| “If you tell a big enough lie and tell it frequently enough, it will be believed.” |

| Adolf Hitler, translated from Mein Kampf |

“Fake news” abounds these days—it’s the buzz-phrase of the day. This is no surprise given where we are in the current 516 year cycle (the very top). But it’s fascinating to me that people are focussing on the “micro-news” that’s fake, when we have much bigger lies getting closer and closer to unravelling.

Some of these lies are immense and go back hundreds of years. Over the last 300 years, they’ve not only grown in size, but in frequency.

When things are not going well for governments, they revert to propaganda, or in extreme cases, war. When under attack, or if their authority is questioned, they will say and do almost anything to stay in power.

Hence the quote at the top of the page.

Hitler’s quote is a translation that’s probably been shortened and slightly reworked to make it more memorable. But the sense of the quote adequately describes the work of today’s conspirators (the “deep state” in the US, the central banking cartel headquartered in Europe, for example). Their tentacles stretch into all aspects of our society.

Their reason for being is all about money. It always has been throughout history. Most big lies are about money. The latest incarnation got and big bump in legitimacy in the 17th century with the founding of the Bank of England. It began a path to an international banking cartel that rules the world today, and is the source of most of our financial problems.

| “Men called bankers we shall hate, for they enrich themselves while doing nothing.” |

| Aristotle, Politics |

Follow the money and you’ll uncover the truth. In this series of four articles, I’m going to list some of the largest lies and the background to them. Banksters and governments together have wound a web of intrigue that is so unbelievable that the general public is slowly coming around to just that conclusion: They are so unbelievable that they are probably true. Indeed, they are.

We’re on the cusp of a major revolution that will uncover many, if not most, of the enormous lies that have allowed the “elite few” to become super-rich and ultra powerful.

The 516 Year Cycles

The bottom of the previous 516 year cycle is arguably around the year 1663. This is also the bottom of the Maunder Minimum (mini-ice age, 1645-1715 approx.). This latest 516 cycle ended in 2007.

If you do the math, you’ll find that dividing 516 by 3 gives a result of 172 years. This is another major cycle of depression and drought. I’ve described the cycle and its general manifestation in a video and article here. Every 172.4 years, Uranus conjuncts with Neptune. The last three times this has happened, we’ve suffered a financial crises fourteen years after than date.

Dr. Raymond Wheeler PhD identified the same 172 year sub-cycle in his life’s work and produced the drought clock which predicts these world-wide phenomena, for the very reason that cycles persist over time and history therefore repeats.

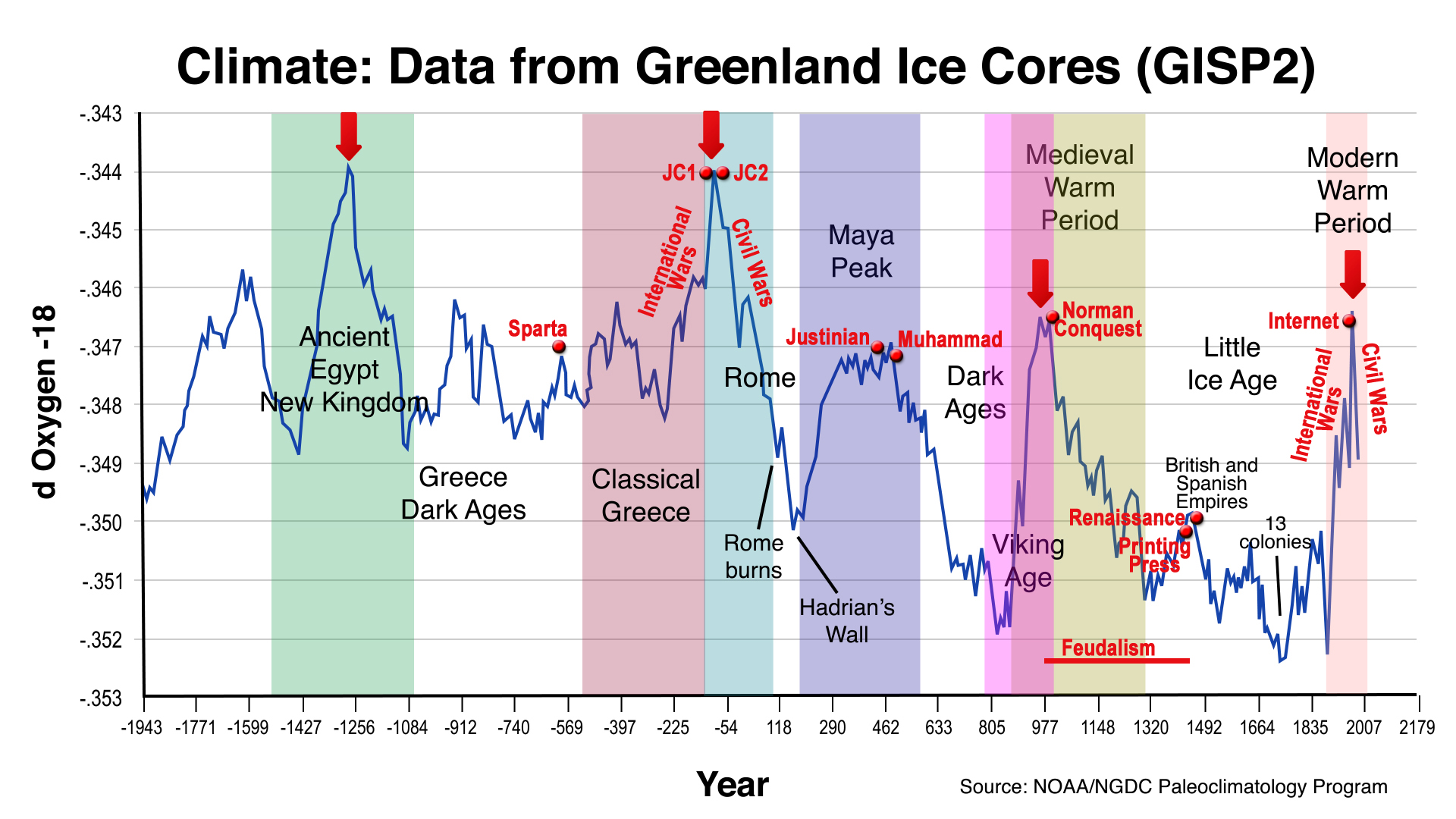

The data above comes from the National Oceanographic and Atmospheric Administration—from the Greenland Ice Core Research project ending in 1992. Ice cores are an extremely accurate method of determining temperature back through the centuries. This data is undisputed by the scientific community, but has been suppressed by the UN-associated, man-made warming advocates. It also reinforces the findings of Dr. Raymond Wheeler in his research over fifty years earlier of tree ring data, weather records, military records, locust plagues, historical chronicles, sunspot records, etc.

What the above chart shows is the temperature cycles over the past 4,000 years. Each time there’s a temperature peak, a major civilization also peaks and then goes into contraction. This has happened over and over again throughout recorded history.

Certain world events take place at predictable points along this 1030 year cycle peak spectrum. “JC1” refers to Julius Caesar, “JC2” to Jesus Christ and the start of Christianity. Note that the Islamic religion also began at a climate peak, around A.D. 600 (Muhammad).

International wars always take place as the climate warms and there is abundance, while civil wars happen on the downswing, in difficult financial times.

History Rhymes. If you want to know the future, study the past.

____________________________

The Big Book

Dr. Raymond Wheeler, PhD created the “Big Book” in the earlier part of the 20th century. In it, he recorded the climate cycles and associated events—leaders, governments, social traits, religions, political regimes, music trends, and much, much more—from B.C. 600 BC to about 1940. With a PhD in psychology, he was as much interested in the cyclic changes in society as he was the changing climate. His findings in climate have been confirmed by the GISP2 scientific data retrieved from ice cores (above).

Dr. Raymond Wheeler, PhD created the “Big Book” in the earlier part of the 20th century. In it, he recorded the climate cycles and associated events—leaders, governments, social traits, religions, political regimes, music trends, and much, much more—from B.C. 600 BC to about 1940. With a PhD in psychology, he was as much interested in the cyclic changes in society as he was the changing climate. His findings in climate have been confirmed by the GISP2 scientific data retrieved from ice cores (above).

The spark for this post came from a viewing of JFK (Oliver Stone), the movie recently. I thought it an interesting exercise to list all the lies I’ve become aware of over the past few years and review them in the context that they seem to get bigger and bolder as time marches on towards the top of this cycle. We’re now sitting at the cusp, but I don’t expect the intrigue to lighten up for some time to come.

_____________________________

Cycles and the Rise of Greed and Deceit

At the bottoms of these cycles, as climate finally begins to turn warmer, the building blocks for the future begin to form. The foundation is laid for the palace intrigue, the scams, the greed, and the nefarious characters who are able to gain the upper hand as society becomes more and more “relaxed” near the very warm top, which is where we are now.

By “relaxed,” I mean that at the top of warm dry cycles, citizens allow their governments to take advantage of them, gain control, and create a society for the rich at the expense of the middle class. Freedoms evaporate; dictatorships become more prevalent, more centralized, and autocratic. Democracies move towards socialism. After the turn, international wars morph into civil wars. Trade wars develop, countries become more nationalistic, and borders start to close. I’ve warned about this for the past several years and you can see this happening all around us. Deflation is already noticeable and the result is that credit is beginning to freeze. Real estate markets are beginning to top out (In Canada this week, we’re seeing the beginning of the end of a major mortgage company—it signals a grand warning of a coming financial collapse) in the US, Australia, and Canada.

At the tops of these 516 year cycles, weak leaders abound. Populist leaders get elected in democracies around the world and greed for power often ends in murders and impeachments at the executive level. You can look to the top of the Roman Empire in A.D. 100 to see the dramatic shift to governments that were tumultuous, short-lived, and despotic. I wrote a brief history of the downward spiral in Rome here.

For example, Julius Caesar was assassinated by his fellow senators in 44 B.C. Ramses III had his throat slit in 1156 B.C. The beheading of English and Scottish kings and queens became somewhat of an epidemic at the top of the 500 year cycle about the year A.D. 1500: James I (1437), Henry VI (1471, Lady Jane Grey (1537), Mary I (1567), and Charles I (1649) were the victims.

The Lies and Warnings

The Fractional Reserve System

Lie: Your money is safe in the bank

In the 1600s in England, transactions were carried out in gold and silver coinage. They had intrinsic value that changed little over time, but they were heavy to carry around in bulk and large amounts needed to be stored for future use. Goldsmiths of the time had the safest vaults in town.

When you deposited your gold and silver with the local goldsmith, they issued you a receipt for your deposit. In time, these receipts were used around town in place of the actual coinage—it was just more convenient. The recipient could, in turn, cash in this receipt and retrieve the original gold coinage from the goldsmith. This type of receipt was also used when people came to the goldsmith for a loan.

“The mischief began when the goldsmith noticed that only about 10 to 20% of their receipts came back to be redeemed in gold at any one time. They could safely “lend” the gold in their strong boxes at interest several times over, as long as they kept 10 to 20% of the value of their outstanding loans in gold to meet the demand. They thus created “paper money” (receipts from receipts for loans of gold) worth several times the gold they actually held. They typically issued notes and made loans in amounts that were four to five times their actual supply of gold.”—Ellen Hodgson Brown, Web of Debt

With those percentage rates, if they were careful, they could actually become quite wealthy in very short order. However, if they got greedy and overextended themselves, and more people tried to redeem their gold than the goldsmiths had on hand, they went bankrupt. Many did, but the system remained, while the townspeople became more and more indebted and the goldsmiths richer and richer.

Lending out money you don’t actually have is fraud. It’s as if you rented out the same house to five different people at the same time.

This eventually morphed into the fractional reserve system we have today, in use all over the world. The percentage of reserves the bank is required bylaw to keep differs from country to country. In the US, it’s generally believed to be about 10%. In Canada, for example, there is no restriction (in effect, “no-reserve banking”)—banks don’t have to keep any of your money. In fact, the law is (not only in Canada) that when you deposit your money in a bank, you’re making an investment. You don’t actually own that money anymore, the bank does. They have a promise to pay, but if the funds aren’t there, guess what? The promise is likely to be broken.

In Canada this month (May, 2017) Moodys has downgraded all the big six Canadian banks due to the vast amount of mortgages people have taken out with the banks, when real estate is clearly in a bubble—in other words, not worth the value of the mortgages. The banks are over-leveraged and if the real estate market plummets and people default on their mortgages, the banks won’t have the money to honour deposits of people like you and me.

This is the fraudulent system we have in place in most countries in the world today.

The Bank of England (1694)

Lie: The Bank of England was founded to bring greater prosperity to the people of England.

In 1694, the Bank of England came into being. It was created to lend King William unlimited sums at 8% per annum so that he could go to war with Louis XIV of France. France, at the time, was not on the “usury system.” This became a pattern going ahead several centuries, in fact, right up today.

“Significantly, most of these wars were started against countries that had implemented interest-free state banking systems, as was the case in the North American colonies and France under Napoléon. This pattern of attacking and enforcing the banker’s system of usury has been deployed widely in the modern era and includes the defeats of Imperial Russia in World War I, Germany, Italy and Japan in World War II and most recently, Libya in 2011. These were all countries that had state banking systems, which distributed the wealth of the respective nations on an equitable basis and provided their populations with a standard of living far superior to that of their rivals and contemporaries.” – Stephen Mitford Goodson, A History of Central Banking

Buried in the Bank of England bill were a range of brand new taxes on ships, bear, and liquor (and many more on everything from marriages to deaths, to pedlars and bachelors) which were to be levied on the citizens to pay the interest on the borrowed money. This is the same system that was later used when the Federal Reserve was set up in the US in 1913. In the latter case, it was also the beginning of federal personal taxation in America.

The Bank of England became the model for western banking for centuries to come.

Assassination of Spencer Percival (May 11, 1812)

Lie: The murder of the Prime Minister of England in 1812 was the work of a lone assassin

In 1809, Spencer Perceval became Prime Minister of England. During this period, England was in a war with France, both sides financed, of course, by the Rothschilds. After the vote in the US to decommission the bank, Nathan Rothschild put tremendous pressure on Perceval to declare war on the US. Perceval was already tied up financially in the war with France and refused.

On May 11, 1812, Perceval arrived at the House of Commons for a debate and vote. He was assassinated in the lobby by John Bellingham, with a shady past and possible ties to the Rothschilds. Within the year, the US and Britain were at war—the War of 1812—which was completely unnecessary.

We’ll see this pattern of assassinations continue throughout history, whenever leaders go against the “flow of money” on an international scale.

| “Let me issue and control a nation’s money, and I care not who writes the laws” |

| Amschel Rothschild |

______________________________

Sources: (links and more information on my recommended books page):

- Web of Debt, Ellen Hodgson Brown

- The Creature from Jekyll Island, G. Edward Griffin

- A History of Central Banking, Stephen Mitford Goodson

- The Public Banking Solution, Ellen Brown

- The Unified Cycle Theory, Stephen J. Puetz

- Climate, The Key to Understanding Business Cycles, Michael Zahorchak

- Tower of Basel, Adam Lebor

- Tragedy and Hope, Carroll Quigley

- Debt, the First 5,000 Years, David Graeber

Hi Peter,

You mentioned in the article the beginning of the end of a major Canadian morgage company. Is there other articles to read regarding which morgage company and what is happening with that company?

Sincerely,

Laura

Hi Laura,

Sorry for the delay in this reply. It’s been an incredibly busy week. I wrote this article in 2017 and the company I was referring to was for reverse mortgages (CHIP) and called. Home Equity Bank. It ended up going bankrupt but was bought out by Warren Buffet. I don’t give them a long life as things are going to change dramatically. We’re going to see a debt jubilee sometime in the next couple of years and that will wipe out all debt, which won’t be very good for them. Good for us, not for banks.

I’m just starting an article on that which I hope to have out by the weekend.