I’m back after a really horrendous weekend (plus a couple of days) in Toronto. I’m still without my main computer, but hopefully I’ll be able to snag a new one tomorrow. Thankfully I back up my work about once a week. That’s the extent of the good news … haha.

There seemed to be a lot of people freaking out about today’s move. I hope I can add some perspective to where we are. I’ve got charts of the main US indices below. They all did much the same thing today, but it seemed to be a result of running out of sellers after a dump off the open and then heading up in a countertrend move. It left a sharp spike at the bottom and they never last very long. It was an abc, 3 wave countertrend move.

I still put us in a third wave with a ton of heavy resistance to get through, so it’s not going to get easier until the clear the “shelf” just below us. But the long term trend still appears to be down.

Breadth was negative, and the advance decline ratio was slightly negative.

A note on Gold: After calling a bottom a couple of weeks ago, GLD is heading up nicely, which fits well with a declining market.

Above is the SP500. It had a big dump at the beginning of the day, ran out of sellers and rallied the rest of the day. However, it only closed at $1.98 to the positive. I’ve drawn a horizontal line at the first target point for the end of the third wave. The SP500 seems to be drawing out a channel, but it’s easier to see in the other indices.

The maximum I see us achieving tomorrow on the upside for the SP is about 2105, but we may not quite make it.

The DOW (above) is the interesting one. It’s definitely in trouble. There’s no way based the lows that it’s going anywhere but down. Remember, it wasn’t even able to get into positive territory today. It was negative .33. This seems to me to have been a snap back rally from oversold and some important resistance. These indices have gone sideways for months, we in summer, and there’s not a lot of volume, so expect volatility.

The Nasdaq looks to have completed a first wave down and is in the third wave. The channel it’s forming is perhaps easier to see than the other indices. It was only positive $7.60. Looking at what the futures are doing tonight, I’m expecting us to head down again tomorrow. But, I would use a ton of caution. It’s a scary market.

I thought I’d add in the Russell 2000, which is a little like “looking under the hood.” Its downtrend is easier to see and it’s been persistent. It’s in trouble longer term. While I’ve drawn in a target for the third wave, it may extend lower.

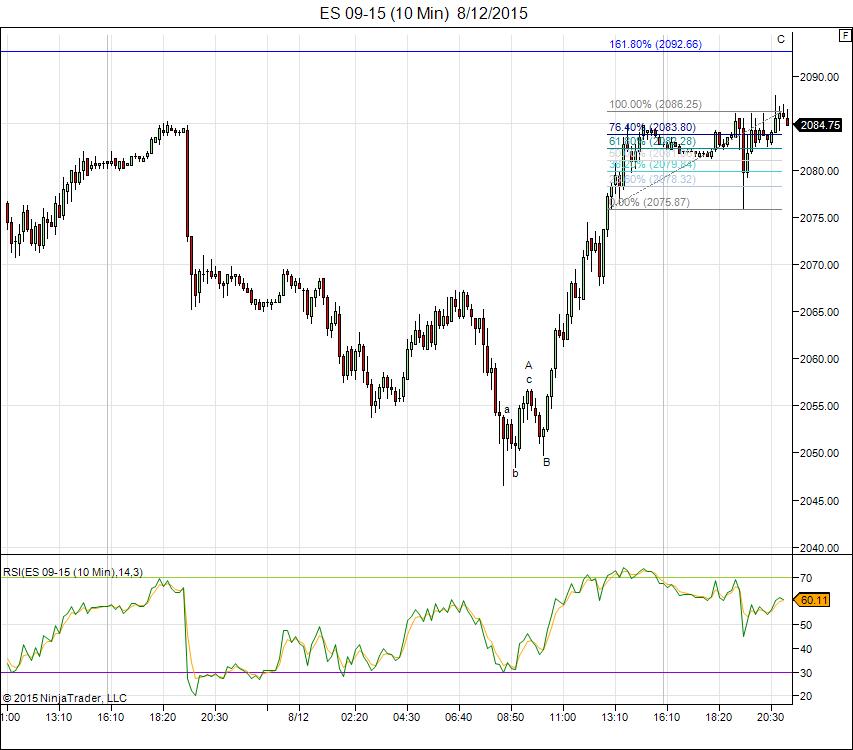

Let’s look at what the futures are doing tonight (after hours). This is a ten minute chart. The ES (SP500 futures) tonight did a small 4th (or b wave) which suggests they’re going to a modest top … marked as C on my chart. We’re in the fifth, or final wave. I’ve projected it at 1.618 times the length of the first wave, which is fairly common. Note that the first wave (marked as the A wave in the chart) is in three waves, so this is a countertrend move. This is a similar pattern to all the major indices today.

Also, spiked bottoms never last. So, it should completely retrace.

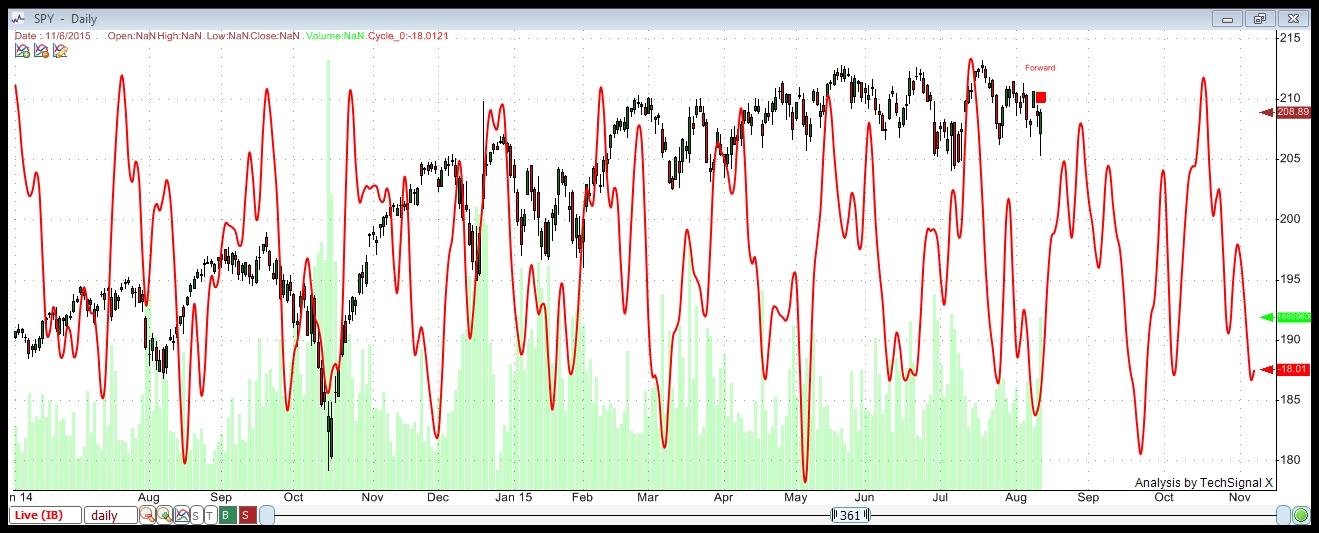

This is an new cycles analysis using TechSignal X from the Foundation for the Study of Cycles. These show show the longer length cycles based on backtested maximum winning trades when trading both cycle highs and lows. We’re showing a positive cycle here but note that it’s not as strong as either the cycle before or after it. The longer term cycles below still show a negative trend heading into September with a second wave peak in October.

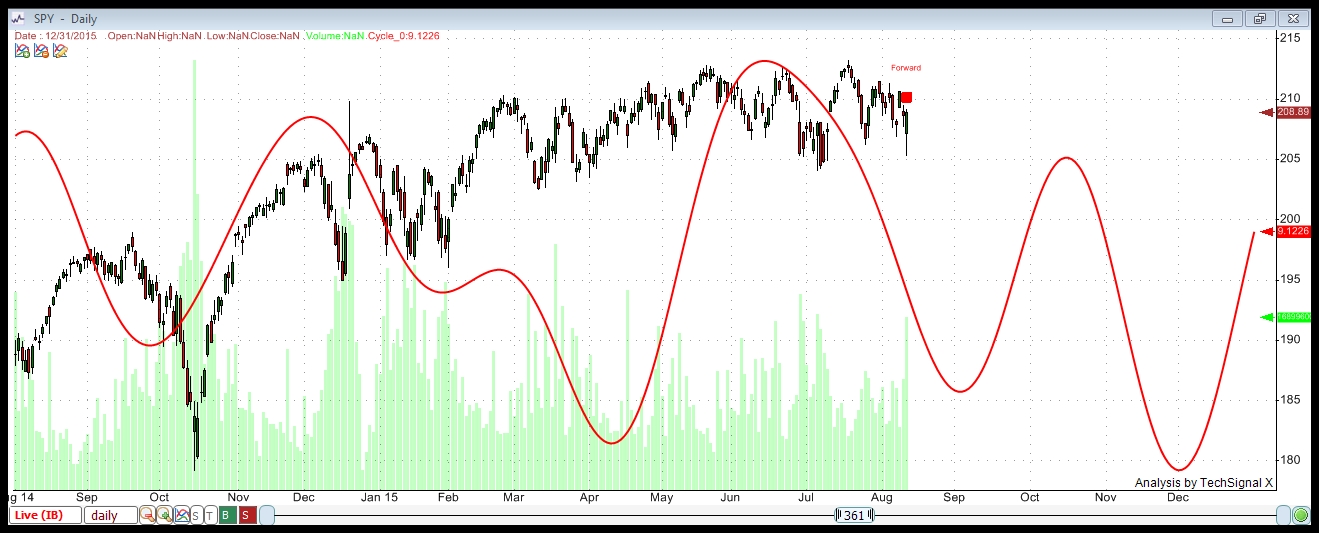

Above is a cycles analysis for the maximum net profit using the same criteria as the above chart. Both charts using 13 years of data.

Little grasshopper reporting for duty! >< Just 2 things about this movie of 1 and a half minutes: 1. I am way cuter. 2. I am way faster (played table tennis at high level). 😛

Thanks for your words again Peter. I must say, now 10:00 am in NL (04:00 am your time) we opened up with a gap and the S&P is at the 2092 level. I think we will go to 2095 max and than BOOM like you said Peter. 🙂 I guess, even with this up move out of nowhere, we are still down. It is just nice to see this confirmed by somebody that has way more experience in reading the markets. I am just busy for like 2 years and pretty new to EW. 😉 Therefore, thanks for sharing again!

@John, yeah I think end of this week or the beginning of next week will be important to switch to longs… Let's say 18 August?

Cheers,

W

PS: @Peter, I DON"T HAVE ANY PROBLEMS WITH SUBMITTING MY RESPONDS ANYMORE, THE PROBLEM GOT FIXED? 🙂

This morning, the wave down is in 3 … a more substantial b wave, so we’re not quite done on the bullish side yet.

Good, glad the issue with the site resolved itself. I’m going to a faster server as soon as I get the time to transfer the site.

This up wave is almost done. We’re in the fifth of the fifth up (within an overall abc countertrend wave). A fifth wave, is, of course, an ending wave. I would expect we turn down tomorrow. I think we’re in a running triangle, although it could be a running flat, which is quite rare. This last wave is a “3” so it should knock out the running flat option.

Oops … another drop. Well, we still need to finish this up wave, so we head back up overnight I would suspect. Lots of fake-outs … Still down in 3.

Just joking Wouter,

I bet you are much cuter.

If we go down tommorow I will sell my put options September.

And I will take an other look on monday,if the euro keeps rising against the dollar I don’t think we have much upside potential in Europe.

Cheers…

slaap lekker..

Haha! 🙂

I say we close the AEX gap at 471 for sure… My target would be 460 to finish a Bullish Bat, however, I think that might be 3 steps to far for tomorrow. I guess the 460 is for next week…

I will do the same, close my put options with some nice profit at 471. Be neutral and lean back and see what happens (460 = FULL LONG the way I see it now, for a short ride wave 4 up).

Cheers John and all others,

W

@Peter, I did send you an e-mail some days ago, just wondering if you received it so I know it works (you don’t have to respond perse, the questions are answered already I guess).

No, I didn’t get it. My computer went kaput and I may have missed it (just got email working properly again yesterday). Send it to me again and I’ll watch for it.

Hi Peter,

I just sent the e-mail again! 🙂

Wave 3 down finally has begun?

Cheers,

W

PS: I hope you like your new computer. 😉

A new post … https://worldcyclesinstitute.com/a-cautionary-tale/

It’s about using some caution with this count right now.