Way Too Much Bull!

Way Too Much Bull!

To be successful in trading, one of your hats has to be a “Contrarian Hat.” When everyone else (the herd) is in a trade and positive it’s going to continue, it’s time for you to look for a trend change. When the movement of an asset (eg – the US Dollar) starts to produce major mainstream news stories, you know a trend change is imminent.

The US Dollar has been all over the media this past week; the trend is all but over.

The herd registers extreme sentiment in one direction near the end of a trend. In other words, extreme mass sentiment of this nature is usually due to “everyone” being fully invested in the current trend. Volume starts to dry up, because there are few others left out there who aren’t already committed (both financially and psychologically). We’re seeing historical off-the-charts extremes.

Daily Sentiment Index (percentage bulls)

Here’s a reading of this week’s sentiment (trade-futures.com), along with the level of bullish sentiment:

Gold: 91%

Euro: 90%

Crude Oil: 96%

Nasdaq: 97%

SP500: 96%

US Dollar: 8% (in other words, heavily bearish)

The last few days of this week, we’ve seen a negative NYSE advance/decline ratio even as US equities rose to extreme new highs. The FANGs (Facebook, Amazon, Netflix, and Google/Alphabet) are the major stocks behind what’s left of this rally—market breadth is very low. Along with the sentiment reading his suggests a turn is imminent.

Also note that the VIX levels have been abnormally high in the final stages of this rally. This non-confirmation is typical of the final stages of a trend. The VIXX has also turned up very recently, also telegraphing a change in trend is likely nearby.

Prepare for a Turn

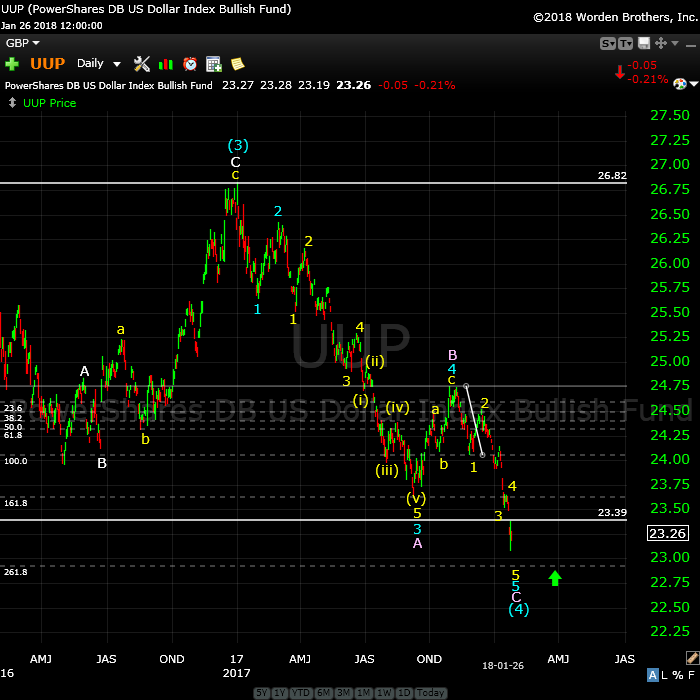

Let’s look at an update of the US Dollar.

I’ve been maintaining for the last couple of years that once the US Dollar found its low (it’s in a large fourth wave—a corrective wave), that it would mark the top of the US market.

Above is the daily chart of UUP (US Dollar ETF). UUP is representative of the structure of DXY (the US index) and will provide an excellent predictor of the impending top in currency pairs and the US indices.

Last weekend, I wrote here that I was expecting a small yellow wave 4 and then a new low in a wave 5. We now have that pattern in place, but it doesn’t look quite complete yet, although very close. I’m expecting one more smaller degree fourth wave now (up) and a final fifth wave to conclude this trend, culminating in a turn up and leading eventually to a new high above 26.82 for UPP and a similar new high for the US Dollar.

The dotted fibonacci line at about 23.00 could be the final target for a turn.

The movement of the dollar strongly influences the movement of just about everything else, so it’s important to pay attention to what it’s doing on a large scale.

___________________________

DAX has potentially topped and tracing out an impulsive sequence to the downside. Some USD currency pairs appear to have changed trend, while others are working on a turn. Oil is looking “toppy.” Gold and silver are heading down with USDJPY. The VIX has also foreshadowing trouble on the horizon. Even the VIXX is showing signs of a trend change. We’re almost all set—we just need the trigger for the US indices. The trigger is the turn of the US Dollar.

In summary, everything is at an inflection point, or very close to a turn, but a little more patience is warranted. This is a trend change internationally; the US market is only one of a huge array of big players. The world turns …

Calling a Top

There was a period in August 2016 where the US market looked like it was heading for a top. I never did call a top, however. You can’t call a top until you have a first impulsive wave down to a previous 4th wave, a second wave up to at least 62% of the drop and then a new low after that. We haven’t had that sequence, so I haven’t called a top. You’ll know when I call a top … lol.

Once the SP500 went to a new high in 2016 (just that one index), it was clear we weren’t going to top at that point, and I proclaimed that we were going to continue heading up. It was an immediate call because EW is very clear at certain points. Once one index provides a technical breach of a key level, its buddies will follow.

This wave up from 2009 is a B wave, a corrective wave. It’s not supposed to be possible, based on Prechter’s book, which flies in the face of what Elliott believed. I wrote about this in my blog a few weeks ago. I’m one of the only ones that believes we’re in a corrective B wave, which is notoriously hard to predict, because there are few to no rules. They end after 5 waves, but will appear to be in 3 waves. The subwaves are often all over the place and fibonacci ratios are often not hit (contrary to what happens in impulsive waves).

EW is price cycles; it has an extremely weak timing element.

So, due to the weak timing cycle, you have to follow EW until you see the final fifth of fifth of fifth (these levels due to the fractal nature of the market). So, while Bob Prechter (EW’s iconic promoter) has called a top several times, I won’t until I see the pattern I’ve outlined above. It might be late for some, but it will be a “firm” call.

This weekend, we have the US indices finishing the fifth etc wave. Several major stocks have already topped and are in the midst of tracing out the pattern I described above. DAX has topped unofficially, along with TSLA, and AAPL and others.

However, I won’t “call” a top in the US market until I’ve seen the above pattern, because it’s unsafe to short until that pattern has unfolded.

People say I’ve called a top. I have not. I’ve been saying we’re topping, but I also say topping is a process. The US indices are part of a much larger picture. They are one asset class of a worldwide topping process. I expect the US indices to top this week. The signs are all over the place, but the key is the US Dollar.

______________________________

The Tesla Train is Leaving the Station

Above is the 2 day chart of Tesla, showing my prediction playing out. The top is not officially in here; we need a new low below ~290.00.

Last week, I suggested we’d head up in a “double-pronged” second wave, which is exactly what we’ve done. We’ve now potentially turned down into a third wave with a target in the 209 area. After hitting that target, we’ll require fourth wave bounce and then a final fifth wave drop to a new low near the 130 area.

There are potential variations to this pattern, but the ultiamate goal for a first wave down should be below 140.00.

Less Expensive iPhones on the Way?

Above is the 2 hour chart of AAPL. Two weeks ago, I predicted a small rise to a final high, which is what happened. It was followed by a turn down.

Now we have what appears to be three waves down in place. Note that the third wave as shown is a fibonacci length of 1.618 X the first wave. I’m expecting a fourth wave bounce and then a large 5th wave down to the 148.00 area.

Ending diagonals always revert back to the start of the ending diagonal, which is the previous 4th wave area (~148.00).

On Deck: Facebook

Above is the 4 hour chart of Facebook (one of the FANG stocks). This shows the final pattern I described last weekend, which is an ending diagonal. Ending diagonals gained that name because they form at the end of a trend. You can short a pattern like this when it drops below the lower trendline.

There will be a lot fewer people posting “look at me!” stories in the coming years … somewhat of an understatement, I think. But again, the key to shorting these “whales” is to wait for a complete first and second wave scenario to play out.

__________________________

Changes to the Free Blog

On Friday of this past week, I removed the ability of “transients” to leave a comment without registering. It also means that the information of commenters won’t show up in the fields at the bottom of the blog … because the fields are no longer there!

After several weeks of exhaustive sleuthing and some fair expense, Bluehost (the hosting service I use for this site) finally admitted that there’s a bug on their server. I’ve had two well-know WordPress development companies go right through my site and both came back with a caching problem diagnosis, and that it was not an issue with the site itself.

However, I have to wait (usually up to 72 hours) for them to hunt it down and fix it. Hopefully, that will end the frustrating issue with posting comments. I don’t actually know that to be the case, but we’ve about run out of options. And these developers I’m working with know WordPress inside out.

Registration for Commenting

Want to comment? You need to be logged in to comment. You can register here.

If you register, it protects your information. It also allows you to comment without filling in your information each time. Once you’re registered, simply go to the home page and click on the login link top right in order to log yourself in. Usually, you’ll be logged in for several days before needing to be logged in again.

______________________________

Problem receiving blog comment emails? Try whitelisting the address. More info.

______________________________

The Market This Week

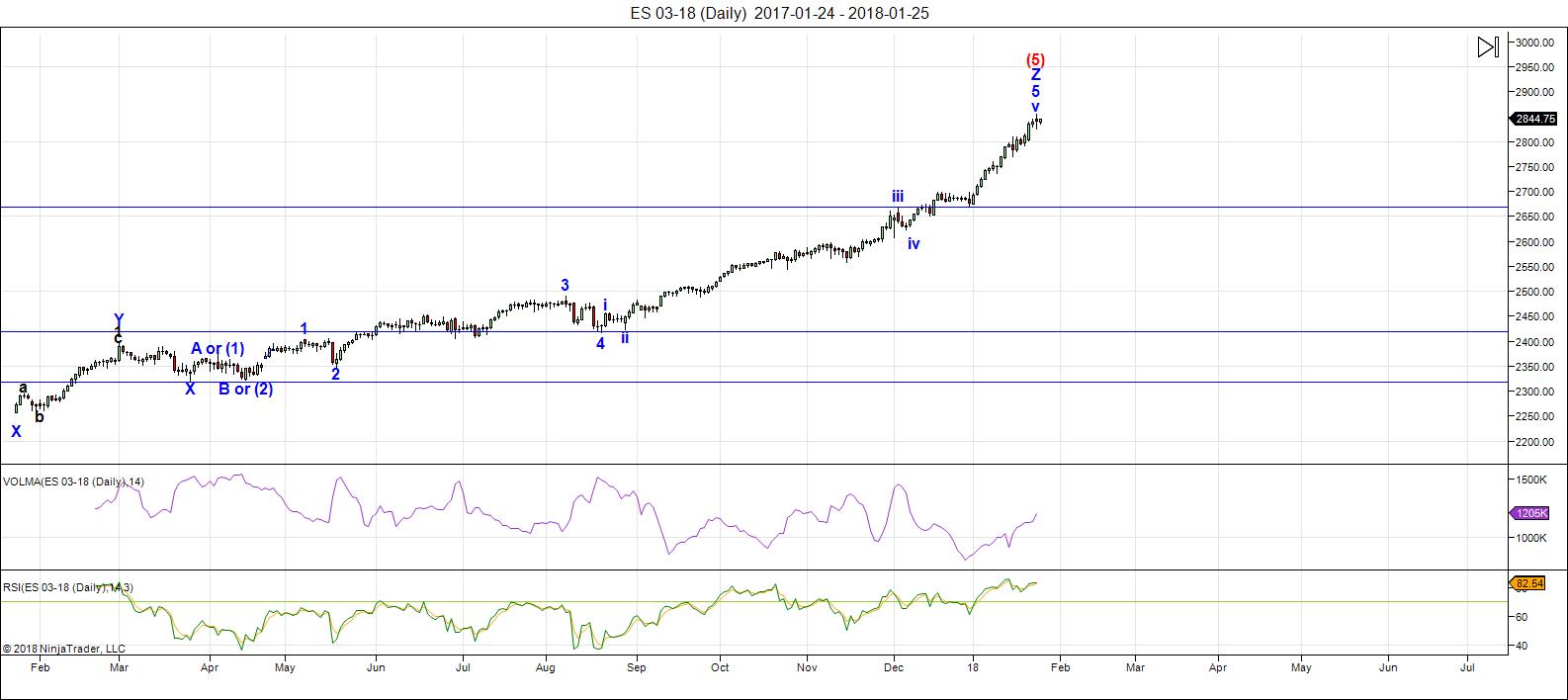

Here's the latest daily chart of ES (emini futures)

Above is the daily chart of ES (click to enlarge, as with any of my charts).

Above is the daily chart of ES (click to enlarge, as with any of my charts).

There have been no material changes to my prognosis. We are at the high. I expect this final wave to turn down imminently.

Another frustrating week as the US Dollar tries to find its bottom. As a result, the US indices have inched a little bit higher in yet another extended subwave of the 5th wave. The underlying technical indicators however, don't support an extended rise.

Volume: It's risen slightly. Bullish sentiment is EXTREME.

Summary: The count is full for the US market in general, except for small subwaves that form the balance of a motive set of waves in SPX and some other major US indices. We're watching for a turn, which will change the trend and end the 500 year bull market.

___________________________

Trader's Gold Subscribers get a comprehensive view of the market, including hourly (and even smaller timeframes, when appropriate) on a daily basis. They also receive updates through the comments area. I provide only the daily timeframe for the free blog, as a "snapshot" of where the market currently trades and the next move on a weekly basis.

______________________________________

Sign up for: The Chart Show

Next Date: Thursday, February 8 at 1:00 pm EST (US market time)

The Chart Show is a one hour webinar in which Peter Temple provides the Elliott Wave analysis in real time for the US market, gold, silver, oil, major USD currency pairs, and more. You won't find a more accurate or comprehensive market prediction anywhere for this price.

Get caught up on the market from an Elliott Wave perspective. You’ll also get Andy Pancholi cycle turn dates for the SP500 for the balance of the current month. There’ll be a Q&A session during and at the end of the webinar and the possibility (depending on time) of taking requests.

All registrants will receive the video playback of the webinar, so even if you miss it, you’ll be sent the full video replay within about an hour of its conclusion. For more information and to sign up, click here.

Impulse down complete and cashed in very nice 5 baggers on the short side. C wave? Or wave one down? I’m SO excited!! :

VERNE – i must protest ………..”MOST” strongly!!……this is unacceptable!

now …………………………. can i have some peanut butter on that ice cream???

as for your wave count – where is the “panic” shakeout selling that would capitulate a wave “C”……………..in fact the vix is elevated…………but much too controlled………. there is selling, and it is dripping………which means to me that the “dump” phase of this wave has “yet” to materialize……

i have a different target “potential”…… i am focusing upon…. https://invst.ly/6ip-d

Yes indeed! I too have noticed the slumber-fest on the part of the herd. VIX has shown nary a spike. Of course the smart money knows better than to short that beast. The sleepy longs are too sedated to buy the protection that they apparently are completely unaware they so desperately need, so yes, the “wet your undies” portion of this decline could still be ahead. Nothing precludes a furious second wave with possibly even a new lower low in VIX to REALLY plump up the sheeple though…lol! 🙂

BTW, I just LOVE that cute green flag flying at the top o’ the mountain…! 🙂

Will the bulls capture it…or…..BE DRAGGED TO THE DEPTHS OF HADES???!!! 😀

…………leave …………..the green flag……………….ALONE!

put your hands in the air……………..slowly……………………..and drop the weapon……………………..!

Verne……..dear genius verne…………………they back loaded the crash to begin in earnest a few days before the end of Yellin’s term………

the “drain off” of the Fed balance sheet……………..was back loaded also so that in this first week of Feb [due to uneven redemptions schedules] 50 billion is scheduled for “drainage”……………….

ahhhhhhhhhhhhhhhhhhhhh……. smell the mountain “coffee” verne…..but leave the flag!

the fed detonation has begun,,,,,,,,and Trump is the “tip of the spear”

verne…..

we be…..busted through the lower trend line!!!

hmmmm……”potential” ………………… is like honey….sweet and sticky

https://invst.ly/6iqwo

Farewell and adieu to you, Spanish Ladies

Farewell and adieu to you, ladies of Spain;

For we’ve received orders for to sail for old England And we may never see you fair ladies again…! 🙂

AAPL with 5 down now.

Yes my dear luri, “busting” through that trend line (please! no mammary glands jokes! Do dispense the milk of human kindness!) smells suspiciously like third wave behaviour….hmmmnnn????!!! 🙂

verne,

its after 2 pm……………………………..that means only one thing………….

NO CIRCUIT BREAKERS!!!……………………………………………….

for the public record………………………………. i loved the acting of Anne Nicole Smith!

🙂 🙂 🙂

And another thing; Although scantly (note, I did NOT say “scantily”; we will leave the matter of the adequacy of the FED’s attire for another discussion!) referred to, a plethora of Hindenburg Omens remain on the clock…what’s not to be bullish about… hmmnnn?

https://invst.ly/6ir7s

look at my “potential” w3 target ……………..

verne…………………. verne……did you faint?

Definitely a bit light-headed!

It may well be that they have decided that the sheeple are already plenty plump! After all, the optimism WAS historic was it not?

Oh Lordy!!! 🙂

I was quite wrong about one thing. I never thought they would do it during the cash session. Payback for the memo release perhaps? 😀

The question bullish folk have to be asking themselves today is:

“Do I remain long this market over the week-end??!!”

After all, the Nanny FED have always rushed to rescue so why would they not once again?

Here is the problem people. A close of VIX above 15 today WILL result in margin calls for the hapless crowd in the short and synthetic short vol co-hort, and those will most certainly go out over the week-end. The leveraged longs had better hope the market Nannies show up….

We are in the zone for wave 1 to be done. 2751ish is where my target is but anywhere in this 2770-2750 should be good for the 1st wave down. Imho

Yep! SPX 2749.00 should do it! 🙂

2749 – nope…………i shall post the end of week charts………in a few

we overlapped. its done!

W(4) and W(5) of 5 of the 1st wave still left to go..

How long d’ya think it will take, for the sheeple to awake?

So far as I am concerned, VIX says…GAME OVER!!

jody,

there is a very real potential that w3 still has a way to run. at this point i would post a chart………..but “investors.com” site platform from whence i chart has the site closed down for maintanence ………….grrrr………….

see chart above for w3 target…………we passed the 1.618% extension of w1………so the next level is the 2.618% level at 2722 level, and the 3.618% extension at 2662 level……

3.618 is the level i am focused upon as w3 target…………… we shall see…

https://invst.ly/6iswb

Yep. No real divergence today. Still, I would be surprised, (not my preference) if we don’t see some kind of rally next week. A bounce back to today’s gap area would be oh so delightful…!

Well, for the way I plan on trading this beast I am going to need some precision EW counting. See y’all at the chart show next Thursday. Closed a couple ten baggers today but now I am out for BLOOD…d’ya hear???!!!

Have a great week-end everybody! 🙂

Luri,

Wave 2 was .62

Wave 3 was 2.618 of 1

Wave 4 was .32

Wave 5 should be 1.618 of 1-3

Monday we should hit the 2751 mark and turn up for wave 2.

Maybe we gap down Monday then reverse until Thursday.

I will wait to see your chart.. I am always open to new ideas.

Looking forward to seeing luri’s charts as well. The new high in VIX does suggest wave three down might still be unfolding. VIX does tend to spike to a LOWER high on completion of the fifth wave of an impulse as it sports a long upper wick.

Looks like the puetz crash window wasn’t false at all despite the insistence of a commenter (not Joe). My biggest problem was when the commenter said she forgot that Friday is an opex day. Lol. 🙂

Hi Liz,

I am not sure who you’re referring to ( not Joe though). This wasn’t a real puetz crash window due to the lack of a preceding solar eclipse, which ties into what Joe has said. However we got a decent sell off post the full moon perigee eclipse. Interesting.

Regards,

Kerry

I was going to ask about the Puetz window, as I didn’t think it was, either, but I haven’t had time to check.

Kenny,

It is in my best interest the bull market continues because of my long-term accounts. I posted this last May:

“It’s difficult for me to be too bearish because many invest in equities automatically via 529s, 401ks, IRAs and Healthcare FSAs. Some companies have stock plans too and employees contribute every paycheck with no transaction fees. I don’t think many of them look at charts and say, “Oh, the RSI is too high, I’m going to stop my contributions on the 15th or 30th.” I feel quite a number are passive investors.”

That said, if you are bullish and advertise your stance to your audience, I feel it is important to communicate caution especially when S&P500 is 3 standard deviations above the 200 dma. I feel it is responsible to ask them to take profits and adjust portfolio accordingly if it is too heavily weighted in equities. Not all your audience can afford a drawdown that can last for months especially when they just piled in the last 2 weeks. The level of exuberance matched the sentiment for BTC from 11/25/17 to 1/6/2018. Yes, I know the BTC top was 12/17/2017 but late HODLers didn’t realize it was the top and probably were dollar cost averaging as it went down.

Our gracious host Peter T. has been saying we are at the top. I confess I don’t know if it’s the top but I do know we were at a major swing high. As a responsible bull, do you tell your audience to keep buying at value high or wait for a value low? What would trigger a swing high in this giddy market? Since this site is unique, using planetary, cycle, etc. influences, I commented on the “crash” windows theory. I gave the 2014 dates as an example.https://worldcyclesinstitute.com/a-pending-top/comment-page-1/#comment-26030

So how many “post full moon perigee eclipse” caused the DOW to drop 666 points? If you don’t want to call it a puetz crash then we can then probably call it a super blue blood moon crash.

As per space.com “the total eclipse of a Blue Moon hasn’t occurred since March 31, 1866.” What happened in 1866? As per Wikipedia (lol), “the Panic of 1866 was an international financial downturn that accompanied the failure of Overend, Gurney and Company in London, and the corso forzoso abandonment of the silver standard in Italy.”

Bottom line, a “crash window” was given as a hypo to warn new buyers from entering a swing high period.

I am rapidly loosing any notion of this being a fourth wave, not because there are no reasonable EW counts, but because of all the smug boasting of bulls about how they remain fully long, and some even contending a bottom is in…I suspect the

spanking will continue 🙂

Hi Verne,

I am a smug bull who remains long and I agree there is no fear. I am very alert to the downside but I intend to remain invested. The drop didn’t instill fear like previous routs. Of course the percentage drop wasn’t that much of a collapse compared to what we have witnessed in the past (yet?)

Ps – Thanks for fixing the sign in bug Peter.

Kerry

It’s not quite fixed yet but will be this weekend when I moved the site to another web provider. Bluehost has turned out to be a joke and won’t do anything about the bug on their server. It’s a pretty sad state when this kind of stuff happens, but it’s not surprising, I suppose, in the world we live in.

I wish you all the best Kerry. Investing and trading styles certainly differ I have no doubt many will remain fully invested long after this market turns and others will continue the merry dip buying…right up the bitter end. It is after all human nature to learn nothing from the past, therefore endlessly repeating it. Nothing new under the Sun!

Markets fall much more swiftly than they rise and so if focus on the former events.

I am quite content to patiently wait for a precise opportunities to make ten baggers on options on ES futures and five baggers on cash session trades than keep hard-earned capital in an overbought market in a time of historic sentiment extremes.

I believe the turn is in and we are in W(1) to the downside.

I will know more this week as the waves unfold.

Bulls will have 1 last chance to exit on the Wave 2 Bounce but that will be it.

We all know what happens after Wave 2. If the Bulls want to deny and not except the market does not go just up and risk their entire account then that is their business and they might as well kiss their account goodbye.

Yep! If we get second wave just ahead, the third wave down is going to be something to behold. Considering the plethora of red flags flying, I am personally amazed at folk still invested fully long the market. A few well known Ellioticians are already confidently proclaiming an important low at hand. While we are indeed seeing some potential bullish divergences developing in DJI and SPX, we see no such thing in NQ. For those divergences to hold the markets will have to turn and do so quite soon. Runaway futures on Sunday evening would be most inimical to the bullish case imho…

Look at a SPX weekly chart.. It is straight up. Anyone that has traded for any length of time know exactly what happens once it turns.. It crashes hard, because it is a blow off wave. Ok so if your Bullish and can’t understand the market goes the other way too, Why would you not move to cash and see what happens? Bulls make money Bears make money Pigs get slaughtered. With the straight up move bulls will take their profit and bears will start to profit on the way down while the rest will get slaughtered. The market comes down way faster than it goes up. Let Friday be a lesson to you.

Like I said on this next pop up will be your last chance to get out or get prepared for the butcher!

Hi Jody. I tend to agree with your bearish take. I can also count a five, triangle, possible five underway for an abc down. In addition to a massive trend change, it could also be just the A wave of a larger corrective decline.

I am intetested in what indicators you use to help you distinguish ABCs from 1,2,3 early. Thanks!

Verne,

C waves are usually 1 – 1.618% of the A wave. The 3 wave was 2.618 of the 1st wave followed by a .32 retrace for wave 4 and now we are in wave 5 that is about done. SPX 2751 is the target I have right now. We could of course retrace .62% then drop for a wave 3 that could in fact be a C for a larger 4. The retrace of that wave and how it is structured for me will confirm for 100% a top is in. 1-2-3 can be A-B-C but this structure down at this point looks motive.

And another thing…what IS it exactly with these DJI triple sixes?! 🙂

,

SPX…swing traders should have been short before Friday’s sell off…bottom indicator’s black line will dictate if this is a short term sell off or something more significant…let’s see if it crosses below the blue horizontal line…

https://twitter.com/allerotrot/status/959855920699379718

https://worldcyclesinstitute.com/a-full-count/comment-page-1/#comment-26558

have previously characterized SVXY as the ‘market tell’…SVXY “Does not track the performance of the CBOE Volatility Index (VIX) and can be expected to perform very differently from the VIX”…it is well worth monitoring!

in early January 2018 the Fed released their 2012 minutes which revealed the Fed had been short volatility…the release of the minutes was confirmation (at least for me) that the Fed had unloaded their short volatility position…further, SVXY was in the 130’s…UVXY was in the 8’s…however, Proshares DID NOT announce splits…that is important!

interesting fractal…let’s see how it plays out!

https://twitter.com/ECantoni/status/959953293765234692

Yep. I agree. The extemely rare TWS signal in VIX back in December was early, but also significant. I shorted SVXY and a few folk here mocked and insulted me… 🙂

https://worldcyclesinstitute.com/the-daily-vigil-focus-on-the-us-dollar/#comment-27260

A new blog post is live at: https://worldcyclesinstitute.com/on-deck-confirmation-of-a-top/

This website is for educational purposes relating to Elliott Wave, natural cycles, and the Quantum Revolution (Great Awakening). I welcome questions or comments about any of these subjects. Due to a heavy schedule, I may not have the time to answer questions that relate to my area of expertise.

I reserve the right to remove any comment that is deemed negative, is unhelpful, or off-topic. Such comments may be removed.

Want to comment? You need to be logged in to comment. You can register here.