The prolonged wait is almost over.

Wave 5 seems to have begun quite suddenly, except for the Nasdaq, which I’ll explain in the final chart. Most of the indices have completed wave 4.

Wave 4 in a motive sequence of 5 waves is always the most complex pattern. There are 11 different configurations to choose from. I generally tend to stay away from them (for trading purposes), because they’re so difficult to forecast. This one was no exception.

Let’s start with some sanity … the NYSE (above). This is the easiest chart of all the indices to decipher (the NYSE usually is). I’m using this chart as the basis for my forecast for the rest of the charts below.

The NYSE didn’t go to a new high today before turning down. This means that the C wave remains the top of wave (4) as labelled. The big picture is that from the top of wave (4), we’ve done one wave of 5 down and then a very large abc correction up almost to the top again. This would be wave 2. So today’s wave would be wave i (or the first wave) of wave 3.

That being the case, after having been able to count 5 waves down, it should retrace 62% (wave ii? on the above chart) and turn down into wave iii of 3. The 62% retrace level is 10,128. The second wave top in any wave is always the preferred point to take a position in the market from an Elliott Wave perspective.

The DOW above has been more difficult to decipher. It’s similar to the chart for the SP500. This index also did not retrace up to a new high, although it was extremely close to a double top. This leaves the top of wave (4) at the top of the C wave as marked on the chart. From the top of (4) we did one wave down. However, this wave ended up being in 3 waves, as far as my count goes.

What happens very often in a case like this is that if part of the wave is in five wave (the very top, for example), the wave will retrace to that point and that appears to be what has happened here (at least, that’s what my count reflects at the moment. In that case, we’ve had a very small wave 1 down and a very large double-pronged wave 2 set-up. This means we have done the first wave (wave 1) down of wave 3. We should retrace now into wave 2. The 62% wave ii retrace level for the DOW is 16,493.00

The SP500, as I said, is similar to the DOW. It did not retrace to a new high and so, being able to count 5 waves down in today’s wave, it looks like we’ve completed the first wave down (wave i) of the third wave. We should retrace 62% to about 1969 and then turn down into wave iii of 3.

As I write this tonight, two things are taking place that seem to support this count.

- The futures are trying to bounce in a second wave, and

- The euro (eur.usd) has finished one full wave up of 5 waves up and is poised to retrace into a second wave. It has been running inversely to the US indices. In other words, as it does the second wave down, the US indices will likely complete a second wave up. They will both turn into third waves (in opposite directions) at the same time.

The Nasdaq is the “black sheep” of the family tonight. It’s the only one of the US indices that went to a new high today. It is also the only one that has retraced 62%, therefore putting it in a wave 2 position. I have labelled it as such. It means that as the other indices trace out wave 3, 4, and 5 of (5), it will trace out wave (3), (4), and (5). So it’s in sync, but it appears at the moment at different degrees of trend.

I may eventually change to labelling back to wave 4, but let’s see what happens going forward.

It also completed a wave down tonight. However, it’s difficult for me to count 5 wave down in this wave, so it may retrace to a double top.

I have place the alternative count on the chart, in case this is, in fact, wave 1 down.

Alternate First Wave Down

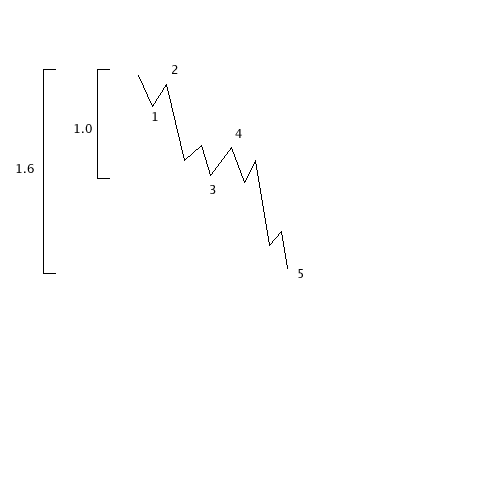

There’s an alternate structure to a first wave. Many times, they come down in 5 waves and simply retrace 62%. More often, though, I find they retrace only 38% to the previous 4th wave. You can see to the left that there’s one wave down to the “3” and then a fourth wave retrace, the “4” on the diagram. So watch for this today, as it’s certainly an option.

In this case, the fifth wave is as long as the first three combined and then the entire wave has to retrace 62%, which will bring it right back to the same 4th wave marker.

So, it’s a complicated market. However, the overall direction of the market is down, with wave 5 scheduled to take us to new market lows, while the Nasdaq follows along to much the same drumbeat.

Thanks for the update Peter. Good work.

Peter, thank you for trying to explain elliot wave to us. I am wondering if it’s possible that the fourth wave is not a triangle but an irregular wave.

I think an irregular is a 3-3-5 sequnce. We are finished with the first three but the ‘A-B-C-D’ you labelled in the SP500 is actually the next 3–a complex first and second wave was just finished and now we are heading into wave B which can be much higher than the start of wave A (Aug.21)? Then from the higher B the downward 5 waves?

HI Liz,

The fourth wave isn’t a triangle. We left that possibility behind last week (actually, I think it was Tuesday).

There is no such thing as an “irregular wave.” The 3-3-5 combination is a flat, which I was expecting until today but which has been negated, due to today’s bearish wave, which has come down in 5 (by the looks of it) and passed the previous fourth wave. Perhaps you haven’t seen tonight’s post. https://worldcyclesinstitute.com/wave-five/

I don’t understand the rest of your comment based on where we are now.

Most of the waves in this fourth wave were 3’s, depending upon the index, and you can’t have a first wave down that’s in 3 waves. And B can’t be higher than A. That’s impossible. Perhaps I don’t understand your comment …

If you have questions about tonight’s post, let me know.

Incredible, Peter,

it functions like a Swiss watches.

The futures have just retraced your level (miss just one point).

This Wave 2 should be in three or in five?

For the moment it is in Three but it looks like it is finished already because the market breaks down

It has to be in 3. All retraces are in 3. Only trend waves are in 5 and they’re down. I got a good chunk of it going up. It didn’t quite make the 62% point, so I suspect it will attempt it again with the market open (usually, it has to make it, or better).

It looks like 3 down as well, which would have to retrace … we’ll see.

Yes, the market is like a Swiss watch, if you know what to expect.

I see, at CME the high is at 1957, but with CFD my order was executed at 1967.

That’s why I’ve thought that it has almost retraced 0,62

It almost retraced to 62%, but not in the main indices of course, as they’re not open. So, it should have to do it again, I think. I’ve never seen it not do that. However, if we go to a new low, then I’m likely in.

What I see is that Europe doesn’t follow 100% ES.

Looks like they are also waiting for the rebound

Yeah, could be. And this is why Elliott-wavers get in on a second wave. Because you’ve seen a first wave down of 5, you look for the 62% retrace (which is almost at the top, really) and then you have a great big, long 3rd wave ahead of you. The safest way to trade.

The only problem here is to determine correctly the wave structure.

I mean, to be sure that it is the first one and not something else

Yes, that’s why it’s important to count five waves. It has to look like the diagram I posted a day or so ago.

That’s why I posted the Nasdaq as a 3 last night … it looked like it came straight down at the top without a valid second wave.

But I think it must also be in 5.

Looks like the market has just broken the yesterday low

But it stopped. The euro is also being a bugger. It has not retraced 62%, but it should. We’ll see. I haven’t given up.

The other thing that “might” be happening is that the ES completed the fifth wave down after hours, as you likely know. If the main market is not “done yet” with yesterday’s first wave down, we might have to sit here to complete it and then start up once the main market is open. That’s why the ES and NQ usually go in opposite directions from the main market at night … the market doesn’t like gaps … and key points, like bottoms and tops have to register when the market is open. Just an observation from years of watching the market.

… like little lambs to the slaughter … 🙂

Yes, it’s incredible

A lot of people don’t believe in Elliott Wave until they have this experience. Cycles and planetary influences are fabulous to give timing for major turns and an overall market direction, but Elliott waves give you entries, a map, and tell you the lengths of waves (pretty much) so that you know when to exit.

So … the A wave may be in 5, then we’ll have a B in 3 and the C should hit 62%.

Do you mean 1957 – the end of C

I don’t know what 1957 is. I have 1970 in the SP and about the same in the ES.

Now, the rule is actually that the second has to do at least a 38% retrace up to 62%, so it’s important to watch for a turn anytime after SP 1957, so maybe that’s what you’re referring to?

It looks like we’re just bottoming properly.

There’s a second first wave configuration that goes up 38% from here to the previous fourth wave and then does a very long fifth wave down, the same length as the first wave, so have to watch for that. But after that, the entire wave has to retrace 62%. So there are a couple of options for this wave up. I’m talking about the main indices here.

ES will likely go up to 62%.

Ok, I thought you were talking about 62% of today move down in futures.

It mean that we should bounce higher than the high in the futures.

In such case when I look after this bounce at ES 24 hour quotes I’ll see the seconde wave done lower low and the higher high before breaking in the third wave. You’ve explained that it is because the cash market want to complete its own structure. But any way it will be difficult to realise this after

I see the ES as doing an abc second wave, so I expect it to have to go up to that original 62% target. SP and the others may take a slightly different path and only go up 38% before turning. The Nasdaq I’m still not sure about. It’s way out in front in the retrace department and it still looks like 3 down to me.

Dmitri,

I put a diagram of the alternate first wave structure (for the main indices) in the blog post above at the bottom.

I think in the ES, we still have 5 of C to go. The C wave is over 1 times the A wave. 1.6 times would be about 1964.

I think the SP and DOW will turn at 38%. A guess at the moment.

Hi Peter

Do you ever see the possibility we close the gap around 2035 ( S&P ) before we take the low of August 24th ?

Regards

AZ

No AZ, 2035 SP is long gone. We’re working on a second wave after doing one wave down of the fifth. It will get retraced likely on the much larger second wave in October.

Hi Peter,

watch out save your energie for the 5th down..

so we have to be patient again and watch to see SP bully die at 1970..

If this happenss tomorrow it will be inline with the bradley (this monday) and mercurius retograde ( people get emotional) till Okt 10..

We’re already in the 5th wave.

I posted the alternate first wave structure above. The SP500 may turn at 38%, which would be 1957 or slightly above at the previous 4th wave. You can check my comments to Dmitri, as well.

Watch for a turn in the SP and 1957 or slightly above. It may not make it to 1970, as per my alternate wave structure diagram (new) in the post above.

Great one as always Peter. I am following your counts very closely. Thank you for your daily update.

How dramatic do you see the magnitude of this current Wave 5 drop after the choppiness this week is completed? I see SPX in the mid 1800s before a solid bounce.

BIG! Too early to tell how BIG. My guess is a bit below that … depends on the wave structure heading down.

In my experience, erick, wave 5 should be about as long as wave 3 in these situations, so we might get to 1775 or so. Hopefully, it will become more obvious once we see wave 3 of 5.

Ditto. You are spot on with your 62% call. It looks like the turn is imminent…

Well, we’re struggling to get there. I have eyes on the euro, which should correct now (down about 62%, I think) and that should help the US markets hit the target. Then the euro will really take off …

Well, forget the euro. It’s in a fourth wave and has to make 1.3310 or so before retracing …

I think the US market is just about done.

Sorry, Peter, do you really see Eur/USD at 1.33 ?

It’s 20%

Yup. I also not positive the euro has done 5 down yet. I think this wave down could be a 3 and that it has to retrace back up to the top. If it is a 5, then it at least has to retrace 38%, which is the same figure I mentioned. 1.33 something … then it will turn. Be interesting to see, because the next turn is a huge wave 3 down.

Oh no … sorry 1.133 … my typing!!

I’m not THAT crazy!

Sorry, that’s 1.133. You must have thought I was nuts.

I wouldn’t be surprised to see the ES done at this double top here.

SP also may top at a test of today’s high.

Well Peter,

If the euro reaches that level the european markets have a steep fall ahead..

No, sorry 1.133 … but it has one heck of a fall coming, anyway.

Ouf, I’ve got some stress

What’s interesting is that if the euro has in fact come down in 5 waves, 1.133 is exactly the previous 4th wave, and a big turn there would put it in sync with the SP500, DOW, and NYSE. Something to watch.

Looks like the market has done corrective A and is now in B flat.

Do you think it is still capable to go up to finish C ?

B was a while ago. I put us in wave 4 of the C wave. I think we top here in the ES, which puts us at 62% of the wave 2 high. ES should top I think as the SP hits 1957. Euro also making a break for it …

SP previous 4th is at 1961. Another turn option.

Nope … we have further to go … in futures.

Or we’ve done B and we are in flat C ?

We’re in C. With this latest move, looks like wave 3 of C.

If we’re in wave 3 of C and it’s 1.618 the length of wave 1, that puts us right at 1970 ES.

Everything seems to be heading for 62% now …

Up to now they’ve made the same high as in futures

Should all top together.

We’ll have top at 1969 if A=C

If C=1.618A the top should be 1994.5 – the top of wave 1 in the futures yesterday

So, there’s another test. Usually when a couple of measurements point to the same place …

Sorry, wrong calculation

Peter,

Once again thank you for the explanation. However, I don’t know how to explain it but my bias is that 9/1 and 9/4 lows will hold.

Well then, that would certainly blow a hole in 80+ years of the Elliott Wave principle, now wouldn’t it! 🙂

Well Liz, I’d be interested to know what you’re using for your analysis. Today was a bit of a watershed day and I’m rethinking the count. I did a cycles analysis and it’s all pointing up. Today we had some minor wave turns that changed the picture – made it ambiguous. So, you may end up being right on the money. Thanks very much for your earlier comment. The more noise, the better sometimes.

In any event, based on today’s action, I’m re-evaluating everything.

We either have had a larger wave 4 down or we could simply extend this wave up a bit. But, we could also head right back up to the top … for now. There’s an October/November disaster on the horizon, I think.

1984.5

I don’t like the look of this wave down. It’s fallen over the trendline. We may have topped.

Yeah, I think we’re done.

This wave in the SP should take us to at least 1842 at 1.618 X wave 1.

Peter, by Monday you will look like a genius !!

All the best

haha. Thanks. But it’s just a guy named Elliott who figured this stuff out a long time ago …

But I thought we’d seen the last of you … good to see you still hangin’ around ….

So, Peter,

you think we go down tomorrow?

There were a lot of buyers last 15 minutes before the close.

That was just to clear out some of the shorts. I believe we are finally on our way down into Monday tuesday.

I agree. Down we go.

Yup, I think so, but it’s likely to be a bit of a brutal market for a little while. Not sure how tonight’s going to go …

But wave two should be finished, as far as I can see. It went up in 3 waves and almost reached 62% (Nasdaq did).

Anything up in 3 is shortable …

That end of day wave was a three.

My only concern is that ES might decide it really has to do a double top. We’re down in three so far, so that’s possible. The market doesn’t like gaps and going down will create one. However, we’re in the fifth wave, so gaps eventually get retraced by the larger second wave that will come later in September. So, I don’t know how that part will play out tonight.

So Peter,

If everything is in place we should go down from here futures leading the way overnight?

Think so. Tomorrow should be quite negative.

PALS and US equities:

Phase: bullish till next Wednesday close

Distance: bearish after Sunday

Declination: bullish till Tuesday close, bearish after

Seasonal probability: bullish until next Tuesday close

Planetary angles: bullish inner planetary positions, bearish Jupiter conjunction

Tides: rising to Sunday, down all next week.

Summary: Expect higher prices, plan to look to short side starting next Tuesday near the close.

Solar eclipse this weekend….. into the storm…. Lunar eclipse Sep 27; the sun has been propping up the market but when it eclipses it opens a trap door

Hello, Peter,

do you think double top is still possible?

Possible, yes. Probable,no. That was for overnight. It tried but didn’t get there. We’re going down. Wait til we drop below the trendline up from the low.

Any way I’m in the position since yesterday.

It seems they are waiting for Europe close.

Market is extremely thin, no volume.

I note that the euro is about to top, imho. Maybe that will be the trigger. The dollar has been sitting in a fourth wave, waiting to turn up.

The market follows the oil last days.

Today oil goes down but the market is stuck

We may get some kind of pop in the markets here within an hour. I am still bearish going into early next week. All the best every one.

Hmmm. Pop? Why say you?

I hope I am wrong ! My own indicators are looking for some kind of head fake before heading down into next week.

ES just did a 62% retrace … yeah, we usually go to the opposite extreme before turning …

I’m looking for a eur/use turn right here … If so, that should begin to shake things up a bit.

Agreed with Dave and Peter. The trend for next week looks quite bearish. Both my primary and alternative counts result in a sizable downward movement. Hence I am fully short in anticipation of SPX dropping to 1890 early next week, then a lot more.

Miners are extremely weak. My GDXJ trade now is turning into a long term investment. Not good 🙁

Good luck everyone!

GLD, which I’m long, is down in 3 waves, so it should turn around and retrace.

But now I note that the extension down from the A wave suggests a new low.

Thanks Peter. I also hold some GLD. It looks like the resistance is around 105.90 to 106.65 should be hit before a bounce?

I agree with you, for new lows. My longer forecast is for gold, is to come under one thousand

I’m actually expecting gold to go up in a countertrend move before it eventually heads down around $750.

In any event, there’s your pop. Great call!

I don’t have a chart on me, but I think that’s the previous 4th wave low. We’ve done an A wave down, looking for a B wave now … but it’s not cooperating.

WOW Peter, I thought I was bearish on gold. I use to get some so much flack from other traders for stating my views on gold for the last two years. I was always looking to $ 875.00 level. But 750.00 that would be a nice price. I hope you are right.

Peter,

where do we go now?

Finally they’ve breaken up the range

If you measure it, I’ll bet it’s 62% … it’s a three wave correction.

Yes, it is if this is 62% correction to the first in the third in cash.

Looks that way to me and it’s clearly corrective. Should turn down here.

We’re down past the previous 4th wave of the pop, so that should mark the all clear in the ES. It may head straight down from here.

Looks like 5 waves down, so this will be another very small 2nd wave retrace in 3 waves.

Sorry, Peter,

at what time frame do you see this five wave down?

haha, you have to drill right down to 1-2 mins.

You can see the same thing on the major indices. Textbook motive wave, and that’s what we’re looking for.

I’ve just looked this wave from 1956 to1946 at 1 min frame.

There are no significant retracement more then 10%.

It is direct. How do you see there waves?

Depends to some extent on your charting software. And I’m do used to picking it out. Yes, it’s hard to see. In any case, one more signpost that we’re heading down.

It retrace up already 76% and in 5 waves

Yeah, well I was dead wrong about that wave! Minus 1 for me! I’m getting tired of this dance …

ES should just do a double top. All the indices look to be doing the same … sigh.

At what level the double top? Of what degree?

1955.50 looks like ES.

Next stop is 1959. Looks like that previous wave came down in 3 waves. We still have a possibility of making that previous top from the other day that was slightly short at about 1967 (it’s still possible). One of these will be the end of this craziness.

Finally, they fight to close DJ at 16400

I think we stay here until the close

ES Wave C is 1.618 X A at 1957.75

All of the indices look to have done a solid first wave down. So we’re likely retracing 62% there. That puts the SP top at 1969, DOW at 16,491. So we may have some more dancing to do over the weekend then come down on Monday.

That might mean we do a fifth wave up in ES to 1967/8, which is the current 62% retracement.

10 of 13 years S&p futs closed higher on 9/11, one year was down 1 tick, another year 9/11 was on a weekend

I agree with Dave that gold might see sub $1000 before a solid V shaped bounce. It might happen when the stock market “crashes” in October???

Erick, that is one possible widow of opportunity. ( Oct – Nov )

I would give it a lot longer time frame. The turn could be in oct (down). The bottom will be when we’re near the bottom of this depression and everybody’s selling everything that isn’t tied down, including gold.

We MAY HAVE just finished that POP. We should know within the hour. Still VERY BEARISH !! going into Monday tuesday

I am even more concerned for the 3 rd week of Sept.

Small position, short eur/usd. Let’s see where this thing goes ….

Mercurius retograde starts sept 14 and end Okt 10…

This has to be the moment when thinks will fall apart..

Retograde 2014 was Okt 4 and ends Okt 25 the Shemita warning…

So be patient if the fall is brutal I wil be out before Sept 18…

Take care..

Thanks, John. Yeah, it’s taking forever to roll over. But I think the dollar is turning as well …

Peter, I sent you an email.

I don’t see it, Dave. What’s the subject line? (I’m getting a lot of spam right now that I’m trying to clear out, but I don’t think I nailed you … lol)

It got bounced back.

I sent you one to your gmail address.

Title Jewish holiday crashes

Nope. Did a search. Definitely don’t have it.

So, Peter,

I think we’ll close here at the top of the day.

What do you think about this wave structure and where we should go from here?

Yup, looking around, everything is heading for that second wave at 62% and then we head down into the third.

What do you mean?

It seems we are still in the same range that yesterday and we finish almost at the yesterday high in cash. May be we’ll go higher in after.

Don’t you think that we may go higher on Monday?

Do you mean that we are still in 2 of the 5 and we should retrace the 1 of the 5 to minimum 1970 and maximum 1990 ?

Yeah, you could call it 2 of five (or the first of 3). I will do a series of 5 minute charts tonight (or tomorrow) and post them so you can see the 5 waves down and the second wave. Remember, I said we missed the second wave in the ES but not by much? Well …. what happens is that the market is sensitive and doesn’t feel complete (I’m half-kidding here) unless it absolutely makes that 62%. So that’s likely what the ES is doing. We’re going back up to test that point, which is now exactly a 62% retrace.

Meanwhile the US indices never have retraced 62% from the first wave (1 of 3), so those figures I gave you in the other comment are the second wave targets at exactly 62%. I would bet big money that’s where we’re headed and that we head down off the open on Monday because we are so, so close.

Second waves retrace 62% and 4th waves retrace 38% and they’ll gyrate around until they make it there. The joy of Elliott Wave.

Thanks, Peter,

but you told that 62% is a minimum of retracement.

So, the question is if it may go higher and what is the level to cut the shorts if it goes higher?

Correct. Technically, it can retrace up to 99% but that’s extremely rare. Most of the time what happens is that the SP/ES retraces 62% and the NQ/Nasdaq goes to 76%. So 85% of the time, you’ll find the retrace is 62-70%.

So, when you have 5 waves down, that signals the trend is down and these retraces are in 3 waves, which is corrective. All waves in 3 totally retrace.

OK? The charts will make it very clear.

Dmitri,

New post up. You’ll want to see this. After looking at all the charts, I’ve changed my mind about the stopping point.

https://worldcyclesinstitute.com/the-trains-pulling-in/

Peter I have tried sending it to inquiries@worldcyclesinsitute.com worldcyclesinsitute.com

No go

I just moved that address and haven’t tested it. Use peter@worldcyclesinstitute.com. My apologies for the problems.

And you’re missing a “t” in “institute.”

It should be arriving shortly. LOL I am only in the next province over here in Vancouver.

haha … well, Canadian snail mail won’t work … hopefully, this is faster.

Since 9/11, $SPX on 9/11 has averaged a gain of 0.43%. $SPX was up 0.45% today. $SPY

Really interesting …

China data out Sunday night… we shall see if this is the catalyst to start the down fall.

I also believe the euro completed a top today. I’ll be posting a chart. GLD poised to take off. The whole market seems to be turning right now.

New post live. https://worldcyclesinstitute.com/the-trains-pulling-in/

Latest Post: I’ve pulled it until I do a more thorough review of the markets.

From solar eclipse to lunar eclipse, bigger swings may resume: Merriman’s MMA Comments on markets & more http://www.mmacycles.com/weekly-preview/mma-comments-for-the-week/mma-comments-for-the-week-of-september-14,-2015/ …

Thanks Dave,

This is really terrific!

I suspect the whip saw action, we have seen over the last 2 weeks will intensify. I certainly see a min 1880 – 1820 sp. With large retracement swings from top to bottom, bottom to top.

Great for swing trading. Good luck every one

I am still fully short with 3 x ETFs and put options. Every one is waiting for the fed meeting. I suspect Mr Market will surprise every one Monday and Tuesday. The sept 14th 15th I have already blogged for the last couple of weeks maybe as surprise dates for the down side. Good luck.