easier because you can measure them. They all have to be in specific ratios to the first wave.

It’s the fractal part that makes it difficult.

But get ready to make some real money … not that much longer. The top of the second wave is like gold.

Thanks, Peter,

so, the count I proposed on Saturday in the comments to your previous article was more or less correct.

We are in the 5th of 5th now before to retrace at least 62% from the top.

The question now if it will be motive or corrective?

Well no, actually, because the length of the wave doesn’t work that way. It really has to be a truncated wave, or 1 and 2 are above 2006, like the futures. You can see them at the very top of the futures, just not in the case indices, so I think it’s a truncated wave. I’ve only seen this happen one other time.

We are in the fifth of fifth of first. Correct. It’s a motive wave.

The second wave will be corrective. There is no question about that.

One of the primary rules is that the third wave cannot be the shortest wave and that pushes the first and second quite high on the SP500 chart. However, they’re simply not there. So it’s really not a good example.

The fourth wave was overly large and what also threw me was that the fifth wave also does not have a valid second wave. I’ve never seen a wave with so many problems fitting into the motive wave rules. The rest of the wave looks OK.

When you say corrective you mean in ABC ?

Yes, it will go up in three waves. I’m off to bed.

If you look at the ES right now, you’ll see the fifth of fifth taking shape. We’ve done one wave down and we’ve retraced exactly 62%. We have a third down to go, then 4th and 5th and should end up around 1902.

Bad example. Went up to create a flat and set off all kinds of alarms. Now it should head down and complete the fifth of fifth.

5 min chart or less.

Dmitri,

The market did not drop last night as I expected, so I’m standing aside. We have to wait to see what this wave is. I don’t think it’s motive. It’s in the middle of a huge rally tonight.

May be we are still in the 4th of the 1st of the 5th.

You thought that we’ve begun it tonight.

Otherwise, may be this is the second?

The 3rd was finished yesterday at ES 1916, then the 4th in the close.

After close we have the 1st of 5th down that was retraced 62% in 2nd.

And the drop was the 3rd that was retraced 38% in 4th.

There is a small wave down after (if it can be considered as 5th).

Finally I am “lost in translation”

Looks very volatile

At this point, it has to do a second wave but it’s sat here trying to go up for 5 solid hours. It’s too volatile and unpredictable to trade, imho.

Dimiti,

Five waves up in the first wave and a double-pronged second wave in ES. Suggests a large third wave up is next.

Dmitri,

In EW, this would be a perfect set-up. 5 waves up to around the previous 4th wave down (wave 1). Then three waves down to exactly 62% or the previous second (wave 2). The next wave is usually fairly obvious. This smells like an ending wave setting up for 5 larger waves up. We’ll see what happens. I’m referring to the setup in ES or NQ.

How low may go this second corrective wave?

I think you have to wait for /ES to fill 1920.25 gap if you’re thinking of going long and see what happens.

How low may go this second corrective wave?

Legally … not to a new low, but typically it’s between 62-76% retrace. At 76, you get out.

Cash indices are all different so I don’t know how they’ll play out.

At any rate, be careful everyone, this is a countertrend wave up in a bear market.

Slowly i am learning to listen to you..[wink]…Nick

Nick,

Jeez … what? … did you go astray for awhile? haha!

Hi Peter,

I really like your cycles data, that is a nice add to your analysis. Thanks for the post. I agree with Full Moon turn to bearishness.

Hi Peter

I do not see my question & message I posted last night ? have you deleted it ?

Regards

AZ

I am a little under water with my shorts from Friday afternoon. Will reconsider, if we blow past 1966 spx level. For now I am happy to sit thru this little pop up before we head back down for lower lows into tomorrow. My gut says we are going back down.

Good luck every one.

Dave,

I also have a bad feeling looking at the Dax it can not get on its’s feet..

Looking at the chart of Tom Mclellan we should be very close to a big drop into early Okt..

http://www.mcoscillator.com/learning_center/weekly_chart/eurodollar_cot_says_ugly_drop_is_still_ahead_of_us/

Hi John,

it’s one month old report

I know but the analogy worked in the past and at this point it shows a big drop till the beginning of august will see.

Excuse I meant Oktober..

Hi John. good info from the Mclellan chart. John I am avoiding any speculation with any sizable drops at this time. My main focus is strictly swing trading. IF and when we do get that sizable drop, I will be on board. For now I am short going short into tomorrow, I will probably go long around the close of tues depending on my pivotal levels. Looking for a swing higher going into Friday from tomorrows lows. Good Luck John

We went slightly higher than my pivot point of 1966 spx. I will maintain my shorts going into tomorrow. I believe Valley will be proven correct again. Valley mentioned a upswing from Wed into Friday.

Peter, thank you for your detailed explanations. I drew a trend line from 7/6 low 2034.24 down to 9/9 High 1992. I extended the trend line to hit 9/17 open 1986.5 and 9/18 High 1983. That is the upper part of my triangle.

I drew another trend line connecting 9/1 low, 9/4 low and the low for last night 1938.5. This is the lower part of my triangle. From the 9/17 High 2011.75 to 1938.5, the retrace area I’m looking to short is in the 1984 area. If I see strong buying momentum then I step back and wait for the 2011 retest.

Liz,

While your trendline is certainly valid, I take you know this is not a valid triangle, in the traditional sense. That aside, today’s action suggests that we’ll do a double top at SP 2020.86. We’ll see what happens with futures tonight.

Peter, I like to connect 7/7 low with 9/9 high. I think maybe it was Andre who said both dates were significant so that is my odd way of connecting the dates. Don’t worry I am also looking at the upward channel you have for 9/3, 9/9 and 9/17 highs. The upward trend line from 9/1, 9/4, 9/18, 9/21 lows are holding currently for the ES, SPY, QQQ, DIA and IWM. Only the IBB broke as you all know.

Was the market from Oct of last year to the top an ending diagonal? What is up with strong dollar, strong market, and strong oil? 1929 bottomed on the lunar eclipse. The lunar eclipse is more typically the 2nd chance top.

Still short, looking for 1920 spx Min.

PALS:

Playing out nicely. Monday opened higher (I sold) and then sold off (I bought). Tuesday to Friday increases in bullishness each day. Tuesday may have sell off sometime during the day but finish up. Wednesday to Friday off to races. Next Monday real selling begins.

So far so good … 🙂

Valley, congratulations your PALS is doing well. What does it stand for again? My problem going long indices tomorrow is today is the ETF VOO’s ex-dividend date. For the dates I looked at, I noticed SPY is negative the day after. Notice I didn’t say SPY because SPY’s ex-div date was last Friday.

Liz, PALS stands for “planetary angles lunar seasonals”. It is made up of:

1. planet angles (conjunction, opposition, quadrature of inner planets mostly)

2. lunar chord made up of phase, distance, and declination.

3. seasonals, market tends to have stat. prob. of being positive on certain days.

(stock traders almanac, daily; intradayseasonals.com, hourly)

The bradley shows something similair like 2008….. we will decline into friday low..

After the weekend we will see a hell of a short squeeze( maybe CB talk) and the market will turn again tuesday.wednesday till okt 9 …final ,ow and end of Mercury retograde

Something happend in 2008 also…

Its a wild card but lets see….

John, Valley will be correct going from Wed thru Friday with the overall trend in the markets I believe. I see ( gut feeling) a rebound from Wed thru Friday also. THIS IS NOT GOING TO BE A 1750 spx) scenario unfolding for this week. All the best John

John,I would have to agree with Valley on the trend from later Wed morning thru Friday for a up move in the markets. We are not going to see a crash this week I believe. Good Luck John

Thanks Dave for your comments, if the AEX goes down tommorow as well I will sell some puts Okt…

Good luck ..

I believe that will be a great Move on your part John. A bird in the hand is worth two in the bush. I see to often, many traders get the right move in the market but end up losing out in the end. They get to greedy

In other words take some profit and pay your self.

Peter, I replied to John earlier with a comment. Posting did not get on the blog.

There now. Every once in a while that happens.

LOL, I thought maybe I got Banned.

Don’t push me … lol.

btw, I think the dollar has bottomed and euro topped. Very motive wave on euro.

This rebound this not going to last (1928), Possible 1915spx next. Still looking for a long entry at the end of day or tomorrow morning.Good luck

Good call. Yeah, it went up in 3. So, futures look like a complete ending diagonal now.

Looks like the market is making a base, to launch higher into later wed thru Friday. I am still a little concern for over night trading into tomorrow thou.

We should continue up from here to the previous 4th wave (1971 or so) and then we’ll get a large second wave down to 62% of this wave, so that may be what you’re referring to. Then we go up in a wave 3.

After this wave down is finished Peter, we may encounter strong resistance at the 1950 level. I will be a long for the wave up after a possible retrace tomorrow morning. If we encounter difficulties penetrating that level, I will go back to short it. I do not see any of these higher levels such as 2040 -2070 that some traders have mentioned in the near future. Good Luck

I’m going to post an update chart. It’s obvious to me that this is a corrective wave down and we should tag the top … only. 2020 SPX.

We’re supposed to hit resistance around 1950 as that will be about the first wave up of 5. Then we need a second wave retrace. That will all have to happen tomorrow as the rest of the wave structure from there is more or less straight up.

We are not done with wave down yet. Going back short into tomorrow morning. Good Luck every one.

I posted a couple of charts at the top of this post.

I have updated the post tonight. After another drop tonight in the futures (not a large one), the count has become clearer. We have a first wave down, based on considering the first and second wave is there somewhere, or that the wave has truncated at the top.

1901 spx futures,? I would be extremely happy, from my short at the end of the day Tuesday.

Yup, you win. I’m short this little stretch tonight. Finally some clarity on that wave. It sets up the rest of the fifth wave, which will be a money-maker.

I’m finding through this exercise that cycles are great at tops and bottoms but do little good when in a motive sequence. They really threw my off in this first wave (not that cycles alone did it … lol).

Where has the update gone? How do I get to it?

Kent,

I’m standing aside until this market gives us a clue as to what’s going on.

Thanks

You’re welcome. I think we’re getting a slightly clearer picture.

I am stuck in the short side for a while. I will liquidate later on today to go long.

Shorted the market sp futures at the end of the day Tuesday (1932) I still believe we have a little more down side before going long.

Waiting for this small wave down to finish, than sell out my shorts. Than go long into the end of the week.I believe Peter and Valley will be correct here shortly, with a up draft in the markets. I am not as optimistic as some are for 2020 ect.

I added a couple of lines to the update in the post above based on what I’m seeing this morning.

I just added a chart to the post.

I sold my AEX puts and bought some turbo’s on the AEX because this product I can sell till US close tonight..

Peter or Dave do you also have this product in the US?

Thanks..

John.

Good for you John. I just finished selling my shorts at the 1922 futures. It was not worth the effort. Only made approx .12 cents a share on TZA. I am going long shortly within the hour. Good luck to you.

I am finally all in, UPRO 53.56 average price. Looking for a upswing to at least 1950ish sp futures. Good luck every one.

This wave up should be at least 1.6 times the length of the first, ES 1970, which is also the 62% retracement level for the entire larger wave down and could be the turn into a third wave down.

John, I am not familiar with that specific investment vehicle here in Canada. I have not heard of such a name here in the US either. We have investment vehicles that are 3 X ETFs in the US and here In Canada. If the sp 500 goes up 100 points, the 3x ETFs go up APPROX 300 points in value

Hi Dave,

Thanks oke I understand

Well the Turbo on the AEX I mentioned is a very speculative product your profits are unlimited but you can also lose the amount of money you put in.

You can be short or long.

The premium you pay works the same like an option only there is no time limit

I think you will have something similair in the US..

I think we have seen the bottom in the SP and we will go up till Sept 28-30…

Sept 28-30 matches with Mercury and turbocycles and the bradley .

Good luck..

Slow start but looks promising. We’ll see what happens overnight.

For what ever, Sept 28th feels very unnerving to me to be long. Perhaps the 29th -30 would work out. Right now I just want to stay focused in the present. ( sept 23- 25th)

If we do get a nice thrust upwards in the markets thru the end of the week, I would mostly likely short over the weekend into the sept 28th. I will see how the markets unfold thru out the week to determine what I may or may not do.

Well, lol, you no doubt know my unhappiness with the first wave down. It has lots of issues as a motive wave. Cash indices have missing waves, waves are not the right length, corrective waves within them are out of proportion. But EWI has a motive count (although now they’re waffling). On the other hand, I don’t often agree with EWI.

If we have 3 waves down, which I still believe we have, then we’re going to test the top—no question about it. So, we either turn at around 62% (1986 SPX) or we top out. Being a recent (a year) convert to the astro religion (lol), I have no qualms about the 28th. Cycles back that up. In fact, I can’t find anything that doesn’t back that up.

So I’m long the rest of the week, focused on the 62% level. Now, we either keel over at that level, or we’ll go into a 4th wave, which will retrace at least 38%. So either way, it’s a short.

I will post some charts either when we get close or end of week.

Peter, for clarity s sake. Could you elaborate a little further on your statement ( I have no qualms about the 28th. Cycles back that up. In fact, I can’t find anything that doesn’t back that up.) Are you bearish or Bullish for the 28th. Thks Peter.

I’m actually neither for the 28th itself. But it’s a likely turning point, based on everything I’ve seen (early yet, perhaps). I let EW tell me when to get bearish or bullish. I follow the waves. So, if the waves finish up on the 28th, then I’m bearish on that date. Waves have a definite pattern that exhibits itself in more or less the same pattern every time.

Right now, this wave has come up on five subwaves so far. That suggests an ending wave (in other words, a wave that will do a double top, likely with the previous wave down, but could exceed it and do one on its own). It could also end in 3 waves at the 62% mark. Waves are usually multiples of phi and very accurate.

Does this make sense?

Got it Peter Thks. Hopefully the wave upwards is finished up, with in the next two trading days. Monday, I just do NOT have a good feeling.

Based on starting the third wave today, we should go up solidly tonight and tomorrow, and have the 4th for Friday and the fifth (or last part of it for Sunday). But I’m not supposed to say that because I trade what I see …. haha.

What I want to ad to this site :

Turbocycles still suggets a high on Sept 30…

so be carefull

Thanks 🙂

FWIW this yr Weds between 2pm and 3 pm is the most positive hr of the week 67.57% so far

Taken from another site.

I think we’re just zigzagging our way on a downward channel.

You are correct Liz, although their is some great swing trades we can make as we go down the channel.

I updated the top chart in the post to reflect today with proper EW wave labelling.

Thanks for providing some technical guidance in these troubling times.

Glad to help. 🙂

Federal Reserve Chairwoman Janet Yellen’s speaks Thursday.

Depending how far the market rises I may sell out my longs just before she speaks. I am looking for a min 18 sp points

Just enough to close 9/21-9/22 gap. 🙂

Hi Liz, LOL are you reading my e mails ? Good catch on that gap Liz.

It seems that every time I leave the room the market drops … lol. So this small drop is still an ABC three waves down. It should retrace. Now I can see why it’s going to take the rest of the week to get to at least 62% … and why I said “be careful.” 2007/8 used to be just like this.

Peter,

don’t leave the room, please. Lol.

The market has taken out yesterday noon low.

Does it change the count for you?

I don’t like it but no. It would have to go to a new low to change the count. We’re still down in 3 waves, just a slightly bigger version. This wave up so far in ES looks motive. Maybe we’ll keep rising into the Yellen speech … dunno. But somehow, we at least have to make 1950 ES, more likely 1970, and maybe even 2012. But 1950 is the minimum.

I went out for dinner, worrying all the time that I’m long ES with no stop, as Interactivebrokers doesn’t give me that option after hours.

Maybe this will give us the levitation we’re looking for … or at least the rumour.

Hi guys, Hi Peet!

You know what I see now?

Big A ending @ 9-17.

Big B ending @ 9-23.

Big C ending @10-9 to 16 oct (my best guess)

In other words, there is some upward movement coming before we go to hell… I still say, 2040 / 2070 is possible!

Last time I said 2040 I got told that we would never see this again, and yet we got to 2020. I am not an EW expert, but I got my methods combined to shout things like this. 😉

Anybody that can see this happen???

Good trading to you all!

Cheers,

W

Hi Whazzup,

I am glad to learn new methods out of EW. What methods are enabling you with high confidence to shout the markets moving higher ?

Many thanks for your openess. Best, Jaze

Hi Jaze,

Counting time (candles), astro (still learning a lot), harmonics, EW, volume, candlesticks, standard patterns / lines.

EW is awesome, but doesn’t say all (at least for me). However, when you are a prof like Peter, you can profit from it for sure. 😉 I am still not good enough in my EW, so still learning. 🙂

Cheers,

W

I don’t think so (my attempt at wit). What I see in most indices is a top in mid July, 1 down into 12 Aug, 2 to 18 Aug, 3 down to 24 Aug, and a 4 up to 17 Sep. That is the way I see it there is also a 1-2 prior to mid July, indicating a similarity to 2008 – several new lows to come. But the no new low like 1987 is always possible.

New update to the post which should finally bring some clarity as to what this wave is doing.

The bradley geo version is still very accurate and suggets a low today or tomorrow after that the big short dead cat bounce 28/30 Sept after that all hell breaks loose..

/ES is now back to Aug. 26 price levels.

That should be it. The SP500 did an ending diagonal and they’re uglier than the normal bear, so we went down a couple of bucks lower. We’re now above the trendline of the ending diagonal, which is a good sign we’re done.

Kind of a drowsy cat bounce coming, John. We’re finally going up 62% in a second wave to 1978 SPX, 1968 ES. Coupla days at least. Maybe it will end Monday morning.

Window dressing.

30 Sept. end of month and 3rd quarter

Maintaining my longs from yesterday. sp futures 1922 area. Upro At these levels on the sp, 1900 I am not going to liquidate. I am still looking for 1950 ish near term. This is just a little hiccup a long the way to my short term goal. All the best every one.

This wave will go up in 3 waves. Now that we have a first wave down, the right length just about exactly, it’s all a numbers game from here. My target is SPX 1978. No new highs. We’re finished the first of the fifth and there’s a whole lot more downside to go after this bounce.

I think that is still a good call Dave…

Bought turbo aex…..for the dead cat bouce wish me luck I wish you all the luck in the world..

I think just like 2008 we will see the dead cat bounce… the mother of all short squeeze`s please let it be true lord X

The all clear for the SP500 is 2020.60, the previous wave 4 high. We’re almost there.

I posted a new chart with the expected path for the ABC wave up. Hope this helps.

I would not get to excited right now futures 1912. Their maybe a retest of the lows. Lots of backing and filling before we actually take off to the upside.

There shouldn’t be a retest as I count 5 waves up. We just did a small second wave and we’ll now going into a large third wave up to about 1931, then a 4th. I’m long ES so I will be out at 1931, going short. I have it pretty well mapped out. Going to daytrade this thing since I’m here today.

It takes time this second

Yeah, this is the last wave I’m going to take long. When you get into the third wave right down to the end, there’s nowhere to hide and longs are really dicey. Even now, it’s way better to short the corrective waves as they come down really fast.

btw, this sequence should be 5-3-5. A wave in 5 waves, B in 3, C in five.

There should be a 4th wave retrace (38% around 1930) and the B wave (a big one, likely 62%) at about 1942. This is ES.

Peter,

if this wave up is ABC the A and C should be in 5 ?

Thanks,

why do you go out from long and go short at 1931 if the B should be at 1942?

You want to play the 4th?

Yes, I will probably play the fourth. 38% of the entire wave up to that point is fairly long.

Dmitri,

This should be the fourth of the third and we will like end around 1930 at the end of the day. I’m guessing we’ll correct tonight (larger fourth) and fifth maybe. Tomorrow … B wave? We’ll see.

The 4th of the 3rd corrects 38% of the third wave only. The larger fourth corrects 38% of the entire wave from the bottom up to where we are when we correct. It usually goes back to the previous fourth (where we are now). Hope this makes sense. I can be confusing.

That was a big wave. It corrected more than 38%.

There is Yellen speaking tonight.

So, the market is anticipating

You know this wave in SPX from the bottom 1909 to the top 1938 has gone in 5.

And the big wave down you are talking about has retraced exactly 38% of this whole wave up. So, may be it was the B wave?

Sorry, mistake. The wave up was in 3 but the two legs were in 5.

Yeah, right. We should still get to a new high before a larger correction. I’m anticipating 1930 ES. But maybe it will be after hours. I just realized I’m out at an event tonight so I won’t be able play. I will exit if we go to a new high.

Might be doing a small triangle here.

So we need a bigger fourth, I think and then a fifth, which should be 1.62 X the length of the first, but from the bottom of the 4th wave correction. I think that’s still to come.

Or this could be the start of the fifth wave, as per your earlier comment. Not sure. 4th waves are always messy, cause there are two in a row.

I expect to get close to the previous 4th wave down at 1942 ES before we do a B wave.

This looks like a 4th wave triangle virtually complete. Should move to a new high.

Hope you made some money today. Should be more to come over the next few days while this abc correction plays out.

To finish off, it looks like we are in the fifth wave. If I measure 1.6 times the first wave from the bottom of the fourth wave, it takes us right to 1942.

So I don’t think this is a triangle. I think it’s a first wave of the fifth and a double second wave and we’re ready to go into the third of the fifth.

May be we finish the 2nd of the 5th.

Yellen may boost it to your target

We’re on the same page 🙂

While I was taping you gave the same count

Oh … Yellen is yelling in a half hour from now … lol.

Dmitri,

Looks like we’re finishing off the third wave. We should top at 1930 ES and then do a fourth wave then a fifth. I’m going to be out for the evening so I’m going to have to leave to happen on its own. Plan on the fifth reaching 1942 or very close.

Nice call Peter !! Back into positive territory for my trade. I just hope some of the hard core Bulls did not sell out at the bottom.

Third waves are fun. Wait till you see the one going down next week.

We’re at the fourth wave of the third. We might actually finish the 3rd at the end of the day and do the bigger fourth overnight. Still should happen at 1930 ES. About 1939 SPX.

Hmmm. Actually, this wave might be extending. Will have to see what happens at 1930 ES.

Dave,

I think we maybe finish off the 5th wave of this A wave up tonight and hit the B wave down tomorrow. What do you think? Then Sunday and Monday, the C wave up.

I agree Dave lower start again and after that up into monday high…

Bought turbo at 0,39 sold at 0,99 so Happy me

Good luck..

Way to go John. Nice trade !

Fridays have been notoriously poor, for any gains in the market in all of 2015

Depending on the over night trading and the opening tomorrow, I maybe doing some swing trading to capture some swings due to the volatility that may play out. Peter, If we finish off the A wave tonight I may liquidate my longs depending where we start at the opening tomorrow morning.

All the best every one!

GUT FEELING – we are not out of the woods just yet. If the 1st hour of opening is a higher high, I will short it. I suspect a high in the morning than lower high by the close.

Wave A should get to 1942 ES, 1949 SP before we go into wave B.

Peter , your 1942 ES may not make it due to the high sophisticated program trading by the big boys. I am more than sure a lot of traders are looking at the 1943 region to short it.If we get up near the 1937ish range, I will short it. Hopefully we are near that area in the morning.

Wrongo. Has to. It has nothing to do with big boys trading.

The 5th wave is 1.618 times the length of the first. There are options, but we typically retrace to the previous fourth (which in this case is exactly the same spot). I’ve seen it happen over and over again without fail for 10 years.

Elliott waves move in pre-defined patterns based on phi, which is based on the movement of the planets.

If the big boys can move the planets, then yup, I’m with ya … lol.

We’ll see 🙂

LOL If we get up near 1937ish I will leave some money on the table for the next guy. LOL GOOD KARMA>

Out at 1928. Close enough. I’ll bet we’ll do both the 4th and fifth overnight, leaving the B wave for tomorrow. I’m out for the evening …

PALS is exceptionally positive Friday. Post perigee and Full moon, next week should be down.

Agreed. Thanks, Valley.

Just sold all my longs at the opening, went short.

Me too this market is like the titanic yesterday at 1912 (lol)

Warren Buffett Rule No.1: Never lose money. Rule No.2: No Stops go untouched in the S&P Rule No.3 Never forget rule No.1. and 2.

1 retweet 1 favorite

Peter, you pretty well nailed that wave up over night.

Thanks. It went a little long I see, because the 4th wave wasn’t very deep.

That’s the B wave done. So we have more set of 5 up to 62%. Looks like it could be Monday morning for the fall.

We should get this wave by today and Sunday 🙂

Peter,

The wave A was of 53 points.

If the wave C will be of the same length it should go up to 1984ES ?

Otherwise, if C=1.62A it should make the double top

Oh … interesting observation, Dmitri. Yeah, it works perfectly, doesn’t it?

Let’s wait until wave 1 of this C wave finishes and then we’ll measure it and see if it confirms.

Really small first wave, Dmitri. This is just barely get us to the 1970 ES target, by my measurement.

In the case if wave B is finished.

The market may levitate until the 30 – the end of the month and the quarter

It doesn’t look very motivated to go up now.

The Europe has been sold in the close on significant volume

I thought wave 1 looked a little wonky. Was 3 up on the ES. From a purely technical perspective, this corrective wave needs to look much bigger than the previous corrective wave, to give the waves the appearance of a 3, even thought there are 5 waves within them (or will be).

Just wanted to say that we may be still haven’t begun the wave up

Well, I was surprised at how short the B wave was initially, although I didn’t pay it as much attention as I should have!

By the length of the B wave, I think we’re going for the 62% mark.

They’ve got it, your 62%.

But it was violent – 25 points in half an hour

And look at the Nasdaq! … almost a double bottom. It’s always more volatile.

Dmitri,

This entire wave up looks more like a 5 wave configuration than a three wave. It always has a three wave look to the final, as one of the corrective waves will always be much bigger than that other (wave 2 and 4). So that being said, we’re going into what would be the 5th wave rather than a longer C, I think.

Peter, you said 5th wave. Does that mean you think we’re heading lower than yesterday’s ES 1897? Maybe test 8/26 low 1875?

No, Liz, corrective very often have 5 waves within them, but look like three waves. If you look at eur/usd right now on a 5 min chart, you’ll see this very clearly. Either the second or fourth wave is very much larger than the other, giving it the very obvious look of an ABC configuration. So, I’m really talking about the C wave here.

btw, if anyone trades currencies, eur/usd is setting up. It has almost retraced 62% from the previous high in a very clear downtrend. Catching it at the 62% retrace point turning down is likely a big opportunity to get in on the third wave down.

To answer your question, more fully (which I now realize I didn’t do … apologies!), I think ES is going up to around 1970, then will turn over into a third wave down.

Thank you Peter. I will miss the 197 upside because I have no intention to go long over the weekend because of the blood moon. I have no idea if its effects are bullish or negative so I will just err on missing the long play. 🙂 Thank you Valley for explaining your PALS system.

Liz, I’m also not 100% sold on wave 1 down being motive – it has lots of problems, imho. So we also could head up to the top of wave 1 before we turn over. But 1970 is the minimum; let’s put it that way.

Warren Buffet rule : Never lose money. I will bail on the shorts here shortly and try again.

Just sold out of my shorts at the 1933 futures. Waiting for a retrace back up to short it again.

Looks like the market is going to Pop up here shortly over 1942. within the hour. I will re short it when it does. Good luck every one

I was walking the dog with my son and ran home my intuition kept saying don’t wait till mondy your to late buy puts now.. so I did..

good luck everybody out there

Valley I hope you are out of your longs?

It’s hard to be long if the bio-tech sector is in bear market territory. Market can’t be propped up by nike sneakers.

Went long SP 1929 UPRO . I missed that short unfortunately.

Well, the ES is all overlapping waves, so we’re coming back up. That’s the brutal thing about going long in a bear market … The drops can be staggering.

Well there she goes rang…. not waiting at the bus stop..

Not sure it will come back today.

1917ES is taken out. So, next target may be under 1900 ?

My chart actually shows a new low on the Nasdaq, but not on the NQ, so we’ll have to see what happens from here. The wave appears to be down in 3.

Well, looks like chasing the stops under 1917ES.

They’ve done the same in futures over 1940ES, violently too.

I don’t understand if EW should take into a count such moves.

It’s a kind of manipulation, not a behavior of millions of market participants.

EW does take into account moves like this. It’s a B wave. In ES, nothing out of the ordinary. Just deep.

In NQ, way deeper than expected, though …

My chart shows a fairly sharp B wave. They can go down to 99.9% and still be valid – just not a new low.

3 waves up now. I think ES will do a double bottom and then up. Wouter might be right. Maybe the turn is closer to end month …

Btw still no second wave

Now, what’s really interesting to me, is that the Nasdaq came down to a new low, but matched Sept 4 (double bottom). But the wave down to me is clearly in 3. I still am having problems with the first wave and this is an added alert that things aren’t quite right. So, imo, the option to tag the Yellen top is still very valid. That’s the 2020 top in the SPX.

I’ll put together a new post tomorrow.

I was waiting for retest of yesterday’s low so I bought some spy 192 weekly put for .10 earlier and just sold for 50 cents. I also bought puts for next week’s expiry and I haven’t sold those.

We can’t go to a new low. the Nasdaq has to turn around here, or the second wave is done. Could be, but this is not a motive wave down, so likely just a very large B wave just to keep us awake.

I agree with you Peter. 😉 I guess we will go up HARD till 29-30 sep. 🙂

Cheers,

W

I count 5 waves in ES and NQ on the 1 min chart … waiting for a small second wave and then up.

Finally we haven’t got the second

Whazzup, good luck to you. Isn’t Sept. 28, Sunday, blood moon perigree? If price tends to rise into the full moon shouldn’t today be the best hope for a rise in prices?

hello peter and others,

I followed your site a few days now and i had to say > very, very nice 🙂

I’m also still learning some EW so my count can be offf, but I think the move down now to the B low is a nice 23,6% of A.

Thanks 🙂

Glad to have you join us.

peter,

is t possible for us to post pictures?

No, I’ve been asked that before. The framework for the site doesn’t allow it in comments unless we write some special code. You can always link to a page somewhere.

ok, then here my daily. we are now 24 bars far from the last cycle low so th e nwe low can be in now. if so, then there is a lot of upwards potential> for the moment in my chart about 2030=es.

good luck all and nice weekend.

http://screencast.com/t/yNOWKoSw

Well, I think we’re going up, too. I just looked at EWI’s count, which says we’ve completed wave 2 and we’re headed down, but I have all kinds of problems with that idea. I’m usually quite happy if I’m the opposite from them … lol.

This wave came down in 3 … actually, I was making a list of all the problems their count has and maybe I’ll just list them in my post on the weekend. We’ll see what news Sunday brings.

Sold out of my UPRO sp futures at 1923 A 6 1/2 loss on that trade. Bought tza 12.58 EOD. 1/2 position trade for Monday Over all a very good week. Peter, I sent you my trades for the week directly from my on line brokerage account to verify. Have a good weekend every one.