Update: Thursday, mid morning, Sept 24

Here’s the expected path for the second wave in ES.

The second wave will go up in 3 waves. It’s the same ABC configuration across the indices. Often, these will be waves of equal length. The A wave typically retraces once it reaches the previous 4th wave, in this case 1942. The C wave will finish the job ending at approx. 1970. We also could have a larger B retrace, where the C wave will end up 1.618 times the length of the A wave.

_________________________________

Update: Thursday Morning pre-market Sept 24

This morning the ES (Sp500 futures) formed a triangle of some sort and has continued down. So the conclusion is that this is a first wave and that it is going to conclude today. I can see triangles on each of the cash indices, although they’re not all that well formed. Triangles are waves in 3.

Here is the SP500 (above). The problem has been that the wave is not long enough and is missing a pronounced first and second wave. If we do one more leg down, this should finish up the first wave and lead to a bounce.

It looks like we have a fourth wave triangle forming (the fourth wave of the fifth (of the first wave down). Triangles signal the end of the wave is near. If we continue down past 1911, then something else is happening and the labelling would need to change, but if this triangle heads down this morning, that should signal the end of the wave is near. More to come when we see how today unfolds.

In terms of the expected length, you typically measure the first three waves and the fibonacci extension from the bottom of the third wave denotes the usual length of the entire wave. You can see the 100% measure at wave 3 and the extension down to wave 5 at 161.8.

The ES looks now to have completed a fourth wave triangle. A triangle in the fourth wave position signals an end of the wave is near at hand. Once the 5th wave finishes, we should bounce in a large second wave. I measure an end to this wave of from about 1903 – 1894.

_________________________________

Update: Wednesday AM Sept 23 before the bell: My recommendation is to let the market play its hand. I’m standing aside until I get more information. I am doubtful that this wave down is a motive wave, so we may be heading back to 2020 SPX. It’s too hard to say at the moment.

Last night, the SPX came down hard but did not bottom properly and set off in a rally almost immediately. The eurodollar has been all over the place all night long. I’d wait until things settle down and we can figure out whether this wave is corrective (which I believe it is) or motive.

Regarding this morning’s action: I count five waves up in last night’s wave – a motive wave. It’s been following this morning by a second wave (3 waves down to 62%). As I write this, we’re forming a second wave down (a corrective wave), which suggests to me a very large third wave up to come. The double pronged second wave is in the futures. Cash just has a second wave forming after 5 waves up.

Five waves up at this point also suggests to me that we’ll trace out a finishing wave with a double top. Not certain, that’s just what is suggested by what I’m seeing.

Chart updated after market close Wednesday, Sept 23 (double click for full size). Note that if we only finish the third wave at 1970, (1) would become A and (2) would become B, reflecting a corrective wave (and 3 would become C).

_____________________________________

Original Post, Sept 19

An important phrase that I learned from a long-time highly successful professional trader is:

Trade what you see, not what you think.

I come back to this phrase every time I have doubts about what’s going on in the markets and it always keeps me safe.

I see many traders quite often suggest what they “think” the market is going to do. That’s inherent bias. It often clouds the mind and destroys any objective view of the markets you might otherwise have. I refer to it as “noise” and I try to stay away from these types of conjectures. It’s important for me to stay as objective as possible and listen intently to what the market is telling me to do.

Thankfully, the Elliott Wave Principle itself helps keep me safe. Because the way I use Elliott Wave, I know almost immediately when my count is wrong. On Friday, mid-way through the day, the red lights went on. The market did what I didn’t expect, destroyed my count and gave a warning to “get out!” Today I’ll explain what happened and why this tool is so valuable.

Secondly, we’ll go through the forecast and why, using what we learned Friday and what a cycles analysis is projecting. It’s a compelling story.

Bottom Line: Friday was a pivotal day. By the end of the day, the market had come down in 3 waves, in all indices and the ES (futures). Waves in 3 retrace. This means the next short-term move is to the top of the current wave down. We’re very close to a longer-term top and a dramatic drop. The key is to wait for the signal. I would expect it sometime within the next ten trading days.

The Short Term Wave Structure

Above is a 15 minute chart of the SP500 to show the action from Friday. We had a turn down on Thursday from ‘C’ to ‘a’ and a continuation on Friday. The first wave down on Thursday looked motive, from an Elliott Wave perspective. However, EW rules call for a 62% retrace in wave 2 that would have had to turn up from ‘a’ to the line marked ‘62%’, and then a turn down into a 3rd wave. That didn’t happen.

Everything was fine until the market went to a new low from the top of ‘b.’ It stopped right at the channel trendline, at ‘c.’ As a result, we ended up with no second wave and a three wave move down, which is a corrective pattern. So, the result is that we’re going back up to the top of this wave, at the very least.

The blue trendline helps to show the ending diagonal pattern that had developed on Thursday. An ending diagonal is a triangle of 5 waves that ends in a sharp wave (in 3 waves) that reverses dramatically. Often however, this ending wave requires a final test before the market moves in the new direction (down, in this case). So one option is that the upcoming wave up moves up to test the top at 2020.86 and then reverses to the downside.

The Longer Term Forecast

Above is a one hour chart of the SP500, showing the bigger picture. Given that we’re going back up to the top of this wave, it would be nice to know if we’re going to stop there or move even higher. I don’t have the answer to that question, but I do have an indicator that will give a very good clue.

An ending wave (one that is going to stop at 2020.86) must go up in 5 waves. If you see 5 waves up, it will likely stop and reverse at the top of the wave. If it’s only 3 waves or some other pattern and moves up past the end of the wave, it’s likely going to continue. This would create the option that we could be tracing out a larger degree, double pronged 2nd wave. In that case, we could see this wave continue up to about 2095.00, before rolling over. The effect of a double pronged second wave like this would result in the next wave being wave 3, leading to a very much bigger downside than if we were in wave 4.

This brings us to the current count, because on Thursday after the Fed meeting, the indices (DOW, SP500, and NYSE) all retraced to the 62% level and retraced. Technically, we could be seeing a second wave top. However, there’s no rule that says this isn’t a 4th wave that has retraced to a very high level. For the moment, I’m leaving the count as a 4th wave, and we’ll consider the count again, once we see what the next wave up has to offer.

The key thing here is that the larger wave up from ‘3’ is a corrective wave and so we should not go to a new high. (The wave would have to be in 5 waves—an ending wave—to end in a double market top. Plus we’ve experienced ending diagonals on most of the indices, with double tops already. So the big top is in.)

In summary, we’re looking for a double top at 2020.28, otherwise we’ll look to other options (if we go above this level).

In terms of timeframes, there are a number of factors, some of which I’ll mention below that suggest September 28 may be a very important date and could result in a major turn.

Above is a one hour chart of the NYSE. This index didn’t quite make the 62% retrace level (it didn’t miss by much). This suggests that it may go slightly above the top of Thursday’s wave top. The three wave corrective pattern from ‘3’ up is even more obvious in this index. The DOW is similar to the SP500 chart.

Above is a one hour chart of the Nasdaq. The difference here (as I mentioned last week) is that the Nasdaq has retraced to an even higher level and has touched the 76% fibonacci level, another key Elliott Wave level. If it rises above this level, there’s a better chance it will retrace to a double second wave configuration, which could take it to about 5090 before turning and heading down. This would set the next wave down as a third wave. Again, this would lead to a much bigger downside.

I had mentioned the possibility that the Nasdaq was in a second wave last week. It has now wandered into the area of the first wave of the second wave, which makes it more probable that this wave is in a second wave position. I have labelled it with a question mark.

The same short term prognosis is in play here. On Friday, the Nasdaq came down in three waves, so we’re going to head up to the top of Thursday’s wave. We’ll see what happens once we get there.

Above is the Friday chart of the currency pair, eurdollar. I look to this as the “canary in the coal mine” at the moment. It’s clearly in a countertrend move and getting very close to the 38% retrace level (the horizontal line) from a first wave down. I would expect it to touch this level. This would be a major event, as the US dollar determines much of the movement of the markets (being the reserve currency) and a turn here may be the trigger for the turn down in the US indices. I’ll be watching it even more closely over the next week or two.

Cycles Analysis

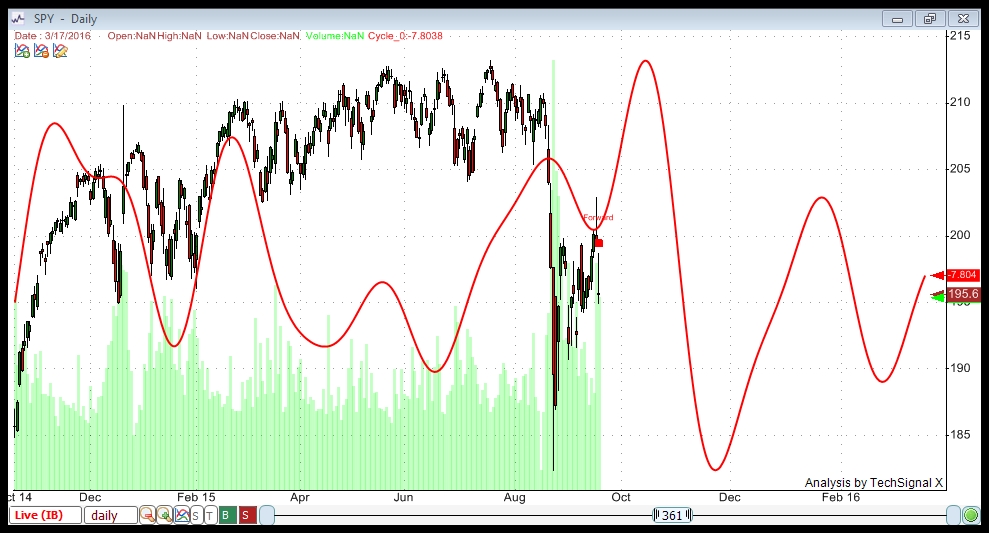

This is the first of two cycles analysis I ran. I’m using data going back to 2002 for both these charts. The software analyses all the data and finds all the cycles inherent in this asset. I chose the top eight cycles that it returned based upon returns in profit (if these cycles had been traded both long and short, from bottoms and tops, over the past 13 years). Cycles repeat and so the past is a good indication of the future. This chart combines all the cycles found to provide a compilation wave. You can see how close-fitting it has been in the recent past. The fit with the current wave is quite stunning and therefore, something to pay attention to.

This analysis suggests a relatively strong positive bias to about October 1.

The second cycle I ran is the same as the first from a dataset perspective. This analysis focuses on percentage wins, playing both sides of the cycles. I used only the top 8 cycles (higher percentage win results) to result in a compilation wave. Choosing only the top cycles historically for this asset should provide a better forecast. The result is for a countertrend wave high into October. It is consistent with the first cycle analysis (net profit).

However, I note that the April through August time period shows a market with a possible inverse relationship to the cycle. That sometimes happens in cycles analysis. Therefore, there is a possibility that an inverse wave here (flipping the cycle vertically) suggests a turn down in the very near future, ending mid October. That would be in sync with the first cycles analysis I ran.

______________________________________

The Panic Phase and the TPD (Turning Point Distribution) Principle

The TPD Principle describes a period in time of several weeks in which an array of cycles congregate, including gravitational, geomagnetic, and nuclear. It’s around this time that markets have historically topped. I was asked to include a reference to this in today’s blog post, which I’m happy to do. This principle generally refers to market tops (which we’ve already seen on May 20, 2015), but it’s interesting to note how many astro events we have occurring over the weeks surrounding the upcoming major turn in the market.

In his book, “the Universal Cycle Theory,” Stephen Puetz writes, “The TPD principle involves the eclipse cycle as well. The eclipse cycle normally peaks on the first new moon before a solar eclipse. Following that reversal point, it takes six weeks for sentiment to shift from euphoria to panic. Then on the first full moon after a solar eclipse, a panic-phase begins. A panic phase usually last two weeks—ending at the time of the next new moon.”

The dates:

Aug 14 , 2015 – First New Moon before the Eclipse (there is a New Moon happing at the same time as an Eclipse—Sept. 13)

Aug 29 – Full Moon before the Solar Eclipse

Sept 13, 2015 – New Moon and Partial Solar Eclipse

Sept 23, 2015 – Fall Equinox

Sept 28, 2015 – Super Blood Moon Eclipse (start of panic phase?)

Oct 13, 2015 – New Moon

So … there’s a lot happening in the area of cycles right around now. Couple this with an ending diagonal Elliott Wave pattern and hitting the 62% retracement level and the September 28 date starts to look important to a possible major market turn.

Peter, Would you have any thoughts or possibly consider posting wave counts for EFA or $GDOW?

Paul,

GDOW is interesting and I’ll use it today/tomorrow as it serves a particular purpose. EFA likely not unless you can sell me on it. It looks to me like it needs to do a double top. GDOW supports my contention that the US indices are going up one last time. Thanks for the GDOW idea. I’ll check on it from time to time.

New post up. https://worldcyclesinstitute.com/a-renegade-count-apparently/