Humpty (meaning the market) had a bit of a “fall” this morning. I don’t think that all the Fed’s horses, or all the Fed’s men have a chance of putting this thing back together again (even though they themselves might think so).

Humpty (meaning the market) had a bit of a “fall” this morning. I don’t think that all the Fed’s horses, or all the Fed’s men have a chance of putting this thing back together again (even though they themselves might think so).

Tonight’s “update” will be just that—short and sweet—since it’s on the heels of last night’s analysis.

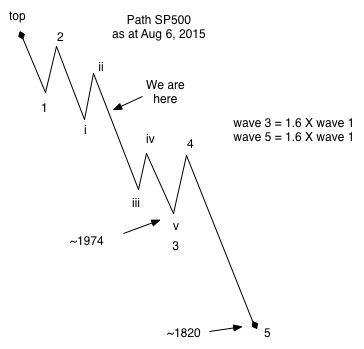

Other than the market coming down a little quicker than even I’d imagined, not that much has changed in terms of the forecast. Down we go—in a “nowhere to hide” third wave. To the left, you’ll see the projected price levels for the various SP500 waves. Based on Elliott Wave typical wave lengths, this is what I’m expecting for the next couple of weeks.

Wave should be at least 1.6 times the length of wave 1 and wave 5, a similar measure. The other indices should come down in parallel.

The SP500 is one of the indices that’s giving the clearest projection in terms of price levels. It would typically come down to the previous 4th, which just so happens to be about 1.6 times the length of the first wave down. So we have a ways to go. I can see a bounce somewhere around 1974 (wave 4), but it will only be 38% of the distance travelled to that point (of wave 3). More about that when it happens. It will take a couple of days at least to work itself out and then we’ll head down into wave 5.

The Nasdaq (above) has some catching up to do and I wouldn’t be surprised to see an extended wave 3 (or wave 5). I’ve shown the first level at 1.6 times the length of wave 1 (the top horizontal line). I’m expecting the end of the 5th wave to get to at least the circled point (not sure at this point how it’s going to decide to do it).

Enjoy the ride.

Hi Peter,

glad to read you again.

Do you think that it is impulsive enough?

What is surprising for me that the other markets don’t follow the US.

Look at Europe.

Hi Dimitri,

I’m don’t know if you’re kidding about being impulsive enough … The moves of other international indices will likely depend more on the dollar being the reserve currency. They’ll move soon enough. The Euro is heading up for a bit, still, as an example, dollar down.

Thanks, Peter, for your answer.

Yes it was impulsive (especially in Nasdaq) but I’m talking about its amplitude for SnP – 0.8% (really not very impressive)

Does it matter?

We’re just getting started. The big drop is still to come … late September/early October.

Also, remember it’s summer. That this is happening at all in August is quite spectacular on its own.

Peter

Hi Peter,

In the previous post, I meant that wave 1 is equal to wave 5 so I would get the 2044 on my screen. Anyway, to clear things up, can I e-mail you my picture so you can see what I mean/see?

Cheers,

W

yes.

How can I reach you Peter?

Cheers,

W

peter@worldcyclesinstitute.com or peter@petertemple.com

So far so good… a small bounce in the morning and then down we go!

I concur. 🙂

Good call…nick

Almost all crashes happen after a lunar square and after a weekend. With a last quarter today, next week looks promising.

So not up into 14-08 but HARD DOWN that is André? Your roadmap for August said up into 14-08, but I guess this has changed due to the 3 and 7 August being different right?

Greetings,

W

Wouter,

My roadmap is leading and hasn’t changed. But the decline sofar has been modest as international markets still seem to be out of sync. This means that different cycles are active, with some cycles still up and other cyles down.

So what I basically mean is that next week will likely be a syncronization week with just a modest rise. After the New moon conjunct Venus (8/14 – 8/15) the decline will be stronger into the supermoon early september.

Cheers,

André

André,

I only see a small rise and in fact, it may be over Monday. We should head back down. No real change from my perspective.

Peter

Peter,

Down from last quarter into the full moon (3 lunar phases) is a very common pattern. That supports what you say. And the moon max North on Monday would suggest a top on Monday. Spiral dates (Carolan technique) also indicates that Monday is an important turndate, as does Gann timing.

It’s just that Venus retro makes me a bit uncertain. So for next week I have 2 scenario’s. Either we make a high on Monday and decline into the early September low, or the strong date creates an inversion and supports (some) markets into the New Moon, delaying the decline by one week.

We’ll see.

Well, we’re in a third wave and the DOW has dropped below the previous fourth so, unfortunately, we’re committed to DOWN … haha.

This is what Ray Merriman says about Venus retrograde.

“Venus retrograde. It is one of the most interesting of all geocosmic phenomena. As seen from Earth, Venus appears to go backwards (retrograde) in the heavens approximately every 19 months. That part is not so unusual. But what is unusual is the fact that every five Venus retrograde occurrences take place in nearly the same part of the zodiac. This occurs over an eight-year period, and when these five points are connected, they form a nearly perfect pentagram.

Although this is most interesting from a mathematically aesthetic point of view, our interest has more to do with the correlation of these points to activities in human cycles – particularly economic and financial market cycles. The Venus retrograde period lasts about 43 days (July 25 through September 6, in this current case). According to the studies published in The Ultimate Book on Stock Market Timing, Volume 3, Geocosmic Correlations to Trading Cycles, the retrograde date has a 78% correlation to primary or greater cycles within 12 trading days in the U.S. stock market, making it one of the strongest correspondences of all to this 13-21 week cycle governing stocks. Venus direct (September 6) also has a very high correlation (73%) to primary cycles within 10 trading days. In many instances, a primary cycle trough will occur nearby to the retrograde date, and a primary cycle crest nearby to the direct date, or vice-versa. It has now been 10 trading days since Venus turned retrograde on July 25, and so far, there has been no primary cycle in the U.S. stock market. Yes, it could happen by Tuesday, the 12th trading day, as the DJIA is still falling. Or, it could happen within 2 trading days of the midpoint of the Venus retrograde period, which happens next weekend, August 15-16. The rule (Merriman’s rule) is this: if a market does not reverse around the time of its retrograde date, then look for it to reverse very close to the midpoint of the retrograde period. This applies to Mercury retrograde periods as well.”

Peter,

The uncertainty part is about me. As I said; you may very well be right. And I hope you are right, because a little volatility would be welcome. And it’s just about next week. My 7/20 timing (Gann) has been confirmed by Apple; that made the high that day and this is significant.

Anyway; Monday HC Mercury square Mars so we’ll have certainty soon.

And the wave up in the SP is a confirmed “3” so it has to retrace.

I am a new reader. So far, very good. Learned about you through solarcycles.net. A couple of questions. You mentioned that 1-2 has a different look which Prechter can’t figure out. What is that and do you have writings on such insights? Parenthetically, when gold was around 1400, I said Prechter of Elliott, Flannagan of GannGlobal, and Rosen of Delta were all bullish on gold, therefore it has to go down. I love Prechter and Elliot. Also Caldaro has been very good, and is long term extremely bullish, ie. since 2009 a 1. Any chance we are in a crash sequence?

Kent,

I have a drawing of a typical first wave down that I will post later today and I’ll send you a link.

I’m bullish on gold short term, but it’s only a b wave bounce. The b wave should retrace about 62% of the distance from the top. Then we should head back down in a c wave to the previous fourth wave which is about $680.00, if I remember correctly. Prechter’s group would tell you the same thing. I just got long this morning, btw.

Hi Kent,

First Wave Down https://worldcyclesinstitute.com/first-wave-down/

Thank you

Hi,

According to Lunar Tuner, unless Venus Inferior Conjunction on 8/15 has more to say, market should be up all of next week. Apogee is a ways off, seasonals good next week, new moon favorable, declination is favorable. Based upon years of data, the VIC often produces exhuberant selling and just as much buying afterwards. So next week could be way down, but I am confident in staying with it.

To your point, Valley, it looks like we’ve done 5 small waves down, so we may get yet another second wave bounce at the end of today. If that happens, it should go up to about SP 2095 or so before resuming the downtrend.

Thanks for joining us Valley! I am glad you read my e-mail. 😉

Greetings,

W

Next week should be very revealing. My roadmap said a low 7/10 August and then up into new moon but Peter disagrees. That’s fine. What we do agree on is that long term the trend is down and the low is years away.

Gann timing is wonderful and I keep finding new things. Gann timing basically consists of 2 classes of techniques :

1) time2time : a date + time = new date

2) Price2time: a date + price converted into time = new date.

When those two cross we have the strongest Gann timing achievable. Example : Mastertiming op the 2007 high and 2009 low both gave 7/20 as a major turn date (=t2t). A p2t technique on the 666 intraday low on the S&P 3/6/2009 gave 7/19/2015. This confluence is mind boggling.

Another analysis uses the DJ 1929 high (381,17). This gave 10-17-2007 and 3/9/2009 as significant dates. Recognize these dates? Anyway, this system shows that 5/15/2015 is equivalent to the 2007 high in a perfect harmonical way. In the Natal NYSE chart we saw a sun-sun conjunction 5/18/2015. See what happens? The DJ 1929 high programmed a date that is matched by a natal NYSE sun/sun conjunction. Birthdate NYSE 1792, DJ 1929, in sync in 2015. Apple peaked 7/20 and S&P peaked 5/21. Something must be working.

This weekend we have some powerful inversions. So the question is what this will do. 2 options : it will create a low on Monday and wallstreet will retrace up into the 8/14-8/15 period and join Europe that still seems to be in an uptrend OR it will pull the European markets in a downtrend so the decline could speed up a bit next week.

A significant event will be Jupiters ingress into Virgo on Tuesday. This should create a low for gold and set off a long awaited rally. Gold and eur/dollar were basically flat last week. That’s another reason why I think next week will be very important. When gold breaks the 1100 usd barrier a huge short squeeze will catapult gold higher, push the euro towards 1,15 and beyond and speed up the decline. My Galactic year starts 6/16; every year. 8/16 would be 60 degrees (sextile). 8/15 is a pentagonical date on the venus transit (once every 1.6 years) date.

So, trend is down longterm and first serious retrace 9/4 (roadmap). As this is a multiyear top it will be round (it has been round for most of 2015!). I am convinced the second half of August will be very clear and remove all my doubts. But next week? I really don’t know, so just ignore me for a few days.

Cheers,

André

Great analysis, André!

I got to Toronto yesterday and my laptop immediately went down (I think it’s the drive), so I won’t be doing an update this weekend. There’s really nothing new to say, anyway. In the meantime, I’m attempting to get another computer organized.

Peter

Peter,

Yesterday was 8-8-8; a magic date. I’ll bet your laptop was the victim.

Good luck with a new setup and we’ll wait for your next post.

Cheers,

André

hmmm ….

I need a new laptop, anyway. I have everything backed up as of about two weeks ago, so just really inconvenient. Back home Wednesday.

The only reason Europe was up last week is the dollar but friday the euro went up again.

I think we will make an important low arround August 18 (turbocycles date) and Mercurius

Latitude date.(19)

After that we will have a recovery.

So buggle up.. and hold tight

Nice sunday

John,

What makes you expect a recovery?

Cheers,

André

Well,

I hope and pray we will see something similar like 2007 a 10 % sale

After that always the dipbuyers will show up..

But I don’t expect a full retracement

I believe this week and after that August 18, September 4,18 and 30 are important dates to watch..

New post https://worldcyclesinstitute.com/a-cautionary-tale/

I’m being cautionary about what’s going on.

Hi all,

Thanks for sharing again! Let’s see if this week wants to go our way, the DOWN way. 😛

Cheers,

W

Lunar Tuner next week:

Phase: Price supportive all week

Distance: Price supportive all week

Declination: Price supportive all week

Seasonals: Price supportive all week

Planets: Mercury quadrature 8/16 bearish all week

Venus inferior conjunction 8/15 bearish before, very bullish after

Post Venus Mercury heliocentric opposition bearish until 8/18.

Results: Lunar seasonals very bullish especially near price lows for year. Planets are not at all supportive, but flip to very supportive following week. Price sometimes bottoms out before the VIC, so if price goes up and away this week would not be surprised.

Hi Valley,

I go for your latest ‘lottery ticket’

Venus Mercury heliocentric opposition bearish until 8/18.

Maybe a panic low like 2007..

The Dax is finally joining the party in the ‘deadly spiral of curency devaluations’

Cheers

John.

Unfortunately, I can’t see a lot, but from what I can see, it looks like the US indices (including the futures – SP, SPY) are setting up a bearish triangle with one more leg up to go. I’m back tomorrow, so I’ll have more to say then.

Yeah Peter, I like to see your new analysis. 🙂

I think that tomorrow (at least for half the day) the indices will go up for the last time (Europe and America) and later on (when America opens???) the indices will finally start the down move for real! But that is just my humble opinion…

Greetings,

W

It’s been a bit of a wild ride. We should head down from here … while I go out and buy a new laptop. If I can get it restored from backup, I’ll post tonight.

Can’t wait! But for now, we are at 2084,75 @ close. 😉 I guess down tomorrow…

Cheers,

W

The US still convincend that the Titanic won’t sink I bet the Fed made a lot of money today buying in to the lows.

Tommorow will be different I guess

I still hold my cards till August 18/19.

Cheers.

Hi all,

What is bothering me, is that we had a big ‘down-day’ (3,4% for the AEX) today while the S&P recovers all the losses… Hmmmmmmmmmmmmmmmmmmmzzzzzzz. Wave 3 not busy or, what is happening?

Cheers,

W

Patience and trust….Little grasshopper

https://www.youtube.com/watch?v=eGblsNXkJog

I am still long, market has up bias next two months due to venus inferior conjunction on 8/15. Two months after is risk on time all assets including gold miners will benefit. I trade the PALS system which is Planetary aspects, Lunar, Seasonals. This week is positive except for this weekends VIC. Next week and two months following VIC are super positive planetarily. As a long term trader, a good bet is to be long the next two months. As a short term trader, I will use PALS the next two months with a bullish bias due to post VIC.

thanks for posting Valley

REVENGE OF THE BEARS TOMORROW

Shorted again at the end of the day with put options and 3X ETFS

I want to see the 2028 spx level at least. Good luck everyone.