Quick Update (last night)

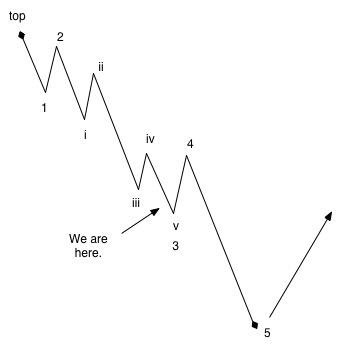

My least favorite pattern is a fourth wave in the position we’re in now. That’s because there are so many different combinations.

We’re also in an area of the wave pattern that finds two fourth waves side by side. You have a fourth wave (iv) of the third wave, which will lead to a single fifth wave down moving to a new low (but usually not all that far). Then you have a higher degree fourth wave (4) of the entire pattern so far.

Early AM Update: At the moment, this is a difficult market to decipher. That’s because the third wave came down so quickly that the subwaves are really difficult to see clearly.

Last night, I thought we were completing the third wave, but because of the action overnight in the futures, it looks more like we’ve already completed the third wave and are now completing the fourth wave, ready to descend in the fifth wave. The fifth wave down will be a big drop.

Overnight, the futures bounced into a second wave, retracing to the 62% mark from the top of the fourth wave. This suggests a third wave down is next.

Recapping the last day or two, it looks like we completed the full third wave, the fourth wave, first wave of the fifth and overnight, we completed the second of the fifth. If we drop below 1820, we should drop much further is a dramatic fifth wave.

I’m providing just one chart tonight because all the indices are pretty much the same (the Nasdaq looking a little different). Here’s the SP500 at the end of the day. I’m showing wave three complete and a fourth wave all but complete. Overnight last night, we bounced into a second wave, illustrated by the white arrow line up. We should open at the top of that arrow line.

If we drop dramatically below 1800, then we’re likely heading into the fifth wave directly. In any event, the larger trend is down, any way you look at it.

Thank you Peter. I am with your preferred count as well that we are at the bottom of a larger wave 3. It seems fitting well with the overbearish sentiment the last few days. We are experiencing a panic that rarely occurs. Traders are panic within the first couple days, then things shall start falling back to normal, when the rebound starts (Larger wave 4. Andre also mentioned a 08/26 reversal date).

From a sentiment standpoint, my take is that the mini crash like what happened on Monday never just immediately bottoms. There is a high chance that we’ll at least get a lower low (wave 5?). Before that lower low, we shall first have a bounce to build sentiment back up (wave 4). I still expect SPX to hit 2000 ish first before a destructive wave 5 drop 1820 or lower.

Erick,

I updated my post based on what happened overnight in the futures. We bounced and completed a second wave, so it’s more likely that we’re going directly into a fifth wave.

Thank you very much for the update Peter

🙂 These waves are humongous.

Yes these are totally extreme moves :). I am still unsure of the pattern. The lower low observed in the futures relative to the one in the cash index has left me with multiple pattern potentials, as you mentioned yesterday in your post. I think ED potentially could be another pattern as well?

What’s ED?

We bounced in three waves. It has to retrace down. I measure us at the end of the bounce.

The ES looks to be in a triangle. Cash will be different than futures, but the overall forecast will be the same. I’m finding the futures much easier to read.

I think we have had 4 of 3 and are headed down now based on the general look of 1929, 2008, and 1987.

Thanks for the update Peter,

Andre, do you have something to new so far on the roadmap shorterm and longerterm?

Thanks in advance

John.

John, this weekend a new post.

Great call Peter! So far the markets are acting like wave 5 is starting after a very weak wave 4 bounce earlier today.

So far, so good. Just broke support in the futures.

I don’t like the look of this wave down (overlapping and not motive) and the market is really volatile, so we may have more upside to go before we’re done.

And sure enough, there we go. Check out SPY, which seems to be in a triangle. I would expect us to touch the upper trendline before rolling over.

Peter… It looks like your least favorite scenario is playing out. Will you be playing wave 5, or are you currently playing the bounce? I am still long, and might stay long until tomorrow maybe.

I think the Nasdaq and SPY are in fourth wave triangles and that this is the higher degree fourth wave, with a large fifth to follow. We just have to wait for it to play out. The others will turn at the same time. Maybe tomorrow. I put us in wave e …

SP maybe did a double bottom—we could go all the way up to a flat. Tough at this point to say what the targets are, but the longer trend is down.

Great! Big thanks as always Peter. Much appreciated your help!

Possibly rolling over now. Triangles look complete for the most part.

Euro bottoming.

We didn’t roll over, so I expect we’re going to at least a flat.

I will do another post tonight, folks, since it’s become much more obvious where we are (in the fourth wave). We may start coming down tomorrow.

New post is live.