(orginally published early 2020)

(orginally published early 2020)

Are you terrified yet?

Politicians and the main stream media around the world are trying to scare you almost to death with the coronavirus threat, but like similar virus pandemics over the last century, it hasn’t had the effect they’ve been predicting. Like the Swine Flu ten years ago (2009), which was also hyped up to be a killer of millions, this latest flu virus is turning out to be another “dud.”

I hear over and over again from politicians and the main stream media that this current situation surrounding the Corona pandemic is “unprecedented.” That’s just not true.

What is unprecedented is the over-the-top reaction of both politicians and the main stream media to this new flu bug. They have little to no information on the severity of this virus, but have shut down an already extremely weak economy. Unfortunately, it isn’t going to come back to what it was.

During the polio pandemic (1918), for example, “panicked New Yorkers shut down schools, public cinemas, and swimming pools.” But, they didn’t shut down the economy.

Polio came back again in 1930, when the market “crashed” and people were hurting badly. Social mood was at an all-time low. It helped spark the well-known outcry from Franklin Delano Roosevelt, “You have nothing to fear but fear itself.” He was afflicted with polio in 1921..

We’ve experienced lots of pandemics in the past; the most recent, more deadly pandemic was the Swine Flu, which travelled across the globe in 2008-9 and reportedly infected 1.4 billion people worldwide. Numbers vary as to how many were killed (150-570,000). The current count for coronavirus is here, but the majority of those deaths are attributed to people over 70 who are already ill with life threatening afflictions.

Keep in mind the fact that seasonal flu kills 650,000 people worldwide on an annual basis.

Social Mood and Pandemics

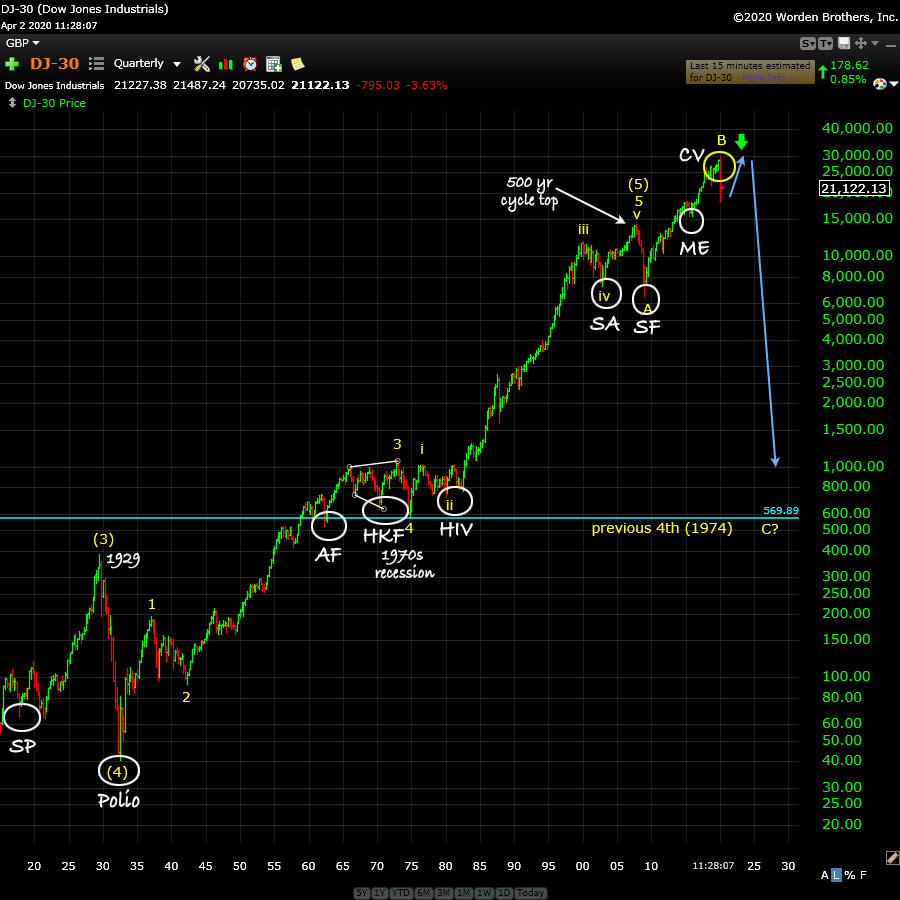

Let’s look a little more closely as to when these diseases strike, because the timing is really quite predictable. We’ll do this by looking at recent pandemics on a chart of the stock market (more specifically, the DOW Industrials—the most watched index in the world).

Above is a quarterly log chart of the DOW showing the period from 1918 through today. I’ve identified all the major pandemics in the timeframe in which they appeared. The key to the chart is in a table just below, along with the numbers afflicted and related deaths.

It’s important to note here that diseases become active when social mood is negative. You can see this clearly from the chart. Major pandemics happen when people’s moods are negative, they are malnourished, or struggling financially. This is what happens when there are recessions and depressions. I say quite often that “the stock market is a mathematical representation of the mood of the masses.”

| Icon | Name | Year | Infected | Deaths |

|---|---|---|---|---|

| SP | Spanish Flu | (1919-20) | 500 million | 100 million |

| Polio | Polio | (1916, 1930s, 1952) | 16,000 (1931) | 2100 (1931) |

| AF | Asian Flu | (1957-58) | 500 million | 1 million |

| HKF | Hong Kong Flu | (1968-72) | 500 million | 1 million |

| HIV | HIV/AIDS | (1980s- now) | 39 million | 770,000 |

| SA | SARS | (2002-3) | 8100 | 774 |

| SF | Swine Flu | (2009) | 1.4 billion | 570,000 |

| ME | Mers | (2012-15) | 1360 | 527 |

| CV | Corona | (2020) | Current stats |

Other “pandemics”:

- Ebola (2013-16) Cases: 28,600, Deaths: 11,323. This is a very dangerous disease that ended up being mostly contained in Africa (not a pandemic), but happened at about the same time as MERS

- Seasonal Flu (annually) Cases: 1 billion, Deaths: 650,000 a year

As I write this, there are scary headlines reporting that there are 100,000 deaths worldwide from the Corona Virus. However, seasonal flu averages 6.5 times that amount every year.

The truth is that the Corona Virus is turning out to be a new strong flu strain that’s not delivering on the hype. Nonetheless, the media and politicians are forcing people to isolate themselves and live in fear. The hysteria is many more times deadly than the virus itself because it has destroyed the already fragile economy worldwide and will destroy the lives of many hard-working families.

It’s also creating despondency and hunger and will lead to a rash of suicides, particularly from those who already suffer from depression.

The Stock Market and Disease

Even though worldwide debt is larger than it has been ever before in history (250 trillion at last count, and obviously growing like wild fire), the “herd” believes that a virus is the thing that’s caused this market downturn. However, I predicted this wave down over a year ago (long before the virus escaped in Wuhan, China). I also said several times that the coming bear market would be blamed on the corona virus, even though that bear market was predicted over a year ago.

The opposite is actually the truth. The drop in the stock market is a reflection of the mood of the masses. This is the perfect time for a virus to occur, when people’s immune systems are at a low, and that’s exactly what’s happened. over and over again, throughout history.

Nevertheless, politicians and the media blame the virus. Few ever look at the lessons of the past.

When the stock market drops and mood turns sour, illness becomes more prevalent. The most recent pandemic before this one was the Swine Flu, which hit in 2009, right at the bottom of “The Great Recession.” As it turns out, that drop was actually the start of what’s going to result in a major depression that will dwarf the Great Depression of the 1930s. We’ll see more (and more lethal) pandemics ahead, as mood turns increasingly more negative (after the top of the market, expected early next year).

The numbers coming out now (after all the hype and fear-mongering) are pointing to the Coronavirus being another flu-like occurrence that will likely kill no more people than would have died this year, anyway, just like the Swine Flu pandemic.

Estimates are that the Swine Flu affected up to 1.4 million people, but killed only about 150-575,000. (with a post-pandemic “spread” in the estimated deaths that large, it’s obvious they have no idea what the actual number is)

It was projected and hyped-up to kill many times more (19 million affected was the original prediction). What’s more, the annual death rates in the US for the years 2007-2011 were almost exactly the same. Statistically, the same number of people died during the year of the virus as died the year before and after.

| Death Rate/1,000 | U.S. |

|---|---|

| 2007 | 8.203 |

| 2008 | 8.124 |

| 2009 | 8.131 |

| 2010 | 8.138 |

| 2011 | 8.145 |

You can see in the above table that the death rate in 2009 was actually lower than it was in 2007, and the same in adjacent years. (Death rates are measured by the number of people per thousand who die from it).

What does this tell us? It tells us that no more people died from the Swine Flu than would have died anyway. This pandemic had no affect on the overall death rate.

The stories coming out of the current pandemic are that physicians are classifying anyone that died with the corona virus as having died because of it; however, in the vast majority of cases, the victims has underlying conditions, such as heart disease, high blood pressure, or respiratory problems.

According to an Italian Government Study, 99% of their Covid-19 fatalities were already chronically ill, and half were diagnosed with 3 or more chronic diseases. People who are dying with the virus are being counted as dying from it, even though the cause of death is much more likely to have been from their pre-existing condition.

This time round, figures coming out of the UK show the same phenomenon. 99% of deaths are to people who were unwell to begin with. The same number of people died in March this year in the United Kingdom (based on early figures) as died in March of last year.

In other words, these “pandemics” tend to hasten the death of people with underlying conditions that were going to die anyway.

It’s estimated that 650,000 people die every year from season flu. We’re nowhere near that number from the Corona Virus, and it’s beginning to subside (the curve is flattening, and even heading down).

The Media and Weak Politicians

We have media who are hyping this thing like crazy, because, let’s face it, they’re broke, and more clicks from scared-to-death consumers makes them more money from advertising. Politicians, who we mistakenly call “leaders” (they’re really “followers” because they always react to the consensus) have jumped on the bandwagon, due to fears of losing their jobs if they’re not seeming to react the way the media and the terrified public expect them to.

The perfect horror-show cocktail.

Dr. Anthony Fauci, current director of the National Institute of Allergy and Infectious Diseases (in the United States) seems to be running the show there. He has been instrumental in shutting down the economy, based upon little information about the current virus, using models that have historically proven to be wrong every single time they’ve been used in the past.

Dr. Anthony Fauci, current director of the National Institute of Allergy and Infectious Diseases (in the United States) seems to be running the show there. He has been instrumental in shutting down the economy, based upon little information about the current virus, using models that have historically proven to be wrong every single time they’ve been used in the past.

When the virus broke out originally, Fauci declared that “millions could die” in the United States. Now that number has inexplicably dropped to 60,000. However, despite the hype in New York, many of their hospitals are almost empty of corona patients. Similar numbers are starting to appear in other countries.

But, as Dr. Fauci announced the lower numbers and suggested the virus was waning, he also announced the “good news” that people would now be able to take their summer holidays. How out-of-touch is this guy? Most people are broke, are out of a job, have lost their business, or have otherwise had their lives ruined!

In 2013, Fauci was all for using promising medications (including hydroxychloroquine, which is proving so effective in fighting the corona virus now), but has come out against using these well-known and effective drugs in this case. What’s going on here?

And then there’s this. But, it’s probably nothing. It wouldn’t be about money …

And this from Robert F. Kennedy Jr.

Not a single model used to project the number of victims has even come close to reality. The scare is just not there.

It will prove that the proposed “cure” will be far more deadly than the virus itself. Even though we’ve had far more deadly flu epidemics, politicians have never before shut down the world economy based upon scientific projections that are highly flawed at best.

We need to pay attention to the cycles of history; they predict the future.

One Scary Crisis After Another

It’s the climate hysteria all over again. By this time, coastal areas all over the world were supposed to be underwater (none are), all polar bears would be dead (we have way more of them than before), and snow in the winter should have been a thing of the past.

But, it’s been colder and dryer over the past few years, just like the natural climate cycles of history predict. In fact, you can predict all kinds of things from climate cycles. We know, for example, that we have weak politicians at 500 year cycle tops (which is where we’re at now).

We also know that there’s always a move to authoritarianism at cycle tops, along with a loss of freedom. Every single time we’ve been at a similar cycle top, we’ve seem raging inflation (which makes our money almost valueless) which always ends in a stock market crash and a depression.

But, we don’t learn; we just don’t “get it.”

What’s to Come

Based on the history of pandemics, you can see that they’re fairly predictable. In times of social crisis in the past, we’ve alerted the public, and worked to develop vaccines. But never before have we shut down the economy worldwide. Particularly alarming is the fact that this has been done with little to no proven data that shows that this new disease is anything but a stronger flu.

The government has destroyed the already weak economy at a time that it can ill-afford to do so. It will not recover to its previous level and will simply limp into the inevitable depression that I’ve been predicting for over ten years now.

Natural cycles, which dramatically affect the economy are not new. There was lots of work done on them at the beginning of the 20th century. In fact, in the 1930s, Edward Dewey (who was originally Chief Economic Analyst under President Herbert Hoover) started the Foundation for the Study of Cycles, of which I was previously executive director. Many books have been written since, and a tremendous amount of scientific data collected that proves their existence and influence on our revolving planet.

Natural cycles, which dramatically affect the economy are not new. There was lots of work done on them at the beginning of the 20th century. In fact, in the 1930s, Edward Dewey (who was originally Chief Economic Analyst under President Herbert Hoover) started the Foundation for the Study of Cycles, of which I was previously executive director. Many books have been written since, and a tremendous amount of scientific data collected that proves their existence and influence on our revolving planet.

As the corona virus disappears in the next couple of months (the stock market is poised to turn up by June, resulting in an new all-time high either in late 2020, or early 2021), the mood of the masses will rebound. The virus is predicted to disappear from the radar, maybe not forever, but for the time-being, at least — naturally.

However, the economy will never recover its vibrancy, a lot more lives will be lost to suicide and social unrest, and there’s going to be a lot of finger-pointing. What was the point of rising to this level of hysteria over hyped, scary predictions that have never panned out in the past?

The truth is that the response has done (and will do) far more damage to people’s lives than the new coronavirus flu bug.

it’s certainly a lesson waiting to be learned. But, as we know from history, the human race is not very good at learning lessons from history.

“Those who cannot remember the past are condemned to repeat it” — Georges Santayana

Well said. All excellent points and entirely accurate. There are certainly many ramifications to come from the decisions taken so far by executives in charge of major banks, markets, corporations and governments. Heads will roll though not enough. As you know, here in Canada, our Prime Minister, little Trudeau, is threatening Martial Law. How quaint, how cute, how droll, how to show that the notwithstanding clause in the Charter of Rights and Freedoms effectively states that we have NO RIGHTS or FREEDOMS. Here we are, just 5 months away from the 50th anniversary of the Martial Law declared by Pierre Elliot Trudeau in 1970. An entirely engineered false flag cover up of his, literally, back stabbing politics and secret plans to bankrupt Canadian Citizens by turning our Bank of Canada into a money laundering profit centre for foreign interests. And that he did. In the process, upon retirement, receiving stocks and a position on the Board of American Barrick Resources. Today called Barrick Resources they are the largest gold miner on the planet and the largest industrial polluter, too. I would bet a $100 that Brian Mulroney is very pleased with his Golden Handshake from the same company. They don’t call it the Chamber of Commerce, fornication, for nothing. Liberals and Conservatives in bed together making deals for retirement. What does that make Justin and Caroline?

How well I remember my visit to Parliament Hill, that cool October morning, to protest the Vietnam War. I admit that it was rather sobering to have a Sten Machine Gun shoved in my face by a kid only 2 or 3 yrs older than me. My father too had signed up for the CDN army at age 16 to go fight a war in Europe that was more about Central Banks and usury than it was about any real threat from Germany. He paid dearly for that, as did my mother and all of my siblings. The Canadian Government treats their soldiers worse than they treat the poor living on the street. I will swear a litany of crimes against these governeurs in the courts of heaven if given the opportunity. Whores. Parliament is a House of whores and nothing more.

Sorry, I digress.

The real problem is usury. The love of money is the root of all evil. The Messiah overturned the tables of the money changers in the temple because those bankers raped the widows and slaughtered the orphans with their usury. Now it is not the one temple of Moneta (the Mint of Money) in Rome, or Jerusalem, but a Central Bank in every country on earth except those who are out of favour with the KIng/Queen/Pope.

Times up. There will be a Jubilee. Those prepared will assist in the cleansing and revitalization of the planet. We know that Silver is Money, Gold is portable real estate, and Copper is the widows tithe so all may participate in the local and global economy and through hard work and judicious trade everyone can achieve the goals of life.

So said, so done.

Many thanks to the World Cycles Institute for teaching all who would come and learn of how the universe functions so provision may be made for all and none would have lack or loss through ignorance or fraud.

I thoroughly enjoy watching every step made towards true freedom and intrinsic wealth for every household. Heaven on earth.

The Jubilee is coming. I can see it now down the road.

well said !

Certainly can’s dispute any of this! Tks, Moriyah

As always Peter, a very well written and accurate projection of where we are, and what’s to come. Thank you for your analysis and the ability to communicate that to us in an understandable manner! You are at the top of your profession!!!

🙂

As quickly as SPX bottomed at 2191could it now be on its way to final top? Then rollover for good late 2020/early 2021?

No, another drop coming first.

This is an awesome article. Very well done.

If you have the time, can you take the same chart (or maybe even further back) and add the “Insanity at the top” events for each peak? Don’t forget Vagina Scented Candles (and the host of other crazy stuff) for this recent one.

Thanks, Mike.

No … in reply to the question … LOL. Don’t get me wrong … I have that info (it’s part of Dr. Wheeler’s work) and it goes back to 600 BC. This article took me over a week to compile and a couple of days to write (was difficult with the distractions of the past two weeks). The amount of data is the problem — it’s taking a long time to work through (that’s over 2000 years!). I’m in the midst of an article on Tudor England and the breakdown and civil wars after Elizabeth I died in 1603. It got cold and dry and it bottomed in about 1663 (Maunder Minimum) and then things started back up again. It’s a good road map to where we’re going … more fodder for the book. So, that’s my main target at the moment.

The top of Rome was the same pattern. Lots of corruption at the top of both cycles, lots of pandemics on the way down.

Cool.

Maybe a short section for the book (which would be even better)?

I really want to see this thing sell, withstand history, then have the masses read it decades later and go, “Wow, those folks really had Vag, Scented Candles at the top of the market”?

Anyway, I’m gonna go find some of Wheeler’s work and read up. Fascinating stuff and I need research for my continuing arguments with the morons who believe humans are primarily responsible for climate change (among other things).

Wheeler didn’t actually publish his larger work. He wrote a book but died before he got it to print. You can find Zahorchak’s book as a second hand book, but it’s out of print, so you have to look for it. You can check out my recommended book list. The more accessible, best alternate, is Puetz’s book, The Unified Cycle Theory.

According to Amazon, I already bought the Puetz book. Now I have to dig it out instead of ordering it for a second time. Must of been when I went over your list. Got so indulged with Anderson at the time, I set the others off to the side & have since moved.

Is the SP morbidity number missing a few zeros ?

Yes, thanks for catching that. Fixed.

Very interesting.

Although piano lessons are on hold, sales of herbal formulas and vitamins for avoiding viruses are high.

3 specific products for $105 last 3 months.People are feeling better and more positive.

Thank goodness for natural supplements!

Lorraine, I’m focused on rosehips and cocoa for more zinc, especially, and Pau D’arco as I have never really challenged it and it is supposed to be a serious antiviral among other attributes.

Funny how we know a lot about 5,000 herbs and next to, or actually, nothing about 995,000 different herbs.

Well, that is kind of job security for herbalists!

peter, Thanks you for giving us the right insight on these topic, would you care to comment on US house price trend for the next 4 years? I am close to retirement age and want to sell the house once the lock down opens, don’t know if it is

a good idea to sell this summer or maybe 3 or 4 years later.

Hi Gladys,

Did you see my video and write-up on the 18.5 year real estate cycle? It was done a few years back was a warning that a top was coming. I’m sure few paid any attention. The top came in 2018. We’re now headed down.

That video is at https://worldcyclesinstitute.com/the-eighteen-year-real-estate-cycle/

Going forward, I’m expecting a bottom in this stock market drop in mid-o-late May and then we’re going to head back up to the very top one last time with the high in early 2021, I think. Social mood is going to kick up once again with everyone thinking they dodged a bullet (and that should bring out some buyers), but once we hit a new high, the financial carnage will start again and this time it’s going to be much worse, ending in a full blown depression that will make the 1930’s look like a small recession.

So, the summer in likely not the best time to sell. I’d wait until the market recovers in the fall, but keep in mind that December/January are not great times to sell, and that the fall is probably going to be better. After that, we’ll be getting close to the ultimate top in the first part of next year roughly.

In five years, homes will sell for 20% or less of their current value. Nothing is certain for the coming months, but this is my best guess. Governments tend to do as much as they can to make things worse, so this also depends on them not completely destroying the market before it heads down naturally starting next year (as they’ve stupidly done this spring).

Best of luck. Hope this helps. Thanks for the kind words.

Another truly amazing article, Peter! Needless to stress on your unspeakable ability to shape the results of sophisticated research into readable and human-face form. Thanks for that! Would you mind to elaborate a bit on inflation as far as described scenario is concerned, please? Is it a time for all-into-gold?

Thanks in advance!

Thanks for the kind words, Dim. Facebook won’t let me promote this to a larger audience. It’s “controversial content,” even though lots of articles and reports from scientists are coming out supporting it. Gotta keep the herd in line …

Inflation? I’ve written about it extensively, so you’ll find other articles on the site. There has never been a depression in the history of the world that has been inflationary. It wouldn’t make sense. Central bankers have been trying to stop creeping deflation, but they aren’t winning, and they won’t. The virus has absolutely nothing to do with the market. I predicted this wave down a long, long, time ago.

Gold, yeah … short.

You’ll find a lot on deflation on the site, too.

Much appreciate your comments, Peter! Got your point on inflation – clear enough, especially as far as you touched upon FB part 😉 I was truly astonished to see ongoing coronacollapse and recalled prediction you made back on Dec.8th last year in your “Herding, Nature, Stock Market “Crashes”” article. Somewhen in early 2018, I also read similar prediction based on works of WD Gann. It was very similar to yours, estimating last decade of December too, which is same compared to what we have seen in the recent month, bearing in mind timeframes in consideration.

Gold is truly overbought – it is just priced up on hype as I see. And indeed this virus is rather a tool of all-pacifying Mother-Nature, and by no means a reason of recent drop off.

So then the question is whether current world’s major reserve currency (USD) will remain as such during large-scale downturn period beginning in 2021? Will it be a shelter and if not what it/they will be?

Thanks, peter. Very enlightening article about the current situation

🙂