The US indices continue to grind higher seemingly without end, but … wait! More signs of a top are showing up.

Using Elliottwave technical analysis, I posted my prognosis for the coming sessions here on March 2, 2015. Sure enough, the next day we headed down and I added over 10% to the bottom line.

However, we came down in three waves which, in EW lingo, means we have to head up to the top one more time. That also makes sense when looking at the overall daily chart, because an ending diagonal is clearly visible on all three indices (Nasdaq, DOW, and SP500).

Below is the Elliott Wave ending diagonal pattern. To a non EW trader, it’s simply a wedge (as per Murphy’s “Technical Analysis of the Financial Markets”). You can find the Elliott Wave explanation here in the Elliott Wave Principle on page 37.

Below is the Elliott Wave ending diagonal pattern. To a non EW trader, it’s simply a wedge (as per Murphy’s “Technical Analysis of the Financial Markets”). You can find the Elliott Wave explanation here in the Elliott Wave Principle on page 37.

|

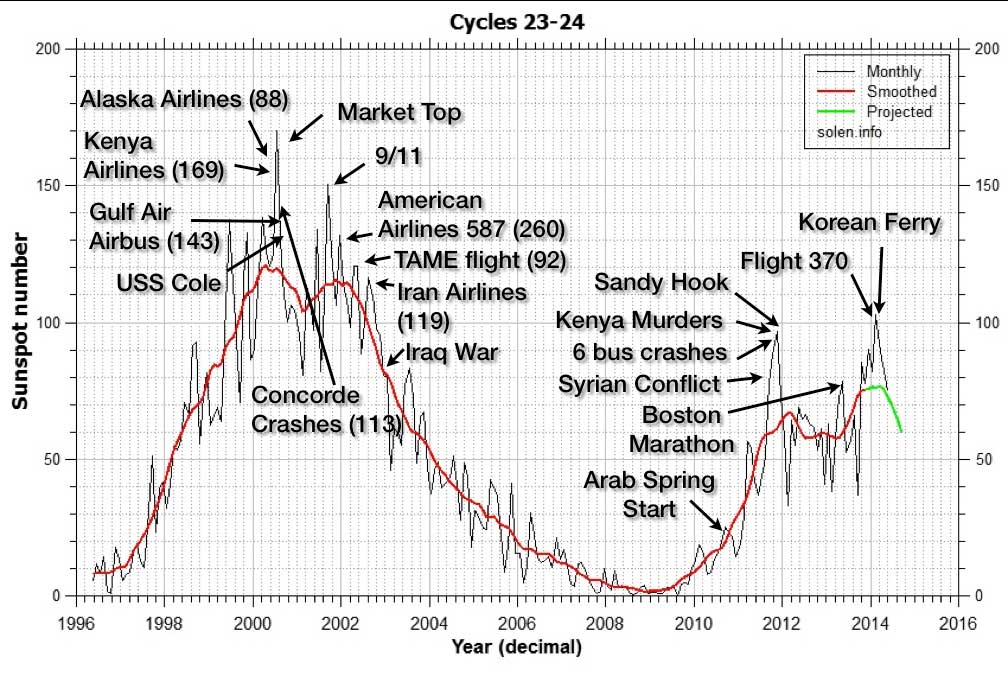

Steve Puetz in his exceptionally well researched book on cycles, The Unified Cycle Theory: How Cycles Dominate the Structure of the Universe and Influence Life on Earth, identified “The Turning Point Distribution Principle” (TPD). If you don’t have his book, I highly recommend getting it.

The TPD point where geomagnetic waves line up to signal a major market turning point. Mr. Puetz cites two causitive agents:

- An extensive period of speculation and leverage must precede a sunspot maximum

- The sunspot cycle maximum must synchronize with either the 6.36 year or the 19 year cycle.

Now, let’s look at some recent dates:

According to Steve, the top of the 172 year cycle (which predicts a market crash historically) was January 27, 2007. (Steve’s major cycles are harmonic—divisible by 3 to get to the next lower length—172 years, 57 years (Kondratieff), 19 years (real estate and market panic), 6.3 years, 2.12 years and 258.11 days. All of them topped on January 27, 2007.

Let’s go back to those two causative requirements: The first one is a no brainer—this is the largest bubble in history— and the second one is just freaky—6.3 years plus the previous US market top of October 11, 2007 takes us to January, 2014, which is the highest point in the most recent sunspot maximum. So the most recent sunspot cycle maximum synced perfectly with the 6.3 year cycle.

Let’s dig deeper:

The top of the US market in 2007 was on October 11 of that year. That was exactly 259 days after the cycle top of January 27, 2007. That’s amazing on its own!

If we roll ahead two cycles of 6.3 years + 2.12 years (a total of 8.5 years roughly), we land on this month in 2015.

The DOW low in 2009 was on March 6. We’re almost exactly seven years later this month. The seven year period seems to be separating market tops over the past couple of decades.

The Panic Phase and the TPD

In his book, Steve writes, “The TPD principle involves the eclipse cycle as well. The eclipse cycle normally peaks on the first new moon before a solar eclipse. Following that reversal point, it takes six weeks for sentiment to shift from euphoria to panic. Then on the first full moon after a solar eclipse, a panic-phase begins. A panic phase usually last two weeks—ending at the time of the next new moon.”

The dates:

March 5, 2015 – First New Moon before the Eclipse

March 20, 2015 – Solar Eclipse and Spring Equinox

April 4, 2015 – Full Moon (start of panic phase?)

April 18, 2015 – New Moon

So … there’s a lot happening in the area of cycles. Couple this with the ending diagonal Elliott Wave pattern and I’m looking intently at March 20 and the following moon phases.

I truly believe using geomagnetic cycles together with Elliott Waves give you an exceptional ability to make more accurate predictions of the market and virtually anything else that happens on Earth. So, lets see what happens over the new couple of weeks!

One more note on Steve Puetz: I interviewed Steve via Skype late last year and this week, I’ll be posting new videos with excerpts of our conversation. You can sign up on the right to get a notice when they’re up.